Automotive Brake Components Market size was valued at USD 24.36 Billion in 2024 and the total Global Automotive Brake Market revenue is expected to grow at a CAGR of 3.88% from 2025 to 2032, reaching nearly USD 33.03 Billion.Automotive Brake Components Market Overview

Automotive brake components are parts of vehicle's braking system designed to slow down or stop motion through resistance or hydraulic force. Key components contain brake pads, discs, drums, callipers and principal cylinders. Global automotive brake components market increasing vehicle production, rising safety concerns and advancements braking technologies. Brake components like pads, rotors, calipers, drums and master cylinders play role in certifying vehicle safety by enabling controlled deceleration and stopping. Growing demand for lightweight, durable and high performance braking systems is pushing manufacturers to adopt advanced materials and technologies. Implementation of stringent safety regulations rising adoption of electric and autonomous vehicles and increasing consumer preference for advanced driver assistance systems. Growing of ecofriendly and copper free brake pads, regenerative braking systems in EVs and AI-integrated smart braking solutions.To know about the Research Methodology :- Request Free Sample Report Depending on the component type, disc brakes dominate the market as their better performance, better heat dissipation, and comprehensive use in both passenger and commercial vehicles. Asia-Pacific holds the largest market share in 2024, which is inspired by high vehicle production in China, India and Japan, as well as growing EVS. Major key players include Brembo S.p.A., Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG and Akebono Brake Industry Co. Ltd. Companies are focusing on R&D, partnerships and supportable product originations to strengthen their market position.

Automotive Brake Components Market Dynamics:

Safety Regulations and Smart Braking Technologies to Drive Automotive Brake Components Market Growth The advancement of smart braking systems in the automobile brake system industry has resulted in a reduction in the number of collisions. The most recent technological developments prevent the car from skidding, lowering the chance of an accident. The rapid increase in vehicle Product Typeion and sales, combined with severe laws regulating stopping distances, is expected to significantly contribute to the market's growth. The automotive brake system market is predicted to see an increase in demand for passive and active safety systems in automobiles. The primary stakeholders have been persuaded to incorporate robust safety features due to growing concern over road traffic crashes and the increasing number of deaths. The automobile brake system market will continue to rise due to stringent safety rules imposed by regulatory organizations and governments. From 2024, the National Highway Traffic Safety Administration (NHTSA), an agency of the United States Department of Transportation (USDOT), plans to make automatic emergency braking systems (AEB) mandatory. To increase the stopping distance performance of truck tractors, the National Highway Traffic Safety Administration (NHTSA) modified the Federal Motor Vehicle Safety Standard (FMVSS) 121 air braking systems in August 2013. Most new heavy truck tractors must achieve a 30 percent reduction in stopping distance compared to current requirements, according to the law. The updated standard requires these large truck tractors (about 99 percent of the fleet) to stop in less than 250 feet when loaded to their gross vehicle weight rating (GVWR) and tested at a speed of 60 miles per hour (mph). Under the same conditions, the stopping distance requirement for a small number of very heavy severe service tractors will be 310 feet. Furthermore, when loaded to their "lightly laden vehicle weight," all heavy truck tractors must stop within 235 feet, according to the final rule (LLVW). The stopping strength of today's disc brakes is excellent when braking. The front wheels also provide 60-90 percent of the vehicle's stopping power. As a result of the implementation of legislation requiring a shorter stopping distance for increased safety, disc brake adoption is predicted to skyrocket. High Repairing cost to Impact the Automotive Brake Components Market Growth Electronic and mechanical systems are intricately linked with advanced braking technology. ABS systems are more expensive than traditional braking systems because they require additional components like sensors, pumps, valves, and controllers. As ESC and EBD become more integrated with ABS, the cost of installation has increased. According to the Transportation Research Board (TRB) of the National Academies of Sciences, Engineering, and Medicine, the cost of adopting ESC on vehicles with anti-lock braking systems can be as much as USD 50 per vehicle. The sensors on each wheel can cost hundreds of dollars, making an ABS system expensive to maintain. According to Repair Smith, the average cost of replacing an ABS module is between $300 and $1,000. Smart Braking Technologies and Safety Regulations to Boost the Automotive Brake Components Market Growth To begin with, brakes remain the single most critical part of active driving safety, independent of vehicle architecture or future brake technologies. Here, reliability is the name of the game, and brake makers do not make sacrifices. When it comes to equipping brakes for future requirements and preserving absolute trust in them, this mindset among professionals and the know-how that has accumulated over decades will become even more crucial in the future: the importance and appreciation of braking as a function will remain unchanged. Everything else, on the other hand, is starting to shift. An industry survey conducted by the AASA/ASA Warranty Task Force in 2015 indicated that 97.5 percent of system-related warranty repairs, not merely the replacement of damaged parts, could have been avoided with earlier routine system maintenance. Participating manufacturers have sent a clear message: We are no longer just in the business of "no questions asked" component replacement warranties; manufacturers and service providers must be "system savvy" and more accountable for wasteful warranty repairs.Automotive Brake Components Market Segment Analysis:

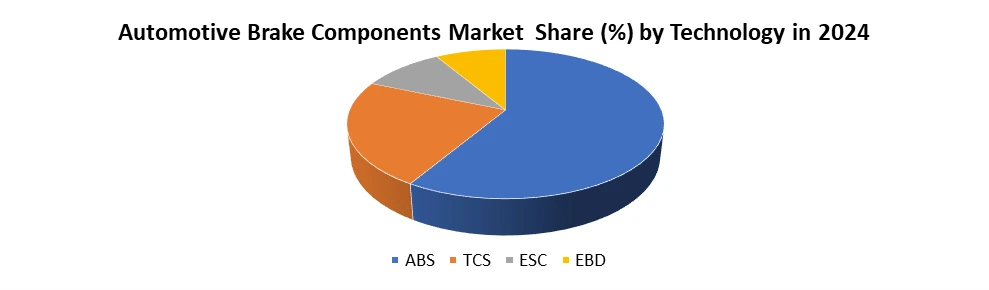

Based on Product Type the market is segmented into brake caliper , brake shoe, brake line, others. Brake calipers segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Due to superior performance, heat dissipation and reliability. Growing preference for disc brakes in both passenger and commercial vehicles in developed regions such as North America driven the demand for brake calipers. Rise in electric and hybrid vehicle adoption has further accelerated the integration of advanced disc brake systems, where high performance calipers are essential. OEMs are also investment in lightweight aluminum calipers to recover fuel efficiency and vehicle dynamics, making segment the top contributor in terms of revenue and volume. Based on Technology, the market is segmented into ABS, TCS, ESC, EBD. ABS segment is dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Because its mandatory implementation in many countries to improve vehicle safety. Prevents wheel lock up during sudden braking ensuring better vehicle control and reduced stopping distance. The system is standard in most passenger cars and light commercial vehicles in North America and parts of Asia-Pacific. Cost effectiveness, regulatory support and integration into entry-level and premium vehicles make ABS the leading segment in 2024, ahead of newer technologies like ESC, TCS, and EBD.

Automotive Brake Components Market Regional Insights:

Asia Pacific Region is expected to dominate the market owing to Demographic Demands: Due to the availability of low-cost labor and raw materials, firms in the region can offer significant cost savings. In addition, the area includes countries like China and India, which together accounted for over 34% of total automobile Product Typeion in 2024. The market is expected to be driven by the rising popularity of active braking systems, as well as an increase in sales of luxury and premium automobiles. Over the projection period, the North American region is expected to increase at a CAGR of 4.7%. This can be related to the growing desire for better performance in inclement weather. Furthermore, since 2023, the mandated installation of ESC technology in all light vehicles has driven the regional market. The market in the Asia Pacific is predicted to expand as more modern safety electronic braking systems, such as ABS, ESC, and TCS, are used. The region's manufacturing of air disc brakes is being driven by a rising partnership between local and worldwide players. For example, Haldex and FAST Group announced in April 2023 that they will form a joint venture to manufacture and distribute air disc brakes and aftermarket services for trucks and buses, with a major focus on the Chinese market. In addition, the market for brake systems is being driven by rising sales of premium and luxury vehicles in the region. Electronic braking systems are currently only found in a small percentage of vehicles in the Rest of Asia Pacific, and they are not required. Thailand has a greater ABS and ESC penetration rate than Indonesia and Malaysia. However, the adoption of modern electronic braking systems is being fueled by collaborations between local and global NCAPs. In June 2018, the Malaysian government stated that ESC would be required in all new passenger cars. As a result of the aforementioned factors, the braking system market in the Rest of Asia Pacific is predicted to develop. Automotive Brake Components Market Competitive Landscape Leading companies, Nissin Kogyo Co., Ltd., ADVICS Co., Ltd., and Akebono Brake Industry Co., Ltd. form backbone of the automotive brake components market. Nissin Kogyo, part of Hitachi Astemo, focusses in advanced braking systems for motorcycles and four-wheel vehicles with durable emphasis on lightweight and high-performance products. ADVICS subsidiary of Toyota Group is standard for premium safety technologies with anti-lock braking system, electronic stability control and recreating braking systems tailored for hybrid and electric vehicles. Akebono Brake Industry stands out with strong partnerships and product innovations in ceramic and disc brake technologies catering to passenger and commercial vehicle segments globally. Companies are enthusiastically capitalizing on R&D, growing production capabilities and forming strategic relations to gain competitive edge. Growing electric and autonomous vehicle integration coupled with stringent safety regulations remains to intensify competition driving innovation and market consolidation across the industry. Automotive Brake Components Market TrendsAutomotive Brake Components Market Key Developments • On 3 June 2024, Brembo S.p.A. (Italy) launched Greenance Kit, an eco-friendly brake pad and disc set designed to reduce emissions and improve durability. • On 22 May 2024, ZF Friedrichshafen AG (Germany) introduced a new electric park brake system for small electric vehicles in Asia. • On 14 May 2024, Continental AG (Germany) expanded its production line in Mexico to increase capacity for brake systems in North America.

Trends Description Technological Advancements Advanced systems like ABS, EBD, and brake-by-wire are being widely adopted. These improve braking efficiency and vehicle control. OEMs are investing heavily in smart and automated braking solutions. Electrification of Vehicles EV adoption boosts demand for regenerative and energy-efficient braking. Brake components are being redesigned for electric platforms. Lightweight and low-noise features are key priorities. Smart Braking Systems Integration of AI, sensors, and ADAS enables predictive and automatic braking. These systems enhance road safety and driver assistance. Demand for intelligent solutions is growing rapidly. Automotive Brake Components Market Scope: Inquiry Before Buying

Global Automotive Brake Components Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 24.36 Bn. Forecast Period 2025 to 2032 CAGR: 3.88% Market Size in 2032: USD 33.03 Bn. Segments Covered: by Product Type Brake Caliper Brake Shoe Brake Line Others by Technology ABS TCS ESC EBD by Vehicle Type Passenger Car Light Commercial Vehicle Medium & Heavy Commercial Vehicle Automotive Brake Components Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Automotive Brake Components Market, Key Players

North America 1. Bendix Commercial Vehicle Systems (USA) 2. Delphi Technologies (USA) 3. TRW Automotive (ZF Friedrichshafen AG) (USA) 4. Akebono Brake Corporation North America (USA) 5. Carlisle Brake & Friction (USA) 6. Meritor Inc. (USA) 7. Centric Parts (APEX) (USA) 8. Wagner Brake (Federal-Mogul) (USA) 9. Raybestos Brakes (Brake Parts Inc.) (USA) 10. Haldex Brake Product Types Corporation (USA) Europe 11. Brembo S.p.A. (Italy) 12. Continental AG (Germany) 13. Robert Bosch GmbH (Germany) 14. ZF Friedrichshafen AG (Germany) 15. ATE (Continental Teves) (Germany) 16. Knorr-Bremse AG (Germany) 17. Valeo SA (France) 18. Ferodo (Tenneco) (UK) 19. Hella Pagid GmbH (Germany) 20. Allied Nippon Europe Ltd. (UK) Asia-Pacific 21. Nissin Kogyo Co., Ltd. (Japan) 22. ADVICS Co., Ltd. (Japan) 23. Akebono Brake Industry Co., Ltd. (Japan) 24. Mando Corporation (South Korea) 25. Hindustan Composites Ltd. (India) 26. ASK Automotive Pvt. Ltd. (India) 27. Tata AutoComp Systems Ltd. (India) 28. Friction Materials India Pvt. Ltd. (FMIPL) (India) 29. Haldex India Ltd. (India) 30. Hitachi Astemo, Ltd. (Japan)Frequently Asked Question

1: Which region dominated the Automotive Brake Components Market in 2024? Ans: Asia-Pacific dominated due to high vehicle production in China, India, and Japan. 2: What product type led the market in 2024? Ans: Brake calipers dominated due to better heat dissipation and rising disc brake adoption. 3: Which technology was most adopted in 2024? Ans: ABS led due to regulatory mandates and cost-effective vehicle safety integration. 4: What is a key driver of market growth? Ans: Stringent safety regulations and rising demand for smart braking systems. 5: Which key player launched copper-free ceramic brake pads in 2025? Ans: ADVICS Co., Ltd. introduced copper-free ceramic brake pads to meet eco-regulations.

1. Automotive Brake Components Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Brake Components Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Technology Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Safety Instrumented : Dynamics 3.1. Region wise Trends of Automotive Brake Components Market 3.1.1. North America Automotive Brake Components Market Trends 3.1.2. Europe Automotive Brake Components Market Trends 3.1.3. Asia Pacific Automotive Brake Components Market Trends 3.1.4. Middle East and Africa Automotive Brake Components Market Trends 3.1.5. South America Automotive Brake Components Market Trends 3.2. Automotive Brake Components Market Dynamics 3.2.1. Global Automotive Brake Components Market Drivers 3.2.1.1. Demand for advanced braking systems 3.2.1.2. Increasing automotive production 3.2.1.3. Rising vehicle safety standards 3.2.2. Global Automotive Brake Components Market Restraints 3.2.3. Global Automotive Brake Components Market Opportunities 3.2.3.1. Expansion of EV brake systems 3.2.3.2. Smart braking system integration 3.2.4. Global Automotive Brake Components Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Automotive Brake Components Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Brake Caliper 4.1.2. Brake Shoe 4.1.3. Brake Line 4.1.4. Others 4.2. Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 4.2.1. ABS 4.2.2. TCS 4.2.3. ESC 4.2.4. EBD 4.3. Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 4.3.1. Passenger Car 4.3.2. Light Commercial Vehicle 4.3.3. Medium & Heavy Commercial Vehicle 4.4. Automotive Brake Components Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Automotive Brake Components Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Brake Caliper 5.1.2. Brake Shoe 5.1.3. Brake Line 5.1.4. Others 5.2. North America Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 5.2.1. ABS 5.2.2. TCS 5.2.3. ESC 5.2.4. EBD 5.3. North America Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 5.3.1. Passenger Car 5.3.2. Light Commercial Vehicle 5.3.3. Medium & Heavy Commercial Vehicle 5.4. North America Automotive Brake Components Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 5.4.1.1.1. Brake Caliper 5.4.1.1.2. Brake Shoe 5.4.1.1.3. Brake Line 5.4.1.1.4. Others 5.4.1.2. United States Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 5.4.1.2.1. ABS 5.4.1.2.2. TCS 5.4.1.2.3. ESC 5.4.1.2.4. EBD 5.4.1.3. United States Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.1.3.1. Passenger Car 5.4.1.3.2. Light Commercial Vehicle 5.4.1.3.3. Medium & Heavy Commercial Vehicle 5.4.2. Canada 5.4.2.1. Canada Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 5.4.2.1.1. Brake Caliper 5.4.2.1.2. Brake Shoe 5.4.2.1.3. Brake Line 5.4.2.1.4. Others 5.4.2.2. Canada Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 5.4.2.2.1. ABS 5.4.2.2.2. TCS 5.4.2.2.3. ESC 5.4.2.2.4. EBD 5.4.2.3. Canada Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.2.3.1. Passenger Car 5.4.2.3.2. Light Commercial Vehicle 5.4.2.3.3. Medium & Heavy Commercial Vehicle 5.4.2.4. Mexico Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 5.4.2.4.1. Brake Caliper 5.4.2.4.2. Brake Shoe 5.4.2.4.3. Brake Line 5.4.2.4.4. Others 5.4.2.5. Mexico Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 5.4.2.5.1. ABS 5.4.2.5.2. TCS 5.4.2.5.3. ESC 5.4.2.5.4. EBD 5.4.2.6. Mexico Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 5.4.2.6.1. Passenger Car 5.4.2.6.2. Light Commercial Vehicle 5.4.2.6.3. Medium & Heavy Commercial Vehicle 6. Europe Automotive Brake Components Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.3. Europe Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4. Europe Automotive Brake Components Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.1.2. United Kingdom Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.1.3. United Kingdom Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.2. France 6.4.2.1. France Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.2.2. France Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.2.3. France Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.3.2. Germany Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.3.3. Germany Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.4.2. Italy Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.4.3. Italy Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.5.2. Spain Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.5.3. Spain Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.6.2. Sweden Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.6.3. Sweden Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.7.2. Austria Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.7.3. Austria Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 6.4.8.2. Rest of Europe Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 6.4.8.3. Rest of Europe Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7. Asia Pacific Automotive Brake Components Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4. Asia Pacific Automotive Brake Components Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.1.2. China Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.1.3. China Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.2.2. S Korea Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.2.3. S Korea Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.3.2. Japan Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.3.3. Japan Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.4. India 7.4.4.1. India Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.4.2. India Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.4.3. India Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.5.2. Australia Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.5.3. Australia Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.6.2. Indonesia Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.6.3. Indonesia Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.7.2. Philippines Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.7.3. Philippines Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.8.2. Malaysia Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.8.3. Malaysia Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.9.2. Vietnam Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.9.3. Vietnam Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.10.2. Thailand Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.10.3. Thailand Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 7.4.11.3. Rest of Asia Pacific Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 8. Middle East and Africa Automotive Brake Components Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 8.4. Middle East and Africa Automotive Brake Components Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 8.4.1.2. South Africa Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 8.4.1.3. South Africa Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 8.4.2.2. GCC Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 8.4.2.3. GCC Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 8.4.3.2. Nigeria Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 8.4.3.3. Nigeria Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 8.4.4.2. Rest of ME&A Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 8.4.4.3. Rest of ME&A Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 9. South America Automotive Brake Components Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 9.3. South America Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 9.4. South America Automotive Brake Components Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 9.4.1.2. Brazil Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 9.4.1.3. Brazil Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 9.4.2.2. Argentina Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 9.4.2.3. Argentina Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Automotive Brake Components Market Size and Forecast, By Product Type (2024-2032) 9.4.3.2. Rest of South America Automotive Brake Components Market Size and Forecast, By Technology (2024-2032) 9.4.3.3. Rest of South America Automotive Brake Components Market Size and Forecast, By Vehicle Type (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Product Type Players) 10.1. Bendix Commercial Vehicle Systems (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. Delphi Technologies (USA) 10.3. TRW Automotive (ZF Friedrichshafen AG) (USA) 10.4. Akebono Brake Corporation North America (USA) 10.5. Carlisle Brake & Friction (USA) 10.6. Meritor Inc. (USA) 10.7. Centric Parts (APEX) (USA) 10.8. Wagner Brake (Federal-Mogul) (USA) 10.9. Raybestos Brakes (Brake Parts Inc.) (USA) 10.10. Haldex Brake Product Types Corporation (USA) 10.11. Brembo S.p.A. (Italy) 10.12. Continental AG (Germany) 10.13. Robert Bosch GmbH (Germany) 10.14. ZF Friedrichshafen AG (Germany) 10.15. ATE (Continental Teves) (Germany) 10.16. Knorr-Bremse AG (Germany) 10.17. Valeo SA (France) 10.18. Ferodo (Tenneco) (UK) 10.19. Hella Pagid GmbH (Germany) 10.20. Allied Nippon Europe Ltd. (UK) 10.21. Nissin Kogyo Co., Ltd. (Japan) 10.22. ADVICS Co., Ltd. (Japan) 10.23. Akebono Brake Industry Co., Ltd. (Japan) 10.24. Mando Corporation (South Korea) 10.25. Hindustan Composites Ltd. (India) 10.26. ASK Automotive Pvt. Ltd. (India) 10.27. Tata AutoComp Systems Ltd. (India) 10.28. Friction Materials India Pvt. Ltd. (FMIPL) (India) 10.29. Haldex India Ltd. (India) 10.30. Hitachi Astemo, Ltd. (Japan) 11. Key Findings 12. Analyst Recommendations 13. Automotive Brake Components Market: Research Methodology