Gas Separation Membranes Market size was valued at USD 1093.27 Mn. in 2024, and the total revenue is expected to grow at a CAGR of 6.7% from 2025-2032, reaching nearly USD 1836.72 Mn.Gas Separation Membranes Market Overview

Gas Separation Membranes are semi-permeable barriers that selectively filter and separate specific gases (e.g., O₂, N₂, CO₂, H₂) from mixed gas streams based on molecular size, solubility, or diffusion rates. These membranes enable energy-efficient, compact, and cost-effective gas purification for industries like energy, healthcare, and manufacturing, replacing traditional methods like cryogenic distillation or absorption. The gas separation membranes market is driven by rising demand for clean energy (H₂, biogas), carbon capture, and industrial gas processing, while supply grows with advanced material innovations (graphene, MOFs) and expanding production capacities by key players. North America dominates the gas separation membranes market, led by Air Products, Honeywell, and MTR, driven by clean energy demand and strict emissions regulations. Europe and Asia-Pacific follow, with key players like Air Liquide, Evonik, and Ube Industries expanding in hydrogen and CCUS applications.To know about the Research Methodology :- Request Free Sample Report

Gas Separation Membranes Market Dynamics

Rising Demand for Clean Energy and Carbon Capture Technologies to Drive Gas Separation Membranes Market The gas separation membranes market is driven by the growing demand for clean energy, particularly hydrogen purification and carbon capture (CCUS). Stricter environmental regulations and the shift toward low-carbon industries boost adoption, as membranes offer energy-efficient, cost-effective separation compared to traditional methods. Expansion in natural gas processing, biogas upgrading, and petrochemical applications further accelerates market growth.High Material Costs and Limited Durability to Restraint Gas Separation Membranes Market

High production costs of advanced materials (e.g., polyimide, MOFs) and membrane degradation under harsh conditions (high temperatures, contaminants) hinder market expansion. Additionally, competition from cryogenic and adsorption-based separation methods limits adoption in some industries.Advancements in Nanotechnology and Hybrid Membranes to Create Gas Separation Membranes Market Opportunity

Innovations in mixed-matrix membranes (MMMs), graphene oxide, and AI-optimized designs present growth opportunities. Emerging applications in blue/green hydrogen production, direct air capture (DAC), and biogas refining create new revenue streams, especially in North America, Europe, and Asia-Pacific markets.Gas Separation Membranes Market Segment Analysis

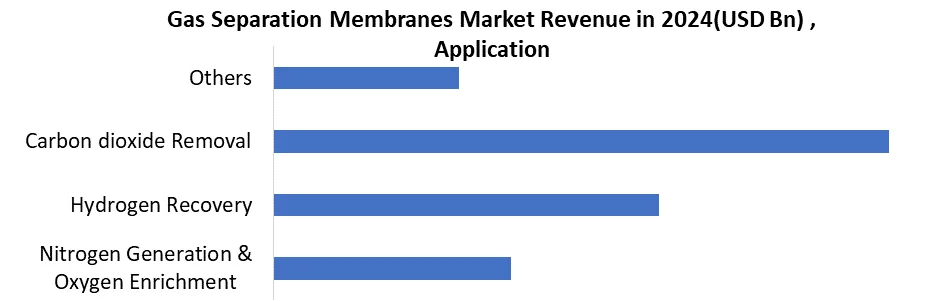

Based on Material, the Gas Separation Membranes Market is segmented into Polyimide & Polyaramide, Polysulfone, Cellulose Acetate and others. Polyimide & Polyaramide segment dominated Gas Separation Membranes Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to its better chemical resistance, high thermal stability and dominance due to excellent selection for gas pairs like CO2/CH4 and O2/N2. These polymers are widely used due to natural gas processing, petrochemicals and carbon captures due to their durability. Their ability to maintain performance at high temperatures and pressures gives them an edge over other materials such as polysulphone and cellulose acetate, which have boundaries in the extreme environment. The increasing demand for energy-efficient and durable separation technologies further enhances their adoption. Based on Application, the market is segmented into Carbon dioxide Removal, Nitrogen Generation & Oxygen Enrichment, Hydrogen Recovery and Others. Carbon dioxide Removal segment dominated Gas Separation Membranes Market in 2024 and is expected to hold the largest market share over the forecast period. Dominance due to increasing investment in stringent emission rules and carbon capture, use and storage (CCUS). The membrane is widely used in natural gas processing, biogas upgrading and flue gas treatment due to their energy efficiency, scalability and low operating costs compared to amine scrubbing. Net-zero emissions and push for growing adoption in oil and gas, power plants and chemical industries further increase demand. While hydrogen recovery and nitrogen generations are increasing, CO, removal is the largest section due to immediate climate policies and expansion of CCUs projects worldwide.

Gas Separation Membranes Market Regional Analysis

Asia Pacific region is expected to dominate the market during the forecast period 2025-2032. Asia Pacific region is expected to hold the largest market share of xx% by 2032. This is due to increasing industrialization in the region, which drives market growth. Market growth is expected to be driven by increased attention on CO2 reduction and rising biogas consumption in countries such as Indonesia, China, and India. The demand for carbon dioxide removal from reservoirs, increased demand for sanitation and freshwater, increased urbanisation, and a higher standard of living are all driving this growth. The market in the region is expected to grow rapidly as a result of rapid growth and innovation, as well as industry consolidations. However, in China, the oil and gas industry are one of the most important users of gas separation membranes. Over the last two decades, China has been investing to boost its refining capacity in response to its increasing economy. Furthermore, China has consistently increased its refining capacity for all types of crudes over a lengthy period of time. According to the Institute for Energy Research, China's refining capacity is expected to reach 20 million barrels by the end of 2025, resulting in a surge in demand for gas separation membranes during the forecast period. The objective of the report is to present a comprehensive analysis of the Global Gas Separation Membranes Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Gas Separation Membranes Market dynamic and structure by analyzing the market segments and projecting the Global market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the market make the report investor’s guide.Gas Separation Membranes Market Competitive Landscape

The fuel separation membranes market is dominated by Air Liquide (France) and Honeywell UOP (USA), with Air Liquide leveraging leadership in hydrogen purification and carbon seize (CCUS) via advanced polyimide and MOF-based membranes, at the same time as Honeywell UOP, with USD xx billion in its Performance Materials phase, excels in herbal fuel processing (CO₂/CH₄ separation) and nitrogen technology the usage of its proprietary Prism spiral-wound membranes. Both companies keep an aggressive aspect through modern R&D, strategic power sector partnerships, and worldwide deliver chains, with Air Liquide specializing in blue hydrogen and biogas upgrading and Honeywell advancing direct air capture (DAC) and high-strain gas separation, leaving smaller players like Schlumberger and Fujifilm to compete in niche applications.Gas Separation Membranes Market Recent Development

• Growing Demand for Carbon Capture (CCUS) – Rising investments in carbon capture, utilization, and storage (CCUS) drive membrane adoption for efficient CO₂ separation from flue gas and natural gas. • Hydrogen Purification Boom – With the clean energy transition, gas separation membranes are increasingly used for hydrogen production and purification (e.g., blue/green hydrogen). • Advanced Material Innovations – Development of mixed-matrix membranes (MMMs) incorporating MOFs, graphene oxide, and nanoparticles to enhance selectivity and permeability. • Shift Toward Energy-Efficient Processes – Industries favor membrane-based separation over traditional methods (like amine scrubbing) due to lower energy consumption and operational costs.

Date Company Country Recent Development 12 May 2024 Air Liquide France Unveiled high-flux carbon molecular sieve membranes for oxygen-enriched combustion in power plants. 05 Mar 2024 Honeywell UOP USA Commercialized integrated membrane-adsorption system for helium recovery from natural gas. 22 Feb 2024 Schlumberger USA Deployed first offshore membrane-based CO₂ removal platform in North Sea gas fields. 30 Jan 2024 Fujifilm Japan Developed ultra-thin composite membranes for hydrogen purification in fuel cell vehicles. 12 Jan 2025 DuPont USA Initiated membrane production facility expansion in Singapore for Asian market growth.Gas Separation Membranes Market Recent Trend Gas Separation Membranes Market Scope: Inquiry Before Buying

Global Gas Separation Membranes Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1093.27 Mn. Forecast Period 2025 to 2032 CAGR: 6.7% Market Size in 2032: USD 1836.72 Mn. Segments Covered: by Material Polyimide & Polyaramide Polysulfone Cellulose Acetate others by Module Type Spiral wound Hollow fiber Plate and frame Others (Capillary and Tubular) by Application Nitrogen Generation & Oxygen Enrichment Hydrogen Recovery Carbon dioxide Removal Others Gas Separation Membranes Key Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Gas Separation Membranes Key Players are:

North America 1. Air Products and Chemicals, Inc. (USA) 2. Honeywell International Inc. (USA) 3. Membrane Technology and Research, Inc. (MTR) (USA) 4. Generon IGS, Inc. (USA) 5. Parker Hannifin Corp. (Parker Balston) (USA) Europe 1. Evonik Industries AG – Germany 2. Air Liquide Advanced Separations (Medal) – France 3. Siemens Energy AG – Germany 4. DMT Environmental Technology – Netherlands 5. GVS S.p.A. – Italy Asia Pacific 1. Ube Industries, Ltd. – Japan 2. Toray Industries, Inc. – Japan 3. Mitsubishi Chemical Corporation – Japan 4. Fujifilm Holdings Corporation – Japan Middle East and Africa 1. Saudi Basic Industries Corporation (SABIC) – Saudi Arabia 2. Qatar Fuel Additives Company (QAFAC) – Qatar 3. DUBAL Holding (Emirates Global Aluminium) – UAE South America 1. Braskem S.A. – Brazil 2. White Martins (Praxair/Linde plc) – BrazilFrequently Asked Questions:

1] Which region is expected to hold the highest share in the Gas Separation Membranes Market? Ans. Asia Pacific is expected to hold the highest share in the Gas Separation Membranes Market. 2] Who are the top key players in the Gas Separation Membranes Market? Ans. Air Products and Chemicals Inc., Air Liquide Advanced Separations LLC and Fujifilm Manufacturing Europe B.V. are the top key players in the Gas Separation Membranes Market. 3] Which segment is expected to hold the largest market share in the Gas Separation Membranes Market by 2032? Ans. Polyimide & Polyaramide material segment is expected to hold the largest market share in the Gas Separation Membranes Market by 2032. 4] What is the market size of the Gas Separation Membranes Market by 2032? Ans. The market size of the Gas Separation Membranes Market is expected to reach USD 1836.72 Mn. by 2032. 5] What was the market size of the Gas Separation Membranes Market in 2024? Ans. The market size of the Gas Separation Membranes Market was worth USD 1093.27Mn. in 2024.

1. Gas Separation Membranes Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Gas Separation Membranes Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Headquarter 2.4.3. Business Segment 2.4.4. End-user Segment 2.4.5. Revenue (2024) 2.4.6. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Gas Separation Membranes Market: Dynamics 3.1. Region wise Trends of Gas Separation Membranes Market 3.1.1. North America Gas Separation Membranes Market Trends 3.1.2. Europe Gas Separation Membranes Market Trends 3.1.3. Asia Pacific Gas Separation Membranes Market Trends 3.1.4. Middle East and Africa Gas Separation Membranes Market Trends 3.1.5. South America Gas Separation Membranes Market Trends 3.2. Gas Separation Membranes Market Dynamics 3.2.1. Global Gas Separation Membranes Market Drivers 3.2.1.1. Rising Demand for Clean Energy & Hydrogen Economy 3.2.1.2. Stringent Environmental Regulations 3.2.2. Global Gas Separation Membranes Market Restraints 3.2.3. Global Gas Separation Membranes Market Opportunities 3.2.3.1. Expansion of Hydrogen Economy 3.2.3.2. Biogas & Renewable Natural Gas (RNG) Upgrading 3.2.4. Global Gas Separation Membranes Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Regulatory Divergence 3.4.2. Demographic Shifts 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Gas Separation Membranes Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 4.1. Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 4.1.1. Polyimide & Polyaramide 4.1.2. Polysulfone 4.1.3. Cellulose Acetate 4.1.4. others 4.2. Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 4.2.1. Spiral wound 4.2.2. Hollow fiber 4.2.3. Plate and frame 4.2.4. Others (Capillary and Tubular) 4.3. Gas Separation Membranes Market Size and Forecast, By Application (2024-2032) 4.3.1. Nitrogen Generation & Oxygen Enrichment 4.3.2. Hydrogen Recovery 4.3.3. Carbon dioxide Removal 4.3.4. Others 4.4. Gas Separation Membranes Market Size and Forecast, by region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Gas Separation Membranes Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 5.1. North America Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 5.1.1. Polyimide & Polyaramide 5.1.2. Polysulfone 5.1.3. Cellulose Acetate 5.1.4. others 5.2. North America Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 5.2.1. Spiral wound 5.2.2. Hollow fiber 5.2.3. Plate and frame 5.2.4. Others (Capillary and Tubular) 5.3. North America Gas Separation Membranes Market Size and Forecast, By Application (2024-2032) 5.3.1. Nitrogen Generation & Oxygen Enrichment 5.3.2. Hydrogen Recovery 5.3.3. Carbon dioxide Removal 5.3.4. Others 5.4. North America Gas Separation Membranes Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 5.4.1.1.1. Polyimide & Polyaramide 5.4.1.1.2. Polysulfone 5.4.1.1.3. Cellulose Acetate 5.4.1.1.4. others 5.4.1.2. United States Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 5.4.1.2.1. Spiral wound 5.4.1.2.2. Hollow fiber 5.4.1.2.3. Plate and frame 5.4.1.2.4. Others (Capillary and Tubular) 5.4.1.3. others United States Gas Separation Membranes Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Nitrogen Generation & Oxygen Enrichment 5.4.1.3.2. Hydrogen Recovery 5.4.1.3.3. Carbon dioxide Removal 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 5.4.2.1.1. Polyimide & Polyaramide 5.4.2.1.2. Polysulfone 5.4.2.1.3. Cellulose Acetate 5.4.2.1.4. others 5.4.2.2. Canada Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 5.4.2.2.1. Spiral wound 5.4.2.2.2. Hollow fiber 5.4.2.2.3. Plate and frame 5.4.2.2.4. Others (Capillary and Tubular) 5.4.2.3. Canada Gas Separation Membranes Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Nitrogen Generation & Oxygen Enrichment 5.4.2.3.2. Hydrogen Recovery 5.4.2.3.3. Carbon dioxide Removal 5.4.2.3.4. Others 5.4.2.4. Mexico Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 5.4.2.4.1. Polyimide & Polyaramide 5.4.2.4.2. Polysulfone 5.4.2.4.3. Cellulose Acetate 5.4.2.4.4. others 5.4.2.5. Mexico Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 5.4.2.5.1. Spiral wound 5.4.2.5.2. Hollow fiber 5.4.2.5.3. Plate and frame 5.4.2.5.4. Others (Capillary and Tubular) 5.4.2.6. Mexico Gas Separation Membranes Market Size and Forecast, By Application (2024-2032) 5.4.2.6.1. Nitrogen Generation & Oxygen Enrichment 5.4.2.6.2. Hydrogen Recovery 5.4.2.6.3. Carbon dioxide Removal 5.4.2.6.4. Others 6. Europe Gas Separation Membranes Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 6.1. Europe Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.2. Europe Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.3. Europe Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4. Europe Gas Separation Membranes Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.1.2. United Kingdom Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.1.3. United Kingdom Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4.2. France 6.4.2.1. France Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.2.2. France Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.2.3. France Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.3.2. Germany Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.3.3. Germany Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.4.2. Italy Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.4.3. Italy Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.5.2. Spain Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.5.3. Spain Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.6.2. Sweden Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.6.3. Sweden Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.7.2. Austria Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.7.3. Austria Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 6.4.8.2. Rest of Europe Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 6.4.8.3. Rest of Europe Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7. Asia Pacific Gas Separation Membranes Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 7.1. Asia Pacific Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.2. Asia Pacific Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.3. Asia Pacific Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4. Asia Pacific Gas Separation Membranes Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.1.2. China Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.1.3. China Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.2.2. S Korea Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.2.3. S Korea Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.3.2. Japan Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.3.3. Japan Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.4. India 7.4.4.1. India Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.4.2. India Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.4.3. India Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.5.2. Australia Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.5.3. Australia Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.6.2. Indonesia Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.6.3. Indonesia Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.7.2. Philippines Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.7.3. Philippines Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.8.2. Malaysia Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.8.3. Malaysia Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.9.2. Vietnam Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.9.3. Vietnam Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.10.2. Thailand Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.10.3. Thailand Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 7.4.11.2. Rest of Asia Pacific Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 7.4.11.3. Rest of Asia Pacific Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 8. Middle East and Africa Gas Separation Membranes Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 8.1. Middle East and Africa Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 8.2. Middle East and Africa Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 8.3. Middle East and Africa Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 8.4. Middle East and Africa Gas Separation Membranes Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 8.4.1.2. South Africa Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 8.4.1.3. South Africa Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 8.4.2.2. GCC Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 8.4.2.3. GCC Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 8.4.3.2. Nigeria Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 8.4.3.3. Nigeria Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 8.4.4.2. Rest of ME&A Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 8.4.4.3. Rest of ME&A Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 9. South America Gas Separation Membranes Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 9.1. South America Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 9.2. South America Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 9.3. South America Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 9.4. South America Gas Separation Membranes Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 9.4.1.2. Brazil Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 9.4.1.3. Brazil Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 9.4.2.2. Argentina Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 9.4.2.3. Argentina Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Gas Separation Membranes Market Size and Forecast, By Material (2024-2032) 9.4.3.2. Rest of South America Gas Separation Membranes Market Size and Forecast, By Module Type (2024-2032) 9.4.3.3. Rest of South America Gas Separation Membranes Market Size and Forecast, Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Air Products and Chemicals, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Honeywell International Inc. 10.3. Membrane Technology and Research, Inc. 10.4. Generon IGS, Inc. 10.5. Parker Hannifin Corp. 10.6. Evonik Industries AG 10.7. Air Liquide Advanced Separations (Medal) 10.8. Siemens Energy AG 10.9. DMT Environmental Technology 10.10. GVS S.p.A. 10.11. Ube Industries, Ltd. 10.12. Toray Industries, Inc. 10.13. Mitsubishi Chemical Corporation 10.14. Fujifilm Holdings Corporation 10.15. Saudi Basic Industries Corporation (SABIC) 10.16. Qatar Fuel Additives Company (QAFAC) 10.17. DUBAL Holding (Emirates Global Aluminium) 10.18. Braskem S.A. 10.19. White Martins (Praxair/Linde plc) 11. Key Findings 12. Analyst Recommendations 13. Gas Separation Membranes Market: Research Methodology