The Companion Animal Health Market Size was valued at USD 26.48 Billion in 2025, and the total revenue is expected to grow at a CAGR of 9.87% from 2026 to 2032, reaching USD 51.48 Billion by 2032Companion Animal Health Market Overview

The global Companion Animal Health Market is experiencing robust growth, driven by surging pet populations, rising disposable incomes, and increased pet humanisation globally. As of 2024, the global pet population continues to expand rapidly, with countries such as the USA, China, the EU, Brazil, and Australia leading in pet ownership rates and expenditures. For instance, the United States alone houses nearly 398 million pets, including 110 million dogs and 81.5 million cats, reflecting a penetration rate of 70% pet ownership among households in 2025. China’s pet population has increased by 113% from 2020 to 2024, driven by relaxed ownership restrictions and demographic shifts. South Korea witnessed a 50% growth in pet ownership from 5 million in 2020 to 7.5 million pets by 2025.To know about the Research Methodology :- Request Free Sample Report

Key Market Highlights

• The U.S. companion animal health market spends nearly USD 103 billion annually, with 36% allocated to veterinary services. • In 2025, Veterinary pharmaceuticals and vaccines constitute over 62% of the market portfolio, with antimicrobials decreasing due to rising disease prevention focus. • The global companion animal diagnostics market was USD 4.6 billion in 2025, growing at a CAGR of 9%. • Industry R&D investments are high, with leading companies allocating up to 10% of revenue to innovation. • Increasing adoption of digital technologies such as wearables and smart diagnostics for precision care. • Rising concerns over antimicrobial resistance (AMR) are driving vaccine adoption and reducing antibiotic use.

Companion Animal Health Market Dynamics

Increasing Global Pet Ownership and Humanization Trends The global surge in pet ownership is a primary growth driver for the Companion Animal Health Market. In China, the rapid population growth is intensifying demand for veterinary pharmaceuticals, diagnostics, and wellness products. The humanisation trend has transformed pets into family members, boosting spending on veterinary care. U.S. pet owners spend an average of USD 1,137 annually, with USD 35.5 billion allocated to veterinary services alone, supporting longer, healthier pet lives.Advances in Veterinary Medicine and Preventive Care to Drive the Market Growth Innovations in vaccines, immunotherapies, and diagnostics have strengthened preventive care for pets, reducing the incidence of infectious diseases. The shift away from antimicrobials, whose share fell by 39% from 2022 to 2024, towards vaccines and parasiticides highlights increased emphasis on disease prevention. Preventive care reduces treatment costs and supports sustainable pet health management, reinforcing Companion Animal Health Market growth globally. Companion Animal Health Market Opportunity: The adoption of digital monitoring tools, including smart collars, wearables, and AI-based diagnostics, opens significant growth avenues. The global companion animal diagnostics market, valued at USD 5.6 billion in 2024-2025 and growing at 9.2% CAGR, reflects rising demand for early disease detection and wellness tracking. These technologies improve pet care outcomes, increase owner engagement, and support sustainable animal health management, especially in tech-savvy markets such as North America and Europe.

The Companion Animal Health Market is significantly impacted by the high pet populations in regions such as the EU (113 million pets), the USA (85 million pets), and China (74 million pets) in 2025. The growing number of pets in these markets drives increased demand for veterinary services, medications, and pet care products, boosting market growth.

Challenges from Antimicrobial Resistance (AMR)

AMR remains a major global health threat impacting companion animal care and is expected to restrain the Companion Animal Health Market growth. Though global antimicrobial use in animals decreased by 5% from 102 mg/kg to 97 mg/kg of animal biomass between 2020 and 2024, regional disparities persist. The Middle East, for example, reported a 43% increase in antimicrobial use, underscoring uneven regulatory enforcement. This challenge forces stricter controls on antibiotic use, raising the need for more vaccines and alternative therapies, which require significant R&D and infrastructure investments, slowing growth in some regions.Import-Export Trends

• The U.S., EU, and China dominate imports and exports of veterinary pharmaceuticals and diagnostics. China is rapidly emerging as both a major consumer and manufacturer, leveraging relaxed pet ownership policies. • South American countries are importing advanced diagnostics and vaccines due to limited domestic production capabilities. • Europe leads in exporting high-quality veterinary vaccines and pet healthcare products globally.Companion Animal Health Market Segment Analysis

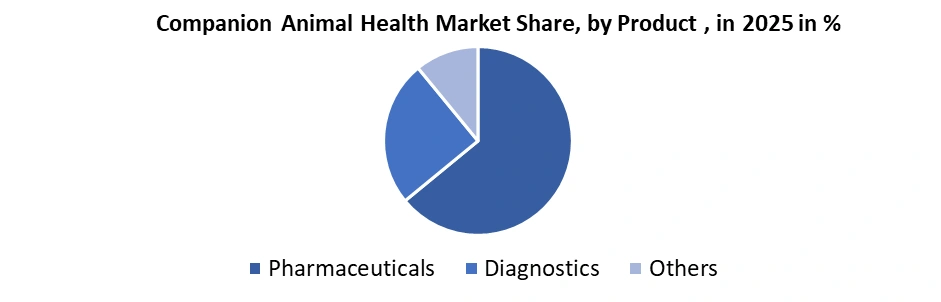

By Product: In 2025, the pharmaceuticals segment dominated the Companion Animal Health Market share, driven by innovations in veterinary drugs such as parasiticides, antibiotics, and anti-inflammatories. For example, Boehringer Ingelheim launched NexGard SPECTRA in India, targeting dogs aged two months and above. The diagnostics segment is poised for rapid growth due to rising disease prevalence, with companies like IDEXX introducing advanced tests for early detection of conditions such as kidney injury in pets.

Companion Animal Health Market Regional Analysis

North America: Dominated the largest Companion Animal Health Market share in 2025 and contributed. The region leads in veterinary infrastructure, digital health adoption, and R&D investment. Europe: Countries like Germany, France, and the UK have matured Companion Animal Health Market, focusing on preventive care and veterinary innovation, driving steady growth. Asia-Pacific: The fastest-growing region, led by China, Japan, and South Korea, was in 2025. Increasing disposable incomes and pet humanisation are key drivers.Competitive Landscape

The Companion Animal Health Market is led by Zoetis Inc., Elanco Animal Health, Boehringer Ingelheim, Merial, and Idexx Laboratories, collectively investing over 7% of revenue in R&D in 2025. Zoetis focuses on AI diagnostics; Elanco drives growth via acquisitions; Boehringer emphasizes vaccines in emerging markets. Idexx dominates diagnostics with a USD 4.6 billion market share. Key strategies include digital health expansion, Asia-Pacific growth, and antimicrobial alternatives to capture a market growing at 8%+ CAGR globally. Recent Strategic Product Launches & Innovations in the Companion Animal Health MarketIn 2025, the companion animal health industry is intensifying its focus on R&D, with expenditure averaging 7.3% of sales, nearly double the overall manufacturing sector average. Innovations in veterinary vaccines are playing a crucial role in disease prevention and combating antimicrobial resistance (AMR), a growing global concern. Additionally, the adoption of digital health technologies, including wearables and smart monitoring devices, is transforming pet wellness management. Emphasising the One Health approach, industry leaders continue to advance breakthroughs in immunotherapies, diagnostics, and senior pet care to enhance pet longevity and overall animal health.

Month & Year Company Product / Innovation Technology / Focus Area Target Animals Key Strategic Impact June 2024 Merck Animal Health (Merck & Co., Inc.) NOBIVAC NXT Rabies Portfolio (NOBIVAC NXT Feline-3 Rabies, NOBIVAC NXT Canine-3 Rabies) Advanced RNA-particle vaccine technology Cats and Dogs Strengthens rabies prevention with next-generation vaccine technology; enhances long-term immunity and safety profile in companion animals January 2024 TheraVet BIOCERA-VET Product Line Osteoarticular disease management solutions Companion animals (primarily dogs & cats) Geographic expansion into Germany improves access to advanced orthopaedic treatments for pet owners January 2024 Zoetis Inc. Vetscan Imagyst – AI Urine Sediment Analysis Integration AI-powered veterinary diagnostics Dogs and Cats Accelerates in-clinic diagnostics; improves accuracy and speed of treatment decisions through AI-driven analysis Companion Animal Health Market Scope: Inquire before buying

Global Companion Animal Health Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 26.48 Bn. Forecast Period 2026 to 2032 CAGR: 9.87% Market Size in 2032: USD 51.48 Bn. Segments Covered: by Animal Canine Feline Equine Avian Others by Product Pharmaceuticals Diagnostics Others by Distribution Channel Retail E-commerce Hospital pharmacies by End-Use Industry Point-of-care/In-house testing Hospitals & Clinics Others Companion Animal Health Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Companion Animal Health Market, Key Players

1. Zoetis Inc. 2. Boehringer Ingelheim Animal Health 3. Elanco Animal Health 4. Merck Animal Health 5. Virbac S.A. 6. Ceva Santé Animale 7. Vetoquinol S.A. 8. IDEXX Laboratories, Inc. 9. Dechra Pharmaceuticals PLC 10. Hill’s Pet Nutrition, Inc. 11. Phibro Animal Health Corporation 12. PetIQ, Inc. 13. Thermo Fisher Scientific Inc. 14. bioMérieux SA 15. Norbrook Laboratories Ltd. 16. Neogen Corporation 17. Zoetis Diagnostics 18. Ourofino Saúde Animal 19. HIPRA 20. B. Braun Vet Care 21. Mars Petcare (Animal Health) 22. Heska Corporation 23. Hester Biosciences Limited 24. Indical Bioscience GmbH 25. Others FAQ: 1. What is the size of the Global Companion Animal Health Market? Ans: The market was valued at USD 26.48 billion in 2025 and is expected to reach USD 51.48 billion by 2032, growing at a CAGR of 9.87%. 2. Which regions dominate the Companion Animal Health Market? Ans: North America, Europe, and Asia-Pacific lead, with the U.S. and China showing significant pet ownership growth. 3. Who are the key players in the Companion Animal Health Market? Ans: Top companies include Zoetis, Boehringer Ingelheim, Elanco, Merck, and IDEXX Laboratories. 4. What trends are driving market growth? Ans: Rising pet ownership, advances in vaccines, AI diagnostics, and digital pet health tools boost growth. 5. How does antimicrobial resistance affect the market? Ans: AMR limits antibiotic use, increasing demand for vaccines and alternative therapies, impacting market dynamics.

1. Companion Animal Health Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Companion Animal Health Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. End-User 2.3.5. Total Company Revenue (2025) 2.3.6. Certifications 2.3.7. Global Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Recent Developments 2.7. Market Positioning & Share Analysis 2.7.1. Company Revenue, Companion Animal Health Revenue, and Market Share (%) 2.7.2. MMR Competitive Positioning 2.8. Strategic Developments & Partnerships 2.8.1. Mergers, acquisitions, and joint ventures 2.8.2. Expansion into emerging markets 2.8.3. Strategic alliances with OEMs or system integrators 2.8.4. Investments in new production facilities 2.8.5. Sustainability initiatives and green product launches 3. Companion Animal Health Market: Dynamics 3.1. Companion Animal Health Market Trends 3.2. Companion Animal Health Market Dynamics 3.2.1. North America 3.2.2. Europe 3.2.3. Asia Pacific 3.2.4. Middle East and Africa 3.2.5. South America 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 4. Companion Animal Health Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 4.1. Companion Animal Health Market Size and Forecast, by Animal (2025-2032) 4.1.1. Canine 4.1.2. Feline 4.1.3. Equine 4.1.4. Avian 4.1.5. Others 4.2. Companion Animal Health Market Size and Forecast, By Product (2025-2032) 4.2.1. Pharmaceuticals 4.2.2. Diagnostics 4.2.3. Others 4.3. Companion Animal Health Market Size and Forecast, by Distribution Channel (2025-2032) 4.3.1. Retail 4.3.2. E-commerce 4.3.3. Hospital pharmacies 4.4. Companion Animal Health Market Size and Forecast, by End-use Industry (2025-2032) 4.4.1. Point-of-care/In-house testing 4.4.2. Hospitals & Clinics 4.4.3. Others 4.5. Companion Animal Health Market Size and Forecast, by Region (2025-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Companion Animal Health Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 5.1. North America Companion Animal Health Market Size and Forecast, by Animal (2025-2032) 5.2. North America Companion Animal Health Market Size and Forecast, By Product (2025-2032) 5.3. North America Companion Animal Health Market Size and Forecast, by Distribution Channel (2025-2032) 5.4. North America Companion Animal Health Market Size and Forecast, by End-use Industry (2025-2032) 5.5. North America Companion Animal Health Market Size and Forecast, by Country (2025-2032) 5.5.1. United States 5.5.2. Canada 5.5.3. Mexico 6. Europe Companion Animal Health Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 6.1. Europe Companion Animal Health Market Size and Forecast, by Animal (2025-2032) 6.2. Europe Companion Animal Health Market Size and Forecast, By Product (2025-2032) 6.3. Europe Companion Animal Health Market Size and Forecast, by Distribution Channel (2025-2032) 6.4. Europe Companion Animal Health Market Size and Forecast, by End-use Industry (2025-2032) 6.5. Europe Companion Animal Health Market Size and Forecast, by Country (2025-2032) 6.5.1. United Kingdom 6.5.2. France 6.5.3. Germany 6.5.4. Italy 6.5.5. Spain 6.5.6. Sweden 6.5.7. Austria 6.5.8. Rest of Europe 7. Asia Pacific Companion Animal Health Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 7.1. Asia Pacific Companion Animal Health Market Size and Forecast, by Animal (2025-2032) 7.2. Asia Pacific Companion Animal Health Market Size and Forecast, By Product (2025-2032) 7.3. Asia Pacific Companion Animal Health Market Size and Forecast, by Distribution Channel (2025-2032) 7.4. Asia Pacific Companion Animal Health Market Size and Forecast, by End-use Industry (2025-2032) 7.5. Asia Pacific Companion Animal Health Market Size and Forecast, by Country (2025-2032) 7.5.1. China 7.5.2. S Korea 7.5.3. Japan 7.5.4. India 7.5.5. Australia 7.5.6. Indonesia 7.5.7. Malaysia 7.5.8. Vietnam 7.5.9. Taiwan 7.5.10. Rest of Asia Pacific 8. Middle East and Africa Companion Animal Health Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 8.1. Middle East and Africa Companion Animal Health Market Size and Forecast, by Animal (2025-2032) 8.2. Middle East and Africa Companion Animal Health Market Size and Forecast, By Product (2025-2032) 8.3. Middle East and Africa Companion Animal Health Market Size and Forecast, by Distribution Channel (2025-2032) 8.4. Middle East and Africa Companion Animal Health Market Size and Forecast, by End-use Industry (2025-2032) 8.5. Middle East and Africa Companion Animal Health Market Size and Forecast, by Country (2025-2032) 8.5.1. South Africa 8.5.2. GCC 8.5.3. Egypt 8.5.4. Nigeria 8.5.5. Rest of ME&A 9. South America Companion Animal Health Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 9.1. South America Companion Animal Health Market Size and Forecast, by Animal (2025-2032) 9.2. South America Companion Animal Health Market Size and Forecast, By Product (2025-2032) 9.3. South America Companion Animal Health Market Size and Forecast, by Distribution Channel (2025-2032) 9.4. South America Companion Animal Health Market Size and Forecast, by End-use Industry (2025-2032) 9.5. South America Companion Animal Health Market Size and Forecast, by Country (2025-2032) 9.5.1. Brazil 9.5.2. Argentina 9.5.3. Chile 9.5.4. Colombia 9.5.5. Rest Of South America 10. Company Profile: Key Players 10.1. Zoetis Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Boehringer Ingelheim Animal Health 10.3. Elanco Animal Health 10.4. Merck Animal Health 10.5. Virbac S.A. 10.6. Ceva Santé Animale 10.7. Vetoquinol S.A. 10.8. IDEXX Laboratories, Inc. 10.9. Dechra Pharmaceuticals PLC 10.10. Hill’s Pet Nutrition, Inc. 10.11. Phibro Animal Health Corporation 10.12. PetIQ, Inc. 10.13. Thermo Fisher Scientific Inc. 10.14. bioMérieux SA 10.15. Norbrook Laboratories Ltd. 10.16. Neogen Corporation 10.17. Zoetis Diagnostics 10.18. Ourofino Saúde Animal 10.19. HIPRA 10.20. B. Braun Vet Care 10.21. Mars Petcare (Animal Health) 10.22. Heska Corporation 10.23. Hester Biosciences Limited 10.24. Indical Bioscience GmbH 10.25. Others 11. Key Findings 12. Industry Recommendations 13. Companion Animal Health Market: Research Methodology C