Collapsible Crate Market size was valued at USD 3.9 Billion in 2024 and the total Global Collapsible Crate Market revenue is expected to grow at a CAGR of 5.9% from 2025 to 2032, reaching nearly USD 6.17 Billion.Collapsible Crate Market Overview

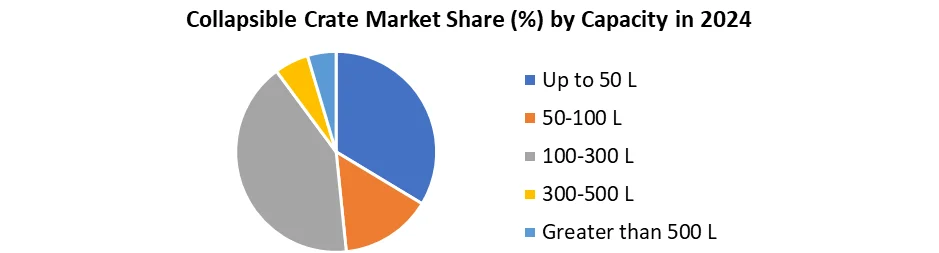

Collapsible crates are reusable, foldable storage and transportation containers designed to save space when not in use. Made of durable materials like plastic, they provide skilled, stacked and cost-effective packaging solutions for various industries such as food, pharmaceuticals and logistics. Global Collapsible Crates Market driven by increasing demand for sustainable, space-savinga as well as reusable packaging solutions across various industries like food & beverage, pharmaceuticals, agriculture and logistics. These crates offer efficient storage and transportation advantages by folding flat when not in use thereby reducing return logistics costs and warehouse space. Fuelling market growth include the rise in e-commerce, rapid industrialization and increasing urbanization, particularly in developing economies. The growing need for efficient and hygienic packaging in the food sector and the shift toward eco-friendly logistics practices are also propelling demand. The expanding retail and FMCG sectors, especially in Asia Pacific, dominated region, accounting for approximately 38% of the global market share in 2024, with a market value of around USD 1.9 billion. The 100–300 L capacity segment dominates the market due to its versatility and widespread use across industrial and commercial sectors. Major players shaping the competitive landscape include Mycrates, Enko Plastics, Shanghai Join Plastic Products Co., Ltd. and ORBIS Corporation. The growing demand for strong, cost-effective as well as environmentally friendly packaging solutions continues to drive the global collapsible crates market.To know about the Research Methodology:-Request Free Sample Report

Collapsible Crate Market Dynamics:

Industrialization and Demand for Efficient Packaging Solutions to Drive the Collapsible Crate Market Growth

These are majorly used by the End-Users Industry such as food and beverage, pharmaceutical, consumer goods, and industrial goods as these are used for storing spaces when not in use for solving the trouble that is faced during transportation and warehousing. Shipments across boundaries are made through emerging e-commerce. A wide range of consumer and industrial goods export is done through the brand owners and manufacturers. The food and Beverage industry produces fresh and processed food that is predominantly supplied by manufacturers. Crates make packaging format easy to handle and also stacking ability that allows a reduction in storage spaces. The collapsible crates are foldable, allowing easy storage. Collapsible crates enable stacking of crates which not only reduces space needed for storage compared to crates with fixed dimensions but also provides safety against damage to the goods to be transported. Additionally, the collapsible crates are collapsible, and they can be shipped back to their source, which can result in saving on return costs, which enhances profit margins for the brand owners and the shipment companies. These are creating a positive impact on the Collapsible Crates Market growth through the forecast period. This is because of the development in industrialization with global consumption. The rise in the disposable income of the people in developing countries is creating a demand for collapsible crates. Urbanization has also led to a growth in the demand for beverages and packed food, beverages, industrial goods, and pharmaceuticals. Collapsible Crates provides protective packaging solutions for packaging sensitive and fragile products. These factors have increased the demand for convenient and protective packaging solutions.Rapid Industrialization to Boost Collapsible Crates Market Growth

The rapid rise in industrialization particularly in developing economies is meaningfully growing the demand for effective and space-saving packaging solutions like collapsible crates. Global trade expands and industrial production scales up, manufacturers and suppliers are increasingly seeking packaging options that not only ensure the safe transport of goods but also optimize storage space. Collapsible crates offer durable as well as reusable alternative to traditional packaging reducing costs related to logistics and warehousing. Their ability to be folded when not in use help in maximizing available storage and reducing return shipment expenses. Industries like automotive, pharmaceuticals, electronics, and food processing are major users of collapsible crates their convenience and protection for fragile or complex goods. The standardization and stickability of these crates streamline supply chain operations, enabling faster and more efficient handling. Industrial output continues to increase demand for collapsible crates is probable to grow steadily through the forecast period.Limited Awareness in Emerging Markets to Restrain Collapsible Crates Adoption

In many developing regions the adoption of collapsible crates is hindered by a lack of awareness regarding their long-term cost-effectiveness and operational benefits. Businesses in these markets often rely on old packaging systems limited exposure to modern, reusable packaging solutions. This knowledge gap prevents them from recognizing the advantages such as space efficiency, durability as well as lower return logistics costs offered by collapsible crates. Inadequate marketing efforts and insufficient distribution systems further limit the access of these products. Despite its growing industrial and commercial activities, the entry into the market is less in emerging economies.Collapsible Crate Market Segment Analysis:

Based on Material, the Collapsible Crates Market is segmented into HDPE (high-density polyethylene), PP (Polypropylene), and others (Plywood, metals, etc.). The HDPE (high-density polyethylene) segment has dominated the largest market share accounting for 48% in 2024, and is expected to grow at a CAGR of 4% during the forecast period. The high durability of HDPE and the high carrying capacity of collapsible crates made from HDPE have led to increased preference for residential consumers and commercial customers. Recently, many manufacturers are shifting from Polypropylene (PP) to HDPE collapsible Crates because Increasing bans on the usage of polypropylene are also expected to supplement the growth of the HDPE-based collapsible crates. Based on Capacity the market is segmented into the Up to 50 L ,50 – 100 L, 100 – 300 L, 300 – 500 L, (CFC) Greater than 500 L.100-300L segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Due to its versatility and widespread usage across various industries, including food & beverage, agriculture, pharmaceuticals, and logistics. Crates in this choice offer the ideal balance between storage volume and ease of handling creation them apposite for moving both bulk a moderate load efficiently. These crates are huge enough to quarter important quantities of goods but remain compact enough for manual handling and efficient stacking. Their folding nature and reusability reduce transportation costs and save storage space, which is particularly beneficial for businesses complex in supply chain as well as warehousing operations. The high adoption rate of these crates in industrial and commercial applications contributed to their leading market share.

Collapsible Crate Market Regional Analysis

Asia Pacific region dominated the market in 2024 & is expected to hold largest share during the forecast period. Accounting for approximately 38% of the total market share, an estimated approximately 1.9 billion USD with market price. Dominance is rapidly inspired by industrialization, expands e-commerce activities, and in countries such as China, India and Japan, there is a strong demand from food and drinks, drugs and logistics segments. The average price of collapsable boxes in the Asia Pacific region is between 12 to USD 25 USD per unit, depending on the average price, material and load-bearing capacity. These competitive prices, large-scale manufacturing capabilities, as well as increasing demand for re-purpose and space-saving packaging solutions, in association with the increase in support market. This area is also experiencing sustainable packaging practices, with businesses transferring away from single-use materials. With continuous infrastructure development and increasing export activities.Collapsible Crate Market Competitive Landscape

Major Key Players like Mycrates, Enko Plastics, Shanghai Join Plastic Products Co., Ltd. form the backbone of the collapsible crate market. The collapsible crates market is vastly competitive, with key players focusing on innovation, material quality as well as cost efficiency to strengthen their market presence. Mycrates is a leading Indian manufacturer specifying in durable, foldable plastic crates tailored for the agriculture and retail sectors. In 2024, the company reported a revenue of approximately USD 42 million, maintained by strong domestic distribution and rising export demand. Mycrates is increasing production capacity to meet growing wants in food logistics as well as e-commerce. Enko Plastics, focuses on collapsible solutions for the FMCG and industrial goods sectors. With a revenue of around USD 36 million in 2024, Enko Plastics is investing in progressive injection molding technologies and recyclable material modernization to boost sustainability and efficiency. Shanghai Join Plastic Products Co., Ltd. is one of the prominent players in China, with an estimated revenue of USD 58 million in 2024. The company supplies collapsible crates to a extensive range of industries including automotive, electronics, and agriculture. Its competitive advantage mass customization and cost-effective exports. These companies make a significant contribution to the Asia Pacific market, taking advantage of the increasing demand for regional manufacturing strength, low production costs and re-purpose, space-saving packaging.Collapsible Crate Market Trends

Trends Description Sustainable Packaging Adoption Increasing preference for reusable and eco-friendly packaging solutions to reduce plastic waste. Growth of E-commerce and Retail Surge in online shopping fueling demand for durable and returnable packaging like collapsible crates. Space Optimization in Warehousing Collapsible crates help optimize storage by reducing space when not in use. Collapsible Crate Market Key Development

• In 15 March 2024 ORBIS Corporation (North America) Announced the launch of a new line of collapsible bulk containers with improved stacking strength and RFID integration for supply chain visibility. • In 10 January 2024 Schoeller Allibert (Europe) Opened a new manufacturing facility in Poland to expand production of foldable crates and meet rising European demand. • In 6 May 2024 Enko Plastics (Asia Pacific) Signed a strategic partnership with logistics firms to supply collapsible crates for food distribution centers across South Asia. • In 28 March 2024 Loadhog Ltd. (Europe) Patented a new lid-locking mechanism for improved crate safety and stackability during transportation. • In 17 April 2024 Rehrig Pacific Company (North America) Launched a collapsible transport crate tailored for last-mile delivery in urban e-commerce hubs.Collapsible Crate Market Scope: Inquire before buying

Global Collapsible Crate Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.9 Billion Forecast Period 2025 to 2032 CAGR: 5.9% Market Size in 2032: USD 6.17 Billion Segments Covered: by Capacity Up to 50L 5O-100 L 100-300 L 300-500 L (CFC) Greater than 500 L by Material HDPE (high-density polyethylene) PP (polypropylene) Others (plywood, metals, etc.) by Lid Type With Lid Collapsible Crate Lidless Collapsible Crate by End Use Industry Food & Beverages Automotive Agriculture Retail Logistics Others by Distribution Channel Offline Online Collapsible Crate Market by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Collapsible Crate Market Key Players are:

North America 1. ORBIS Corporation (U.S.) 2. Buckhorn Inc. (U.S.) 3. Rehrig Pacific Company (U.S.) 4. Monoflo International (U.S.) 5. TranPak Inc. (U.S.) Europe 6. Schoeller Allibert (Netherlands) 7. Bekuplast GmbH (Germany) 8. UTZ Group (Switzerland) 9. Loadhog Ltd. (U.K.) 10. Craemer GmbH (Germany) Asia Pacific 11. Mycrates (India) 12. Enko Plastics (India) 13. Shanghai Join Plastic Products Co., Ltd. (China) 14. Zhejiang Zhengji Plastic Industry Co., Ltd. (China) 15. Taizhou Huangyan JMT Mould Co., Ltd. (China) 16. Suzhou Huiyuan Plastic Products Co., Ltd. (China) 17. Nilkamal Ltd. (India) 18. Plastene India Ltd. (India) South America 19. Plásticos Rimax S.A. (Colombia) 20. Petropack S.A. (Argentina) 21. Cratecno (Brazil) Middle East & Africa 22. Interplast Co. Ltd. (UAE) 23. Mpact Limited (South Africa) 24. Jokey Group (UAE operations) 25. RPC Promens (South Africa)Frequently Asked Question

1: What was the market value of collapsible crates in 2024? Ans: The collapsible crate market was valued at USD 3.9 Billion in 2024. 2: Which region dominated the collapsible crate market in 2024? Ans: Asia Pacific dominated the market, holding approximately 38% of the global share. 3: What is the leading material used in collapsible crates? Ans: High-density polyethylene (HDPE) is the most widely used material due to its durability. 4: Which capacity segment dominates the collapsible crate market? Ans: The 100–300 L capacity segment dominates due to its versatility and industrial demand. 5: Name one recent development in the collapsible crate market. Ans: On 15 March 2024, ORBIS Corporation launched collapsible bulk containers with RFID integration.

1. Collapsible Crate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Collapsible Crate Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Lid Type Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Collapsible Crate Market: Dynamics 3.1. Region wise Trends of Collapsible Crate Market 3.1.1. North America Collapsible Crate Market Trends 3.1.2. Europe Collapsible Crate Market Trends 3.1.3. Asia Pacific Collapsible Crate Market Trends 3.1.4. Middle East and Africa Collapsible Crate Market Trends 3.1.5. South America Collapsible Crate Market Trends 3.2. Collapsible Crate Market Dynamics 3.2.1. Global Collapsible Crate Market Drivers 3.2.1.1. Rapid industrialization 3.2.1.2. Demand for space-saving packaging 3.2.2. Global Collapsible Crate Market Restraints 3.2.3. Global Collapsible Crate Market Opportunities 3.2.3.1. Expansion in emerging markets 3.2.3.2. Sustainable packaging solutions 3.2.4. Global Collapsible Crate Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Collapsible Crate Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 4.1.1. Up to 50 L 4.1.2. 50 – 100 L 4.1.3. 100 – 300 L 4.1.4. 300 – 500 L (CFC) 4.1.5. Greater than 500 L 4.2. Collapsible Crate Market Size and Forecast, By Material (2024-2032) 4.2.1. HDPE (high-density polyethylene) 4.2.2. PP (polypropylene) 4.2.3. Others (plywood, metals, etc.) 4.3. Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 4.3.1. With Lid Collapsible Crate 4.3.2. Lidless Collapsible Crate 4.4. Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 4.4.1. Food & Beverages 4.4.2. Automotive 4.4.3. Agriculture 4.4.4. Retail 4.4.5. Logistics 4.4.6. Others 4.5. Collapsible Crate Market Size and Forecast, By Distribution Channel 4.5.1. Offline 4.5.2. Online 4.6. Collapsible Crate Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Collapsible Crate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 5.1.1. Up to 50 L 5.1.2. 50 – 100 L 5.1.3. 100 – 300 L 5.1.4. 300 – 500 L (CFC) 5.1.5. Greater than 500 L 5.2. North America Collapsible Crate Market Size and Forecast, By Material (2024-2032) 5.2.1. HDPE (high-density polyethylene) 5.2.2. PP (polypropylene) 5.2.3. Others (plywood, metals, etc.) 5.3. North America Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 5.3.1. With Lid Collapsible Crate 5.3.2. Lidless Collapsible Crate 5.4. North America Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 5.4.1. Food & Beverages 5.4.2. Automotive 5.4.3. Agriculture 5.4.4. Retail 5.4.5. Logistics 5.4.6. Others 5.5. North America Collapsible Crate Market Size and Forecast, by Distribution Channel 5.5.1. Offline 5.5.2. Online 5.6. North America Collapsible Crate Market Size and Forecast, by Country (2024-2032) 5.6.1. United Packaging Types 5.6.1.1. United States Collapsible Crate Market Size and Forecast, By Capacity (2024-2032 5.6.1.1.1. Up to 50 L 5.6.1.1.2. 50 – 100 L 5.6.1.1.3. 100 – 300 L 5.6.1.1.4. 300 – 500 L (CFC) 5.6.1.1.5. Greater than 500 L 5.6.1.2. United States Collapsible Crate Market Size and Forecast, By Material Type (2024-2032) 5.6.1.2.1. HDPE (high-density polyethylene) 5.6.1.2.2. PP (polypropylene) 5.6.1.2.3. Others (plywood, metals, etc.) 5.6.1.3. United States Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 5.6.1.3.1. With Lid Collapsible Crate 5.6.1.3.2. Lidless Collapsible Crate 5.6.1.4. United States Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 5.6.1.4.1. Food & Beverages 5.6.1.4.2. Automotive 5.6.1.4.3. Agriculture 5.6.1.4.4. Retail 5.6.1.4.5. Logistics 5.6.1.4.6. Others 5.6.1.5. United States Collapsible Crate Market Size and Forecast, By Distribution Channel (2024-2032) 5.6.1.5.1. Offline 5.6.1.5.2. Online 5.6.2. Canada 5.6.2.1. Canada Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 5.6.2.1.1. Up to 50 L 5.6.2.1.2. 50 – 100 L 5.6.2.1.3. 100 – 300 L 5.6.2.1.4. 300 – 500 L (CFC) 5.6.2.1.5. Greater than 500 L 5.6.2.2. Canada Collapsible Crate Market Size and Forecast, By Material (2024-2032) 5.6.2.2.1. HDPE (high-density polyethylene) 5.6.2.2.2. PP (polypropylene) 5.6.2.2.3. Others (plywood, metals, etc.) 5.6.2.3. Canada Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 5.6.2.3.1. With Lid Collapsible Crate 5.6.2.3.2. Lidless Collapsible Crate 5.6.2.4. Canada Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 5.6.2.4.1. Food & Beverages 5.6.2.4.2. Automotive 5.6.2.4.3. Agriculture 5.6.2.4.4. Retail 5.6.2.4.5. Logistics 5.6.2.4.6. Others 5.6.2.5. Canada Collapsible Crate Market Size and Forecast, By Distribution Channel (2024-2032) 5.6.2.5.1. Offline 5.6.2.5.2. Online 5.6.3. Mexico 5.6.3.1. Mexico Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 5.6.3.1.1. Up to 50 L 5.6.3.1.2. 50 – 100 L 5.6.3.1.3. 100 – 300 L 5.6.3.1.4. 300 – 500 L (CFC) 5.6.3.1.5. Greater than 500 L 5.6.3.2. Mexico Collapsible Crate Market Size and Forecast, By Material Type (2024-2032) 5.6.3.2.1. HDPE (high-density polyethylene) 5.6.3.2.2. PP (polypropylene) 5.6.3.2.3. Others (plywood, metals, etc.) 5.6.3.3. Mexico Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 5.6.3.3.1. With Lid Collapsible Crate 5.6.3.3.2. Lidless Collapsible Crate 5.6.3.4. Mexico Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 5.6.3.4.1. Food & Beverages 5.6.3.4.2. Automotive 5.6.3.4.3. Agriculture 5.6.3.4.4. Retail 5.6.3.4.5. Logistics 5.6.3.4.6. Others 5.6.3.5. Mexico Collapsible Crate Market Size and Forecast, By Distribution Channel (2024-2032) 5.6.3.5.1. Offline 5.6.3.5.2. Online 6. Europe Collapsible Crate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.2. Europe Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.3. Europe Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.4. Europe Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.5. Europe Collapsible Crate Market Size and Forecast, By Distribution Channel (2024-2032) 6.6. Europe Collapsible Crate Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.1.2. United Kingdom Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.1.3. United Kingdom Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.1.4. United Kingdom Collapsible Crate Market Size and Forecast, By End-User (2024-2032) 6.6.1.5. United Kingdom Collapsible Crate Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.2. France 6.6.2.1. France Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.2.2. France Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.2.3. France Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.2.4. France Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.6.2.5. France Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.2.6. 6.6.3. Germany 6.6.3.1. Germany Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.3.2. Germany Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.3.3. Germany Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.3.4. Germany Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.6.3.5. Germany Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.3.6. 6.6.4. Italy 6.6.4.1. Italy Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.4.2. Italy Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.4.3. Italy Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.4.4. Italy Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.6.4.5. Italy Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.5.2. Spain Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.5.3. Spain Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.5.4. Spain Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.6.5.5. Spain Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.6.2. Sweden Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.6.3. Sweden Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.6.4. Sweden Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.6.6.5. Sweden Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.7.2. Austria Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.7.3. Austria Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.7.4. Austria Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.6.7.5. Austria Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 6.6.8.2. Rest of Europe Collapsible Crate Market Size and Forecast, By Material (2024-2032) 6.6.8.3. Rest of Europe Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 6.6.8.4. Rest of Europe Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 6.6.8.5. Rest of Europe Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7. Asia Pacific Collapsible Crate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.2. Asia Pacific Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.3. Asia Pacific Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.4. Asia Pacific Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.5. Asia Pacific Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6. Asia Pacific Collapsible Crate Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.1.2. China Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.1.3. China Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.1.4. China Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.1.5. China Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.2.2. S Korea Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.2.3. S Korea Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.2.4. S Korea Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.2.5. S Korea Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.3.2. Japan Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.3.3. Japan Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.3.4. Japan Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.3.5. Japan Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.4. India 7.6.4.1. India Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.4.2. India Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.4.3. India Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.4.4. India Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.4.5. India Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.5.2. Australia Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.5.3. Australia Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.5.4. Australia Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.5.5. Australia Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.6.2. Indonesia Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.6.3. Indonesia Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.6.4. Indonesia Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.6.5. Indonesia Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.7. Philippines 7.6.7.1. Philippines Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.7.2. Philippines Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.7.3. Philippines Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.7.4. Philippines Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.7.5. Philippines Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.8. Malaysia 7.6.8.1. Malaysia Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.8.2. Malaysia Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.8.3. Malaysia Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.8.4. Malaysia Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.8.5. Malaysia Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.9. Vietnam 7.6.9.1. Vietnam Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.9.2. Vietnam Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.9.3. Vietnam Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.9.4. Vietnam Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.9.5. Vietnam Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.10. Thailand 7.6.10.1. Thailand Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.10.2. Thailand Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.10.3. Thailand Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.10.4. Thailand Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.10.5. Thailand Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.11. Rest of Asia Pacific 7.6.11.1. Rest of Asia Pacific Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 7.6.11.2. Rest of Asia Pacific Collapsible Crate Market Size and Forecast, By Material (2024-2032) 7.6.11.3. Rest of Asia Pacific Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 7.6.11.4. Rest of Asia Pacific Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 7.6.11.5. Rest of Asia Pacific Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 8. Middle East and Africa Collapsible Crate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 8.2. Middle East and Africa Collapsible Crate Market Size and Forecast, By Material (2024-2032) 8.3. Middle East and Africa Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 8.4. Middle East and Africa Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 8.5. Middle East and Africa Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6. Middle East and Africa Collapsible Crate Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 8.6.1.2. South Africa Collapsible Crate Market Size and Forecast, By Material (2024-2032) 8.6.1.3. South Africa Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 8.6.1.4. South Africa Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 8.6.1.5. South Africa Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 8.6.2.2. GCC Collapsible Crate Market Size and Forecast, By Material (2024-2032) 8.6.2.3. GCC Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 8.6.2.4. GCC Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 8.6.2.5. GCC Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 8.6.3.2. Nigeria Collapsible Crate Market Size and Forecast, By Material (2024-2032) 8.6.3.3. Nigeria Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 8.6.3.4. Nigeria Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 8.6.3.5. Nigeria Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 8.6.4.2. Rest of ME&A Collapsible Crate Market Size and Forecast, By Material (2024-2032) 8.6.4.3. Rest of ME&A Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 8.6.4.4. Rest of ME&A Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 8.6.4.5. Rest of ME&A Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 9. South America Collapsible Crate Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 9.2. South America Collapsible Crate Market Size and Forecast, By Material (2024-2032) 9.3. South America Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 9.4. South America Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 9.5. South America Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 9.6. South America Collapsible Crate Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 9.6.1.2. Brazil Collapsible Crate Market Size and Forecast, By Material (2024-2032) 9.6.1.3. Brazil Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 9.6.1.4. Brazil Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 9.6.1.5. Brazil Collapsible Crate Market Size and Forecast, By Distribution Chanel (2024-2032) 9.6.1.6. 9.6.2. Argentina 9.6.2.1. Argentina Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 9.6.2.2. Argentina Collapsible Crate Market Size and Forecast, By Material (2024-2032) 9.6.2.3. Argentina Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 9.6.2.4. Argentina Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 9.6.2.5. Argentina Collapsible Crate Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.3. Rest of South America 9.6.3.1. Rest of South America Collapsible Crate Market Size and Forecast, By Capacity (2024-2032) 9.6.3.2. Rest of South America Collapsible Crate Market Size and Forecast, By Material (2024-2032) 9.6.3.3. Rest of South America Collapsible Crate Market Size and Forecast, By Lid Type (2024-2032) 9.6.3.4. Rest of South America Collapsible Crate Market Size and Forecast, By End-Users Industry (2024-2032) 9.6.3.5. Rest of South America Collapsible Crate Market Size and Forecast, By Distribution Channel (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. ORBIS Corporation (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Buckhorn Inc. (U.S.) 10.3. Rehrig Pacific Company (U.S.) 10.4. Monoflo International (U.S.) 10.5. TranPak Inc. (U.S.) 10.6. Schoeller Allibert (Netherlands) 10.7. Bekuplast GmbH (Germany) 10.8. UTZ Group (Switzerland) 10.9. Loadhog Ltd. (U.K.) 10.10. Craemer GmbH (Germany) 10.11. Mycrates (India) 10.12. Enko Plastics (India) 10.13. Shanghai Join Plastic Products Co., Ltd. (China) 10.14. Zhejiang Zhengji Plastic Industry Co., Ltd. (China) 10.15. Taizhou Huangyan JMT Mould Co., Ltd. (China) 10.16. Suzhou Huiyuan Plastic Products Co., Ltd. (China) 10.17. Nilkamal Ltd. (India) 10.18. Plastene India Ltd. (India) 10.19. Plásticos Rimax S.A. (Colombia) 10.20. Petropack S.A. (Argentina) 10.21. Cratecno (Brazil) 10.22. Interplast Co. Ltd. (UAE) 10.23. Mpact Limited (South Africa) 10.24. Jokey Group (UAE operations) 10.25. RPC Promens (South Africa) 10 Key Findings 11 Analyst Recommendations 12 Collapsible Crate Market: Research Methodology