The Coconut Sugar Market size was valued at USD 2.70 billion in 2024, and the total Revenue is expected to grow at a CAGR of 5.6% from 2025 to 2032, reaching nearly USD 4.18 billion. This growth reflects rising Coconut Sugar Demand supported by increasing adoption of Natural Sugar Alternatives Market products.Coconut Sugar Market Overview:

The MMR Coconut Sugar Market report provides a comprehensive analysis of key industry aspects. It covers Regional Demand & Usage Analysis, including seasonal consumption trends, urban vs. rural dynamics, and distribution infrastructure readiness. The report examines Market Penetration & Adoption Trends, highlighting awareness of Coconut Sugar Health Benefits, demographic adoption patterns, and barriers to entry for new players. Production Analysis addresses global production trends, form- and nature-wise output, key manufacturing regions, and supply constraints, especially within the Indonesian coconut sugar industry, which leads global Coconut Sugar Production. Consumer Behavior Analysis explores buying preferences, motivations, demographic insights, and the influence of digital platforms and e-commerce. The report further provides Pricing, Cost & Value Analysis by Region, Import–Export & Trade Flow Analysis, and Technology & Process Innovations covering processing, packaging, traceability, and renewable energy adoption.it reviews the Supply Chain & Distribution Network and Regulatory & Quality Standards by Region, ensuring a holistic understanding of market dynamics, challenges, and growth opportunities in the global Coconut Sugar Market and the rapidly expanding Natural Sweeteners Market. Coconut sugar, also known as coco sap sugar, is produced from the sap of cut flower buds of the coconut palm. coconut sugar comes in granules, rock, powder, cubes, and liquid form. It contains essential vitamins, macro and micronutrients, and has been used as a traditional natural sweetener for thousands of years in South and South-East Asia. The world's largest producers of coconuts are the Philippines and Indonesia, making the Asia-Pacific Coconut Sugar Market the key regional hub. In Indonesia, about 600,000 metric tonnes of coconut sugar production Indonesia produced annually, mostly for domestic use. The Indonesian powerhouse purchases over 30,000 MT of coconut sugar per year for instant noodles, and Unilever also purchases a significant volume for its sweet soy sauce product. Indonesia currently has over 100,000 coconut sugar producers who bring over 50,000 MT of coconut sugar to the domestic market per month. The rising consumer desire for natural sugar alternatives, with similar tastes and sweetness to white sugar, is driving the global Coconut Sugar Market and supporting strong coconut sugar market growth. Coconut sugar has widely become a popular sugar alternative because of its perceived health Benefits and flavor. Consumer demand for coconut sugar is driven by rising interest in healthy lifestyles and growing demand for organic coconut sugar. Coconut sugar’s unique properties and growing availability make it a favorable choice for food manufacturers worldwide. The food industry is increasingly using it in chocolates, candies, beverages, and bakery products as a healthier, natural sweetener. This trend is expected to increase the demand for the Coconut Sugar Market during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Coconut Sugar Market Dynamics:

The growing use of Coconut Sugar by Whey Protein and the Superfoods Industry and the Baking Industry Sweeteners are an essential part of the daily menu, both for household consumption and industrial usage. With global sugar consumption crossing 170 million tons, there is a huge opportunity for expanding Coconut Sugar Production and tapping into the growing Natural Sweeteners Market. Coconut sugar is one of the most popular natural sweeteners used worldwide. Its major advantage is its low glycemic index (GI 35). Many coffee shops now use coconut sugar for beverages such as dalgona coffee. Superfood brands and whey protein companies increasingly prefer Organic Coconut Sugar because they want cleaner, healthier ingredients. The baking industry uses coconut sugar widely due to its flavor, texture, and Coconut health Benefits. Exporters of coconut sugar are capitalizing on global trends such as demand for natural, organic, and vegan products. Top manufacturers like Cook Organic Foods LLP, Activa Enterprises Ventures Inc., and American Key Food Products are expanding to meet rising global Coconut Sugar Demand. Premium chocolate manufacturers like Barry Callebaut are using Organic Coconut Sugar to strengthen their organic product lines. The use of coconut sugar in vegan applications and rising health consciousness especially across Europe coconut sugar demand markets are pushing usage to new levels. Increasing demand for vegan products to driving the Coconut Sugar Market growth There is a growing demand for vegan products across the world. The use of coconut sugar as a vegan product has recently increased the demand for coconut sugar. The increasing prevalence of obesity and diabetes among a large global population has produced a need for sugar substitutes, which is expected to propel the coconut sugar market. The MMR reported that Europe accounted for more than one-third of the global vegan product market, with Europe expected to dominate in the coming years. Growing consumer awareness of the health benefits associated with a vegan diet is one of the key drivers for market demand. The number of applications for coconut sugar in the food and beverage industry is also growing. The demand for coconut sugar is expected to increase because coconut sugar is considered a vegan alternative to regular sugar. Organic certification further increases market trust, particularly in Europe and North America, where natural sugar alternatives market products are in high demand. Exporters of coconut sugar from developing countries are going for certification. They are targeting the organic sector in which the premium can be justified. The anti-aging benefits of Coconut sugar boost the Coconut Sugar Market growth Coconut sugar is now used in skincare due to its Coconut Sugar Health Benefits and mineral-rich profile. Its demand in scrubs, gels, creams, and natural cosmetics is rising, supported by the booming FMCG and herbal cosmetics sector. It is high in vitamins and minerals, including vitamin C, potassium, calcium, magnesium, iron, copper, phosphorus, phytonutrients, flavonoids, polyphenols, and anthocyanins. The content of these vitamins and minerals is very useful for skin health; therefore, many skincare companies use coconut sugar as one of the ingredients for their products. Usually, coconut sugar used in scrub products has a rough texture. The growing demand for the product in the manufacturing of different skincare products, such as body scrubs, shaving gels, and face and body creams, is expected to fuel market growth over the forecast period. The rise of the FMCG industry, along with rising consumer demand for herbal skin and hair care products, is likely to boost the Coconut sugar market growth. The increasing prevalence of obesity and diabetes across the world According to the WHO, there are increasing rates of diabetes among all age groups across the world. It is estimated that the rate of obesity has tripled, reaching about 60 million people. Unhealthy diets and sedentary lifestyles are the reasons for the increased obesity. Healthy diets and exercise are the best ways to prevent type 2 diabetes. Coconut sugar has a glycemic index (GI) of approximately half as compared to regular table sugar. Hence, diabetic consumers increasingly turn to Organic Coconut Sugar as a safer alternative. The rising prevalence of diabetes is likely to drive up demand for coconut sugar in the coming years. Foods with a high glycemic index cause blood sugar levels to spike suddenly, affecting insulin levels. Coconut sugar also contains a fiber that is known to decrease glucose absorption. some leading diabetes organizations, such as Diabetes UK, are of the view that although coconut sugar is marketed as a healthier alternative to sugar. This trend is expected to increase the demand for the Coconut sugar market in the future. Many alternatives to Coconut Sugar are available in Coconut Sugar Market The market faces stiff competition from the availability of alternative products such as maple syrup, corn syrup, chocolate syrup, honey, molasses, agave nectar, date syrup and other players in the Natural Sweeteners Market. Maple syrup is one of the most common and popular natural sugar substitutes preferred by consumers because of its natural sweetness obtained from the maple tree. Chocolate syrup and honey are also the most common sweeteners that are used and available in different retail shops. Therefore, the availability of a large number of alternatives for coconut syrup hampers the growth of the coconut sugar market.Coconut Sugar Market Segment Analysis:

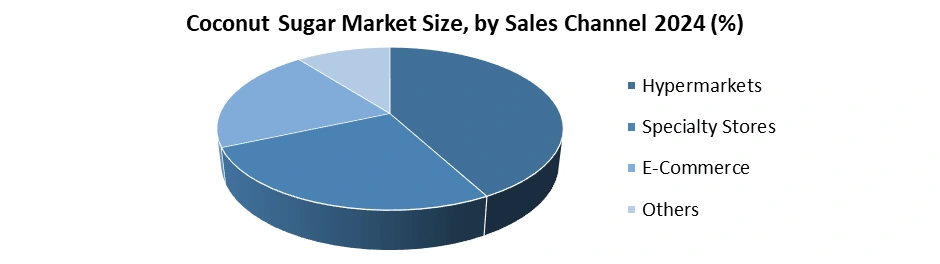

Based on Nature, in 2024, Conventional Coconut Sugar is expected to dominate the Coconut Sugar Market, driven by its wide availability, cost-effectiveness, and strong presence across mainstream food and beverage applications. Its affordability and established supply chains make it the preferred choice for mass consumption. Organic Coconut Sugar, while smaller in market share, is experiencing rapid growth due to increasing consumer awareness of health, sustainability, and chemical-free products. The premiumization trend in natural and organic foods, along with the expanding presence of organic retail channels, is supporting adoption. the market exhibits a dual growth pattern: volume-driven demand for Conventional Coconut Sugar and value-driven expansion for Organic Coconut Sugar.Based on Sales Channel, in 2024, Hypermarkets are expected to dominate the Coconut Sugar Market, driven by their extensive product availability, strong supply chains, and consumer preference for one-stop shopping experiences. Specialty Stores follow closely, supported by growing demand for premium, organic, and high-quality products among health-conscious consumers. E-Commerce is witnessing rapid growth, fueled by increasing digital adoption, convenience of doorstep delivery, and targeted online promotions. The Others segment, including local grocery stores and direct-to-consumer channels, holds a smaller share but continues to serve regional demand pockets and price-sensitive buyers. Together, these channels highlight the market’s balance between mass-market accessibility through hypermarkets and value-driven adoption via specialty and online platforms.

Coconut Sugar Market Regional Insights

In North America, the Coconut Sugar market accounted for the highest revenue share in 2024. North America is expected to witness the highest growth in the market because of the increase in snack consumption. The rise in organic and clean-label food consumption trends, especially in the U.S., has increased the sales performance of coconut sugar in this region. According to the Organic Trade Association, organic food sales in the U.S. increased by 5.8% in 2024, which is expected to drive the coconut sugar market growth in the North American region. The Asia-Pacific Coconut Sugar Market dominated production due to abundant coconuts, strong supply chains, and expanding international exports. Asia Pacific is expected to have significant growth because coconut sugar has been widely used as a natural sweetener by people in Malaysia and Indonesia. Indonesia is the largest producer of coconut, which makes the wide availability of raw materials. The increase in the disposable income of consumers allows them to pay a premium price for the product, which has boosted its regional market growth during the forecast period. Asia Pacific is expected to be the largest producer of the item due to abundant raw material availability and technology and the surging demand in the international market. The manufacturers need to look into the prices to gain a higher share of the global market. The rapid growth of the food & beverage and cosmetics industry in countries like Korea, China, and India is expected to have a positive impact on the Coconut Sugar Market growth over the forecast period. Rising European coconut sugar demand is driven by veganism, organic certification, and premium confectionery expansion. Global and regional players in the Coconut Sugar industry are discussed in depth, including revenue data and market share information. The Coconut Sugar market analysis includes trends in Coconut Sugars, information about the potential market and needs, and lists of potential competitors. MMR has segmented the global Coconut Sugar Market report based on Application, form, Nature, and region. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies like new product launches, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses. Our team of analysts can also provide you with data in excel files and pivot tables or can assist you in creating presentations from the data sets available in the report.Coconut Sugar Market Competitive Landscape

The Coconut Sugar market is increasingly competitive with players like Dr. Goerg GmbH, Big Tree Farms, Madhava, and Nutiva Inc. leveraging organic certification, premium positioning, and supply-chain transparency. Demand for natural sweeteners, low-GI sugar alternatives, and organic coconut sugar fuels product innovation, private-label partnerships, and expanded retail distribution across Europe, North America, and Southeast Asia, and e-commerce channels and marketplaces. Key strategies among leaders such as PT Mega Inovasi Organik, Dr. Goerg, Treelife, and The Coconut Company UK include sustainable sourcing, Fair Trade certification, traceability, and SKU diversification into organic syrup, coconut nectar, and private-label lines. Competitive moves focus on margin protection via premium pricing, direct-to-consumer channels, and strengthening export logistics to capture global demand aggressively.Recent Developments

• On 2 June 2025, Indonesia’s coconut sugar sector announced a strategic shift toward premium, granulated coconut sugar to boost export competitiveness. Producers are modernising sap-collection methods, improving granulation technology, and strengthening quality-control and traceability systems. This transition enables higher purity, lower moisture content, and consistent grain size—allowing manufacturers to secure premium pricing and meet rising global demand for clean-label natural sweeteners. • On 22 October 2025, at the International Coconut Community (ICC) Trade Expo in Indonesia, industry leaders emphasized stronger global collaboration, digital traceability upgrades, and standardized sustainability protocols across the coconut value chain. These initiatives are designed to elevate coconut sugar’s export competitiveness, reinforce ethical sourcing, and enhance its appeal in premium international markets through improved transparency and long-term supply-chain reliability. • On 29 October 2025, The Coconut Sugar Company (India) introduced a luxury artisan confectionery line crafted with single-origin coconut sugar to target premium global consumers. The range emphasises sustainable sourcing, fair-trade practices, and high-quality flavour profiles, transforming traditional coconut-based sweetening into an elevated gourmet category while strengthening the brand’s positioning in the premium natural sweeteners market.Coconut Sugar Market Trends

Trend Description Health-driven demand (low-GI & minerals Rising demand for coconut sugar, boosted by interest in low GI sweeteners, organic coconut sugar, and natural sweetener benefits, especially across bakery, beverages, and healthy sugar alternatives globally. Premiumization & clean-label The shift toward clean-label, organic coconut sugar, and premium natural sweeteners drives higher pricing, attracting brands marketing natural, minimally processed, and regionally sourced coconut sugar products. Vegan & plant-based demand Growth in vegan sweeteners, plant-based sugar alternatives, and natural sweeteners boosts coconut sugar usage in dairy alternatives, snacks, and confectionery targeting ethical consumers. E-commerce & D2C channels Expansion of online coconut sugar, buy coconut sugar online, and D2C channels supports global reach of organic brands, improving visibility for coconut sugar suppliers and niche producers. Supply chain & sustainability pressures Climate concerns and raw material shortages drive the need for sustainable coconut farming, fair trade coconut sugar, and certified organic coconut sugar, improving transparency across major exporting regions. Price premium vs conventional sugars Coconut sugar price premium remains high versus refined sugar; premium pricing is supported by health-benefit keywords, organic coconut sugar, and clean-label demand, though affordability challenges persist in emerging regions. Regulatory & certification focus Stricter rules increase adoption of certified organic coconut sugar, transparent labeling, and quality-assured coconut sweeteners, supporting global retail compliance while increasing operational standards and export competitiveness. Coconut Sugar Market Scope: Inquiry Before Buying

Coconut Sugar Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.70 Bn. Forecast Period 2025 to 2032 CAGR: 5.6% Market Size in 2032: USD 4.18 Bn. Segments Covered: by Form Granular Liquid Powdered by Nature Organic Conventional by Application Food and Beverage Cosmetics Personal Care Others by End User Commercial Residential by Sales Channel Hypermarkets Specialty Stores E-Commerce Others Coconut Sugar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Coconut Sugar Market, Key Players

1. Big Tree Farms Inc. 2. Celebes Agricultural Corporation 3. The Coconut Company UK Ltd. 4. Earth Circle Organics LLC 5. Madhava 6. Nutiva Inc. 7. PT Mega Inovasi Organik 8. Nisarga Coconut 9. Coco Sugar 10. NOW Foods 11. Saudi Food Ingredients Factory 12. The Groovy Food Co. 13. Tradin Organic Agriculture B.V. 14. Treelife 15. Whole Earth Brands, Inc 16. BetterBody Foods 17. SOC CHEF, S.L.U. 18. BATA Food 19. CV. Bonafide Anugerah Sentosa 20. BUXTRADE GmbH 21. American Key Food Products 22. Samara Farm Indonesia 23. Blue Mountain Organics 24. Delphi Organic GmbH 25. Greenville Agro Corporation 26. Phalada Agro 27. PMA Indonesia (Lewi’s Organics) 28. Dr. Goerg GmbH 29. Amala Earth 30. OthersFrequently Asked Questions:

1] What segments are covered in the Coconut Sugar Market report? Ans. The segments covered in the Coconut Sugar Market report are based on Form, Nature, Application, End User, Sales Channel, and region 2] Which region is expected to hold the highest share of the Coconut Sugar Market? Ans. The Asia Pacific region is expected to hold the highest share of the Coconut Sugar Market. 3] What is the market size of the Coconut Sugar Market by 2032? Ans. The market size of the Coconut Sugar Market by 2032 is USD 4.18 Bn. 4] What is the growth rate of the Coconut Sugar Market? Ans. The Global Coconut Sugar Market is growing at a CAGR of 5.6 % during the forecasting period 2025-2032. 5] What was the market size of the Coconut Sugar Market in 2024? Ans. The market size of the Coconut Sugar Market in 2024 was USD 2.70 Bn.

1. Coconut Sugar Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion, Volume in Tons) - By Segments, Regions, and Country 2. Coconut Sugar Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. End-User 2.3.5. Revenue 2024 2.3.6. Market Share (%) 2.3.7. Discount (%) 2.3.8. Certifications 2.3.9. Pricing Strategy 2.3.10. Quality Consistency Index 2.3.11. Sales Channels 2.3.12. Customer Engagement Metrics 2.3.13. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Coconut Sugar Market: Dynamics 3.1. Coconut Sugar Market Trends 3.2. Coconut Sugar Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Coconut Sugar Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Regional Demand & Usage Analysis 4.1. Seasonal Consumption Trends (2024) 4.1.1. Coconut Sugar Usage in Peak vs. Off-Peak Seasons 4.1.2. Regional Preferences Across Food, Beverage, Cosmetics, and Personal Care Applications 4.1.3. Climate and Cultural Influences on Consumption Patterns 4.2. Urban vs. Rural Consumption Dynamics 4.2.1. Usage Patterns in Urban Centers vs. Rural Areas 4.2.2. Retail vs. Traditional Local Market Preferences 4.2.3. Regional Popularity: Asia-Pacific, Europe, North America, Latin America 4.3. Distribution Infrastructure & Channel Readiness 4.3.1. Hypermarkets, Specialty Stores, E-Commerce, and Modern Retail Penetration 4.3.2. Investments in Warehousing, Cold Storage, and Logistics 4.3.3. Last-Mile Delivery Challenges in Emerging Markets 5. Market Penetration & Adoption Trends 5.1. Current Global Market Penetration Across Key Regions 5.2. Awareness of Health & Organic Benefits 5.3. Adoption Across Income Levels, Demographics, and Consumer Segments 5.4. Barriers to Entry for New Players 6. Production Analysis (2024) 6.1. Global Production Overview and Trends 6.2. Production by Form: Granular, Liquid, and Powdered 6.3. Production by Nature: Organic vs. Conventional 6.4. Key Manufacturing Regions and Country-wise Production Volumes 6.5. Production Challenges, Capacity Utilization, and Supply Constraints 7. Consumer Behavior Analysis 7.1. Buying Preferences 7.1.1. Organic vs. Conventional Preference 7.1.2. Motivations: Health, Sustainability, Taste, Convenience 7.1.3. Packaging Preferences and Form Selection 7.2. Demographic Insights 7.2.1. Age, Income, Household Size, and Regional Differences 7.2.2. Adoption in Emerging vs. Developed Markets 7.3. Digital Influence 7.3.1. Role of Online Platforms and E-Commerce in Global Sales 7.3.2. Social Media, Influencer Marketing, and Awareness Campaigns 8. Pricing, Cost & Value Analysis By Region 8.1. Average Selling Price of Coconut Sugar by Form and Region (2019–2024) 8.2. Cost Structure: Raw Material, Processing, Packaging, and Logistics 8.3. Consumer Price Sensitivity Across Regions 8.4. Factors Influencing Price Changes 9. Import–Export & Trade Flow Analysis (2024) 9.1. Top 10 Importing Countries of Coconut Sugar 9.2. Top 10 Exporting Countries of Coconut Sugar 9.3. Global Trade Dynamics and Supply Chain Considerations 9.4. Factors Affecting Trade: Tariffs, Logistics, Regulatory Compliance 10. Technology & Process Innovations 10.1. Advances in Coconut Sugar Processing and Drying 10.2. Packaging Innovations for Shelf-Life and Sustainability 10.3. Development of Specialty and Flavored Coconut Sugars 10.4. Integration of Blockchain and Digital Traceability 10.5. Adoption of Renewable Energy in Production Units 10.6. Micro-Encapsulation and Fortification Techniques 11. Supply Chain & Distribution Analysis 11.1. Raw Material Sourcing and Supplier Relationships 11.2. Global Distribution Networks: Importers, Warehouses, and Retailers 11.3. Logistics Challenges, Risk Factors, and Bottlenecks 11.4. Inventory Management Practices and Stock Optimization 11.5. Transportation Modes and Cost Analysis (Road, Sea, Air) 11.6. Impact of Seasonal Fluctuations and Climate on Supply Chain Reliability 12. Regulatory & Quality Standards by Region 12.1. Food Safety and Labeling Guidelines 12.2. Overview of Regulatory Frameworks by Region 12.3. Impact of Regulations on the Food Industry Sector 12.4. Industry Certifications and Approvals 13. Coconut Sugar Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2024-2032) 13.1. Coconut Sugar Market Size and Forecast, By Form (2024-2032) 13.1.1. Granular 13.1.2. Liquid 13.1.3. Powdered 13.2. Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 13.2.1. Organic 13.2.2. Conventional 13.3. Coconut Sugar Market Size and Forecast, By Application (2024-2032) 13.3.1. Food and Beverage 13.3.2. Cosmetics 13.3.3. Personal Care 13.3.4. Others 13.4. Coconut Sugar Market Size and Forecast, By End User (2024-2032) 13.4.1. Commercial 13.4.2. Residential 13.5. Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 13.5.1. Hypermarkets 13.5.2. Specialty Stores 13.5.3. E-Commerce 13.5.4. Others 13.6. Coconut Sugar Market Size and Forecast, By Region (2024-2032) 13.6.1. North America 13.6.2. Europe 13.6.3. Asia Pacific 13.6.4. Middle East and Africa 13.6.5. South America 14. North America Coconut Sugar Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2024-2032) 14.1. North America Coconut Sugar Market Size and Forecast, By Form (2024-2032) 14.1.1. Granular 14.1.2. Liquid 14.1.3. Powdered 14.2. North America Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 14.2.1. Organic 14.2.2. Conventional 14.3. North America Coconut Sugar Market Size and Forecast, By Application (2024-2032) 14.3.1. Food and Beverage 14.3.2. Cosmetics 14.3.3. Personal Care 14.3.4. Others 14.4. North America Coconut Sugar Market Size and Forecast, By End User (2024-2032) 14.4.1. Commercial 14.4.2. Residential 14.5. North America Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 14.5.1. Hypermarkets 14.5.2. Specialty Stores 14.5.3. E-Commerce 14.5.4. Others 14.6. North America Coconut Sugar Market Size and Forecast, by Country (2024-2032) 14.6.1. United States 14.6.1.1. United States Coconut Sugar Market Size and Forecast, By Form (2024-2032) 14.6.1.1.1. Granular 14.6.1.1.2. Liquid 14.6.1.1.3. Powdered 14.6.1.2. United States Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 14.6.1.2.1. Organic 14.6.1.2.2. Conventional 14.6.1.3. United States Coconut Sugar Market Size and Forecast, By Application (2024-2032) 14.6.1.3.1. Food and Beverage 14.6.1.3.2. Cosmetics 14.6.1.3.3. Personal Care 14.6.1.3.4. Others 14.6.1.4. United States Coconut Sugar Market Size and Forecast, By End User (2024-2032) 14.6.1.4.1. Commercial 14.6.1.4.2. Residential 14.6.1.5. United States Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 14.6.1.5.1. Hypermarkets 14.6.1.5.2. Specialty Stores 14.6.1.5.3. E-Commerce 14.6.1.5.4. Others 14.6.2. Canada 14.6.2.1. Canada Coconut Sugar Market Size and Forecast, By Form (2024-2032) 14.6.2.1.1. Granular 14.6.2.1.2. Liquid 14.6.2.1.3. Powdered 14.6.2.2. Canada Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 14.6.2.2.1. Organic 14.6.2.2.2. Conventional 14.6.2.3. Canada Coconut Sugar Market Size and Forecast, By Application (2024-2032) 14.6.2.3.1. Food and Beverage 14.6.2.3.2. Cosmetics 14.6.2.3.3. Personal Care 14.6.2.3.4. Others 14.6.2.4. Canada Coconut Sugar Market Size and Forecast, By End User (2024-2032) 14.6.2.4.1. Commercial 14.6.2.4.2. Residential 14.6.2.5. Canada Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 14.6.2.5.1. Hypermarkets 14.6.2.5.2. Specialty Stores 14.6.2.5.3. E-Commerce 14.6.2.5.4. Others 14.6.3. Mexico 14.6.3.1. Mexico Coconut Sugar Market Size and Forecast, By Form (2024-2032) 14.6.3.1.1. Granular 14.6.3.1.2. Liquid 14.6.3.1.3. Powdered 14.6.3.2. Mexico Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 14.6.3.2.1. Organic 14.6.3.2.2. Conventional 14.6.3.3. Mexico Coconut Sugar Market Size and Forecast, By Application (2024-2032) 14.6.3.3.1. Food and Beverage 14.6.3.3.2. Cosmetics 14.6.3.3.3. Personal Care 14.6.3.3.4. Others 14.6.3.4. Mexico Coconut Sugar Market Size and Forecast, By End User (2024-2032) 14.6.3.4.1. Commercial 14.6.3.4.2. Residential 14.6.3.5. Mexico Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 14.6.3.5.1. Hypermarkets 14.6.3.5.2. Specialty Stores 14.6.3.5.3. E-Commerce 14.6.3.5.4. Others 15. Europe Coconut Sugar Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2024-2032) 15.1. Europe Coconut Sugar Market Size and Forecast, By Form (2024-2032) 15.2. Europe Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 15.3. Europe Coconut Sugar Market Size and Forecast, By Application (2024-2032) 15.4. Europe Coconut Sugar Market Size and Forecast, By End User (2024-2032) 15.5. Europe Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 15.6. Europe Coconut Sugar Market Size and Forecast, By Country (2024-2032) 15.6.1. United Kingdom 15.6.2. France 15.6.3. Germany 15.6.4. Italy 15.6.5. Spain 15.6.6. Sweden 15.6.7. Russia 15.6.8. Rest of Europe 16. Asia Pacific Coconut Sugar Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2024-2032) 16.1. Asia Pacific Coconut Sugar Market Size and Forecast, By Form (2024-2032) 16.2. Asia Pacific Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 16.3. Asia Pacific Coconut Sugar Market Size and Forecast, By Application (2024-2032) 16.4. Asia Pacific Coconut Sugar Market Size and Forecast, By End User (2024-2032) 16.5. Asia Pacific Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 16.6. Asia Pacific Coconut Sugar Market Size and Forecast, by Country (2024-2032) 16.6.1. China 16.6.2. S Korea 16.6.3. Japan 16.6.4. India 16.6.5. Australia 16.6.6. Indonesia 16.6.7. Malaysia 16.6.8. Philippines 16.6.9. Thailand 16.6.10. Vietnam 16.6.11. Rest of Asia Pacific 17. Middle East and Africa Coconut Sugar Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2024-2032) 17.1. Middle East and Africa Coconut Sugar Market Size and Forecast, By Form (2024-2032) 17.2. Middle East and Africa Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 17.3. Middle East and Africa Coconut Sugar Market Size and Forecast, By Application (2024-2032) 17.4. Middle East and Africa Coconut Sugar Market Size and Forecast, By End User (2024-2032) 17.5. Middle East and Africa Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 17.6. Middle East and Africa Coconut Sugar Market Size and Forecast, By Country (2024-2032) 17.6.1. South Africa 17.6.2. GCC 17.6.3. Nigeria 17.6.4. Rest of ME&A 18. South America Coconut Sugar Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Tons) (2024-2032) 18.1. South America Coconut Sugar Market Size and Forecast, By Form (2024-2032) 18.2. South America Coconut Sugar Market Size and Forecast, By Nature (2024-2032) 18.3. South America Coconut Sugar Market Size and Forecast, By Application (2024-2032) 18.4. 18.5. South America Coconut Sugar Market Size and Forecast, By End User (2024-2032) 18.6. South America Coconut Sugar Market Size and Forecast, By Sales Channel (2024-2032) 18.7. South America Coconut Sugar Market Size and Forecast, By Country (2024-2032) 18.7.1. Brazil 18.7.2. Argentina 18.7.3. Colombia 18.7.4. Chile 18.7.5. Rest of South America 19. Company Profile: Key Players 19.1. Big Tree Farms 19.1.1. Company Overview 19.1.2. Business Portfolio 19.1.3. Financial Overview 19.1.4. SWOT Analysis 19.1.5. Strategic Analysis 19.2. Celebes Agricultural Corporation 19.3. The Coconut Company UK Ltd. 19.4. Earth Circle Organics LLC 19.5. Madhava 19.6. Nutiva Inc. 19.7. PT Mega Inovasi Organik 19.8. Nisarga Coconut 19.9. Coco Sugar 19.10. NOW Foods 19.11. Saudi Food Ingredients Factory 19.12. The Groovy Food Co. 19.13. Tradin Organic Agriculture B.V. 19.14. Treelife 19.15. Whole Earth Brands, Inc 19.16. BetterBody Foods 19.17. SOC CHEF, S.L.U. 19.18. BATA Food 19.19. CV. Bonafide Anugerah Sentosa 19.20. BUXTRADE GmbH 19.21. American Key Food Products 19.22. Samara Farm Indonesia 19.23. Blue Mountain Organics 19.24. Delphi Organic GmbH 19.25. Greenville Agro Corporation 19.26. Phalada Agro 19.27. PMA Indonesia (Lewi’s Organics) 19.28. Dr. Goerg GmbH 19.29. Amala Earth 19.30. Others 20. Key Findings 21. Analyst Recommendations 22. Coconut Sugar Market – Research Methodology