The Cleanroom Apparels Market was valued at USD 641.3 million in 2025 and is estimated to reach USD 926.7 million by 2032, growing at a CAGR of 5.4% over the forecast period. This growth highlights the expanding demand across the Cleanroom Clothing Market and Cleanroom PPE Market globally. The Cleanroom Apparels Market comprises specialized protective clothing designed to control contamination and protect personnel in regulated environments. This Cleanroom Protective Clothing Market includes products such as cleanroom coveralls, cleanroom hoods, cleanroom booties, cleanroom gowns, cleanroom gloves, and cleanroom face masks, offering varying levels of protection ranging from standard cleanroom apparel to high-performance and ESD cleanroom apparel. These cleanroom garments are manufactured using materials such as polyester, polypropylene, and cotton to meet ISO cleanroom apparel and hygiene standards. The market serves pharmaceutical, biotechnology, healthcare, semiconductor, aerospace, and food processing industries.To know about the Research Methodology :- Request Free Sample Report

Key Highlights

• The semiconductor industry remains a key growth driver for the cleanroom garments market, as advanced fabrication plants require ISO Class 1–5 cleanroom apparel and ESD cleanroom garments for semiconductor fabs. TSMC’s USD 100 billion additional U.S. investment highlights sustained demand for premium ESD cleanroom suits, cleanroom coveralls, cleanroom hoods, and specialised cleanroom footwear. • Asia-Pacific is the fastest-growing cleanroom apparel market, driven by expanding electronics manufacturing, pharmaceutical manufacturing, and biotechnology research in China, South Korea, Japan, and India. The region records the highest volume growth for cleanroom coveralls, cleanroom masks, cleanroom hoods, and cleanroom booties, supported by ongoing cleanroom facility expansions. • Food safety concerns are driving increased adoption of cleanroom PPE and protective clothing worldwide. Unsafe food causes 600 million illnesses and 420,000 deaths annually, while 48 million people fall ill each year in the U.S., reinforcing demand for cleanroom apparel for food processing industry environments. • In Europe, 5,691 foodborne outbreaks were reported in 2023, resulting in 52,127 cases, 2,894 hospitalizations, and 65 deaths. European Commission hygiene regulations are accelerating adoption of cleanroom clothing, gloves, hairnets, masks, and cleanroom footwear across food processing operations.

Cleanroom Apparels Market Dynamics

Cleanroom Apparels Market Drivers

• The high prevalence of healthcare-associated infections (HAIs) continues to drive demand for cleanroom PPE and sterile cleanroom apparel in medical and emergency services. With 1 in 31 hospital patients affected by HAIs and ~99,000 annual deaths in U.S. hospitals, healthcare providers increasingly rely on cleanroom gloves, cleanroom masks, respirators, cleanroom suits, and sterile PPE to minimize cross-contamination. • Regulatory mandates, including OSHA Bloodborne Pathogens standards and EU GMP guidelines, are strengthening adoption of GMP compliant cleanroom clothing across healthcare, laboratory, and pharmaceutical environments. N95 respirators reduce infection risk by ~83%, while layered cleanroom PPE systems reduce airborne pathogen exposure by over 99%. • Rising exposure to hazardous chemicals, toxic compounds, microorganisms, and HPAPIs in laboratories and pharmaceutical manufacturing drives demand for sterile cleanroom apparel for pharmaceutical manufacturing. Approximately 60–70% of laboratory staff handle hazardous substances daily, while 40–45% of pharmaceutical processes involve potent compounds.

Cleanroom Apparels Market Opportunities

• Increasing R&D investment in the European pharmaceutical industry, which reached USD 59.9 billion in 2024, is creating opportunities for advanced cleanroom apparel, disposable cleanroom apparel, and reusable cleanroom garments that support innovation and regulatory compliance. • The growing volume of clinical research, with 21,500 clinical trials hosted in Europe in 2024, is expanding demand for cleanroom garments for medical device manufacturing, cleanroom PPE for biotech laboratories, and contamination-control products. • Intensifying regulatory scrutiny, including a 35% increase in sterile production inspections between 2019 and 2023, is accelerating the adoption of EU GMP Annex 1 cleanroom apparel and validated ISO Class 1–8 cleanroom garments.

Cleanroom Apparels Market Restraints

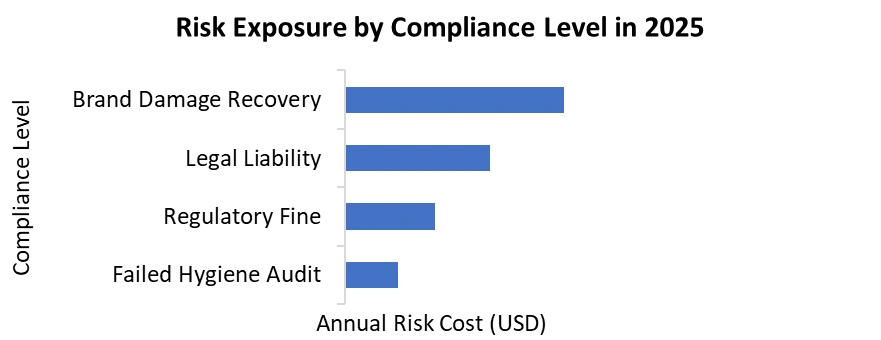

• High compliance costs and operational complexity act as key restraints in the Cleanroom Apparel Market. Regulatory non-compliance can cost manufacturers USD 2.2–3.3 million per incident and delay launches by 4–6 months. • Frequent PPE replacement requirements, including 3,000–6,000 glove pairs and 300–800 masks per worker annually, increase operational costs and strain supply chains. • Continuous updates to regulatory frameworks, including the EU GMP Annex 1 revision (2023), increase documentation and validation burdens for cleanroom clothing manufacturers and buyers.Cleanroom Apparels Market Segment Analysis

Based on product type, the Cleanroom Apparels Market is segmented into cleanroom coveralls, cleanroom hoods, cleanroom booties, cleanroom gowns, cleanroom gloves, cleanroom face masks, and others. Among these, cleanroom coveralls dominated the Cleanroom Apparels Market in 2025 and is expected to maintain dominance during the forecast period. The dominance of cleanroom coveralls is attributed to their full-body protection and critical role in reducing human-borne contamination. Coveralls are widely used across pharmaceutical manufacturing, biotechnology laboratories, medical device production, and semiconductor cleanrooms, particularly in ISO Class 5–7 and EU GMP Grade A–C environments. Their integration with hoods, masks, gloves, and booties into complete cleanroom gowning systems further strengthens adoption. In value terms, coveralls account for the largest share of cleanroom apparel spending, often procured as sterile cleanroom apparel packs.Cleanroom Apparels Market Regional Analysis

Asia-Pacific accounted for the largest share of the global Cleanroom Apparel Market in 2025 and remains the fastest-growing region. Growth is driven by large-scale investments in semiconductor cleanrooms, pharmaceutical manufacturing, and biotechnology research across China, South Korea, Japan, Taiwan, and India. The region records the highest consumption of cleanroom coveralls, cleanroom hoods, cleanroom masks, and cleanroom booties due to high workforce intensity and frequent gowning cycles. Cost-competitive manufacturing and increasing adherence to global quality standards reinforce Asia-Pacific’s dominance in the Cleanroom Apparels Market.Recent Developments:

In 2024, DuPont expanded its Tyvek IsoClean cleanroom apparel portfolio and extended its recycling program for disposable cleanroom garments, supporting sustainability and contamination control. These initiatives strengthened DuPont’s position in pharmaceutical, biotechnology, and semiconductor cleanroom applications. In 2024, Ansell Limited strengthened its cleanroom presence through the acquisition of Kimberly-Clark’s PPE business, including Kimtech and KleenGuard brands, expanding its sterile PPE and cleanroom apparel offerings while advancing sustainability initiatives and regulatory-compliant solutions.Global Cleanroom Apparels Market Scope: Inquire before buying

Global Cleanroom Apparels Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 641.3 Mn. Forecast Period 2026 to 2032 CAGR: 5.4% Market Size in 2032: USD 926.7 Mn. Segments Covered: by Product Type Coveralls Hoods Booties Gowns Gloves Face Masks Others by Protection Level Controlled Environment Standard Protection High-Performance Protection ESD (Electrostatic Discharge) Protection Particle-repellent by Material Type Polyester Polypropylene Cotton Others by End-User Pharmaceutical Biotechnology Healthcare Semiconductors Aerospace Food Processing by Distribution Channel Online Retail Distributors Direct Sales Wholesale Specialty Stores Cleanroom Apparels Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Cleanroom Apparels Market, Key Players

1. DuPont 2. Kimberly-Clark / Kimtech 3. 3M 4. Ansell (BioClean) 5. Berkshire Corporation 6. Alpha Pro Tech 7. Lakeland Industries (CleanMax) 8. Micronclean 9. Valutek 10. KM Corporation 11. Worklon (Superior Uniform Group) 12. Aramark 13. Cintas 14. UniClean (UniFirst Corporation) 15. Prudential Cleanroom Services 16. Cardinal Health 17. Medline Industries 18. Honeywell 19. Cole-Parmer (Antylia Scientific) 20. Contec, Inc. 21. Illinois Tool Works (ITW) 22. CliniMed Holdings 23. Dycem 24. Foamtec International (WCC) 25. High Tech Conversions 26. Terra Universal 27. VAI (Veltek Associates, Inc.) 28. Micronova Manufacturing 29. Narang Medical 30. Lindström 31. Others FAQs 1. Which product segment dominates the Cleanroom Apparels Market? Answer: Cleanroom coveralls dominate the market due to their full-body protection, high adoption in ISO Class 5–7 and EU GMP Grade A–C cleanrooms, and frequent use in pharmaceutical manufacturing and semiconductor fabrication facilities. 2. What industries drive demand for cleanroom apparels? Answer: Key demand-driving industries include pharmaceuticals, biotechnology, healthcare, semiconductors, aerospace, and food processing, where strict hygiene, sterility, and contamination-control regulations mandate the use of cleanroom garments. 3. Why is Asia-Pacific the fastest-growing region in the Cleanroom Apparels Market? Answer: Asia-Pacific leads growth due to rapid expansion of semiconductor fabs, pharmaceutical manufacturing, and biotechnology facilities in countries such as China, South Korea, Japan, Taiwan, and India, resulting in high-volume demand for cleanroom coveralls, hoods, masks, and booties. 4. What is the future outlook of the Cleanroom Apparels Market? Answer: The market is expected to grow steadily, driven by stricter regulatory standards, increasing sterile drug production, rising semiconductor investments, and growing food safety concerns, with continued demand for sterile, ESD-safe, and high-performance cleanroom apparel. 5. What is the Cleanroom Apparels Market? Answer: The Cleanroom Apparels Market includes specialized protective garments such as coveralls, hoods, booties, gowns, gloves, and face masks designed to control contamination and protect personnel in regulated environments like pharmaceuticals, biotechnology, semiconductors, healthcare, and food processing.

1. Cleanroom Apparels Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Cleanroom Apparels Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Cleanroom Apparels Market: Dynamics 3.1. Cleanroom Apparels Market Trends 3.2. Cleanroom Apparels Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 3.8. Technology & Material Insights 3.8.1. Comparison of Material Types Used in Cleanroom Apparels 3.8.2. Performance Differentiation Parameters in Cleanroom Garments 3.8.3. Material Innovations for Sterile and High-Risk Cleanroom Environments 3.8.4. Longevity, Maintenance, and Serviceability of Reusable Cleanroom Apparels 3.8.5. Compatibility of Cleanroom Apparels with ISO Class 1–8 Cleanroom Operations 3.8.6. Emerging Technologies in Cleanroom Apparels (ESD, Smart Fabrics, Antimicrobial Coatings) 3.8.7. Thermal, Chemical, and Mechanical Resistance Benchmarking of Cleanroom Apparels 3.9. Application Analysis 3.9.1. Role of Cleanroom Apparels in Pharmaceutical Manufacturing and Aseptic Processing 3.9.2. Application of Cleanroom Apparels in Biotechnology and Medical Device Production 3.9.3. Use of Cleanroom Apparels in Semiconductor and Electronics Manufacturing 3.9.4. Process Optimization and Contamination Control through Cleanroom Apparels 3.9.5. Impact of Cleanroom Apparels on Worker Safety and Regulatory Compliance 3.9.6. Integration of Cleanroom Apparels into Controlled Manufacturing Workflows 3.10. Cost, ROI & Operational Efficiency 3.10.1. Total Cost of Ownership (TCO) of Cleanroom Apparels 3.10.2. ROI Comparison: Disposable vs. Reusable Cleanroom Apparels 3.10.3. Operational Efficiency Metrics (Changeover Time, Garment Life Cycles) 3.10.4. Cost Impact of Wear, Tear, and Fabric Degradation 3.10.5. Payback Period Analysis for Reusable Cleanroom Apparel Systems 3.10.6. Advanced vs. Conventional Cleanroom Apparels (ESD, Sterile Packs, Smart 3.10.7. Energy and Resource Efficiency in Cleanroom Apparel 3.11. Sustainability & Environmental Impact 3.11.1. Environmental Footprint of Materials Used in Cleanroom Apparels 3.11.2. Emission Control and Contamination Prevention through Apparel Design 3.11.3. Energy Efficiency in Laundering and Sterilization Processes 3.11.4. Environmental Compliance Standards for Cleanroom Apparels 3.11.5. Impact of Reusable and Modular Cleanroom Apparel Systems 3.11.6. Circular Economy Initiatives in Cleanroom Apparel Manufacturing 3.12. Impact of Cleanroom Apparels on Spill, and Cross-Contamination 3.12.1. Supply Chain & Procurement Analysis 3.12.2. Supplier Concentration and OEM Dominance in the Cleanroom Apparels 3.12.3. Lead Time and Delivery Benchmarking for Cleanroom Apparel Supply 3.12.4. Raw Material Dependency Risks (Polyester, PP, Specialty Fabrics) 3.12.5. Strategic Sourcing of High-Performance and Sterile Cleanroom Apparels 3.12.6. Vendor Evaluation Criteria for Cleanroom Apparel Suppliers 3.12.7. Impact of Logistics Disruptions on Cleanroom Apparel Availability 3.12.8. Procurement Best Practices for Cleanroom Apparels and Garment Services 3.13. Operational Performance & Reliability 3.13.1. Lifecycle Performance Metrics of Cleanroom Apparels 3.13.2. Consistency of Particle and Microbial Barrier Performance 3.13.3. Fabric Stress, Tear Resistance, and Seam Integrity Analysis 3.13.4. Downtime Risks Due to Apparel Failure or Non-Compliance 3.13.5. Reliability of Cleanroom Apparels in High-Humidity and High-Sterility Environments 3.13.6. Preventive Maintenance and Replacement Benchmarking 3.13.7. Correlation between Apparel Performance and Cleanroom Uptime 3.14. Regulatory Compliance & Quality Standards 3.14.1. Global Standards and Certifications for Cleanroom Apparels (ISO, GMP, FDA) 3.14.2. Safety and Contamination Control Requirements for Cleanroom Garments 3.14.3. Validation and Testing Protocols for Cleanroom Apparels 3.14.4. Regional Regulatory Impact on Cleanroom Apparel Design and Materials 3.14.5. Quality Assurance and Traceability Metrics 3.14.6. Audit Readiness and Inspection Support Provided by Cleanroom Apparel Vendors 3.14.7. Certification and Compliance Trends in the Cleanroom Apparels Market 4. Cleanroom Apparels Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume 000’Units) (2025-2032) 4.1. Cleanroom Apparels Market Size and Forecast, By Product Type (2025-2032) 4.1.1. Coveralls 4.1.2. Hoods 4.1.3. Booties 4.1.4. Gowns 4.1.5. Gloves 4.1.6. Face Masks 4.2. Cleanroom Apparels Market Size and Forecast, By Protection Level (2025-2032) 4.2.1. Controlled Environment 4.2.2. Standard Protection 4.2.3. High-Performance Protection 4.2.4. ESD (Electrostatic Discharge) Protection 4.2.5. Particle-repellent 4.3. Cleanroom Apparels Market Size and Forecast, By Material Type (2025-2032) 4.3.1. Polyester 4.3.2. Polypropylene 4.3.3. Cotton 4.3.4. Others 4.4. Cleanroom Apparels Market Size and Forecast, By End User (2025-2032) 4.4.1. Pharmaceutical 4.4.2. Biotechnology 4.4.3. Healthcare 4.4.4. Semiconductors 4.4.5. Aerospace 4.4.6. Food Processing 4.5. Cleanroom Apparels Market Size and Forecast, By Distribution Channel (2025-2032) 4.5.1. Online Retail 4.5.2. Distributors 4.5.3. Direct Sales 4.5.4. Wholesale 4.5.5. Specialty Stores 4.6. Cleanroom Apparels Market Size and Forecast, By Region (2025-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Cleanroom Apparels Market Size and Forecast by Segmentation (by Value in USD Million and Volume 000’Units) (2025-2032) 5.1. North America Cleanroom Apparels Market Size and Forecast, By Product Type (2025-2032) 5.2. North America Cleanroom Apparels Market Size and Forecast, By Protection Level (2025-2032) 5.3. North America Cleanroom Apparels Market Size and Forecast, By Material Type (2025-2032) 5.4. North America Cleanroom Apparels Market Size and Forecast, By End User (2025-2032) 5.5. North America Cleanroom Apparels Market Size and Forecast, By Distribution Channel (2025-2032) 5.6. North America Cleanroom Apparels Market Size and Forecast, by Country (2025-2032) 5.6.1. United States 5.6.2. Canada 5.6.3. Mexico 6. Europe Cleanroom Apparels Market Size and Forecast by Segmentation (by Value in USD Million and Volume 000’Units) (2025-2032) 6.1. Europe Cleanroom Apparels Market Size and Forecast, By Product Type (2025-2032) 6.2. Europe Cleanroom Apparels Market Size and Forecast, By Protection Level (2025-2032) 6.3. Europe Cleanroom Apparels Market Size and Forecast, By Material Type (2025-2032) 6.4. Europe Cleanroom Apparels Market Size and Forecast, By End User (2025-2032) 6.5. Europe Cleanroom Apparels Market Size and Forecast, By Distribution Channel (2025-2032) 6.6. Europe Cleanroom Apparels Market Size and Forecast, by Country (2025-2032) 6.6.1. United Kingdom 6.6.2. France 6.6.3. Germany 6.6.4. Italy 6.6.5. Spain 6.6.6. Sweden 6.6.7. Russia 6.6.8. Rest of Europe 7. Asia Pacific Cleanroom Apparels Market Size and Forecast by Segmentation (by Value in USD Million and Volume 000’Units) (2025-2032) 7.1. Asia Pacific Cleanroom Apparels Market Size and Forecast, By Product Type (2025-2032) 7.2. Asia Pacific Cleanroom Apparels Market Size and Forecast, By Protection Level (2025-2032) 7.3. Asia Pacific Cleanroom Apparels Market Size and Forecast, By Material Type (2025-2032) 7.4. Asia Pacific Cleanroom Apparels Market Size and Forecast, By End User (2025-2032) 7.5. Asia Pacific Cleanroom Apparels Market Size and Forecast, By Distribution Channel (2025-2032) 7.6. Asia Pacific Cleanroom Apparels Market Size and Forecast, by Country (2025-2032) 7.6.1. China 7.6.2. S Korea 7.6.3. Japan 7.6.4. India 7.6.5. Australia 7.6.6. Indonesia 7.6.7. Malaysia 7.6.8. Philippines 7.6.9. Thailand 7.6.10. Vietnam 7.6.11. Rest of Asia Pacific 8. Middle East and Africa Cleanroom Apparels Market Size and Forecast (by Value in USD Million and Volume 000’Units) (2025-2032) 8.1. Middle East and Africa Cleanroom Apparels Market Size and Forecast, By Product Type (2025-2032) 8.2. Middle East and Africa Cleanroom Apparels Market Size and Forecast, By Protection Level (2025-2032) 8.3. Middle East and Africa Cleanroom Apparels Market Size and Forecast, By Material Type (2025-2032) 8.4. Middle East and Africa Cleanroom Apparels Market Size and Forecast, By End User (2025-2032) 8.5. Middle East and Africa Cleanroom Apparels Market Size and Forecast, By Distribution Channel (2025-2032) 8.6. Middle East and Africa Cleanroom Apparels Market Size and Forecast, by Country (2025-2032) 8.6.1. South Africa 8.6.2. GCC 8.6.3. Egypt 8.6.4. Nigeria 8.6.5. Rest of ME&A 9. South America Cleanroom Apparels Market Size and Forecast by Segmentation (by Value in USD Million and Volume 000’Units) (2025-2032) 9.1. South America Cleanroom Apparels Market Size and Forecast, By Product Type (2025-2032) 9.2. South America Cleanroom Apparels Market Size and Forecast, By Protection Level (2025-2032) 9.3. South America Cleanroom Apparels Market Size and Forecast, By Material Type (2025-2032) 9.4. South America Cleanroom Apparels Market Size and Forecast, By End User (2025-2032) 9.5. South America Cleanroom Apparels Market Size and Forecast, By Distribution Channel (2025-2032) 9.6. South America Cleanroom Apparels Market Size and Forecast, by Country (2025-2032) 9.6.1. Brazil 9.6.2. Argentina 9.6.3. Colombia 9.6.4. Chile 9.6.5. Rest Of South America 10. Company Profile: Key Players 10.1. DuPont 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Kimberly-Clark / Kimtech 10.3. 3M 10.4. Ansell (BioClean) 10.5. Berkshire Corporation 10.6. Alpha Pro Tech 10.7. Lakeland Industries (CleanMax) 10.8. Micronclean 10.9. Valutek 10.10. KM Corporation 10.11. Worklon (Superior Uniform Group) 10.12. Aramark 10.13. Cintas 10.14. UniClean (UniFirst Corporation) 10.15. Prudential Cleanroom Services 10.16. Cardinal Health 10.17. Medline Industries 10.18. Honeywell 10.19. Cole-Parmer (Antylia Scientific) 10.20. Contec, Inc. 10.21. Illinois Tool Works (ITW) 10.22. CliniMed Holdings 10.23. Dycem 10.24. Foamtec International (WCC) 10.25. High Tech Conversions 10.26. Terra Universal 10.27. VAI (Veltek Associates, Inc.) 10.28. Micronova Manufacturing 10.29. Narang Medical 10.30. Lindström 10.31. Others 11. Key Findings 12. Analyst Recommendations 13. Cleanroom Apparels Market: Research Methodology