Biometric Vehicle Access Systems Market size was valued at US$ 840 Mn. in 2021 and the total revenue is expected to grow at 13.5% through 2022 to 2029, reaching nearly US$ 2313.37 Mn.Biometric Vehicle Access Systems Market Overview:

A biometric vehicle access system is a technology that allows for automated vehicle access based on behavioural or physiological characteristics. It is used for manual access verification and identification for better anti-theft protection and insight into car owners' comfort and safety. The biometric vehicle access system technology is simple, safe, and convenient to use. The term "biometric vehicle access system" refers to a variety of versions, including fingerprint recognition, voice recognition, and others. The fingerprint recognition system for vehicle access is more widely available in the market than the voice recognition system. The use of a Biometric vehicle access system ensures easy tracking. Numerous brands are adopting biometric vehicle access technology to seek better ways to increase the safety and security system of the vehicles. The global Biometric Vehicle Access System Market is expected to grow rapidly due to rising demand for authentication and high security, which is driving the market toward the adoption of a biometric vehicle access system. Furthermore, improved legislation regarding biometric identification systems is contributing to market growth.To know about the Research Methodology:-Request Free Sample Report

Biometric Vehicle Access Systems Market Dynamics:

Global biometric vehicle access is a growing new market in the vehicle security industry, with these systems currently being used in luxury cars and retrofitted by commercial vehicle owners for security and fleet monitoring. The size of the Biometric Vehicle Access Market will grow due to rising demand for automated safety and security features in automobiles. Biometric Vehicle Access Systems Market Drivers: • Insurance companies' premium reductions for vehicles equipped with biometric systems will increase market demand. • Multi-factor authentication for vehicle safety will improve safety and make it more appealing to vehicle buyers, resulting in increased market demand. • An increase in biometric identification system legislation. • During the forecast period, technological advancements for quick authentication and user-friendly high-end protection systems will drive demand for the biometric vehicle access market. • Design standards specified by International Organization for Standardization (ISO) and International Electrotechnical Commission (IEC) ensures the system operationality resulting in improved performance. Biometric Vehicle Access Systems Market Restraints: The potential failure of electronic components used in biometric vehicle access systems is a major factor limiting market growth. Biometric vehicle access systems rely heavily on electronic components such as electrical wiring and batteries to function properly. Any of these components failing could compromise the vehicle's security system. This also leads to a high number of replacements in the event of minor damage to the security system. The dependability of electronic components is critical in complex security systems such as fingerprint recognition systems. As a result, the potential failure of electronic components could be a stumbling block for the biometric vehicle access market. Biometric Vehicle Access Systems Market Opportunities: • Rising demand for safety features and convenience in vehicle will create new market opportunities for manufacturers. Biometric Vehicle Access Systems Market Challenges: • Increased connectivity would increase risk of cyber attacks as more and more electronic parts are involved in the vehicles. • Because most biometric systems are not specifically designed for extreme weather conditions, weather conditions may impair their functionality. • Owners' concerns about data security and threats posed by increasing electronic components in automobiles will limit the biometric vehicle access market. • System dysfunctionality will limit technology adoption during the forecast period, resulting in system failure and false authentication.Biometric Vehicle Access Systems Market Segment Analysis:

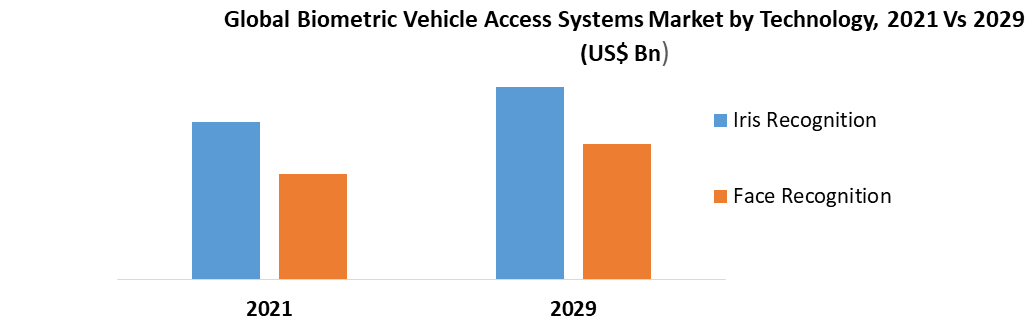

Based on Product, the Biometric Vehicle Access Systems market is bifurcated into Hand Geometry, Voice Recognition, and Fingerprint. Given its high reliability, the fingerprint recognition system is expected to account for the largest chunk of market revenue. Two people's fingerprints are never the same; they can be distinguished. As a result, the likelihood of fraud in the fingerprint recognition system is lower than in the voice recognition system. Based on Application, the Biometric Vehicle Access Systems market is bifurcated into Passenger Vehicle and Commercial Vehicle. The commercial vehicle segment is expected to grow at the fastest rate during the forecast period. The factors that can be attributed to the segment's growth include the increasing demand for biometric vehicle access systems in commercial vehicles due to the increased demand for authentication and high security.Based on technology, the Biometric Vehicle Access Systems market can be segregated into retina or iris and face recognition systems. The iris recognition system's demand is expected to rise rapidly as demand for safety features rises. Because faces can be cloned, the face recognition system is vulnerable to fraud. Many scams involving face cloning have been exposed in the past. As a result, demand for iris or retina recognition systems has increased. The segment is currently growing and is expected to grow significantly by 2029.

Biometric Vehicle Access Systems Market Regional Insights:

North America is expected to hold a relatively larger share of the global automotive biometrics vehicle access system market due to the region's rising disposable income and growing consumer adaptability to such extremely technologically advanced products. In 2021, Europe dominated the global biometric vehicle access market. Europe has a sophisticated banking sector and public transportation that employs cutting-edge access technology. This has contributed to biometric vehicle access technology gaining a strong foothold in the European market. Many automotive OEMs in Europe produce high-end luxury cars and heavy commercial vehicles. Europe is the largest market for high-end vehicles, so Europe has the largest market share in the biometric vehicle access market. Asia Pacific is expected to grow at a higher rate, with significant growth in the second half of the forecast period. Population growth in Asia Pacific is expected to drive market growth in the region. The market for automotive biometric access systems in India and China is rapidly expanding. China is the global leader in the electric vehicle industry, which is expected to drive market growth. Demand for these systems is anticipated to rise in the near future due to the expanding automobile industry in the region. The report's goal is to provide industry stakeholders with a comprehensive analysis of the Biometric Vehicle Access Systems market. The report analyses complicated data in simple language and presents the past and current state of the industry, as well as forecasted market size and trends. The report examines all aspects of the industry, including a detailed examination of key players such as market leaders, followers, and new entrants. The report includes a PORTER and PESTEL analysis, as well as the potential impact of market microeconomic factors. External and internal factors that are expected to have a positive or negative impact on the business have been examined, providing a clear future view of the industry. The report also aids in understanding the Biometric Vehicle Access Systems market dynamics, structure, and size by analysing market segments. The report is an investor's guide due to its clear representation of competitive analysis of key players in the Biometric Vehicle Access Systems market by product, price, financial position, product portfolio, growth strategies, and regional presence.Biometric Vehicle Access Systems Market Scope: Inquire before buying

Global Biometric Vehicle Access Systems Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 840 Mn. Forecast Period 2022 to 2029 CAGR: 13.5% Market Size in 2029: US $ 2313.37 Mn. Segments Covered: by Product • Hand Geometry • Voice Recognition • Fingerprint by Application • Commercial • Passenger by Technology • Iris Recognition • Face Recognition Biometric Vehicle Access Systems Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaBiometric Vehicle Access Systems Market Key Players are:

• BioEnable (India) • Fingerprint Cards Ab (Sweden) • Fujitsu Ltd (Japan) • Hid-Global (USA) • Hitachi Ltd (Japan) • Methode Electronics (USA) • Miaxis (China) • Nuance Communications (USA) • Nymi (Canada) • Safran S.A (paris) • Sonavation (USA) • Synaptics Incorporated (USA) • Techshino (USA) • Voicebox Technologies (USA) • Voxx International (USA) Frequently Asked Questions: 1. What is the forecast period considered for the Biometric Vehicle Access Systems market report? Ans. The forecast period for the Biometric Vehicle Access Systems market is 2022-2029. 2. Which key factors are hindering the growth of the Biometric Vehicle Access Systems market? Ans. The potential failure of electronic components used in biometric vehicle access systems is a major factor limiting market growth 3. What is the compound annual growth rate (CAGR) of the Biometric Vehicle Access Systems market for the forecast period? Ans. The Biometric Vehicle Access Systems market is estimated to grow at CAGR of 13.5% through the forecasted period (2022-2029).

1. Biometric Vehicle Access Systems Market: Research Methodology 2. Biometric Vehicle Access Systems Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Biometric Vehicle Access Systems Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Biometric Vehicle Access Systems Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Biometric Vehicle Access Systems Market Segmentation 4.1. Biometric Vehicle Access Systems Market, by Product Type (2021-2029) • Hand Geometry • Voice Recognition • Fingerprint 4.2. Biometric Vehicle Access Systems Market, by Application (2021-2029) • Passenger • Commercial 4.3. Biometric Vehicle Access Systems Market, by Technology (2021-2029) • Iris Recognition • Face Recognition 5. North America Biometric Vehicle Access Systems Market (2021-2029) 5.1. North America Biometric Vehicle Access Systems Market, by Product Type (2021-2029) • Hand Geometry • Voice Recognition • Fingerprint 5.2. North America Biometric Vehicle Access Systems Market, by Application (2021-2029) • Commercial • Passenger 5.3. North America Biometric Vehicle Access Systems Market, by Technology (2021-2029) • Iris Recognition • Face Recognition 5.4. North America Biometric Vehicle Access Systems Market, by Country (2021-2029) • US • Canada • Mexico 6. European Biometric Vehicle Access Systems Market (2021-2029) 6.1. European Biometric Vehicle Access Systems Market, by Product Type (2021-2029) 6.2. European Biometric Vehicle Access Systems Market, by Application (2021-2029) 6.3. European Biometric Vehicle Access Systems Market, by Technology (2021-2029) 6.4. European Biometric Vehicle Access Systems Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Biometric Vehicle Access Systems Market (2021-2029) 7.1. Asia Pacific Biometric Vehicle Access Systems Market, by Product Type (2021-2029) 7.2. Asia Pacific Biometric Vehicle Access Systems Market, by Application (2021-2029) 7.3. Asia Pacific Biometric Vehicle Access Systems Market, by Technology (2021-2029) 7.4. Asia Pacific Biometric Vehicle Access Systems Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Biometric Vehicle Access Systems Market (2021-2029) 8.1. Middle East and Africa Biometric Vehicle Access Systems Market, by Product Type (2021-2029) 8.2. Middle East and Africa Biometric Vehicle Access Systems Market, by Application (2021-2029) 8.3. Middle East and Africa Biometric Vehicle Access Systems Market, by Technology (2021-2029) 8.4. Middle East and Africa Biometric Vehicle Access Systems Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Biometric Vehicle Access Systems Market (2021-2029) 9.1. South America Biometric Vehicle Access Systems Market, by Product Type (2021-2029) 9.2. South America Biometric Vehicle Access Systems Market, by Application (2021-2029) 9.3. South America Biometric Vehicle Access Systems Market, by Technology (2021-2029) 9.4. South America Biometric Vehicle Access Systems Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. BioEnable (India) 10.1.1. Overview 10.1.2. Financial Overview 10.1.3. Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Fingerprint Cards Ab (Sweden) 10.3. Fujitsu Ltd (Japan) 10.4. Hid-Global (USA) 10.5. Hitachi Ltd (Japan) 10.6. Methode Electronics (USA) 10.7. Miaxis (China) 10.8. Nuance Communications (USA) 10.9. Nymi (Canada) 10.10. Safran S.A (paris) 10.11. Sonavation (USA) 10.12. Synaptics Incorporated (USA) 10.13. Techshino (USA) 10.14. Voicebox Technologies (USA) 10.15. Voxx International (USA)