The Automotive carbon wheels Market size was valued at USD 687.17 million in 2023 and the total Automotive Carbon Wheels Market size is expected to grow at a CAGR of 8.1% from 2024 to 2030, reaching nearly USD 1185.34 million in 2030.Automotive Carbon Wheels Market Overview: -

Automotive carbon wheels are lightweight, have a long wheel life, and are extremely strong. They have also other advantages over the traditional wheels, including high fatigue damage strength & durability, self-vibration dissipative, good traction, and high-temperature rigidity. Carbon wheels enhance fuel efficiency and lower carbon emissions, are all such factors drive the global automotive carbon wheels market. Steel and aluminium materials are also comparatively bulkier than carbon wheels. Hence, manufacturers catering to high-performance luxury, racing, or motorsports applications prefer carbon wheels to obtain benefits, such as weight reduction, enhanced ride comfort, and improved vehicle dynamics. The recent trends towards increased comfort and safety concerns, luxury, and advanced technologies in the automotive sector will drive the Automotive Carbon Wheels penetration. The market forecast is poised to witness sustainable demand, encouraging the flow of investments into the sector.To know about the Research Methodology :- Request Free Sample Report

Automotive Carbon Wheel Market Dynamics:

The Improving Fuel Efficiency to drive the Demand for Automotive Carbon Wheels Market The automotive industry is continuously working on improving the efficiency and performance of wheels. By reducing the weight of the vehicle's wheels, it improves the driving experience, faster acceleration, faster deceleration, improved suspension, and improved fuel efficiency. Consumers are increasingly looking for customized automotive interiors and exteriors that reflect their style and preferences. Automotive carbon wheels are an integral part of the customization trend, as they allow consumers to choose from a wide range of designers and finishes. The relentless pursuit of excellence acts as a driving force, ensuring they not only meet current market demands but also proactively stay ahead in an environment marked by constant evolution. EV manufacturers are focusing on reducing vehicle mass and enhancing range and ride comfort. The Surge of Carbon Wheels in Automotive Manufacturing The automotive companies are adopting new design tools and materials, such as high-strength steel, to innovate wheels. Several automotive component manufacturers are investing in enhancing their manufacturing facilities, which in turn is likely to witness major growth for the market during the forecast period. Fuelled by technological advancements, shifting consumer preferences, and strategic innovations, the market is poised for rapid growth. In India, the growth rate of alloy wheels is more than the growth in the automotive wheel market average. Passenger cars have been growing at a rate of approximately 9% per annum. The growth rate of alloy wheels has been more than 15%, which is expected to grow at 20% in the forecast period. Ford, one of the leading automakers, has introduced the world’s first mass-produced carbon wheels for the Mustang Shelby GT350R. Ford has also fitted carbon wheels to its Ford GT and Mustang Shelby Gt500. the market is witnessing the development of advanced manufacturing techniques and materials, such as hybrid carbon fiber composites, which aim to further enhance the performance and cost-effectiveness of carbon fiber wheels. Growing Opportunities in the Luxury Automotive Market The rising demand for luxury vehicles in the four-wheeler segment is expected to expand the market's opportunities during the forecast period. Increasing innovation to improve the speed efficiency of the automobile is anticipated to create massive investment opportunities in the market. BMW, Audi, Mercedes-Benz, Volvo, Jaguar, Rolls-Royce, and Land Rover are major automakers that produce the vast majority of luxury vehicles. The increasing availability of hybrid and electric vehicles as a result of growing concern about climate change and global warming will drive demand for carbon wheels. Globalization and digitalization will play key roles in shaping its trajectory, offering lucrative opportunities for stakeholders. Navigating Non-Standardization and Regulatory Gaps Lack of market standardization and regulatory measures in developing and undeveloped countries such as African nations can restrict the market growth in the forecast period. When a carbon rim cracks or is damaged, it should be removed and replaced immediately, as opposed to an aluminium rim. An aluminium rim is trued, tensioned, and ridden even if it is dented or flat-spotted. All such factors restrict the market growth in the 2024-2030.

Automotive Carbon Wheel Market Segment Analysis:-

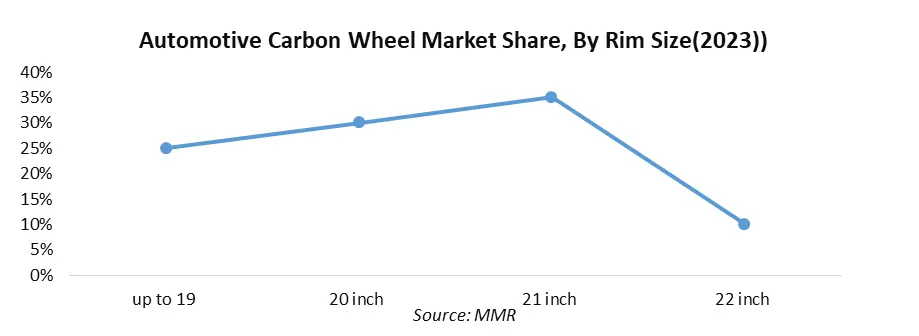

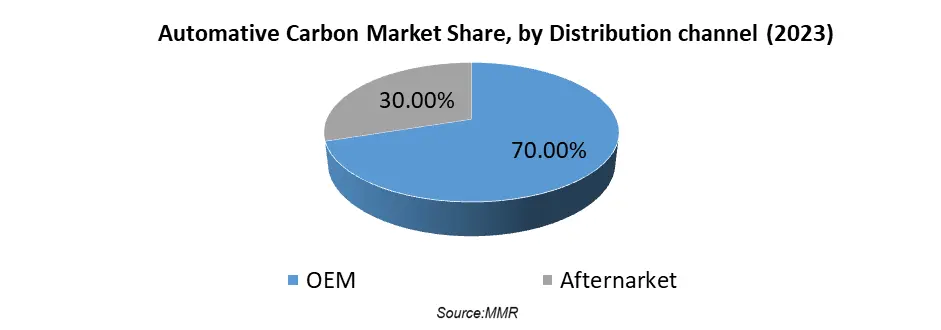

By Vehicle type, the passenger vehicles segment type is estimated to hold the largest share of the global market and is expected to grow at a CAGR of 8.42 %, with USD 2,847,897.10 million by 2030. In 2023, total passenger vehicle sales increased from 30, 69,523 to 38, 90,114 units. China and the United States make up approximately 50% of the total global revenue generated by the Passenger Cars market. The passenger vehicle wheels play a pivotal role in the overall performance, aesthetics, and safety of vehicles, encompassing a wide range of designs, materials, and specifications. Opportunities within the Passenger Vehicle Wheels Market are abundant, driven by technological advancements, evolving consumer preferences, and the perpetual quest for enhanced fuel efficiency. The Tesla Model Y was the most registered new passenger car of March and Q1 2023.By Distribution Channel, in the OEM segment, the carbon wheels market is anticipated to reach USD 705 million between 2024 and 2030. Germany-based Volkswagen AG is the leading automotive OEM in the world (by revenue). OEM end-users are manufactured in conformance to OEM manufacturing capabilities and quality standards that maintain brand value, which simulates the uptake of carbon wheels by OEMs. OEM wheels are designed to last long with the vehicle life and, also be replaced or changed in case of accidental damage or by an enthusiast. The need for original equipment manufacturing parts has become significant in passenger vehicles because there is a rise in the market for cars and the upsurge in usage of these vehicles globally. Rapid technological advancements have augmented demand for filters for diesel engine vehicles, and increased demand for automotive parts innovation. The countries involvement in the automotive original equipment manufacturer (OEMS) market are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel.

Automotive Carbon Wheels Market by Regional Insight,

Europe region is the dominant market and is expected to grow at CAGR 8.6% during 2024- 2030, impelled by higher visibility of significant innovation and product differentiation among carbon wheel manufacturers in the region. Automotive carbon wheel market demand is likely to increase shortly in Europe owing to the growth in the adoption of electric vehicles. High investment rising competition among luxury automakers, and the significant presence of luxury automakers are fuelling the automotive carbon wheel market in Europe. The demand for automotive tires in Europe is closely tied to vehicle sales. High production of vehicles including passenger cars, light commercial vehicles, and heavy commercial vehicles, can impact tire demand. Economic conditions, consumer purchasing power, and government regulations play essential roles in vehicle sales and consequently, tire demand. Europe also has a strong market for premium and high-performance tires. Consumers in the region value safety, performance, and handling characteristics, leading to a demand for specialized tires that offer enhanced traction, handling, and durability. The rising demand for electric vehicles is expected to have a significant impact on the automotive tire industry in Europe. Hyundai Motor Europe Technical Centre and Thyssenkrupp AG collaborated to develop carbon fiber and aluminum hybrid wheels. The share held is being driven by ongoing developments and partnerships between industry players. All such factors are expected to drive the European automotive carbon wheels market and witness noticeable growth.The Asia Pacific Automotive Carbon Wheels Market is expected to witness market growth of 9.7% CAGR during the forecast period. The growth of the automotive carbon wheel market is attributed to the increased production and demand for passenger vehicles. Also, the increasing demand for fuel economy, vehicle performance, and the growing purchasing power of consumers in developing countries are driving the market in the Asia Pacific region. In 2018, China's specialist car components industry was valued at $3.5 million, representing a 30 percent annual growth rate. Although China's 'Road Safety Law' virtually outlaws modifications, the car modification business continues popular in several major cities, and overseas specialty equipment manufacturers have recognized the market's potential. India is a major vehicle exporter, with excellent export growth prospects in the forecast period. Additional, initiatives by the Indian government and major vehicle manufacturers are anticipated to accelerate India to the forefront. Automotive Carbon Wheel Market Competitive Landscape: - 1. In 2023, Ford launched the new Mustang ‘Dark Horse’ with Carbon Revolution’s carbon fiber wheels. The marks of Carbon Revolution’s first core vehicle program with Ford, demonstrating broader adoption of our lightweight wheel technology. 2. In 2023, General Motors launched the Corvette E-Ray, the second Corvette model that will also feature Carbon Revolution wheels as announced in last of the 2023. 3. In 2023, Jaguar Landrover revealed the 2024 Range Rover Sport SV with our wheels. The Carbon Revolution’s debut in the SUV carbon fiber wheel sector highlights a remarkable expansion of our advanced lightweight wheel technology into the vast SUV segment. 4. In September 2023, Carbon Revolution Limited (Carbon Revolution), a Tier 1 OEM supplier and a leading global manufacturer of lightweight advanced technology carbon fiber wheels, is pleased to announce shareholders overwhelmingly approved the proposed scheme of arrangement under which Carbon Revolution plc (Irish company number: 607450) (MergeCo) will acquire Carbon Revolution.

Automotive Carbon Wheels Market Scope: Inquire before buying

Automotive Carbon Wheels Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 687.17 Mn. Forecast Period 2024 to 2030 CAGR: 8.1% Market Size in 2030: US $ 1185.34 Mn. Segments Covered: by Vehicle Type Two Wheelers Passenger Cars Commercial Vehicles by Distribution Channel OEM Aftermarket Automotive Carbon Wheels Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Industry Player In The Automotive Carbon Wheels Market:

1. Carbon Revolution Ltd. 2. Thyssenkrupp AG 3. Hitachi Metals, Ltd. (Hitachi, Ltd.) 4. Dymag Group Ltd. 5. HRE Performance Wheels 6. Litespeed Racing Inc. 7. Rolko Kohlgrüber GmbH 8. Ronal Group 9. Rotobox d.o.o. 10. ESE Carbon Company 11. Blackstone Tek, 12. Bucci Composites, 13. Geric,HRE, 14. Phoenix Wheel Company, 15. GmbH, Frequently Asked Questions: 1] What segments are covered in the Automotive Carbon Wheels Market report? Ans. The segments covered in the Automotive Carbon Wheels Market report are based on Vehicle Type and Distribution Channel. 2] Which region is expected to hold the highest share in the Automotive Carbon Wheels Market? Ans. The Asia Pacific region is expected to hold the highest share of the Automotive Carbon Wheels Market. 3] What is the market size of the Automotive Carbon Wheels Market by 2030? Ans. The market size of the Automotive Carbon Wheels Market by 2030 is US$1185.34 M. 4] What is the forecast period for the Automotive Carbon Wheels Market? Ans. The Forecast period for the Automotive Carbon Wheels Market is 2024- 2030.

1. Automotive Carbon Wheels Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Carbon Wheels Market: Dynamics 2.1. Automotive Carbon Wheels Market Trends by Region 2.1.1. North America Automotive Carbon Wheels Market Trends 2.1.2. Europe Automotive Carbon Wheels Market Trends 2.1.3. Asia Pacific Automotive Carbon Wheels Market Trends 2.1.4. Middle East and Africa Automotive Carbon Wheels Market Trends 2.1.5. South America Automotive Carbon Wheels Market Trends 2.2. Automotive Carbon Wheels Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Carbon Wheels Market Drivers 2.2.1.2. North America Automotive Carbon Wheels Market Restraints 2.2.1.3. North America Automotive Carbon Wheels Market Opportunities 2.2.1.4. North America Automotive Carbon Wheels Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Carbon Wheels Market Drivers 2.2.2.2. Europe Automotive Carbon Wheels Market Restraints 2.2.2.3. Europe Automotive Carbon Wheels Market Opportunities 2.2.2.4. Europe Automotive Carbon Wheels Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Carbon Wheels Market Drivers 2.2.3.2. Asia Pacific Automotive Carbon Wheels Market Restraints 2.2.3.3. Asia Pacific Automotive Carbon Wheels Market Opportunities 2.2.3.4. Asia Pacific Automotive Carbon Wheels Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Carbon Wheels Market Drivers 2.2.4.2. Middle East and Africa Automotive Carbon Wheels Market Restraints 2.2.4.3. Middle East and Africa Automotive Carbon Wheels Market Opportunities 2.2.4.4. Middle East and Africa Automotive Carbon Wheels Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Carbon Wheels Market Drivers 2.2.5.2. South America Automotive Carbon Wheels Market Restraints 2.2.5.3. South America Automotive Carbon Wheels Market Opportunities 2.2.5.4. South America Automotive Carbon Wheels Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Automotive Carbon Wheels Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Carbon Wheels Industry 2.9. Automotive Carbon Wheels Market Trade Analysis 2.10. The Global Pandemic Impact on Automotive Carbon Wheels Market 3. Automotive Carbon Wheels Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 3.1.1. Two Wheelers 3.1.2. Passenger Cars 3.1.3. Commercial Vehicles 3.2. Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 3.2.1. OEM 3.2.2. Aftermarket 3.3. Automotive Carbon Wheels Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Automotive Carbon Wheels Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 4.1.1. Two Wheelers 4.1.2. Passenger Cars 4.1.3. Commercial Vehicles 4.2. North America Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 4.2.1. OEM 4.2.2. Aftermarket 4.3. North America Automotive Carbon Wheels Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.1.1.1. Two Wheelers 4.3.1.1.2. Passenger Cars 4.3.1.1.3. Commercial Vehicles 4.3.1.2. United States Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1.2.1. OEM 4.3.1.2.2. Aftermarket 4.3.2. Canada 4.3.2.1. Canada Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.2.1.1. Two Wheelers 4.3.2.1.2. Passenger Cars 4.3.2.1.3. Commercial Vehicles 4.3.2.2. Canada Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.2.2.1. OEM 4.3.2.2.2. Aftermarket 4.3.3. Mexico 4.3.3.1. Mexico Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 4.3.3.1.1. Two Wheelers 4.3.3.1.2. Passenger Cars 4.3.3.1.3. Commercial Vehicles 4.3.3.2. Mexico Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.3.2.1. OEM 4.3.3.2.2. Aftermarket 5. Europe Automotive Carbon Wheels Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.2. Europe Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3. Europe Automotive Carbon Wheels Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.1.2. United Kingdom Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.2. France 5.3.2.1. France Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.2.2. France Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.3.2. Germany Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.4.2. Italy Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.5.2. Spain Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.6.2. Sweden Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.7.2. Austria Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 5.3.8.2. Rest of Europe Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Automotive Carbon Wheels Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.2. Asia Pacific Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3. Asia Pacific Automotive Carbon Wheels Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.1.2. China Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.2.2. S Korea Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.3.2. Japan Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.4. India 6.3.4.1. India Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.4.2. India Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.5.2. Australia Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.6.2. Indonesia Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.7.2. Malaysia Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.8.2. Vietnam Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.9.2. Taiwan Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Automotive Carbon Wheels Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 7.2. Middle East and Africa Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 7.3. Middle East and Africa Automotive Carbon Wheels Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.1.2. South Africa Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.2.2. GCC Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.3.2. Nigeria Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 7.3.4.2. Rest of ME&A Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Automotive Carbon Wheels Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 8.2. South America Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 8.3. South America Automotive Carbon Wheels Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 8.3.1.2. Brazil Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 8.3.2.2. Argentina Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Automotive Carbon Wheels Market Size and Forecast, by Vehicle Type (2023-2030) 8.3.3.2. Rest Of South America Automotive Carbon Wheels Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Automotive Carbon Wheels Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Automotive Carbon Wheels Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Carbon Revolution Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Thyssenkrupp AG 10.3. Hitachi Metals, Ltd. (Hitachi, Ltd.) 10.4. Dymag Group Ltd. 10.5. HRE Performance Wheels 10.6. Litespeed Racing Inc. 10.7. Rolko Kohlgrüber GmbH 10.8. Ronal Group 10.9. Rotobox d.o.o. 10.10. ESE Carbon Company 10.11. Blackstone Tek, 10.12. Bucci Composites, 10.13. Geric,HRE, 10.14. Phoenix Wheel Company, 10.15. GmbH, 11. Key Findings 12. Industry Recommendations 13. Automotive Carbon Wheels Market: Research Methodology 14. Terms and Glossary