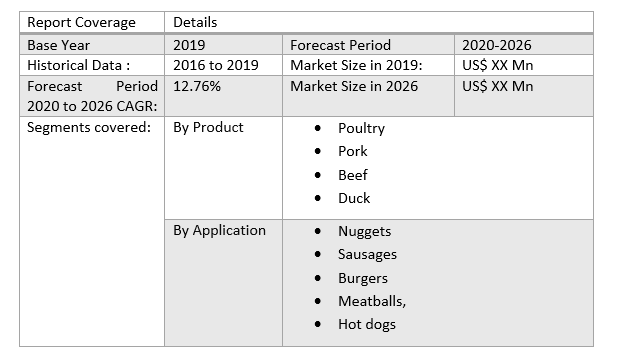

Australian Artificial Meat Market size is expected to reach nearly US$ 364 Mn by 2026 with the CAGR of 12.76% during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Australian Artificial Meat Market Overview:

The artificial meat market has seen a major growth due to factors like wider application in hotels, restaurants, cafes, & in household usage. Also, increasing demand for meat-based suitability food items like nuggets, sausage, burgers, meatballs, & hotdogs among the customers is again prompting artificial meat market. Furthermore, growing customer inclination towards animal welfare, together with inventions in cellular agriculture and tissue engineering, are some other major drivers that are estimated to drive the Australian artificial meat market. However, there are several strict regulations in naturally adapted food products which can have a bad influence on the growth of artificial meat, which in turn may impede the artificial meat market development. Nevertheless, with the stable development in the food processing industry & the tissue engineering segment, there are opportunities for the artificial meat market players to invest in artificial meat market. 2019 has been an amazing year for Australian red meat exports, with local & worldwide conditions fluctuating intensely. While lack induced turnoff has sustained meat supply, China’s pull on Australian red meat & a soft A$ has buoyed global demand. With one month to go, the year 2019 is fixed to be the 3rd major year ever for beef exports the best year for lamb, 3rd for mutton & 10th for goat meat.Beef exports increase with China adding market share:

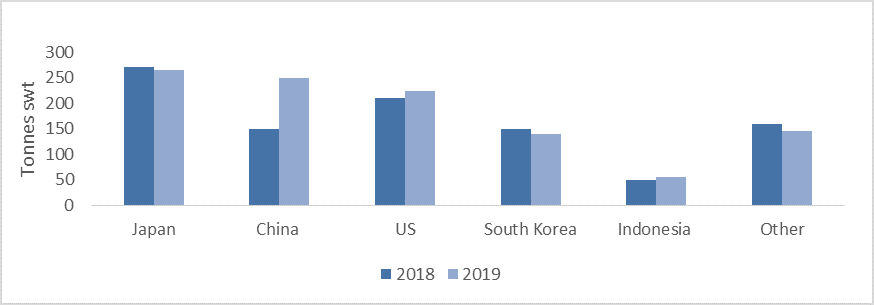

Beef exports in the year 2019 have been excellent, overall export volume sits at 1.11 Mn tonnes shipped weight, 8 percent above 2018 for the year-to-November time period. Development of grass-fed beef exports has been massive, with an extra 73,500 tonnes shipped weight ten percent shipped in the year 2019. Grain fed beef shipments raised by 5,000 tonnes shipped weight, up 2 percent in the year 2018. Beef exports to the United States and Indonesia have sustained constant however the majority of other markets are dejected as a result of pouring demand from China. China has accounted for entirely Australia’s extra export volume in the year 2019 & then some, increasing by 119,000 tonnes shipped weight. Then, China’s share of entire Australian beef exports has improved from 14 percent in the year 2018 to 24 percent in the year 2019 now sitting even with traditional powerhouse, Japan. Assuming December volumes imitate November, Japan will relinquish the heading of Australia’s top beef export destination to China.Beef Export:

Lamb exports:

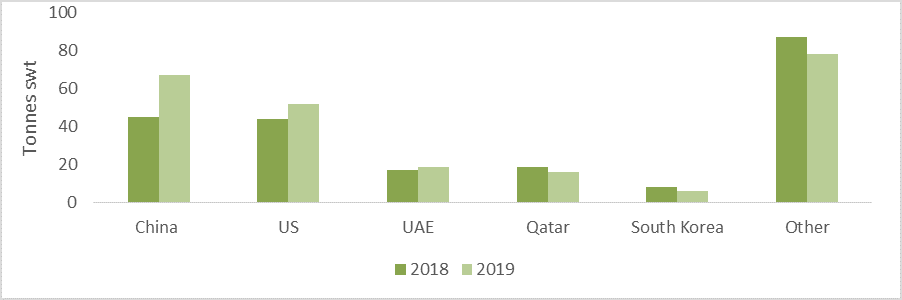

Lamb exports have supported again in the year 2019, with the year set to mark the major ever for lamb exports & the 4th repeated year of development. Total lamb exports for the year 2019 year-to-November were 258,000 tonnes( swt), up 5 percent in the year 2018. Lamb exports to China have improved 35 percent YoY, while the majority of other markets have seen only slight shifts in 2018 export volumes, representing a more even distribution of extra export development in comparison to beef. South Korea & Iran were the only markets to see a major drop in their share of exports, while China improved its share by 6 percent.Lamb Export:

Mutton market:

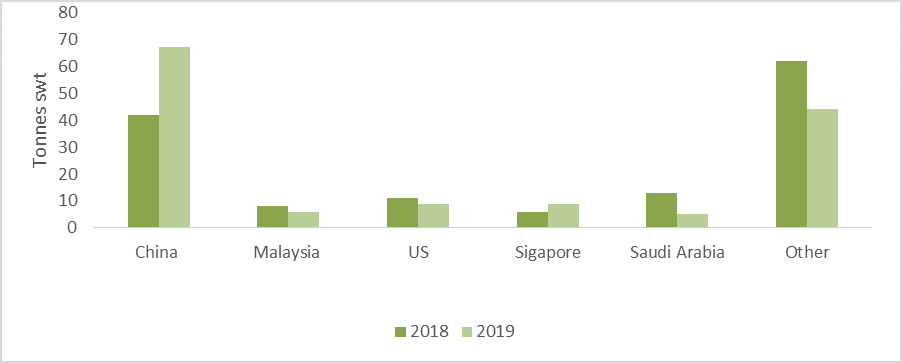

Mutton exports have enhanced somewhat in 2018, reaching 164,000 tonnes shipped weight for the year-to-November, up 1 percent YoY. China has led the mutton market, taking 72,000 tonnes shipped weight so far in the year 2019, up 52 percent in 2018 & with an entire mutton export market share of 44 percent. Chinese demand has undoubtedly been engaging other markets under pressure, given topmost mutton markets, with the exclusion of Singapore, have recorded bad progress in 2019.Mutton Export:

Business as usual for goats:

Goat exports for the year-to-November touched 19,800 tonnes shipped weight, up 1 percent in 2018. The United States remains the main market for Australian goat, imposing 70 percent market share off the back of 4 percent YoY volume development. Looking forward, 2021 will be supported by a constant shift in global dynamics, with Australian supply set to constrict, South American beef exports likely to expand & the constant impact of African swine fever fluctuating meat trade flows to China.Billion dollar opportunity:

Australians are amongst the maximum meat consumers on the planet, consuming approximately 100 Kg per capita in the year 2019. But that number has actually been decreasing in current years as red meats become more costly & artificial meat alternatives become more reasonable & closer in taste & texture to their animal equivalents. MMR report estimates artificial meat products will make USD 1.4 Bn in local retail sales by the year 2030. Under this model, only 10% of locally-made products will be exported, transporting in only USD 47 Mn. But that number rises meaningfully to USD 337.3 Mn if the industry is supported by “strong domestic R&D” & demand endures to grow. In this situation, exports account for twenty five percent of total sales for domestic producers, & establish a valued new export class equivalent to 42,200 tonnes. But conclusion the support to reach this could prove problematic, although the segment has excellent development potential. The report covers Poultry, Pork, Beef, Duck with the detailed analysis Australian Artificial Meat Market industry with the classifications of the market on the, Product, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled fifteen key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw Products, labor cost, availability of advanced Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major countries policies about manufacturing & Covid 19 impact on demand side are covered in the report.Scope of the Australian Artificial Meat Market: Inquire before buying

Australian Artificial Meat Market Key Players

• MosaMeat • Just, Inc • SuperMeat • Aleph Farms Ltd • Finless Foods Inc • Integriculture • Balletic Foods • Future Meat Technologies Ltd • Avant Meats Company Limited • Higher Steaks • Appleton Meats • Fork & Goode • Biofood Systems LTD • Mission Barns • BlueNalu, Inc. • Mutable.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Australian Artificial Meat Market Size, by Market Value (US$ Mn) 3.1. Australian Market Segmentation 3.2. Australian Market Segmentation Share Analysis, 2019 3.3. Geographical Snapshot of the Artificial Meat Market 3.4. Geographical Snapshot of the Artificial Meat Market, By Manufacturer share 4. Australian Artificial Meat Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Australian Artificial Meat Market 5. Supply Side and Demand Side Indicators 6. Australian Artificial Meat Market Analysis and Forecast, 2019-2026 6.1. Australian Artificial Meat Market Size & Y-o-Y Growth Analysis. 7. Australian Artificial Meat Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Product, 2019-2026 7.1.1. Poultry 7.1.2. Pork 7.1.3. Beef 7.1.4. Duck 7.2. Market Size (Value) Estimates & Forecast By Application, 2019-2026 7.2.1.1. Nuggets 7.2.1.2. Sausages 7.2.1.3. Burgers 7.2.1.4. Meatballs, 7.2.1.5. Hot dogs 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the Australian Artificial Meat Market 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 8.2.2. New Product Launches and Product Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 8.3. Company Profile : Key Players 8.3.1. MosaMeat. 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Product Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. Just, Inc 8.3.3. SuperMeat 8.3.4. Aleph Farms Ltd 8.3.5. Finless Foods Inc 8.3.6. Integriculture 8.3.7. Balletic Foods 8.3.8. Future Meat Technologies Ltd 8.3.9. Avant Meats Company Limited 8.3.10. Higher Steaks 8.3.11. Appleton Meats 8.3.12. Fork & Goode 8.3.13. Biofood Systems LTD 8.3.14. Mission Barns 8.3.15. BlueNalu, Inc. 8.3.16. Mutable 8.3.17. Seafuture Sustainable Biotech 8.3.18. Shiok Meats 8.3.19. Wild Type 8.3.20. Lab farm Foods 8.3.21. Kiran Meats 8.3.22. Cubiq Foods 8.3.23. Cell Farm FOOD Tech 8.3.24. Granjua Celular S.A. 9. Primary Key Insights