AI in Drug Discovery Market size was valued at USD 1.41 Billion in 2024 and the total AI in Drug Discovery revenue is expected to grow at a CAGR of 28.58% from 2025 to 2032, reaching nearly USD 10.53 Billion.AI in Drug Discovery Market Overview:

The use of the Artificial Intelligence has been increasing in various sectors of Pharmaceutical Industry. AI models are used to determine relationship between the structural properties of chemical compounds and biological toxicity. AI is impacting drug discovery in new and previously unimaginable ways.Investors have largerly gravitated toward the hype throwing an un-precedented amount of funding toward Artificial Intelligence in Drug Discovery. Artificail Intelligence in Drug Discovery not only flash gene-sequencing work,but also trained to predict drug efficacy and side effects. By implementing AI solutions, the length of the clinical trial cycle is shortened, and the procedure is more efficient and accurate. As a result, stakeholders in the life science industry are becoming more and more interested in implementing these cutting-edge AI solutions in drug discovery procedures. The strategic alliances and collaborations between the largest AI-based drug discovery businesses and pharmaceutical corporations expanded from 4 partnerships in 2015 to 27 partnerships in 2020, according to Clinical Trials Arena data forecasts for 2022. The AI among top biopharmaceutical companies is a result of expanding interest in AI in the pharmaceutical industry and rising expenses on medication development. Modern algorithms are created by combining AI with cutting-edge biology and chemistry techniques, and this technology has the ability to move drug screening from the bench to the virtual lab without the need for a lot of experimental input or human labour.To increase the research power of immuno-oncology medications, metabolic disease therapies, cancer treatments, and many other therapeutic targets, the majority of sizable biopharmaceutical companies have started internal programmes or are partnering to develop AI platforms for drug discovery.To know about the Research Methodology :- Request Free Sample Report

Scope of the Report:

The report provides a comprehensive analysis of the global AI in Drug Discovery Market. This report estimates the market in terms of USD value from 2025 to 2032. The research contains In-depth analysis about the major factors that are driving and hampering the growth of the AI in Drug Discovery market across the world. The report includes a thorough segmental analysis based on offerings, Therapeutic insights and application. In-depth understanding of the potential of the AI in Drug Discovey market has gained from regional examination of the innovation, merger and acquisition, corporate operations, and market value. In addition, there is a separate section on the market structure. The section offers a thorough analysis of the major industry participants and their plans for growth in the world AI in Drug Discovery market. The Research aims to provide market participants with an overview of the AI in Drug Discovery Market. The study looks at the markets recent, ongoing, and predicted future changes. It also provides a simple analysis of complex data. New entrants, industry titans, and followers are some of the primary forces that actively and carefully perform research. The study displays the results of the PORTER and PESTEL analyses as well as probable outcomes of the microeconomic market elements. After accounting for internal and external variables that can have a favorable or unfavorable impact on the firm, decision-makers will have a clear futuristic perspective of the market. The market segmentation analysis and market size forecast in the research help investors better understand the dynamics and structure of the AI in Drug Discovery market. The report acts as a buyer's guide by clearly outlining the comparative analysis of the top AI in Drug Discovery businesses by price, financial position, product, product portfolio, growth strategies, and regional presence.AI in Drug Discovery Market Dynamics:

Big Tech and Pharmaceutical companies investing together

In order to use Microsoft's AI algorithms on the massive datasets used in pharma, Novartis and the computer company established a multi-year strategic agreement in 2019. The businesses said that in order to produce personalised medicine and improve cell and gene therapy, they intended to apply picture analysis and generative methods. In April, Nvidia, a company that makes graphics processing units and has been stepping up its AI efforts, teamed up with Schrödinger in an effort to speed up and improve the software's ability to forecast molecules.These aforementioned factors are greatly driving the AI in Drug Discovery Market. Exscientia is one of many businesses formed in the last ten years around AI-based approaches to drug discovery and development, many of which have lately generated significant finance. Some of them are creating instruments to speed up the discovery of potential small-molecule medication candidates. For Instance, Recursion Pharmaceuticals, raised $436 million in its IPO, producing enormous volumes of customised data on cellular behaviour in the expectation that these may be mined using AI to provide biological insights that could guide the creation of novel medications. Additionaly IT firms like IBM, Microsoft, and Google are also participating in investing and having finanvial collaboration with the pharmaceutical companies for building up AI in Drug Discovery Market.Technical Challenges

In many ways, artificial intelligence and machine learning are already developed. The quality of data sets, however presents a substantial obstacle when using Artificial intelligence methods for drug development. Numerous data sets are further challenging factors,while it is generally acknowledged that cooperation is crucial to advancing the use of AI in drug discovery, challenging problems relating to data ownership and sharing confidentially need to be handled. The field currently lacks strong instances of promising leads from the start, and many current technologies have been verified retroactively.The search for quality over quantity in drug discovery

Artificial Intelligence offer potential approaches in examininig the large number of aspects of the drug discovery at an early stage before the compounds need to be taken in laboratory.For Instance AstraZeneca has implemented “5R framework”to improve R&D PRODUCTIVITY.By implementing 5R framework,AstraZeneca reports has improve the use of Ariticial Intelligence in drug discovery by 19%.Partnering between Pharma Companies and Artificial Intelligence companies are definitely booming across the industry.For Instance, Weatherall points to a collaboration launched in 2019 between AstraZenca and Benevolent Artificial Intelligence , To discover new drugs for chronic kidney diseases and idiopathic pulmonary fibrosis. Artificial Intelligence with its ability to look at vast quantatites of existing data and learn patterns which are too complex for human to recognize can recognize and predict small molecules with the desirable properties, taking the computation skills to the next levels.For Instance,the Iktos,announced in March 2022 that it was applying its technology to a number of small molecule discovery programmes at Pfizer. It has also made collaboration with Merck ,KGaA,Almirall, which is a Barcelona based company working on treatments of skin diseases. There has been surge of interest in approaches based around generating data specifically with the Artificial Intelligence application in mind, for Instance, Insitro which was founded in 2018 are rapidly generating high quality biological data sets suitable for machine learning in drug Discovery creating a growth opportunities in AI in Drug Discovery Market.

Companies Date Deals involving in Companies creating growth opportunites of Artificial Intelligence in Drug Discovery Market. Recursion Pharmaceuticals Bayer September 2020

Bayer and Recursion Pharmaceuticals collaborated on the development of novel small-molecule therapeutics for the treatment of fibrotic illnesses using Recursion's AI-guided drug discovery platform in addition to its Series D investment round. Insitro,Bristol Myers Squibb October 2020

By creating prediction models of amyotrophic lateral sclerosis and frontotemporal dementia, Insitro will be able to identify prospective therapeutic targets using its machine-learning technology, the Insitro Human platform. The candidates chosen by Bristol Myers Squibb will next undergo further development. Roivant,Silicon Therapeutics February 2021

For $450 million, Roivant acquires Silicon, including its physics-based platform for in silico small-molecule drug design, which will be combined with machine learning strategies used by Roivant. Iktos,Pfizer March 2021

Iktos will use Pfizer's small-molecule programmes to implement its AI-driven de novo design software. AI in Drug Discovery Market Segment Analysis:

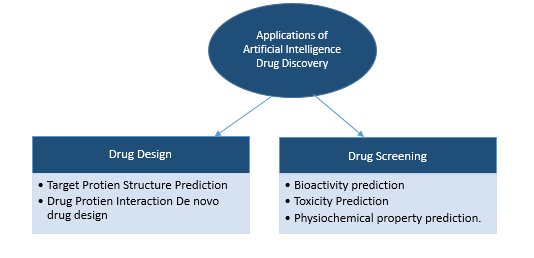

By Offering, the AI in Drug Discovery Market is segmented into Software, Hardware Services. Software is expected to dominate the market during the forecast period. AI software platforms enable pharmaceutical companies to analyze vast datasets, simulate molecular interactions, and predict drug efficacy more efficiently than traditional methods. These software solutions integrate advanced technologies like deep learning, natural language processing, and predictive analytics, which are essential for tasks such as virtual screening, biomarker discovery, and drug repurposing. Although hardware and services also contribute to the AI ecosystem, software remains central as it powers the core functions of AI in drug discovery. The growing demand for more sophisticated computational tools in the pharmaceutical industry underscores the importance of software, particularly in reducing the time and cost associated with drug development. Additionally, software offerings are often paired with cloud-based platforms, allowing seamless integration with existing research pipelines and enhancing scalability. As AI continues to evolve, software will maintain its dominance due to the need for increasingly powerful algorithms and analytical tools to support the discovery of new, effective treatments. By Therapeutic Area, the market is segmented into the Oncology, Neurology, Cardiovascular Diseases, Metabolic Diseases, Immunology and others. Oncology is held the largest AI in Drug Discovery Market share in 2024. Oncology stands out as the most useful therapeutic area for AI in drug discovery due to the immense potential it holds in transforming cancer treatment. Cancer is one of the most complex and heterogeneous diseases, with each type exhibiting unique genetic and molecular profiles, making traditional drug discovery methods slow and costly. AI's ability to analyze massive datasets, such as genomic sequences and clinical trial data, is revolutionizing how researchers identify potential drug targets and develop personalized therapies. In oncology, AI is instrumental in speeding up the drug discovery process by predicting which compounds are likely to be effective against specific cancer subtypes. Additionally, AI-driven models can identify biomarkers that help stratify patients based on their likelihood of responding to certain treatments, paving the way for more personalized, targeted therapies. By Application, the AI in Drug Discovery Market is by application is segment into AI used in pharmacology, drug design, drug screening, drug repurposing, In which Ai used in drug design and drug screening segment dominate the market. According to MMR finding the AI used in Drug scrrening showed that 70% of anti microbial activity could accurately predict the toxic properties of the drug with only 4% of error rate.AI are widely used to find inhibitor molecule for specific protiens. Further the AI in drug Discovery are widely used in Clinical trials application and this segment is forecasted to dominate the market.The recent development of AI tools for the clinical trials during drug discoery have been ideal for recognizing diseases of patients, identifying gene targets and off targets.AI in drug discovery are used to identify and predict human relevant biomarkers of diseases to select and recruit specific patient population which has further increased the success rate of Clinical trials.

AI in Drug Discovery Market Regional Insights:

In 2024, North America's revenue share was above 56%, which was the highest. The United States has been at the forefront of AI technology since its inception. Due to IBM's usage of their supercomputer "Watson" to win the game "Jeopardy," the business has since improved on the concept of AI. The tech sectors have made AI a significant component, and it is commonly used in a variety of fields, including the pharmaceutical industry. To accelerate medication research, design, and repurposing, major tech corporations in the United States have all partnered with esteemed institutions. Additionally, they are utilising AI to investigate disorders and draw pertinent conclusions that can enhance disease management. Thanks to the growing acceptance of smart cities in developing nations like India and China, the Asia Pacific AI in Drug Discovery market is expected to account for a sizeable portion of the global market. The market for AI In Drug Discovery is also expected to be driven by an increase in population in APAC nations.AI in Drug Discovery Market Ecosystem

AI in Drug Discovery Market Scope: Inquiry Before Buying

Global AI in Drug Discovery Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.41 Billion. Forecast Period 2025 to 2032 CAGR: 28.58% Market Size in 2032: USD 10.53 Billion. Segments Covered: by Offering Software Services Hardware by Therapeutic Area Oncology Neurology Cardiovascular Diseases Metabolic Diseases Immunology Others by Technology Machine Learning Natural Language Processing Others by Application Target Selection and Validation Drug Screening and Lead Optimization Clinical Studies Preclinical studies Others AI in Drug Discovery Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Players in the AI in Drug Discovery Market are:

1. GNS Healthcare (US) 2. BioSymetrics (US) 3. BPGbio, Inc (US) 4. Atomwise Inc (US) 5. Insitro (US) 6. NVIDIA Corporation (US) 7. IBM Corporation (US) 8. Microsoft Corporation (US) 9. Aria Pharmaceuticals, Inc. (US) 10. Insilico Medicine (US) 11. NuMedii, Inc. (US) 12. Owkin Inc. (US) 13. Schrödinger, Inc. (US) 14. DEEP GENOMICS (Canada) 15. Cyclica (Canada) 16. BenevolentAI (UK) 17. Exscientia (UK) 18. Iktos (France) 19. Euretos (Netherlands) 20. Evaxion Biotech A/S (Denmark) 21. XtalPi Inc (China) 22. Standigm (South Korea)Frequently Asked Questions:

1] What segments are covered in the Global AI in Drug Discovery Market report? Ans. The segments covered in the AI in Drug Discovery Market report are based on Offering, Therapeutic Area, Technology and Application. 2] Which region is expected to hold the highest share in the Global AI in Drug Discovery Market? Ans. The North America region is expected to hold the highest share in the AI in Drug Discovery Market. 3] What is the market size of the Global AI in Drug Discovery Market by 2032? Ans. The market size of the AI in Drug Discovery Market by 2032 is expected to reach US$ 10.53 Bn. 4] What is the forecast period for the Global AI in Drug Discovery Market? Ans. The forecast period for the AI in Drug Discovery Market is 2025-2032. 5] What was the market size of the Global AI in Drug Discovery Market in 2024? Ans. The market size of the AI in Drug Discovery Market in 2024 was valued at US$ 1.41 Bn.

1. AI in Drug Discovery Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Evolution of AI in Drug Discovery 1.4. Executive Summary 2. Global AI in Drug Discovery Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Product-specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Type Segment 2.5.3. Product Segment 2.5.4. Revenue (2024) 2.5.5. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. AI in Drug Discovery Market: Dynamics 3.1. AI in Drug Discovery Market Trends 3.2. AI in Drug Discovery Market Dynamics 3.2.1.1. AI in Drug Discovery Market Drivers 3.2.1.2. AI in Drug Discovery Market Restraints 3.2.1.3. AI in Drug Discovery Market Opportunities 3.2.1.4. AI in Drug Discovery Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. South America 3.6. Analysis of Government Schemes and Initiatives For the AI in Drug Discovery Industry 3.7. Technological Advancements 4. AI in Drug Discovery Market: Global Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 4.1. AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 4.1.1. Software 4.1.2. Services 4.1.3. Hardware 4.2. AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 4.2.1. Oncology 4.2.2. Neurology 4.2.3. Cardiovascular Diseases 4.2.4. Metabolic Diseases 4.2.5. Immunology 4.2.6. Others 4.3. AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 4.3.1. Machine Learning 4.3.2. Natural Language Processing 4.3.3. Others 4.4. AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 4.4.1. Target Selection and Validation 4.4.2. Drug Screening and Lead Optimization 4.4.3. Clinical Studies 4.4.4. Preclinical studies 4.4.5. Others 4.5. AI in Drug Discovery Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America AI in Drug Discovery Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 5.1. North America AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 5.1.1. Software 5.1.2. Services 5.1.3. Hardware 5.2. North America AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 5.2.1. Oncology 5.2.2. Neurology 5.2.3. Cardiovascular Diseases 5.2.4. Metabolic Diseases 5.2.5. Immunology 5.2.6. Others 5.3. North America AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 5.3.1. Machine Learning 5.3.2. Natural Language Processing 5.3.3. Others 5.4. North America AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 5.4.1. Target Selection and Validation 5.4.2. Drug Screening and Lead Optimization 5.4.3. Clinical Studies 5.4.4. Preclinical studies 5.4.5. Others 5.5. North America AI in Drug Discovery Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 5.5.1.1.1. Software 5.5.1.1.2. Services 5.5.1.1.3. Hardware 5.5.1.2. United States AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 5.5.1.2.1. Oncology 5.5.1.2.2. Neurology 5.5.1.2.3. Cardiovascular Diseases 5.5.1.2.4. Metabolic Diseases 5.5.1.2.5. Immunology 5.5.1.2.6. Others 5.5.1.3. United States AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 5.5.1.3.1. Machine Learning 5.5.1.3.2. Natural Language Processing 5.5.1.3.3. Others 5.5.1.4. United States AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Target Selection and Validation 5.5.1.4.2. Drug Screening and Lead Optimization 5.5.1.4.3. Clinical Studies 5.5.1.4.4. Preclinical studies 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 5.5.2.1.1. Software 5.5.2.1.2. Services 5.5.2.1.3. Hardware 5.5.2.2. Canada AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 5.5.2.2.1. Oncology 5.5.2.2.2. Neurology 5.5.2.2.3. Cardiovascular Diseases 5.5.2.2.4. Metabolic Diseases 5.5.2.2.5. Immunology 5.5.2.2.6. Others 5.5.2.3. Canada AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 5.5.2.3.1. Machine Learning 5.5.2.3.2. Natural Language Processing 5.5.2.3.3. Others 5.5.2.4. Canada AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Target Selection and Validation 5.5.2.4.2. Drug Screening and Lead Optimization 5.5.2.4.3. Clinical Studies 5.5.2.4.4. Preclinical studies 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 5.5.3.1.1. Software 5.5.3.1.2. Services 5.5.3.1.3. Hardware 5.5.3.2. Mexico AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 5.5.3.2.1. Oncology 5.5.3.2.2. Neurology 5.5.3.2.3. Cardiovascular Diseases 5.5.3.2.4. Metabolic Diseases 5.5.3.2.5. Immunology 5.5.3.2.6. Others 5.5.3.3. Mexico AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 5.5.3.3.1. Machine Learning 5.5.3.3.2. Natural Language Processing 5.5.3.3.3. Others 5.5.3.4. Mexico AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Target Selection and Validation 5.5.3.4.2. Drug Screening and Lead Optimization 5.5.3.4.3. Clinical Studies 5.5.3.4.4. Preclinical studies 5.5.3.4.5. Others 6. Europe AI in Drug Discovery Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 6.1. Europe AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.2. Europe AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.3. Europe AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.4. Europe AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5. Europe AI in Drug Discovery Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.1.2. United Kingdom AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.1.3. United Kingdom AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.1.4. United Kingdom AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.2.2. France AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.2.3. France AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.2.4. France AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.3.2. Germany AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.3.3. Germany AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.3.4. Germany AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.4.2. Italy AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.4.3. Italy AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.4.4. Italy AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.5.2. Spain AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.5.3. Spain AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.5.4. Spain AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.6.2. Sweden AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.6.3. Sweden AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.6.4. Sweden AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.7.2. Austria AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.7.3. Austria AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.7.4. Austria AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 6.5.8.2. Rest of Europe AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 6.5.8.3. Rest of Europe AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 6.5.8.4. Rest of Europe AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific AI in Drug Discovery Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 7.1. Asia Pacific AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.2. Asia Pacific AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.3. Asia Pacific AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.4. Asia Pacific AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific AI in Drug Discovery Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.5.1.2. China AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.1.3. China AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.5.1.4. China AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.5.2.2. S Korea AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.2.3. S Korea AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.5.2.4. S Korea AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.5.3.2. Japan AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.3.3. Japan AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.5.3.4. Japan AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.5.4.2. India AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.4.3. India AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.5.4.4. India AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.5.5.2. Australia AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.5.3. Australia AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.5.5.4. Australia AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7.5.6. ASEAN 7.5.6.1. ASEAN AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.5.6.2. ASEAN AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.6.3. ASEAN AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.5.6.4. ASEAN AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 7.5.7. Rest of Asia Pacific 7.5.7.1. Rest of Asia Pacific AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 7.5.7.2. Rest of Asia Pacific AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 7.5.7.3. Rest of Asia Pacific AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 7.5.7.4. Rest of Asia Pacific AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa AI in Drug Discovery Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Middle East and Africa AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 8.2. Middle East and Africa AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 8.3. Middle East and Africa AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 8.4. Middle East and Africa AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa AI in Drug Discovery Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 8.5.1.2. South Africa AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.1.3. South Africa AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 8.5.1.4. South Africa AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 8.5.2.2. GCC AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.2.3. GCC AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 8.5.2.4. GCC AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 8.5.3.2. Nigeria AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.3.3. Nigeria AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 8.5.3.4. Nigeria AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 8.5.4.2. Rest of ME&A AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 8.5.4.3. Rest of ME&A AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 8.5.4.4. Rest of ME&A AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 9. South America AI in Drug Discovery Market Size and Forecast by Segmentation (by Value USD Mn) (2024-2032) 9.1. South America AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 9.2. South America AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 9.3. South America AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 9.4. South America AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 9.5. South America AI in Drug Discovery Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 9.5.1.2. Brazil AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 9.5.1.3. Brazil AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 9.5.1.4. Brazil AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 9.5.2.2. Argentina AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 9.5.2.3. Argentina AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 9.5.2.4. Argentina AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America AI in Drug Discovery Market Size and Forecast, by Offering (2024-2032) 9.5.3.2. Rest Of South America AI in Drug Discovery Market Size and Forecast, by Therapeutic Area (2024-2032) 9.5.3.3. Rest Of South America AI in Drug Discovery Market Size and Forecast, by Technology (2024-2032) 9.5.3.4. Rest Of South America AI in Drug Discovery Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. GNS Healthcare (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis (Technological strengths and weaknesses) 10.1.5. Strategic Analysis (Recent strategic moves) 10.1.6. Recent Developments 10.2. BioSymetrics (US) 10.3. BPGbio, Inc (US) 10.4. Atomwise Inc (US) 10.5. Insitro (US) 10.6. NVIDIA Corporation (US) 10.7. IBM Corporation (US) 10.8. Microsoft Corporation (US) 10.9. Aria Pharmaceuticals, Inc. (US) 10.10. Insilico Medicine (US) 10.11. NuMedii, Inc. (US) 10.12. Owkin Inc. (US) 10.13. Schrödinger, Inc. (US) 10.14. DEEP GENOMICS (Canada) 10.15. Cyclica (Canada) 10.16. BenevolentAI (UK) 10.17. Exscientia (UK) 10.18. Iktos (France) 10.19. Euretos (Netherlands) 10.20. Evaxion Biotech A/S (Denmark) 10.21. XtalPi Inc (China) 10.22. Standigm (South Korea) 11. Key Findings 12. Analyst Recommendations 13. AI in Drug Discovery Market: Research Methodology