Global Acoustic Material Market size was valued at USD 16.84 Bn in 2024 and the total Acoustic Material Market revenue is expected to grow by 5.64% from 2025 to 2032, reaching nearly USD 26.12 Bn by 2032.Acoustic Material Market Overview

Acoustic materials are specialized materials designed to control, absorb, dampen or block sound waves to improve noise management and acoustic performance in various environment. Global acoustic material market has been experiencing steady growth driven by rising demand for noise control solution across construction, automotive and industrial sector supported by stringent noise pollution regulation and increasing urbanization. Asia Pacific dominated acoustic materials market fuelled by advanced building standard and high adoption in commercial construction and automotive manufacturing with innovation leaders like Rockwool and 3M pioneering high performance, sustainable material such as recycled fiberglass, biobased foams and smart sound absorbing panel. Acoustic Material Market benefits from diverse application residential and commercial building prioritize soundproofing for occupant comfort, automotive manufacturer integrate lightweight acoustic material for quieter cabin and industrial facilities employ vibration damping solution to meet OSHA standards. This dynamic landscape highlights how acoustic material are evolving with ecofriendly innovation and advanced technology meeting modern demand for noise reduction while aligning with sustainability goal and smart city initiative.To know about the Research Methodology :- Request Free Sample Report

Acoustic Material Market Dynamics

Construction Sector to Boost Acoustic Material Market

Growth in population, increase in the rate of migration of people from the rural area to urban area, these result growth in construction and manufacturing sector, driving the Acoustic Material Market. Growth in the commercial building sector, particularly in emerging economies like India and China also contributing in market.Acoustic Material Market Segment Analysis

Based on Material Type, market is sub segmented into Fiberglass, ABS, Polypropylene, Polyurethane, PVC, Textiles, etc. In 2024 Fiberglass dominated acoustic material market due to its superior sound absorption properties, cost effectiveness and versatility across multiple industry. It is widely used in building & construction (residential, commercial, and industrial spaces), automotive and HVAC systems because of its lightweight, fire resistant and moisture resistant characteristics. Fiberglass effectively dampen noise by trapping sound waves within its porous structure making it ideal for insulation in walls, ceiling and automotive panel. Based on End-User, market is sub segmented into Building & Construction, Transportation, etc. In 2024, the Building & Construction segment dominated the acoustic material market, driven by rapid urbanization, stringent noise regulation standards, and increasing demand for soundproofing in residential and commercial spaces. The surge in infrastructure development, smart city projects, and green building initiatives (such as LEED certification) has amplified the need for high-performance acoustic insulation in walls, floors, and ceilings.Acoustic Material Market Regional Analysis

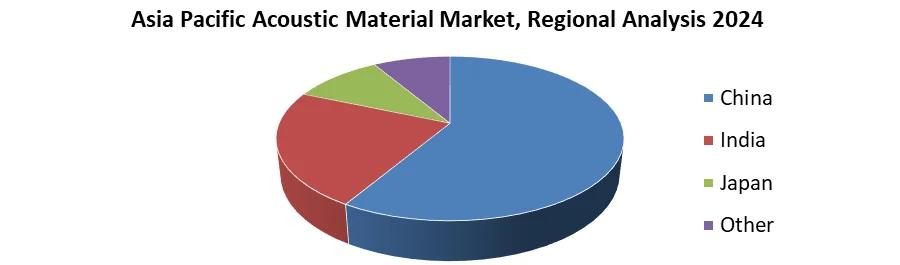

Asia Pacific dominated global market accounting for over 40% of market share in 2024 driven by rapid urbanization, booming construction activity and increasing automotive production. According to the World Bank region's construction sector is projected to grow at 6-8% annually with China and India leading demand for noise control solution in residential and commercial infrastructure. Additionally automotive sector which contributes 35% of regional acoustic material demand is expanding due to rising EV adoption and stringent noise regulations. Government initiatives like China's "Green Building" standard and India's Smart Cities Mission further accelerate demand making APAC dominant region in market. The region's cost competitive manufacturing and high industrialization also reinforce its dominance.

Acoustic Material Market Competitive Landscape

Key Players in Global Acoustic Material Market are Rockwool International (Denmark), Saint Gobain (France), Knauf Insulation (Germany) and 3M (US). In 2024 Rockwool International A/S solidifies its dominance in the market as the leading stone wool insulation provider commanding an estimated 22-25% global market share in mineral wool acoustic solution. The company's competitive edge stem from its superior fire resistant and sound absorbing stone wool product which hold 40%+ market penetration in Europe's commercial construction sector (Green Building Council data). Rockwool's proprietary dual density technology achieves noise reduction coefficients (NRC) of 0.95-1.10, outperforming 70% of fiberglass alternatives in laboratory tests. With 8 new manufacturing facilities launched since 2022 (including major plants in India and Texas) production capacity has expanded by 30% year-over-year, enabling service to 90+ countries. Strategic wins include supplying 60% of acoustic materials for London's Crossrail project and 75% of China's green-certified office towers in 2024.Acoustic Material Key Trends

Sustainability-Driven Material Innovation-Leading manufacturers are prioritizing eco-friendly acoustic solutions, with 60% of new 2024 product launches featuring recycled or bio-based materials (e.g., Rockwool’s bio-binders, Saint-Gobain’s recycled panels). Lightweight Solutions for Electric Vehicles-The EV boom is driving demand for thin, high-performance acoustic foams, with 3M and BASF developing materials that reduce weight by 30%+ while maintaining noise suppression. Smart Acoustic Technologies-Integration of AI and IoT in soundproofing (e.g., Goertek’s metamaterials, Nitto Denko’s adaptive dampers) enables real-time noise cancellation in buildings and vehicles.Acoustic Material Market Key Developments

• Saint-Gobain (France) – June 2024: Launched "Ecophon Edge", a hybrid acoustic panel with 50% recycled content, targeting LEED-certified offices. • 3M Inc. (USA) – March 2025: Introduced 3M™ Thinsulate™ Acoustic EV, a lightweight foam for electric vehicles, reducing cabin noise by 30%. • Knauf Insulation (Germany) – January 2025: Unveiled "Knauf ECOSE® BioSilent", a formaldehyde-free mineral wool with 20% faster installation for residential projects. • Nitto Denko Corporation (Japan) – April 2024: Developed "Nitto Acoustic PVDF Film", a vibration-damping material for aerospace, cutting aircraft noise by 15dB. • Goertek Inc. (China) – August 2024: Partnered with Xiaomi to supply ultra-thin acoustic metamaterials for smartphones, enhancing ANC performance.Acoustic Material Market Scope: Inquire before Buying

Global Acoustic Material Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: US $ 16.84 Bn. Forecast Period 2025 to 2032 CAGR: 5.64% Market Size in 2032: US $ 26.12 Bn. Segments Covered: by Material Type ABS Fiberglass Polypropylene Polyurethane PVC Textiles Others by Type Building & Construction Residential Commercial Industrial/HVAC & OEM Transportation Automotive Marine Aerospace Others Acoustic Material by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Acoustic Material key players are:

North America 1. 3M Inc. (US) 2. Johns Manville (US) 3. Owens Corning (US) 4. DuPont (US) 5. Auralex Acoustics, Inc. (US) 6. Primacoustic (Canada) Europe 7. BASF SE (Germany) 8. Knauf Insulation (Germany) 9. Saint-Gobain (France) 10. Saint-Gobain Ecophon AB (Sweden) 11. Sika AG (Switzerland) 12. Rockwool International A/S (Denmark) Asia Pacific 13. Nitto Denko Corporation (Japan) 14. Asahi Kasei Corporation (Japan) 15. Goertek Inc. (China) 16. Sichuan ZISEN Acoustics Technology (China) 17. Shenzhen Vinco Soundproofing Materials Co., Ltd. (China) 18. Polybond Insulation Pvt. Ltd. (India) 19. Greenlam Industries Ltd. (India) 20. Fletcher Insulation (Australia)Frequently Asked Questions:

1. Which region has the largest share in Global Acoustic Material Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global Acoustic Material Market? Ans: The Global Acoustic Material Market is growing at a CAGR of 5.64% during forecasting period 2025-2032. 3. What is scope of the Global Acoustic Material market report? Ans: Global Acoustic Material Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Acoustic Material market? Ans: The important key players in the Global Acoustic Material Market are – Sika AG, Rockwool International A/S, DuPont, Knauf Insulation, 3M Inc., Saint-Gobain, BASF SE, Fletcher Insulation, Johns Manville, dB Acoustics Pte Ltd., E. I. du Pont de Nemours and Company, Bayer AG, and Owens Corning. 5. What is the study period of this market? Ans: The Global Acoustic Material Market is studied from 2025 to 2032.

1. Acoustic Material Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Acoustic Material Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Acoustic Material Market: Dynamics 3.1. Acoustic Material Market Trends 3.1.1. North America Acoustic Material Market Trends 3.1.2. Europe Acoustic Material Market Trends 3.1.3. Asia Pacific Acoustic Material Market Trends 3.1.4. Middle East and Africa Acoustic Material Market Trends 3.1.5. South America Acoustic Material Market Trends 3.2. Acoustic Material Market Dynamics 3.2.1. Acoustic Material Market Drivers 3.2.1.1. Construction Sector 3.2.2. Acoustic Material Market Restraints 3.2.3. Acoustic Material Market Opportunities 3.2.4. Acoustic Material Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Acoustic Material Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 4.1.1. ABS 4.1.2. Fiberglass 4.1.3. Polypropylene 4.1.4. Polyurethane 4.1.5. PVC 4.1.6. Textiles 4.1.7. Others 4.2. Acoustic Material Market Size and Forecast, By End-user (2024-2032) 4.2.1. Building & Construction 4.2.1.1. Residential 4.2.1.2. Commercial 4.2.1.3. Industrial/HVAC & OEM 4.2.2. Transportation 4.2.2.1. Automotive 4.2.2.2. Marine 4.2.2.3. Aerospace 4.2.3. Others 4.3. Acoustic Material Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Acoustic Material Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 5.1.1. ABS 5.1.2. Fiberglass 5.1.3. Polypropylene 5.1.4. Polyurethane 5.1.5. PVC 5.1.6. Textiles 5.1.7. Others 5.2. North America Acoustic Material Market Size and Forecast, By End-user (2024-2032) 5.2.1. Building & Construction 5.2.1.1. Residential 5.2.1.2. Commercial 5.2.1.3. Industrial/HVAC & OEM 5.2.2. Transportation 5.2.2.1. Automotive 5.2.2.2. Marine 5.2.2.3. Aerospace 5.2.3. Others 5.3. North America Acoustic Material Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 5.3.1.1.1. ABS 5.3.1.1.2. Fiberglass 5.3.1.1.3. Polypropylene 5.3.1.1.4. Polyurethane 5.3.1.1.5. PVC 5.3.1.1.6. Textiles 5.3.1.1.7. Others 5.3.1.2. United States Acoustic Material Market Size and Forecast, By End-user (2024-2032) 5.3.1.2.1. Building & Construction 5.3.1.2.1.1. Residential 5.3.1.2.1.2. Commercial 5.3.1.2.1.3. Industrial/HVAC & OEM 5.3.1.2.2. Transportation 5.3.1.2.2.1. Automotive 5.3.1.2.2.2. Marine 5.3.1.2.2.3. Aerospace 5.3.1.2.3. Others 5.3.2. Canada 5.3.2.1. Canada Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 5.3.2.1.1. ABS 5.3.2.1.2. Fiberglass 5.3.2.1.3. Polypropylene 5.3.2.1.4. Polyurethane 5.3.2.1.5. PVC 5.3.2.1.6. Textiles 5.3.2.1.7. Others 5.3.2.2. Canada Acoustic Material Market Size and Forecast, By End-user (2024-2032) 5.3.2.2.1. Building & Construction 5.3.2.2.1.1. Residential 5.3.2.2.1.2. Commercial 5.3.2.2.1.3. Industrial/HVAC & OEM 5.3.2.2.2. Transportation 5.3.2.2.2.1. Automotive 5.3.2.2.2.2. Marine 5.3.2.2.2.3. Aerospace 5.3.2.2.3. Others 5.3.3. Mexico 5.3.3.1. Mexico Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 5.3.3.1.1. ABS 5.3.3.1.2. Fiberglass 5.3.3.1.3. Polypropylene 5.3.3.1.4. Polyurethane 5.3.3.1.5. PVC 5.3.3.1.6. Textiles 5.3.3.1.7. Others 5.3.3.2. Mexico Acoustic Material Market Size and Forecast, By End-user (2024-2032) 5.3.3.2.1. Building & Construction 5.3.3.2.1.1. Residential 5.3.3.2.1.2. Commercial 5.3.3.2.1.3. Industrial/HVAC & OEM 5.3.3.2.2. Transportation 5.3.3.2.2.1. Automotive 5.3.3.2.2.2. Marine 5.3.3.2.2.3. Aerospace 5.3.3.2.3. Others 6. Europe Acoustic Material Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.2. Europe Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.3. Europe Acoustic Material Market Size and Forecast, By Distribution Channel (2024-2032) 6.4. Europe Acoustic Material Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.1.2. United Kingdom Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.4.2. France 6.4.2.1. France Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.2.2. France Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.3.2. Germany Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.4.2. Italy Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.5.2. Spain Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.6.2. Sweden Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.7.2. Russia Acoustic Material Market Size and Forecast, By End-user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 6.4.8.2. Rest of Europe Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7. Asia Pacific Acoustic Material Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.2. Asia Pacific Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3. Asia Pacific Acoustic Material Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.1.2. China Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.2.2. S Korea Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.3.2. Japan Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.4. India 7.3.4.1. India Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.4.2. India Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.5.2. Australia Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.6.2. Indonesia Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.7.2. Malaysia Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.8. Philippines 7.3.8.1. Philippines Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.8.2. Philippines Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.9. Thailand 7.3.9.1. Thailand Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.9.2. Thailand Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.10. Vietnam 7.3.10.1. Vietnam Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.10.2. Vietnam Acoustic Material Market Size and Forecast, By End-user (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Acoustic Material Market Size and Forecast, By End-user (2024-2032) 8. Middle East and Africa Acoustic Material Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 8.2. Middle East and Africa Acoustic Material Market Size and Forecast, By End-user (2024-2032) 8.3. Middle East and Africa Acoustic Material Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 8.3.1.2. South Africa Acoustic Material Market Size and Forecast, By End-user (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 8.3.2.2. GCC Acoustic Material Market Size and Forecast, By End-user (2024-2032) 8.3.3. Egypt 8.3.3.1. Egypt Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 8.3.3.2. Egypt Acoustic Material Market Size and Forecast, By End-user (2024-2032) 8.3.4. Nigeria 8.3.4.1. Nigeria Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 8.3.4.2. Nigeria Acoustic Material Market Size and Forecast, By End-user (2024-2032) 8.3.5. Rest of ME&A 8.3.5.1. Rest of ME&A Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 8.3.5.2. Rest of ME&A Acoustic Material Market Size and Forecast, By End-user (2024-2032) 9. South America Acoustic Material Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 9.2. South America Acoustic Material Market Size and Forecast, By End-user (2024-2032) 9.3. South America Acoustic Material Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 9.3.1.2. Brazil Acoustic Material Market Size and Forecast, By End-user (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 9.3.2.2. Argentina Acoustic Material Market Size and Forecast, By End-user (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 9.3.3.2. Colombia Acoustic Material Market Size and Forecast, By End-user (2024-2032) 9.3.4. Chile 9.3.4.1. Chile Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 9.3.4.2. Chile Acoustic Material Market Size and Forecast, By End-user (2024-2032) 9.3.5. Rest Of South America 9.3.5.1. Rest Of South America Acoustic Material Market Size and Forecast, By Material Type (2024-2032) 9.3.5.2. Rest Of South America Acoustic Material Market Size and Forecast, By End-user (2024-2032) 10. Company Profile: Key Players 10.1. 3M Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Johns Manville 10.3. Owens Corning 10.4. DuPont 10.5. Auralex Acoustics, Inc. 10.6. Primacoustic 10.7. BASF SE 10.8. Knauf Insulation 10.9. Saint-Gobain 10.10. Saint-Gobain Ecophon AB 10.11. Sika AG 10.12. Rockwool International A/S 10.13. Nitto Denko Corporation 10.14. Asahi Kasei Corporation 10.15. Goertek Inc. 10.16. Sichuan ZISEN Acoustics Technology 10.17. Shenzhen Vinco Soundproofing Materials Co., Ltd. 10.18. Polybond Insulation Pvt. Ltd. 10.19. Greenlam Industries Ltd. 10.20. Fletcher Insulation 11. Key Findings 12. Industry Recommendations 13. Acoustic Material Market: Research Methodology