The Submersible Pumps Market size was valued at USD 59.40 Billion in 2023 and the total Submersible Pumps revenue is expected to grow at a CAGR of 5.6 % from 2024 to 2030, reaching nearly USD 86.98 Billion by 2030. A submersible pump, or electrical submersible pump (ESP), is a water pump immersed in liquid for diverse applications. The pump incorporates a hermetically sealed electric motor, closely coupled to eliminate the need for priming as it operates submerged in the liquid. The rising need for efficient water management in various industries such as agriculture, mining, and wastewater treatment boosting the growth of Submersible Pumps Market. The demand is further driven by urbanization, population growth, and the need for reliable water supply systems. The Submersible Pumps Market is benefiting from technological advancements in pump design and materials, leading to enhanced performance, energy efficiency, and durability. The increased emphasis on renewable energy sources has resulted in the development of solar-powered submersible pumps, contributing to the market's sustainability and environmental consciousness. Submersible Pumps Market Key players in have actively engaged in strategic initiatives to strengthen their market position. Recent developments include product innovations, mergers, acquisitions, and collaborations.To know about the Research Methodology :- Request Free Sample Report For instance, major players like Grundfos, Xylem Inc., and KSB Group have introduced smart and digitally integrated submersible pumps that offer real-time monitoring and control, optimizing operational efficiency. Furthermore, partnerships between manufacturers and technology providers have facilitated the integration of advanced features like remote monitoring and predictive maintenance, ensuring enhanced reliability and reduced downtime. The market is also witnessing increased investments in research and development to introduce pumps with higher energy efficiency and lower environmental impact. As governments worldwide focus on sustainable water management practices, the submersible pumps market is poised for continued growth, with key players playing a pivotal role in shaping the industry landscape through innovation and strategic collaborations.

Submersible Pumps Market Dynamics:

The Flourishing Mining and Construction Sectors Driving The Growth of Submersible Pumps Market Rising global water scarcity crisis, coupled with a surging demand for efficient irrigation systems in agriculture driving the growth of Submersible Pumps Market. For instance, in India, a major agricultural hub, companies such as Kirloskar play an important role in mitigating water scarcity challenges in regions such as Punjab, ensuring reliable water supply for extensive crop cultivation and boosting agricultural productivity. Rapid urbanization and ongoing infrastructure projects worldwide contribute to the rising demand for submersible pumps, particularly in water supply and wastewater management. Cities such as Beijing exemplify this trend, where brands like Sulzer are deployed to address water distribution challenges and support the infrastructure development necessary for expanding urban populations. The booming mining and construction industries also fuel the submersible pump market, with a focus on dewatering operations. In Australia, for instance, the mining sector extensively uses submersible pumps from companies such as Flygt (Xylem) to manage groundwater and ensure safe working conditions in excavation sites. Technological advancements in submersible pump design contribute significantly to market growth. Companies like Grundfos lead the way by incorporating digital technology, exemplified by products like the SMART Digital S pump, offering intelligent features for precise control and energy efficiency. The integration of submersible pumps with renewable energy sources, such as solar power, aligns with the global shift towards sustainability. In African countries like Kenya, solar-powered submersible pumps, including those from LORENTZ, provide eco-friendly solutions for water supply in remote areas with limited access to electricity. Government initiatives promoting sustainable water management further drive the adoption of submersible pumps. In the United States, programs like the Clean Water State Revolving Fund support investments in water infrastructure, boosting the demand for efficient pumping solutions. The industrial expansion in emerging economies, exemplified by Brazil and China, stimulates the submersible pump market, catering to diverse industrial applications. Companies like Grundfos and Wilo ensure a reliable water supply for industrial processes amid the economic growth of these countries. Concerns about environmental conservation and wastewater treatment drive the demand for advanced submersible pump technologies. In European countries like Germany, investments are made to optimize wastewater treatment processes, aligning with stringent environmental standards. Submersible pumps' ability to operate in harsh environments, such as deep wells and corrosive conditions, makes them indispensable, as demonstrated in the Middle East. Submersible pumps efficiently extract groundwater for various applications, showcasing resilience in challenging conditions. The expanding global oil and gas exploration activities also create opportunities for submersible pump manufacturers. Companies like Baker Hughes provide reliable solutions for fluid extraction and transportation in deep-sea drilling operations worldwide, supporting the growth of the energy industry. In addition to these factors, investments in the construction industry, increasing urbanization, and the need for cost-effective and reliable fluid lifting options further contribute to the substantial growth of the submersible pumps market. The market faces challenges from local and regional players offering cheaper alternatives, particularly in developing countries, creating a competitive landscape for global players. Despite these challenges, the market is expected to witness significant growth, driven by the critical role submersible pumps play in addressing diverse global needs. Fluctuating Stance on Cryptocurrency Legality Hinders the Submersible Pumps Market Growth Intense competition from local players providing more affordable alternatives, especially in developing nations such as India, puts global manufacturers at a disadvantage, these dynamic affects Submersible Pumps Market growth and pricing dynamics, hindering the potential for revenue growth. Stringent environmental standards in European countries, for instance, Germany, necessitate substantial investments to meet wastewater treatment regulations. This adds operational complexities and costs, particularly for companies like Grundfos operating in the region. The Submersible Pumps Market vulnerability to economic downturns is another significant challenge. Reliance on industrial expansion in emerging economies such as Brazil and China expose the submersible pump market to reduced demand during economic slowdowns. This was evident during the economic downturn in Brazil, impacting companies like Wilo, which cater to diverse industrial applications. Additionally, the presence of cheaper alternatives from local players in developing countries, as seen in Southeast Asian markets, restricts the Submersible Pumps Market growth of global players, thereby affecting overall revenue. Volatility in the oil and gas sector significantly influences the submersible pump market. Fluctuations in demand for fluid extraction and transportation in deep-sea drilling operations, as observed globally, lead to uncertainties and challenges for companies like Baker Hughes, affecting strategic planning and future growth prospects. Challenges persist in the push for renewable energy integration, especially in remote areas with limited access to electricity. In regions like Africa, reliance on solar-powered submersible pumps leads to maintenance and reliability issues due to inconsistent access to solar energy, hampering the widespread adoption of eco-friendly solutions. Submersible pumps' operation in harsh conditions, such as deep wells and corrosive environments, poses challenges in terms of maintenance and durability. In the Middle East, where submersible pumps are utilized in challenging conditions, frequent maintenance requirements add operational complexities and costs for end-users. The severity of global water scarcity impacts the market as well, with unpredictable climatic conditions and increasing water stress affecting the demand for submersible pumps, particularly in regions like India. Despite technological advancements, challenges arise in terms of end-user adoption. Reluctance to transition from traditional pump systems to digitally advanced submersible pumps, like the SMART Digital S pump from Grundfos, hinders widespread acceptance in some regions. Lastly, the market's reliance on government initiatives supporting sustainable water management introduces uncertainties. Changes in government priorities and funding allocations, as seen in the United States with Programs like the Clean Water State Revolving Fund, can impact the demand for efficient pumping solutions, adding a layer of unpredictability for market players. The reliability of submersible pump motors is also a concern, as applications exceeding design limits lead to failures and increased troubleshooting costs, ultimately acting as a restraint for Submersible Pumps Market growth.Submersible Pumps Market Segment Analysis:

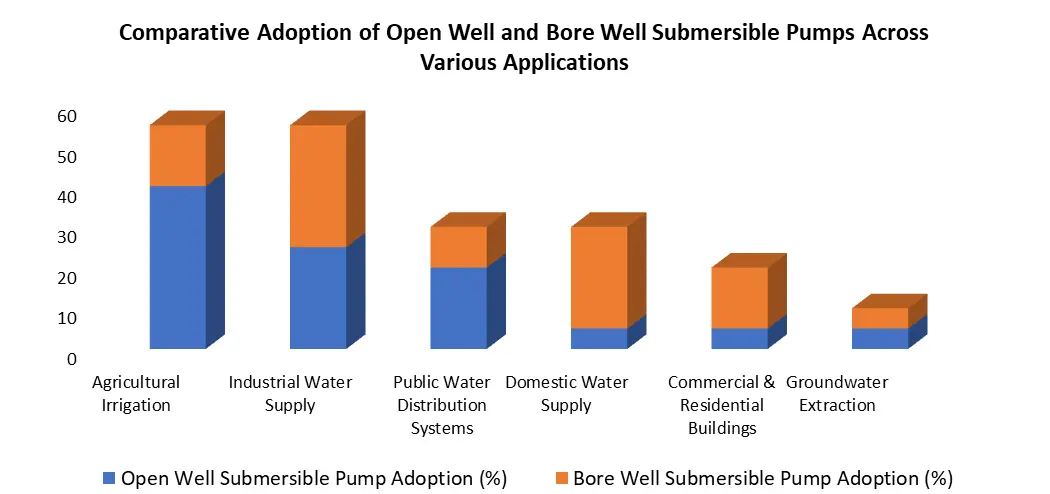

Based on Type, Open well submersible pumps dominated the Submersible Pumps Market in 2023 and is expected to maintain its dominance over the forecast period. It find widespread use in applications such as agricultural irrigation, industrial water supply, and public water distribution systems. Their adaptability to open wells, ponds, or tanks makes them a preferred choice for agriculture, ensuring efficient water supply for crops. On the other hand, Bore Well submersible pumps are commonly employed in deeper water sources, such as boreholes or wells, making them crucial for domestic water supply, commercial and residential building services, and groundwater extraction. The Bore Well pumps exhibit versatility in reaching deeper water reservoirs, making them indispensable for areas where the water table is deeper. This comparative analysis underscores the tailored applications of Open Well and Bore Well submersible pumps, reflecting their strategic roles in diverse sectors and water source conditions.

Submersible Pumps Market Regional Insights:

Asia Pacific Dominance in the Submersible Pumps Market The Asia-Pacific (APAC) region dominated the Submersible Pumps Market in 2023 and is expected to maintain its dominance e throughout the forecast period as a key player, driven by robust industrial activities in countries such as India and China. China, in particular, is expected to witness significant growth in crude oil refining capacity, underlining the increasing demand for submersible pumps in industries such as oil and chemicals. The region is experiencing a growth phase, driven by a high rate of population expansion, leading to an escalated need for water supply. The excessive extraction of water in countries like India, Bangladesh, and Indonesia has resulted in a decline in water levels, consequently boosting the demand for submersible pumps to address water scarcity. According to the World Investment Report 2022, India's Foreign Direct Investment (FDI) inflows reached USD 81,973 million during 2020-21, marking a substantial 10% increase from the previous year. The infusion of high investments, supportive policies, and the growth of various industries is expected to drive the submersible pumps market in the APAC region throughout the forecast period. In India, solar pumps find a significant application in irrigation, making the country a substantial market for solar submersible pumps. The government's initiatives, such as the Jawaharlal Nehru National (JNN) Solar Mission launched in 2010, with a target of achieving 100 GW of solar PV by 2022, and the relaunch of the Solar Pumping Programme for Irrigation and Drinking Water in 2019 by the Ministry of New and Renewable Energy (MNRE), are expected to fuel the growth of the submersible pumps market in India, supported by government initiatives. North America and Europe also exhibit significant markets share with a strong focus on water conservation and sustainable water management, showcasing a balanced demand for submersible pumps in both agricultural and industrial sectors. In the Middle East and Africa, the arid climate shapes the market, emphasizing the importance of bore well submersible pumps for water extraction from deeper wells. Latin America experiences a balanced demand for both open well and bore well submersible pumps, reflecting its diverse landscape and varied agricultural practices. This comprehensive regional analysis highlights the intricate dynamics influencing the Submersible Pumps Market globally, with each region presenting unique challenges and opportunities.Scope of the Global Submersible Pumps Market: Inquire before buying

Global Submersible Pumps Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 59.40 Bn. Forecast Period 2024 to 2030 CAGR: 5.6% Market Size in 2030: US $ 86.98 Bn. Segments Covered: by Type of Cryptocurrency Supported Bitcoin Ethereum Litecoin Various Altcoins by Transaction Type Buy-Only ATMs Sell-Only ATMs Two-Way ATMs (Buying and Selling) by Deployment Type Airports Shopping Malls Retail Stores Standalone Installations by Accessibility Public ATMs Private ATMs by Ownership Type Cryptocurrency Company Operated Financial Institution Operated Independent Operators Submersible Pumps Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Submersible Pumps Market Key Players:

Major Contributors in the Submersible Pumps Industry in North America: 1. Franklin Electric, United States. 2. Xylem Inc. (Goulds Pumps), United States. 3. Zoeller Pump Company, United States. Leading players in the Europe Submersible Pumps Market: 1. Grundfos, Denmark. 2. KSB SE & Co. KGaA, Germany. 3. Wilo SE, Germany. 4. Sulzer Ltd., Switzerland. 5. Pedrollo S.p.A., Italy. 6. Atlas Copco AB (Varisco), Sweden. Key players driving the Asia-Pacific Submersible Pumps Market: 1. Ebara Corporation, Japan. 2. Tsurumi Manufacturing Co., Ltd., Japan. 3. Shakti Pumps (I) Ltd., India. 4. Crompton Greaves Consumer Electricals Ltd., India. 5. Kirloskar Brothers Limited, India. 6. TSURUMI MANUFACTURING CO., LTD., Japan. FAQs: 1] What Major Key players in the Global Market report? Ans. The Major Key players covered in the Submersible Pumps Market report are Grundfos, Denmark., KSB SE & Co. KGaA, Germany., Wilo SE, Germany.,Sulzer Ltd., Switzerland., Pedrollo S.p.A., Italy. 2] Which region is expected to hold the highest share in the Global Market? Ans. APAC region is expected to hold the highest share in the Submersible Pumps Market. 3] What is the market size of the Global Submersible Pumps Market by 2030? Ans. The market size of the Submersible Pumps Market by 2030 is expected to reach US$ 86.98 Billion. 4] What is the forecast period for the Global Submersible Pumps Market? Ans. The forecast period for the Submersible Pumps Market is 2024-2030. 5] What was the market size of the Global Submersible Pumps Market in 2023? Ans. The market size of the Submersible Pumps Market in 2023 was valued at US$ 59.40 Billion.

1. Submersible Pumps Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Submersible Pumps Market: Dynamics 2.1. Submersible Pumps Market Trends by Region 2.1.1. North America Submersible Pumps Market Trends 2.1.2. Europe Submersible Pumps Market Trends 2.1.3. Asia Pacific Submersible Pumps Market Trends 2.1.4. Middle East and Africa Submersible Pumps Market Trends 2.1.5. South America Submersible Pumps Market Trends 2.2. Submersible Pumps Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Submersible Pumps Market Drivers 2.2.1.2. North America Submersible Pumps Market Restraints 2.2.1.3. North America Submersible Pumps Market Opportunities 2.2.1.4. North America Submersible Pumps Market Challenges 2.2.2. Europe 2.2.2.1. Europe Submersible Pumps Market Drivers 2.2.2.2. Europe Submersible Pumps Market Restraints 2.2.2.3. Europe Submersible Pumps Market Opportunities 2.2.2.4. Europe Submersible Pumps Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Submersible Pumps Market Drivers 2.2.3.2. Asia Pacific Submersible Pumps Market Restraints 2.2.3.3. Asia Pacific Submersible Pumps Market Opportunities 2.2.3.4. Asia Pacific Submersible Pumps Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Submersible Pumps Market Drivers 2.2.4.2. Middle East and Africa Submersible Pumps Market Restraints 2.2.4.3. Middle East and Africa Submersible Pumps Market Opportunities 2.2.4.4. Middle East and Africa Submersible Pumps Market Challenges 2.2.5. South America 2.2.5.1. South America Submersible Pumps Market Drivers 2.2.5.2. South America Submersible Pumps Market Restraints 2.2.5.3. South America Submersible Pumps Market Opportunities 2.2.5.4. South America Submersible Pumps Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Submersible Pumps Industry 2.8. Analysis of Government Schemes and Initiatives For Submersible Pumps Industry 2.9. Submersible Pumps Market Trade Analysis 2.10. The Global Pandemic Impact on Submersible Pumps Market 3. Submersible Pumps Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 3.1.1. Bitcoin 3.1.2. Ethereum 3.1.3. Litecoin 3.1.4. Various Altcoin 3.2. Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 3.2.1. Buy-Only ATMs 3.2.2. Sell-Only ATMs 3.2.3. Two-Way ATMs (Buying and Selling) 3.3. Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 3.3.1. Airports 3.3.2. Shopping Malls 3.3.3. Retail Stores 3.3.4. Standalone Installations 3.4. Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 3.4.1. Public ATMs 3.4.2. Private ATMs 3.5. Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 3.5.1. Cryptocurrency Company Operated 3.5.2. Financial Institution Operated 3.5.3. Independent Operators 3.6. Submersible Pumps Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 4.1.1. Bitcoin 4.1.2. Ethereum 4.1.3. Litecoin 4.1.4. Various Altcoin 4.2. North America Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 4.2.1. Buy-Only ATMs 4.2.2. Sell-Only ATMs 4.2.3. Two-Way ATMs (Buying and Selling) 4.3. North America Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 4.3.1. Airports 4.3.2. Shopping Malls 4.3.3. Retail Stores 4.3.4. Standalone Installations 4.4. North America Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 4.4.1. Public ATMs 4.4.2. Private ATMs 4.5. North America Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 4.5.1. Cryptocurrency Company Operated 4.5.2. Financial Institution Operated 4.5.3. Independent Operators 4.6. North America Submersible Pumps Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 4.6.1.1.1. Bitcoin 4.6.1.1.2. Ethereum 4.6.1.1.3. Litecoin 4.6.1.1.4. Various Altcoin 4.6.1.2. United States Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 4.6.1.2.1. Buy-Only ATMs 4.6.1.2.2. Sell-Only ATMs 4.6.1.2.3. Two-Way ATMs (Buying and Selling) 4.6.1.3. United States Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 4.6.1.3.1. Airports 4.6.1.3.2. Shopping Malls 4.6.1.3.3. Retail Stores 4.6.1.3.4. Standalone Installations 4.6.1.4. United States Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 4.6.1.4.1. Public ATMs 4.6.1.4.2. Private ATMs 4.6.1.5. United States Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 4.6.1.5.1. Cryptocurrency Company Operated 4.6.1.5.2. Financial Institution Operated 4.6.1.5.3. Independent Operators 4.6.2. Canada 4.6.2.1. Canada Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 4.6.2.1.1. Bitcoin 4.6.2.1.2. Ethereum 4.6.2.1.3. Litecoin 4.6.2.1.4. Various Altcoin 4.6.2.2. Canada Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 4.6.2.2.1. Buy-Only ATMs 4.6.2.2.2. Sell-Only ATMs 4.6.2.2.3. Two-Way ATMs (Buying and Selling) 4.6.2.3. Canada Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 4.6.2.3.1. Airports 4.6.2.3.2. Shopping Malls 4.6.2.3.3. Retail Stores 4.6.2.3.4. Standalone Installations 4.6.2.4. Canada Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 4.6.2.4.1. Public ATMs 4.6.2.4.2. Private ATMs 4.6.2.5. Canada Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 4.6.2.5.1. Cryptocurrency Company Operated 4.6.2.5.2. Financial Institution Operated 4.6.2.5.3. Independent Operators 4.6.3. Mexico 4.6.3.1. Mexico Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 4.6.3.1.1. Bitcoin 4.6.3.1.2. Ethereum 4.6.3.1.3. Litecoin 4.6.3.1.4. Various Altcoin 4.6.3.2. Mexico Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 4.6.3.2.1. Buy-Only ATMs 4.6.3.2.2. Sell-Only ATMs 4.6.3.2.3. Two-Way ATMs (Buying and Selling) 4.6.3.3. Mexico Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 4.6.3.3.1. Airports 4.6.3.3.2. Shopping Malls 4.6.3.3.3. Retail Stores 4.6.3.3.4. Standalone Installations 4.6.3.4. Mexico Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 4.6.3.4.1. Public ATMs 4.6.3.4.2. Private ATMs 4.6.3.5. Mexico Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 4.6.3.5.1. Cryptocurrency Company Operated 4.6.3.5.2. Financial Institution Operated 4.6.3.5.3. Independent Operators 5. Europe Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.2. Europe Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.3. Europe Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.4. Europe Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.5. Europe Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6. Europe Submersible Pumps Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.1.2. United Kingdom Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.1.3. United Kingdom Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.1.4. United Kingdom Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.1.5. United Kingdom Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6.2. France 5.6.2.1. France Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.2.2. France Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.2.3. France Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.2.4. France Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.2.5. France Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.3.2. Germany Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.3.3. Germany Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.3.4. Germany Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.3.5. Germany Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.4.2. Italy Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.4.3. Italy Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.4.4. Italy Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.4.5. Italy Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.5.2. Spain Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.5.3. Spain Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.5.4. Spain Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.5.5. Spain Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.6.2. Sweden Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.6.3. Sweden Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.6.4. Sweden Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.6.5. Sweden Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.7.2. Austria Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.7.3. Austria Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.7.4. Austria Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.7.5. Austria Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 5.6.8.2. Rest of Europe Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 5.6.8.3. Rest of Europe Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 5.6.8.4. Rest of Europe Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 5.6.8.5. Rest of Europe Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6. Asia Pacific Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.2. Asia Pacific Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.3. Asia Pacific Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.4. Asia Pacific Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.5. Asia Pacific Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6. Asia Pacific Submersible Pumps Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.1.2. China Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.1.3. China Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.1.4. China Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.1.5. China Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.2.2. S Korea Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.2.3. S Korea Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.2.4. S Korea Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.2.5. S Korea Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.3.2. Japan Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.3.3. Japan Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.3.4. Japan Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.3.5. Japan Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.4. India 6.6.4.1. India Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.4.2. India Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.4.3. India Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.4.4. India Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.4.5. India Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.5.2. Australia Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.5.3. Australia Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.5.4. Australia Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.5.5. Australia Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.6.2. Indonesia Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.6.3. Indonesia Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.6.4. Indonesia Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.6.5. Indonesia Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.7.2. Malaysia Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.7.3. Malaysia Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.7.4. Malaysia Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.7.5. Malaysia Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.8.2. Vietnam Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.8.3. Vietnam Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.8.4. Vietnam Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.8.5. Vietnam Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.9.2. Taiwan Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.9.3. Taiwan Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.9.4. Taiwan Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.9.5. Taiwan Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 6.6.10.2. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 6.6.10.3. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 6.6.10.4. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 6.6.10.5. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 7. Middle East and Africa Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.2. Middle East and Africa Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 7.3. Middle East and Africa Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 7.4. Middle East and Africa Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 7.5. Middle East and Africa Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 7.6. Middle East and Africa Submersible Pumps Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.1.2. South Africa Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 7.6.1.3. South Africa Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 7.6.1.4. South Africa Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 7.6.1.5. South Africa Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.2.2. GCC Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 7.6.2.3. GCC Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 7.6.2.4. GCC Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 7.6.2.5. GCC Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.3.2. Nigeria Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 7.6.3.3. Nigeria Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 7.6.3.4. Nigeria Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 7.6.3.5. Nigeria Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 7.6.4.2. Rest of ME&A Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 7.6.4.3. Rest of ME&A Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 7.6.4.4. Rest of ME&A Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 7.6.4.5. Rest of ME&A Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 8. South America Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.2. South America Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 8.3. South America Submersible Pumps Market Size and Forecast, by Deployment Type(2023-2030) 8.4. South America Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 8.5. South America Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 8.6. South America Submersible Pumps Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.6.1.2. Brazil Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 8.6.1.3. Brazil Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 8.6.1.4. Brazil Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 8.6.1.5. Brazil Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.6.2.2. Argentina Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 8.6.2.3. Argentina Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 8.6.2.4. Argentina Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 8.6.2.5. Argentina Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Submersible Pumps Market Size and Forecast, by Type of Cryptocurrency Supported (2023-2030) 8.6.3.2. Rest Of South America Submersible Pumps Market Size and Forecast, by Transaction Type (2023-2030) 8.6.3.3. Rest Of South America Submersible Pumps Market Size and Forecast, by Deployment Type (2023-2030) 8.6.3.4. Rest Of South America Submersible Pumps Market Size and Forecast, by Accessibility (2023-2030) 8.6.3.5. Rest Of South America Submersible Pumps Market Size and Forecast, by Ownership Type (2023-2030) 9. Global Submersible Pumps Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Submersible Pumps Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Franklin Electric, United States. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Xylem Inc. (Goulds Pumps), United States. 10.3. Zoeller Pump Company, United States. 10.4. Grundfos, Denmark. 10.5. KSB SE & Co. KGaA, Germany. 10.6. Wilo SE, Germany. 10.7. Sulzer Ltd., Switzerland. 10.8. Pedrollo S.p.A., Italy. 10.9. Atlas Copco AB (Varisco), Sweden. 10.10. Ebara Corporation, Japan. 10.11. Tsurumi Manufacturing Co., Ltd., Japan. 10.12. Shakti Pumps (I) Ltd., India. 10.13. Crompton Greaves Consumer Electricals Ltd., India. 10.14. Kirloskar Brothers Limited, India. 10.15. TSURUMI MANUFACTURING CO., LTD., Japan. 11. Key Findings 12. Industry Recommendations 13. Submersible Pumps Market: Research Methodology 14. Terms and Glossary