The Automotive Market in India was accounted for 3.99 Mn units in 2023 and the market is expected to reach 6.38 Mn units at a CAGR of 6.94 % by 2030.Overview about Automotive Market in India

The automotive vehicle industry simply means the production, manufacturing and sale of vehicles. These vehicles are basically classified by their unique design, utility and purpose. The Indian Automotive market is witnessing high demand in recent years due to various factors such as, modifying transportation laws, , need for alternative source of fuels, and many others. The market report analyses information regarding the automotive industry and provides a detailed analysis in terms of dynamics, segmentations, competitive landscape, regional analysis etc. This report focuses on using primary and secondary information to give the market outlook and competitive landscape of key companies. The innovative ideas for making more efficient and sustainable automotive products has led to growth in the market. The report has provided with the detailed analysis of SWOT and PESTLE along with the PORTER analysis.To know about the Research Methodology :- Request Free Sample Report

Automotive Market in India Dynamics

Rising in the use of Automotive leading to driving the market The increasing young population and rising income of middle-class families has been considered resulting in the growing market share for India in the automotive industry. India’s rapid urbanization in the recent years in all industrial sector, especially the automobile industry has driven the market. According to the Society of Indian Automobile Manufacturers (SIAM), in June 2021, the total production volume of commercial vehicles, passenger cars, three-wheelers, and two-wheelers combined was 1,693,639 units. Government initiative for the fast production and adoption of hybrid electric vehicles has increased while focusing on lowering the use of fossil fuels. The demand for the automotive market is further driven by increasing exports of Indian manufactured vehicles to other countries by the terms of volume. Indian automotive exports accounted for 1,419,430 units from April 2021 to June 2021. Price of using new technology restraints the growth Regardless of the growth of the world’s one of the fastest growing automobile industrial sectors, it faces several challenges. The increasing pollution is the utmost growing concern in India, as some of the major cities like Delhi and Mumbai experience a high range of air pollution and noise pollution. The need for clearer air and the use of cleaner sources of energy alternatives is increasing in demand due to various environmental concerns. Government policies for maintaining safety and quality standards of vehicles due to increased road incidents have been raised. Government regulations for the automotive industry change frequently and adapting to these policies may be time-consuming for manufacturers. The road safety measure is increased due to road incidents and fatalities because of the lack of proper roads in rural regions of India. The Rising price of fuel puts a tremendous pressure on vehicle prices along with making them costlier and less affordable. New alternative source of energy for vehicle that is the electric vehicles requires bigger amount of money for manufacturing purposes. Adapting and implementing new technologies like autonomous driving systems is costlier, thus increasing the prices of vehicles. Rising investment for research and development Increasing government initiative for using electric vehicle are expected to drive a huge demand for the automotive market in India as the Make in India and Atmanirbhar Bharat initiative are ongoing in India. The Automotive Mission Plan (2016 - 26) is a mutual initiative between Govt. of India and the Indian Automotive industry for development of automobile sector and making a detailed roadmap for the development. Indian government is rising many opportunities for the foreign automobile companies to start a manufacturing plant of auto-components and growing their company in auto-component sales market in India. Expanding the research and development hub of India in the automotive industry by introducing more innovative ideas of making connected cars with internet access inside cars that can be controlled remotely. This will indirectly increase the connected car market in India and will drive the growth of the market in India. According to SIAM, India accounts for 40% of the total $31 Bn. of global engineering and R&D spending. 8% of the country’s R&D expenditure is in the automotive sector. With the growth in technological development for manufacturing of Electric vehicles in India, the need for making use of wiring harnesses has increased recently. The wiring harness includes the use of sensors, a combination of wires, electric component, actuators and lithium-ion batteries for the effective production of EV’s in India.Increase in air pollution The Indian automobile sector is leading concerns about increasing air pollution and simultaneously declining quality air quality. Some Indian cities, such as Delhi have often been on lists of the most polluted and dirty cities in the world. With the growing pressure from NGOs and environmental groups, The Indian government has initiated and implemented a number of steps. New pollution rules were released, and electric car taxes were significantly decreased compared to conventional automobiles. The rising air pollution in India has made it compulsory and made an initiative to make use of more electric vehicles. India being on track to overtake China in the increasing population in world and becoming the most populated country, the traffic in India is rising and need for development of tiny, medium size off-road, underdeveloped roadways has raised.

Automotive Market in India Segments Analysis

On the basis of vehicle type: The automotive industry is bifurcated into several sub-types. The most commonly used types of vehicles are the two-wheelers, passenger vehicles and commercial vehicles. The two wheeler vehicle dominates the automobile industry because of heavy use, reliability and it’s demand in Indian region. Two-wheelers are very affordable and cost effective for long and short distance travels as well.. As per the road conditions and connectivity in India, two-wheelers are the most useful no matter if it’s an EV or petrol vehicle. The key leading companies seeks to make more technological advancement for improving the efficiency of these vehicles. These two wheelers are then sub divided into different types. The most demanding two–wheelers are the motorcycles, followed by scooters and then mopeds. The top companies in manufacturing of two-wheelers are HERO MotoCorp, Bajaj Auto, HONDA Motors and TVS Company. These companies are focusing on producing more efficient, affordable and best performing vehicles. The rise in sales of passenger cars is increasing due to urbanization, changing lifestyle and increasing incomes of middle class. The technological development in India has been a driving factor for the growth of automobile sector. This development has led to increase in income of the population and creating more working opportunities. The rise in income is directly affected to the change in lifestyle and making use of passenger cars thus driving the market. The commercial vehicles demand has raised in recent years due to the growing economy and industrial sector, which need transportation of goods to long distance places. This commercial vehicle market significantly contributes in the rising economy of India and drives the automobile industry.Based on type: The automotive market in India is dominated by the petrol vehicles. The petrol-powered vehicle is most popular in India because of its affordability. These petrol vehicles are known as best performers in the sector because of their fuel efficiency, reliability, overall performance as well as availability in every corner of the country. The top key companies in manufacturing and selling two-wheelers are HERO MotoCorp, Bajaj, and Honda Motorcycle. The petrol-powered passenger cars are also most popular in India as these companies provide cars those are affordable for every middle-class person to fulfil their dream. Petrol cars have the best performance and gives an excellent mileage on every single fuel top-up. The diesel-powered vehicle has the second market for automotive vehicle in India. These diesel vehicles are popular for their heavy duty performance, long-range capability, and fuel efficiency. The commercial vehicles are mostly diesel-powered vehicles such as buses and trucks. These vehicles have the best durability and are mostly used for heavy duty applications like transportation of goods for longer distances. The key companies in the manufacturing of commercial diesel-powered vehicles are Ashok Leyland, Tata Motors, and Mahindra & Mahindra. Passenger cars also come in diesel type, and these are more popular than the two-wheelers. Diesel-powered cars are more efficient and reliable than petrol powered as these are more durable.

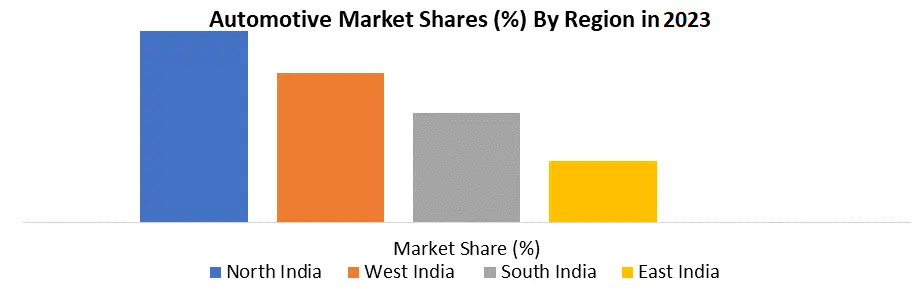

Regional Insights for Automotive Market in India

North Indian Market: The Indian automotive market is divided in four regions that is the North India, West India, South India, and East India. North Indian region is a largest automotive market because of the population density, and rapid development in this region. North Indian region is driven by the two-wheelers market, as there are large sales of two-wheelers in this region. This region has a majority of the middle andupper-class population, whose demand for vehicles hasincreased. Passenger cars like SUVs are more popular here, as the rapid rise in urbanization has raised the demand for passenger cars. This urbanization has also raised the demand for more commercial and light weight vehicles such as trucks and buses. West Indian Market: This region has a strong base for light and heavy weight commercial vehicles due to large amount of agricultural land and transport facilities by means of trucks. West India is very close to important major harbor and ports which makes this location ideal for doing commercial business. This region is house for India’s most wealthy people and demand for luxurious passenger car like Hatchback and Maybacks is gaining popularity. Sedans are gaining more popularity than SUVs due to high use and rise in disposable income of middle-class population. Western region of India is undergoing infrastructural development, which has given many fabulous opportunities for transport sector by means of light weight and heavy weight commercial vehicles. South Indian Market: This region has a strong base for two-wheelers, hatchbacks, and SUVs, due to the rise in population of this region. The use of two-wheelers is done mostly by the middle-class population for their daily activities and among young generation along with rise in use by women’s. South Indian region is hub for India’s one of the best educational facilities and has India’s biggest IT hub, which makes this region a best suitable for the use of two-wheelers. Other passenger cars like hatchbacks and SUVs are most popular and cover a large percentage of the automotive market. This region also has a used car market, where luxury cars and other vehicles are found commonly known as the second-hand cars market. South India region is also a well-known vacation destination because of wonderful weather and natural springs, which require more vehicles that can be leased on rent to visit these places. East India: This is the smallest regional market for automotive vehicle, due to the small population. This region has a number of mountains, which is ideal place for tea production. This region does not have a plain land but has hill sloppy land which is not suitable for vehicle driving. But some of the areas like villages in Assam and Nagaland have plain roads where the sales of two-wheelers is more for transport purpose.

Competitive Landscape

The MMR report provide details of competitive companies in the market of automotive vehicle in India. Tata Motors is the market leader in the Indian automotive vehicle market who has a strong presence and strong core in the industrial sector in India. Tata Motor are specialized in the passenger car market, with models such as the Tata Nexon, Tata Harrier, and Tata Altroz. Tata Motors is also expanding its presence in the electric vehicle market. This company has export services in around 100 countries around the world. Tata Motors is using advanced technology to make advanced autonomous cars in world. Maruti Suzuki India stated in July 2021 that it would invest Rs. 18,000 crore (US$ 2.42 billion) on a new manufacturing facility in Haryana, with an annual production capacity of 7.5-10 lakh vehicles of all types. Hyundai Motor India expanded their facilities and made a new headquarter in Gurgaon by investing of about Rs. 2000 Crore (USD 269 million). The next company is the Mahindra & Mahindra who has made a deal of about USD 403 million for the manufacturing of electric vehicles in India.Automotive Market in India Scope: Inquiry Before Buying

Automotive Market in India Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: 3.99 Million Units. Forecast Period 2024 to 2030 CAGR: 6.94% Market Size in 2030: 6.38 Million Units. Segments Covered: by Vehicle Type Passenger Vehicles Hatchbacks Mini Hatchback Small Hatchback Sedans SUVs MUVs/ MPVs Other Commercial Vehicles Truck Bus Light Commercial Vehicle (LCV) Others Two Wheelers Motorcycles Scooters Electric Bikes Three Wheelers Auto Rickshaws Goods Carriers Others by Type Petrol Diesel Electric cars Others Automotive Market by Region

North India South India East India West IndiaKey Players in Automotive Market in India

1. Tata Motors Ltd 2. Maruti Suzuki India Ltd 3. Mahindra & Mahindra Ltd 4. Hero MotoCorp Ltd 5. Bajaj Auto Ltd 6. Ashok Leyland Ltd 7. TVS Motor Company Ltd 8. Eicher Motors Ltd 9. Force Motors Ltd 10. SML ISUZU Ltd. 11. Honda Motor Co., Ltd. 12. Hyundai Motor India 13. Daimler AG 14. Piaggio & C.S.p.a. 15. Toyota Motor Corporation 16. Volkswagen AG 17. AB VolvoFAQ’S:

1) What is the market share of the Global Automotive market in India in 2023? Answer: The Automotive market in India was accounted for 3.99 million Units in the year 2023. 2) Which vehicle segment is dominating the Automotive market in India? Answer: The local Indian car market is dominated by two-wheelers and passenger automobiles. Small and mid-sized cars are the most popular passenger vehicles. In FY20, two-wheelers and passenger cars accounted for 80.8% and 12.9% of the market share. 3) What are the key players in the Automotive market in India? Answer: The major players operating in the Automotive market in India include Tata Motors Ltd, Maruti Suzuki India Ltd, Mahindra & Mahindra Ltd, Hero MotoCorp Ltd, Bajaj Auto Ltd, Ashok Leyland Ltd, TVS Motor Company Ltd, Eicher Motors Ltd, Force Motors Ltd, SML ISUZU Ltd., Honda Motor Co., Ltd., Hyundai Motor India, Daimler AG, Piaggio & C.S.p.a., Toyota Motor Corporation, Volkswagen AG, AB Volvo 4) Which factor acts as the driving factor for the growth of the Automotive market in India? Answer: Increasing young population and rising income of middle-class families is considered to result in highest market share for India in the automotive sector. 5) What factors are restraining the growth of the Automotive market in India? Answer: The car sector has been concerned about the problem of declining air quality and increased congestion.

1. Automotive Market in India: Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Market in India: Industry Overview 2.1. Automotive Industry in India: Detailed Scenario 2.2. Automotive Industry in India: Contribution to the National Economy 2.3. Total Production of Automobiles in India by Vehicles (2018-2023) 2.4. Total Sales of Automobiles in India by Vehicles (2018-2023) 2.5. Automotive Trade Analysis in India 2.5.1. 10 Largest Importers Countries In India 2.5.2. 10 Largest Exporters Countries From India 2.6. Analysis of Price Fluctuations in Different Vehicle 2.7. The role of Market leaders and their strategic perspective 3. Automotive Market in India: Driverless Technology Market Analysis 3.1. Detailed Analysis of Driverless Technology in India 3.2. Analysis of Market Penetration Strategies and Competitive Environment 3.3. Regional Variances in Consumer Preferences and Demand towards Driverless technology 4. Automotive Market in India: Market Dynamics 4.1. India Automotive Market Trends 4.2. Impact of Technological Advancements on the Automotive Industry 4.3. India Automotive Market Dynamics 4.3.1. Market Drivers 4.3.2. Market Restraints 4.3.3. Market Opportunities 4.3.4. Market Challenges 4.4. PORTER’s Five Forces Analysis 4.5. PESTLE Analysis 4.6. Technology Roadmap 4.7. Regulatory Landscape 4.8. Key Opinion Leader Analysis of the India Automotive Industry 4.9. Analysis of Government Schemes and Initiatives for India Automotive Industry 4.10. The Global Pandemic Impact on Automotive Market in India 5. India Automotive Market: Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 5.1. India Automotive Market Size and Forecast, by Vehicle Type (2023-2030) 5.1.1. Passenger Vehicles 5.1.1.1. Hatchbacks 5.1.1.1.1. Mini Hatchback 5.1.1.1.2. Small Hatchback 5.1.1.2. Sedans 5.1.1.3. SUVs 5.1.1.4. MUVs/ MPVs 5.1.1.5. Other 5.1.2. Commercial Vehicles 5.1.2.1. Truck 5.1.2.2. Bus 5.1.2.3. Light Commercial Vehicle (LCV) 5.1.2.4. Others 5.1.3. Two Wheelers 5.1.3.1. Motorcycles 5.1.3.2. Scooters 5.1.3.3. Electric Bikes 5.1.4. Three Wheelers 5.1.4.1. Auto Rickshaws 5.1.4.2. Goods Carriers 5.1.4.3. Others 5.2. India Automotive Market Size and Forecast, by Fuel Type (2023-2030) 5.2.1. Petrol 5.2.2. Diesel 5.2.3. Electric cars 5.2.4. Others 6. India Automotive Market Competitive Landscape: Automotive Vs. Driverless Automotive 6.1. MMR Competition Matrix 6.1.1. Brand Equity 6.1.2. Market Share 6.2. Competitive Landscape 6.3. Comparison of Units Sold by Leading Players (2018-2023) 6.4. Key Players Benchmarking 6.4.1. Company Name 6.4.2. Product Segment 6.4.3. End-user Segment 6.4.4. Revenue (2023) 6.4.5. Manufacturing Locations 6.4.6. Production in Units (2023) 6.5. Leading Automotive Market Companies, by market capitalization 6.6. Market Structure 6.6.1. Market Leaders 6.6.2. Market Followers 6.6.3. Emerging Players 6.7. Mergers and Acquisitions Details 7. Company Profiles: Leading Automotive Market Key Players Strategic Intent 7.1. Tata Motors Ltd 7.1.1. Company Overview 7.1.2. Business Portfolio 7.1.3. Financial Overview 7.1.4. SWOT Analysis 7.1.5. Strategic Analysis 7.1.6. Recent Developments 7.2. Maruti Suzuki India Ltd 7.3. Mahindra & Mahindra Ltd 7.4. Hero MotoCorp Ltd 7.5. Bajaj Auto Ltd 7.6. Ashok Leyland Ltd 7.7. TVS Motor Company Ltd 7.8. Eicher Motors Ltd 7.9. Force Motors Ltd 7.10. SML ISUZU Ltd. 7.11. Honda Motor Co., Ltd. 7.12. Hyundai Motor India 7.13. Daimler AG 7.14. Piaggio & C.S.p.a. 7.15. Toyota Motor Corporation 7.16. Volkswagen AG 7.17. AB Volvo 8. Company Profiles: Startups in Driverless Technology: Strategic Intent 8.1. Flux Auto 8.1.1. Company Overview 8.1.2. Business Portfolio 8.1.3. Financial Overview 8.1.4. SWOT Analysis 8.1.5. Strategic Analysis 8.1.6. Recent Developments 8.2. FishEyeBox 8.3. Hi-Tech Robotic Systemz 8.4. EC Mobility Pvt. Ltd. 8.5. ATImotors 8.6. Netradyne 8.7. Swaayat Robots 8.8. Auro Robotics 8.9. OmniPresent Robotics 8.10. Mahindra & Mahindra 8.11. SeDrica 1. O 9. Key Findings 10. Industry Recommendations 11. Automotive Market: Research Methodology 12. Terms and Glossary