Zero-Turn Mower Market size was valued at USD 3.80 Billion in 2024 and the total Global Zero-Turn Mower Market revenue is expected to grow at a CAGR of 10.6% from 2025 to 2032, reaching nearly USD 8.51 Billion.Zero-Turn Mower Market Overview

A Zero-Turn Mower is a high-performance riding lawn mower with a zero-degree turning radius, allowing it to pivot on the spot for maximum manoeuvrability. It is commonly used in residential as well as commercial applications for efficiently mowing great and obstacle-rich parts. Global Zero-Turn mower market the growth is driven by increasing demand for efficient, time-saving lawn care solutions in together the residential and commercial sectors. Zero-turn mowers are highly manoeuvrable due to their zero-degree turning radius allowing users to mow around obstacles with ease suggestively falling mowing time. Growing popularity of professional landscaping services, the expansion of commercial green spaces such as golf courses and parks, and the growing preference for advanced non-invasive mowing equipment. The incring adoption of home lawn care and the increasing trend of DIY landscaping are fuelling market demand. The 50 to 60 inches cutting width segment dominated the market in 2024, due to its optimal balance between area coverage and manoeuvrability. North America emerged as the leading regional market in 2024 accounting for nearly 47% of global revenue approx. USD 820 million, driven by a strong landscaping industry larger lawn size, and a concentration of leading manufacturers. Major key players dominating the market include Deere & Company, The Toro Company, Husqvarna Group, AriensCo, and Kubota Corporation are focusing on innovations such as electric, battery-powered and autonomous zero-turn mowers to meet evolving consumer needs. Product innovation and urban landscaping expand; the market is predictable to witness strong long-term growth.To know about the Research Methodology :- Request Free Sample Report

Zero-Turn Mower Market Dynamics:

Rising Demand for Landscaping Services to Drive the Zero-Turn Mower Market Growth The increasing popularity of well-kept lawns in together residential and commercial areas has led to a growing need for professional landscaping services. Persons are becoming more aware of how outdoor spaces affect property value and total appeal. Homeowners and businesses are investing more in lawn care. Zero-turn mowers are in high demand because they help complete jobs faster as well as with greater accuracy. Their capacity to direct tight spaces makes them ideal for detailed landscaping work. This trend is expected to grow as more people prioritize green, attractive outdoor environments. Emergence of Electric and Battery-Powered Mowers to Boost the Zero-Turn Mower Market Growth Electric and battery-powered zero-turn mowers are becoming more popular as people look for cleaner and quieter ways to continue their lawns. Many property holder and landscaping businesses need to move left from gas-powered machines due to concerns about air pollution and rising fuel costs. Battery-powered mowers offer several benefits, like lower noise levels, less maintenance, and no harmful emissions. Battery life and performance improve, these machines are proving they handle larger areas just as well as traditional models. With more focus on sustainability as well as eco-friendly practices the demand for electric zero-turn mowers is expected to keep growing in the coming years. High Maintenance and Repair Expenses to Impact on Zero-Turn Mower Market Zero-turn mowers are built with advanced technology and precision components which improv performance also make maintenance more complicated and costly. Parts like hydraulic systems, blade assemblies as well as electronic controls require regular servicing and, at times, professional repairs. Unlike standard mowers, these machines often need specialized technicians which adds to the expense. For commercial users’ frequent usage can lead to quicker wear and tear, further increasing upkeep costs. This ongoing financial burden discourages small businesses and individual users from investing in zero-turn mowers despite their operational advantages.Zero-Turn Mower Market Segment Analysis

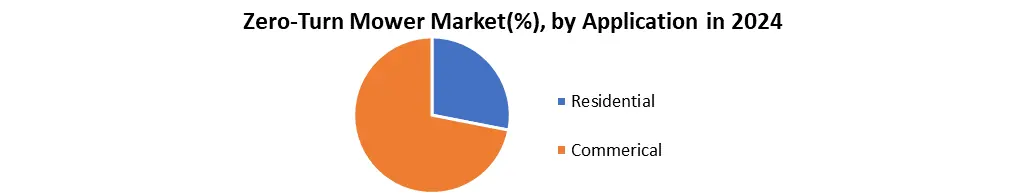

Based On Cutting Width, the market is segmented into less than 50 inches, 50 to 60 inches, more than 60 inches.50 to 60 inches segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Due to its optimal balance between efficiency and mobility, it is highly suitable for both residential and commercial landscaping applications. It is widely preferred to maintain large size lawn and green places by professional lawy care providers, municipalities and convenience managers. The versatility of this size range allows operators to carry out actions rapidly without compromising on accurate, especially in moderate to dense landscaping areas. Prominent manufacturers such as Dere & Co., The Toro Company and Huskwarna Group offer a variety of models in this range, which has to move forward. The availability of advanced features, ergonomic design and competitive pricing within this section has contributed significantly to the dominance of its market in 2024. Based on Application, the market is segmented into commercial and residential. The commercial segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. This dominance is inspired by high demand from landscaping service providers, municipal bodies, golf courses and educational institutions, all of which require efficient and durable grass cutting solutions for mass operation. Commercial users prefer zero-turn mawers due to their ability to quickly cover wide areas, providing accurate cutting results. This section also benefits from adopting advanced technologies such as GPS, automation and battery-powered systems, which increase productivity and reduce long-term operating costs. The wholesale purchases by landscaping companies and fleet operators contribute significantly to market share. The ongoing expansion of urban infrastructure including parks and recreational green locations, strengthening the leading position of the commercial segment in the market during 2024 further enhances the need for professional lawn maintenance tools.

Zero-Turn Mower Market Regional Analysis

North America dominated the market in 2024 & is expected to hold largest share during the forecast period. Accounting for an estimated USD 820 million in revenue, which represents approximately 47% of the global market share. This sturdy position is driven by high demand from both residential and commercial segment particularly in the United States which alone contributed over USD 700 million. The region profits from a well-established landscaping industry and widespread use of large residential lawns, fuelling the need for efficient mowing equipment. Top Leading manufacturers such as Deere & Company, The Toro Company, AriensCo, and Hustler Turf Equipment are headquartered in the region, giving it a competitive advantage in innovation and product availability. Early acceptance of electric and smart mower technologies combined with favourable infrastructure high disposable income as well as strong after-sales service networks, continue to support regional growth. Green Public Space also contributes to increasing adoption for permanent landscaping practices and investments. Zero-Turn Mower Market Competitive Landscape Major key Players such as Deere & Company, The Toro Company and Husqvarna Group form backbone of the zero-turn mower market. Collectively account for approximately 55–60% of the global market share as of 2024. Deere & Company known for its ZTrak™ series holds the largest share at around 21–23% offering a wide range of commercial and residential zero-turn mowers backed by a strong dealer network and investments in electric models. The Toro Company follows closely with an estimated 18–20% market share providing versatile solutions through its Time Cutter and TITAN series. Toro lasts to emphasis on innovation particularly in battery-powered and autonomous mower technology aligning with sustainability trends. Husqvarna Group with a 15–17% share is recognized for high-performance commercial zero-turn mowers under the Husqvarna and Red Max brands. The company is actively expanding its product portfolio through R&D in robotic and eco-friendly mowing technologies. As of 2024 the global zero-turn mower market is valued at approximately USD 3.80 billion. Strategic partnership, product innovation and conscious product lines towards the environment remain central for competitive advantage in this developed scenario. Zero-Turn Mower Market TrendsZero-Turn Mower Market Key Development • In 15 February 2024 Deere & Company (North America) Launched a new electric ZTrak zero-turn mower series targeting both residential and commercial users. • In 9 April 2024 Husqvarna Group (Europe) Unveiled its next-generation battery-powered zero-turn mowers, with improved runtime and fast-charging capabilities. • In 25 January 2025 Kubota Corporation (Asia-Pacific) Introduced a hybrid zero-turn mower with dual power modes (battery + fuel) aimed at reducing emissions and fuel costs. • In 14 March 2025 STIGA S.p.A. (Europe) Developed and showcased a robotic zero-turn mower prototype with smart connectivity for real-time remote control. • In 3 June 2024 The Toro Company (North America) Rolled out its autonomous zero-turn mower for commercial landscaping with integrated GPS and AI navigation.

Trends Description Shift Toward Electric Mowers Growing demand for battery-powered zero-turn mowers due to environmental concerns and regulations. Rising Adoption in Residential Sector Homeowners increasingly prefer zero-turn mowers for efficient and fast lawn care. Technological Advancements Integration of GPS, automation, and smart control features to improve performance and convenience. Zero-Turn Mower Market Scope: Inquiry Before Buying

Zero-Turn Mower Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.80 Bn. Forecast Period 2025 to 2032 CAGR: 10.6% Market Size in 2032: USD 8.51 Bn. Segments Covered: by Cutting Width Less Than 50 inches 50 to 60 inches More than 60 inches by Horsepower Less Than 25 Hp More Than 25 Hp by Application Residential Commercial Zero-Turn Mower Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Zero-Turn Mower Market Key Players

North America 1. Deere & Company (USA) 2. Husqvarna Group (USA/Sweden) 3. The Toro Company (USA) 4. Ariens Company (USA) 5. MTD Products Inc. (USA) 6. Bad Boy Mowers (USA) 7. Spartan Mowers (USA) 8. Dixie Chopper (USA) Europe 9. Husqvarna AB (Sweden) 10. Stiga S.p.A. (Italy) 11. AL-KO Kober SE (Germany) 12. ETESIA S.A.S. (France) 13. Grillo S.p.A. (Italy) 14. MTD Deutschland GmbH (Germany) Asia-Pacific 15. Kubota Corporation (Japan) 16. Yamaha Motor Co., Ltd. (Japan) 17. Iseki & Co., Ltd. (Japan) 18. Honda Motor Co., Ltd. (Japan) 19. Mahindra Group (India) 20. TAFE – Tractors and Farm Equipment Limited (India) South America 21. Briggs & Stratton do Brasil Ltda.(Brazil) 22. Yanmar South America (Brazil) 23. Stihl Brasil Ltda. (Brazil) Middle East & Africa 24. Alamo Group (South Africa / USA) 25. CNH Industrial (Turkey and North Africa operations) 26. Eliet Machines N.V. (Distributor network in Middle East) 27. Husqvarna Middle East FZE (UAE)Frequently Asked Question

1: What was the value of the Zero-Turn Mower Market in 2024? Ans: The market was valued at USD 3.80 billion in 2024. 2: Which cutting width segment dominated the market in 2024? Ans: The 50 to 60 inches segment dominated due to its efficiency and versatility. 3: Which region led the global Zero-Turn Mower Market in 2024? Ans: North America led the market with 47% share, totaling around USD 820 million. 4: Who are the top three key players in the market? Ans: Deere & Company, The Toro Company, and Husqvarna Group are the leading players. 5: What is the expected market size by 2032? Ans: The market is expected to reach USD 8.51 billion by 2032.

1. Zero-Turn Mower Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Zero-Turn Mower Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Horsepower Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Zero-Turn Mower Market: Dynamics 3.1. Region wise Trends of Zero-Turn Mower Market 3.1.1. North America Zero-Turn Mower Market Trends 3.1.2. Europe Zero-Turn Mower Market Trends 3.1.3. Asia Pacific Zero-Turn Mower Market Trends 3.1.4. Middle East and Africa Zero-Turn Mower Market Trends 3.1.5. South America Zero-Turn Mower Market Trends 3.2. Zero-Turn Mower Market Dynamics 3.2.1. Global Zero-Turn Mower Market Drivers 3.2.1.1. Rising landscaping service demand 3.2.1.2. Growth in residential lawn care 3.2.1.3. Preference for time-saving equipment 3.2.2. Global Zero-Turn Mower Market Restraints 3.2.3. Global Zero-Turn Mower Market Opportunities 3.2.3.1. Innovation in mower technology 3.2.3.2. Expansion in emerging markets 3.2.4. Global Zero-Turn Mower Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government equipment regulations 3.4.2. Rising disposable income 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Zero-Turn Mower Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 4.1.1. Less Than 50 inches 4.1.2. 50 to 60 inches 4.1.3. More than 60 inches 4.2. Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 4.2.1. Less Than 25 Hp 4.2.2. More Than 25 Hp 4.3. Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 4.3.1. Residential 4.3.2. Commercial 4.4. Zero-Turn Mower Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Zero-Turn Mower Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 5.1.1. Less Than 50 inches 5.1.2. 50 to 60 inches 5.1.3. More than 60 inches 5.2. North America Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 5.2.1. Less Than 25 Hp 5.2.2. More Than 25 Hp 5.3. North America Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 5.3.1. Residential 5.3.2. Commercial 5.4. North America Zero-Turn Mower Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 5.4.1.1.1. Less Than 50 inches 5.4.1.1.2. 50 to 60 inches 5.4.1.1.3. More than 60 inches 5.4.1.2. United States Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 5.4.1.2.1. Less Than 25 Hp 5.4.1.2.2. More Than 25 Hp 5.4.1.3. United States Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Residential 5.4.1.3.2. Commercial 5.4.2. Canada 5.4.2.1. Canada Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 5.4.2.1.1. Less Than 50 inches 5.4.2.1.2. 50 to 60 inches 5.4.2.1.3. More than 60 inches 5.4.2.2. Canada Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 5.4.2.2.1. Less Than 25 Hp 5.4.2.2.2. More Than 25 Hp 5.4.2.3. Canada Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Residential 5.4.2.3.2. Commercial 5.4.2.4. Mexico Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 5.4.2.4.1. Less Than 50 inches 5.4.2.4.2. 50 to 60 inches 5.4.2.4.3. More than 60 inches 5.4.2.5. Mexico Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 5.4.2.5.1. Less Than 25 Hp 5.4.2.5.2. More Than 25 Hp 5.4.2.6. Mexico Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 5.4.2.6.1. Residential 5.4.2.6.2. Commercial 6. Europe Zero-Turn Mower Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.2. Europe Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.3. Europe Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4. Europe Zero-Turn Mower Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.1.2. United Kingdom Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.1.3. United Kingdom Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.2.2. France Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.2.3. France Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.3.2. Germany Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.3.3. Germany Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.4.2. Italy Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.4.3. Italy Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.5.2. Spain Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.5.3. Spain Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.6.2. Sweden Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.6.3. Sweden Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.7.2. Austria Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.7.3. Austria Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 6.4.8.2. Rest of Europe Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 6.4.8.3. Rest of Europe Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Zero-Turn Mower Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.2. Asia Pacific Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.3. Asia Pacific Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Zero-Turn Mower Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.1.2. China Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.1.3. China Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.2.2. S Korea Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.2.3. S Korea Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.3.2. Japan Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.3.3. Japan Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.4.2. India Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.4.3. India Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.5.2. Australia Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.5.3. Australia Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.6.2. Indonesia Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.6.3. Indonesia Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.7.2. Philippines Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.7.3. Philippines Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.8.2. Malaysia Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.8.3. Malaysia Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.9.2. Vietnam Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.9.3. Vietnam Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.10.2. Thailand Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.10.3. Thailand Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 7.4.11.2. Rest of Asia Pacific Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 7.4.11.3. Rest of Asia Pacific Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Zero-Turn Mower Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 8.2. Middle East and Africa Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 8.3. Middle East and Africa Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Zero-Turn Mower Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 8.4.1.2. South Africa Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 8.4.1.3. South Africa Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 8.4.2.2. GCC Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 8.4.2.3. GCC Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 8.4.3.2. Nigeria Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 8.4.3.3. Nigeria Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 8.4.4.2. Rest of ME&A Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 8.4.4.3. Rest of ME&A Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 9. South America Zero-Turn Mower Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 9.2. South America Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 9.3. South America Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 9.4. South America Zero-Turn Mower Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 9.4.1.2. Brazil Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 9.4.1.3. Brazil Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 9.4.2.2. Argentina Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 9.4.2.3. Argentina Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Zero-Turn Mower Market Size and Forecast, By Cutting Width (2024-2032) 9.4.3.2. Rest of South America Zero-Turn Mower Market Size and Forecast, By Horsepower (2024-2032) 9.4.3.3. Rest of South America Zero-Turn Mower Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Deere & Company (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Husqvarna Group (USA/Sweden) 10.3. The Toro Company (USA) 10.4. Ariens Company (USA) 10.5. MTD Products Inc. (USA) 10.6. Bad Boy Mowers (USA) 10.7. Spartan Mowers (USA) 10.8. Dixie Chopper (USA) 10.9. Husqvarna AB (Sweden) 10.10. Stiga S.p.A. (Italy) 10.11. AL-KO Kober SE (Germany) 10.12. ETESIA S.A.S. (France) 10.13. Grillo S.p.A. (Italy) 10.14. MTD Deutschland GmbH (Germany) 10.15. Kubota Corporation (Japan) 10.16. Yamaha Motor Co., Ltd. (Japan) 10.17. Iseki & Co., Ltd. (Japan) 10.18. Honda Motor Co., Ltd. (Japan) 10.19. Mahindra Group (India) 10.20. TAFE – Tractors and Farm Equipment Limited (India) 10.21. Briggs & Stratton do Brasil Ltda.(Brazil) 10.22. Yanmar South America (Brazil) 10.23. Stihl Brasil Ltda. (Brazil) 10.24. Alamo Group (South Africa / USA) 10.25. CNH Industrial (Turkey and North Africa operations) 10.26. Eliet Machines N.V. (Distributor network in Middle East) 10.27. Husqvarna Middle East FZE (UAE) 11. Key Findings 12. Analyst Recommendations 13. Zero-Turn Mower Market: Research Methodology