Warehouse Automation System Market size was valued at USD 20.8 Bn in 2024 and the total Global Warehouse Automation System Market revenue is expected to grow at a CAGR of 16.24% from 2025 to 2032, reaching nearly USD 69.33 Bn by 2032.Warehouse Automation System Market Overview:

Warehouse automation refers to the use of technology to perform tasks traditionally done by human workers, aiming to increase efficiency and accuracy in warehouse operations. Warehouse automation market is driven by the rise of e-commerce, increasing demand for fast and accurate order processing, and the need to optimize space and labor costs. Industries such as retail, logistics, food & beverage, and pharmaceuticals are major adopters, seeking to improve throughput, accuracy, and scalability. Growing labor shortages and the rising cost of warehouse space are further increasing automation adoption. North America led the market in 2024, driven by rapid e-commerce expansion, strong logistics infrastructure, and high labor costs. Europe is also a major contributor, with smart warehousing initiatives, Industry 4.0 integration, and automation-friendly policies in nations like Germany, the Netherlands, and the UK. Top key players such as Daifuku Co., Dematic, and Honeywell Intelligrated compete based on technology integration, modularity, AI-driven systems, cost efficiency, and after-sales service networks. These companies continuously innovate in robotic automation, predictive analytics, and cloud-based management platforms to gain a competitive edge. The report provides complete insights into market dynamics, key segment performance, and strategic positioning of major vendors, analyzing players by technology type, warehouse size, end-user industry, service integration, and geographic presence to project the Warehouse Automation System Market growth over the forecast period.To know about the Research Methodology :- Request Free Sample Report

Warehouse Automation System Market Dynamics:

Demand for e-commerce in warehouse to creates new opportunities Market growth is expected to be fueled by the development of electronic commerce and the resulting increase in online consumers, especially in developing countries. Online retailers can outsource services like bundling, warehousing, shipping, and other value-added services like return management and urgent package service through fulfillment service centers. A fulfillment center is the best option for retailers that have the capacity to manage inventory in-house and do not want to invest additional time in shipping. The online marketers may also operate e-commerce fulfillment services internally. Due to the various advantages given in terms of convenience, affordability, selection, and lead time, many customers prefer purchasing things online as opposed to doing so in physical stores. To deliver items from production facilities/retailers to end-users in a shorter lead time, e-commerce enterprises depend heavily on storage and shipping capabilities. Traditional warehousing required a lot of work, but in recent years, companies have started automating tasks in the lanes of modern warehouses to eliminate the need for human interaction, increase order fulfillment productivity, and shorten delivery times. For example, Amazon.com, Inc. makes use of robots in its fulfillment facilities to help employees with tasks and speed up deliveries with the help of a warehouse automation system. The location of a fulfillment center is essential to the success of e-commerce companies since the bulk of online transactions are made in urban areas and because customers are requesting faster product delivery. Players may deliver goods faster and gain customers' trust by having fulfillment facilities close to big cities that don't just store things but also handle other fulfillment tasks like sorting, packing, labeling, and shipping, which drive the demand for e-commerce in the warehouse automation system market. Investment in warehousing systems by SMEs to drive the demand during the forecast period A warehouse management system is a complex, multifaceted software program that helps organizations in organizing and manage warehouse operations. Most warehouse management systems are built to grow up to meet the requirements of larger, more established companies. They can also be useful for a lot of small enterprises, however. these technologies can particularly help in the optimization of warehouse operations including receiving, picking, and shipping. Additionally, real-time tracking features are provided by warehouse management systems to assist smaller companies in maintaining control over their inventory levels and increasing productivity. In general, warehouse management systems are necessary for every company wishing to maximize warehouse operations and increase profitability, which creates a new opportunity for small market players to increase productivity with the help of the warehouse automation system market. For small companies, in particular, investing in a warehouse management system may be quite profitable. Cybersecurity and risk goods during storage The most prevalent risk is the loss of goods and assets as a result of criminal activity. Although high-value things such as electronics, phones, and cosmetics will always be targeted, the item's mobility and ease of robbery and hiding will be the key determinant, which hampers the warehouse automation system market. The location of a site, what it contains, and the security mechanisms in place will all influence whether it is attacked. Organizations must defend their locations and structures from external threats by employing a combination of detection and prevention methods. CCTV cameras, alarms, and control systems, particularly at points of entrance and egress, can be included, as well as a staff/visitor management system to guarantee that only those who are authorized are permitted to various locations of the site. The risks of cyber-attacks have never been higher, with many organizations depending largely on automated procedures and vast volumes of data being transmitted between individuals in the supply chain. Hackers frequently locate an entry point into the chain by assaulting the less secure pieces, allowing them access to other organizations’ systems and data, which create serious concern towered Warehouse automation systems market players.Warehouse Automation System Market Segment Analysis:

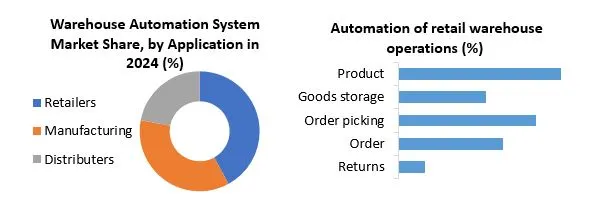

Based on Component, the Warehouse Automation System Market is segmented into hardware and software. Hardware is expected to dominate the market during the forecast period. Significant technological developments have allowed the robotics industry to explore the untapped potential in various warehousing End-Uses while achieving an ideal operational flow and logistics efficiency, among other achievements, across the different industry verticals. Examples of these developments include sensor technologies that enable enhanced object perception and an accurate positioning system. By 2025, robotic technology will be used to complete 45% of all manufacturing operations, forecasts from Bank of America. This new trend has led to the replacement of 10,000 and 60,000 people, respectively, by automated equipment at the factories of significant companies like Foxconn Technology, a Chinese supplier for major technology manufacturers like Samsung, and Raymond Limited, a well-known Indian textile company.Based on the End-Use, the Warehouse Automation System Market is segmented into Retailers, Manufacturing, and Distributors. Retailers are expected to dominate the warehouse automation market during the forecast period. Retail companies that sell goods and services to end users include clothes, appliance, and technology stores, as well as supermarkets, department stores, pharmacies, and eCommerce and other. In general, retail warehouses manage a large number of SKUs, which can be stored on pallets or in boxes. As a result, all processes must be improved to eliminate mistakes and ensure the availability of items to clients, which increased the demand for the warehouse automation system market. A number of retail warehouses have been created, which increased the productivity of logistic operations. For example, Spartoo, a major European company in online sales of footwear, handbags, and clothes, needed to streamline its logistics processes to grow its product catalog and raise order quantities in order to drive its global expansion. In France, the Mecalux Group established a warehouse for Spartoo, which has been developed year after year to meet rising demand.

Warehouse Automation System Market Regional Insights:

North America dominated the market with a 43 % share in 2024. North America is expected to witness significant growth during the forecast period. The warehouse management system market's fundamentals of distribution and storage are being significantly impacted by the tremendous development of the North American supply chain industry. The majority of these changes are caused by new technologies, which have reduced the distance between supply chain activities and customers. These technological advancements, especially those brought on by the widespread use of e-commerce, have made it possible for customers in North America to have an instantaneous and real-time demand impact on product delivery processes, which drives the warehouse automation system market. Demand for highly adaptable and flexible warehouse management systems is expected to be fueled by this real-time demand effect along with the growing multichannel distribution support business model (WMS). However, things have changed, and today's warehouse management systems are virtually entirely automated and effective in helping the warehouse manager with product monitoring at different levels of storage and distribution operations. Traditionally, warehouse management required a lot of paperwork. Current WMS implementations range from basic computer automation systems to more advanced management programs that offer improved facilities such as monitoring inventory management, order picking, and improved dock logistics capabilities. A technologically advanced region is North America. The adoption of Big Data, IoT, and Software as Service technology has been particularly strong in this area. More deployments will increase regional competition, the market for warehouse management systems as a whole will grow, and this will drive product development and innovation, which drives the warehouse automation system market. There are many different big and small warehouses, as well as 3PLs, in the North American warehouse management system market (3rd Part Logistics). Through the forecast period, the US is expected to dominate the North American warehouse management system market. There are around 9000 commercial storage buildings in the region, covering an area of about 829 million square feet. The desire for exceedingly thin profit margins by enterprises has increased due to the prevalence of such a large number of storage facilities. Therefore, players in the warehouse management system industry have been seen spending heavily on technologies like RFID and voice-assisted receiving in order to survive in such a competitive environment. Warehouse Automation System Market Competitive Landscape Top key players such as Daifuku Co., Dematic, Honeywell Intelligrated, are driving innovation through advanced robotics, AI integration, and scalable automation platforms. These global leaders are heavily investing in intelligent automation technologies that improve operational efficiency, accuracy, and warehouse flexibility while addressing labor shortages and e-commerce fulfillment demands. Daifuku Co. stands out for its extensive product portfolio and turnkey solutions in material handling, providing fully integrated systems for diverse industries, including manufacturing, retail, and automotive. The company highlights modularity and system reliability in large-scale automation deployments. Honeywell Intelligrated delivers robust warehouse execution systems, robotics, and conveyor solutions with a focus on adaptability and cost-efficiency. The company is recognized for its data-driven approach and expertise in managing complex logistics environments. These companies consistently shape the competitive landscape through R&D, AI-enhanced automation software, and strategic collaborations with cloud providers and ERP vendors. Warehouse Automation System Market Trends • Rise of E-commerce Fulfillment Automation The rapid growth of e-commerce is driving demand for faster, error-free order fulfillment. Warehouses are increasingly deploying robotic picking, sorting, and packaging systems to meet same-day or next-day delivery expectations. • Integration of AI and Machine Learning AI and ML are used to optimize warehouse operations, predicting demand, improving inventory accuracy, and enabling autonomous decision-making in real-time through smart warehouse management systems. • Labor Shortage Accelerating Automation Investment Rising labor costs and workforce shortages, especially in mature markets, are compelling businesses to invest in automation to maintain productivity and reduce dependence on manual labor. Recent Development

Date Company Development May 7, 2025 Amazon Amazon unveiled its Vulcan robot, which marks a “fundamental leap” in warehouse robotics by adding tactile sensing. Vulcan’s force-sensing arm and AI enable it to pick and stow around 75% of items, including oddly shaped ones, working 20-hour shifts in Spokane (WA) and Hamburg (Germany) March 13, 2025 Dematic At LogiMAT in Stuttgart Dematic demonstrated its AI-powered bin-to-picker AMR, EnvelopePort, Condition Monitoring System, and highlighted partnerships (e.g., with NVIDIA, AutoStore). May 2025 ABB In May 2025, ABB released an upgraded Flexley Mover P604 AMR, featuring 3D vSLAM navigation and an enhanced AMR Studio interface, aiming to improve versatility and ease of deployment. May 2025 Brightpick Brightpick installed 37 Autopicker robots at Superior Communications’ Tennessee distribution center in May 2025, automating the entire fulfillment flow from picking and buffering to packaging Warehouse Automation System Market Scope: Inquiry Before Buying

Warehouse Automation System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 20.8 Bn. Forecast Period 2025 to 2032 CAGR: 16.24% Market Size in 2032: USD 69.33 Bn. Segments Covered: by Component Hardware Software by Application Automotive Food & Beverage E-commerce Pharmaceutical Other by End-use Retailers Manufacturing and Distributors Warehouse Automation System Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Warehouse Automation System Market Key Players

North America 1. Amazon Robotics (USA) 2. Honeywell Intelligrated (USA) 3. Zebra Technologies (USA) 4. Locus Robotics (USA) 5. Berkshire Grey (USA) 6. Fetch Robotics (USA) 7. Boston Dynamics (USA) 8. AutoStore US (USA) 9. Ambi Robotics (USA) 10. RightHand Robotics (USA) Europe 11. Dematic (Germany) 12. Swisslog (Switzerland) 13. Vanderlande Industries (Netherlands) 14. KNAPP AG (Austria) 15. Ocado Group (UK) 16. TGW Logistics Group (Austria) 17. Scallog (France) Asia-Pacific 18. Daifuku Co., Ltd. (Japan) 19. Murata Machinery (Japan) 20. Toyota Industries Corporation (Japan) 21. Panasonic System Solutions (Japan) 22. FANUC Corporation (Japan) 23. Geek+ (China) 24. Hikrobot (China) 25. GreyOrange (India) 26. Invia Robotics APAC (Singapore) 27. Quicktron (China)FAQs:

1. Which region has the largest share in the Warehouse Automation System Market? Ans: The North America region held the highest share in 2024 in the Warehouse Automation System Market. 2. What are the key factors driving the growth of the Warehouse Automation System Market? Ans: Investment in warehousing systems by SMEs to drive the demand during the forecast period. 3. Who are the key competitors in the Warehouse Automation System Market? Ans: Daifuku Co., Dematic, Honeywell Intelligrated are the key competitors in the Warehouse Automation System Market. 4. What are the opportunities for the Warehouse Automation System Market? Ans: Demand for e-commerce in warehouses creates new opportunities in the Warehouse Automation System Market. 5. Which component type segment dominates the Warehouse Automation System Market? Ans: The hardware component segment dominated the Warehouse Automation System Market.

1. Warehouse Automation System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Warehouse Automation System Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Warehouse Automation System Market: Dynamics 3.1. Region wise Trends of Warehouse Automation System Market 3.1.1. North America Warehouse Automation System Market Trends 3.1.2. Europe Warehouse Automation System Market Trends 3.1.3. Asia Pacific Warehouse Automation System Market Trends 3.1.4. Middle East and Africa Warehouse Automation System Market Trends 3.1.5. South America Warehouse Automation System Market Trends 3.2. Warehouse Automation System Market Dynamics 3.2.1. Warehouse Automation System Market Drivers 3.2.1.1. E-commerce and retail growth 3.2.1.2. Labor shortage and rising costs 3.2.2. Warehouse Automation System Market Restraints 3.2.3. Warehouse Automation System Market Opportunities 3.2.3.1. Innovation in mobile and modular automation 3.2.3.2. Automation demand in emerging markets 3.2.4. Warehouse Automation System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Trade and e-commerce growth regulations 3.4.2. Labor laws driving automation adoption 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Warehouse Automation System Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 4.1.1. Hardware 4.1.2. Software 4.2. Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 4.2.1. Corrosion Protection 4.2.2. Wear Resistance 4.2.3. Thermal Barrier Coatings 4.2.4. Others 4.3. Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 4.3.1. Retailers 4.3.2. Manufacturing and Distributors 4.4. Warehouse Automation System Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 5.1.1. Hardware 5.1.2. Software 5.2. North America Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 5.2.1. Automotive 5.2.2. Food & Beverage 5.2.3. E-commerce 5.2.4. Pharmaceutical 5.2.5. Other 5.3. North America Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 5.3.1. Retailers 5.3.2. Manufacturing and Distributors 5.4. North America Warehouse Automation System Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 5.4.1.1.1. Hardware 5.4.1.1.2. Software 5.4.1.2. United States Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Automotive 5.4.1.2.2. Food & Beverage 5.4.1.2.3. E-commerce 5.4.1.2.4. Pharmaceutical 5.4.1.2.5. Other 5.4.1.3. Others United States Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 5.4.1.3.1. Retailers 5.4.1.3.2. Manufacturing and Distributors 5.4.2. Canada 5.4.2.1. Canada Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 5.4.2.1.1. Hardware 5.4.2.1.2. Software 5.4.2.2. Canada Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Automotive 5.4.2.2.2. Food & Beverage 5.4.2.2.3. E-commerce 5.4.2.2.4. Pharmaceutical 5.4.2.2.5. Other 5.4.2.3. Canada Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 5.4.2.3.1. Retailers 5.4.2.3.2. Manufacturing and Distributors 5.4.2.4. Mexico Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 5.4.2.4.1. Hardware 5.4.2.4.2. Software 5.4.2.5. Mexico Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 5.4.2.5.1. Automotive 5.4.2.5.2. Food & Beverage 5.4.2.5.3. E-commerce 5.4.2.5.4. Pharmaceutical 5.4.2.5.5. Other 5.4.2.6. Mexico Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 5.4.2.6.1. Retailers 5.4.2.6.2. Manufacturing and Distributors 6. Europe Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.2. Europe Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.3. Europe Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4. Europe Warehouse Automation System Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.1.2. United Kingdom Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4.2. France 6.4.2.1. France Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.2.2. France Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.3.2. Germany Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.4.2. Italy Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.5.2. Spain Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.6.2. Sweden Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.7.2. Austria Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 6.4.8.2. Rest of Europe Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7. Asia Pacific Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.2. Asia Pacific Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4. Asia Pacific Warehouse Automation System Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.1.2. China Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.2.2. S Korea Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.3.2. Japan Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.4. India 7.4.4.1. India Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.4.2. India Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.5.2. Australia Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.6.2. Indonesia Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.7.2. Philippines Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.8.2. Malaysia Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.9.2. Vietnam Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.10.2. Thailand Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 7.4.11.2. Rest of Asia Pacific Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 8. Middle East and Africa Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 8.2. Middle East and Africa Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 8.4. Middle East and Africa Warehouse Automation System Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 8.4.1.2. South Africa Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 8.4.2.2. GCC Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 8.4.3.2. Nigeria Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 8.4.4.2. Rest of ME&A Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 9. South America Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 9.2. South America Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 9.3. South America Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 9.4. South America Warehouse Automation System Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 9.4.1.2. Brazil Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 9.4.2.2. Argentina Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Warehouse Automation System Market Size and Forecast, By Component (2024-2032) 9.4.3.2. Rest of South America Warehouse Automation System Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Warehouse Automation System Market Size and Forecast, By End-user (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1 Amazon Robotics 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2 Honeywell Intelligrated 10.3 Zebra Technologies 10.4 Locus Robotics 10.5 Berkshire Grey 10.6 Fetch Robotics 10.7 Boston Dynamics 10.8 AutoStore US 10.9 Ambi Robotics 10.10 RightHand Robotics 10.11 Dematic 10.12 Swisslog 10.13 Vanderlande Industries 10.14 KNAPP AG 10.15 Ocado Group 10.16 TGW Logistics Group 10.17 Scallog 10.18 Daifuku Co., Ltd. 10.19 Murata Machinery 10.20 Toyota Industries Corporation 10.21 Panasonic System Solutions 10.22 FANUC Corporation 10.23 Geek+ 10.24 Hikrobot 10.25 GreyOrange 10.26 Invia Robotics APAC 10.27 Quicktron 10 Key Findings 11 Analyst Recommendations 12 Warehouse Automation System Market: Research Methodology