The VLSI Semiconductor Market was valued at 60.71 Bn in 2024, and total Global VLSI Semiconductor Market revenue is expected to grow at a CAGR of 6.1% from 2025 to 2032, reaching nearly USD 97.49 Bn.VLSI Semiconductor Market Overview

Very-large-scale integration (VLSI) is the process of creating an integrated circuit (IC) by combining millions or billions of MOS transistors onto a single chip. VLSI technology uses modular technology and saves the microchip area by decreasing the interconnecting fabric area. This provides more room for IC designers to create their designs for integrated circuits (ICs). The VLSI IC market growth is defined by the need for polish and grind processes in making MEMS (micro-electromechanical systems) sensors, chips, integrated circuits, optics as well as composite semiconductors. A rise in the popularity of electric and hybrid vehicles is boosting the requirement for more Semiconductor manufacturing. The market for VLSI semiconductors is growing greatly as there's a rising need for high-tech electronic equipment in many areas such as consumer electronics, the automotive industry, the healthcare field, and the communication sector. This increase in demand is associated with changing customer choices, advancements in technology, and the inclusion of smart functions into ordinary devices. The VLSI semiconductor market has many chances for growth and creativity. Progress in making methods like extreme ultraviolet (EUV) lithography and 3D integration bring advantages in terms of better chip densities, superior functioning capability, as well as less power usage. Growing applications such as edge computing, virtual reality (VR), augmented reality (AR), and 5G connectivity are opening new market segments for VLSI semiconductor manufacturers to explore. The VLSI semiconductor market is mainly dominated by the Asia-Pacific region. Countries such as China, Japan South Korea, and Taiwan are big players in this market. The growth of demand for electronic devices in these places along with substantial investments made into infrastructure for manufacturing semiconductors contributes to their strong hold on global markets. Major companies being present here and many sectors using integrated VLSI chips also help keep control within this area's sphere of influence over worldwide markets. The VLSI semiconductor market in North America is also significant, and the main contributor of revenue here is the United States. Applied Materials, NVIDIA, Intel Corporation, and Samsung Electronics are established main participants bringing about innovation and technological progress within the VLSI semiconductor market. These companies engage in a competitive environment by participating in activities such as materials engineering solutions, graphics processing units (GPUs), and central processing units (CPUs) to produce laptops or computers and make consumer electronics like smartphones etcetera among other things too. The dynamics of competition are influenced by elements like technology innovation, how good products work out for customers along their relationship management; all these factors help them keep their place strong in the market while also gaining an advantage over rivals.To know about the Research Methodology :- Request Free Sample Report

VLSI Semiconductor Market Dynamics

The rising need for high-tech electronic equipment in different sectors such as customer electronics, cars, health care, and communication is the important driver. The increase in demand comes from changing preferences of customers, advancements in technology, and adding intelligent functions to routine items. The increase in Internet of Things (IoT) gadgets and the fast growth of data centers are causing a demand for VLSI chips with strong performance to deal with complicated computing jobs effectively. The use of artificial intelligence (AI) and machine learning (ML) is increasing which creates a need for VLSI semiconductors that handle the computation demands of these applications. These technologies are being applied in various fields such as self-driving cars, robots, health diagnosis systems, and natural language understanding programs which require more powerful yet less energy-consuming VLSI chips. On the other side, the VLSI semiconductor market also experiences some difficulties that are expected to limit its growth. A big problem is the complicated nature and high expenses tied to making semiconductors. When chip designs become more complex and feature sizes get smaller, developing and producing VLSI chips becomes more expensive. The dependability and excellence of VLSI chips is a problem that needs to be dealt with. This becomes more crucial because producers are working hard to match strict performance rules and reduce flaws. Another point to consider is that the market of VLSI semiconductors is affected by cyclical patterns in demand and fluctuations in the macroeconomic environment. Economic recessions, geopolitical issues, as well as trade disagreements disrupt supply chains, postpone investments, and decrease consumer expenses - all these factors have an effect on the demand for VLSI chips.The VLSI semiconductor market contains many chances for growth and fresh ideas. A possible opportunity is focused on making improved manufacturing technologies like extreme ultraviolet (EUV) lithography and 3D integration. These have benefits in terms of better chip densities, increased performance as well as less power usage. The new applications that are coming up like edge computing, virtual reality (VR), augmented reality (AR), and 5G connectivity create a chance for VLSI semiconductor makers to make use of these fresh market segments. This is expected to lead to an increase in demand for certain chips designed specifically for these applications. The emphasis on energy effectiveness and durability is boosting the need for VLSI chips that use less power and have a minor impact on the environment. VLSI semiconductor industry has its difficulties concerning complex manufacturing demands, high costs, and the changing nature of the market. But it also shows big chances for growth and creativity because of new tech trends and developing uses. If these problems are tackled well along with taking advantage of opportunities, manufacturers in VLSI semiconductors can make their place strong in an industry that is continually changing.VLSI Semiconductor Market Segmentation

VLSI Semiconductor Market Segment Analysis

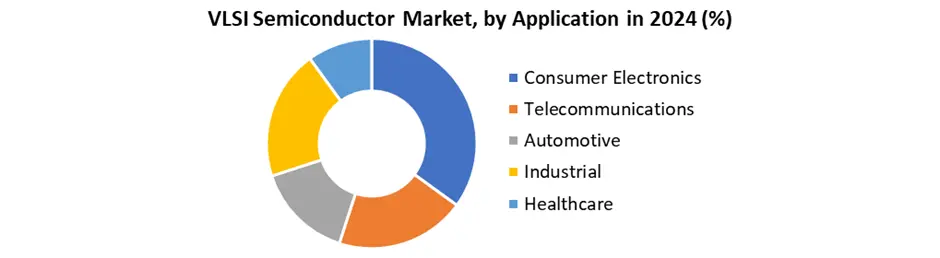

Based on Product Type, the VLSI semiconductor market is segmented by product type in Microcontrollers, Microprocessors, FPGA, ASIC and MEMS. ASIC segment dominated the market in 2024. ASICs are made for specific tasks, offering high performance and efficiency, mainly in smartphones, networking hardware and data centers. Microcontrollers and microprocessors form foundation of embedded systems and computing devices, majorly used in automotive electronics, consumer appliances and IoT devices. FPGAs provide flexibility and reprogrammability, making them necessary in prototyping, defence systems and AI acceleration. MEMS, combine mechanical and electrical components at micro scale, used in sensors and actuators for wearables, automotive and healthcare devices. ASICs and microcontrollers lead in revenue generation by their application volume, while FPGAs are gaining traction in AI driven fields. Segmentation reflects the evolving demand for intelligent, application specific and low power computing solutions. Based on Application, the VLSI semiconductor market is categorized in Consumer Electronics, Telecommunications, Automotive, Industrial and Healthcare. Consumer electronics dominated the market in 2024, due to high demand for smartphones, tablets, wearables and smart home devices that require advanced, compact chip solutions. Telecommunications sector rely on VLSI chips for 5G infrastructure, routers, base stations and signal processing. In automotive industry, VLSI semiconductors are essential for electric vehicles, ADAS, infotainment and battery management systems. Industrial applications include automation, robotics, PLCs and predictive maintenance and reliable chips are required. Healthcare is an emerging high growth segment, using VLSI in imaging systems, diagnostics and portable medical devices. Each application segment is driven by trends such as miniaturization, low power consumption and real time data processing. The expansion of AI, IoT and edge computing continues to push VLSI integration deeper in these sectors.

VLSI Semiconductor Market Regional Insights

Asia Pacific Dominated the VLSI Semiconductor Market in 2024 Asia Pacific VLSI Semiconductor market is expected to grow a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. The market's growth is attributed to robust demand for electronic devices, along with substantial investments in semiconductor manufacturing. The main reason behind this is the rise in the use of VLSI chips in daily equipment. The Asia Pacific region has the largest VLSI semiconductor industry in the world and it is growing rapidly because of the high use of integrated VLSI chips across all types of industries from verticals such as mobile and consumer electronics to automobiles, medical equipment, and high-definition TVs as well as laptops which have increased requirements for packaging along with assembly equipment. The presence of many major players in the Asian region boosts the VLSI Semiconductor Industry. China, Japan, South Korea, and Taiwan are the main countries that contribute to this market growth. China VLSI Semiconductor market contributes the large portion of the revenue. Integrated circuits experience growth due to increasing demand for consumer electronics and automotive electronics. The market of VSLI Semiconductor, with the progress made by Taiwan Semiconductor Manufacturing Company (TSMC) in technology nodes less than 5nm size, is expected to keep growing in revenue over next ten years even though there might be cyclical ups and downs.VLSI semiconductor industry is gaining popularity in the North American region. The United States market made up more than 80 percent and it earned around xx U.S. dollars in the year 2024. Canada's income from VLSI semiconductor and other electronic component manufacturing is expected to hit xx billion dollars by 2032. The VLSI semiconductor market is characterized by an exchange of import and export actions, with the United States taking the lead in this complex trade environment. The nation plays an important part as a major exporter and importer of semiconductor devices, and recent numbers show its trade dynamics. • In November, the US sent out $653 million worth of semiconductor devices which was an increase of 5.01% from last year showing steady growth, this increasing trend contrasts with a significant $1430 million trade gap that shows the delicate equilibrium between what America sells abroad and what it brings in from other countries. • Important locations for US semiconductor exports are Mexico, China, and Thailand. Vietnam and Thailand to become important suppliers to the US semiconductor market, which confirms Southeast Asia's crucial part in the worldwide semiconductor supply chain. These complex trade routes highlight the worldwide connection and strength of the VLSI semiconductor market. Table for Key Destinations for US Semiconductor Exports

Mexico $129 Million China $70 Million Thailand $57 Million Spain $53 Million Malaysia $50 Million VLSI Semiconductor Market Competitive Landscape

Applied Materials is a worldwide guide in materials engineering answers, which are utilized to make almost every fresh chip and high-level display around the globe. Among businesses like Lam Research Corporation and ASML Holding NV that function within the semiconductor equipment sector. Technological advancement, product effectiveness, and customer connections are what stimulate rivalry here. NVIDIA controls the market for separate graphics processing units (GPUs) and has a big impact on artificial intelligence (AI) as well as gaming sectors. In the AI part, NVIDIA has to deal with rivalry from businesses such as Intel Corporation and Qualcomm. These companies are putting significant resources into AI studies and creating hardware solutions that are crucial for AI. Intel Corporation is a major supplier of semiconductor chips for various computing gadgets such as Personal Computers (PCs), servers, and Internet of Things (IoT) appliances. In the Central Processing Unit (CPU) market, there is tough rivalry from Advanced Micro Devices (AMD). AMD has been increasing its portion with products like Ryzen series processors that provide a good balance between cost-effectiveness and performance. Samsung Electronics is a world-scale provider of consumer electronics, semiconductors, and display technologies. In the mobile phone area specifically, Samsung encounters strong rivalry with Apple Inc., especially in the top-end section where both firms struggle to gain market portion using their best products. Also, within the semiconductor sector, there is competition with TSMC - one big player in the foundry business- and Intel which holds a significant position due to its leading role as a supplier for the CPUs market. • India is preparing to receive two big semiconductor fabrication plants along with chip assembly and packaging units, which is expected have investments in the billions. Minister Rajeev Chandrasekhar gave confirmation about these projects that include a $8 billion proposal from Tower Semiconductors as well as another one by Tata Group - indicating substantial progress being made within India's semiconductor industry sector.VLSI Semiconductor Market Trends

Trends Description AI & ML Integration Increasing adoption of VLSI chips to handle heavy computational loads in AI, ML, and deep learning applications. Shift to Advanced Nodes (<7nm) Growing demand for smaller, more power-efficient chips for mobile, automotive, and HPC use cases. Rise of Chiplet Architecture Modular chiplet based VLSI designs gaining traction to enhance performance and reduce production cost. VLSI Semiconductor Market Key Developments

• 5th July 2025 NVIDIA (U.S) received U.S. government approval to resume exports of its H20 AI chips to China following CEO Jensen Huang’s meeting with former President Trump reopening a market that generated approximately $17 billion in annual revenue for NVIDIA. • 9th May 2025, NVIDIA (U.S) announced a "downgraded" H20 version for China to align with export controls, targeting a July release. • 31st March 2025, TSMC (Taiwan) initiated commercial-scale production at its 2 nm Kaohsiung fab (fab 22), aiming for 30,000 wafers/month before year-end. • 25th April 2024, TSMC (Taiwan) confirmed volume ramp of its GAAFET-based N2 (2 nm) node in H2 2025, featuring the NanoFlex cell architecture for optimized performance power area. • 8th February 2025, Rapidus (Japan) began trial production on its first 2 nm fab (April 2025), with planned chip sample delivery to Broadcom by June marking Japan’s first deployment of EUV technology.VLSI Semiconductor Market Scope: Inquiry Before Buying

VLSI Semiconductor Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 60.71 Bn. Forecast Period 2025 to 2032 CAGR: 6.1% Market Size in 2032: USD 97.49 Bn. Segments Covered: by Technology Analog IC Digital IC Mixed Signal IC Radio-Frequency IC Power management IC by Product Type Microcontrollers Microprocessors FPGA ASIC MEMS by Application Consumer Electronics Telecommunications Automotive Industrial Healthcare VLSI Semiconductor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Thailand, Bangladesh, Philippines and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Rest of South America)VLSI Semiconductor Market Key Players

The VLSI Semiconductor market players include semiconductor companies that excel in designing and manufacturing VLSI chips, as well as those advancing technology through innovations in design, fabrication, and materials. These companies are engaged in the technically advanced VLSI semiconductor solutions focusing on enhancing security and connectivity for their clients. The significant investment of these key players in research and development to push the boundaries of semiconductor technology and maintain a competitive edge in the VLSI industry. North America 1. Applied Materials (United States) 2. NVIDIA (United States) 3. Intel Corporation (United States) 4. Texas Instruments (United States) 5. Micron Technology (United States) 6. Qualcomm (United States) 7. Broadcom Inc. (United States) 8. Advanced Micro Devices (AMD) (United States) 9. Marvell Technology (United States) 10. Synopsys Inc. (United States) Europe 11. NXP Semiconductors (Netherlands) 12. Infineon Technologies (Germany) 13. SUSS MicroTec (Germany) 14. STMicroelectronics (France) 15. Dialog Semiconductor (Germany) Asia Pacific 16. Samsung Electronics (South Korea) 17. Taiwan Semiconductor Manufacturing Co. (TSMC) (Taiwan) 18. SK Hynix Inc. (South Korea) 19. MediaTek (Taiwan) 20. KIOXIA Holdings Corp. (Japan) 21. Semiconductor Manufacturing International Corp. (SMIC) (China) 22. ROHM Co., Ltd. (Japan) 23. DISCO Corporation (Japan) 24. ASE Technology Holding Co. (Taiwan) 25. ASM Pacific Technology (ASMPT) (Hong Kong) 26. Vanguard International Semiconductor Corp. (Taiwan) 27. Renesas Electronics Corporation (Japan) Middle East & Africa 28. Tower Semiconductor (Israel) South America 29. CEITEC S.A. (Brazil)VLSI Semiconductor Market FAQs

1] What segments are covered in the VLSI Semiconductor Market report? Ans. The segments covered in the VLSI Semiconductor Market report, By Technology, By Product Type and By Application. 2] Which region is expected to hold the highest share in the VLSI Semiconductor Market? Ans. The Asia Pacific region is expected to hold the highest share in the VLSI Semiconductor Market. 3] What is the market size of the VLSI Semiconductor Market by 2032? Ans. The VLSI Semiconductor market size is expected to reach USD 97.49 Bn by 2032. 4] What is the forecast period for the VLSI Semiconductor Market? Ans. The forecast period for the VLSI Semiconductor Market is 2025-2032. 5] What was the market size of the VLSI Semiconductor Market in 2024? Ans. The market size of the VLSI Semiconductor Market in 2024 was valued at USD 60.71 Bn.

1. VLSI Semiconductor Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. VLSI Semiconductor Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. VLSI Semiconductor Market: Dynamics 3.1. Region-wise Trends of VLSI Semiconductor Market 3.1.1. North America VLSI Semiconductor Market Trends 3.1.2. Europe VLSI Semiconductor Market Trends 3.1.3. Asia Pacific VLSI Semiconductor Market Trends 3.1.4. Middle East and Africa VLSI Semiconductor Market Trends 3.1.5. South America VLSI Semiconductor Market 3.2. VLSI Semiconductor Market Dynamics 3.2.1. VLSI Semiconductor Market Drivers 3.2.1.1. IoT Expansion 3.2.1.2. AI Integration 3.2.1.3. Consumer Electronics Boom 3.2.2. VLSI Semiconductor Market Restraints 3.2.3. VLSI Semiconductor Market Opportunities 3.2.3.1. Edge Computing 3.2.3.2. EUV Lithography 3.2.3.3. 5G & AR/VR 3.2.4. VLSI Semiconductor Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Trade Regulations 3.4.2. Tech Innovation 3.4.3. Skilled Workforce 3.5. VLSI Semiconductor Rate (%), by region 3.6. Technological Advancements in VLSI Semiconductor 3.7. Price Trend Analysis by Region 3.8. Technological Roadmap 3.9. Regulatory Landscape by Region 3.9.1. North America 3.9.2. Europe 3.9.3. Asia Pacific 3.9.4. Middle East and Africa 3.9.5. South America 3.10. Analysis of Government Schemes and Initiatives for VLSI Semiconductor Industry 3.11. Key Opinion Leader Analysis 4. VLSI Semiconductor Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 4.1.1. Analog IC 4.1.2. Digital IC 4.1.3. Mixed Signal IC 4.1.4. Radio-Frequency IC 4.1.5. Power management IC 4.2. VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 4.2.1. Microcontrollers 4.2.2. Microprocessors 4.2.3. FPGA 4.2.4. ASIC 4.2.5. MEMS 4.3. VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 4.3.1. Consumer Electronics 4.3.2. Telecommunications 4.3.3. Automotive 4.3.4. Industrial 4.3.5. Healthcare 4.4. VLSI Semiconductor Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America VLSI Semiconductor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 5.1.1. Analog IC 5.1.2. Digital IC 5.1.3. Mixed Signal IC 5.1.4. Radio-Frequency IC 5.1.5. Power management IC 5.2. North America VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 5.2.1. Microcontrollers 5.2.2. Microprocessors 5.2.3. FPGA 5.2.4. ASIC 5.2.5. MEMS 5.3. VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 5.3.1. Consumer Electronics 5.3.2. Telecommunications 5.3.3. Automotive 5.3.4. Industrial 5.3.5. Healthcare 5.4. North America VLSI Semiconductor Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 5.4.1.1.1. Analog IC 5.4.1.1.2. Digital IC 5.4.1.1.3. Mixed Signal IC 5.4.1.1.4. Radio-Frequency IC 5.4.1.1.5. Power management IC 5.4.1.2. United States VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 5.4.1.2.1. Microcontrollers 5.4.1.2.2. Microprocessors 5.4.1.2.3. FPGA 5.4.1.2.4. ASIC 5.4.1.2.5. MEMS 5.4.1.3. United States VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Consumer Electronics 5.4.1.3.2. Telecommunications 5.4.1.3.3. Automotive 5.4.1.3.4. Industrial 5.4.1.3.5. Healthcare 5.4.2. Canada 5.4.2.1. Canada VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 5.4.2.1.1. Analog IC 5.4.2.1.2. Digital IC 5.4.2.1.3. Mixed Signal IC 5.4.2.1.4. Radio-Frequency IC 5.4.2.1.5. Power management IC 5.4.2.2. Canada VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 5.4.2.2.1. Microcontrollers 5.4.2.2.2. Microprocessors 5.4.2.2.3. FPGA 5.4.2.2.4. ASIC 5.4.2.2.5. MEMS 5.4.2.3. Canada VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Consumer Electronics 5.4.2.3.2. Telecommunications 5.4.2.3.3. Automotive 5.4.2.3.4. Industrial 5.4.2.3.5. Healthcare 5.4.3. Mexico 5.4.3.1. Mexico VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 5.4.3.1.1. Analog IC 5.4.3.1.2. Digital IC 5.4.3.1.3. Mixed Signal IC 5.4.3.1.4. Radio-Frequency IC 5.4.3.1.5. Power management IC 5.4.3.2. Mexico VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 5.4.3.2.1. Microcontrollers 5.4.3.2.2. Microprocessors 5.4.3.2.3. FPGA 5.4.3.2.4. ASIC 5.4.3.2.5. MEMS 5.4.3.3. Mexico VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 5.4.3.3.1. Consumer Electronics 5.4.3.3.2. Telecommunications 5.4.3.3.3. Automotive 5.4.3.3.4. Industrial 5.4.3.3.5. Healthcare 6. Europe VLSI Semiconductor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.2. Europe VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.3. Europe VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4. Europe VLSI Semiconductor Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.1.2. United Kingdom VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.1.3. United Kingdom VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.2.2. France VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.2.3. France VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.3.2. Germany VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.3.3. VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.3.4. Germany VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.4.2. Italy VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.4.3. Italy VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.5.2. Spain VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.5.3. Spain VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.6.2. Sweden VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.6.3. Sweden VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.7. Russia 6.4.7.1. Russia VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.7.2. Russia VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.7.3. Russia VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 6.4.8.2. Rest of Europe VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 6.4.8.3. Rest of Europe VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific VLSI Semiconductor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.2. Asia Pacific VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.3. Asia Pacific VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific VLSI Semiconductor Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.1.2. China VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.1.3. China VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.2.2. S Korea VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.2.3. S Korea VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.3.2. Japan VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.3.3. Japan VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.4.2. India VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.4.3. India VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.5.2. Australia VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.5.3. Australia VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.6.2. Indonesia VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.6.3. Indonesia VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.7.2. Malaysia VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.7.3. Malaysia VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.8.2. Philippines VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.8.3. Philippines VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.9.2. Thailand VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.9.3. Thailand VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.10.2. Vietnam VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.10.3. Vietnam VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 7.4.11.2. Rest of Asia Pacific VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 7.4.11.3. Rest of Asia Pacific VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa VLSI Semiconductor Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 8.2. Middle East and Africa VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 8.3. Middle East and Africa VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa VLSI Semiconductor Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 8.4.1.2. South Africa VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 8.4.1.3. South Africa VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 8.4.2.2. GCC VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 8.4.2.3. GCC VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 8.4.3.2. Egypt VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 8.4.3.3. Egypt VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 8.4.4.2. Nigeria VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 8.4.4.3. Nigeria VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 8.4.5.2. Rest of ME&A VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 9. South America VLSI Semiconductor Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 9.2. South America VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 9.3. South America VLSI Semiconductor Market Size and Forecast, By Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 9.3.1.2. Brazil VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 9.3.1.3. Brazil VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 9.3.2.2. Argentina VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 9.3.2.3. Argentina VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 9.3.3.2. Colombia VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 9.3.3.3. Colombia VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 9.3.4. Chile 9.3.4.1. Chile VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 9.3.4.2. Chile VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 9.3.4.3. Chile VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 9.3.5. Rest of South America 9.3.5.1. Rest of South America VLSI Semiconductor Market Size and Forecast, By Technology (2024-2032) 9.3.5.2. Rest of South America VLSI Semiconductor Market Size and Forecast, By Product Type (2024-2032) 9.3.5.3. Rest of South America VLSI Semiconductor Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Applied Materials (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. NVIDIA (United States) 10.3. Intel Corporation (United States) 10.4. Texas Instruments (United States) 10.5. Micron Technology (United States) 10.6. Qualcomm (United States) 10.7. Broadcom Inc. (United States) 10.8. Advanced Micro Devices (AMD) (United States) 10.9. Marvell Technology (United States) 10.10. Synopsys Inc. (United States) 10.11. NXP Semiconductors (Netherlands) 10.12. Infineon Technologies (Germany) 10.13. SUSS MicroTec (Germany) 10.14. STMicroelectronics (France) 10.15. Dialog Semiconductor (Germany) 10.16. Samsung Electronics (South Korea) 10.17. Taiwan Semiconductor Manufacturing Co. (TSMC) (Taiwan) 10.18. SK Hynix Inc. (South Korea) 10.19. MediaTek (Taiwan) 10.20. KIOXIA Holdings Corp. (Japan) 10.21. Semiconductor Manufacturing International Corp. (SMIC) (China) 10.22. ROHM Co., Ltd. (Japan) 10.23. DISCO Corporation (Japan) 10.24. ASE Technology Holding Co. (Taiwan) 10.25. ASM Pacific Technology (ASMPT) (Hong Kong) 10.26. Vanguard International Semiconductor Corp. (Taiwan) 10.27. Renesas Electronics Corporation (Japan) 10.28. Tower Semiconductor (Israel) 10.29. CEITEC S.A. (Brazil) 11. Key Findings 12. Analyst Recommendations 13. VLSI Semiconductor Market: Research Methodology