The Global Video Measuring System Market was valued at USD 748.77 Million in 2024 and is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching approximately USD 1,438.09 Million by 2032Video Measuring System Market Overview

A Video Measuring System is an optical measuring device which is non-contact; it uses imaging processing software, high quality optics (i.e. cameras and lenses) to inspect, measure, and analyze complex parts with high measuring accuracy. They are used widely for quality control and inspection across manufacturing and industrial use. Video Measuring Systems Market demand is growing due to precision in production, quality assurance, and automation. With the increasing growth of sectors such as automotive, aerospace, and electronics, there is a growing need for accurate measuring in non-contact environments. However, the supply of the Video Measuring System remains largely based on factors such as advanced technology and software, availability, production capacity, and trained operators of the systems and the components need. The Asia Pacific region dominated the Video Measuring System market in 2024, with early adoption of industrial automation to improve speed, efficiency, and accuracy amongst an advanced manufacturing infrastructure. Rapid market growth within the Asia Pacific region is driven by the electronics, automotive, and aviation sectors in countries like China, Japan, and South Korea. Key players in the Video Measuring Systems market include: Hexagon AB (Sweden), Nikon Corporation (Japan), Mitutoyo Corporation (Japan), and Carl Zeiss AG (Germany). MMR Data Analysis has covered all regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. They used to provide key data analysis for the historical period from 2019 to 2024. The report includes the Video Measuring System Market's drivers, limitations, prospects, and barriers. The MMR report includes investor recommendations based on thorough research of the Video Measuring System Market competitive scenario.To know about the Research Methodology :- Request Free Sample Report

Video Measuring System Market Dynamics

Rising Demand For High-Precision, Non-Contact Inspection to Drive the Video Measuring System Market The growing emphasis on precision and accuracy in manufacturing processes is providing considerable business value for the Video Measuring System market. As industries evolve such as automotive, aerospace, electronics, and medical devices, the demand for non-contact and highly accurate measurement technology has increased significantly. VMS tools allow manufacturers to conduct dimensional measurement in real-time, ensuring dimensional compliance and minimizing defect rates within production. The evolving idea of Industry 4.0 and smart factories has also contributed to the increase in adoption of automated optical inspection systems (such as VMS) to improve operational efficiency and quality control functions. These systems fit into the digital workflow and advanced analytics to help firms meet them regulations requirements. Demand for VMS systems will increase as the current move towards miniaturization of all electronic and health care components makes the need for VMS solutions more urgent and essential in a modern manufacturing environment. High Initial Investment and Maintenance Costs to Restrain Video Measuring System Market Although demand is increasing, the high initial cost associated with video measuring systems represents a significant hurdle for many firms, especially small and medium-sized enterprises (SMEs). Video measuring systems represent a substantial capital investment not only to purchase, but to customize, integrate with other equipment, and train staff. It should also be noted that calibration and consistently updating the software installed on the video measuring systems also requires skilled personnel, as well as ongoing operational costs which can financially handicap newer companies with limited budgets; price-sensitive firms, or firms operating in a price-competitive market altogether, could be discouraged from implementing the new technology altogether. Other considerations aside, the lack of overall standardization and compatibility issues with current equipment can also add friction to the implementation process. Integration of AI and Machine Learning Capabilities to Create Video Measuring System Opportunity Artificial Intelligence (AI) and Machine Learning (ML) have brought about one of the most exciting opportunities in the Video Measuring System business. These technologies are changing the way measurements and inspections are performed through real-time data visualisation, adaptive learning, autonomous decision making, and intelligent systems. The new breed of AI measuring systems can process visual data too big for a human to comprehend simultaneously, recognise defects, predict quality variation over time, and manage defects in a particular process without human interaction. Not only does this reduce inspection time, but it also increases precision and repeatability. Machine learning algorithms enable continual improvement through the ability to observe new inspections and scenarios. Intelligent systems are compelling for manufacturers operating in a high-speed, high-precision process requiring inspection, as AI support quality assurance and process improvement. As AI becomes cheaper and easier to integrate into VMS, it can only imagine the application for these technologies, standards in industrial inspection.Video Measuring System Market Segment Analysis

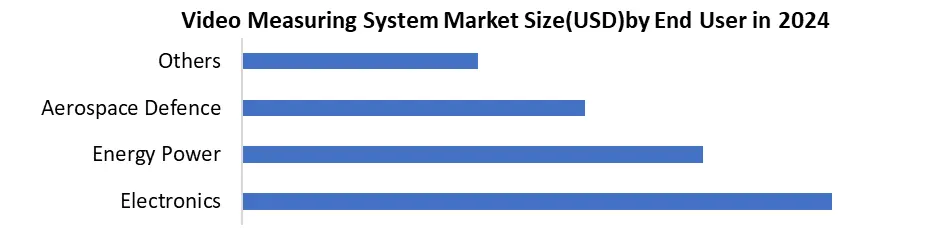

Based on end user, Video Measuring System Market is segmented into Electronics, Energy Power, Aerospace Defence and Others. The electronics segment dominated the Video Measuring System Market in 2024 and is expected to hold the largest market share over the forecast period. The dominance is due to the industry's critical need for high-precision measurement and quality assurance. As the dimensions and complexity of electronic components continue to shrink, primarily with the advent of microelectronics and semiconductors, manufacturers turn to non-contact and high-resolution measurement tools to product measures are accurate, consistent, and perform as intended. Video measurement systems (VMS) present a viable option for manufacturers to conduct detailed inspections of complex circuits, solder joints, PCB layouts, and microchips without damaging those components. Additionally, the rapid innovation cycles of electronic goods, such as the proliferation of smartphones, wearables, and the Internet of Things (IoT), require shorter inspection cycles along with the ability to implement real-time quality control, all capabilities that VMS system. With many electronics manufacturers moving toward automated production lines and smart factories, the need for integrated optical measurement methods is propelling the electronics industry to be the largest application in the global Video Measuring System market.

Video Measuring System Market Regional Analysis

The Asia-Pacific region dominated the global Video Measuring System (VMS) market due to its profitable manufacturing base, rapid industrialization, and technological advancements in 2024. Countries such as China, Japan, South Korea, and Taiwan are top producers in electronics, automotive, and semiconductors, and all of these industries require precise measurement. Government initiatives supporting automation, smart manufacturing, and digital transformation also benefit the region and improve the adoption rates of advanced metrology like VMS. Additionally, the large category of OEMs and component manufacturers in countries such as China and India created demand for quality inspection tools to maintain acceptable quality standards for global exports. The research and development investments and the associated lower labor costs provided a competitive advantage. Furthermore, the demand for miniaturization in electronics and high-speed lines in automotive in the APAC region drives demand for VMS systems. Asia-Pacific’s unique combination of qualities secures its position in the 2024 video measuring system market landscape.Video Measuring System Market Competitive Landscape

The global Video Measuring System (VMS) market is highly competitive, dominated by a few key players that combine precision engineering with advanced AI and automation capabilities. Carl Zeiss Industrial Metrology leads the market with an estimated 2024 revenue of USD 2.1 billion in metrology solutions, driven by its high-end VMS platforms like the O-INSPECT for multi sensor measurements. Mitutoyo Corporation follows closely, generating approximately USD 1.8 billion in 2024, with strong adoption of its Quick Vision series in automotive and aerospace sectors. Keyence Corporation ranks third, reporting around USD 1.5 billion in VMS-related revenue, leveraging its optical and laser-based systems for high-speed inspections in electronics manufacturing. These top players compete on AI-powered automation, micron-level accuracy (down to 0.5µm), and Industry 4.0 integration, with Zeiss focusing on premium solutions, Mitutoyo on durability, and Keyence on plug-and-play efficiency. Emerging challengers like Hexagon (via Nikon Metrology) and FARO Technologies are gaining traction, but the market remains consolidated, with the top 3 controlling over 55% of the global VMS revenue in 2024. The competitive landscape of the Video Measuring System market is strategic collaborations, continuous innovation, and advanced product development. The competitive companies' emphasis on improving measurement accuracy, adding AI and automation, and expanding their geographic footprint. The innovations in multi-sensor systems and upgrades to software are stimulating competition with companies emphasizing customer-centric solutions and industry-specific applications.Video Measuring System Market Recent Trend

1. AI & Machine Learning Integration AI-Driven Smart Metrology: Next-gen VMS autonomously detect sub-micron defects, intelligently categorize components, and self-optimize inspection paths—slashing measurement time by 30%. Predictive Quality Control: Machine learning algorithms analyze historical data to predict measurement errors before they occur. 2. Automation & Industry 4.0 Adoption Robotic VMS: Integration with collaborative robots (cobots) for fully automated inspection lines. IoT & Cloud Connectivity: Real-time data sharing between VMS and ERP/MES systems for smart factory workflows. 3. Multi-Sensor & Hybrid Metrology Systems Combining Optical, Laser, and Touch Probes: Single systems now offer multi-sensor capabilities for diverse measurement needs. 4. Portable & Handheld VMS Growth On-Site Metrology: Demand rising for compact, portable VMS for field inspections in aerospace, automotive, and heavy machinery.Video Measuring System Market Recent Development

1. 6 May 2025 — Hexagon AB (Stuttgart, Germany): MAESTRO Next-Gen Coordinate Measuring Machine Hexagon’s Manufacturing Intelligence division introduced MAESTRO, a next-generation coordinate measuring machine (CMM) built for high-speed, precision-focused manufacturing environments. 2. 6 May 2025 — ZEISS Industrial Quality Solutions (Oberkochen, Germany): ZEISS Smartzoom 100 Digital Microscope ZEISS Smartzoom 100 offers 4K imaging at 60 fps, enhancing precision and comfort in inspections. 3. 13 May 2025 — ZEISS Industrial Quality Solutions (Oberkochen, Germany): ZEISS CALYPSO/PiWeb/Connected Quality 2025 Software Suite ZEISS enhanced its metrology software portfolio—CALYPSO, PiWeb, and Connected Quality—to improve CMM performance via optimized GD&T tools, customizable CAD import workflows, remote planning, and global cloud-based inspection management. 4. 1 July 2025 — Mitutoyo Corporation (Kawasaki, Japan): CRYSTA‑Apex V PLUS Series CNC CMM Mitutoyo launched the CRYSTA‑Apex V PLUS series, expanding its temperature accuracy range to 15–30 °C and introducing an “Air Reduction Function” to optimize energy usage. These enhancements enable reliable near-line measurements with reduced operating costs and environmental impact.Video Measuring System Market Scope: Inquire before buying

Video Measuring System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 748.77 Mn. Forecast Period 2025 to 2032 CAGR: 8.5% Market Size in 2032: USD 1438.09 Mn. Segments Covered: by Product Automated Semi-Automated Manual by Offering Hardware Software Services by End User Electronics Energy Power Aerospace Defence Others Video Measuring System Market by Region

North America (United States, Canada, and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam, and Rest of Asia Pacific) Middle East and Africa (MEA) (South Africa, GCC, Nigeria, and Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, and Rest of South America)Video Measuring System Market Key Players are:

North America 1. Quality Vision International Inc. (QVI) – USA 2. Perceptron Inc. – USA 3. Optical Gaging Products (OGP Inc.) – USA 4. L.S. Starrett Company – USA 5. View Engineering (division of QVI) – USA 6. Faro Technologies – USA 7. Zygo Corporation – USA 8. Renishaw – UK-based with US operations 9. Creaform – Canada Europe 1. Hexagon AB – Sweden 2. Carl Zeiss AG – Germany 3. Werth Messtechnik GmbH – Germany 4. VisiConsult X‑ray Systems & Solutions GmbH – Germany 5. Dr. Heinrich Schneider Messtechnik GmbH – Germany 6. WENZEL Group GmbH & Co. KG – Germany 7. GOM Metrology – Germany 8. Renishaw – UK 9. Vision Engineering – UK Asia Pacific 1. Mitutoyo Corporation – Japan 2. Keyence Corporation – Japan 3. Nikon Metrology – Japan 4. Tokyo Seimitsu Co., Ltd. (ACCRETECH) – Japan 5. Advantest Corporation – Japan 6. Shimadzu Corporation – Japan 7. CHOTEST Technology Inc. – Shenzhen 8. UNIMETRO Precision Machinery – Dongguan 9. Qingdao Leader Metrology Instruments – Qingdao 10. Leader Precision Instrument Co., Ltd. – Shenzhen 11. Dongguan Yihui Optoelectronics Technology – China 12. CARMAR Accuracy Co., Ltd. – Taichung 13. ARCS Precision Technology – Taiwan 14. Sipcon Technologies Pvt. Ltd. – Ambala 15. ATQ Metrology – Pune 16. QS Metrology – Gurugram 17. Sahil Technocrats – India 18. Canopus Measurement Solutions – India 19. Intelligent Vision System (IVS) – South KoreaFrequently Asked Questions:

1. Which region has the largest share in Global Video Measuring System Market? Ans: Asia Pacific region held the highest Video Measuring System Market share in 2024. 2. What is the Forecast year of Global Video Measuring System Market? Ans: The Global Video Measuring System Market is growing at a CAGR of 8.5% during the forecast period 2025-2032. 3. What is the scope of the Global Video Measuring System Market report? Ans: The Video Measuring System Market report helps with the PESTEL, PORTER, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Video Measuring System Market? Ans: The important key players in the Global Video Measuring System Market are Carl Zeiss, Faro Technologies, Hexagon, Nikon, and Mitutoyo. 5. What is the study period of this Market? Ans: The Global Video Measuring System Market is studied from 2024 to 2032

1. Video Measuring System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Video Measuring System Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Video Measuring System Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Video Measuring System Market: Dynamics 3.1. Video Measuring System Market Trends by Region 3.1.1. North America Video Measuring System Market Trends 3.1.2. Europe Video Measuring System Market Trends 3.1.3. Asia Pacific Video Measuring System Market Trends 3.1.4. Middle East and Africa Video Measuring System Market Trends 3.1.5. South America Video Measuring System Market Trends 3.2. Video Measuring System Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Video Measuring System Market Drivers 3.2.1.2. North America Video Measuring System Market Restraints 3.2.1.3. North America Video Measuring System Market Opportunities 3.2.1.4. North America Video Measuring System Market Challenges 3.2.2. Europe 3.2.2.1. Europe Video Measuring System Market Drivers 3.2.2.2. Europe Video Measuring System Market Restraints 3.2.2.3. Europe Video Measuring System Market Opportunities 3.2.2.4. Europe Video Measuring System Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Video Measuring System Market Drivers 3.2.3.2. Asia Pacific Video Measuring System Market Restraints 3.2.3.3. Asia Pacific Video Measuring System Market Opportunities 3.2.3.4. Asia Pacific Video Measuring System Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Video Measuring System Market Drivers 3.2.4.2. Middle East and Africa Video Measuring System Market Restraints 3.2.4.3. Middle East and Africa Video Measuring System Market Opportunities 3.2.4.4. Middle East and Africa Video Measuring System Market Challenges 3.2.5. South America 3.2.5.1. South America Video Measuring System Market Drivers 3.2.5.2. South America Video Measuring System Market Restraints 3.2.5.3. South America Video Measuring System Market Opportunities 3.2.5.4. South America Video Measuring System Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Video Measuring System Industry 3.8. Analysis of Government Schemes and Initiatives For Video Measuring System Industry 3.9. Video Measuring System Market Trade Analysis 3.10. The Global Pandemic Impact on Video Measuring System Market 4. Video Measuring System Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Video Measuring System Market Size and Forecast, by Product (2024-2032) 4.1.1. Automated 4.1.2. Semi-Automated 4.1.3. Manual 4.2. Video Measuring System Market Size and Forecast, by Offering (2024-2032) 4.2.1. Hardware 4.2.2. Software 4.2.3. Services 4.3. Video Measuring System Market Size and Forecast, by End User (2024-2032) 4.3.1. Electronics 4.3.2. Energy Power 4.3.3. Aerospace Defence 4.3.4. Others 4.4. Video Measuring System Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Video Measuring System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Video Measuring System Market Size and Forecast, by Product (2024-2032) 5.1.1. Automated 5.1.2. Semi-Automated 5.1.3. Manual 5.2. North America Video Measuring System Market Size and Forecast, by Offering (2024-2032) 5.2.1. Hardware 5.2.2. Software 5.2.3. Services 5.3. North America Video Measuring System Market Size and Forecast, by End User (2024-2032) 5.3.1. Electronics 5.3.2. Energy Power 5.3.3. Aerospace Defence 5.3.4. Others 5.4. North America Video Measuring System Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Video Measuring System Market Size and Forecast, by Product (2024-2032) 5.4.1.1.1. Automated 5.4.1.1.2. Semi-Automated 5.4.1.1.3. Manual 5.4.1.2. United States Video Measuring System Market Size and Forecast, by Offering (2024-2032) 5.4.1.2.1. Hardware 5.4.1.2.2. Software 5.4.1.2.3. Services 5.4.1.3. United States Video Measuring System Market Size and Forecast, by End User (2024-2032) 5.4.1.3.1. Electronics 5.4.1.3.2. Energy Power 5.4.1.3.3. Aerospace Defence 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Video Measuring System Market Size and Forecast, by Product (2024-2032) 5.4.2.1.1. Automated 5.4.2.1.2. Semi-Automated 5.4.2.1.3. Manual 5.4.2.2. Canada Video Measuring System Market Size and Forecast, by Offering (2024-2032) 5.4.2.2.1. Hardware 5.4.2.2.2. Software 5.4.2.2.3. Services 5.4.2.3. Canada Video Measuring System Market Size and Forecast, by End User (2024-2032) 5.4.2.3.1. Electronics 5.4.2.3.2. Energy Power 5.4.2.3.3. Aerospace Defence 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Video Measuring System Market Size and Forecast, by Product (2024-2032) 5.4.3.1.1. Automated 5.4.3.1.2. Semi-Automated 5.4.3.1.3. Manual 5.4.3.2. Mexico Video Measuring System Market Size and Forecast, by Offering (2024-2032) 5.4.3.2.1. Hardware 5.4.3.2.2. Software 5.4.3.2.3. Services 5.4.3.3. Mexico Video Measuring System Market Size and Forecast, by End User (2024-2032) 5.4.3.3.1. Electronics 5.4.3.3.2. Energy Power 5.4.3.3.3. Aerospace Defence 5.4.3.3.4. Others 6. Europe Video Measuring System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.2. Europe Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.3. Europe Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4. Europe Video Measuring System Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.1.2. United Kingdom Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.1.3. United Kingdom Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4.2. France 6.4.2.1. France Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.2.2. France Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.2.3. France Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.3.2. Germany Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.3.3. Germany Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.4.2. Italy Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.4.3. Italy Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.5.2. Spain Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.5.3. Spain Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.6.2. Sweden Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.6.3. Sweden Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.7.2. Austria Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.7.3. Austria Video Measuring System Market Size and Forecast, by End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Video Measuring System Market Size and Forecast, by Product (2024-2032) 6.4.8.2. Rest of Europe Video Measuring System Market Size and Forecast, by Offering (2024-2032) 6.4.8.3. Rest of Europe Video Measuring System Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Video Measuring System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.3. Asia Pacific Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4. Asia Pacific Video Measuring System Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.1.2. China Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.1.3. China Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.2.2. S Korea Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.2.3. S Korea Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.3.2. Japan Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.3.3. Japan Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.4. India 7.4.4.1. India Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.4.2. India Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.4.3. India Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.5.2. Australia Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.5.3. Australia Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.6.2. Indonesia Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.6.3. Indonesia Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.7.2. Malaysia Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.7.3. Malaysia Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.8.2. Vietnam Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.8.3. Vietnam Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.9.2. Taiwan Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.9.3. Taiwan Video Measuring System Market Size and Forecast, by End User (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Video Measuring System Market Size and Forecast, by Product (2024-2032) 7.4.10.2. Rest of Asia Pacific Video Measuring System Market Size and Forecast, by Offering (2024-2032) 7.4.10.3. Rest of Asia Pacific Video Measuring System Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Video Measuring System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Video Measuring System Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Video Measuring System Market Size and Forecast, by Offering (2024-2032) 8.3. Middle East and Africa Video Measuring System Market Size and Forecast, by End User (2024-2032) 8.4. Middle East and Africa Video Measuring System Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Video Measuring System Market Size and Forecast, by Product (2024-2032) 8.4.1.2. South Africa Video Measuring System Market Size and Forecast, by Offering (2024-2032) 8.4.1.3. South Africa Video Measuring System Market Size and Forecast, by End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Video Measuring System Market Size and Forecast, by Product (2024-2032) 8.4.2.2. GCC Video Measuring System Market Size and Forecast, by Offering (2024-2032) 8.4.2.3. GCC Video Measuring System Market Size and Forecast, by End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Video Measuring System Market Size and Forecast, by Product (2024-2032) 8.4.3.2. Nigeria Video Measuring System Market Size and Forecast, by Offering (2024-2032) 8.4.3.3. Nigeria Video Measuring System Market Size and Forecast, by End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Video Measuring System Market Size and Forecast, by Product (2024-2032) 8.4.4.2. Rest of ME&A Video Measuring System Market Size and Forecast, by Offering (2024-2032) 8.4.4.3. Rest of ME&A Video Measuring System Market Size and Forecast, by End User (2024-2032) 9. South America Video Measuring System Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Video Measuring System Market Size and Forecast, by Product (2024-2032) 9.2. South America Video Measuring System Market Size and Forecast, by Offering (2024-2032) 9.3. South America Video Measuring System Market Size and Forecast, by End User(2024-2032) 9.4. South America Video Measuring System Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Video Measuring System Market Size and Forecast, by Product (2024-2032) 9.4.1.2. Brazil Video Measuring System Market Size and Forecast, by Offering (2024-2032) 9.4.1.3. Brazil Video Measuring System Market Size and Forecast, by End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Video Measuring System Market Size and Forecast, by Product (2024-2032) 9.4.2.2. Argentina Video Measuring System Market Size and Forecast, by Offering (2024-2032) 9.4.2.3. Argentina Video Measuring System Market Size and Forecast, by End User (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Video Measuring System Market Size and Forecast, by Product (2024-2032) 9.4.3.2. Rest Of South America Video Measuring System Market Size and Forecast, by Offering (2024-2032) 9.4.3.3. Rest Of South America Video Measuring System Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Quality Vision International Inc. (QVI) – USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Perceptron Inc. – USA 10.3. Optical Gaging Products (OGP Inc.) – USA 10.4. L.S. Starrett Company – USA 10.5. View Engineering (division of QVI) – USA 10.6. Faro Technologies – USA 10.7. Zygo Corporation – USA 10.8. Renishaw – UK-based with US operations 10.9. Creaform – Canada 10.10. Hexagon AB – Sweden 10.11. Carl Zeiss AG – Germany 10.12. Werth Messtechnik GmbH – Germany 10.13. VisiConsult X‑ray Systems & Solutions GmbH – Germany 10.14. Dr. Heinrich Schneider Messtechnik GmbH – Germany 10.15. WENZEL Group GmbH & Co. KG – Germany 10.16. GOM Metrology – Germany 10.17. Renishaw – UK 10.18. Vision Engineering – UK 10.19. Mitutoyo Corporation – Japan 10.20. Keyence Corporation – Japan 10.21. Nikon Metrology – Japan 10.22. Tokyo Seimitsu Co., Ltd. (ACCRETECH) – Japan 10.23. Advantest Corporation – Japan 10.24. Shimadzu Corporation – Japan 10.25. CHOTEST Technology Inc. – Shenzhen 10.26. UNIMETRO Precision Machinery – Dongguan 10.27. Qingdao Leader Metrology Instruments – Qingdao 10.28. Leader Precision Instrument Co., Ltd. – Shenzhen 10.29. Dongguan Yihui Optoelectronics Technology – China 10.30. CARMAR Accuracy Co., Ltd. – Taichung 10.31. ARCS Precision Technology – Taiwan 10.32. Sipcon Technologies Pvt. Ltd. – Ambala 10.33. ATQ Metrology – Pune 10.34. QS Metrology – Gurugram 10.35. Sahil Technocrats – India 10.36. Canopus Measurement Solutions – India 10.37. Intelligent Vision System (IVS) – South Korea 11. Key Findings 12. Industry Recommendations 13. Video Measuring System Market: Research Methodology 14. Terms and Glossary