The Global Vaccine Storage Packaging Market is estimated to be valued at USD 24.33 billion in 2024. The market is expected to reach USD 54.47 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.6% from 2025 to 2032.Global Vaccine Storage Packaging Market Overview

The vaccine storage packaging market comprises the design, production, and supply of specialized packaging solutions that ensure the safe storage, handling, and transportation of vaccines by maintaining required temperature ranges, protecting product integrity, and complying with regulatory standards. This includes primary packaging (such as vials, ampoules, and pre-filled syringes), secondary and tertiary packaging (such as cartons, insulated boxes, and bulk containers), as well as advanced cold chain packaging solutions (including passive and active temperature-controlled systems, smart packaging, and monitoring devices). The Vaccine Storage Packaging Market serves pharmaceutical manufacturers, healthcare providers, logistics companies, and global immunization programs, addressing the critical need to preserve vaccine efficacy throughout the entire supply chain, from production to administration.Key Companies Insights

• Lineage, Inc. specializes in cold storage and logistics services and operates across multiple regions. Its key service offerings include cold storage warehousing, port-centric warehousing, automated warehousing, sustainable warehousing, supply chain engineering, temperature-controlled rail, and others. • DB SCHENKER, a global logistics solutions provider, offers various services, including contract logistics, advanced logistics services, industry-specific solutions, and more. It operates across nearly 1,850 locations worldwide and has a network of 725 warehouses.To know about the Research Methodology :- Request Free Sample Report

Vaccine Storage Packaging Market Dynamics

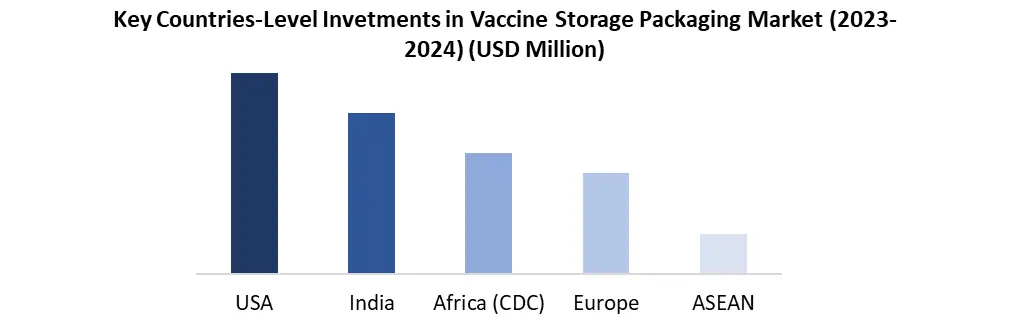

Surging Cold Chain Logistics Demand Accelerating Vaccine Storage Packaging Market Growth The Vaccine Storage Packaging Market has witnessed significant growth, primarily driven by the rising demand for cold chain logistics. This surge is largely attributed to the increasing distribution of temperature-sensitive vaccines, particularly during and after the COVID-19 pandemic. The introduction of mRNA-based vaccines, such as Pfizer-BioNTech’s Comirnaty (BNT162b2), which requires ultra-cold storage at -70°C, and Moderna’s mRNA-1273, which requires -20°C storage, has created an unprecedented demand for specialized ultra-cold storage packaging solutions. • McKesson remained a key partner to the U.S. federal government’s Strategic National Stockpile in 2024, continuing to distribute vaccines that require strict temperature-controlled storage and packaging. Delivered approximately 400-500 million doses globally from 2023-2024, with increasing shipments of combination COVID + flu vaccines. With the approval of combined influenza and COVID-19 boosters, McKesson scaled up its cold chain infrastructure, integrating validated packaging systems to handle millions of temperature-sensitive doses across its extensive national distribution network. The company’s expertise in packaging validation and end-to-end supply chain management played a critical role in maintaining vaccine efficacy during transport. In response, countries have continued to make substantial investments to strengthen their cold chain infrastructure. As of 2024, India’s Universal Immunization Program (UIP) has expanded its network to nearly 32,000 cold chain points, incorporating advanced temperature monitoring and solar-powered refrigeration units to support new vaccines, including malaria and HPV. In Africa, the Africa CDC, with support from Gavi, UNICEF, and other partners, implemented extensive cold chain upgrades between 2023 and 2024 across all 54 African nations to support routine immunization and malaria vaccine rollouts. In the United States, federal and state governments continued to allocate funding throughout 2023 and 2024, with additional investments exceeding USD 2 billion to upgrade cold storage capacity, expand warehouse facilities, and modernize packaging systems for combination vaccines. This ongoing demand has driven continued business growth for key players in the Vaccine Storage Packaging Market. Softbox (UK) introduced its next-generation reusable shippers with enhanced phase-change materials in 2024 to reduce packaging waste, while Pelican BioThermal (USA) expanded its network of global service centers to support the increasing demand for sustainable, reusable packaging solutions. Meanwhile, Cryoport (USA) reported strong revenue growth in 2024, driven by expanded contracts for mRNA vaccine transport, cell therapy logistics, and advanced cold storage packaging services, building on its leadership in ultra-cold and cryogenic packaging solutions.

Vaccine Storage Packaging Market Segment Analysis

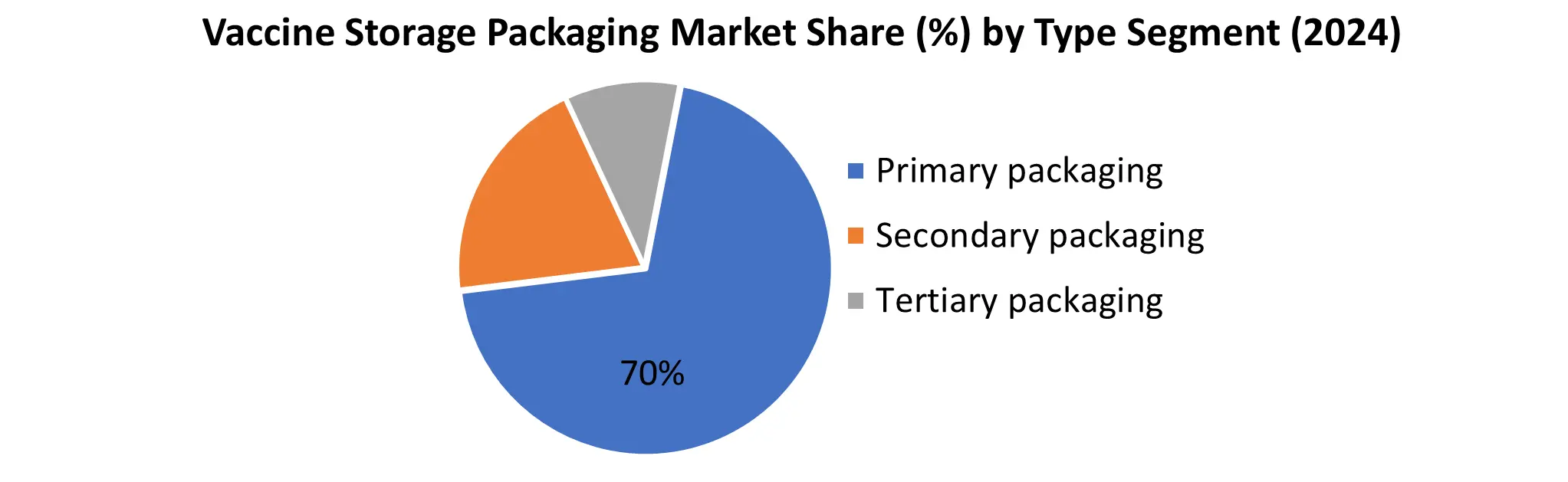

By Product Type: The Vaccine Storage Packaging Market has witnessed significant growth in 2024, particularly within the insulated boxes sub-segment, which currently holds 36% a dominant share in the cold chain packaging category. As the global vaccine supply chain adapts to increasingly complex temperature-sensitive vaccine distribution needs, insulated boxes have become essential for maintaining temperature stability throughout long-distance transportation. The surge in demand was notably triggered by the distribution of mRNA-based COVID-19 vaccines like Pfizer-BioNTech’s Comirnaty and Moderna’s mRNA-1273, requiring storage at ultra-cold temperatures (-70°C to -20°C). The dominant position of insulated boxes stems from their versatility, cost-effectiveness, and ability to provide passive temperature control without continuous power sources, making them highly suitable for global immunization efforts led by organizations such as the WHO, GAVI, and COVAX. Companies like Softbox, Pelican BioThermal, and Sonoco ThermoSafe have scaled up production capacities to meet the rising demand. The insulated boxes sub-segment continues to act as a major boosting factor for the Vaccine Storage Packaging Market growth, especially in emerging economies where portable and reliable cold chain packaging is crucial. By Type: Primary Packaging holds the 32% dominant share. Primary packaging directly encloses the vaccine and plays the most critical role in maintaining sterility, integrity, and efficacy throughout storage, transportation, and administration. This includes vials, prefillable syringes, vial closures, and ampoules, all of which ensure the vaccine is safe from contamination and degradation. The enormous global vaccination drive, particularly during the COVID-19 pandemic, created massive demand for primary packaging solutions, as vaccines like Pfizer-BioNTech’s and Moderna’s mRNA-based formulations required billions of doses to be packaged securely. In 2023–2024, Pfizer reported delivering over 1 billion doses globally, primarily including updated COVID-19 boosters and combo vaccines (COVID-19 + Influenza). Reduced volumes compared to the pandemic peak, but still a major driver for cold chain packaging and ultra-low temperature storage. Continued reliance on advanced packaging technologies with real-time temperature monitoring and dry ice packaging for certain destinations. largely relying on glass vials, which remain the most widely used form of primary packaging due to their chemical stability, compatibility with ultra-cold chain logistics, and ability to scale production rapidly. Key players such as Schott AG, Corning, and SiO2 significantly expanded their production to meet the global surge. The dominance of primary packaging is also being reinforced by the increasing development of biopharmaceuticals and personalized vaccines, which require secure, individualized dose-level packaging. This sustained growth in primary packaging continues to act as a key boosting factor for the overall Vaccine Storage Packaging Market growth.

Vaccine Storage Packaging Market Regional Analysis

The Vaccine Storage Packaging Market experiences substantial demand contributions from large population countries such as India, China, and several nations across Southeast Asia and Africa. These regions conduct extensive routine immunization programs for diseases such as hepatitis, polio, HPV, influenza, and pediatric vaccines, requiring significant cold chain infrastructure and packaging solutions. In countries like India, large-scale government-led vaccination programs under initiatives like the Universal Immunization Program (UIP) consistently create high demand for packaging materials such as vials, ampoules, insulated boxes, and gel packs. Similarly, countries across Africa have expanded their cold chain capacity through partnerships with international organizations to strengthen routine immunization, contributing to consistent packaging needs, especially in remote and rural areas where reliable storage and transport solutions are essential. In comparison, highly developed regions such as North America, Europe, and Japan contribute more significantly to the Vaccine Storage Packaging Market in terms of high-value, technology-intensive packaging solutions. These markets are driven by advanced biopharmaceutical development, increasing adoption of new-generation vaccines, and complex storage needs for personalized medicine, gene therapies, and novel biologics. Strict regulatory standards in these regions require advanced primary packaging like glass vials and pre-filled syringes, combined with smart cold chain systems that feature real-time temperature monitoring, data logging, and traceability. Governments in these regions also maintain strategic vaccine stockpiles, which further drives demand for ultra-cold and controlled temperature packaging systems. Therefore, while emerging markets contribute significantly in terms of vaccination volume, developed regions lead in market revenue due to their reliance on high-cost, technology-driven packaging systems.

Vaccine Storage Packaging Market Recent Developments

• In April 2025, Lineage, Inc. announced that it acquired Bellingham Cold Storage along with its three warehouses in Washington state, totaling 24 million cubic feet and 85,000 pallet positions. This acquisition expands Lineage's Pacific Northwest network to 40 facilities and adds a strategic presence at the Port of Bellingham, a key hub for seafood and agricultural products. • In April 2025, Gavi, the Vaccine Alliance, a private-public global health partnership, announced the establishment of a new vaccine storage facility in the Suba West sub-county store of Mfangano Island. This is anticipated to help local immunization programs and enable health officials to stock larger quantities of required vaccines. • In January 2025, Lineage Inc. acquired Australian company Fremantle City Coldstores (FCC). The acquisition added significant capacity and is expected to support Lineage Inc.'s commitment to enhancing the long-term strategic growth plan for Australia and other countries in the Asia Pacific region. • In March 2024, SCHOTT Pharma to expand its operations in the United States by investing USD 371 million in a new manufacturing facility located in Wilson, North Carolina. This facility will be the first in the U.S. dedicated to producing prefillable polymer and glass syringes, which are essential for the storage and transportation of mRNA medications, as well as therapies for conditions like diabetes and obesity. • In February 2023, West Pharmaceutical Services, Inc. expanded its collaboration with Corning Incorporated, to include exclusive distribution rights for Corning Valor Glass vials and the launch of their first product, the West Ready Pack with Corning Valor RTU Vials utilizing SG EZ-fill technology.Vaccine Storage Packaging Market Scope: Inquire before buying

Vaccine Storage Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 10 Bn. Segments Covered: by Product Type Vials Prefillable syringes Vial closures Ampoules Insulated boxes Others by Type Primary packaging Secondary packaging Tertiary packaging by Material Glass Plastics Metals by End-Use Vaccine manufacturers Healthcare providers Hospitals Clinics Vaccination centers Research institutions Others Vaccine Storage Packaging Market, By Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South America)Vaccine Storage Packaging Market key players

1. Lineage, Inc. 2. AmerisourceBergen Corporation 3. DHL 4. DB SCHENKER 5. CARDINAL LOGISTICS 6. MCKESSON CORPORATION 7. Thermo Fisher Scientific Inc. 8. PHCbi (PANASONIC HEALTHCARE CO., LTD) 9. American Biotech Supply 10. Arctiko 11. NIPRO 12. Amcor 13. Aptar Group 14. Aseptic 15. Becton Dickinson 16. Blowkings 17. Corning 18. CSafe 19. DWK Life Sciences 20. Fengchen Group 21. Gerresheimer 22. Romaco Group 23. Schott 24. Sealed Air 25. SGD Pharma 26. Shandong Province Medicinal Glass 27. Stevanato Group 28. UFP Technologies 29. West Pharmaceutical Services 30. OthersFrequently Asked Questions

Q1: What drives market growth? Ans: Global vaccination programs, rise in biologics, stricter regulations, and cold chain expansion. Q2: Which segment dominates? Ans: Primary packaging, especially vials, leads due to wide vaccine usage. Q3: Why is cold chain packaging important? Ans: Ensures temperature-sensitive vaccines remain effective during transport and storage. Q4: Which regions contribute most? Ans: North America and Europe lead in revenue due to advanced, high-value packaging technologies. Q5: Key market challenges? Ans: Temperature control issues, infrastructure gaps, high costs, and sustainability concerns.

1. Vaccine Storage Packaging Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Vaccine Storage Packaging Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Service Segment 2.2.3. End-User Segment 2.2.4. Revenue (2024) 2.2.5. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Vaccine Storage Packaging Market: Dynamics 3.1. Vaccine Storage Packaging Market Trends 3.2. Vaccine Storage Packaging Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Vaccine Storage Packaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Vials 4.1.2. Prefillable syringes 4.1.3. Vial closures 4.1.4. Ampoules 4.1.5. Insulated boxes 4.1.6. Others 4.2. Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 4.2.1. Primary packaging 4.2.2. Secondary packaging 4.2.3. Tertiary packaging 4.3. Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 4.3.1. Glass 4.3.2. Plastics 4.3.3. Metals 4.4. Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 4.4.1. Vaccine manufacturers 4.4.2. Healthcare providers 4.4.2.1. Hospitals 4.4.2.2. Clinics 4.4.3. Vaccination centers 4.4.4. Research institutions 4.4.5. Others 4.5. Vaccine Storage Packaging Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Vaccine Storage Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Vials 5.1.2. Prefillable syringes 5.1.3. Vial closures 5.1.4. Ampoules 5.1.5. Insulated boxes 5.1.6. Others 5.2. North America Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 5.2.1. Primary packaging 5.2.2. Secondary packaging 5.2.3. Tertiary packaging 5.3. North America Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 5.3.1. Glass 5.3.2. Plastics 5.3.3. Metals 5.4. North America Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 5.4.1. Vaccine manufacturers 5.4.2. Healthcare providers 5.4.2.1. Hospitals 5.4.2.2. Clinics 5.4.3. Vaccination centers 5.4.4. Research institutions 5.4.5. Others 5.5. North America Vaccine Storage Packaging Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 5.5.1.1.1. Vials 5.5.1.1.2. Prefillable syringes 5.5.1.1.3. Vial closures 5.5.1.1.4. Ampoules 5.5.1.1.5. Insulated boxes 5.5.1.1.6. Others 5.5.1.2. United States Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 5.5.1.2.1. Primary packaging 5.5.1.2.2. Secondary packaging 5.5.1.2.3. Tertiary packaging 5.5.1.3. United States Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 5.5.1.3.1. Glass 5.5.1.3.2. Plastics 5.5.1.3.3. Metals 5.5.1.4. United States Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 5.5.1.4.1. Vaccine manufacturers 5.5.1.4.2. Healthcare providers 5.5.1.4.2.1. Hospitals 5.5.1.4.2.2. Clinics 5.5.1.4.3. Vaccination centers 5.5.1.4.4. Research institutions 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 5.5.2.1.1. Vials 5.5.2.1.2. Prefillable syringes 5.5.2.1.3. Vial closures 5.5.2.1.4. Ampoules 5.5.2.1.5. Insulated boxes 5.5.2.1.6. Others 5.5.2.2. Canada Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 5.5.2.2.1. Primary packaging 5.5.2.2.2. Secondary packaging 5.5.2.2.3. Tertiary packaging 5.5.2.3. Canada Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 5.5.2.3.1. Glass 5.5.2.3.2. Plastics 5.5.2.3.3. Metals 5.5.2.4. Canada Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 5.5.2.5. End-Use (2024-2032) 5.5.2.5.1. Vaccine manufacturers 5.5.2.5.2. Healthcare providers 5.5.2.5.2.1. Hospitals 5.5.2.5.2.2. Clinics 5.5.2.5.3. Vaccination centers 5.5.2.5.4. Research institutions 5.5.2.5.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 5.5.3.1.1. Vials 5.5.3.1.2. Prefillable syringes 5.5.3.1.3. Vial closures 5.5.3.1.4. Ampoules 5.5.3.1.5. Insulated boxes 5.5.3.1.6. Others 5.5.3.2. Mexico Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 5.5.3.2.1. Primary packaging 5.5.3.2.2. Secondary packaging 5.5.3.2.3. Tertiary packaging 5.5.3.3. Mexico Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 5.5.3.3.1. Glass 5.5.3.3.2. Plastics 5.5.3.3.3. Metals 5.5.3.4. Mexico Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 5.5.3.4.1. Vaccine manufacturers 5.5.3.4.2. Healthcare providers 5.5.3.4.2.1. Hospitals 5.5.3.4.2.2. Clinics 5.5.3.4.3. Vaccination centers 5.5.3.4.4. Research institutions 5.5.3.4.5. Others 6. Europe Vaccine Storage Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.3. Europe Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.4. Europe Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5. Europe Vaccine Storage Packaging Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.1.2. United Kingdom Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.1.3. United Kingdom Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.1.4. United Kingdom Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5.2. France 6.5.2.1. France Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.2.2. France Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.2.3. France Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.2.4. France Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.3.2. Germany Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.3.3. Germany Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.3.4. Germany Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.4.2. Italy Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.4.3. Italy Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.4.4. Italy Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.5.2. Spain Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.5.3. Spain Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.5.4. Spain Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.6.2. Sweden Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.6.3. Sweden Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.6.4. Sweden Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.7.2. Russia Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.7.3. Russia Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.7.4. Russia Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 6.5.8.2. Rest of Europe Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 6.5.8.3. Rest of Europe Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 6.5.8.4. Rest of Europe Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7. Asia Pacific Vaccine Storage Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.3. Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.4. Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5. Asia Pacific Vaccine Storage Packaging Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.1.2. China Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.1.3. China Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.1.4. China Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.2.2. S Korea Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.2.3. S Korea Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.2.4. S Korea Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.3.2. Japan Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.3.3. Japan Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.3.4. Japan Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.4. India 7.5.4.1. India Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.4.2. India Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.4.3. India Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.4.4. India Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.5.2. Australia Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.5.3. Australia Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.5.4. Australia Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.6.2. Indonesia Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.6.3. Indonesia Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.6.4. Indonesia Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.7.2. Malaysia Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.7.3. Malaysia Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.7.4. Malaysia Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.8.2. Philippines Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.8.3. Philippines Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.8.4. Philippines Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.9.2. Thailand Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.9.3. Thailand Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.9.4. Thailand Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.10.2. Vietnam Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.10.3. Vietnam Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.10.4. Vietnam Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 7.5.11.4. Rest of Asia Pacific Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 8. Middle East and Africa Vaccine Storage Packaging Market Size and Forecast (by Value in USD Million) (2024-2032 8.1. Middle East and Africa Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 8.3. Middle East and Africa Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 8.4. Middle East and Africa Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 8.5. Middle East and Africa Vaccine Storage Packaging Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 8.5.1.2. South Africa Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 8.5.1.3. South Africa Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 8.5.1.4. South Africa Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 8.5.2.2. GCC Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 8.5.2.3. GCC Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 8.5.2.4. GCC Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 8.5.3.2. Egypt Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 8.5.3.3. Egypt Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 8.5.3.4. Egypt Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 8.5.4.2. Nigeria Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 8.5.4.3. Nigeria Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 8.5.4.4. Nigeria Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 8.5.5.2. Rest of ME&A Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 8.5.5.3. Rest of ME&A Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 8.5.5.4. Rest of ME&A Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 9. South America Vaccine Storage Packaging Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 9.1. South America Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 9.3. South America Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 9.4. South America Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 9.5. South America Vaccine Storage Packaging Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 9.5.1.2. Brazil Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 9.5.1.3. Brazil Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 9.5.1.4. Brazil Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 9.5.2.2. Argentina Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 9.5.2.3. Argentina Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 9.5.2.4. Argentina Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 9.5.3.2. Colombia Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 9.5.3.3. Colombia Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 9.5.3.4. Colombia Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 9.5.4.2. Chile Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 9.5.4.3. Chile Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 9.5.4.4. Chile Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Vaccine Storage Packaging Market Size and Forecast, By Product Type (2024-2032) 9.5.5.2. Rest Of South America Vaccine Storage Packaging Market Size and Forecast, By Type (2024-2032) 9.5.5.3. Rest Of South America Vaccine Storage Packaging Market Size and Forecast, By Material (2024-2032) 9.5.5.4. Rest Of South America Vaccine Storage Packaging Market Size and Forecast, By End-Use (2024-2032) 10. Company Profile: Key Players 10.1. Lineage, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. AmerisourceBergen Corporation 10.3. DHL 10.4. DB SCHENKER 10.5. CARDINAL LOGISTICS 10.6. MCKESSON CORPORATION 10.7. Thermo Fisher Scientific Inc. 10.8. PHCbi (PANASONIC HEALTHCARE CO., LTD) 10.9. American Biotech Supply 10.10. Arctiko 10.11. NIPRO 10.12. Amcor 10.13. Aptar Group 10.14. Aseptic 10.15. Becton Dickinson 10.16. Blowkings 10.17. Corning 10.18. CSafe 10.19. DWK Life Sciences 10.20. Fengchen Group 10.21. Gerresheimer 10.22. Romaco Group 10.23. Schott 10.24. Sealed Air 10.25. SGD Pharma 10.26. Shandong Province Medicinal Glass 10.27. Stevanato Group 10.28. UFP Technologies 10.29. West Pharmaceutical Services 10.30. Others 11. Key Findings 12. Industry Recommendations 13. Vaccine Storage Packaging Market: Research Methodology