The Global Synthetic Blood Substitutes and Blood Product Market is entering a transformative phase, driven by advances in biotechnology, increasing prevalence of chronic blood disorders, and rising adoption of minimally invasive medical procedures. Valued at USD 6.2 Billion in 2024, the market is projected to reach USD 14.81 Billion by 2032, growing at a CAGR of 11.5%.Global Synthetic Blood Substitutes and Blood Market Outlook

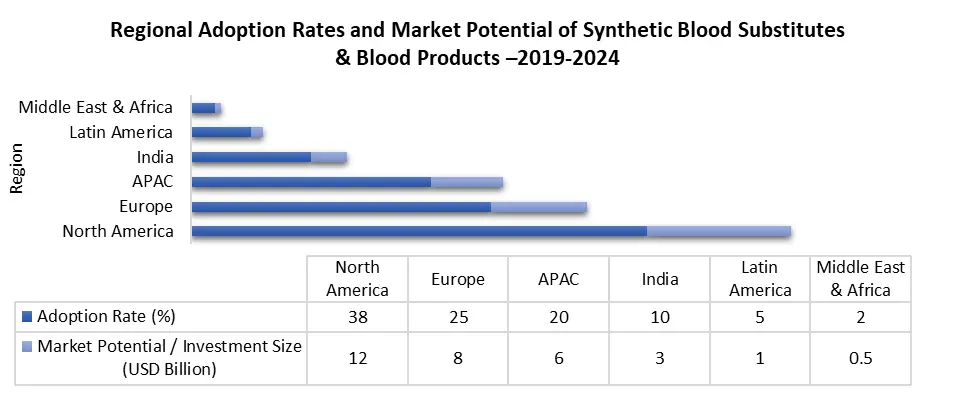

Once a pioneering biotech solution, synthetic blood substitutes, artificial blood, haemoglobin-based oxygen carriers, perfluorocarbon blood products, and oxygen therapeutics are now critical in trauma care, surgical transfusions, emergency medicine, and critical care. This insight-rich RD Research report uncovers market dynamics, growth opportunities, regional adoption, clinical applications, and strategies for stakeholders to leverage the expanding global synthetic blood market. Quick Stats and Growth Highlights- Synthetic Blood Substitutes and Blood Product MarketTo know about the Research Methodology:- Request Free Sample Report Know Your Market Definition & Value Chain: From lab to patient — research & development, clinical trials, production, quality control, packaging, distribution, hospital administration. Regional market trends and adoption rates The Synthetic Blood Substitutes and Blood Product Market is witnessing uneven adoption across regions, driven by clinical need, regulatory support, and healthcare infrastructure. North America leads due to early approvals, strong hospital networks, and government-backed defense programs, while Europe follows with stringent regulations but high clinical adoption in trauma and surgical care. APAC and India are emerging hotspots, leveraging cost-efficient manufacturing, growing clinical trials, and increasing investment in remote and emergency healthcare solutions. Latin America and MEA show slower adoption, limited by infrastructure and regulatory variability, but present potential for targeted trauma and military applications.

Synthetic Blood Substitutes and Blood Product Market Segment Analysis:

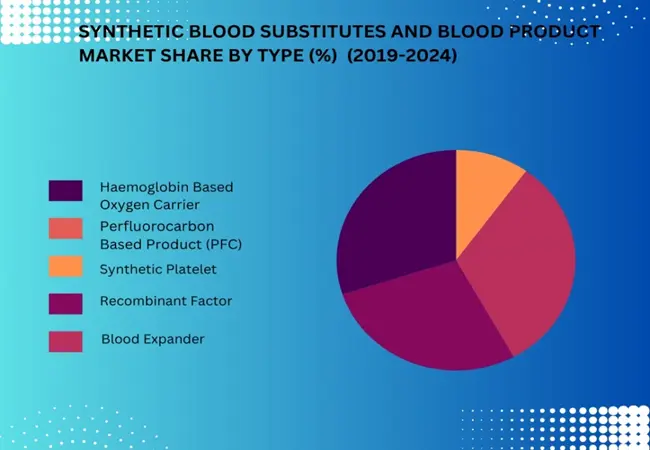

Haemoglobin Based Oxygen Carriers (HBOCs) dominate the market, accounting for the largest share due to their versatility in trauma, surgery, and emergency care. Recombinant factors and PFCs are gaining traction, especially in specialized clinical applications and remote care scenarios. Synthetic platelets and blood expanders hold smaller shares but are critical in targeted therapies and niche medical use cases. Synthetic Blood Substitutes and Blood Product Market Share by Type (%) (2019-2024)

Dynamics in the Artificial Blood Substitutes Market

DARPA, NIH, and DoD Funding Boost Next-Gen Synthetic Blood Programs According to Science.org, the U.S. Department of Defence (DoD) has committed approximately USD 46–46.4 million in federal funding (DARPA-led) to accelerate the development of a bio-synthetic, whole-blood product designed for battlefield trauma care. This product is intended to be storable at room temperature, reconstitutable in the field, and able to perform key functions like stabilizing blood pressure and aiding in clotting. Beyond that flagship investment, smaller but meaningful grants are in motion: e.g., a four-year NIH grant of USD2.7 million awarded to a team led by Dipanjan Pan for next-generation synthetic blood (Nano-RBC) efforts aimed at improving oxygen-carrier design and morphological mimicry of natural red blood cells. Likewise, biotech company Safi Biotherapeutics received US$3.5 million in non-dilutive DoD funding for optimizing cryo-storage of manufactured red blood cells (mRBCs) for both military and civilian transfusion uses. Key funding from DARPA, NIH, and the DoD is boosting next-gen synthetic blood programs, summarized below with associated purposes and logistics advantages.

Synthetic Blood Substitutes and Blood Product Market Drivers

Logistics Advantage – Long Shelf Life, No Cold Chain Requirement, and Universal Compatibility Recent developments show synthetic and artificial blood substitutes making strong claims for significantly extended shelf life, reduced dependency on cold chain, and universal compatibility — which together form a compelling value proposition. For example, researchers in Japan (Nara Medical University) have developed an artificial blood product that is universal (no blood type matching required) and room-temperature stable for up to 2 years, while refrigerated storage extends its life to as much as 5 years. This compares with a standard shelf life of ~42 days for donated red blood cells under cold storage. Other projects, including ErythroMer (by KaloCyte / University of Maryland), are targeting a freeze-dried or ambient-temperature-stable whole blood substitute. This would enable medics to carry a product that can be reconstituted on demand in the field, air ambulance, or remote settings. The DoD program supporting this aims to deliver transfusion-capable formulations within ~30 minutes of injury. Statistically, some hemoglobin-based oxygen carriers in development are projected or reported to have shelf lives of 1 to 3 years at ambient or refrigerated conditions — a several-fold increase over current donor blood units. Clinical Complexity and Use-Case Specificity to Challenge Synthetic Blood Substitutes and Blood Product Market Artificial oxygen carriers (AOCs) are primarily being developed for targeted applications such as battlefield trauma and remote emergency care, rather than as broad replacements for donor blood. According to Case Western Reserve University, the DARPA-funded $46.4 million project is focused on creating a freeze-dried, room-temperature stable blood substitute that can be rapidly deployed in emergencies. This specialized focus reflects the current limitation in the addressable market: broader clinical adoption requires extensive trials, regulatory approvals, and validation across multiple medical scenarios, highlighting the product’s high clinical complexity and narrow early commercial use case.

Competitive landscape with strategic initiatives by leading players

The Synthetic Blood Substitutes and Blood Product Market is segmented into Leaders, Challengers, Followers, and Nichers based on innovation, scale, and market presence. Strategic Growth Plans for Synthetic Blood Substitutes and Blood Product Market Pricing Strategies: Implementing value-based and tiered pricing models based on end-user segments such as hospitals, defense, and emergency care. Premium pricing adopted for advanced oxygen carriers and long-shelf-life formulations, while cost-effective variants are introduced for developing healthcare markets and bulk procurement tenders. Investments: Surge in foreign direct investments (FDIs) toward biomanufacturing infrastructure, including GMP-certified modular plants, AI-enabled quality systems, and blockchain-based traceability solutions for regulatory compliance and transparency. Strategic funding directed toward clinical trial hubs and technology transfer collaborations to accelerate commercialization. R&D Focus: Innovation centered on improving biocompatibility, oxygen-carrying efficiency, and long-term storage stability. Development of next-generation synthetic platelets, recombinant hemoglobin products, and AI-integrated quality control systems to reduce production waste and enhance scalability. Emphasis on regulatory compliance, universality, and reduced immunogenic risk across formulations.

Synthetic Blood Substitutes and Blood Product Market Scope: Inquire before buying

Synthetic Blood Substitutes and Blood Product Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.2 Bn. Forecast Period 2025 to 2032 CAGR: 11.5% Market Size in 2032: USD 2.3 Bn. Segments Covered: by Type Perfluorocarbon Based Product (PFC) Haemoglobin Based Oxygen Carrier Synthetic Platelet Recombinant Factor Blood Expander by Source Animal Blood Synthetic Polymers Stem Cells Others by Application Cardiovascular Diseases Anaemia Organ Transplant Injury and Trauma Others by End-User Hospitals and Clinics Blood Banks Others Synthetic Blood Substitutes and Blood Product Market, Key Players

North America: 1. HbO2 Therapeutics 2. KaloCyte Inc. 3. NuvOx Pharma 4. OXYVITA Inc. 5. HemoBioTech Inc. 6. Prolong Pharmaceuticals 7. FluorO2 Therapeutics 8. Sangart Inc. 9. OPK Biotech 10. Erythromer Inc. 11. NanoBlood LLC 12. Dentritech 13. Haemonetics Corporation 14. HemaCare Corporation 15. Vitalant 16. Cerus Corporation 17. Baxter International Inc. Europe: 1. Hemarina 2. SpheriTech Ltd. 3. Aurum Biosciences Ltd. 4. Bio Product Laboratory 5. CSL Behring 6. Grifols S.A. 7. Octapharma AG 8. Fresenius Kabi AG 9. B. Braun Melsungen AG 10. Kedrion Biopharma 11. Biotest AG 12. LFB Group 13. Sanofi S.A. 14. Macopharma Asia Pacific: 1. Takeda Pharmaceutical Company 2. Mitsubishi Tanabe Pharma Corporation 3. Terumo Blood and Cell Technologies 4. Hualan Biological Engineering Inc. Key Questions Answered 1. What’s the near-term commercial runway for synthetic blood substitutes and blood products in hospitals, trauma care, and emergency medicine? 2. How are biotech developers protecting profit margins during costly clinical trials and regulatory approvals for synthetic blood technologies? 3. Which country or region offers the highest ROI for synthetic blood manufacturing, large-scale production, and commercialization with regulatory clarity? 4. Who’s leading the clinical adoption and direct-to-consumer (D2C) market for HBOCs, PFCs, plasma expanders, recombinant factors, and next-generation blood products? Why This Report? • 20+ country deep-dives with trade, pricing & distribution analysis (hospitals, military procurement, blood banks) • Visual segmentation by technology (HBOC, PFC, recombinant proteins, platelets), application (trauma, surgery, oncology support, remote transfusion), and region • Competitor playbook: clinical pipeline maps, strategic priorities, funding & partnering outlook • Trusted Data Sources: Industry market reports, trade statistics, defense procurement data, and clinical trial registries Strategic Recommendations • Niche First Approach: Focus on targeted trauma or military use cases for faster approvals. • Cost Leadership through Regional Partnerships: Collaborate with CMOs in India and APAC to reduce manufacturing costs.

1. Synthetic Blood Substitutes and Blood Product Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Synthetic Blood Substitutes and Blood Product Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Synthetic Blood Substitutes and Blood Product Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Synthetic Blood Substitutes and Blood Product Market: Dynamics 3.1. Synthetic Blood Substitutes and Blood Product Market Trends by Region 3.1.1. North America Synthetic Blood Substitutes and Blood Product Market Trends 3.1.2. Europe Synthetic Blood Substitutes and Blood Product Market Trends 3.1.3. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Trends 3.1.4. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Trends 3.1.5. South America Synthetic Blood Substitutes and Blood Product Market Trends 3.2. Synthetic Blood Substitutes and Blood Product Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Synthetic Blood Substitutes and Blood Product Market Drivers 3.2.1.2. North America Synthetic Blood Substitutes and Blood Product Market Restraints 3.2.1.3. North America Synthetic Blood Substitutes and Blood Product Market Opportunities 3.2.1.4. North America Synthetic Blood Substitutes and Blood Product Market Challenges 3.2.2. Europe 3.2.2.1. Europe Synthetic Blood Substitutes and Blood Product Market Drivers 3.2.2.2. Europe Synthetic Blood Substitutes and Blood Product Market Restraints 3.2.2.3. Europe Synthetic Blood Substitutes and Blood Product Market Opportunities 3.2.2.4. Europe Synthetic Blood Substitutes and Blood Product Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Drivers 3.2.3.2. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Restraints 3.2.3.3. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Opportunities 3.2.3.4. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Drivers 3.2.4.2. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Restraints 3.2.4.3. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Opportunities 3.2.4.4. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Challenges 3.2.5. South America 3.2.5.1. South America Synthetic Blood Substitutes and Blood Product Market Drivers 3.2.5.2. South America Synthetic Blood Substitutes and Blood Product Market Restraints 3.2.5.3. South America Synthetic Blood Substitutes and Blood Product Market Opportunities 3.2.5.4. South America Synthetic Blood Substitutes and Blood Product Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Synthetic Blood Substitutes and Blood Product Industry 3.8. Analysis of Government Schemes and Initiatives For Synthetic Blood Substitutes and Blood Product Industry 3.9. Synthetic Blood Substitutes and Blood Product Market Trade Analysis 3.10. The Global Pandemic Impact on Synthetic Blood Substitutes and Blood Product Market 4. Synthetic Blood Substitutes and Blood Product Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 4.1.1. Perfluorocarbon Based Product (PFC) 4.1.2. Haemoglobin Based Oxygen Carrier 4.1.3. Synthetic Platelet 4.1.4. Recombinant Factor 4.1.5. Blood Expander 4.2. Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 4.2.1. Animal Blood 4.2.2. Synthetic Polymers 4.2.3. Stem Cells 4.2.4. Others 4.3. Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 4.3.1. Cardiovascular Diseases 4.3.2. Anaemia 4.3.3. Organ Transplant 4.3.4. Injury and Trauma 4.3.5. Others 4.4. Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 4.4.1. Hospitals and Clinics 4.4.2. Blood Banks 4.4.3. Others 4.5. Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Synthetic Blood Substitutes and Blood Product Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 5.1.1. Perfluorocarbon Based Product (PFC) 5.1.2. Haemoglobin Based Oxygen Carrier 5.1.3. Synthetic Platelet 5.1.4. Recombinant Factor 5.1.5. Blood Expander 5.2. North America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 5.2.1. Animal Blood 5.2.2. Synthetic Polymers 5.2.3. Stem Cells 5.2.4. Others 5.3. North America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 5.3.1. Cardiovascular Diseases 5.3.2. Anaemia 5.3.3. Organ Transplant 5.3.4. Injury and Trauma 5.3.5. Others 5.4. North America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 5.4.1. Hospitals and Clinics 5.4.2. Blood Banks 5.4.3. Others 5.5. North America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Perfluorocarbon Based Product (PFC) 5.5.1.1.2. Haemoglobin Based Oxygen Carrier 5.5.1.1.3. Synthetic Platelet 5.5.1.1.4. Recombinant Factor 5.5.1.1.5. Blood Expander 5.5.1.2. United States Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 5.5.1.2.1. Animal Blood 5.5.1.2.2. Synthetic Polymers 5.5.1.2.3. Stem Cells 5.5.1.2.4. Others 5.5.1.3. United States Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Cardiovascular Diseases 5.5.1.3.2. Anaemia 5.5.1.3.3. Organ Transplant 5.5.1.3.4. Injury and Trauma 5.5.1.3.5. Others 5.5.1.4. United States Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Hospitals and Clinics 5.5.1.4.2. Blood Banks 5.5.1.4.3. Others 5.5.2. Canada 5.5.2.1. Canada Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Perfluorocarbon Based Product (PFC) 5.5.2.1.2. Haemoglobin Based Oxygen Carrier 5.5.2.1.3. Synthetic Platelet 5.5.2.1.4. Recombinant Factor 5.5.2.1.5. Blood Expander 5.5.2.2. Canada Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 5.5.2.2.1. Animal Blood 5.5.2.2.2. Synthetic Polymers 5.5.2.2.3. Stem Cells 5.5.2.2.4. Others 5.5.2.3. Canada Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Cardiovascular Diseases 5.5.2.3.2. Anaemia 5.5.2.3.3. Organ Transplant 5.5.2.3.4. Injury and Trauma 5.5.2.3.5. Others 5.5.2.4. Canada Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Hospitals and Clinics 5.5.2.4.2. Blood Banks 5.5.2.4.3. Others 5.5.3. Mexico 5.5.3.1. Mexico Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Perfluorocarbon Based Product (PFC) 5.5.3.1.2. Haemoglobin Based Oxygen Carrier 5.5.3.1.3. Synthetic Platelet 5.5.3.1.4. Recombinant Factor 5.5.3.1.5. Blood Expander 5.5.3.2. Mexico Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 5.5.3.2.1. Animal Blood 5.5.3.2.2. Synthetic Polymers 5.5.3.2.3. Stem Cells 5.5.3.2.4. Others 5.5.3.3. Mexico Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Cardiovascular Diseases 5.5.3.3.2. Anaemia 5.5.3.3.3. Organ Transplant 5.5.3.3.4. Injury and Trauma 5.5.3.3.5. Others 5.5.3.4. Mexico Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Hospitals and Clinics 5.5.3.4.2. Blood Banks 5.5.3.4.3. Others 6. Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.2. Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.3. Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.4. Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5. Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.1.3. United Kingdom Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.2.3. France Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.3.3. Germany Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.4.3. Italy Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.5.3. Spain Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.6.3. Sweden Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.7.3. Austria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 6.5.8.3. Rest of Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.3. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.1.3. China Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.2.3. S Korea Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.3.3. Japan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.4.3. India Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.5.3. Australia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.6.3. Indonesia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.7.3. Malaysia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.8.3. Vietnam Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.9.3. Taiwan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 7.5.10.3. Rest of Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 8.3. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 8.5.1.3. South Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 8.5.2.3. GCC Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 8.5.3.3. Nigeria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 8.5.4.3. Rest of ME&A Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 9. South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 9.2. South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 9.3. South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application(2024-2032) 9.4. South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 9.5. South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 9.5.1.3. Brazil Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 9.5.2.3. Argentina Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Source (2024-2032) 9.5.3.3. Rest Of South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Synthetic Blood Substitutes and Blood Product Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. HbO2 Therapeutics 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. KaloCyte Inc. 10.3. NuvOx Pharma 10.4. OXYVITA Inc. 10.5. HemoBioTech Inc. 10.6. Prolong Pharmaceuticals 10.7. FluorO2 Therapeutics 10.8. Sangart Inc. 10.9. OPK Biotech 10.10. Erythromer Inc. 10.11. NanoBlood LLC 10.12. Dentritech 10.13. Haemonetics Corporation 10.14. HemaCare Corporation 10.15. Vitalant 10.16. Cerus Corporation 10.17. Baxter International Inc. 10.18. Hemarina 10.19. SpheriTech Ltd. 10.20. Aurum Biosciences Ltd. 10.21. Bio Product Laboratory 10.22. CSL Behring 10.23. Grifols S.A. 10.24. Octapharma AG 10.25. Fresenius Kabi AG 10.26. B. Braun Melsungen AG 10.27. Kedrion Biopharma 10.28. Biotest AG 10.29. LFB Group 10.30. Sanofi S.A. 10.31. Macopharma 10.32. Takeda Pharmaceutical Company 10.33. Mitsubishi Tanabe Pharma Corporation 10.34. Terumo Blood and Cell Technologies 10.35. Hualan Biological Engineering Inc. 11. Key Findings 12. Industry Recommendations 13. Synthetic Blood Substitutes and Blood Product Market: Research Methodology 14. Terms and Glossary