The Small Modular Reactor Market size was valued at USD 6.08 Billion in 2024, and the total Small Modular Reactor revenue is expected to grow at a CAGR of 3.2 % from 2025 to 2032, reaching nearly USD 7.82 Billion.Small Modular Reactor Market Overview

Small Modular Reactors (Small modular reactor) are compact, factory-fabricated nuclear reactors designed for scalable deployment. They offer flexible power generation, lower capital investment, and enhanced safety. Applications include electricity generation, district heating, desalination, and hydrogen production. End-use industries include energy utilities, chemical processing, remote mining operations, and military and marine propulsion systems. The Small Modular Reactor Market has been growing due to the rising demand for clean, flexible, and reliable energy solutions. Small modular reactor present a cost-effective and safer alternative to traditional large-scale nuclear plants. Their modular nature allows for reduced on-site construction time and scalability, ideal for remote locations and industrial use. Governments worldwide are investing in SMR projects to achieve decarbonization goals and energy security. The Small Modular Reactor market is driven by advancements in reactor design, supportive regulatory frameworks, and public-private partnerships. North America and Europe are early adopters, while Asia-Pacific is expected to witness rapid growth due to industrialization and energy diversification efforts. Key players Small Modular Reactor Industry include NuScale Power, Rolls-Royce SMR, Terrestrial Energy, and GE Hitachi. In 2024, GE Hitachi partnered with Ontario Power Generation to advance the BWRX-300 SMR, marking a pivotal step toward commercial deployment and grid integration in Canada.To know about the Research Methodology :- Request Free Sample Report

Small Modular Reactor Market Dynamics

Increasing Demand for Clean, Reliable Energy to Drive the Small Modular Reactor (SMR) Market The increasing global demand for clean, reliable, and flexible power generation has been driving the Small Modular Reactor Market growth. As countries strive to meet ambitious decarbonization targets and reduce dependence on fossil fuels, Small modular reactors offer a compelling solution. The conventional nuclear plants, Small modular reactors, are designed with smaller footprints, enhanced safety features, and modular scalability, making them suitable for remote locations, off-grid areas, and integration with renewable energy sources. Governments and utility providers are recognizing Small modular reactors as a low-carbon alternative that can operate consistently, regardless of weather conditions, unlike solar or wind. This makes Small modular reactor ideal for stabilizing power grids and supporting industrial and district heating applications. The international efforts, such as the U.S. Department of Energy’s Advanced Reactor Demonstration Program and support from countries such as Canada, the UK, and Japan, have accelerated the commercialization of SMR technologies. As the world moves toward achieving net-zero goals by mid-century, the ability of Small modular reactor to deliver zero-emission baseload power with economic and siting flexibility positions them as a central driver in the future of global energy systems. Global Rising Momentum in Small Modular Reactor Deployment to Drive Decarbonization and Industrial Energy Transition Small Modular Reactors (Small modular reactor) are emerging as a pivotal solution in the global energy transition, addressing both the urgent need for decarbonization and increasing electricity demand. With compact designs offering outputs between 10–300 MWe, Small modular reactor is gaining traction due to their modular, standardized, and factory-built nature, enabling faster, more predictable deployments. More than 50 SMR concepts are currently under development, demonstrating the growing confidence in their technological maturity and versatility. A critical driver is the demand from heavy industries, data centers, and global tech companies such as Microsoft and Google, all seeking reliable, zero-emission energy sources that fit existing infrastructure. Small modular reactor is uniquely positioned to repower decommissioned coal sites or integrate with chemical, steel, and hydrogen facilities, offering cogeneration of electricity, heat, and steam. Unlocking their full potential hinges on building a global Small Modular Reactor market, supported by fit-for-purpose licensing, financing innovations, and international collaboration. The World Economic Forum’s new framework aims to accelerate this process by aligning stakeholders on standardized design, delivery, and regulatory pathways. As countries commit to tripling nuclear capacity by 2050, Small modular reactors play a transformative role in reshaping global energy systems and industrial decarbonization. Decentralized Energy Access in Remote Regions to Create a Lucrative Opportunity for Market Growth The traditional large-scale nuclear power plants, Small modular reactor offer flexible deployment with lower capital requirements and a smaller footprint, making them ideal for isolated communities, island nations, and mining operations. Addressing energy access gaps in remote and off-grid regions is expected to boost the Small Modular Reactor market growth. With modular design and factory fabrication, these reactors have been transported to locations that are otherwise inaccessible to conventional energy infrastructure. This presents governments and private entities with the chance to provide clean, reliable power while reducing dependency on diesel or coal-based generation. As global attention intensifies on energy equity and decarbonization, Small modular reactor uniquely position themselves as scalable solutions to electrify the underserved. Technological innovation is a cornerstone of the Small Modular Reactor market, with developments focusing on advanced reactor types such as pressurized water reactors (PWRs), high-temperature gas-cooled reactors (HTGRs), and molten salt reactors (MSRs). PWR-based Small modular reactor, such as NuScale’s VOYGR design, emphasize passive safety features and scalability. The MSRs explored by Terrestrial Energy offer high thermal efficiency and fuel flexibility, enabling long-duration operation with minimal refuelling. Additionally, lead-cooled fast reactors and sodium-cooled reactors are being researched for their potential in waste reduction and superior performance. These technologies are pushing the boundaries of nuclear energy by enabling safer, more adaptable, and proliferation-resistant designs.Types of Small Modular Reactor (SMR) Technologies

Major players in the Small Modular Reactor market are channelling substantial resources into research and development to gain a technological edge. NuScale Power, a pioneer in PWR-based Small modular reactor, has attracted over $1.4 billion in funding, including substantial support from the U.S. Department of Energy (DOE). Rolls-Royce is spearheading the UK’s SMR program with a vision to deploy its reactors by the early 2030s, investing over USD 586.51 million into modular reactor design and manufacturing. In Canada, Terrestrial Energy and Moltex Energy are advancing MSR technologies, supported by funding from Sustainable Development Technology Canada (SDTC). China’s CNNC is actively working on its ACP100 SMR and recently began construction of a demonstration plant. These investments underscore the accelerating momentum and confidence in Small modular reactor as next-generation clean energy sources.Small Modular Reactor Market Segment Analysis

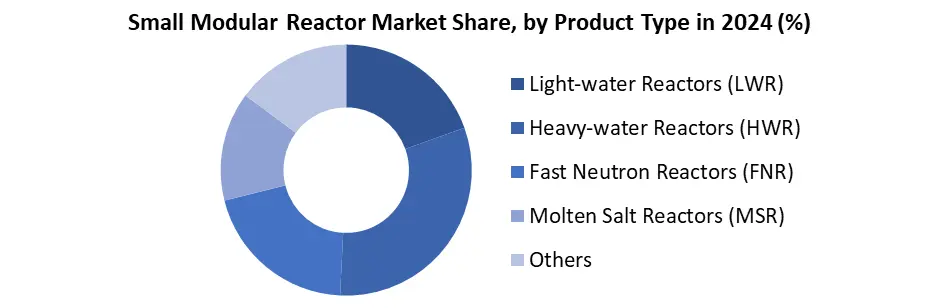

Based on product type, the heavy water reactors segment held the largest Small Modular Reactor Market share at xx% in 2024 and is expected to grow during the forecast period. This dominance is due to their ability to use natural uranium efficiently, eliminating the need for costly enrichment processes, an advantage particularly appealing to regions with abundant natural uranium but limited enrichment infrastructure. Additionally, heavy water reactors offer superior neutron economy, enabling higher fuel burn-up rates and extended operational cycles, which enhance fuel efficiency and minimize nuclear waste. The demand for light water Small modular reactor is expected to grow at the fastest rate between 2024 and 2032. Their compatibility with existing nuclear infrastructure and established global fuel supply chains supports seamless integration. Their proven safety record and mature regulatory frameworks further accelerate adoption.

Small Modular Reactor Market Regional Analysis

North America held the largest Small Modular Reactor Market share in 2024. The region's push for clean energy and decarbonization is the primary driving factor of market growth. Small Modular Reactors are gaining traction as a viable replacement for aging fossil fuel infrastructure. The U.S. Small Modular Reactor Industry is expected to grow at a CAGR of xx%, fueled by supportive federal and state policies, significant R&D funding, and net-zero emission goals. The strong government initiatives and the presence of leading SMR developers are expected to boost the segment. The U.S. is home to several private enterprises that have secured regulatory and R&D approvals, accelerating commercialization. The growth is moderated by factors such as complex licensing procedures, high upfront costs, long deployment timelines, and public skepticism about nuclear safety. Despite these, the region remains pivotal to global SMR advancements due to its innovation ecosystem and policy support.Small Modular Reactor Market Competitive Landscape:

The Small Modular Reactor Market is moderately consolidated, dominated by a few key players leveraging strong technological expertise and robust capital backing. Notable players include NuScale Power, Rolls-Royce SMR, GE Hitachi Nuclear Energy, Rosatom, and Terrestrial Energy. NuScale currently holds a leading position due to its early design approvals and partnerships with U.S. and international utilities. Rolls-Royce SMR is aggressively expanding in Europe with government backing, while GE Hitachi benefits from mature nuclear technology integration with digital systems. Rosatom dominates in Russia and emerging economies through state-funded initiatives and export deals. Market share remains dynamic, as commercial deployment is still nascent, but competitive positioning is being shaped by regulatory approvals, intellectual property, strategic alliances, and supply chain readiness. The landscape is further influenced by national energy policies, geopolitical alliances, and innovation in reactor safety and modularization. Players with scalable models and first-mover advantages are likely to secure long-term dominance.Recent Developments in the Small Modular Reactor

Date Recent Developments June 2024 – KEPCO Engineering & Construction Co., Inc. and Rwanda KEPCO Engineering & Construction signed a Memorandum of Understanding (MoU) with the Government of Rwanda during the Korea-Africa Summit. The agreement focuses on collaboration in the development of Small Modular Reactors (Small modular reactor) and Used Battery Energy Storage Systems (UBESS). Both parties committed to technical cooperation, personnel exchange, and business collaboration to support Rwanda’s energy infrastructure development and address its growing electricity demand. July 2023 – X-energy and Energy Northwest (USA) X-energy entered into a joint development agreement with Energy Northwest to deploy up to 12 Xe-100 advanced Small modular reactor in central Washington State. These reactors are expected to generate a total of 960 megawatts of carbon-free electricity by 2030. The initiative aims to enhance the region’s clean energy grid, meet rising energy demands, and create new job opportunities in the clean energy sector. Small Modular Reactor Market Scope: Inquire before buying

Small Modular Reactor Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.08 Bn. Forecast Period 2025 to 2032 CAGR: 3.2% Market Size in 2032: USD 7.82 Bn. Segments Covered: by Product Type Light-water Reactors (LWR) Heavy-water Reactors (HWR) Fast Neutron Reactors (FNR) Molten Salt Reactors (MSR) Others by Deployment Mode Single-module Multi-module by Location Onshore Offshore by Application Power Generation Desalination District Heating Hydrogen Production Others Small Modular Reactor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Thailand, Philippines, and Rest of APAC) South America (Brazil, Argentina, Rest of South America) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, Rest of MEA)Small Modular Reactor Market Key Players

1. NuScale Power 2. TerraPower 3. GE Hitachi Nuclear Energy 4. X-energy 5. Fluor Corporation 6. ARC Energy LLC 7. Westinghouse Electric Company 8. Holtec International 9. Kairos Power 10. BWX Technologies, Inc. 11. Ultra Safe Nuclear Corporation (USNC) 12. General Atomics 13. Rolls-Royce SMR Ltd 14. Moltex Energy 15. LeadCold Reactors 16. EDF (Électricité de France) 17. Rosatom (JSC Afrikantov OKBM) 18. Korea Atomic Energy Research Institute (KAERI) 19. Samsung Heavy Industries 20. Mitsubishi Heavy Industries 21. Toshiba Energy Systems & Solutions Corp. 22. Hitachi Ltd. 23. Seaborg Technologies 24. Newcleo 25. Copenhagen Atomics 26. China National Nuclear Corporation 27. OthersFrequently Asked Questions:

1) What is the Small Modular Reactor market size, and what is the expected growth? Ans: The Small modular reactor market was valued at USD 6.08 Billion in 2024 and is projected to reach nearly USD 7.82 Billion by 2032, growing at a CAGR of 3.2%. 2) What makes Small Modular Reactors attractive compared to conventional nuclear plants? Ans: Small modular reactor offer modular construction, enhanced safety, lower capital investment, and quicker deployment, making them ideal for remote areas and industrial applications. 3) Which regions are expected to lead the Small Modular Reactor market growth? Ans: North America and Europe are early adopters, while Asia-Pacific is expected to experience rapid growth due to industrial expansion and clean energy goals. 4) Who are the major players in the global Small Modular Reactor market? Ans: Key players include NuScale Power, Rolls-Royce SMR, GE Hitachi Nuclear Energy, Terrestrial Energy, and Rosatom, all leading in development, partnerships, and regulatory approvals. 5) What are the key challenges facing Small Modular Reactor commercialization? Ans: The Small Modular Reactor Market faces hurdles such as complex licensing frameworks, high upfront costs, long construction timelines, and public concerns regarding nuclear safety.

1. Small Modular Reactor Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Small Modular Reactor Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2024 2.2.6. Market Share (%) 2.2.7. Technological Advancements 2.2.8. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Small Modular Reactor Market: Dynamics 3.1. Small Modular Reactor Market Trends 3.2. Small Modular Reactor Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis For the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Small Modular Reactor Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2024-2032) 4.1. Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Light-water Reactors (LWR) 4.1.2. Heavy-water Reactors (HWR) 4.1.3. Fast Neutron Reactors (FNR) 4.1.4. Molten Salt Reactors (MSR) 4.1.5. Others 4.2. Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 4.2.1. Single-module 4.2.2. Multi-module 4.3. Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 4.3.1. Onshore 4.3.2. Offshore 4.4. Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 4.4.1. Power Generation 4.4.2. Desalination 4.4.3. District Heating 4.4.4. Hydrogen Production 4.4.5. Others 4.5. Small Modular Reactor Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Small Modular Reactor Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2024-2032) 5.1. North America Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Light-water Reactors (LWR) 5.1.2. Heavy-water Reactors (HWR) 5.1.3. Fast Neutron Reactors (FNR) 5.1.4. Molten Salt Reactors (MSR) 5.1.5. Others 5.2. North America Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 5.2.1. Single-module 5.2.2. Multi-module 5.3. North America Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 5.3.1. Onshore 5.3.2. Offshore 5.4. North America Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 5.4.1. Power Generation 5.4.2. Desalination 5.4.3. District Heating 5.4.4. Hydrogen Production 5.4.5. Others 5.5. North America Small Modular Reactor Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 5.5.1.1.1. Light-water Reactors (LWR) 5.5.1.1.2. Heavy-water Reactors (HWR) 5.5.1.1.3. Fast Neutron Reactors (FNR) 5.5.1.1.4. Molten Salt Reactors (MSR) 5.5.1.1.5. Others 5.5.1.2. United States Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 5.5.1.2.1. Single-module 5.5.1.2.2. Multi-module 5.5.1.3. United States Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 5.5.1.3.1. Onshore 5.5.1.3.2. Offshore 5.5.1.4. United States Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. Power Generation 5.5.1.4.2. Desalination 5.5.1.4.3. District Heating 5.5.1.4.4. Hydrogen Production 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 5.5.2.1.1. Light-water Reactors (LWR) 5.5.2.1.2. Heavy-water Reactors (HWR) 5.5.2.1.3. Fast Neutron Reactors (FNR) 5.5.2.1.4. Molten Salt Reactors (MSR) 5.5.2.1.5. Others 5.5.2.2. Canada Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 5.5.2.2.1. Single-module 5.5.2.2.2. Multi-module 5.5.2.3. Canada Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 5.5.2.3.1. Onshore 5.5.2.3.2. Offshore 5.5.2.4. Canada Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. Power Generation 5.5.2.4.2. Desalination 5.5.2.4.3. District Heating 5.5.2.4.4. Hydrogen Production 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 5.5.3.1.1. Light-water Reactors (LWR) 5.5.3.1.2. Heavy-water Reactors (HWR) 5.5.3.1.3. Fast Neutron Reactors (FNR) 5.5.3.1.4. Molten Salt Reactors (MSR) 5.5.3.1.5. Others 5.5.3.2. Mexico Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 5.5.3.2.1. Single-module 5.5.3.2.2. Multi-module 5.5.3.3. Mexico Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 5.5.3.3.1. Onshore 5.5.3.3.2. Offshore 5.5.3.4. Mexico Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. Power Generation 5.5.3.4.2. Desalination 5.5.3.4.3. District Heating 5.5.3.4.4. Hydrogen Production 5.5.3.4.5. Others 6. Europe Small Modular Reactor Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2024-2032) 6.1. Europe Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.3. Europe Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.4. Europe Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5. Europe Small Modular Reactor Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.1.2. United Kingdom Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.1.3. United Kingdom Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.1.4. United Kingdom Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.2.2. France Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.2.3. France Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.2.4. France Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.3.2. Germany Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.3.3. Germany Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.3.4. Germany Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.4.2. Italy Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.4.3. Italy Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.4.4. Italy Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.5.2. Spain Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.5.3. Spain Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.5.4. Spain Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.6.2. Sweden Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.6.3. Sweden Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.6.4. Sweden Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.7.2. Russia Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.7.3. Russia Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.7.4. Russia Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 6.5.8.2. Rest of Europe Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 6.5.8.3. Rest of Europe Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 6.5.8.4. Rest of Europe Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Small Modular Reactor Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2024-2032) 7.1. Asia Pacific Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.3. Asia Pacific Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.4. Asia Pacific Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Small Modular Reactor Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.1.2. China Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.1.3. China Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.1.4. China Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.2.2. S Korea Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.2.3. S Korea Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.2.4. S Korea Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.3.2. Japan Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.3.3. Japan Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.3.4. Japan Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.4.2. India Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.4.3. India Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.4.4. India Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.5.2. Australia Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.5.3. Australia Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.5.4. Australia Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.6.2. Indonesia Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.6.3. Indonesia Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.6.4. Indonesia Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.7.2. Malaysia Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.7.3. Malaysia Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.7.4. Malaysia Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.8.2. Philippines Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.8.3. Philippines Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.8.4. Philippines Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.9.2. Thailand Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.9.3. Thailand Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.9.4. Thailand Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.10.2. Vietnam Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.10.3. Vietnam Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.10.4. Vietnam Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 7.5.11.3. Rest of Asia Pacific Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 7.5.11.4. Rest of Asia Pacific Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Small Modular Reactor Market Size and Forecast (by Value in USD Million and Volume Units) (2024-2032 8.1. Middle East and Africa Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 8.3. Middle East and Africa Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 8.4. Middle East and Africa Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Small Modular Reactor Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 8.5.1.2. South Africa Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 8.5.1.3. South Africa Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 8.5.1.4. South Africa Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 8.5.2.2. GCC Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 8.5.2.3. GCC Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 8.5.2.4. GCC Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 8.5.3.2. Egypt Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 8.5.3.3. Egypt Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 8.5.3.4. Egypt Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 8.5.4.2. Nigeria Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 8.5.4.3. Nigeria Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 8.5.4.4. Nigeria Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 8.5.5.2. Rest of ME&A Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 8.5.5.3. Rest of ME&A Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 8.5.5.4. Rest of ME&A Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 9. South America Small Modular Reactor Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2024-2032 9.1. South America Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 9.3. South America Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 9.4. South America Small Modular Reactor Market Size and Forecast, By End User (2024-2032) 9.5. South America Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 9.6. South America Small Modular Reactor Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 9.6.1.2. Brazil Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 9.6.1.3. Brazil Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 9.6.1.4. Brazil Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 9.6.2.2. Argentina Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 9.6.2.3. Argentina Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 9.6.2.4. Argentina Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 9.6.3. Colombia 9.6.3.1. Colombia Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 9.6.3.2. Colombia Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 9.6.3.3. Colombia Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 9.6.3.4. Colombia Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 9.6.4. Chile 9.6.4.1. Chile Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 9.6.4.2. Chile Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 9.6.4.3. Chile Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 9.6.4.4. Chile Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 9.6.5. Rest Of South America 9.6.5.1. Rest Of South America Small Modular Reactor Market Size and Forecast, By Product Type (2024-2032) 9.6.5.2. Rest Of South America Small Modular Reactor Market Size and Forecast, By Deployment Mode (2024-2032) 9.6.5.3. Rest Of South America Small Modular Reactor Market Size and Forecast, By Location (2024-2032) 9.6.5.4. Rest Of South America Small Modular Reactor Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. NuScale Power 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. TerraPower 10.3. GE Hitachi Nuclear Energy 10.4. X-energy 10.5. Westinghouse Electric Company 10.6. Holtec International 10.7. Kairos Power 10.8. BWX Technologies, Inc. 10.9. Ultra Safe Nuclear Corporation (USNC) 10.10. General Atomics 10.11. Rolls-Royce SMR Ltd 10.12. Moltex Energy 10.13. LeadCold Reactors 10.14. EDF (Électricité de France) 10.15. Rosatom (JSC Afrikantov OKBM) 10.16. Korea Atomic Energy Research Institute (KAERI) 10.17. Samsung Heavy Industries 10.18. Mitsubishi Heavy Industries 10.19. Toshiba Energy Systems & Solutions Corp. 10.20. Hitachi Ltd. 10.21. Seaborg Technologies 10.22. Newcleo 10.23. Copenhagen Atomics 10.24. China National Nuclear Corporation 10.25. Fluor Corporation 10.26. ARC Energy LLC 10.27. Others 11. Key Findings 12. Analyst Recommendations 13. Small Modular Reactor Market: Research Methodology