The global shipbuilding market reached USD 162.14 billion in 2024 and is expected to grow to USD 228.82 billion by 2032, at a CAGR of 4.4%. This report covers shipbuilding market size, share, growth, trends, forecast 2025–2032, key players, regional insights, commercial and naval segments, and technological advancements.Shipbuilding Market Overview

Shipbuilding is the process of designing, constructing, and launching ships and marine vessels, using specialized materials, technologies, and shipyards to produce commercial, military, and offshore vessels for global maritime operations. The global shipbuilding market is a critical component of maritime transport and global trade, supporting over 90% of world cargo movement and driving economic connectivity across regions. The Asia Pacific market is leading due to China’s dominance, holding 53% of the global market share, followed by South Korea at 28% and Japan at 12%. However, despite strong shipbuilding Industry growth, the sector faces significant challenges, including market volatility, excess shipyard capacity, rising costs, and disruptions caused by geopolitical tensions such as the Russia-Ukraine conflict and attacks affecting Red Sea shipping routes. Environmental pressure is accelerating green shipbuilding, boosting demand in the LNG-powered vessels market and autonomous ships market, while digitalization in shipbuilding and Industry 4.0 in shipyards reshape efficiency and competitiveness.To know about the Research Methodology:-Request Free Sample Report

Trend: Green Shipbuilding & Digital Transformation

As IMO emission rules tighten, shipbuilders are investing heavily in LNG-powered vessels, hybrid propulsion systems, wind-assisted technologies, and alternative fuels such as ammonia and methanol. This trend is especially strong in the Asia Pacific shipbuilding market, where China, South Korea, and Japan lead in energy-efficient vessel production. The adoption of digitalization in shipbuilding, including AI-based production planning, digital twins, robotics, and 3D printing, is redefining manufacturing efficiency. These advancements reduce operational costs and shorten construction timelines, directly supporting shipbuilding Industry growth. Demand for autonomous ships and unmanned surface vessels is also rising, creating opportunities for naval shipbuilding and offshore support vessels. Europe is focusing on sustainable cruise shipbuilding, while North America emphasizes smarter naval systems.Driver: Rising Seaborne Trade & Strategic Government Support

The shipbuilding market growth is the continuous rise in international seaborne trade, driven by global supply chains, containerization, and energy transportation. More than 90% of global trade by volume moves by sea, increasing demand for cargo ships, tankers, LNG carriers, and container vessels. The Asia Pacific market benefits the most from this surge, with China holding the largest shipbuilding market share globally. China’s shipyards produced more commercial tonnage in 2024 than the entire U.S. shipbuilding industry has built since World War II, underlining its dominance in both commercial and naval shipbuilding. Government support is another major driver. Nations such as India, targeting a 5% global shipbuilding Industry share by 2032, South Korea, Japan, and the European Union are implementing subsidies, tax incentives, green financing, and modernization programs. These policies support shipbuilding industry analysis showing increased investments in shipyard expansion, digitalization, and LNG-powered vessels. Strengthening maritime security and naval modernization initiatives further boost demand for military and patrol vessels. Shortage of Skilled Workforce & Rising Labor Costs to Restrain the Shipbuilding Market A significant restraint limiting the global shipbuilding market growth is the growing shortage of skilled labor across major shipbuilding regions. Shipbuilding is a highly specialized industry requiring welders, naval architects, marine engineers, designers, and technicians trained in advanced manufacturing. However, many traditional shipbuilding nations are facing an aging workforce, declining vocational enrollment, and difficulty attracting younger talent. This shortage impacts production timelines, raises operational costs, and widens the productivity gap between countries. In markets like Europe, Japan, South Korea, and North America, shipbuilding labor costs have increased by 15–25% over the last five years, reducing competitiveness against low-cost hubs such as China. As China dominates the Asia Pacific market with an abundant labor pool and government-backed training programs, competitors struggle to match delivery speed and pricing. Even emerging shipbuilders such as India, which targets a 5% share in the global shipbuilding market by 2032, face shortages of certified welders, marine electricians, and digital manufacturing specialists. The shift toward digitalization in shipbuilding, autonomous ships, and Industry 4.0 technologies intensifies the skill gap, as shipyards need advanced digital and AI-based expertise.Shipbuilding Market Segment Analysis

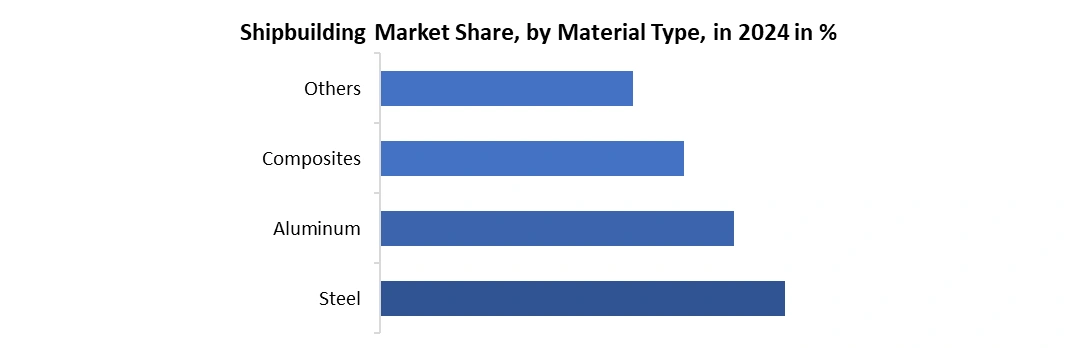

By Ship Type, the market is segmented into Tankers, Bulk Carriers, Container Ships, Cargo Ships, Passenger Ships and Others. Container Type is expected to dominate the Shipbuilding market over the forecast period. The rising demand for fast, efficient, and high-capacity vessels to support the expansion of global trade networks. Container ships accounted for over 34–36% of total new shipbuilding orders in 2024, making them the single largest segment by order volume. The segment benefits from strong investments in global logistics, the shift toward mega-container ships, and increased e-commerce demand. Asian shipyards especially in China and South Korea received the highest volume of container ship orders, with China alone capturing more than 70% of all container ship CGT orders. Rising requirements for dual-fuel LNG and methanol-ready containerships have also increased demand for technologically advanced vessels. In 2024, over 45% of all alternative-fuel newbuild orders were for container ships, highlighting a rapid transformation toward greener maritime operations. Mega-vessels in the 15,000–24,000 TEU class dominate new orders because they offer lower cost-per-container, higher fuel efficiency, and compliance with IMO emission targets.By Material Type, the market is categorized into Steel, Aluminum, Composites, and Others. Steel dominated the Shipbuilding Market in 2024. Steel is the dominant material type in the shipbuilding industry, accounting for over 85% of all materials used in new ship constructions in 2024–2025. Its dominance stems from its exceptional strength, structural durability, cost-effectiveness, and suitability for large and heavy oceangoing vessels. Whether it is tankers, bulk carriers, container ships, or naval vessels, steel forms the core structural framework due to its high load-bearing capacity and resistance to impact and harsh marine conditions. In 2024, global consumption of marine-grade steel in shipbuilding exceeded 23 million tonnes, with China contributing nearly 45% of the world’s shipbuilding steel demand due to its massive shipyard capacity. Steel plates and sections represent the primary materials in hull fabrication, accounting for 70–75% of a vessel’s total structural weight. Furthermore, advanced grades such as high-tensile steel (HTS) and EH36 marine steel are widely used in modern vessels to reduce weight while enhancing safety and fuel efficiency. The shift toward LNG-fuelled and large-capacity container ships, which require thick and specialized steel grades for cryogenic safety and structural stability, strengthens steel’s market dominance.

Shipbuilding Market Regional Insights

Asia Pacific dominated the Shipbuilding Market in 2024 and is expected to continue its dominance over the forecast period. The Asia Pacific shipbuilding market remains the undisputed global leader, accounting for the majority of the world’s vessel production, with China, South Korea, and Japan collectively dominating more than 93% of global shipbuilding output. In 2023, China alone built over 36 million gross tons (GT) of merchant ships, representing approximately 53% of the global market share and delivering around 150 of the world’s largest container vessels, surpassing the entire U.S. shipbuilding output since World War II. South Korea followed as the second-largest producer with approximately 18 million GT and a 28% market share, driven by technologically advanced LNG carriers, eco-friendly ships, and complex high-value vessels built by industry giants like Hyundai Heavy Industries, the world’s largest shipbuilder. Japan ranked third with around 10 million GT and a 12% market share, supported by shipyards such as Mitsubishi Heavy Industries, known for energy-efficient LNG ship designs and hybrid propulsion systems. In 2024, global shipbuilding demand surged with orders worth USD 204 billion, marking the highest order intake in 17 years, and the Asia Pacific region captured the largest share of these contracts, fueled by container ships, gas carriers, cruise ships, bulk carriers, and specialized vessels. China’s dual-use shipyards exported 75% of their output to foreign buyers, funnelling billions into its naval-industrial base and accelerating its military-civil fusion strategy, while South Korea and Japan deepened industrial partnerships with the United States through multi-billion-dollar investment frameworks such as Japan’s USD 550 billion strategic pact and South Korea’s USD 350 billion trade commitment to strengthen shipbuilding supply chains. With countries like India also targeting a 5% share of the global shipbuilding market by 2030, the Asia Pacific region continues to set the global benchmark in production scale, technological innovation, and green shipbuilding leadership, reaffirming its position as the core of the world’s shipbuilding ecosystem. Top 5 Dominating Shipbuilding Nations (2025)

Rank(2025) Country 2024 CGT / Market Share Key Strengths Strategic Focus Areas (2025) Major Challenges 1 China 46.45 million CGT (70% share) Largest workforce; strong govt support; high R&D; full-range shipbuilding capability; huge yard capacity Green ships, LNG/LPG/fuel-flexible vessels, digital shipyards, autonomous ships US tariff concerns; overcapacity risk 2 South Korea 10.98 million CGT (17% share) High-tech vessels, leadership in LNG carriers, strong engineering, and advanced ship systems AI-enabled ship intelligence, CCS-ready designs, ammonia/LPG carriers Labour shortages, stiff price competition from China 3 Japan 8.38 million CGT (13% share) Expertise in specialised vessels, advanced technology, and high-quality production Autonomous ships, eco-friendly carriers, industry consolidation, and increasing order share to 20% by 2030 Ageing workforce; limited labour supply 4 Philippines 805,938 GT output (2023); 4% more ships built in 2024 Competitive labour costs, strong foreign investment, large coastline, strong ship repair & medium-sized vessel capability Bulk carriers, tankers, passenger vessels, small–mid-size exports Dependence on foreign yards; infrastructure constraints 5 Vietnam Domestic capacity: 3.5 million tonnes; rising global share Strong government incentives, improving maritime infrastructure, and competitive costs General cargo ships, LPG carriers, service vessels, tech upgrades, localisation Outdated technology gaps; dependence on imported materials Shipbuilding Market Competitive Landscape

The global market is highly consolidated, dominated by major Asian players who hold the largest shipbuilding market share and shape market trends. China leads through state-owned shipbuilding companies, supported by massive Asia Pacific shipyard capacity, giving it a strong advantage in both commercial shipbuilding and naval shipbuilding. South Korea remains competitive in high-value vessels such as LNG carriers, leveraging advanced technology and strong shipbuilding by propulsion capabilities, while Japan focuses on energy-efficient designs and hybrid propulsion, strengthening its position in the Japan shipbuilding industry analysis. Europe maintains specialization in cruise vessels within the European shipbuilding market, led by companies like Fincantieri in Italy.Recent Developments

• September 12, 2023, Hyundai Heavy Industries (HHI) unveiled its advanced HCX-23 trimaran concept, marking a major step in stealth-focused naval design. Previously showcased at MADEX 2023, the HCX-23 features a stealthy trimaran hull, a retractable radar system, and drone-support capabilities, including space for quadcopters and a VTOL-compatible flight deck. The vessel integrates launch systems for USVs and UUVs and is powered by dual water-jet propulsion. Measuring 130 m in length with a 6,000-tonne displacement, it is armed with a laser weapon system and a 48-cell KVLS-I/II vertical launch system, highlighting HHI’s innovation in next-generation naval platforms. • July 9, 2025, China has moved closer to forming the world’s largest shipbuilding conglomerate after the Shanghai Stock Exchange approved the merger of China State Shipbuilding Corporation (CSSC) and China Shipbuilding Industry Corporation (CSIC). Valued at 115.2 billion yuan (USD 16 billion), the deal sees CSSC absorb all CSIC assets, liabilities, and employees, with CSIC delisting. The combined entity will hold RMB 400 billion (USD 56 billion) in assets and generate RMB 130 billion in annual revenue. In 2024, the two firms secured 257 ships (28.61 million DWT), representing 17% of global orders, solidifying China’s shipbuilding dominance.Shipbuilding Market Scope: Inquire before buying

Global Shipbuilding Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 162.14 Bn. Forecast Period 2025 to 2032 CAGR: 4.4% Market Size in 2032: USD 228.82 Bn. Segments Covered: by Ship Type Tankers Bulk Carriers Container Ships Cargo Ships Passenger Ships Others by Material Type Steel Aluminum Composites Others by Process Designing Planning Cutting & Welding Assembly & Outfitting Launching Testing & Trials Others by Propulsion Technology Conventional Dual-Fuel LNG Hybrid/Electric Others by End User Transport / Commercial Military Offshore Others Shipbuilding Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Shipbuilding Key Players

1. HD Hyundai Heavy Industries 2. Samsung Heavy Industries 3. Hanwha Ocean 4. Hyundai Mipo Dockyard 5. Hyundai Samho Heavy Industries 6. China State Shipbuilding Corporation (CSSC) 7. China Shipbuilding Industry Corporation (CSIC) 8. Jiangnan Shipyard 9. Hudong-Zhonghua Shipbuilding 10. COSCO Shipping Heavy Industry 11. Yangzijiang Shipbuilding 12. New Times Shipbuilding 13. Dalian Shipbuilding Industry Company 14. Bohai Shipbuilding Heavy Industry 15. Imabari Shipbuilding 16. Japan Marine United Corporation 17. Mitsui E&S Shipbuilding 18. Mitsubishi Heavy Industries 19. Oshima Shipbuilding 20. Tsuneishi Shipbuilding 21. Fincantieri S.p.A. 22. Damen Shipyards Group 23. Lürssen Werft 24. Meyer Werft 25. Austal Limited 26. Cochin Shipyard Limited 27. Garden Reach Shipbuilders & Engineers (GRSE) 28. Mazagon Dock Shipbuilders Limited (MDL) 29. Vietnam Shipbuilding Industry Group (SBIC) 30. Colombo DockyardFrequently Asked Questions:

1] What is the growth rate of the Global Shipbuilding Market? Ans. The Global Shipbuilding Market is growing at a significant rate of 4.4% during the forecast period. 2] Which region is expected to dominate the Global Shipbuilding Market? Ans. Asia Pacific is expected to dominate the Shipbuilding Market during the forecast period. 3] What was the Global Shipbuilding Market size in 2024? Ans. The Shipbuilding Market size is expected to reach USD 162.14 billion in 2024. 4] What is the expected Global Shipbuilding Market size by 2032? Ans. The Shipbuilding Market size is expected to reach USD 228.82 billion by 2032. 5] Which are the top players in the Global Shipbuilding Market? Ans. The major players in the Global Shipbuilding Market are HD Hyundai Heavy Industries, Samsung Heavy Industries, Hanwha Ocean, Hyundai Mipo Dockyard and Others. 6] What are the factors driving the Global Shipbuilding Market growth? Ans. The Global Shipbuilding Market is driven by rising seaborne trade, demand for eco-friendly vessels, naval fleet modernization, LNG-powered ships, digitalization, Industry 4.0 adoption, and expanding Asia Pacific shipyard capacity.

1. Shipbuilding Market: Research Methodology 2. Shipbuilding Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Shipbuilding Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Ship Type Segment 3.3.4. End User Segment 3.3.5. Total Company Revenue (2024) 3.3.6. Market Share (%) 3.3.7. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Shipbuilding Market: Dynamics 4.1. Shipbuilding Market Trends 4.2. Shipbuilding Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Shipbuilding Market 5. Shipbuilding Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 5.1. Shipbuilding Market Size and Forecast, by Ship Type (2024-2032) 5.1.1. Tankers 5.1.2. Bulk Carriers 5.1.3. Container Ships 5.1.4. Cargo Ships 5.1.5. Passenger Ships 5.1.6. Others 5.2. Shipbuilding Market Size and Forecast, by Material Type (2024-2032) 5.2.1. Steel 5.2.2. Aluminum 5.2.3. Composites 5.2.4. Others 5.3. Shipbuilding Market Size and Forecast, by Process (2024-2032) 5.3.1. Designing 5.3.2. Planning 5.3.3. Cutting & Welding 5.3.4. Assembly & Outfitting 5.3.5. Launching 5.3.6. Testing & Trials 5.3.7. Others 5.4. Shipbuilding Market Size and Forecast, By Propulsion Technology (2024-2032) 5.4.1. Conventional 5.4.2. Dual-Fuel LNG 5.4.3. Hybrid/Electric 5.4.4. Others 5.5. Shipbuilding Market Size and Forecast, by End-User (2024-2032) 5.5.1. Transport / Commercial 5.5.2. Military 5.5.3. Offshore 5.5.4. Others 5.6. Shipbuilding Market Size and Forecast, by Region (2024-2032) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Shipbuilding Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 6.1. North America Shipbuilding Market Size and Forecast, by Ship Type (2024-2032) 6.1.1. Tankers 6.1.2. Bulk Carriers 6.1.3. Container Ships 6.1.4. Cargo Ships 6.1.5. Passenger Ships 6.1.6. Others 6.2. North America Shipbuilding Market Size and Forecast, by Material Type (2024-2032) 6.2.1. Steel 6.2.2. Aluminum 6.2.3. Composites 6.2.4. Others 6.3. North America Shipbuilding Market Size and Forecast, by Process (2024-2032) 6.3.1. Designing 6.3.2. Planning 6.3.3. Cutting & Welding 6.3.4. Assembly & Outfitting 6.3.5. Launching 6.3.6. Testing & Trials 6.3.7. Others 6.4. North America Shipbuilding Market Size and Forecast, By Propulsion Technology (2024-2032) 6.4.1. Conventional 6.4.2. Dual-Fuel LNG 6.4.3. Hybrid/Electric 6.4.4. Others 6.5. North America Shipbuilding Market Size and Forecast, by End-User (2024-2032) 6.5.1. Transport / Commercial 6.5.2. Military 6.5.3. Offshore 6.5.4. Others 6.6. North America Shipbuilding Market Size and Forecast, by Country (2024-2032) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Shipbuilding Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 7.1. Europe Shipbuilding Market Size and Forecast, by Ship Type (2024-2032) 7.2. Europe Shipbuilding Market Size and Forecast, by Material Type (2024-2032) 7.3. Europe Shipbuilding Market Size and Forecast, by Process (2024-2032) 7.4. Europe Shipbuilding Market Size and Forecast, By Propulsion Technology (2024-2032) 7.5. Europe Shipbuilding Market Size and Forecast, by End-User (2024-2032) 7.6. Europe Shipbuilding Market Size and Forecast, by Country (2024-2032) 7.6.1. United Kingdom 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Russia 7.6.7. Rest of Europe 8. Asia Pacific Shipbuilding Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 8.1. Asia Pacific Shipbuilding Market Size and Forecast, by Ship Type (2024-2032) 8.2. Asia Pacific Shipbuilding Market Size and Forecast, by Material Type (2024-2032) 8.3. Asia Pacific Shipbuilding Market Size and Forecast, by Process (2024-2032) 8.4. Asia Pacific Shipbuilding Market Size and Forecast, By Propulsion Technology (2024-2032) 8.5. Asia Pacific Shipbuilding Market Size and Forecast, by End-User (2024-2032) 8.6. Asia Pacific Shipbuilding Market Size and Forecast, by Country (2024-2032) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Rest of Asia Pacific 9. Middle East and Africa Shipbuilding Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 9.1. Middle East and Africa Shipbuilding Market Size and Forecast, by Ship Type (2024-2032) 9.2. Middle East and Africa Shipbuilding Market Size and Forecast, by Material Type (2024-2032) 9.3. Middle East and Africa Shipbuilding Market Size and Forecast, by Process (2024-2032) 9.4. Middle East and Africa Shipbuilding Market Size and Forecast, By Propulsion Technology (2024-2032) 9.5. Middle East and Africa Shipbuilding Market Size and Forecast, by End-User (2024-2032) 9.6. Middle East and Africa Shipbuilding Market Size and Forecast, by Country (2024-2032) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Nigeria 9.6.4. Rest of ME&A 10. South America Shipbuilding Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 10.1. South America Shipbuilding Market Size and Forecast, by Ship Type (2024-2032) 10.2. South America Shipbuilding Market Size and Forecast, by Material Type (2024-2032) 10.3. South America Shipbuilding Market Size and Forecast, by Process (2024-2032) 10.4. South America Shipbuilding Market Size and Forecast, By Propulsion Technology (2024-2032) 10.5. South America Shipbuilding Market Size and Forecast, by End-User (2024-2032) 10.6. South America Shipbuilding Market Size and Forecast, by Country (2024-2032) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Colombia 10.6.4. Chile 10.6.5. Rest Of South America 11. Company Profile: Key Players 11.1. HD Hyundai Heavy Industries 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Samsung Heavy Industries 11.3. Hanwha Ocean 11.4. Hyundai Mipo Dockyard 11.5. Hyundai Samho Heavy Industries 11.6. China State Shipbuilding Corporation (CSSC) 11.7. China Shipbuilding Industry Corporation (CSIC) 11.8. Jiangnan Shipyard 11.9. Hudong-Zhonghua Shipbuilding 11.10. COSCO Shipping Heavy Industry 11.11. Yangzijiang Shipbuilding 11.12. New Times Shipbuilding 11.13. Dalian Shipbuilding Industry Company 11.14. Bohai Shipbuilding Heavy Industry 11.15. Imabari Shipbuilding 11.16. Japan Marine United Corporation 11.17. Mitsui E&S Shipbuilding 11.18. Mitsubishi Heavy Industries 11.19. Oshima Shipbuilding 11.20. Tsuneishi Shipbuilding 11.21. Fincantieri S.p.A. 11.22. Damen Shipyards Group 11.23. Lürssen Werft 11.24. Meyer Werft 11.25. Austal Limited 11.26. Cochin Shipyard Limited 11.27. Garden Reach Shipbuilders & Engineers (GRSE) 11.28. Mazagon Dock Shipbuilders Limited (MDL) 11.29. Vietnam Shipbuilding Industry Group (SBIC) 11.30. Colombo Dockyard 12. Key Findings 13. Analyst Recommendations