The Remote Asset Management Market size was valued at USD 24.89 Billion in 2024 and the total Remote Asset Management revenue is expected to grow at a CAGR of 14.92% from 2025 to 2032, reaching nearly USD 75.72 Billion. Remote Asset Management (RAM) involves monitoring, tracking, and managing assets located at remote sites using technology like IoT, sensors, and software. Increasing demand for efficient asset monitoring across industries such as manufacturing, transportation, energy, and healthcare driving the growth of Remote Asset Management Market. The current scenario reflects a robust adoption of Remote Asset Management solutions driven by the need for real-time asset tracking, predictive maintenance, and cost optimization.To know about the Research Methodology:-Request Free Sample Report Developments of IoT devices, advancements in connectivity technologies such as 5G, cost reduction in sensor technology, and the growing trend toward predictive analytics driving the growth of Remote Asset Management Market. Remote Asset Management Market Key players such as IBM, Cisco Systems, and Siemens have made significant strides in the RAM space, introducing innovative solutions. For instance, IBM's Maximo Asset Management offers comprehensive asset monitoring and predictive maintenance capabilities, while Cisco's IoT Field Network Director enables remote asset tracking and management for various industries. Siemens has also been a frontrunner with its Remote Service Platform, providing remote diagnostics and maintenance capabilities. These developments reflect a trend toward more integrated and sophisticated RAM solutions, leveraging AI and machine learning for predictive insights and enabling businesses to optimize asset performance and reduce downtime. As the demand for efficient asset management grows across industries, the Remote Asset Management market is poised for further growth and innovation, with an increasing focus on enhancing real-time monitoring, predictive analytics, and scalability to meet diverse industry needs.

Remote Asset Management Market Dynamics:

Rising IoT Integration in Remote Asset Management Driving Market Growth Increasing integration of IoT devices across industries driving the growth of Remote Asset Management Market. Companies such as Maersk leverage IoT sensors to globally track shipping containers, offering real-time data on location and conditions, optimizing supply chains. Similarly, Vestas in the wind energy sector utilizes Remote Asset Management for predictive maintenance, reducing costs and enhancing operational efficiency. These examples showcase how IoT integration significantly influences Remote Asset Management Market growth. While Advancements in connectivity, such as 5G networks, further boost RAM adoption. Telecommunications firms, such as AT&T, utilize 5G for remote tower monitoring, ensuring uninterrupted service quality. Additionally, predictive analytics integrated into RAM systems, as demonstrated by Delta Airlines in aviation, enables proactive maintenance, predicting component failures to prevent disruptions and ensure passenger safety.Cloud-based RAM solutions, exemplified by Philips' HealthSuite Insights platform in healthcare, offer scalability and accessibility, enhancing patient care outcomes. The proliferation of remote work across industries, seen in energy companies such as Shell, drives the demand for RAM tools, optimizing operations and ensuring safety. Stringent regulations drive the need for asset monitoring, as seen in Pfizer's utilization of RAM for temperature-sensitive vaccines, ensuring compliance. AI-driven solutions, like those employed by Schneider Electric in energy management, optimize asset management and sustainability. RAM's contribution to smart city initiatives, as in Barcelona's transportation systems, optimizes schedules for efficient city-wide mobility. Heightened security concerns further drive Remote Asset Management Market growth. Verkada's surveillance systems offer remote monitoring, enhancing asset protection across various industries. This amalgamation of IoT integration, predictive analytics, cloud technology, remote work trends, regulatory compliance, AI integration, smart city development, and security enhancement collectively drives the growth of the Remote Asset Management market. In the manufacturing sector, RAM solutions play a pivotal role in optimizing production, reducing costs, and ensuring efficiency. With benefits like enhanced visibility into operations and reduced downtime, companies are increasingly adopting digital twin technology for remote asset monitoring. Major Remote Asset Management Market players such as GE Digital, IBM, and Birlasoft offer solutions in this realm, supporting reliability-centered maintenance. The market's evolution is evident in the innovative solutions introduced by companies like Bosch and inMotionNow's acquisition of Lytho, catering to a wide range of industries and their evolving needs in remote asset management. The market is poised for further growth, especially considering the growing number of manufacturing establishments, creating ample opportunities for RAM players to develop tailored solutions and capture Remote Asset Management Market share. Stringent regulations Hinders the Remote Asset Management Market Growth The Remote Asset Management market confronts complex challenges that impact its efficacy across industries. Security vulnerabilities pose a significant risk for instance, the Mirai botnet attack in , illustrating the potential for cybersecurity threats within RAM systems. This attack targeted IoT devices, including those integral to RAM, underscoring the critical need for robust security measures to avert data breaches and service disruptions. Integrating diverse legacy systems with modern RAM solutions presents complexities, particularly in industries like utilities grappling with outdated infrastructure. This integration hurdle obstructs seamless data flow and comprehensive monitoring capabilities, hindering the optimal functioning of RAM platforms. Stringent data privacy regulations such as GDPR create compliance challenges, especially in healthcare where patient data protection is paramount, impacting the collection and usage of data within RAM systems.

Data Privacy Regulations and Implications for Remote Asset Management (RAM)

The substantial upfront costs associated with implementing RAM solutions pose a barrier to adoption, in sectors such as agriculture considering IoT-based monitoring systems. Despite the potential long-term benefits, the initial investment becomes a hindrance. Interoperability challenges arise due to the lack of standardized protocols, affecting integration in smart buildings and impeding comprehensive asset monitoring within RAM platforms. Remote locations with limited connectivity pose hurdles for real-time data transmission, particularly in industries like mining, restricting effective remote asset monitoring. Traditional industries, including manufacturing, exhibit resistance to adopting new technology such as RAM, to disrupt established workflows and reliant on manual processes. Overcoming this resistance demands a shift in mindset and significant organizational change. Industries implementing RAM systems require skilled personnel, as seen in the oil and gas sector, necessitating specialized training for effective remote asset monitoring and predictive maintenance. Scaling RAM to accommodate growing asset portfolios presents further challenges, notably for utilities expanding their infrastructure, demanding scalable solutions for effective management. In transportation, ensuring the continuous functionality of IoT sensors on vehicles or cargo containers remains crucial for efficient RAM, presenting maintenance challenges amid harsh environmental conditions. These collective challenges underscore the complexities faced by Remote Asset Management Market, necessitating innovative solutions to surmount these hurdles and enhance its efficacy across diverse sectors.

Regulation Description Implications for RAM GDPR (General Data Protection Regulation) European Union's comprehensive data protection law 1. Requires explicit consent for data collection and processing 2. Mandates data encryption and pseudonymization 3. Imposes strict penalties for data breaches HIPAA (Health Insurance Portability and Accountability Act) U.S. law protecting sensitive patient health information 1. Ensures security and confidentiality of healthcare data 2. Affects RAM usage in healthcare for patient monitoring and equipment data protection CCPA (California Consumer Privacy Act) U.S. state law granting consumers more control over personal data 1. Grants consumers the right to opt-out of data sharing 2. Requires businesses to disclose data collection practices 3. Influences data handling in RAM for California-based entities PIPEDA (Personal Information Protection and Electronic Documents Act) Canadian federal privacy law governing the collection of personal information 1. Regulates how organizations collect, use, and disclose personal data 2. Impacts RAM usage in Canadian industries for data protection and consent management LGPD (Lei Geral de Proteção de Dados) Brazilian data protection law similar to GDPR 1. Establishes rules for the processing of personal data in Brazil 2. Influences RAM practices in Brazilian industries for data protection Remote Asset Management Market Segment Analysis:

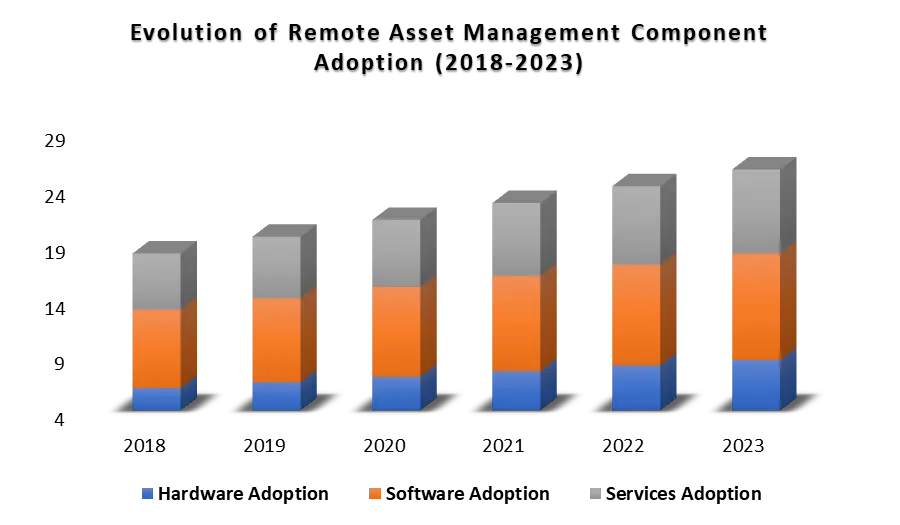

Based on Application, Predictive Maintenance dominated the Remote Asset Management Market in 2024 and is expected to maintain its dominance during the forecast period due to its widespread adoption across industries, leveraging data analytics and IoT to predict asset failures and optimize maintenance schedules. Industries such as manufacturing and aviation heavily rely on Predictive Maintenance, with examples like General Electric using RAM to foresee turbine failures in wind energy. Real-time Location Systems (RTLS) enable precise asset tracking in logistics and healthcare, ensuring efficient inventory management and patient tracking. Condition Monitoring, vital for assessing asset health, finds extensive use in sectors like oil and gas, where continuous monitoring of equipment ensures operational efficiency. Remote Diagnostics facilitates remote troubleshooting and repair, prominently used in automotive and healthcare sectors. For instance, automotive companies like Tesla employ RAM for remote diagnostics, ensuring prompt vehicle issue resolutions. Each application within RAM caters to specific industry needs, driving efficiency, and minimizing operational downtime. Based on Components, Hardware segment dominated the Remote Asset Management Market as it forms the foundational infrastructure, encompassing IoT sensors, devices, and connectivity tools crucial for data collection. Industries such as manufacturing rely on hardware components for asset monitoring, seen in sensor-equipped machinery for predictive maintenance. Software acts as the backbone, facilitating data analysis, visualization, and decision-making. Platforms like cloud-based RAM software enable seamless data processing and analytics for diverse industries, exemplified in healthcare for remote patient monitoring systems. Services encompass consultancy, implementation, and maintenance, serving as a crucial support system for RAM deployment. Companies offering RAM services provide expertise in integration and management, essential for sectors like utilities navigating complex infrastructure integrations. Each component plays a pivotal role in Remote Asset Management, with hardware laying the groundwork, software enabling data-driven insights, and services ensuring efficient deployment and ongoing support.

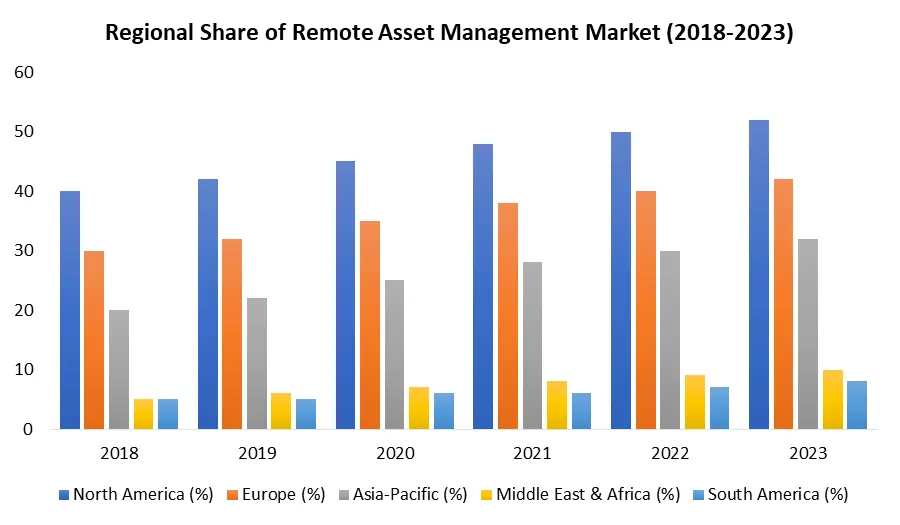

Remote Asset Management Market Regional Insights:

North America Dominance in the Remote Asset Management Market North America dominated the Remote Asset Management Market as the United States, emerges as a pivotal hub both in the creation and consumption of RAM technologies. With its tech-savvy culture and robust infrastructure, the U.S. serves as a major generator and adopter of RAM solutions. The U.S. fleet management sector showcases high utilization of GPS fleet tracking software, highlighting substantial adoption of remote asset management technology. For instance, North America's dominance in RAM is substantiated by its tech-forward approach, well-established telecommunication networks, and a skilled workforce. The proliferation of connected devices, forecasted to reach unprecedented levels in the U.S. by 2024, further propels the Remote Asset Management market. Concurrently, strategic initiatives like Canada's Digital Operations Strategic Plan (DOSP) underscore the criticality of managing digital assets, creating potential opportunities for Remote Asset Management solutions. This convergence of technological advancements and strategic initiatives across diverse regions substantiates the global growth and innovation within the Remote Asset Management industry. In Europe, countries such as Germany and the UK play vital roles in Remote Asset Management owing to their advanced technological capabilities. Germany's focus on Industry 4.0 technologies and industrial expertise significantly influences Remote Asset Management solutions production, while the UK's innovation hubs drive advancements in asset management solutions. The Asia-Pacific region, led by influential markets such as Japan and China, steadily emerges as a significant adopter of Remote Asset Management solutions. China's rapid integration of IoT devices and smart technologies in manufacturing and logistics sectors positions it as a burgeoning market for Remote Asset Management adoption.

Remote Asset Management Market Scope:Inquire before buying

Global Remote Asset Management Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 24.89 Bn. Forecast Period 2025 to 2032 CAGR: 14.92% Market Size in 2032: USD 75.72 Bn. Segments Covered: by Component Hardware Software Services by Deployment Model Cloud-based On-premises by Asset Type Fixed Assets Mobile Assets by Application Predictive Maintenance Real-time Location System (RTLS) Condition Monitoring Remote Diagnostics by End Use Industry Manufacturing Healthcare Transportation & Logistics Energy & Utilities Retail Others Remote Asset Management Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Remote Asset Management Market Key Players:

Major Contributors in the Remote Asset Management Industry in North America: 1. Cisco Systems - San Jose, USA 2. IBM - Armonk, USA 3. General Electric (GE) - Boston, USA 4. Verizon - New York, USA 5. Microsoft - Redmond, USA 6. Honeywell International - Charlotte, USA 7. Oracle - Redwood City, USA 8. Rockwell Automation - Milwaukee, USA 9. PTC - Boston, USA 10. Emerson Electric - St. Louis, USA 11. Trimble - Sunnyvale, USA 12. Zebra Technologies - Lincolnshire, USA 13. Fleet Complete - Toronto, Canada 14. Digi International - Hopkins, USA Leading players in the Europe Remote Asset Management Market: 1. Siemens - Munich, Germany 2. Bosch - Gerlingen, Germany 3. Schneider Electric - Rueil-Malmaison, France 4. SAP - Walldorf, Germany 5. ABB - Zurich, Switzerland 6. Accenture - Dublin, Ireland Key players driving the Asia-Pacific Remote Asset Management Market: 1. Hitachi - Tokyo, Japan 2. Tata Consultancy Services (TCS) - Mumbai, India 3. Infosys - Bangalore, India 4. Wipro - Bangalore, India 5. Tech Mahindra - Pune, India 6. HCL Technologies - Noida, India FAQs: 1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Component, Deployment Model, Asset Type, Application, End-Use Industry and Region. 2] Which region is expected to hold the highest share in the Global Remote Asset Management Market? Ans. North America region is expected to hold the highest share in the Remote Asset Management Market. 3] What is the market size of the Global Remote Asset Management Market by 2032? Ans. The market size of the Remote Asset Management Market by 2032 is expected to reach USD 75.72 Bn. 4] What is the forecast period for the Global Remote Asset Management Market? Ans. The forecast period for the Remote Asset Management Market is 2025-2032. 5] What was the Global Remote Asset Management Market size in 2024? Ans: The Global Remote Asset Management Market size was USD 24.89 Billion in 2024.

1. Remote Asset Management Market: Research Methodology 2. Remote Asset Management Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Remote Asset Management Market: Dynamics 3.1. Remote Asset Management Market Trends by Region 3.1.1. North America Remote Asset Management Market Trends 3.1.2. Europe Remote Asset Management Market Trends 3.1.3. Asia Pacific Remote Asset Management Market Trends 3.1.4. Middle East and Africa Remote Asset Management Market Trends 3.1.5. South America Remote Asset Management Market Trends 3.2. Remote Asset Management Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Remote Asset Management Market Drivers 3.2.1.2. North America Remote Asset Management Market Restraints 3.2.1.3. North America Remote Asset Management Market Opportunities 3.2.1.4. North America Remote Asset Management Market Challenges 3.2.2. Europe 3.2.2.1. Europe Remote Asset Management Market Drivers 3.2.2.2. Europe Remote Asset Management Market Restraints 3.2.2.3. Europe Remote Asset Management Market Opportunities 3.2.2.4. Europe Remote Asset Management Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Remote Asset Management Market Drivers 3.2.3.2. Asia Pacific Remote Asset Management Market Restraints 3.2.3.3. Asia Pacific Remote Asset Management Market Opportunities 3.2.3.4. Asia Pacific Remote Asset Management Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Remote Asset Management Market Drivers 3.2.4.2. Middle East and Africa Remote Asset Management Market Restraints 3.2.4.3. Middle East and Africa Remote Asset Management Market Opportunities 3.2.4.4. Middle East and Africa Remote Asset Management Market Challenges 3.2.5. South America 3.2.5.1. South America Remote Asset Management Market Drivers 3.2.5.2. South America Remote Asset Management Market Restraints 3.2.5.3. South America Remote Asset Management Market Opportunities 3.2.5.4. South America Remote Asset Management Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technological Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Remote Asset Management End-Use Industry 3.8. Analysis of Government Schemes and Initiatives For Remote Asset Management End-Use Industry 3.9. The Global Pandemic Impact on Remote Asset Management Market 4. Remote Asset Management Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Remote Asset Management Market Size and Forecast, by Component (2024-2032) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 4.2.1. Cloud 4.2.2. On-Premises 4.3. Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 4.3.1. Fixed Assets 4.3.2. Mobile Assets 4.4. Remote Asset Management Market Size and Forecast, by Application (2024-2032) 4.4.1. Predictive Maintenance 4.4.2. Real-time Location System (RTLS) 4.4.3. Condition Monitoring 4.4.4. Remote Diagnostics 4.5. Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 4.5.1. Manufacturing 4.5.2. Healthcare 4.5.3. Transportation & Logistics 4.5.4. Energy & Utilities 4.5.5. Retail 4.5.6. Others 4.6. Remote Asset Management Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Remote Asset Management Market Size and Forecast, by Component (2024-2032) 5.1.1. Hardware 5.1.2. Software 5.1.3. Services 5.2. North America Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 5.2.1. Cloud-based 5.2.2. On-premises 5.3. North America Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 5.3.1. Fixed Assets 5.3.2. Mobile Assets 5.4. North America Remote Asset Management Market Size and Forecast, by Application (2024-2032) 5.4.1. Predictive Maintenance 5.4.2. Real-time Location System (RTLS) 5.4.3. Condition Monitoring 5.4.4. Remote Diagnostics 5.5. North America Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 5.5.1. Manufacturing 5.5.2. Healthcare 5.5.3. Transportation & Logistics 5.5.4. Energy & Utilities 5.5.5. Retail 5.5.6. Others 5.6. Remote Asset Management Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Remote Asset Management Market Size and Forecast, by Component (2024-2032) 5.6.1.1.1. Hardware 5.6.1.1.2. Software 5.6.1.1.3. Services 5.6.1.2. United States Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 5.6.1.2.1. Cloud-based 5.6.1.2.2. On-premises 5.6.1.3. United States Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 5.6.1.3.1. Fixed Assets 5.6.1.3.2. Mobile Assets 5.6.1.4. United States Remote Asset Management Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Predictive Maintenance 5.6.1.4.2. Real-time Location System (RTLS) 5.6.1.4.3. Condition Monitoring 5.6.1.4.4. Remote Diagnostics 5.6.1.5. United States Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 5.6.1.5.1. Manufacturing 5.6.1.5.2. Healthcare 5.6.1.5.3. Transportation & Logistics 5.6.1.5.4. Energy & Utilities 5.6.1.5.5. Retail 5.6.1.5.6. Others 5.6.2. Canada 5.6.2.1. Canada Remote Asset Management Market Size and Forecast, by Component (2024-2032) 5.6.2.1.1. Hardware 5.6.2.1.2. Software 5.6.2.1.3. Services 5.6.2.2. Canada Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 5.6.2.2.1. Cloud-based 5.6.2.2.2. On-premises 5.6.2.3. Canada Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 5.6.2.3.1. Fixed Assets 5.6.2.3.2. Mobile Assets 5.6.2.4. Canada Remote Asset Management Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Predictive Maintenance 5.6.2.4.2. Real-time Location System (RTLS) 5.6.2.4.3. Condition Monitoring 5.6.2.4.4. Remote Diagnostics 5.6.2.5. Canada Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 5.6.2.5.1. Manufacturing 5.6.2.5.2. Healthcare 5.6.2.5.3. Transportation & Logistics 5.6.2.5.4. Energy & Utilities 5.6.2.5.5. Retail 5.6.2.5.6. Others 5.6.3. Mexico 5.6.3.1. Mexico Remote Asset Management Market Size and Forecast, by Component (2024-2032) 5.6.3.1.1. Hardware 5.6.3.1.2. Software 5.6.3.1.3. Services 5.6.3.2. Mexico Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 5.6.3.2.1. Cloud-based 5.6.3.2.2. On-premises 5.6.3.3. Mexico Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 5.6.3.3.1. Fixed Assets 5.6.3.3.2. Mobile Assets 5.6.3.4. Mexico Remote Asset Management Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Predictive Maintenance 5.6.3.4.2. Real-time Location System (RTLS) 5.6.3.4.3. Condition Monitoring 5.6.3.4.4. Remote Diagnostics 5.6.3.5. Mexico Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 5.6.3.5.1. Manufacturing 5.6.3.5.2. Healthcare 5.6.3.5.3. Transportation & Logistics 5.6.3.5.4. Energy & Utilities 5.6.3.5.5. Retail 5.6.3.5.6. Others 6. Europe Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.2. Europe Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.3. Europe Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.4. Europe Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.5. Europe Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6. Europe Remote Asset Management Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.1.2. United Kingdom Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.1.3. United Kingdom Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.1.4. United Kingdom Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6.2. France 6.6.2.1. France Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.2.2. France Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.2.3. France Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.2.4. France Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.3.2. Germany Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.3.3. Germany Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.3.4. Germany Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.4.2. Italy Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.4.3. Italy Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.4.4. Italy Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.5.2. Spain Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.5.3. Spain Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.5.4. Spain Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.6.2. Sweden Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.6.3. Sweden Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.6.4. Sweden Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.7.2. Austria Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.7.3. Austria Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.7.4. Austria Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Remote Asset Management Market Size and Forecast, by Component (2024-2032) 6.6.8.2. Rest of Europe Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 6.6.8.3. Rest of Europe Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 6.6.8.4. Rest of Europe Remote Asset Management Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7. Asia Pacific Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.2. Asia Pacific Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.3. Asia Pacific Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.4. Asia Pacific Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6. Asia Pacific Remote Asset Management Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.1.2. China Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.1.3. China Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.1.4. China Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.2.2. S Korea Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.2.3. S Korea Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.2.4. S Korea Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.3.2. Japan Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.3.3. Japan Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.3.4. Japan Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.4. India 7.6.4.1. India Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.4.2. India Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.4.3. India Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.4.4. India Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.5.2. Australia Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.5.3. Australia Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.5.4. Australia Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.6.2. Indonesia Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.6.3. Indonesia Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.6.4. Indonesia Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.7.2. Malaysia Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.7.3. Malaysia Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.7.4. Malaysia Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.8.2. Vietnam Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.8.3. Vietnam Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.8.4. Vietnam Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.9.2. Taiwan Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.9.3. Taiwan Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.9.4. Taiwan Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Remote Asset Management Market Size and Forecast, by Component (2024-2032) 7.6.10.2. Rest of Asia Pacific Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 7.6.10.3. Rest of Asia Pacific Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 7.6.10.4. Rest of Asia Pacific Remote Asset Management Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 8. Middle East and Africa Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 8.1. Middle East and Africa Remote Asset Management Market Size and Forecast, by Component (2024-2032) 8.2. Middle East and Africa Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 8.3. Middle East and Africa Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 8.4. Middle East and Africa Remote Asset Management Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 8.6. Middle East and Africa Remote Asset Management Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Remote Asset Management Market Size and Forecast, by Component (2024-2032) 8.6.1.2. South Africa Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 8.6.1.3. South Africa Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 8.6.1.4. South Africa Remote Asset Management Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Remote Asset Management Market Size and Forecast, by Component (2024-2032) 8.6.2.2. GCC Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 8.6.2.3. GCC Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 8.6.2.4. GCC Remote Asset Management Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Remote Asset Management Market Size and Forecast, by Component (2024-2032) 8.6.3.2. Nigeria Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 8.6.3.3. Nigeria Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 8.6.3.4. Nigeria Remote Asset Management Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Remote Asset Management Market Size and Forecast, by Component (2024-2032) 8.6.4.2. Rest of ME&A Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 8.6.4.3. Rest of ME&A Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 8.6.4.4. Rest of ME&A Remote Asset Management Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 9. South America Remote Asset Management Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 9.1. South America Remote Asset Management Market Size and Forecast, by Component (2024-2032) 9.2. South America Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 9.3. South America Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 9.4. South America Remote Asset Management Market Size and Forecast, by Application (2024-2032) 9.5. South America Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 9.6. South America Remote Asset Management Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Remote Asset Management Market Size and Forecast, by Component (2024-2032) 9.6.1.2. Brazil Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 9.6.1.3. Brazil Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 9.6.1.4. Brazil Remote Asset Management Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Remote Asset Management Market Size and Forecast, by Component (2024-2032) 9.6.2.2. Argentina Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 9.6.2.3. Argentina Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 9.6.2.4. Argentina Remote Asset Management Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Remote Asset Management Market Size and Forecast, by Component (2024-2032) 9.6.3.2. Rest Of South America Remote Asset Management Market Size and Forecast, by Deployment (2024-2032) 9.6.3.3. Rest Of South America Remote Asset Management Market Size and Forecast, by Asset Type (2024-2032) 9.6.3.4. Rest Of South America Remote Asset Management Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Remote Asset Management Market Size and Forecast, by End-Use Industry (2024-2032) 10. Global Remote Asset Management Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2024) 10.3.5. Company Locations 10.4. Leading Remote Asset Management Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Cisco Systems - San Jose, USA 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. IBM - Armonk, USA 11.3. General Electric (GE) - Boston, USA 11.4. Verizon - New York, USA 11.5. Microsoft - Redmond, USA 11.6. Honeywell International - Charlotte, USA 11.7. Oracle - Redwood City, USA 11.8. Rockwell Automation - Milwaukee, USA 11.9. PTC - Boston, USA 11.10. Emerson Electric - St. Louis, USA 11.11. Trimble - Sunnyvale, USA 11.12. Zebra Technologies - Lincolnshire, USA 11.13. Fleet Complete - Toronto, Canada 11.14. Digi International - Hopkins, USA 11.15. Siemens - Munich, Germany 11.16. Bosch - Gerlingen, Germany 11.17. Schneider Electric - Rueil-Malmaison, France 11.18. SAP - Walldorf, Germany 11.19. ABB - Zurich, Switzerland 11.20. Accenture - Dublin, Ireland 11.21. Hitachi - Tokyo, Japan 11.22. Tata Consultancy Services (TCS) - Mumbai, India 11.23. Infosys - Bangalore, India 11.24. Wipro - Bangalore, India 11.25. Tech Mahindra - Pune, India 11.26. HCL Technologies - Noida, India 12. Key Findings 13. End-Use Industry Recommendations