Propylene Oxide Market was valued at USD 26.14 Bn. in 2024 and the total Global Propylene Oxide Market revenue is expected to grow at a CAGR of 6.67% from 2025 to 2032 reaching nearly 43.82 Bn. by 2032.Propylene Oxide Market Overview:

Global Propylene Oxide Market consist a critical class of organic chemical compounds mostly used as intermediates in the production of polyether polyols, propylene glycol and other derivatives. downstream chemicals are essential for manufacturing polyurethane foams automotive parts, coatings, adhesives and a wide range of consumer and industrial products. Propylene oxide is produced via multiple technologies including chlorohydrin process, styrene monomer co product process and increasingly the environmentally preferred hydrogen peroxide to propylene oxide (HPPO) method. Asia Pacific dominated the Propylene Oxide Market in 2024 recording the highest CAGR due to accelerated industrialization, construction activities and increasing automotive and furniture manufacturing sectors across China, India and Southeast Asia. Increase in demand for flexible and rigid polyurethane foams in insulation, bedding and packaging applications grow in regional consumption. Government incentives for sustainable materials and infrastructure investments have amplified propylene oxide utilization in developing economies. Leading market players include Dow Inc., BASF SE, Lyondell Basell Industries, Shell PLC, INEOS Oxide and Sumitomo Chemical many companies are turning toward greener HPPO processes and forging regional joint ventures to optimize feedstock security and logistics efficiency. Global Propylene Oxide Market Report covers detailed insights into Propylene Oxide Market dynamics and structure by analysing technology types application segments and regional impression in projecting market size through 2032. It delivers a comprehensive competitive analysis of major players based on product portfolios process technologies financial performance strategic alliances and regional presence helping stakeholders assess growth opportunities and strategic positioning in a globally competitive landscape.To know about the Research Methodology :- Request Free Sample Report

Propylene Oxide Market Dynamics:

Growing Automotive Industry to drive the Propylene Oxide Market Growth Automotive industry is growingly emphasizing light-weighting vehicles to minimize emissions and improve fuel efficiency. Propylene oxide-derived polyurethane foams are lightweight materials that provide excellent insulation and cushioning properties. They are used in insulation, automotive seating, interiors and other components. The lightweight materials contribute to fuel efficiency improvements and consent with stricter emission regulations, and this results in to increase in the demand for Propylene Oxide. Comfort and safety are essential components for automotive consumers and manufacturers. Rising Demand for Polyurethane in EVs to Boost the Propylene Oxide Market Growth Polyurethane foams offer preferable comfort and vibration-dampening characteristics. By reducing noise and vibrations and enhancing comfort in the seats, they contribute to improving the overall driving experience. Adhesives and coatings made of polyurethane offer strong bonding and protective properties, assuring the long-term dependability of automobile parts. The growth in the electric vehicle market is a substantial driver for the propylene oxide market growth. Electric vehicles used polyurethane-based materials for battery encapsulation, thermal management and interior components. As the increase in demand for electric vehicles, there is an increase in the demand for propylene oxide-derived polyurethane materials increases to help the propylene oxide industry grow. Growing Demand for Propylene Oxide Derivatives to Boost opportunity in Propylene Oxide Market Growing Shift towards Propylene Oxide Derivatives Polyurethanes are the primary applications of propylene oxide derivatives. The increasing demand for end-use products in the automotive chemical industries has led to an increase in the demand for propylene oxide derivatives. Propylene oxide derivatives provide superior properties and functionalities that make them preferable for various applications. For instance, propylene glycol (PG) is utilized as a humectant, solvent and antifreeze agent in food and beverage, pharmaceuticals, cosmetics, and personal care industries. Polyether polyols another propylene oxide derivative, are imperative in the production of flexible and rigid polyurethane foams with superior insulation and cushioning properties. The versatility and performance of these derivatives boost the adoption of propylene oxide market in different industries. The propylene oxide market has witnessed a growing interest to develop sustainable and environmentally friendly alternatives to traditional production processes. Price Volatility and Rising Feedstock Costs to restrain Propylene Oxide Market Price Volatility and Fluctuating Feedstock Costs to Restraint the Propylene Oxide Market Growth: Fluctuating feedstock costs, particularly for propylene, directly affect the production costs of propylene oxide. When feedstock prices increase, it puts pressure on manufacturers to absorb the higher costs. In a competitive market, it has not always been possible to pass on the cost increases entirely, which has restrained profit margins for manufacturers and suppliers. The volatility in price and fluctuating feedstock costs make it challenging for market participants to create stable pricing strategies. Rapid changes in feedstock costs have resulted in immediate price adjustments, which have been impacting customer relationships and propylene oxide market competitiveness.Propylene Oxide Market Segment Analysis

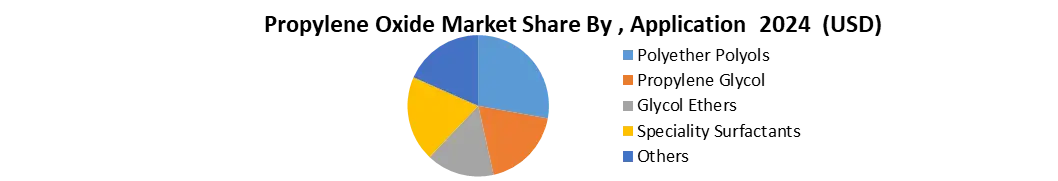

By Production Method, Propylene Oxidation held the largest propylene oxide market share of 90.87% in 2024 and is expected to have the highest CAGR of 7.12% over the forecast period. Propylene Oxidation provides higher conversion rates and selectivity in propylene oxide production. This aids a larger proportion of the propylene feedstock is efficiently converted into propylene oxide, leading to higher yields and improved overall process efficiency. Propylene Oxidation is typically introduced as a more environmentally friendly production method compared to alternative processes including the Chlorohydrin Process. The advancements in catalyst technologies and process optimization have improved the performance and efficiency of the Propylene Oxidation process. Ongoing research and development activities have resulted in the development of innovative catalyst systems and improved reaction conditions, enhancing the competitiveness of propylene oxidation in the propylene oxide market. Based on Application, Polyether Polyols dominated the Market with the largest Propylene Oxide market share of 68.82% in 2024. Polyether polyols derived from propylene oxide have an extensive range of applications across several industries. Polyether Polyols are used in polyurethane foams production, which is utilized in the automotive, furniture, insulation and bedding sectors. Due to their adaptability and versatility, Polyether polyols are selective for a variety of polyurethane foam types including flexible foams, rigid foams and specialty foams. The demand for polyurethane foams has been constantly growing due to their desirable properties including cushioning, insulation, durability and versatility, across multiple industries. The automotive industry relies increasingly on polyurethane foams for insulation, interior seating and soundproofing.

Propylene Oxide Market Regional Insights:

Asia Pacific dominated the largest propylene oxide market share of 46.20% in 2024 and is expected to continue its dominance over the forecast period. Developing economies such as China and India have substantiated rapid urbanization and industrialization resulting in increasing demand for propylene oxide market. The region has a substantial population such as a growing middle-class population. This demographic shift has led to increasing consumption of products that use propylene oxide derivatives such as polyurethanes and propylene glycols. The regional large consumer base creates a huge demand evolve for propylene oxide products. Asia Pacific has become a manufacturing hub for several industries such as chemicals and plastics. The region provides benefits including the availability of raw materials, lower labour costs and supportive government policies and appealing investments in propylene oxide production facilities. Propylene Oxide Market Competitive Landscape Global Propylene Oxide Market is shaped by a concentrated group of multinational chemical giants whose production scale, proprietary technologies and downstream integration define the competitive dynamics. We have more than 25 prominent manufacturers profile in that Dow Inc. (USA), Lyondell Basell Industries N.V. (Netherlands), BASF SE (Germany), Shell Plc (UK), Huntsman Corporation (USA), and Sumitomo Chemical Co., Ltd. (Japan) are the strength of Global Propylene Oxide Market. Dow Inc. anchors the industry with its proprietary (tert-butyl alcohol) co-production technology which ensures high yield and minimal waste, making it a benchmark for cost-efficiency. Lyondell Basell benefits from a global network of integrated plants and long-term supply contracts enabling it to maintain operational agility and price leadership across diverse markets. BASF SE leverages cutting-edge HPPO (Hydrogen Peroxide to Propylene Oxide) technology to deliver greener production alternatives meeting rising environmental standards and customer sustainability goals. Shell brings competitive advantage through its Shell Smart Propylene Oxide technology, emphasizing energy efficiency and safety in high-volume output. Huntsman Corporation distinguishes itself with a strong presence in polyurethane feedstock’s, integrating PO with its downstream derivatives portfolio to serve automotive, construction, and insulation industries. Recent Trends in Propylene Market and its Impact on Market:Recent Developments in Propylene Oxide Market • On 6 March 2025, Dow Inc. (USA) announced the successful commissioning of its new world-scale Propylene Oxide and Tertiary Butyl Alcohol (PO/TBA) plant in Texas, significantly boosting production capacity and reinforcing its leadership in cost-effective and integrated PO manufacturing. • On 18 January 2025, BASF SE (Germany) and Solvay SA (Belgium) entered into a joint development agreement to advance HPPO technology, aiming to lower carbon emissions and water usage across production cycles by 20% by 2027. • On 2 December 2024, Lyondell Basell (Netherlands) completed a major turnaround at its propylene oxide facility in Channelview, Texas, incorporating upgraded catalysts and automation systems to enhance yield efficiency and process safety. • On 20 October 2024, Huntsman Corporation (USA) finalized the acquisition of a specialty PO derivatives manufacturer in Southeast Asia, strengthening its regional supply chain and expanding its reach in construction and automotive end-use markets. • On 29 September 2024, Shell Plc (UK) initiated a feasibility study for building a new PO plant using Smart PO technology in Saudi Arabia, in collaboration with local petrochemical partners, aligning with regional diversification and clean energy goals.

Sr No Trends Impact on Market 1 Shift Toward Sustainable Production Adoption of eco-friendly technologies like HPPO (Hydrogen Peroxide to Propylene Oxide) is reducing environmental footprint and attracting ESG-focused investors. 2 Growing Demand from Polyurethane Segment Rising consumption of polyurethane in automotive, construction, and insulation industries is driving demand for propylene oxide as a key intermediate. 3 Expansion in Emerging Markets (Asia-Pacific, Latin America) Industrialization and urbanization in developing economies are boosting propylene oxide consumption, prompting capacity expansion by major players. 4 Volatility in Propylene Feedstock Prices Fluctuating raw material prices are impacting profit margins and pushing companies to secure backward integration or long-term feedstock contracts. Propylene Oxide Market Scope: Inquire Before Buying

Propylene Oxide Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 26.14 Bn. Forecast Period 2025 to 2032 CAGR: 6.67% Market Size in 2032: USD 43.82 Bn. Segments Covered: by Production Method Propylene Oxidation Chlorohydrin Process by Application Polyether Polyols Propylene Glycol Glycol Ethers Speciality Surfactants Others by End User Automotive Construction Packaging Furniture and Bedding Electronics Pharmaceuticals Personal Care Others Global Propylene Oxide Market by Region:

North America (United Packaging Types, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Key Players in Propylene Oxide Market

North America 1. Balchem Corp. (USA) 2. Dow Inc. (USA) 3. Huntsman Corporation (USA) 4. Nova Chemicals Corp. (Canada) Europe 5. BASF SE (Germany) 6. Merck KGaA (Germany) 7. PCC Rokita (Poland) 8. Repsol (Spain) 9. INEOS Oxide (United Kingdom) 10. LyondellBasell Industries Holdings B.V. (Netherlands) 11. Shell PLC (United Kingdom/Netherlands) 12. Evonik Industries AG (Germany) 13. Covestro AG (Germany) 14. Solvay SA (Belgium) Asia-Pacific 15. AGC Inc. (Japan) 16. Befar Group (China) 17. Indorama Ventures Public Company Ltd. (Thailand) 18. Manali Petrochemicals (India) 19. SKC Company (South Korea) 20. S-OIL Corporation (South Korea) 21. Sumitomo Chemical Co., Ltd. (Japan) 22. Tianjin Dagu Chemical Co., Ltd. (China) 23. Tokuyama Corporation (Japan) 24. Tokyo Chemical Industry Co., Ltd. (Japan) 25. Wanhua Chemical Group Co. Ltd. (China) 26. Wudi Xinyue Chemical Co., Ltd. (China) 27. Shin-Etsu Chemical Co., Ltd. (Japan) Middle East & Africa 28. Sadara Chemical Company (Saudi Arabia) 29. Sasol Limited (South Africa) South America 30. Braskem (Brazil)Frequently ask questions:

1. What is the expected market size of the Global Propylene Oxide Market by 2032? Ans: The market is projected to reach USD 43.82 Bn. by 2032, growing at a CAGR of 6.67%. 2. Which application segment dominated the Propylene Oxide Market in 2024? Ans: Polyether Polyols led with a 68.82% share due to high demand in automotive, insulation, and furniture industries. 3. What production method held the highest share in the Propylene Oxide Market in 2024? Ans: Propylene Oxidation held a 90.87% market share, driven by efficiency and environmentally friendly processing. 4. Which region dominated the Propylene Oxide Market in 2024? Ans: Asia Pacific led the market with a 46.20% share, driven by industrialization and rising demand for derivatives. 5. What key factor is restraining the growth of the Propylene Oxide Market? Ans: Price volatility and fluctuating feedstock costs are restraining profit margins and market stability.

1. Propylene Oxide Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Propylene Oxide Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Propylene Oxide Market: Dynamics 3.1. Region wise Trends of Propylene Oxide Market 3.1.1. North America Propylene Oxide Market Trends 3.1.2. Europe Propylene Oxide Market Trends 3.1.3. Asia Pacific Propylene Oxide Market Trends 3.1.4. Middle East and Africa Propylene Oxide Market Trends 3.1.5. South America Propylene Oxide Market Trends 3.2. Propylene Oxide Market Dynamics 3.2.1. Propylene Oxide Market Drivers 3.2.1.1. High demand for polyurethane foams 3.2.1.2. Growth in automotive and construction sectors 3.2.1.3. Rising use of propylene glycol 3.2.2. Propylene Oxide Market Opportunities 3.2.2.1. Expansion in Asia-Pacific and Middle East 3.2.2.2. Green and bio-based PO production 3.2.3. Propylene Oxide Market Challenges 3.2.4. Propylene Oxide Market Restrains 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Propylene Oxide Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 4.1.1. Propylene Oxidation 4.1.2. Chlorohydrin Process 4.2. Propylene Oxide Market Size and Forecast, By Application (2024-2032) 4.2.1. Polyether Polyols 4.2.2. Propylene Glycol 4.2.3. Glycol Ethers 4.2.4. Speciality Surfactants 4.2.5. Others 4.3. Propylene Oxide Market Size and Forecast, By End User (2024-2032) 4.3.1. Automotive 4.3.2. Construction 4.3.3. Packaging 4.3.4. Furniture and Bedding 4.3.5. Electronics 4.3.6. Pharmaceuticals 4.3.7. Personal Care 4.3.8. Others 4.4. Propylene Oxide Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Propylene Oxide Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 5.1.1. Propylene Oxidation 5.1.2. Chlorohydrin Process 5.2. North America Propylene Oxide Market Size and Forecast, By Application (2024-2032) 5.2.1. Polyether Polyols 5.2.2. Propylene Glycol 5.2.3. Glycol Ethers 5.2.4. Speciality Surfactants 5.2.5. Others 5.3. North America Propylene Oxide Market Size and Forecast, By By End User (2024-2032) 5.3.1.1. Automotive 5.3.1.2. Construction 5.3.1.3. Packaging 5.3.1.4. Furniture and Bedding 5.3.1.5. Electronics 5.3.1.6. Pharmaceuticals 5.3.1.7. Personal Care 5.3.1.8. Others 5.4. North America Propylene Oxide Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 5.4.1.1.1. Propylene Oxidation 5.4.1.1.2. Chlorohydrin Process 5.4.1.2. United States Propylene Oxide Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Polyether Polyols 5.4.1.2.2. Propylene Glycol 5.4.1.2.3. Glycol Ethers 5.4.1.2.4. Speciality Surfactants 5.4.1.2.5. Others 5.4.1.3. United States Propylene Oxide Market Size and Forecast, By End User (2024-2032) 5.4.1.3.1. Automotive 5.4.1.3.2. Construction 5.4.1.3.3. Packaging 5.4.1.3.4. Furniture and Bedding 5.4.1.3.5. Electronics 5.4.1.3.6. Pharmaceuticals 5.4.1.3.7. Personal Care 5.4.1.3.8. Others 5.4.1.4. Canada Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 5.4.1.4.1. Propylene Oxidation 5.4.1.4.2. Chlorohydrin Process 5.4.1.5. Canada Propylene Oxide Market Size and Forecast, By Application (2024-2032) 5.4.1.5.1. Polyether Polyols 5.4.1.5.2. Propylene Glycol 5.4.1.5.3. Glycol Ethers 5.4.1.5.4. Speciality Surfactants 5.4.1.5.5. Others 5.4.1.6. Canada Propylene Oxide Market Size and Forecast, By End User (2024-2032) 5.4.1.6.1. Automotive 5.4.1.6.2. Construction 5.4.1.6.3. Packaging 5.4.1.6.4. Furniture and Bedding 5.4.1.6.5. Electronics 5.4.1.6.6. Pharmaceuticals 5.4.1.6.7. Personal Care 5.4.1.6.8. Others 5.4.1.7. Mexico Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 5.4.1.7.1. Propylene Oxidation 5.4.1.7.2. Chlorohydrin Process 5.4.1.8. Mexico Propylene Oxide Market Size and Forecast, By Application (2024-2032) 5.4.1.8.1. Polyether Polyols 5.4.1.8.2. Propylene Glycol 5.4.1.8.3. Glycol Ethers 5.4.1.8.4. Speciality Surfactants 5.4.1.8.5. Others 5.4.1.9. Mexico Propylene Oxide Market Size and Forecast, By End User (2024-2032) 5.4.1.9.1. Automotive 5.4.1.9.2. Construction 5.4.1.9.3. Packaging 5.4.1.9.4. Furniture and Bedding 5.4.1.9.5. Electronics 5.4.1.9.6. Pharmaceuticals 5.4.1.9.7. Personal Care 5.4.1.9.8. Others 6. Europe Propylene Oxide Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.2. Europe Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.3. Europe Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4. Europe Propylene Oxide Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.1.2. United Kingdom Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4.2. France 6.4.2.1. France Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.2.2. France Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.3.2. Germany Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.4.2. Italy Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.5.2. Spain Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.6.2. Sweden Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.7.2. Austria Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Propylene Oxide Market Size and Forecast, By End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 6.4.8.2. Rest of Europe Propylene Oxide Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Propylene Oxide Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.2. Asia Pacific Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4. Asia Pacific Propylene Oxide Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.1.2. China Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.2.2. S Korea Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.3.2. Japan Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.4. India 7.4.4.1. India Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.4.2. India Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.5.2. Australia Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.6.2. Indonesia Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.7.2. Philippines Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.8.2. Malaysia Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.9.2. Vietnam Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.10.2. Thailand Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Propylene Oxide Market Size and Forecast, By End User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 7.4.11.2. Rest of Asia Pacific Propylene Oxide Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Propylene Oxide Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Propylene Oxide Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 8.2. Middle East and Africa Propylene Oxide Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Propylene Oxide Market Size and Forecast, By End User (2024-2032) 8.4. Middle East and Africa Propylene Oxide Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 8.4.1.2. South Africa Propylene Oxide Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Propylene Oxide Market Size and Forecast, By End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 8.4.2.2. GCC Propylene Oxide Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Propylene Oxide Market Size and Forecast, By End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 8.4.3.2. Nigeria Propylene Oxide Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Propylene Oxide Market Size and Forecast, By End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 8.4.4.2. Rest of ME&A Propylene Oxide Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Propylene Oxide Market Size and Forecast, By End User (2024-2032) 9. South America Propylene Oxide Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 9.2. South America Propylene Oxide Market Size and Forecast, By Application (2024-2032) 9.3. South America Propylene Oxide Market Size and Forecast, By End User (2024-2032) 9.4. South America Propylene Oxide Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 9.4.1.2. Brazil Propylene Oxide Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Propylene Oxide Market Size and Forecast, By End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 9.4.2.2. Argentina Propylene Oxide Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Propylene Oxide Market Size and Forecast, By End User (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Propylene Oxide Market Size and Forecast, By Production Method (2024-2032) 9.4.3.2. Rest of South America Propylene Oxide Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Propylene Oxide Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Balchem Corp. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Dow Inc. (USA) 10.3. Huntsman Corporation (USA) 10.4. Nova Chemicals Corp. (Canada) 10.5. BASF SE (Germany) 10.6. Merck KGaA (Germany) 10.7. PCC Rokita (Poland) 10.8. Repsol (Spain) 10.9. INEOS Oxide (United Kingdom) 10.10. LyondellBasell Industries Holdings B.V. (Netherlands) 10.11. Shell PLC (United Kingdom/Netherlands) 10.12. Evonik Industries AG (Germany) 10.13. Covestro AG (Germany) 10.14. Solvay SA (Belgium) 10.15. AGC Inc. (Japan) 10.16. Befar Group (China) 10.17. Indorama Ventures Public Company Ltd. (Thailand) 10.18. Manali Petrochemicals (India) 10.19. SKC Company (South Korea) 10.20. S-OIL Corporation (South Korea) 10.21. Sumitomo Chemical Co., Ltd. (Japan) 10.22. Tianjin Dagu Chemical Co., Ltd. (China) 10.23. Tokuyama Corporation (Japan) 10.24. Tokyo Chemical Industry Co., Ltd. (Japan) 10.25. Wanhua Chemical Group Co. Ltd. (China) 10.26. Wudi Xinyue Chemical Co., Ltd. (China) 10.27. Shin-Etsu Chemical Co., Ltd. (Japan) 10.28. Sadara Chemical Company (Saudi Arabia) 10.29. Sasol Limited (South Africa) 10.30. Braskem (Brazil) 11. Key Findings 12. Analyst Recommendations 13. Propylene Oxide Market: Research Methodology