Global Power Generator Rental Market size was valued at USD 2.73 Bn in 2024, and the total power generator rental Market revenue is expected to grow by 5.1 % from 2025 to 2032, reaching nearly USD 4.06 Bn.Power Generator Rental Market Overview:

The power generator rental market encompasses businesses that lease portable and stationary generators to provide temporary access to electricity where grid power is unavailable, unreliable, and insufficient. These rental solutions provide to diverse requirements, ranging from small-scale generators for events to large systems for industrial operations and emergency response. The market has gained momentum as organizations increasingly prefer flexible rental models over investing in costly equipment ownership.Several opportunities are driving growth, including rapid infrastructure development, increasing frequency of natural disasters, rising construction activities, and growing demand for uninterrupted power in remote or off-grid areas. Industries such as oil and gas, mining, healthcare, construction, and event management heavily depend on rental generators to ensure smooth operations, manage peak load requirements, and avoid downtime.To know about the Research Methodology:-Request Free Sample Report The market include the need for continuous power supply in regions with frequent blackouts, cost advantages associated with renting, and the ability to deploy backup power quickly in emergencies.Also , the expansion of outdoor events and industrial projects in developing areas without reliable grid infrastructure further boosts demand.Real applications highlight the market’s importance music festivals rent generators to power lighting and sound systems, hospitals rely on them during outages, construction firms use them at undeveloped sites, and relief agencies deploy them for disaster recovery. These factors collectively position the Power Generator Rental Market for significant and sustained global growth .

Global Power Generator Rental Market Dynamics:

The rising demand for reliable backup power solutions is emerging as a key catalyst for the growth of the power generator rental market. The growing need for reliable backup power is a major driver of the power generator rental market. As countries accelerate the transition from fossil fuels to renewable energy, investments in clean technologies have surged, particularly in replacing coal. However, the intermittent nature of renewables, combined with the limited maturity of energy storage solutions, creates challenges in ensuring continuous power supply. To address this gap, rental power solutions provide a practical and cost-effective alternative, offering quick accessibility, minimal maintenance, and reliable performance for both industrial and residential needs. These advantages position rental generators as a critical support system in stabilizing energy supply, especially during periods of renewable fluctuation. Consequently, the demand for temporary and backup power is set to rise steadily, driving market expansion throughout the forecast period. The extensive utilization of rental power within the mining industry is poised to accelerate power generator rental market growth.The mining industry emerges as a significant consumer of rental power solutions. Mining sites, often located in remote areas detached from the grid, heavily rely on temporary generator sets. Rental generators witness moderate demand within industrial sectors, particularly during peak load demand or brief outages, necessitating additional power support beyond existing systems. Given the mining industry's dependence on rental power due to inadequate grid power supplies, it is poised to drive power generator rental market growth substantially during the forecast period.Rising Fuel Costs of Diesel Generators are A Major Restraint for the Power Generator Rental Market The escalating operational costs associated with diesel generators pose a constraint on power generator rental market growth. Diesel generator sets stand out as a preferred choice for backup power solutions among various end-users, including sectors like oil & gas and manufacturing. Their popularity is attributed to their quick start-up time, affordability in terms of initial investments, compact size, and ease of installation and operation. However, it's crucial to note that diesel generator sets come with significant operational costs, primarily due to the high price of fuel. With fuel expenses constituting over 80% of the total life cycle expenditure of a diesel generator set, the cost-effectiveness of diesel as a backup solution diminishes, especially as solar power prices decline. This factor is expected to act as a major barrier, hindering the growth trajectory of the power rental market during the forecast period. Regulatory Compliance: A Key Challenge for the Power Generator Rental Market Stringent regulations across regions pose significant challenges for the power generator rental market. Emission standards, such as those set by India’s CPCB, limit pollutants including nitrogen oxides, hydrocarbons, carbon monoxide, and particulate matter from diesel generators. For instance, gensets up to 19kW cannot exceed 7.5g/kW-hr of nitrogen oxides and hydrocarbons, or 0.3g/kW-hr of particulates. This compels rental companies to retrofit or upgrade older units with advanced emission control systems, driving up operational costs. The U.S. EPA restricts backup generator operation to 100 hours annually before mandatory reporting, with penalties for non-compliance. Such restrictions reduce flexibility for long-duration rental applications. Local governments also enforce strict noise and location-based rules, banning generator usage in residential areas, hospitals, or environmentally sensitive zones, thereby limiting business opportunities.Moreover, obtaining permits and adhering to real-time monitoring requirements add complexity and regulatory risks for rental providers. While these rules are designed to safeguard public health, air quality, and environmental sustainability, they collectively act as barriers to market expansion by increasing costs and reducing operational scope.

Power Generator Rental Market Segment Analysis:

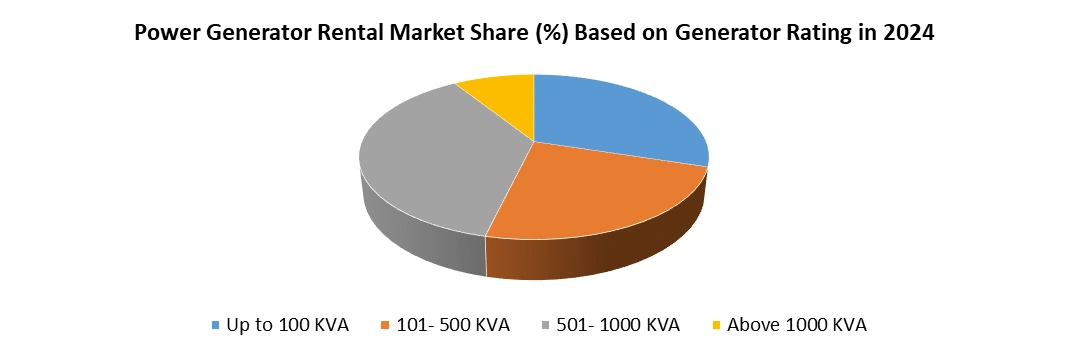

Based on Generator Rating, the market is segmented into Up to 100 KVA, 101- 500 KVA 501- 1000 KVA Above 1000 KVA. In terms of power rating, the 501-1000 KVA segment dominates the global Power Rental market. This growth is primarily driven by the essential requirement for emergency power in heavy-duty applications. Generators ranging from 501 to 1000 KVA are versatile, capable of providing standby power as well as a continuous power supply during outages and peak shaving scenarios. Moreover, developing countries often experience more frequent power outages compared to developed nations, attributed to inadequate transmission and distribution infrastructure, as well as aging power plants. To address this challenge and ensure reliable access to electricity across industries, utility-scale power generation plants have been established on a rental basis in certain regions, further propelling power generator rental market growth.

Power Generator Rental Market Regional Insights:

North America dominated the Power Rental Market in 2024. Due to Aging power infrastructure and the rising occurrence of outages caused by extreme weather events such as hurricanes and winter storms. The record-breaking 2023 hurricane season significantly disrupted electricity supply, highlighting the critical role of rental generators in ensuring emergency power for businesses and communities. Beyond emergency use, the region’s strong industrial base, particularly oil and gas operations in remote locations such as the Permian Basin, sustains steady demand for reliable off-grid power solutions. The expansion of data centers and large-scale infrastructure projects strengthens market growth. In addition, the availability of advanced, energy-efficient, and environmentally compliant generator technologies, supported by favorable government incentives and cost-effective rental models, is accelerating adoption. Together, these factors reinforce North America’s dominance in the market, positioning it as a key hub for innovation and demand in temporary and backup power solutions. Power Generator Rental Market Competitive Landscape The Power Generator Rental Market is facing intense competition between multinational corporations and regional players striving to meet rising demand for temporary power solutions. Leading global providers dominate with extensive fleets of diesel, gas, and hybrid generators, while regional companies leverage strong local expertise, reliability, and customer-focused services. A wide network of specialized firms further strengthens competition, offering flexible and scalable solutions across construction, industrial, utilities, and event sectors. Market growth is boosted by large-scale infrastructure projects, increasing demand for backup power in events and industrial facilities, and a growing shift toward hybrid and eco-friendly technologies.Also, strict emission regulations and the global transition toward renewable energy are pressuring traditional diesel-based offerings, increasing operational costs and compliance challenges. To stay competitive, companies are investing in cleaner technologies, hybrid systems, and innovative rental models that balance cost efficiency with sustainability, ultimately intensifying the market’s competitive dynamics and reshaping strategies for long-term growth. Global Power Generator Rental Market Recent Development On October 25, 2022, Amazon Web Services (AWS) applied for an emissions license from Ireland’s Environmental Protection Agency to install 105 backup diesel generators and four fire pumps at its new Dublin data center in Clonshaugh Business and Technology Park. The generators, with a combined capacity of 674MW, aim to address concerns over electricity grid strain amid a moratorium on new Dublin data center connections until 2028. The move reflects regulatory pressure for facilities to use alternative power sources to ease network constraints. On October 18, 2022, United Rentals, Inc. the world’s largest equipment rental company, announced plans to add several zero-emissions hydrogen power generators to its North American rental fleet. The EODev GEH2 electro-hydrogen units, supplied through Generac, provide up to 110 kVA of clean, quiet, and reliable power without releasing CO₂, NOx, or particulate matter. Expected to deploy in late 2022 and 2023, the generators support sustainable electrification at construction sites, events, and industrial applications. On June 13, 2022, Cummins Inc. has introduced the C1000D6RE, a new 1MW twinpack rental generator designed to deliver high-performance, reliable mobile power across North America. Built in Fridley, Minnesota, the unit integrates two 500kW Tier 4 Final-certified QSX15 engines into a 40-foot container, ensuring compliance with stringent EPA standards while eliminating the need for a Diesel Particulate Filter. Offering parallel capability, masterless load demand, and remote start/stop functions, the generator enhances uptime and reduces costs. With rugged design, low noise, and Cummins’ extensive service network, it supports applications in construction, industrial, utilities, events, and emergency power. Global Power Generator Rental Market Recent Trends 1. Migration of Digital Technologies and IoT in Rental Generators The integration of digital technology and IoT-enabled sensors and remote monitor systems in rental generators is becoming a prominent trend in the generator rental industry. Digital technology allow the operator to monitor fuel consumption, generator performance, and maintenance reporting in real-time; thus helping the operator reduce downtime and maintain an operationally efficient generator. Rental firms across North America and Europe, are beginning to incorporate these types of smart technologies with the goal of expanding value-added services, predictive maintenance programs, and improved customer experience with a transition to smart or data-enabled fleet management. 2. Development of Rental Services in Emerging Economies Emerging economies in Asia, Africa, and Latin America are experiencing growth in their generator rental businesses due to increased urbanization, unreliable utility infrastructure, and continued industrialization. The demand for temporary power and backup power in renovation and infrastructural construction work, food and beverage or retail sector roll-outs, utility-level oil and gas exploration in areas such as India, Nigeria and Brazil, for example, is fuelling national expansion and development of rental sites and networks. As a result, rental firms are investing to establish local service hubs that provide flexibility and rental models to meet these expanding markets with focus on providing accessibility, affordability, and scale.Power Generator Rental Market, Scope: Inquire before buying

Power Generator Rental Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.73 Bn. Forecast Period 2025 to 2032 CAGR: 5.1% Market Size in 2032: USD 4.06 Bn. Segments Covered: by Generator Rating Up to 100 KVA 101- 500 KVA 501- 1000 KVA Above 1000 KVA by Fuel Type Diesel Natural Gas by End Users Utilities Mining Oil & Gas Construction Event Others Power Generator Rental Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Power Generator Rental Market, Key Players:

The Power Generator Rental market significantly influences key players such as Aggreko, United Rentals, Herc Rentals, and Cummins Inc. These companies adapt to the increasing demand for flexible, efficient, and sustainable power solutions. Aggreko has leveraged its extensive experience to offer highly specialized, modular power solutions, ensuring it remains a market leader in providing emergency and long-term power needs.Global Power Generator Rental Market, Key Players

1. Aggreko (Glasgow, Scotland, UK) 2. Atlas Copco (Nacka, Sweden) 3. Cummins Inc. (Columbus, Indiana, USA) 4. United Rentals (Stamford, Connecticut, USA) 5. Herc Rentals (Bonita Springs, Florida, USA) 6. Generac Power Systems (Waukesha, Wisconsin, USA) 7. Wärtsilä (Helsinki, Finland) 8. Kohler Co. (Kohler, Wisconsin, USA) 9. APR Energy (Jacksonville, Florida, USA) 10. Wacker Neuson SE (Munich, Germany) 11. Modern Hiring Service (Mumbai, India) 12. Aggreko Energy Rental India Pvt Ltd (New Delhi, India) 13. Caterpillar Inc. (Irving, Texas, USA) 14. Reddy Generators (Hyderabad, India) 15. Boels Rental (Sittard, Netherlands) 16. Speedy Hire Plc (Newton-le-Willows, UK) 17. Bredenoord (Apeldoorn, Netherlands) 18. Himoinsa (a Yanmar Company) (Murcia, Spain) 19. Mateco Group (Stuttgart, Germany) 20. Power Electrics (Bristol, UK) 21. Sudhir Power Ltd. (Gurugram, India) 22. FG Wilson (Caterpillar brand) (Belfast, Northern Ireland, UK) 23. Altaaqa Global Energy Services (Dubai, UAE) 24. Smart Energy Solutions (SES) (Dubai, UAE) OthersFAQs:

1. Which region has the largest share in Global Power Generator Rental Market? Ans: North America region holds the highest share in 2024. 2. What is the growth rate of Global Power Generator Rental Market? Ans: The Global Power Generator Rental Market is growing at a CAGR of 5.1% during forecasting period 2025-2032. 3. What segments are covered in Global Power Generator Rental market? Ans: Global Power Generator Rental Market is segmented into Generator Rating, Fuel Type, End Users, and region. 4. What is the study period of this market? Ans: The Global Power Generator Rental Market is studied from 2024 to 2032.

1. Power Generator Rental Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Power Generator Rental Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Power Generator Rental Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Power Generator Rental Market: Dynamics 3.1. Power Generator Rental Market Trends by Region 3.1.1. North America Power Generator Rental Market Trends 3.1.2. Europe Power Generator Rental Market Trends 3.1.3. Asia Pacific Power Generator Rental Market Trends 3.1.4. Middle East and Africa Power Generator Rental Market Trends 3.1.5. South America Power Generator Rental Market Trends 3.2. Power Generator Rental Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Power Generator Rental Market Drivers 3.2.1.2. North America Power Generator Rental Market Restraints 3.2.1.3. North America Power Generator Rental Market Opportunities 3.2.1.4. North America Power Generator Rental Market Challenges 3.2.2. Europe 3.2.2.1. Europe Power Generator Rental Market Drivers 3.2.2.2. Europe Power Generator Rental Market Restraints 3.2.2.3. Europe Power Generator Rental Market Opportunities 3.2.2.4. Europe Power Generator Rental Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Power Generator Rental Market Drivers 3.2.3.2. Asia Pacific Power Generator Rental Market Restraints 3.2.3.3. Asia Pacific Power Generator Rental Market Opportunities 3.2.3.4. Asia Pacific Power Generator Rental Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Power Generator Rental Market Drivers 3.2.4.2. Middle East and Africa Power Generator Rental Market Restraints 3.2.4.3. Middle East and Africa Power Generator Rental Market Opportunities 3.2.4.4. Middle East and Africa Power Generator Rental Market Challenges 3.2.5. South America 3.2.5.1. South America Power Generator Rental Market Drivers 3.2.5.2. South America Power Generator Rental Market Restraints 3.2.5.3. South America Power Generator Rental Market Opportunities 3.2.5.4. South America Power Generator Rental Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Power Generator Rental Industry 3.8. Analysis of Government Schemes and Initiatives For Power Generator Rental Industry 3.9. Power Generator Rental Market Trade Analysis 3.10. The Global Pandemic Impact on Power Generator Rental Market 4. Power Generator Rental Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 4.1.1. Up to 100 KVA 4.1.2. 101- 500 KVA 4.1.3. 501- 1000 KVA 4.1.4. Above 1000 KVA 4.2. Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 4.2.1. Diesel 4.2.2. Natural Gas 4.3. Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 4.3.1. Utilities 4.3.2. Mining 4.3.3. Oil & Gas 4.3.4. Construction 4.3.5. Event 4.3.6. Others 4.4. Power Generator Rental Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Power Generator Rental Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 5.1.1. Up to 100 KVA 5.1.2. 101- 500 KVA 5.1.3. 501- 1000 KVA 5.1.4. Above 1000 KVA 5.2. North America Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 5.2.1. Diesel 5.2.2. Natural Gas 5.3. North America Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 5.3.1. Utilities 5.3.2. Mining 5.3.3. Oil & Gas 5.3.4. Construction 5.3.5. Event 5.3.6. Others 5.4. North America Power Generator Rental Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 5.4.1.1.1. Up to 100 KVA 5.4.1.1.2. 101- 500 KVA 5.4.1.1.3. 501- 1000 KVA 5.4.1.1.4. Above 1000 KVA 5.4.1.2. United States Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 5.4.1.2.1. Diesel 5.4.1.2.2. Natural Gas 5.4.1.3. United States Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 5.4.1.3.1. Utilities 5.4.1.3.2. Mining 5.4.1.3.3. Oil & Gas 5.4.1.3.4. Construction 5.4.1.3.5. Event 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 5.4.2.1.1. Up to 100 KVA 5.4.2.1.2. 101- 500 KVA 5.4.2.1.3. 501- 1000 KVA 5.4.2.1.4. Above 1000 KVA 5.4.2.2. Canada Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 5.4.2.2.1. Diesel 5.4.2.2.2. Natural Gas 5.4.2.3. Canada Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 5.4.2.3.1. Utilities 5.4.2.3.2. Mining 5.4.2.3.3. Oil & Gas 5.4.2.3.4. Construction 5.4.2.3.5. Event 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 5.4.3.1.1. Up to 100 KVA 5.4.3.1.2. 101- 500 KVA 5.4.3.1.3. 501- 1000 KVA 5.4.3.1.4. Above 1000 KVA 5.4.3.2. Mexico Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 5.4.3.2.1. Diesel 5.4.3.2.2. Natural Gas 5.4.3.3. Mexico Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 5.4.3.3.1. Utilities 5.4.3.3.2. Mining 5.4.3.3.3. Oil & Gas 5.4.3.3.4. Construction 5.4.3.3.5. Event 5.4.3.3.6. Others 6. Europe Power Generator Rental Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.2. Europe Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.3. Europe Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4. Europe Power Generator Rental Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.1.2. United Kingdom Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.1.3. United Kingdom Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4.2. France 6.4.2.1. France Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.2.2. France Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.2.3. France Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.3.2. Germany Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.3.3. Germany Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.4.2. Italy Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.4.3. Italy Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.5.2. Spain Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.5.3. Spain Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.6.2. Sweden Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.6.3. Sweden Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.7.2. Austria Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.7.3. Austria Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 6.4.8.2. Rest of Europe Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 6.4.8.3. Rest of Europe Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7. Asia Pacific Power Generator Rental Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.2. Asia Pacific Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.3. Asia Pacific Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4. Asia Pacific Power Generator Rental Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.1.2. China Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.1.3. China Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.2.2. S Korea Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.2.3. S Korea Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.3.2. Japan Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.3.3. Japan Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.4. India 7.4.4.1. India Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.4.2. India Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.4.3. India Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.5.2. Australia Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.5.3. Australia Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.6.2. Indonesia Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.6.3. Indonesia Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.7.2. Malaysia Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.7.3. Malaysia Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.8.2. Vietnam Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.8.3. Vietnam Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.9.2. Taiwan Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.9.3. Taiwan Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 7.4.10.2. Rest of Asia Pacific Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 7.4.10.3. Rest of Asia Pacific Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 8. Middle East and Africa Power Generator Rental Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 8.2. Middle East and Africa Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 8.3. Middle East and Africa Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 8.4. Middle East and Africa Power Generator Rental Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 8.4.1.2. South Africa Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 8.4.1.3. South Africa Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 8.4.2.2. GCC Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 8.4.2.3. GCC Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 8.4.3.2. Nigeria Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 8.4.3.3. Nigeria Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 8.4.4.2. Rest of ME&A Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 8.4.4.3. Rest of ME&A Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 9. South America Power Generator Rental Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 9.2. South America Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 9.3. South America Power Generator Rental Market Size and Forecast, by End Users(2024-2032) 9.4. South America Power Generator Rental Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 9.4.1.2. Brazil Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 9.4.1.3. Brazil Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 9.4.2.2. Argentina Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 9.4.2.3. Argentina Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Power Generator Rental Market Size and Forecast, by Generator Rating (2024-2032) 9.4.3.2. Rest Of South America Power Generator Rental Market Size and Forecast, by Fuel Type (2024-2032) 9.4.3.3. Rest Of South America Power Generator Rental Market Size and Forecast, by End Users (2024-2032) 10. Company Profile: Key Players 10.1. Aggreko (Glasgow, Scotland, UK) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Atlas Copco (Nacka, Sweden) 10.3. Cummins Inc. (Columbus, Indiana, USA) 10.4. United Rentals (Stamford, Connecticut, USA) 10.5. Herc Rentals (Bonita Springs, Florida, USA) 10.6. Generac Power Systems (Waukesha, Wisconsin, USA) 10.7. Wärtsilä (Helsinki, Finland) 10.8. Kohler Co. (Kohler, Wisconsin, USA) 10.9. APR Energy (Jacksonville, Florida, USA) 10.10. Wacker Neuson SE (Munich, Germany) 10.11. Modern Hiring Service (Mumbai, India) 10.12. Aggreko Energy Rental India Pvt Ltd (New Delhi, India) 10.13. Caterpillar Inc. (Irving, Texas, USA) 10.14. Reddy Generators (Hyderabad, India) 10.15. Boels Rental (Sittard, Netherlands) 10.16. Speedy Hire Plc (Newton-le-Willows, UK) 10.17. Bredenoord (Apeldoorn, Netherlands) 10.18. Himoinsa (a Yanmar Company) (Murcia, Spain) 10.19. Mateco Group (Stuttgart, Germany) 10.20. Power Electrics (Bristol, UK) 10.21. Sudhir Power Ltd. (Gurugram, India) 10.22. FG Wilson (Caterpillar brand) (Belfast, Northern Ireland, UK) 10.23. Altaaqa Global Energy Services (Dubai, UAE) 10.24. Smart Energy Solutions (SES) (Dubai, UAE) 10.25. Others 11. Key Findings 12. Industry Recommendations 13. Power Generator Rental Market: Research Methodology 14. Terms and Glossary