The Pizza Ovens Market, valued at USD 634.42 million in 2024, is projected to reach USD 973.64 million by 2032 at a 5.5% CAGR.Pizza Oven Market Overview

The Pizza Oven Market is growing steadily due to rising global pizza consumption, which exceeds 5 billion pizzas sold annually worldwide, with the U.S. alone consuming 3 billion pizzas per year. Growing foodservice operations pizzerias, restaurants, cloud kitchens, hotels, and food trucks continue to rely heavily on high-output ovens, with the commercial sector accounting for over 70% of total pizza oven installations globally. Residential demand is also rising as nearly 48% of consumers now engage in gourmet-style home cooking, and outdoor kitchen adoption has increased by over 30% in the past three years. Compact and portable outdoor pizza ovens have seen sales growth of 20–25% annually, driven by digital retail penetration and lifestyle shifts. Demand remains strong for multiple oven types: brick ovens, deck ovens, conveyor ovens, and convection ovens. Electric and gas pizza ovens have witnessed a 15–18% surge in adoption due to improved safety, faster heating cycles, and easier installation. Asia Pacific and North America lead market expansion, supported by a booming food-delivery ecosystem. Asia handles over 70 million pizza deliveries per month and highly developed restaurant infrastructure. Europe maintains strong interest in artisanal baking traditions, with wood-fired ovens used in over 40% of independent pizzerias. Manufacturers are increasingly benefiting from innovations such as energy-efficient oven designs, AI-controlled baking systems, portable outdoor ovens, and eco-friendly refractory materials, aligning with evolving consumer and foodservice trends.To know about the Research Methodology :- Request Free Sample Report

Pizza Oven Market Dynamics

Growing Pizza Consumption Driving Global Pizza Ovens Market Expansion Growing worldwide pizza consumption continues to fuel the Pizza Ovens Market, supported by rising QSR penetration, café expansion, and the spread of Western food culture. Globally, more than 5 billion pizzas are consumed each year, with the U.S. alone accounting for nearly 3 billion annually. This massive demand is pushing commercial operators to invest heavily in Commercial Pizza Ovens, Electric Pizza Ovens, Gas Pizza Ovens, and Wood-Fired Pizza Ovens, ensuring faster output and consistent quality. North America and Asia Pacific remain high-growth regions North America records over 45 million pizza orders per week, while Asia Pacific has seen a 30–35% surge in Western fast-food chains in the last five years. Digital food delivery is another significant driver, with platforms like DoorDash, Uber Eats, Swiggy, and Meituan facilitating hundreds of millions of monthly pizza orders, raising the need for high-capacity commercial ovens. Segments such as Commercial Pizza Ovens, Restaurant Pizza Ovens, and QSR Equipment are benefiting from advanced features like energy-efficient burners, AI-based baking systems, and conveyor ovens capable of producing 100–200 pizzas per hour. This consumption surge is strengthening global adoption across all foodservice formats. High Cost & Maintenance Barriers Slowing Pizza Oven Adoption Despite strong demand, the Pizza Oven Industry faces notable constraints. Premium Commercial Pizza Ovens, Brick Pizza Ovens, Deck Ovens, and Smart Digital Ovens often require an upfront investment of USD 5,000–40,000, depending on capacity. Installation costs—including insulation, ventilation, refractory stones, stainless steel housing, and burner systems—can increase total expenses by 30–50%, discouraging small restaurants and budget-conscious households. Commercial units can require annual servicing expenses of USD 300–1,200, especially for gas and electric models with advanced digital controls. Space limitations in dense urban regions such as Tokyo, Seoul, London, and Mumbai restrict the adoption of large-format ovens, with over 60% of small restaurants unable to accommodate traditional brick ovens. These barriers slow the adoption of Residential Pizza Ovens, Outdoor Pizza Ovens, and high-capacity commercial systems, ultimately reducing replacement cycles and dampening overall market penetration. Booming Outdoor & Artisan Pizza Culture Creating High-Growth Opportunities The surge in artisan-style pizza and outdoor cooking culture is unlocking strong opportunities for pizza oven manufacturers. Outdoor pizza cooking has increased by 25–30% globally over the past three years, driven by social media food trends, home-gourmet culture, and an expanding DIY culinary community. Demand for Portable Pizza Ovens, Hybrid Pizza Ovens, Wood-Fired Pizza Ovens, and Multi-Fuel Pizza Ovens is rising sharply in North America, Europe, and Australia. Portable outdoor pizza ovens many weighing under 20 kg have experienced annual sales growth of 20–25%, making them one of the fastest-growing categories in residential cooking appliances. E-commerce is also boosting the segment, with online sales of outdoor and portable ovens growing by 30–40% year-over-year, driven by platforms like Amazon, Walmart, and specialty pizza equipment retailers. Consumers increasingly prefer features such as rapid heating (800–950°F), dual-fuel compatibility, and energy-efficient burners, transforming buying behavior in both developed and emerging markets.Pizza Oven Market Segment Analysis

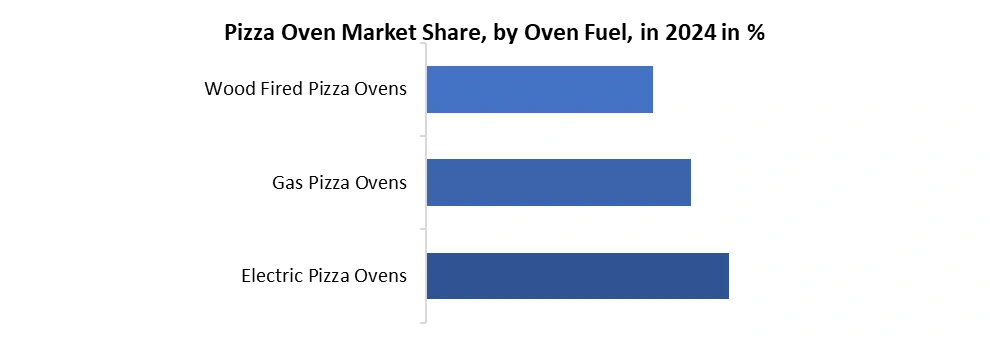

By Type, the Pizza Oven Market is segmented into Brick Ovens, Pizza Deck Ovens, Conveyor Pizza Ovens, and Pizza Convection Ovens. The Conveyor Pizza Ovens segment dominated the market in 2024 and is projected to maintain its lead throughout the forecast period. Brick Ovens maintain strong demand in gourmet restaurants and artisanal outlets, driven by interest in authentic pizza ovens, artisan pizza ovens, and traditional wood-fired pizza baking across Europe and North America. Pizza Deck Ovens remain essential in restaurants requiring consistent crust quality, professional pizza ovens, and stable heat performance suitable for commercial kitchen equipment. Pizza Convection Ovens continue gaining traction among households, cafés, and food trucks seeking compact pizza ovens, energy-efficient pizza ovens, home pizza ovens, and small commercial pizza ovens. these types support diverse global demand for high-performance pizza ovens and modern pizza-baking solutions.By Oven Fuel, The market is segmented into Wood Fired Pizza Ovens, Gas Pizza Ovens, and Electric Pizza Ovens, with Electric Pizza Ovens dominated the segment in 2024 due to their rising adoption in residential kitchens, cafes, food trucks, and commercial spaces requiring safe, efficient, and easily installed equipment. Their growth is strengthened by increasing demand for energy-efficient pizza ovens, smart pizza ovens, compact electric pizza ovens, indoor pizza ovens, and modern home pizza ovens, especially across Asia Pacific, North America, and urban European markets. Gas Pizza Ovens hold a significant share in commercial foodservice owing to their temperature consistency, rapid heating, and cost-effective performance, making them ideal for commercial gas pizza ovens, high-efficiency pizza ovens, and restaurant pizza ovens used in QSRs, pizzerias, and high-volume kitchens. Wood Fired Pizza Ovens continue to thrive in premium and artisanal dining environments, supported by strong interest in traditional pizza ovens, wood-fired pizza ovens, outdoor pizza ovens, backyard pizza ovens, and Neapolitan pizza ovens, especially in Europe, Australia, and North America where authentic, smoky-flavored pizzas remain culturally significant. Collectively, these fuel types address the global shift toward versatile and performance-driven solutions in both residential and commercial applications, reinforcing market demand for high-performance pizza ovens, premium pizza oven equipment, and professional pizza-baking solutions across diverse consumer segments.

Pizza Oven Market Regional Insights

North America dominated the Pizza Ovens Market, driven by strong demand for commercial pizza ovens, high-performance pizza ovens, and outdoor pizza ovens across the U.S. and Canada. Rising popularity of home pizza ovens, electric pizza ovens, and backyard pizza ovens also supports residential growth. Europe remains a key market, fueled by the cultural preference for wood-fired pizza ovens, artisan pizza ovens, and traditional pizza ovens, particularly in Italy, Germany, and the UK. Strong commercial infrastructure and established pizzeria chains boost adoption of professional pizza ovens throughout the region. Asia Pacific is the fastest-growing region, driven by rapid expansion of QSRs, modern kitchens, and rising interest in compact pizza ovens, smart pizza ovens, and energy-efficient pizza ovens across India, China, and Japan. Increasing urbanization and growing café culture accelerate demand for gas pizza ovens and commercial-grade pizza ovens. The Middle East & Africa show steady growth supported by hotel expansions and outdoor dining trends, encouraging sales of premium pizza ovens and outdoor pizza cooking equipment. South America continues expanding through rising restaurant chains and adoption of affordable pizza ovens in emerging cities.Pizza Oven Market Competitive Landscape

The Pizza Ovens Market is highly competitive, led by major players such as BakerStone, Middleby Corporation, Ooni, Gozney, and Welbilt offering a wide range of commercial pizza ovens, electric pizza ovens, gas pizza ovens, and premium pizza ovens. These brands focus on innovation, durability, and energy efficiency. Their portfolios include smart pizza ovens, compact pizza ovens, and outdoor pizza ovens, catering to both residential and commercial customers worldwide. Top manufacturers including BakerStone, Middleby Corporation, Gozney, Ooni, and Marsal & Sons continue to expand their presence through advanced technology, custom solutions, and strong distribution networks. Companies are investing in AI-enabled pizza ovens, high-performance pizza ovens, and professional pizza oven equipment to support the fast-growing QSR and restaurant sectors. Strategic collaborations, new product launches, and e-commerce growth strengthen their reach in global markets. Brands specializing in artisan pizza ovens, wood-fired pizza ovens, and commercial-grade pizza ovens also focus on sustainability by introducing energy-efficient pizza ovens and low-emission models to meet modern consumer expectations.Recent Developments

• In March 2024, Sveba Dahlen introduced its High Temp Pizza Oven, an advanced electric oven capable of reaching 500°C in just 30 minutes. Equipped with a specially crafted Italian stone surface, it enables rapid baking of Neapolitan-style pizzas in 60–120 seconds. The oven is designed for professional kitchens seeking authentic texture, high throughput, and consistent results in both artisanal and commercial pizza production. • In January 7, 2025, Current Backyard unveiled the Model P Smart Pizza Oven at CES 2025. This Wi-Fi-enabled electric oven cooks a 12-inch pizza in just 2 minutes, reaching up to 850°F (450°C). It includes a unique Pizza Build Calculator that automatically adjusts time and temperature based on dough and toppings, ensuring even heat distribution without the need to rotate the pizza, suitable for both indoor and outdoor use. • In October 2025, Ooni launched its Volt 2 electric pizza oven, equipped with a new “Pizza Intelligence” feature that uses sensor data to adjust heating in real time for more uniform cooking. The oven heats up to 450 °C (842°F) and can bake pizzas up to 13 inches. It also supports multiple cooking presets (Neapolitan, New York, deep-pan) and allows custom user settings. Designed for countertop use, the Volt 2 brings AI-style adaptive heating to electric pizza ovens, ideal for users seeking high performance in a compact, intelligent format.Pizza Oven Market Trends

Trend Description Shift Toward High-Temperature & Fast-Cooking Ovens Demand is rising for ovens reaching 450–500°C, enabling pizzas in under two minutes. Restaurants and home chefs prefer these high-performance models for faster service, authentic texture, and consistent baking quality. Rising Demand for Smart, Programmable & Connected Pizza Ovens Smart ovens with Wi-Fi, preset modes, and automated temperature control are growing rapidly. Their convenience, precision, and energy efficiency drive strong adoption across modern homes and tech-enabled commercial kitchens in North America and Europe. Growing Popularity of Outdoor & Home Pizza Ovens Portable and outdoor pizza ovens are trending as consumers seek gourmet-style cooking at home. Rising backyard gatherings, DIY pizza culture, and premium outdoor appliances support strong residential demand. Strong Shift Toward Energy-Efficient & Eco-Friendly Ovens Eco-friendly electric ovens and low-emission gas models are gaining traction due to sustainability regulations. Businesses and homeowners prefer energy-efficient ovens to reduce operating costs and carbon emissions. Rapid Expansion of Commercial Pizza Chains & QSR Growth Growth in pizza chains, cloud kitchens, and QSR outlets boosts demand for high-capacity conveyor and deck ovens. Expansion in Asia-Pacific and the Middle East strengthens commercial oven adoption. Increasing Demand for Multi-Fuel & Hybrid Pizza Ovens Multi-fuel ovens offering wood, gas, and electric compatibility are increasingly popular for flavor flexibility and efficient cooking. Adoption is high in Europe and North America for artisan-style pizza preparation. Pizza Oven Market Scope: Inquire Before Buying

Pizza Oven Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 634.42 Mn. Forecast Period 2025 to 2032 CAGR: 5.5% Market Size in 2032: USD 973.64 Mn. Segments Covered: by Type Brick Ovens Pizza Deck Ovens Conveyor Pizza Ovens Pizza Convection Ovens by End Use Residential Commercial by Oven Fuel Wood Fired Pizza Ovens Gas Pizza Ovens Electric Pizza Ovens by Distribution Channel Wholesalers/Distributors Specialty Stores Online Retailers Pizza Oven Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Pizza Oven Key Players

1. BakerStone (United States) 2. Forno Bravo (United States) 3. Pizzacraft (United States) 4. Blackstone (United States) 5. Earthstone Ovens (United States) 6. Ilfornino (United States) 7. Mugnaini (United States) 8. Fuego (United States) 9. Authentic Pizza Ovens (Canada) 10. Alfa Refrattari (Italy) 11. Fontana Forni (Italy) 12. Cuppone (Italy) 13. Clementi (Italy) 14. Valoriani (Italy) 15. Ooni (United Kingdom) 16. Roccbox (United Kingdom) 17. Gozney (United Kingdom) 18. Jamie Oliver (United Kingdom) 19. The Stone Bake Oven Company (United Kingdom) 20. Piteba (Netherlands) 21. Le Panyol (France) 22. Four Grand-Mère (France) 23. Uuni (Finland) 24. Bushman Wood Fired Ovens (Australia) 25. Bella Outdoor Living (Australia) 26.OthersFrequently Asked Questions:

1] What is the growth rate of the Global Pizza Oven Market? Ans. The Global Pizza Oven Market is growing at a significant rate of 5.5 % during the forecast period. 2] Which region is expected to dominate the Global Pizza Oven Market? Ans. North America is expected to dominate the Pizza Oven Market during the forecast period. 3] What was the Global Pizza Oven Market size in 2024? Ans. The Pizza Oven Market size is expected to reach USD 634.42 Million in 2024. 4] What is the expected Global Pizza Oven Market size by 2032? Ans. The Pizza Oven Market size is expected to reach USD 973.64 Million by 2032. 5] What segments are covered in the Pizza Oven Market report? Ans. The segments covered in the Pizza Oven Market report are based on Type, Use, Oven Fuel, Distribution Channel and region

1. Pizza Oven Market: Research Methodology 1.1. Pizza Oven Market Introduction 1.2. Study Assumption and Market Definition 1.3. Scope of the Study 1.4. Executive Summary 2. Global Pizza Oven Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Segment 2.3.4. End User Segment 2.3.5. Revenue (2024) 2.3.6. Revenue Growth Rate (Y-O-Y) % 2.3.7. Profit Margin (%) 2.3.8. Certifications 2.3.9. Sales Channels 2.3.10. Customer Satisfaction Index 2.3.11. Ad Spend as % of Sales 2.3.12. Geographical Presence 2.4. Mergers and Acquisitions Details 3. Pizza Oven Market: Dynamics 3.1. Pizza Oven Market Trends 3.2. Pizza Oven Market Dynamics 3.2.1.1. Drivers 3.2.1.2. Restraints 3.2.1.3. Opportunities 3.2.1.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Regulatory Landscape by Region 3.7. Analysis of Government Schemes and Initiatives for Pizza Oven Market 4. Import Export Analysis 4.1. Top Importing Country 4.2. Top Exporting Country 5. Comparison Analysis of Pizza Oven: Rural Vs. Urban Areas 5.1. Demand and Preferences 5.2. Infrastructure and Power Supply 5.3. Cost Considerations 5.4. Commercial vs. Domestic Use 5.5. Technology and Innovation 5.6. Fuel Availability and Usage 5.7. Space and Installation 5.8. Regional and Cultural Influences 6. Technological Advancements 6.1. Smart Pizza Ovens with IoT Integration 6.2. Portable and Compact Oven Innovations 6.3. Heat Retention and Energy Efficiency Enhancements 7. Consumer Behaviour Insights 7.1. Preference for Artisanal vs. Fast-food Pizza, By Country 7.2. Residential Adoption of Outdoor Pizza Ovens, By Region 7.3. Impact of the DIY and Home-cooking Trends 7.4. Average Spending on Pizza Ovens for Residential and Commercial Buyers 8. Pricing Analysis By Region 8.1. Price Trends Analysis (2018-2023), By Region 8.2. Comparative Pricing of Residential vs. Commercial Ovens, By Region 8.3. Impact of Raw Material Costs on Final Pricing, By Region 8.4. Regional Pricing Differences 9. Supply Chain Analysis 9.1. Key stages in the pizza oven supply chain. 9.2. Key Supply Chain Challenges 9.3. Mitigation strategies for Pizza Oven 10. Pizza Oven Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 10.1. Pizza Oven Market Size and Forecast, by Type (2024-2032) 10.1.1. Brick Ovens 10.1.2. Pizza Deck Ovens 10.1.3. Conveyor Pizza Ovens 10.1.4. Pizza Convection Ovens 10.2. Pizza Oven Market Size and Forecast, By End-Use (2024-2032) 10.2.1. Residential 10.2.2. Commercial 10.3. Pizza Oven Market Size and Forecast, by Oven Fuel (2024-2032) 10.3.1. Wood Fired Pizza Ovens 10.3.2. Gas Pizza Ovens 10.3.3. Electric Pizza Ovens 10.4. Pizza Oven Market Size and Forecast, by Distribution Channel (2024-2032) 10.4.1. Wholesalers/Distributors 10.4.2. Specialty Stores 10.4.3. Online Retailers 10.5. Pizza Oven Market Size and Forecast, by Region (2024-2032) 10.5.1. North America 10.5.2. Europe 10.5.3. Asia Pacific 10.5.4. Middle East and Africa 10.5.5. South America 11. North America Pizza Oven Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 11.1. North America Pizza Oven Market Size and Forecast, by Type (2024-2032) 11.1.1. Brick Ovens 11.1.2. Pizza Deck Ovens 11.1.3. Conveyor Pizza Ovens 11.1.4. Pizza Convection Ovens 11.2. North America Pizza Oven Market Size and Forecast, By End-Use (2024-2032) 11.2.1. Residential 11.2.2. Commercial 11.3. North America Pizza Oven Market Size and Forecast, by Oven Fuel (2024-2032) 11.3.1. Wood Fired Pizza Ovens 11.3.2. Gas Pizza Ovens 11.3.3. Electric Pizza Ovens 11.4. North America Pizza Oven Market Size and Forecast, by Distribution Channel (2024-2032) 11.4.1. Wholesalers/Distributors 11.4.2. Specialty Stores 11.4.3. Online Retailers 11.5. North America Pizza Oven Market Size and Forecast, by Country (2024-2032) 11.5.1. United States 11.5.2. Canada 11.5.3. Mexico 12. Europe Pizza Oven Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 12.1. Europe Pizza Oven Market Size and Forecast, by Type (2024-2032) 12.2. Europe Pizza Oven Market Size and Forecast, By End-Use (2024-2032) 12.3. Europe Pizza Oven Market Size and Forecast, by Oven Fuel (2024-2032) 12.4. Europe Pizza Oven Market Size and Forecast, by Distribution Channel (2024-2032) 12.5. Europe Pizza Oven Market Size and Forecast, by Country (2024-2032) 12.5.1. United Kingdom 12.5.2. France 12.5.3. Germany 12.5.4. Italy 12.5.5. Spain 12.5.6. Russia 12.5.7. Rest of Europe 13. Asia Pacific Pizza Oven Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 13.1. Asia Pacific Pizza Oven Market Size and Forecast, by Type (2024-2032) 13.2. Asia Pacific Pizza Oven Market Size and Forecast, By End-Use (2024-2032) 13.3. Asia Pacific Pizza Oven Market Size and Forecast, by Oven Fuel (2024-2032) 13.4. Asia Pacific Pizza Oven Market Size and Forecast, by Distribution Channel (2024-2032) 13.5. Asia Pacific Pizza Oven Market Size and Forecast, by Country (2024-2032) 13.5.1. China 13.5.2. S Korea 13.5.3. Japan 13.5.4. India 13.5.5. Australia 13.5.6. Rest of Asia Pacific 14. Middle East and Africa Pizza Oven Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 14.1. Middle East and Africa Pizza Oven Market Size and Forecast, by Type (2024-2032) 14.2. Middle East and Africa Pizza Oven Market Size and Forecast, By End-Use (2024-2032) 14.3. Middle East and Africa Pizza Oven Market Size and Forecast, by Oven Fuel (2024-2032) 14.4. Middle East and Africa Pizza Oven Market Size and Forecast, by Distribution Channel (2024-2032) 14.5. Middle East and Africa Pizza Oven Market Size and Forecast, by Country (2024-2032) 14.5.1. South Africa 14.5.2. GCC 14.5.3. Nigeria 14.5.4. Rest of ME&A 15. South America Pizza Oven Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 15.1. South America Pizza Oven Market Size and Forecast, by Type (2024-2032) 15.2. South America Pizza Oven Market Size and Forecast, By End-Use (2024-2032) 15.3. South America Pizza Oven Market Size and Forecast, by Oven Fuel (2024-2032) 15.4. South America Pizza Oven Market Size and Forecast, by Distribution Channel (2024-2032) 15.5. South America Pizza Oven Market Size and Forecast, by Country (2024-2032) 15.5.1. Brazil 15.5.2. Argentina 15.5.3. Colombia 15.5.4. Chile 15.5.5. Peru 15.5.6. Rest Of South America 16. Company Profile: Key Players 16.1. BakerStone (United States) 16.1.1. Company Overview 16.1.2. Business Portfolio 16.1.3. Financial Overview 16.1.4. SWOT Analysis 16.1.5. Strategic Analysis 16.1.6. Recent Developments 16.2. Forno Bravo (United States) 16.3. Pizzacraft (United States) 16.4. Blackstone (United States) 16.5. Earthstone Ovens (United States) 16.6. Ilfornino (United States) 16.7. Mugnaini (United States) 16.8. Fuego (United States) 16.9. Authentic Pizza Ovens (Canada) 16.10. Alfa Refrattari (Italy) 16.11. Fontana Forni (Italy) 16.12. Cuppone (Italy) 16.13. Clementi (Italy) 16.14. Valoriani (Italy) 16.15. Ooni (United Kingdom) 16.16. Roccbox (United Kingdom) 16.17. Gozney (United Kingdom) 16.18. Jamie Oliver (United Kingdom) 16.19. The Stone Bake Oven Company (United Kingdom) 16.20. Piteba (Netherlands) 16.21. Le Panyol (France) 16.22. Four Grand-Mère (France) 16.23. Uuni (Finland) 16.24. Bushman Wood Fired Ovens (Australia) 16.25. Bella Outdoor Living (Australia) 17. Key Findings 18. Analyst Recommendations 19. Pizza Oven Market – Research Methodology