The Outdoor Apparel Market size was valued at USD 31.2 Billion in 2024 and is expected to reach USD 45.09 Billion by 2032, at a CAGR of 5.4 % The global outdoor apparel market is evolving rapidly, driven by sustainability initiatives, material innovation, and technological advancements across key regions. In North America, the U.S. and Canada lead the market due to a strong culture of outdoor recreation and eco-conscious consumers. Brands like Patagonia and The North Face are pioneering innovations such as endlessly reusable wetsuits and FUTUREFLEECE technology, focusing on sustainability and high performance. In, countries such as Germany, the UK, and France are emphasizing eco-certified fabrics and circular fashion. European brands are investing in biodegradable textiles and recycled fibers to meet stringent environmental standards. Meanwhile, Asia-Pacific, led by China, Japan, and South Korea, is emerging as a manufacturing hub and innovation center, with growing demand for smart and weather-resistant outdoor apparel among urban consumers. New players such as Soča and Arc’teryx are expanding globally, offering advanced designs such as quick-dry, UPF-protected, and temperature-regulating garments. These developments highlight how R&D, material science, and digital retail growth are shaping the future of the outdoor apparel industry worldwide.To know about the Research Methodology :- Request Free Sample Report

Global Outdoor Apparel Market Key Trends

Increasing Participation in Outdoor Recreational Activities to Drive the Growth of Outdoor Apparel Market The Global Outdoor Apparel Market is witnessing growth driven by multiple factors such as the increasing participation in outdoor recreational activities such as hiking, camping, trekking, and adventure sports. Rising awareness of health and wellness lifestyles has encouraged consumers to engage in outdoor experiences, creating a sustained demand for high-performance and comfortable outdoor clothing. Technological advancements in fabric innovation, such as moisture-wicking, waterproof, and breathable materials, are further enhancing product quality and consumer satisfaction. Major brands such as The North Face, Patagonia, and Columbia Sportswear are introducing sustainable outdoor clothing lines that blend durability with eco-friendly materials, appealing to environmentally conscious consumers. The rapid growth of e-commerce and digital retail platforms has expanded the accessibility of outdoor apparel globally. Increased disposable income levels in developing regions, particularly Asia-Pacific (India, China, and South Korea), are encouraging consumers to invest in premium outdoor sportswear. Furthermore, collaborations between outdoor brands and fashion influencers have bridged the gap between functionality and style, positioning outdoor apparel as a mainstream fashion choice. Growing demand for sustainable outdoor apparel, coupled with brand initiatives toward circular fashion such as Patagonia’s Worn Wear program is expected to significantly boost market growth through 2032. Rising Costs of Raw Materials and Logistics Limits the Outdoor Apparel Market growth The outdoor apparel industry faces significant challenges. Intense market competition from global and regional brands exerts pressure on pricing and profit margins. Seasonal demand fluctuations and unpredictable weather conditions can significantly impact sales volumes, particularly in cold-weather apparel segments. Rising costs of raw materials and logistics, along with supply chain disruptions, can limit operational efficiency. Moreover, maintaining compliance with sustainability certifications and environmental regulations adds complexity and costs to manufacturing. Counterfeiting and imitation products in online marketplaces pose additional threats to brand reputation and consumer trust. To overcome these restraints, key players are focusing on supply chain optimization, local manufacturing, and digital authentication systems to ensure quality and transparency. Companies investing in innovation, sustainability, and adaptive marketing strategies are expected to thrive despite these challenges, driving the future of the global outdoor apparel market. Innovation in Eco-Friendly Outdoor Wear creates lucrative growth opportunities to the Outdoor Clothing Market The Outdoor Clothing Market presents lucrative opportunities for innovation and expansion. The surge in demand for eco-friendly outdoor wear is prompting manufacturers to invest in organic, recycled, and biodegradable fabrics. With sustainability becoming a key purchasing factor, brands that adopt transparent and ethical production processes are gaining consumer trust and competitive advantage. Technological integration represents another major opportunity. The development of smart outdoor apparel, featuring embedded sensors for temperature regulation, GPS tracking, or UV protection, is reshaping the performance clothing market. For example, Columbia Sportswear’s Omni-Heat Infinity technology and Under Armour’s smart fitness wearables illustrate how brands are leveraging innovation to enhance outdoor experiences. The expansion of online retail channels provides outdoor clothing brands with direct access to a global consumer base. Companies are enhancing their digital marketing and omnichannel strategies to create seamless shopping experiences. Emerging markets in Asia-Pacific and Latin America offer untapped potential due to rising adventure tourism and fitness awareness. Collaborations between outdoor brands and government initiatives promoting sustainable fashion such as the European Green Deal are also expected to create long-term growth prospects for the global outdoor apparel industry.

Global Outdoor Apparel Market: Dynamics

Global Outdoor Apparel Market: Segment Analysis

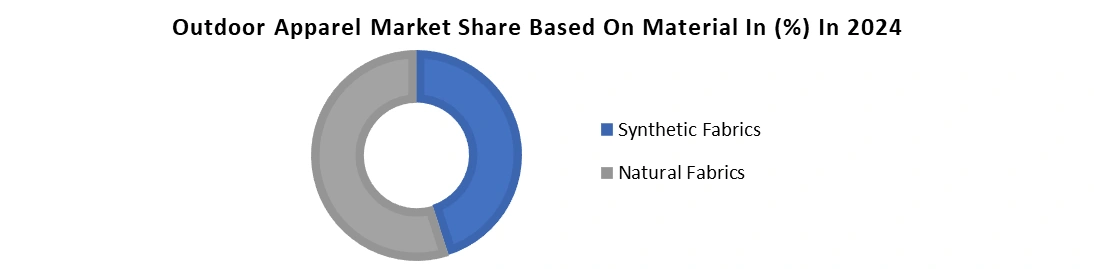

Based On Product Type, the Outdoor Apparel market is segmented into Top, Bottom, Others. The Top wear segment dominated the Product Type segment in year 2024. The top wear segment includes T-shirts, Tank Tops, Sports Bras, Jackets, Sweatshirts, and Others (track suits, swimmer suits). Due to its wide application and consumer preference for versatile and functional clothing. This category includes T-shirts, jackets, sweatshirts, sports bras, and tank tops, which are essential for various outdoor activities such as hiking, trekking, running, and camping. The growing trend of athleisure and outdoor fashion has increased the demand for stylish yet performance-oriented apparel. Technological advancements in fabric innovation, including moisture-wicking, quick-dry, and thermal insulation materials, have enhanced the comfort and durability of top wear products. Leading brands like The North Face, Patagonia, and Columbia Sportswear continuously introduce eco-friendly and weather-resistant tops, catering to the growing demand for sustainable outdoor apparel. The rise in fitness awareness, coupled with the convenience of online retail platforms, has further boosted sales in this category, solidifying the dominance of the top wear segment in the global outdoor clothing market.Based On Material, the market is segmented into Synthetic fabrics and Natural Fabrics. The Natural segment dominated the Material segment in year 2024. The rising consumer preference for eco-friendly and sustainable clothing materials. Natural fabrics such as cotton, wool, hemp, and bamboo are increasingly favored for their breathability, comfort, and biodegradability, making them ideal for outdoor activities like hiking, trekking, and camping. With growing awareness of environmental impact, consumers are shifting away from synthetic fibers toward organic and renewable textiles. Leading brands expanded their product lines using merino wool and organic cotton, aligning with the global trend toward sustainable outdoor apparel. Moreover, government initiatives promoting sustainable textile production and advancements in natural fiber processing have enhanced product quality and performance. The combination of durability, skin-friendliness, and reduced environmental footprint has positioned the natural fabric segment as the preferred choice in the global outdoor clothing market, fueling its continued dominance through the forecast period.

Global Outdoor Apparel Market: Regional Analysis

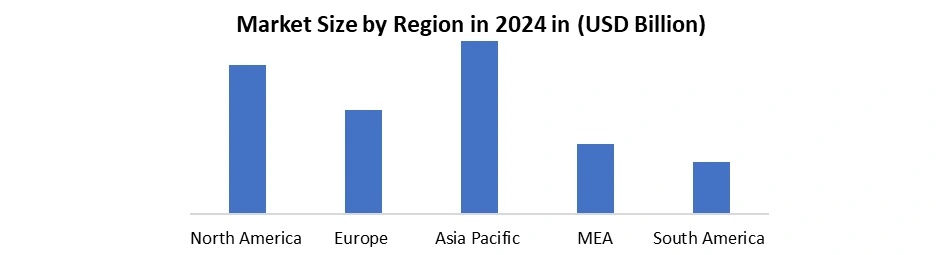

North America dominated the global outdoor apparel market in 2024, supported by robust retail networks, advanced R&D, and high consumer spending on premium outdoor wear. Leading brands such as The North Face, Patagonia, and Columbia Sportswear are investing heavily in fabric technology and performance innovation. For instance, The North Face introduced DOTKNIT and FUTUREFLEECE technologies and expanded its Vectiv shoe line, enhancing thermal comfort and durability while strengthening brand loyalty. In Europe, strict sustainability regulations under the EU Green Deal and REACH have encouraged brands to adopt recycled fabrics, circular manufacturing, and low-impact dyeing technologies. The region’s focus on eco-friendly production continues to drive research in durable, biodegradable textiles. The Asia-Pacific region remains the fastest-growing market, fueled by urbanization, e-commerce expansion, and localized product launches, Countries like China, Japan, and India are becoming major hubs for manufacturing, innovation, and sustainable R&D partnerships. Across all regions, investments in smart textiles, digital retail channels, and green materials are shaping the future of the outdoor apparel industry.

Global Outdoor Apparel Market: Competitive Landscape

The global outdoor apparel market highly competitive and evolving rapidly, with brands focusing on technological advancement, product customization, and sustainability leadership. Companies such as Marmot, Helly Hansen, and Arc’teryx are introducing lightweight, weather-adaptive fabrics to enhance user comfort in extreme conditions. Decathlon continues to dominate the affordable outdoor wear segment through in-house innovation and global retail expansion. Meanwhile, European and North American brands are investing in biodegradable fibers, waterless dyeing, and circular fashion models to reduce carbon footprints. Strategic collaborations between apparel firms and textile technology companies are accelerating the adoption of smart fabrics and temperature-regulating apparel. Emerging players in Asia-Pacific, particularly in China and Japan, are leveraging digital design tools and e-commerce platforms to attract young, adventure-driven consumers. With rising sustainability standards and design innovation, competition is shifting toward eco-performance apparel, reshaping brand positioning in the global outdoor clothing industry.Global Outdoor Apparel Market: Recent Development

1.In May 2, 2024, Patagonia partnered with Colorado-based startup Wibbeler to Patagonia partnered with Colorado-based startup Wibbeler to develop endlessly reusable wetsuits, marking a major step toward sustainable innovation in outdoor apparel. The collaboration focuses on crafting adventure wear from plastic-free merino wool and Tencel blends, setting a new benchmark for eco-friendly and responsible fashion solutions in the industry. 2.In 2025, the brand introduced new models such as Norvan LD 4, Vertex Speed, Konseal, and Norvan Nivalis, each designed for distinct mountain terrains. These launches underscore the company’s commitment to technical innovation and performance excellence in both outdoor footwear and apparel. 3.In November 12, 2025, Soča made its debut as a women’s fly-fishing apparel brand, unveiling its first collection featuring “The Button Down,” “The Jacket,” and “The Sun Shirt.” These versatile essentials blend technical performance with everyday style, crafted from quick-dry, anti-pilling, and water-repellent fabrics with UPF sun protection, offering comfort and durability for both active outdoor use and urban wear.Outdoor Apparel Market Scope: Inquire Before Buying

Global Outdoor Apparel Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 31.2 Bn. Forecast Period 2025 to 2032 CAGR: 5.4% Market Size in 2032: USD 45.09 Bn. Segments Covered: by Product Top T-shirts Tank tops Sports bras Jackets Sweatshirts Others (track suits, swimmer suits) Bottom Leggings Shorts Sweatpants Track pants Others (Yoga pants, skirts) Others by Material Synthetic fabrics Polyester Nylon Natural fabrics Cotton fabrics Hemp Bamboo Wool Others by Pricing Low Medium High by End-User Male Female Kids by Distribution Channel Online retail Ecommerce Company website Offline Specialty stores Mega retail stores Others Outdoor Apparel Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Outdoor Apparel Market, Key Players

1. Patagonia (United States) 2. Nike Inc. (United States) 3. Columbia Sportswear (United States) 4. Arc'teryx (Canada) 5. The North Face (United States) 6. Helly Hansen (Norway) 7. Fjällräven (Sweden) 8. Mammut (Switzerland) 9. Bergans of Norway (Norway) 10. Haglöfs (Sweden) 11. PUMA (Germany) 12. Vaude (Germany) 13. Berghaus (United Kingdom) 14. Rab (United Kingdom) 15. Kathmandu (New Zealand) 16. Icebreaker (New Zealand) 17. BlackYak (South Korea) 18. Montbell (Japan) 19. The North Face Korea (South Korea) 20. Hi-Tec (United States) 21. Salomon (France) 22. Trilhas & Rumos (Brazil) 23. Conquista (Brazil) 24. Kailash (Brazil)Frequently Asked Questions:

1. What are the growth drivers for the Market? Ans. The growth drivers for the Outdoor Apparel Market include rising participation in outdoor activities and increasing awareness of health and fitness. 2. What is the major restraint for the Market growth? Ans. One major restraint for the Outdoor Apparel Market growth is the increasing competition from counterfeit and low-cost products. 3. Which region is expected to lead the global Market during the forecast period? Ans. Asia-Pacific is expected to lead the global Outdoor Apparel Market during the forecast period. 4. What is the projected market size & growth rate of the Market? Ans. The Market size was valued at USD 31.2 Billion in 2023 and the total Outdoor Apparel Market revenue is expected to grow at a CAGR of 5.4% from 2024 to 2030, reaching nearly USD 45.09 Billion. 5. What segments are covered in the Market report? Ans. The segments covered in the Market report are product type, fabric, end user, distribution channel, and region.

1. Outdoor Apparel Market: Research Methodology 2. Outdoor Apparel Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Outdoor Apparel Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Type Segment 3.3.3. End User Segment 3.3.4. Revenue (2024) 3.3.5. Headquarter 3.4. Mergers and Acquisitions Details 4. Consumer Insights 4.1.1. Demographic Analysis 4.1.2. Outdoor Participation Trends 4.1.3. Gender and Age Preferences 4.1.4. Spending Behavior 4.1.5. Seasonal Buying Patterns 4.1.6. Brand Loyalty and Awareness 5. Pricing Analysis 5.1. Global Price Trends 5.2. Price Segmentation (Premium, Mid-range, Economy) 5.3. Regional Price Comparison 5.4. Cost Structure Analysis 5.5. Factors Influencing Pricing 5.6. Forecast of Price Dynamics 6. Outdoor Apparel Market: Dynamics 6.1. Outdoor Apparel Market Trends by Region 6.2. Outdoor Apparel Market Dynamics 6.2.1.1. Drivers 6.2.1.2. Restraints 6.2.1.3. Opportunities 6.2.1.4. Challenges 6.3. PORTER’s Five Forces Analysis 6.4. PESTLE Analysis 6.5. Value Chain Analysis 6.6. Analysis of Government Schemes and Initiatives for Outdoor Apparel Market 7. Outdoor Apparel Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 7.1.1. Top 7.1.1.1. T-shirts 7.1.1.2. Tank tops 7.1.1.3. Sports bras 7.1.1.4. Jackets 7.1.1.5. Sweatshirts 7.1.1.6. Others (track suits, swimmer suits) 7.1.2. Bottom 7.1.2.1. Leggings 7.1.2.2. Shorts 7.1.2.3. Sweatpants 7.1.2.4. Track pants 7.1.2.5. Others (Yoga pants, skirts) 7.1.3. Others 7.2. Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 7.2.1. Synthetic fabrics 7.2.1.1. Polyester 7.2.1.2. Nylon 7.2.2. Natural fabrics 7.2.2.1. Cotton fabrics 7.2.2.2. Hemp 7.2.2.3. Bamboo 7.2.2.4. Wool 7.2.2.5. Others 7.3. Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 7.3.1. Low 7.3.2. Medium 7.3.3. High 7.4. Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 7.4.1. Men 7.4.2. Women 7.4.3. Child 7.5. Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 7.5.1. Online retail 7.5.1.1. Ecommerce 7.5.1.2. Company website 7.5.2. Offline 7.5.2.1. Specialty stores 7.5.2.2. Mega retail stores 7.5.2.3. Others 7.6. Outdoor Apparel Market Size and Forecast, by region (2024-2032) 7.6.1. North America 7.6.2. Europe 7.6.3. Asia Pacific 7.6.4. Middle East and Africa 7.6.5. South America 8. North America Outdoor Apparel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. North America Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 8.2. North America Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 8.3. North America Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 8.4. North America Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 8.5. North America Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 8.6. North America Outdoor Apparel Market Size and Forecast, by Country (2024-2032) 8.6.1. United States 8.6.2. Canada 8.6.3. Mexico 9. Europe Outdoor Apparel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. Europe Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.2. Europe Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.3. Europe Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.4. Europe Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.5. Europe Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 9.6. Europe Outdoor Apparel Market Size and Forecast, by Country (2024-2032) 9.6.1. United Kingdom 9.6.1.1. United Kingdom Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.6.1.2. United Kingdom Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.6.1.3. United Kingdom Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.6.1.4. United Kingdom Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.6.1.5. United Kingdom Outdoor Apparel Market Size and Forecast, By Distribution channel (2024-2032) 9.6.2. France 9.6.2.1. France Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.6.2.2. France Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.6.2.3. France Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.6.2.4. France Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.6.2.5. France Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.3. Germany 9.6.3.1. Germany Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.6.3.2. Germany Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.6.3.3. Germany Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.6.3.4. Germany Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.6.3.5. Germany Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.4. Italy 9.6.4.1. Italy Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.6.4.2. Italy Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.6.4.3. Italy Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.6.4.4. Italy Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.6.4.5. Italy Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.5. Spain 9.6.5.1. Spain Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.6.5.2. Spain Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.6.5.3. Spain Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.6.5.4. Spain Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.6.5.5. Spain Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.6. Russia 9.6.6.1. Russia Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.6.6.2. Russia Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.6.6.3. Russia Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.6.6.4. Russia Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.6.6.5. Russia Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.7. Rest of Europe 9.6.7.1. Rest of Europe Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 9.6.7.2. Rest of Europe Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 9.6.7.3. Rest of Europe Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 9.6.7.4. Rest of Europe Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 9.6.7.5. Rest of Europe Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 10. Asia Pacific Outdoor Apparel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 10.1. Asia Pacific Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 10.2. Asia Pacific Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 10.3. Asia Pacific Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 10.4. Asia Pacific Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 10.5. Asia Pacific Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 10.6. Asia Pacific Outdoor Apparel Market Size and Forecast, by Country (2024-2032) 10.6.1. China 10.6.1.1. China Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 10.6.1.2. China Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 10.6.1.3. China Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 10.6.1.4. China Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 10.6.1.5. China Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 10.6.2. S Korea 10.6.2.1. S Korea Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 10.6.2.2. S Korea Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 10.6.2.3. S Korea Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 10.6.2.4. S Korea Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 10.6.2.5. S Korea Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 10.6.3. Japan 10.6.3.1. Japan Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 10.6.3.2. Japan Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 10.6.3.3. Japan Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 10.6.3.4. Japan Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 10.6.3.5. Japan Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 10.6.4. India 10.6.4.1. India Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 10.6.4.2. India Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 10.6.4.3. India Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 10.6.4.4. India Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 10.6.4.5. India Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 10.6.5. Australia 10.6.5.1. Australia Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 10.6.5.2. Australia Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 10.6.5.3. Australia Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 10.6.5.4. Australia Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 10.6.5.5. Australia Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 10.6.6. Rest of Asia Pacific 10.6.6.1. Rest of Asia Pacific Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 10.6.6.2. Rest of Asia Pacific Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 10.6.6.3. Rest of Asia Pacific Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 10.6.6.4. Rest of Asia Pacific Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 10.6.6.5. Rest of Asia Pacific Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 11. Middle East and Africa Outdoor Apparel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 11.1. Middle East and Africa Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 11.2. Middle East and Africa Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 11.3. Middle East and Africa Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 11.4. Middle East and Africa Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 11.5. Middle East and Africa Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 11.6. Middle East and Africa Outdoor Apparel Market Size and Forecast, by Country (2024-2032) 11.6.1. South Africa 11.6.1.1. South Africa Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 11.6.1.2. South Africa Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 11.6.1.3. South Africa Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 11.6.1.4. South Africa Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 11.6.1.5. South Africa Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 11.6.2. GCC 11.6.2.1. GCC Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 11.6.2.2. GCC Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 11.6.2.3. GCC Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 11.6.2.4. GCC Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 11.6.2.5. GCC Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 11.6.3. Nigeria 11.6.3.1. Nigeria Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 11.6.3.2. Nigeria Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 11.6.3.3. Nigeria Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 11.6.3.4. Nigeria Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 11.6.3.5. Nigeria Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 11.6.4. Rest of ME&A 11.6.4.1. Rest of ME&A Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 11.6.4.2. Rest of ME&A Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 11.6.4.3. Rest of ME&A Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 11.6.4.4. Rest of ME&A Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 11.6.4.5. Rest of ME&A Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 12. South America Outdoor Apparel Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 12.1. South America Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 12.2. South America Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 12.3. South America Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 12.4. South America Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 12.5. South America Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 12.6. South America Outdoor Apparel Market Size and Forecast, by Country (2024-2032) 12.6.1. Brazil 12.6.1.1. Brazil Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 12.6.1.2. Brazil Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 12.6.1.3. Brazil Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 12.6.1.4. Brazil Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 12.6.1.5. Brazil Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 12.6.2. Argentina 12.6.2.1. Argentina Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 12.6.2.2. Argentina Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 12.6.2.3. Argentina Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 12.6.2.4. Argentina Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 12.6.2.5. Argentina Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 12.6.3. Rest Of South America 12.6.3.1. Rest Of South America Outdoor Apparel Market Size and Forecast, By Product (2024-2032) 12.6.3.2. Rest Of South America Outdoor Apparel Market Size and Forecast, By Material (2024-2032) 12.6.3.3. Rest Of South America Outdoor Apparel Market Size and Forecast, By Pricing (2024-2032) 12.6.3.4. Rest Of South America Outdoor Apparel Market Size and Forecast, By End-User (2024-2032) 12.6.3.5. Rest Of South America Outdoor Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 13. Company Profile: Key Players 13.1. Patagonia (United States) 13.1.1. Company Overview 13.1.2. Business Portfolio 13.1.3. Financial Overview 13.1.4. SWOT Analysis 13.1.5. Strategic Analysis 13.1.6. Recent Developments 13.2. Nike Inc. (United States) 13.3. Columbia Sportswear (United States) 13.4. Arc'teryx (Canada) 13.5. The North Face (United States) 13.6. Helly Hansen (Norway) 13.7. Fjällräven (Sweden) 13.8. Mammut (Switzerland) 13.9. Bergans of Norway (Norway) 13.10. Haglöfs (Sweden) 13.11. PUMA (Germany) 13.12. Vaude (Germany) 13.13. Berghaus (United Kingdom) 13.14. Rab (United Kingdom) 13.15. Kathmandu (New Zealand) 13.16. Icebreaker (New Zealand) 13.17. BlackYak (South Korea) 13.18. Montbell (Japan) 13.19. The North Face Korea (South Korea) 13.20. Hi-Tec (United States) 13.21. Salomon (France) 13.22. Trilhas & Rumos (Brazil) 13.23. Conquista (Brazil) 13.24. Kailash (Brazil) 14. Key Findings 15. Analyst Recommendations