Oil and Gas Drilling Automation Market was valued $1.24 Bn in 2022 and is expected to reach $1.33 Bn by 2029, at a CAGR of 1.0%.Oil and Gas Drilling Automation Market Introduction

Drilling automation initially gained acceptance in the Oil & Gas industry as a solution to increase rig site safety. While safety-related drilling automation has been implemented, many companies are beginning to recognize that drilling automation offers possibilities of performance enhancement also. Technology is enabling the companies to drill challenging and unconventional wells which were previously assumed to be undrillable. The industry is slowly adapting automated drilling systems as a powerful means to increase productivity, quality and most importantly personnel safety.To Know About The Research Methodology :- Request Free Sample Report

Oil and Gas Drilling Automation Market Dynamics

Automated systems achieve better safety by moving people away from the rig site and is a key factor driving the market for Oil and Gas Drilling Automation. Oil & Gas industry is an industry where periodic downturn cycles are common. Increasing Rate of Penetration (ROP), reducing non-productive time (NPT) and eliminating invisible lost time (ILT) because of automation are boosting the market growth. Increased well complexity, access to limited expert resources, knowledge transfer as a result of the exodus of skilled employees, data overload, environmental concerns also contribute in propelling the market. The shorter the time, the more profitable the drilling project will be. Hence, companies are very interested in increasing the efficiency of their operations by improving the reliability and availability of the hardware used. The oil and gas industry has been witnessing an increase in the production of shale oil and gas over recent years. Countries such as the US have been observing an increase in shale oil production. The drilling and extraction of shale oil and gas involve various challenges such as adherence to stringent compliance requirements, preparing wells, equipment installation and operations. Automated drilling solutions reduce the time spent on developing, installing, integrating, and initiating the drilling and extraction process. The growth in the production of shale oil is encouraging manufacturers to offer innovative automated drilling solutions specifically for shale oil and gas extraction projects. Thus, the rapid growth in shale oil production is expected to influence market growth positively during the forecast period. The fact that drilling activity takes place in extreme working conditions, above ground in unhospitable areas and down hole with high temperature, high pressure (HTHP) formations, assumption that a human can better process the data and make better decisions and difficulty in finding control equipment and sensors to handle this environment are major factors restraining the Oil and Gas Drilling Automation Market.Segment Analysis

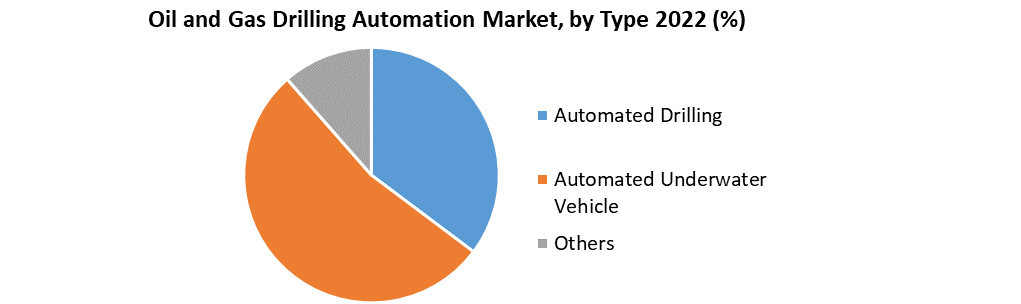

By Type, Automated drilling segment is expected to exhibit a significant revenue of $xx Bn in the forecast period. Drilling for oil and gas is still a process requiring extensive manual work on onshore and offshore drilling platforms. Fully automatic drilling system for largely unmanned drilling operations are being developed by major key players of the market. This will help the industry to save costs while greatly improving reliability and availability of the drilling equipment. This innovative technology is the first step towards more efficient, less risky and more profitable drill floor operations based on digital industrial communication, control and automation. It will also provide a wealth of process data to better understand and optimize the drilling process. Automated drilling takes a step further, using algorithms to map out wells, make complex calculations and decisions on the fly, and drill for long periods without making costly errors. Many operators predict this technology has the capacity to reduce drilling costs by 30% to 50%, saving owners significant overheads. And by monitoring drilling activity, these devices can cancel out production errors and the lapses of concentration that inevitably come with fatigue induced by long hours on the drilling floor. Danish drilling leviathan Maersk is also upgrading its offshore platforms and using algorithms to make them more efficient and eco-friendly. The jack-up rig Maersk Intrepid, for instance, will incorporate a NOVOS ADC system that is linked to third-party algorithms to help the drill floor team work more consistently. Adoption of automated drilling by top players is expanding the segment growth, thereby fuelling the market. By application segment, the market is segmented into on shore and offshore. From oil wells to pipelines, onshore upstream and downstream vendors are seeking to improve their infrastructure to be more efficient. Onshore automation systems must not only address control and report requirements but also mitigate risks and assist producers with process challenges. SCADA (supervisory control and data acquisition) systems are at the heart of most automation efforts both onshore and off. Artificial lift automation is also common onshore. When integrated into one or a series of wells, artificial lift pumping systems can reduce energy consumption, decrease rates of mechanical failure, and improve well production. On shore and off shore applications are also contributing to the oil and gas drilling automation market.

Regional Insights

The US accounted for over 29.4% of the Global Oil and Gas Drilling Automation Market in 2022 In the US, oil and gas drilling automation market was valued $366.7 Mn in 2022 and is likely to dominate the market in the forecast period. In South American market, Venezuela has the largest proven oil reserves in the world. Columbia has onshore and offshore oil deposits. Ecuador also has a huge market for oil exports. The huge potential for growth in oil & gas production and distribution will boost the automation market in this region. China, the world’s second largest economy is expected to reach a revenue value of $229.4 Mn by 2029 at a CAGR of xx%. The markets in Japan and Canada are expected to showcase a CAGR of xx% and xx% in the forecast period. European market is expected to generate a revenue market value of $229.4 Mn by 2029. Asia-Pacific is one of the fastest-growing markets in the world, with investments flooding from all around the world. This has put enormous pressure on the oil & gas sector to produce more. The production and import of oil have increased manifold in this region. It has one of the biggest refineries in the world like Reliance Jamnagar Refinery in India and Ulsan Refinery in South Korea. Wireless sensors play an important part in the safety of the equipment and also the people handling it. As a result, the demand for oil and gas automation in this region is expected to grow in the coming years.Oil and Gas Drilling Automation Market Scope : Inquire before buying

Oil and Gas Drilling Automation Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.24 Bn. Forecast Period 2023 to 2029 CAGR: 1% Market Size in 2029: US $ 1.33 Bn. Segments Covered: by Type Automated Drilling Automated Underwater Vehicle Others by Application Onshore Offshore Oil and Gas Drilling Automation Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)Oil and Gas Drilling Automation Market Key Players

1. ABB Group 2. National Oilwell Varco, Inc. 3. Kongsberg Gruppen 4. Pason Systems Corp. 5. Nabors Industries Ltd. 6. Rockwell Automation, Inc. Frequently Asked Questions: 1. Which region has the largest share in Global Oil and Gas Drilling Automation Market? Ans: Asia Pacific region held the highest share in 2022. 2. What is the growth rate of Global Oil and Gas Drilling Automation Market? Ans: The Global Oil and Gas Drilling Automation Market is growing at a CAGR of 1% during forecasting period 2023-2029. 3. What is scope of the Global Oil and Gas Drilling Automation Market report? Ans: Global Oil and Gas Drilling Automation Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What was the Global Oil and Gas Drilling Automation Market size in 2022? Ans: The Global Oil and Gas Drilling Automation market was valued at US$ 1.24 Bn. In 2022. 5. What is the study period of this Market? Ans: The Global Oil and Gas Drilling Automation Market is studied from 2022 to 2029.

Global Oil and Gas Drilling Automation Market

Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Oil and Gas Drilling Automation Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2022 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Oil and Gas Drilling Automation Market 3.4. Geographical Snapshot of the Oil and Gas Drilling Automation Market, By Manufacturer share 4. Global Oil and Gas Drilling Automation Market Overview, 2022-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Oil and Gas Drilling Automation Market 5. Supply Side and Demand Side Indicators 6. Global Oil and Gas Drilling Automation Market Analysis and Forecast, 2022-2029 6.1. Global Oil and Gas Drilling Automation Market Size & Y-o-Y Growth Analysis. 7. Global Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 7.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 7.1.1. Automated Drilling 7.1.2. Automated Underwater Vehicle 7.1.3. Others 7.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 7.2.1. Onshore 7.2.2. Offshore 8. Global Oil and Gas Drilling Automation Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2022-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 9.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 9.1.1. Automated Drilling 9.1.2. Automated Underwater Vehicle 9.1.3. Others 9.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 9.2.1. Onshore 9.2.2. Offshore 10. North America Oil and Gas Drilling Automation Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 11.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 11.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 12. Canada Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 12.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 12.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 13. Mexico Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 13.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 13.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 14. Europe Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 14.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 14.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 15. Europe Oil and Gas Drilling Automation Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 16.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 16.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 17. France Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 17.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 17.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 18. Germany Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 18.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 18.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 19. Italy Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 19.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 19.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 20. Spain Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 20.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 20.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 21. Sweden Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 21.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 21.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 22. CIS Countries Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 22.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 22.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 23. Rest of Europe Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 23.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 23.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 24. Asia Pacific Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 24.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 24.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 25. Asia Pacific Oil and Gas Drilling Automation Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2022-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 26.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 26.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 27. India Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 27.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 27.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 28. Japan Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 28.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 28.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 29. South Korea Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 29.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 29.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 30. Australia Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 30.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 30.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 31. ASEAN Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 31.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 31.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 32. Rest of Asia Pacific Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 32.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 32.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 33. Middle East Africa Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 33.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 33.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 34. Middle East Africa Oil and Gas Drilling Automation Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 35.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 35.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 36. GCC Countries Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 36.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 36.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 37. Egypt Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 37.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 37.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 38. Nigeria Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 38.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 38.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 39. Rest of ME&A Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 39.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 39.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 40. South America Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 40.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 40.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 41. South America Oil and Gas Drilling Automation Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2022-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 42.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 42.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 43. Argentina Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 43.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 43.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 44. Rest of South America Oil and Gas Drilling Automation Market Analysis and Forecasts, 2022-2029 44.1. Market Size (Value) Estimates & Forecast By Type, 2022-2029 44.2. Market Size (Value) Estimates & Forecast By Application, 2022-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Oil and Gas Drilling Automation Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Applications 45.2.3.2. M&A Key Players, Forward Integration and Backward Integration 45.3. Company Profile – ABB Group 45.3.1. Company Overview 45.3.2. Financial Overview 45.3.3. Geographic Footprint 45.3.4. Product Portfolio 45.3.5. Business Strategy 45.3.6. Recent Developments 45.4. National Oilwell Varco, Inc. 45.5. Kongsberg Gruppen 45.6. Pason Systems Corp. 45.7. Nabors Industries Ltd. 45.8. Rockwell Automation, Inc 45.9. Other Key Players