The North America RFID Market size was valued at USD 6.73 Billion in 2023 and the total North America RFID Market revenue is expected to grow at a CAGR of 8.13% from 2024 to 2030, reaching nearly USD 11.64 Billion. The North America RFID (Radio Frequency Identification) market refers to the adoption and utilization of RFID technology within the geographical region of North America, comprising the United States, Canada, and Mexico. RFID technology utilizes radio waves to automatically identify and track objects or individuals wirelessly, enabling real-time data capture and improved operational efficiency across various industries. North America continues to lead in RFID adoption, with widespread deployment across various applications. Key industries such as retail leverage RFID technology for inventory management, supply chain optimization, and enhancing customer experiences. The healthcare sector utilizes RFID for asset tracking, patient monitoring, and improving operational efficiency. Logistics and transportation companies in North America are also investing in RFID solutions to improve package tracking and optimize supply chain operations. Government mandates for enhanced security and traceability, particularly in the defense and healthcare sectors, are fueling RFID adoption. Technological advancements such as smaller, more affordable tags, and improved read ranges are making RFID solutions more accessible and attractive to businesses.To know about the Research Methodology:-Request Free Sample Report The integration of RFID with other emerging technologies such as blockchain and artificial intelligence. This integration enhances RFID capabilities and opens new opportunities for innovative applications, including secure supply chain tracking and personalized customer experiences. Additionally, there is a growing trend towards the adoption of RFID data analytics, enabling businesses to gain valuable insights for better decision-making and process optimization. The retail sector presents significant opportunities for RFID adoption, with retailers leveraging RFID technology to improve inventory accuracy, reduce out-of-stock situations, and enhance operational efficiency. Several key players in the North America RFID market have made significant developments to enhance their offerings and cater to evolving North America RFID market demands. For example, companies like Avery Dennison and Zebra Technologies have introduced advanced RFID solutions tailored to specific industry needs, such as retail and logistics. Additionally, advancements in RFID reader technology, software platforms, and cloud-based solutions have further expanded the capabilities and applications of RFID technology in North America.

Market Dynamics:

IoT Revolution RFID's Crucial Role in Smart Building Management: Retailers are leveraging RFID technology to improve inventory management and enhance the customer shopping experience. For example, Macy's implemented RFID to reduce out-of-stock situations and enhance inventory accuracy, leading to improved sales and customer satisfaction. The healthcare sector is adopting RFID for asset tracking, patient monitoring, and supply chain management. Hospitals like the Mayo Clinic are using RFID to track medical equipment and improve patient safety by ensuring the availability of necessary supplies. Government mandates for enhanced security and traceability drive RFID adoption. For instance, the U.S. Department of Defense requires suppliers to use RFID for inventory management, leading to widespread adoption in defense logistics. The logistics and transportation industry utilizes RFID for efficient tracking of goods and vehicles. Companies like UPS are investing in RFID technology to improve package tracking, reduce misloads, and enhance operational efficiency. RFID technology is a crucial component of the Internet of Things (IoT), driving its adoption in various North America RFID Market. For example, IoT-enabled smart buildings use RFID for access control, asset tracking, and energy management. Continuous advancements in RFID technology, such as smaller, more affordable tags and improved read ranges, make RFID more accessible and attractive to businesses across industries. The COVID-19 pandemic has accelerated the demand for contactless technologies, including RFID, in industries like retail, healthcare, and hospitality, driving adoption for safer and more efficient operations. RFID enables real-time visibility and traceability in the supply chain, reducing errors, minimizing stockouts, and improving overall operational efficiency. Companies like Walmart have successfully implemented RFID to enhance supply chain visibility and reduce costs. RFID generates vast amounts of data that is analysed to gain valuable insights into consumer behavior, inventory management, and operational efficiency. By leveraging RFID data analytics, businesses make informed decisions to optimize processes and drive North America RFID Market growth. Integration of RFID with other emerging technologies like blockchain and artificial intelligence further enhances its capabilities and opens new opportunities for innovative applications, such as secure supply chain tracking and personalized customer experiences.Government Mandates Drive RFID Adoption Across Sectors: North America's retail sector presents a significant growth opportunity for RFID adoption. Retailers leverage RFID for inventory management and customer experience enhancement. For instance, Macy's successful implementation of RFID technology led to reduced out-of-stock instances and improved inventory accuracy, resulting in enhanced sales and customer satisfaction. The healthcare industry in North America offers ample opportunities for RFID market growth. Hospitals and healthcare facilities utilize RFID for asset tracking, patient monitoring, and supply chain management. Mayo Clinic's adoption of RFID enables efficient tracking of medical equipment, ensuring patient safety and timely access to essential supplies. Government mandates for enhanced security and traceability drive North America RFID Market adoption across various sectors. For example, the U.S. Department of Defense requires RFID use for inventory management, leading to widespread adoption in defense logistics and opening opportunities for RFID solution providers. The logistics and transportation industry in North America presents growth opportunities for RFID implementation. Companies like UPS are investing in RFID technology to enhance package tracking, reduce misloads, and improve operational efficiency, creating opportunities for RFID solution providers to cater to the sector's needs. RFID technology plays a crucial role in the Internet of Things (IoT) ecosystem, driving its adoption across industries in North America. IoT-enabled applications, such as smart buildings, utilize RFID for access control, asset tracking, and energy management, presenting growth opportunities for RFID solution providers. Continuous advancements in RFID technology, including smaller, more affordable tags and improved read ranges, make RFID solutions more accessible and attractive to businesses across North America, fostering growth opportunities for RFID solution providers. RFID generates vast amounts of data that is analyzed to gain valuable insights into consumer behavior, inventory management, and operational efficiency. Businesses in North America leverage RFID data analytics to make informed decisions and optimize processes, creating growth opportunities for RFID solution providers offering data analytics solutions. Integration of RFID with other emerging technologies like blockchain and artificial intelligence further enhances its capabilities and opens new opportunities for innovative applications in North America RFID Market. Secure supply chain tracking and personalized customer experiences are among the opportunities for RFID solution providers to leverage integrated technologies.

Complex integration processes pose barriers to RFID implementation: The implementation of RFID systems often requires significant upfront investment in hardware, software, and infrastructure, which is a barrier for small and medium-sized enterprises (SMEs). For example, deploying RFID technology across multiple retail stores or warehouses entails considerable capital expenditure, limiting adoption among businesses with budget constraints North America RFID Market. Integrating RFID systems with existing legacy systems and software is complex and time-consuming, leading to compatibility issues and disruptions in operations. For instance, migrating from barcode systems to RFID technology require extensive system upgrades and customization, posing challenges for seamless integration and hindering adoption in certain industries. The use of RFID tags raises privacy concerns regarding the tracking and collection of sensitive data, such as personal information or consumer behavior. Instances of unauthorized access or data breaches erode consumer trust and lead to regulatory scrutiny. For example, concerns over the potential misuse of RFID data have prompted regulatory bodies to impose stringent privacy regulations, impacting the widespread adoption of RFID technology in sectors like retail and healthcare. RFID systems encounter limitations in read range and performance due to environmental factors such as interference from metals or liquids. In warehouse environments or densely populated areas, signal interference affects the reliability and accuracy of RFID tag detection. For instance, in industrial settings with heavy machinery or metal structures, RFID readers struggle to maintain consistent communication with tags, hampering inventory tracking and management. Resistance to change among employees and stakeholders impede the successful deployment and utilization of RFID technology in North America RFID Market. Introducing new processes and workflows associated with RFID implementation require extensive training and retraining efforts, resulting in productivity losses and operational disruptions. For example, employees accustomed to manual inventory management methods resist adopting RFID systems, delaying the realization of efficiency gains and ROI for businesses.

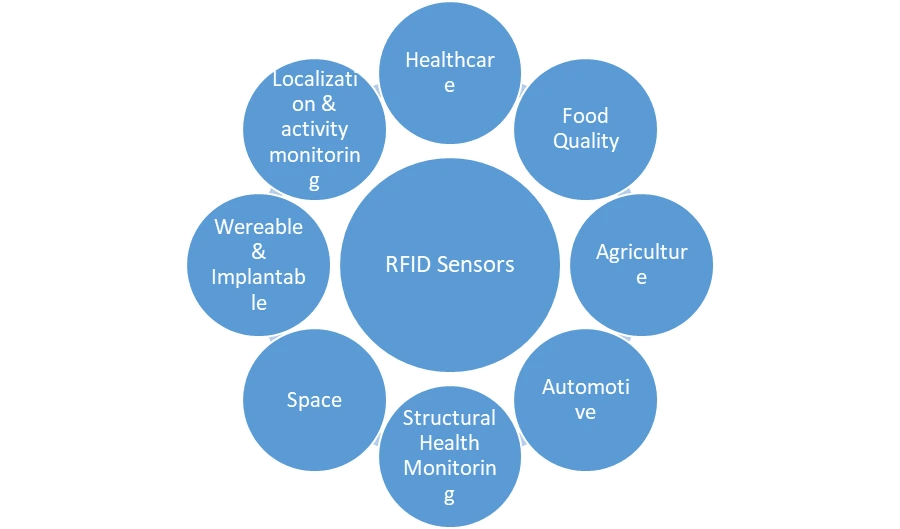

Chart: RFID Sensors- Application Fields

North America RFID Market Segment Analysis:

Based on Frequency, Ultra-high frequency (UHF) dominates the North America RFID market and expected to dominate during forecast period due to its widespread adoption across various industries. UHF RFID technology offers longer read ranges and higher data transfer speeds, making it suitable for applications requiring rapid and long-distance tag detection, such as inventory management and supply chain tracking. Its dominance is expected to continue as businesses increasingly seek scalable and cost-effective RFID solutions. High Frequency (HF) RFID follows, particularly prevalent in sectors like healthcare and access control, where shorter read ranges and higher security levels are prioritized. Low Frequency (LF) RFID, while less common, finds niche applications such as animal tracking and proximity card systems. Active Ultra-high Frequency (Active UHF) RFID, featuring battery-powered tags for extended read ranges and real-time tracking capabilities, is gaining traction in applications like vehicle tracking and asset management. However, its adoption is relatively low compared to passive UHF RFID due to higher costs and maintenance requirements. UHF RFID dominates and is expected to maintain its dominance, driven by its versatility and cost-efficiency across diverse industry verticals in North America.North America RFID Market Regional Insights:

The North America RFID (Radio Frequency Identification) market is a dynamic and rapidly growing sector that encompasses various countries, including the United States, Canada, and Mexico. Regional insights reveal a thriving market landscape driven by factors such as technological advancements, increasing adoption across industries, and government initiatives promoting RFID implementation. According to MMR reports, North America holds a significant share of the global RFID market, with the region poised for continued growth. In the United States, RFID technology adoption is widespread across sectors such as retail, healthcare, logistics, and manufacturing. Companies leverage RFID for inventory management, supply chain optimization, asset tracking, and enhancing operational efficiency. The United States is a major contributor to the North America RFID market, with substantial investments in RFID solutions to meet evolving business needs. Canada demonstrates a growing interest in RFID technology, particularly in industries like retail and healthcare. Canadian businesses recognize the value of RFID in improving operational visibility, reducing costs, and enhancing customer experiences. With favorable government policies and increasing awareness about RFID benefits, the Canadian RFID market is expected to witness significant growth in the coming years. Mexico is also emerging as a key player in the North America RFID market, driven by factors such as expanding industrialization, rising demand for efficient supply chain management solutions, and growing adoption of RFID technology in sectors like automotive and manufacturing. Mexican companies are investing in RFID solutions to streamline operations, improve inventory accuracy, and enhance overall productivity. The North America RFID market presents a diverse landscape of opportunities and challenges. While the region boasts advanced infrastructure and technological capabilities conducive to RFID adoption, there are also regulatory considerations, privacy concerns, and interoperability issues that need to be addressed. However, with ongoing innovations, strategic partnerships, and collaborative efforts between industry stakeholders, the North America RFID market is poised for sustained growth and innovation in the years ahead. Competitive Landscape UPS's RFID initiative's growth is poised to drive market growth in North America by setting a precedent for enhanced efficiency and cost reduction in logistics operations. By leveraging RFID technology to streamline package tracking and reduce manual scans, UPS improves its operations and sets a standard for the industry. This initiative creates opportunities for growth by demonstrating the tangible benefits of RFID implementation, prompting other logistics companies to follow suit. As more businesses adopt RFID solutions to optimize their operations, the North American market for RFID technology is expected to experience significant growth, driven by the demand for improved efficiency and customer satisfaction. October 2, 2023, marked a groundbreaking advancement by NTT Corporation in collaboration with The University of Tokyo. They introduced the world's first millimeter-wave RFID tag, revolutionizing drone navigation accuracy. These tags, unaffected by weather conditions, enable precise navigation even in low visibility scenarios like night, fog, or rain. This innovation promises an aerial sensor network that operates seamlessly under diverse weather conditions, enhancing environmental monitoring in previously challenging areas such as the seas and disaster zones. Presented at ACM MobiCom 2023, this development signifies a significant leap in IoT and ubiquitous computing, promising a more adaptable and resilient society. On February 10, 2023, UPS announced plans to extend its RFID initiative across its entire U.S. network this year, building on the success of its pilot program in 2022. CEO Carol Tomé reveals that the expansion aims to streamline operations by reducing manual scans and misloads with RFID tags on packages and employees. With an investment of $140 million, UPS targets improved efficiency, cost reduction, and an enhanced customer experience. CFO Brian Newman highlights a goal to have misloads, while Tomé envisions a future where package cars interact directly with RFID tags, cutting down manual scans and optimizing operations further.The scope of the North America RFID Market: Inquire before buying

North America RFID Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.73 Bn. Forecast Period 2024 to 2030 CAGR: 8.13% Market Size in 2030: US $ 11.64 Bn. Segments Covered: by Product Liquid Powder Stigma Petals Stamen by Wafer Size Organic Conventional by Working Grade I Grade II Grade III Grade IV by Frequency Food Supplements Cosmetics Personal Care Products Food & Beverage Others by End User B2B B2C by Form Factor Button Card Electronic Housing Implants Key Fob Label Paper Tickets Wristband Others by Label Type Plastic Paper Metal Glass Others North America RFID Market Key Players:

1. CCL Industries (Canada) 2. Honeywell International Inc. (United States) 3. HL Smart Label Solutions (United States) 4. Omnia Technologies (United States) 5. SES RFID GmbH (USA) 6. Invengo Technology Pte. Ltd. (United States). 7. RFID4U (United States) 8. Avery Dennison Corporation (United States). 9. Jadak – A Novanta Company (United States) 10. Alien Technology, LLC (United States) 11. Impinj, Inc. (United States) 12. NXP Semiconductors (United States) 13. Zebra Technologies Corp. (United States) 14. SimplyRFID (United States) 15. Identiv, Inc. (United States) 16. HID Global Corporation (United States) FAQs: 1. What are the growth drivers for the North America RFID Market? Ans. IoT Revolution RFID's Crucial Role in Smart Building Management and Wellness Industry expected to be the major driver for the North America RFID Market. 2. What is the major Opportunity for the North America RFID Market growth? Ans. Government Mandates Drive RFID Adoption Across Sectors are the major opportunity for the North America RFID market. 3. Which country is expected to lead the global North America RFID Market during the forecast period? Ans. North America is expected to lead the North America RFID Market during the forecast period. 4. What is the projected market size and growth rate of the North America RFID Market? Ans. The North America RFID Market size was valued at USD 6.73 Billion in 2023 and the total North America RFID Market revenue is expected to grow at a CAGR of 8.13 % from 2023 to 2030, reaching nearly USD 11.64 Billion. 5. What segments are covered in the North America RFID Market report? Ans. The segments covered in the North America RFID Market report are by Product, Wafer Size, Working, Frequency, End-User, Form Factor, Label Type, and Region.

1. North America RFID Market: Research Methodology 2. North America RFID Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. North America RFID Market: Dynamics 3.1 North America RFID Market Trends 3.2 North America RFID Market Dynamics by Region 3.2.1 Drivers 3.2.2 Restraints 3.2.3 Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape 3.7 Analysis of Government Schemes and Initiatives for the North America RFID Industry 3.8 The Pandemic and Redefining of The North America RFID Industry Landscape 3.9 Technological Road Map 4. North America RFID Market: Market Size and Forecast by Segmentation (Value) (2023-2030) 4.1 North America RFID Market Size and Forecast, By Product (2023-2030) 4.1.1 Tags 4.1.2 Reader 4.1.3 Software 4.2 North America RFID Market Size and Forecast, By Wafer Size (2023-2030) 4.2.1 200mm 4.2.2 300mm 4.2.3 Others 4.3 North America RFID Market Size and Forecast, By Working (2023-2030) 4.3.1 Passive RFID 4.3.2 Active RFID 4.4 North America RFID Market Size and Forecast, By Frequency (2023-2030) 4.4.1 Low Frequency 4.4.2 High Frequency 4.4.3 Ultra-high Frequency 4.4.4 Active Ultra-High Frequency 4.5 North America RFID Market Size and Forecast, By End-User (2023-2030) 4.5.1 Animal Tracking/Agriculture 4.5.2 Commercial 4.5.3 Transportation 4.5.4 Healthcare 4.5.5 Logistics and Supply Chain 4.5.6 Aerospace 4.5.7 Défense 4.5.8 Retail 4.5.9 Security and Access Control 4.5.10 Sports 4.6 North America RFID Market Size and Forecast, By Form Factor (2023-2030) 4.6.1 Button 4.6.2 Card 4.6.3 Electronic Housing 4.6.4 Implants 4.6.5 Key Fob 4.6.6 Label 4.6.7 Paper Tickets 4.6.8 Wristband 4.6.9 Others 4.7 North America RFID Market Size and Forecast, By Label Type (2023-2030) 4.7.1 Plastic 4.7.2 Paper 4.7.3 Metal 4.7.4 Glass 4.7.5 Others 4.8 North America RFID Market Size and Forecast, by Country (2023-2030) 4.8.1 United States 4.8.1.1 United States RFID Market Size and Forecast, By Product (2023-2030) 4.8.1.1.1 Tags 4.8.1.1.2 Reader 4.8.1.1.3 Software 4.8.1.2 United States RFID Market Size and Forecast, By Wafer Size (2023-2030) 4.8.1.2.1 200mm 4.8.1.2.2 300mm 4.8.1.2.3 Others 4.8.1.3 United States RFID Market Size and Forecast, By Working (2023-2030) 4.8.1.3.1 Passive RFID 4.8.1.3.2 Active RFID 4.8.1.4 United States RFID Market Size and Forecast, By Frequency (2023-2030) 4.8.1.4.1 Low Frequency 4.8.1.4.2 High Frequency 4.8.1.4.3 Ultra-high Frequency 4.8.1.4.4 Active Ultra-High Frequency 4.8.1.5 United States RFID Market Size and Forecast, By End-User (2023-2030) 4.8.1.5.1 Animal Tracking/Agriculture 4.8.1.5.2 Commercial 4.8.1.5.3 Transportation 4.8.1.5.4 Healthcare 4.8.1.5.5 Logistics and Supply Chain 4.8.1.5.6 Aerospace 4.8.1.5.7 Défense 4.8.1.5.8 Retail 4.8.1.5.9 Security and Access Control 4.8.1.5.10 Sports 4.8.1.6 United States RFID Market Size and Forecast, By Form Factor (2023-2030) 4.8.1.6.1 Button 4.8.1.6.2 Card 4.8.1.6.3 Electronic Housing 4.8.1.6.4 Implants 4.8.1.6.5 Key Fob 4.8.1.6.6 Label 4.8.1.6.7 Paper Tickets 4.8.1.6.8 Wristband 4.8.1.6.9 Others 4.8.1.7 United States RFID Market Size and Forecast, By Label Type (2023-2030) 4.8.1.7.1 Plastic 4.8.1.7.2 Paper 4.8.1.7.3 Metal 4.8.1.7.4 Glass 4.8.1.7.5 Others 4.8.2 Canada 4.8.2.1 Canada RFID Market Size and Forecast, By Product (2023-2030) 4.8.2.1.1 Tags 4.8.2.1.2 Reader 4.8.2.1.3 Software 4.8.2.2 Canada RFID Market Size and Forecast, By Wafer Size (2023-2030) 4.8.2.2.1 200mm 4.8.2.2.2 300mm 4.8.2.2.3 Others 4.8.2.3 Canada RFID Market Size and Forecast, By Working (2023-2030) 4.8.2.3.1 Passive RFID 4.8.2.3.2 Active RFID 4.8.2.4 Canada RFID Market Size and Forecast, By Frequency (2023-2030) 4.8.2.4.1 Low Frequency 4.8.2.4.2 High Frequency 4.8.2.4.3 Ultra-high Frequency 4.8.2.4.4 Active Ultra-High Frequency 4.8.2.5 Canada RFID Market Size and Forecast, By End-User (2023-2030) 4.8.2.5.1 Animal Tracking/Agriculture 4.8.2.5.2 Commercial 4.8.2.5.3 Transportation 4.8.2.5.4 Healthcare 4.8.2.5.5 Logistics and Supply Chain 4.8.2.5.6 Aerospace 4.8.2.5.7 Défense 4.8.2.5.8 Retail 4.8.2.5.9 Security and Access Control 4.8.2.5.10 Sports 4.8.2.6 Canada RFID Market Size and Forecast, By Form Factor (2023-2030) 4.8.2.6.1 Button 4.8.2.6.2 Card 4.8.2.6.3 Electronic Housing 4.8.2.6.4 Implants 4.8.2.6.5 Key Fob 4.8.2.6.6 Label 4.8.2.6.7 Paper Tickets 4.8.2.6.8 Wristband 4.8.2.6.9 Others 4.8.2.7 Canada RFID Market Size and Forecast, By Label Type (2023-2030) 4.8.2.7.1 Plastic 4.8.2.7.2 Paper 4.8.2.7.3 Metal 4.8.2.7.4 Glass 4.8.2.7.5 Others 4.8.3 Mexico 4.8.3.1 Mexico RFID Market Size and Forecast, By Product (2023-2030) 4.8.3.1.1 Tags 4.8.3.1.2 Reader 4.8.3.1.3 Software 4.8.3.2 Mexico RFID Market Size and Forecast, By Wafer Size (2023-2030) 4.8.3.2.1 200mm 4.8.3.2.2 300mm 4.8.3.2.3 Others 4.8.3.3 Mexico RFID Market Size and Forecast, By Working (2023-2030) 4.8.3.3.1 Passive RFID 4.8.3.3.2 Active RFID 4.8.3.4 Mexico RFID Market Size and Forecast, By Frequency (2023-2030) 4.8.3.4.1 Low Frequency 4.8.3.4.2 High Frequency 4.8.3.4.3 Ultra-high Frequency 4.8.3.4.4 Active Ultra-High Frequency 4.8.3.5 Mexico RFID Market Size and Forecast, By End-User (2023-2030) 4.8.3.5.1 Animal Tracking/Agriculture 4.8.3.5.2 Commercial 4.8.3.5.3 Transportation 4.8.3.5.4 Healthcare 4.8.3.5.5 Logistics and Supply Chain 4.8.3.5.6 Aerospace 4.8.3.5.7 Défense 4.8.3.5.8 Retail 4.8.3.5.9 Security and Access Control 4.8.3.5.10 Sports 4.8.3.6 Mexico RFID Market Size and Forecast, By Form Factor (2023-2030) 4.8.3.6.1 Button 4.8.3.6.2 Card 4.8.3.6.3 Electronic Housing 4.8.3.6.4 Implants 4.8.3.6.5 Key Fob 4.8.3.6.6 Label 4.8.3.6.7 Paper Tickets 4.8.3.6.8 Wristband 4.8.3.6.9 Others 4.8.3.7 Mexico RFID Market Size and Forecast, By Label Type (2023-2030) 4.8.3.7.1 Plastic 4.8.3.7.2 Paper 4.8.3.7.3 Metal 4.8.3.7.4 Glass 4.8.3.7.5 Others 5. North America RFID Market: Competitive Landscape 5.1 MMR Competition Matrix 5.2 Competitive Landscape 5.3 Key Players Benchmarking 5.3.1 Company Name 5.3.2 Product Segment 5.3.3 End-user Segment 5.3.4 Revenue (2023) 5.3.5 Locations 5.4 Market Analysis by Organized Players vs. Unorganized Players 5.4.1 Organized Players 5.4.2 Unorganized Players 5.5 Leading North America RFID Companies, by market capitalization 5.6 Market Structure 5.6.1 Market Leaders 5.6.2 Market Followers 5.6.3 Emerging Players 5.7 Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1 99 CCL Industries (Canada) 6.1.1 Company Overview 6.1.2 Business Portfolio 6.1.3 Financial Overview 6.1.4 SWOT Analysis 6.1.5 Strategic Analysis 6.1.6 Scale of Operation (small, medium, and large) 6.1.7 Details on Partnership 6.1.8 Regulatory Accreditations and Certifications Received by Them 6.1.9 Awards Received by the Firm 6.1.10 Recent Developments. 6.2 Honeywell International Inc. (United States) 6.3 HL Smart Label Solutions (United States) 6.4 Omnia Technologies (United States) 6.5 SES RFID GmbH (USA) 6.6 Invengo Technology Pte. Ltd. (United States). 6.7 RFID4U (United States) 6.8 Avery Dennison Corporation (United States). 6.9 Jadak – A Novanta Company (United States) 6.10 Alien Technology, LLC (United States) 6.11 Impinj, Inc. (United States) 6.12 NXP Semiconductors (United States) 6.13 Zebra Technologies Corp. (United States) 6.14 SimplyRFID (United States) 6.15 Identiv, Inc. (United States) 6.16 HID Global Corporation (United States) 7. Key Findings and Analyst Recommendations 8. Terms and Glossary