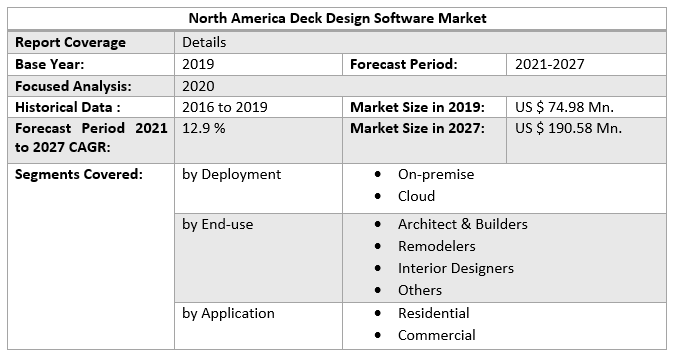

North America Deck Design Software Market size was valued at US$ 74.98 Mn. in 2019 and the total revenue is expected to grow at 12.9% through 2021 to 2027, reaching nearly US$ 190.58 Mn.North America Deck Design Software Market Overview:

The rise in complexity in deck design is boosting the construction industry's growth. With the rise in complexity in deck design, manually created deck designs have no way of ensuring their quality and correctness. The real estate industry has been able to give more time-efficient and higher-quality services as a result of digital disruption in the field of deck-building and architectural services.North America Deck Design Software Market Dynamics:

The U.S. deck design software market has been growing steadily since 2017, thanks to the existence of multiple suppliers and the continuous introduction of advanced deck design tools that can help architects and designers choose materials and designs based on their projects. For example, AZEK Company Inc., a supplier of outdoor living products, provides Azek Deck Designer software, which has a list of more than 140 products and deck design templates. The software also provides customization of pre-built templates and allows users to develop their designs in 3D. Several other designs tools on the market provide features that homeowners and experts can use for their renovation and home improvement activities. Additionally, the integration of technologies like AI and machine learning, as well as the incorporation of innovative design layouts is expected to boost the efficiency of these solutions, and people awareness regarding the new technologies in the market which helps to drive the North America deck design software market. Deck design is a complex process that requires consideration of several rules and the latest technical requirements. Implementing the deck manually requires a lot of effort to meet all requirements, and the process is error-prone and the risk of failure is high. Manual design attempts also take a significant amount of time and work. The requirement to accommodate such a difficult procedure has prompted architects and homeowners to request deck design software with built-in design templates.North America Deck Design Software Market Segment Analysis:

On the basis of deployment, North America deck design software market is sub-segmented into on-premise, and cloud. The cloud segment held the largest market share of more than 55.1% in 2020. Because the data generated by the software is stored in the cloud, which is available to all departments, cloud-based software activities are emerging trend in the North American deck design software market. Over the forecast period, the segment is expected to be driven by the implementation of various severe data protection regulations to preserve important customer data in the cloud and on remote devices. Another significant element boosting the cloud segment is the increased use of the internet to buy and share information about raw materials across organizations. Furthermore, cloud-based deck design software providers are concentrating their efforts on developing a high-level security patch to reduce the possibility of a cyber-attack. This reason is also driving the deck design software market by producing huge demand from end-users.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2026. 2019 is considered a base year however 2020’s numbers are on real output of the companies in the market. Special attention is given to 2020 and effect of lockdown on the demand and supply, and also the impact of lockdown for next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report. On the basis of end-user, the North America deck design software market is sub-segmented into architect & builders, remodelers, interior designers, others. The architect & builders segment held a large market share of 50.2 % in 2020. Architects can use deck design software to find and analyse structural faults, calculate project costs, and manage large-scale real estate projects more efficiently. Deck design software is helpful to saving money, makes visualizing design parameters easier, resulting in greater demand. Additionally, in recent years, the need for deck design solutions has increased among remodelers. The demand for remodeling software solutions has grown as the number of home improvement or renovation projects has increased. Deck design software is used by remodelers to visualize existing and new deck models in relation to existing infrastructure. On the basis of application, the North America deck design software market is sub-segmented into residential and commercial. The residential segment held a large share of 55% in 2020. New prospects for the implementation of deck design software have arisen as a result of an increase in demand from remodelers to design gardens/backyards for enjoyment as well as dining. The industry has seen an increase in the usage of cloud-based and app-based deck design tools, mainly among homeowners, which is expected to open up new growth opportunities in the future. The commercial segment is expected to grow at the highest CAGR of xx% during the forecast period, owing to rising individuals and companies, it investing more in real estate to live and work in a relaxing the atmosphere in both established and developing countries, which is boosting demand for deck design software.

North America Deck Design Software Market Regional Insights:

In North America deck design software market, the United States has the largest revenue share of 85.1 % in 2020. The significant increase in home deck installations used for holding outdoor events is one of the main trends driving the growth of the US market. The substantial investments in building renovations and construction projects across the country have contributed to market growth. In addition, the high growth rate of cloud-based technology and existing infrastructure capabilities, as well as favorable government policies to protect consumer data, have increased the market growth prospects. In the past few years, Canada's residential decorations and trends have maintained steady growth and are expected to continue during the forecast period. Composite materials and wooden decks are mainly favoured in new housing construction and renovation projects. As building materials are exposed to the extreme environmental conditions commonly observed in the country, some renovation projects have created a pathway for market growth.Recent Development:

• In November 2020, Fiberon received FDA approval of their partnership with Wolf Home Products. Fiberon decking and railing materials will now be available throughout Ohio, Western Pennsylvania, and upstate New York, signifying the development of the two companies' collaboration across many states. The objective of the report is to present a comprehensive analysis of the North America Deck Design Software market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the North America Deck Design Software market dynamics, structure by analyzing the market segments and projects the North America Deck Design Software market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the North America Deck Design Software market make the report investor’s guide.North America Deck Design Software Market Scope: Inquire before buying

North America Deck Design Software Market, by Countries

• North America o U.S. o Canada o MexicoNorth America Deck Design Software Market Key Players

• AZEK Building Products • Fiberon • MiTek Inc. • Simpson Strong-Tie • Chief Architect, Inc. • Trex Company, Inc. • SmartDraw, LLC • Delta Software • Idea Spectrum • ACC Corporation • Luxwood Software Tools • Punch Software • SketchUpFrequently Asked Questions:

1. How big is the North America Deck Design Software Market? Ans: The North America Deck Design Software Market was estimated at USD 74.98 million in the year 2019 and is expected to reach USD 190.58 million in 2027. 2. What is the growth rate of North America Deck Design Software Market? Ans: The North America Deck Design Software Market is growing at a CAGR of 12.9 % during forecasting period 2021-2027. 3. What segments are covered in North America Deck Design Software Market? Ans: North America Deck Design Software Market is segmented into deployment, end-user, application and region. 4. Who are the key players in North America Deck Design Software Market? Ans: The important key players in the North America Deck Design Software Market are AZEK Building Products, Fiberon, MiTek Inc., Simpson Strong-Tie, Chief Architect, Inc., Trex Company, Inc., SmartDraw, LLC, Delta Software, Idea Spectrum, ACC Corporation, Luxwood Software Tools, Punch Software, and SketchUp. 5. What is the study period of this market? Ans: The North America Deck Design Software Market is studied from 2019 to 2027.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: North America Deck Design Software Market Size, by Market Value (US$ Bn) 3.1. North America Segmentation 3.2. North America Market Segmentation Share Analysis, 2019 3.2.1. By countries (USA, Canada, Mexico) 3.3. Geographical Snapshot of the North America Deck Design Software Market 3.4. Geographical Snapshot of the North America Deck Design Software Market, By Manufacturer share 4. North America Deck Design Software Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. By countries (USA, Canada, Mexico) 4.1.2. Restraints 4.1.2.1. By countries (USA, Canada, Mexico) 4.1.3. Opportunities 4.1.3.1. By countries (USA, Canada, Mexico) 4.1.4. Challenges 4.1.4.1. By countries (USA, Canada, Mexico) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the North America Deck Design Software Market 5. Supply Side and Demand Side Indicators 6. North America Deck Design Software Market Analysis and Forecast, 2019-2027 6.1. North America Deck Design Software Market Size & Y-o-Y Growth Analysis. 7. North America Deck Design Software Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 7.1.1. On-premise 7.1.2. Cloud 7.2. Market Size (Value) Estimates & Forecast By End-user, 2019-2027 7.2.1. Architect & Builders 7.2.2. Remodelers 7.2.3. Interior Designers 7.2.4. Others 7.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 7.3.1. Residential 7.3.2. Commercial 8. North America North America Deck Design Software Market Analysis and Forecasts, By Country 8.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 8.1.1. US 8.1.2. Canada 8.1.3. Mexico 9. U.S. North America Deck Design Software Market Analysis and Forecasts, 2019-2027 9.1. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 9.2. Market Size (Value) Estimates & Forecast By End-user, 2019-2027 9.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 10. Canada North America Deck Design Software Market Analysis and Forecasts, 2019-2027 10.1. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 10.2. Market Size (Value) Estimates & Forecast By End-user, 2019-2027 10.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 11. Mexico North America Deck Design Software Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 11.2. Market Size (Value) Estimates & Forecast By End-user, 2019-2027 11.3. Market Size (Value) Estimates & Forecast By Application, 2019-2027 12. Competitive Landscape 12.1. Geographic Footprint of Major Players in the North America Deck Design Software Market 12.2. Competition Matrix 12.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 12.2.2. New Product Launches and Product Enhancements 12.2.3. Market Consolidation 12.2.3.1. M&A by Regions, Investment and Verticals 12.2.3.2. M&A, Forward Integration and Backward Integration 12.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 12.3. Company Profile : Key Players 12.3.1. AZEK Building Products 12.3.1.1. Company Overview 12.3.1.2. Financial Overview 12.3.1.3. Geographic Footprint 12.3.1.4. Product Portfolio 12.3.1.5. Business Strategy 12.3.1.6. Recent Developments 12.3.2. Fiberon 12.3.3. MiTek Inc. 12.3.4. Simpson Strong-Tie 12.3.5. Chief Architect, Inc. 12.3.6. Trex Company, Inc. 12.3.7. SmartDraw, LLC 12.3.8. Delta Software 12.3.9. Idea Spectrum 12.3.10. ACC Corporation 12.3.11. Luxwood Software Tools 12.3.12. Punch Software 12.3.13. SketchUp 13. Primary Key Insights