Metaverse Market has valued at US$ 143.23 Bn. in 2023. The Metaverse Market size is estimated to grow at a CAGR of 48.12% over the forecast period.Metaverse Market Overview:

The Metaverse is a simulated digital environment with virtual reality (VR), augmented reality (AR), mixed reality, Blockchain, and other technologies. These technologies are used to develop places for a rich virtual space user experience. The report explores the Metaverse market's segments (Component, Device, Application, Technology, and Region). Data has been provided by market participants and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). This market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2023. The report investigates the spectroscopy market's drivers, limitations, prospects, and barriers. This MMR report includes investor recommendations based on a thorough examination of the Metaverse market's contemporary competitive scenario.To know about the Research Methodology:- Request Free Sample Report

Metaverse Market COVID 19 Insights:

Through the forecast period, the impact of COVID-19 has resulted in a surge in service demand. The rapid acceleration of online video game services and video conferencing services is principally responsible for the above-average growth. This development can be ascribed to a boom in online video game usage as well as a growing demand among customers for online retail shopping. The metaverse's adoption was inescapable, although the epidemic accelerated the process by years. Numerous social, educational, and economic opportunities exist. When it comes to resuming physical labor, companies have been on a "will they or won't they" basis since the initial pandemic lockdowns in 2021. Obviously, some organizations cannot operate without physical employees, but for those with office workers and others who can work from home, the debate over when it is safe to return to work and whether individuals should return to work full-time at all persists. Business owners believe that retaining employees in one area makes them more efficient and capable of spontaneous cooperation, but with labor shortages at an all-time high, workers hold the majority of the cards. Moreover, the pandemic has transformed client desire for online purchasing and shopping in the digital virtual world. Several companies have entered the online market as a result of the current trend. Several major players have completed investments during the epidemic by implementing various commercial strategies, product releases, and collaborations. As an example, Niantic, Inc., a virtual and augmented reality platform, secured $300 million from Coatue, the Pokémon GO gaming business, in November 2021. The business intends to provide a platform for real-time virtual worlds. Epic Games Inc. received $1 billion in the capital in April 2021 to support future potential in the metaverse market. The Sony Group Corporations have made a strategic investment of USD 200 million in the company's fundraising round.Metaverse Market Dynamics:

Digital twins, such as digital and physical worlds, become more powerful and complicated as their capabilities and complexity grow. To realize their full potential, however, system and data integration across entire business ecosystems may be required. Users may now communicate online, gather sensor data and recreate situations in real-time, understand what-if scenarios more clearly, foresee repercussions more precisely, and issue instructions to affect the actual environment. It might illustrate all subcomponents and their lineage in the bigger supply chain, from the design table to the end-user, or it can represent a new product's technical drawings and specifications. It develops novel manufacturing techniques and collects data in order to make better judgments and predictions, which could aid in the automation of complex chemical and biological processes. These are driving the growth of the metaverse market. The Metaverse acts as a bridge between the real and virtual worlds. The Metaverse is a web of interconnected online domains in which physical, augmented, and virtual reality collide. Users can communicate with friends, work, travel, buy and sell goods and services, and attend events. People cannot migrate between virtual worlds while keeping their identities and assets, despite the fact that there are several virtual worlds available on the Internet. In the future, this problem could be remedied by integrating many internet domains into a single, seamless entity. As more people work and attend school online, there has been a surge in demand for techniques to make online contact more realistic. As a result, the metaverse market is being driven by a growing focus on bringing the digital and physical worlds together through the Internet. The Metaverse market depicts the next step in the Internet's evolution. It's a collaborative online environment that combines physical, augmented, and virtual reality. The Metaverse is the present Internet's four-dimensional counterpart. As the concept evolves, it will be expanded outside video games and social media platforms. The Metaverse's possible features include remote labour, decentralized government, and digital identification. Virtual reality (VR) could become more multidimensional with the advent of networked virtual reality (VR) headsets and glasses, allowing users to roam around and explore 3D environments. Real-world applications include gaming, social networking, education, and job training. Virtual reality (VR)-based devices that transfer people to a virtual environment from the comfort of their own homes could further disrupt several businesses. Artificial intelligence is bridging the gap between humans and robots. AI will benefit the Metaverse in a variety of ways. People, landscapes, buildings, character routines, and other Metaverse assets can all be created with the use of AI technology. The Metaverse combines augmented reality, virtual reality, machine learning, blockchain technology, and artificial intelligence. In ways that games do not, the Metaverse market will pervade everyday life, bringing new ways to acquire goods and services, connect with friends and family, and collaborate with coworkers. Cyber-attacks on the Metaverse are a big source of concern for the global economy. Attacks on the Metaverse's infrastructure are a big concern. A cyber threat is a malicious act that damages or disrupts software, as well as steals data, lowering system efficiency. Data leaks and illegal instructions are two examples of cyber-attacks. System failure is caused by cyber-attacks, which causes the Metaverse to malfunction. As a result, Metaverse must be structured in such a way that cyber-attacks are avoided and mitigated. Cybersecurity is essential for constructing a secure and stable network that allows a Metaverse to function properly. This factor is restraining the growth of the metaverse market.Recent Developments in Metaverse Market:

Epic Games' three-dimensional development tool Unreal Engine will link with Spire's feature animation pipeline to build into metaverse experiences in February 2022, allowing the firm to transition its existing character assets and worlds to the metaverse. Tencent Holdings Ltd. declared its interest in acquiring gaming smartphone maker Black Shark in January 2022, marching deeper into the metaverse. Black Shark is one of China's most well-known gaming smartphone manufacturers. It will become a manufacturer of virtual reality headsets for Tencent once the purchase is completed. NVIDIA Omniverse Enterprise, the world's first technological platform that enables global 3D design teams working across numerous software suites to interact in real time in a shared virtual area, will be available in April 2022.Metaverse Market Segmentation:

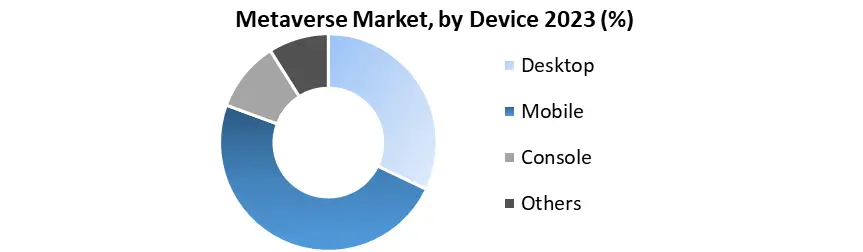

Based on the Device, Due to increased use of online gaming, the desktop dominated the market with 43.4% in 2023. The market is growing due to rising video game income and an increase in the number of video gaming audiences around the world. There are more than 2.5 billion video game audiences worldwide in 2023. As the number of users who play video games grows, there is a huge need for desktop that can be used to play virtual reality games. Moreover, the metaverse market through the forecast period, mobile is predicted to develop at the fastest rate. This is largely due to an increase in revenue from mobile gaming audiences.

Metaverse Market Regional Insights:

North America region dominated the market with 43% share in 2023. The most significant driver of metaverse market growth is the growing emphasis on merging digital and physical worlds via the internet, as well as the growing traction and popularity of mixed reality in this region. To better their business processes, several companies in North America are relying extensively on advanced virtual reality, 3D simulation, and augmented reality. From the perspective of business intelligence, technologies like Extended Reality, 5G, and AI may make the metaverse futuristic. Because of increased investment in platforms by prominent players such as Met, Roblox Corporation, NVIDIA Corporation, and others, North America is likely to hold the greatest share of the market. Through the forecast period, Europe is expected to increase at a CAGR of 27%. This is due to the growing number of users on social media platforms and in the gaming industry. The rising online gaming industry in key European countries such as France, Italy, the United Kingdom, Germany, and others is driving the metaverse market in Europe. In addition, financial service companies are embracing Meta platforms in order to work more effectively. As a result of significant projects like AEGLE and Meaningful Integration of Data, Analytics, and Services, the metaverse market is projected to gain traction in Europe. Some virtual reality and augmented reality applications for healthcare have been tried, with clinicians doing procedures remotely using robotic arms and a combination of technology. The objective of the report is to present a comprehensive analysis of the Metaverse Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Metaverse Market dynamics, and structure by analyzing the market segments and projecting the Metaverse Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Metaverse Market make the report investor’s guide.Metaverse Market Scope: Inquire before buying

Metaverse Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 143.23 Bn. Forecast Period 2024 to 2030 CAGR: 48.12% Market Size in 2030: US $ 2240.45 Bn. Segments Covered: by Component Hardware Software/Platform Services by Device Desktop Mobile Console Others by Application Online Shopping Gaming Social Media Content Creation Conferences Others by Technology Blockchain VR and AR Mixed Reality Metaverse Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Metaverse Market Key Players are:

1. Tencent Holdings Ltd. 2. NVIDIA Corporation 3. Meta (Facebook Inc.) 4. Roblox Corporation 5. Microsoft Corporation 6. Globant 7. Queppelin 8. Alibaba Cloud 9. Netease Inc. 10.Magic Leap, Inc. 11.Bytedance 12.Epic Games 13.Lilith Games 14.Nextech AR Solutions Inc. 15.Unity Software Inc. 16.OthersFAQ:

1] What segments are covered in the Metaverse Market report? Ans. The segments covered in the Metaverse Market report are based on Component, Device, Application, and Technology. 2] Which region is expected to hold the highest share in the Metaverse Market? Ans. North America Region is expected to hold the highest share in the Metaverse Market. 3] What is the market size of the Metaverse Market by 2030? Ans. The market size of the Metaverse Market by 2030 is US$ 2240.45 Bn. 4] What is the forecast period for the Metaverse Market? Ans. The Forecast period for Metaverse Market is 2024-2030. 5] What was the market size of the Metaverse Market in 2023? Ans. The market size of the Metaverse Market in 2023 was US$ 143.23 Bn.

1. Metaverse Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Metaverse Market: Dynamics 2.1. Metaverse Market Trends by Region 2.1.1. North America Metaverse Market Trends 2.1.2. Europe Metaverse Market Trends 2.1.3. Asia Pacific Metaverse Market Trends 2.1.4. Middle East and Africa Metaverse Market Trends 2.1.5. South America Metaverse Market Trends 2.2. Metaverse Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Metaverse Market Drivers 2.2.1.2. North America Metaverse Market Restraints 2.2.1.3. North America Metaverse Market Opportunities 2.2.1.4. North America Metaverse Market Challenges 2.2.2. Europe 2.2.2.1. Europe Metaverse Market Drivers 2.2.2.2. Europe Metaverse Market Restraints 2.2.2.3. Europe Metaverse Market Opportunities 2.2.2.4. Europe Metaverse Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Metaverse Market Drivers 2.2.3.2. Asia Pacific Metaverse Market Restraints 2.2.3.3. Asia Pacific Metaverse Market Opportunities 2.2.3.4. Asia Pacific Metaverse Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Metaverse Market Drivers 2.2.4.2. Middle East and Africa Metaverse Market Restraints 2.2.4.3. Middle East and Africa Metaverse Market Opportunities 2.2.4.4. Middle East and Africa Metaverse Market Challenges 2.2.5. South America 2.2.5.1. South America Metaverse Market Drivers 2.2.5.2. South America Metaverse Market Restraints 2.2.5.3. South America Metaverse Market Opportunities 2.2.5.4. South America Metaverse Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Metaverse Industry 2.8. Analysis of Government Schemes and Initiatives For Metaverse Industry 2.9. Metaverse Market Trade Analysis 2.10. The Global Pandemic Impact on Metaverse Market 3. Metaverse Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Metaverse Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software/Platform 3.1.3. Services 3.2. Metaverse Market Size and Forecast, by Device (2023-2030) 3.2.1. Desktop 3.2.2. Mobile 3.2.3. Console 3.2.4. Others 3.3. Metaverse Market Size and Forecast, by Application (2023-2030) 3.3.1. Online Shopping 3.3.2. Gaming 3.3.3. Social Media 3.3.4. Content Creation 3.3.5. Conferences 3.3.6. Others 3.4. Metaverse Market Size and Forecast, by Technology (2023-2030) 3.4.1. Blockchain 3.4.2. VR and AR 3.4.3. Mixed Reality 3.5. Metaverse Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Metaverse Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Metaverse Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software/Platform 4.1.3. Services 4.2. North America Metaverse Market Size and Forecast, by Device (2023-2030) 4.2.1. Desktop 4.2.2. Mobile 4.2.3. Console 4.2.4. Others 4.3. North America Metaverse Market Size and Forecast, by Application (2023-2030) 4.3.1. Online Shopping 4.3.2. Gaming 4.3.3. Social Media 4.3.4. Content Creation 4.3.5. Conferences 4.3.6. Others 4.4. North America Metaverse Market Size and Forecast, by Technology (2023-2030) 4.4.1. Blockchain 4.4.2. VR and AR 4.4.3. Mixed Reality 4.7. North America Metaverse Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Metaverse Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software/Platform 4.5.1.1.3. Services 4.5.1.2. United States Metaverse Market Size and Forecast, by Device (2023-2030) 4.5.1.2.1. Desktop 4.5.1.2.2. Mobile 4.5.1.2.3. Console 4.5.1.2.4. Others 4.5.1.3. United States Metaverse Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Online Shopping 4.5.1.3.2. Gaming 4.5.1.3.3. Social Media 4.5.1.3.4. Content Creation 4.5.1.3.5. Conferences 4.5.1.3.6. Others 4.5.1.4. United States Metaverse Market Size and Forecast, by Technology (2023-2030) 4.5.1.4.1. Blockchain 4.5.1.4.2. VR and AR 4.5.1.4.3. Mixed Reality 4.5.2. Canada 4.5.2.1. Canada Metaverse Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software/Platform 4.5.2.1.3. Services 4.5.2.2. Canada Metaverse Market Size and Forecast, by Device (2023-2030) 4.5.2.2.1. Desktop 4.5.2.2.2. Mobile 4.5.2.2.3. Console 4.5.2.2.4. Others 4.5.2.3. Canada Metaverse Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Online Shopping 4.5.2.3.2. Gaming 4.5.2.3.3. Social Media 4.5.2.3.4. Content Creation 4.5.2.3.5. Conferences 4.5.2.3.6. Others 4.5.2.4. Canada Metaverse Market Size and Forecast, by Technology (2023-2030) 4.5.2.4.1. Blockchain 4.5.2.4.2. VR and AR 4.5.2.4.3. Mixed Reality 4.5.3. Mexico 4.5.3.1. Mexico Metaverse Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software/Platform 4.5.3.1.3. Services 4.5.3.2. Mexico Metaverse Market Size and Forecast, by Device (2023-2030) 4.5.3.2.1. Desktop 4.5.3.2.2. Mobile 4.5.3.2.3. Console 4.5.3.2.4. Others 4.5.3.3. Mexico Metaverse Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Online Shopping 4.5.3.3.2. Gaming 4.5.3.3.3. Social Media 4.5.3.3.4. Content Creation 4.5.3.3.5. Conferences 4.5.3.3.6. Others 4.5.3.4. Mexico Metaverse Market Size and Forecast, by Technology (2023-2030) 4.5.3.4.1. Blockchain 4.5.3.4.2. VR and AR 4.5.3.4.3. Mixed Reality 5. Europe Metaverse Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Metaverse Market Size and Forecast, by Component (2023-2030) 5.2. Europe Metaverse Market Size and Forecast, by Device (2023-2030) 5.3. Europe Metaverse Market Size and Forecast, by Application (2023-2030) 5.4. Europe Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5. Europe Metaverse Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.1.3. United Kingdom Metaverse Market Size and Forecast, by Application(2023-2030) 5.5.1.4. United Kingdom Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5.2. France 5.5.2.1. France Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.2.3. France Metaverse Market Size and Forecast, by Application(2023-2030) 5.5.2.4. France Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.3.3. Germany Metaverse Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.4.3. Italy Metaverse Market Size and Forecast, by Application(2023-2030) 5.5.4.4. Italy Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.5.3. Spain Metaverse Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.6.3. Sweden Metaverse Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.7.3. Austria Metaverse Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Metaverse Market Size and Forecast, by Technology (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Metaverse Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe Metaverse Market Size and Forecast, by Device (2023-2030) 5.5.8.3. Rest of Europe Metaverse Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Metaverse Market Size and Forecast, by Technology (2023-2030) 6. Asia Pacific Metaverse Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Metaverse Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Metaverse Market Size and Forecast, by Device (2023-2030) 6.3. Asia Pacific Metaverse Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5. Asia Pacific Metaverse Market Size and Forecast, by Country (2023-2030) 6.7.1. China 6.5.1.1. China Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.1.3. China Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.2.3. S Korea Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.3.3. Japan Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.4. India 6.5.4.1. India Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.4.3. India Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.5.3. Australia Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.6.3. Indonesia Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.7.3. Malaysia Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.8.3. Vietnam Metaverse Market Size and Forecast, by Application(2023-2030) 6.5.8.4. Vietnam Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.9.3. Taiwan Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Metaverse Market Size and Forecast, by Technology (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Metaverse Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Metaverse Market Size and Forecast, by Device (2023-2030) 6.5.10.3. Rest of Asia Pacific Metaverse Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Metaverse Market Size and Forecast, by Technology (2023-2030) 7. Middle East and Africa Metaverse Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Metaverse Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Metaverse Market Size and Forecast, by Device (2023-2030) 7.3. Middle East and Africa Metaverse Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Metaverse Market Size and Forecast, by Technology (2023-2030) 7.5. Middle East and Africa Metaverse Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Metaverse Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa Metaverse Market Size and Forecast, by Device (2023-2030) 7.5.1.3. South Africa Metaverse Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Metaverse Market Size and Forecast, by Technology (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Metaverse Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC Metaverse Market Size and Forecast, by Device (2023-2030) 7.5.2.3. GCC Metaverse Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Metaverse Market Size and Forecast, by Technology (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Metaverse Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria Metaverse Market Size and Forecast, by Device (2023-2030) 7.5.3.3. Nigeria Metaverse Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Metaverse Market Size and Forecast, by Technology (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Metaverse Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A Metaverse Market Size and Forecast, by Device (2023-2030) 7.5.4.3. Rest of ME&A Metaverse Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Metaverse Market Size and Forecast, by Technology (2023-2030) 8. South America Metaverse Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Metaverse Market Size and Forecast, by Component (2023-2030) 8.2. South America Metaverse Market Size and Forecast, by Device (2023-2030) 8.3. South America Metaverse Market Size and Forecast, by Application(2023-2030) 8.4. South America Metaverse Market Size and Forecast, by Technology (2023-2030) 8.5. South America Metaverse Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Metaverse Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil Metaverse Market Size and Forecast, by Device (2023-2030) 8.5.1.3. Brazil Metaverse Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Metaverse Market Size and Forecast, by Technology (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Metaverse Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina Metaverse Market Size and Forecast, by Device (2023-2030) 8.5.2.3. Argentina Metaverse Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Metaverse Market Size and Forecast, by Technology (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Metaverse Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America Metaverse Market Size and Forecast, by Device (2023-2030) 8.5.3.3. Rest Of South America Metaverse Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Metaverse Market Size and Forecast, by Technology (2023-2030) 9. Global Metaverse Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Metaverse Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Tencent Holdings Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. NVIDIA Corporation 10.3. Meta (Facebook Inc.) 10.4. Roblox Corporation 10.5. Microsoft Corporation 10.6. Globant 10.7. Queppelin 10.8. Alibaba Cloud 10.9. Netease Inc. 10.10. Magic Leap, Inc. 10.11. Bytedance 10.12. Epic Games 10.13. Lilith Games 10.14. Nextech AR Solutions Inc. 10.15. Unity Software Inc. 10.16. Others 11. Key Findings 12. Industry Recommendations 13. Metaverse Market: Research Methodology 14. Terms and Glossary