The Global Metal Fabrication Market was valued at USD 22.48 Bn in 2024. The market is expected to grow at a CAGR of 4.7% to reach USD 32.47 Bn by 2032. Key global growth drivers include increasing demand in the metal fabrication industry, increasing adoption of CNC machining, laser cutting, robotic welding, and the expansion of the fabricated metal products market across automotive, aerospace, energy, marine, and construction sectors.Metal Fabrication Market Overview

Metal fabrication is the industrial process of cutting, shaping, welding, machining, and assembling metal materials to create structures, components, and finished products used in industries such as automotive, construction, aerospace, machinery, and electronics. It transforms raw metal into functional, precise parts. The production of essential metal structures, components, and assemblies used across automotive, aerospace & defense, construction, energy, marine, heavy machinery, and electronics sectors drive the Metal Fabrication Market. Metal fabrication involves a wide range of processes, including cutting, welding, machining, forming, bending, rolling, stamping, punching, and finishing to transform raw metals such as steel, aluminum, and specialty alloys into functional end-use products. With the rise of industrial automation, the industry is rapidly transitioning toward precision fabrication, CNC machining, robotic welding, laser cutting, and fully automated fabrication solutions to improve accuracy, efficiency, and productivity. The Metal Fabrication Industry is driven by increasing infrastructure development, industrial expansion, and technological evolution in metal processing. Traditional segments such as sheet metal fabrication, structural steel fabrication, and custom metal fabrication services continue to experience high demand, while advanced capabilities such as high-precision machining, 5-axis machining, AI-enabled fabrication, and Industry 4.0–based smart manufacturing are reshaping competitive dynamics. The industry is also witnessing growing adoption of digital twins, IoT-enabled monitoring, automated material handling, and advanced metal finishing equipment, improving quality control and reducing operational costs.To know about the Research Methodology:- Request Free Sample Report

Trend: Increasing Global Demand for Metal Processing & Machining

The demand for metal processing, machining, and metal cutting accelerates across key industries, boosting the Metal Fabrication Market growth. Automotive OEMs and tier suppliers are increasing their use of fabricated metal parts, such as chassis components, brackets, exhaust systems, battery housings, and lightweight EV structures, driving volumes for sheet metal fabrication and structural steel fabrication worldwide. The aerospace & defense fabrication services segment is expanding, driven by rising demand for precision-machined parts, welded assemblies, and high-strength alloy structures. The energy sector, particularly renewables, is another powerful demand engine. Wind turbine towers, solar mounting structures, transformer housings, and power-grid components all require sophisticated metal fabrication services and heavy fabrication services. Growth in electronics and semiconductor metal components is adding to the momentum, as OEMs outsource enclosures, racks, and heat-sink fabrication to specialist job shops and contract fabricators in North America, Europe, Asia Pacific, and South America. The rapid scaling of the CNC Machining Services Market, Robotic Welding Market, and laser Cutting Equipment Market. Fabricators are investing in multi-axis CNC machining centers, fiber-laser cutting machines, and automated metal forming & bending lines to meet tighter tolerances, shorter lead times, and higher mix–low volume requirements. Automated fabrication solutions help reduce scrap, minimize human error, and support continuous operations across global metal manufacturing hubs. Global buyers are increasingly looking for custom metal fabrication services, integrated welding and machining, and full-service partners capable of design-to-delivery execution. As a result, capacity utilization is rising in both developed and emerging markets, and the overall metal processing, Metal Fabrication Market, and Fabricated Metal Products Market. Technological Advancements in Global Metal Manufacturing to Boost the Metal Fabrication Market Technological progress is reshaping the Global Metal Fabrication Market and pushing the metal fabrication industry toward higher automation, accuracy, and productivity. Widespread adoption of computer-aided design (CAD) and computer-aided manufacturing (CAM) enables complex geometries, faster programming, and seamless transfer of digital models to shop-floor equipment. These tools, combined with advanced nesting and simulation software, reduce material waste and optimize throughput in sheet metal fabrication and structural steel fabrication. The CNC Machining Services Market is evolving rapidly, with 3-axis, 4-axis, and 5-axis machining centers capable of handling multi-material, high-precision workpieces for automotive, aerospace, medical, and industrial applications. Integrating high-speed spindles, tool monitoring, and automated pallet changers allows fabricators to run lights-out production and meet global demand for precision CNC components. The Global Welding Equipment Market is shifting toward robotic welding cells, cobots, and intelligent power sources that ensure consistent weld quality and traceability. Laser Cutting Equipment Market growth is driven by fiber-laser systems, which deliver faster cutting speeds, reduced operating costs, and better edge quality for thin to medium-thick metals. These are integrated into automated material-handling systems, stackers, and warehouse solutions, forming the backbone of smart fabrication lines. Metal forming & bending equipment is also becoming more sophisticated, with CNC press brakes, servo-driven rollers, and automated tool-changers enabling quick set-ups and flexible production. Emerging technologies such as AI-enabled process control, IoT-based real-time monitoring, digital twins, and predictive maintenance are transforming the traditional metal fabrication equipment market into a connected, data-driven ecosystem.Shifting Global Trends Creating New Opportunities

Several structural shifts are unlocking fresh opportunities in the Global Metal Fabrication Market and reshaping long-term demand patterns. Rapid expansion of renewable energy projects is driving strong requirements for wind turbine towers, nacelle frames, solar mounting systems, battery enclosures, and power-grid hardware, all of which depend on advanced sheet metal fabrication, structural steel fabrication, and heavy fabrication services. This significantly boosts demand for cutting machines, welding machines, and metal forming & bending equipment across major manufacturing hubs. Marine and shipbuilding fabrication is also gaining traction in regions such as the Asia Pacific, Europe, and the Middle East, where investments in ports, LNG carriers, offshore structures, and defense vessels are increasing. These projects require high-quality welding, large-format plate processing, and robust corrosion-resistant metal components, supporting growth in the global welding equipment market and custom metal fabrication services. Fabricators are deploying connected CNC machining centers, robotic welding cells, automated laser cutting systems, and IoT-enabled metal finishing equipment to build smart, data-driven fabrication lines. Automation and digitalization enable real-time monitoring, predictive maintenance, and better utilization of fabrication equipment, helping reduce downtime and improve profitability. Cross-industry demand is expanding as construction, automotive, aerospace & defense, electronics, and heavy machinery manufacturers increasingly rely on outsourcing to specialized industrial fabrication services partners. Global buyers seek full-service suppliers capable of design engineering, prototyping, production, and assembly across multiple regions, stimulating growth in the Metal Fabrication Equipment Market and the wider Metal Manufacturing Market. These shifts collectively create a favorable environment for long-term growth in the global Metal Fabrication Industry. Challenges: Skilled Labor Shortage & Additive Manufacturing Impact The shortage of skilled welders, machinists, fabricators, and CNC programmers across North America, Europe, and the Asia Pacific. As the Metal Fabrication Industry adopts more advanced CNC machining, robotic welding, laser cutting, and metal forming & bending technologies, the skills gap widens between legacy operators and the digital capabilities required for modern smart factories. Fabricators contend with volatility in steel, aluminum, and other raw material prices, which compresses margins in sheet metal fabrication, structural steel fabrication, and custom metal fabrication services. Fluctuations in energy, logistics, and labor costs further complicate pricing strategies for global suppliers of sheet metal and CNC components and raise working-capital requirements for job shops and contract manufacturers. The rise of additive manufacturing, which can bypass some traditional metal cutting and welding steps for complex, low-volume parts. While large-scale adoption of 3D-printed metal components is still limited by cost and throughput, it is increasingly used in aerospace, medical, and high-end industrial applications. This compels Metal Fabrication Companies worldwide to rethink their value proposition and differentiate through speed, quality, design support, and integrated services. The impact of additive manufacturing remains complementary rather than fully disruptive in most segments. Demand for conventional machining, heavy fabrication services, and high-volume sheet metal fabrication continues to grow, especially in construction, automotive, energy, and infrastructure. Companies that invest in workforce upskilling, supply-chain resilience, and hybrid manufacturing models are best positioned to manage these challenges and sustain competitiveness in the global fabricated metal products market.Metal Fabrication Market Segment Analysis

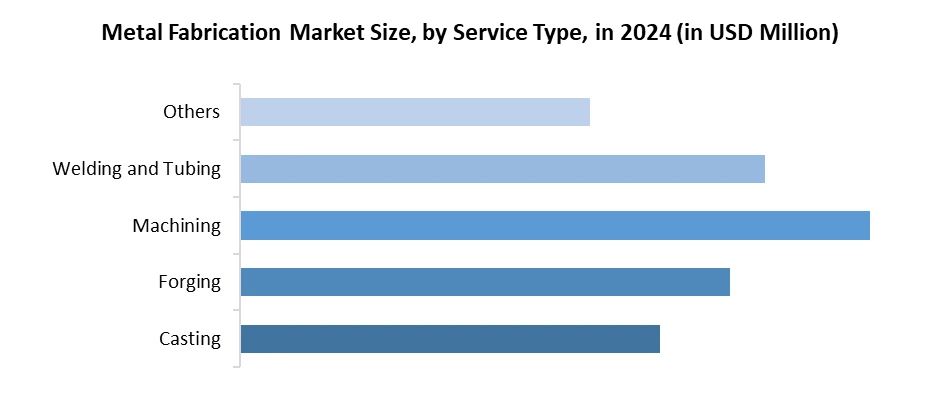

Based on Material Type, the market is segmented into Steel, Aluminum and Others. The steel Material is the dominant material type in the Global Metal Fabrication Market in 2024, accounting for the largest share due to its superior strength, durability, cost-efficiency, and widespread End users across construction, automotive, heavy machinery, energy, shipbuilding, and infrastructure industries. Steel remains the preferred choice for structural steel fabrication, sheet metal fabrication, piping, frameworks, and industrial equipment because of its high tensile strength, weldability, machinability, and long service life. Its extensive use in bridges, buildings, metro rail systems, renewable energy structures, automotive chassis, and heavy equipment manufacturing reinforces steel’s market leadership globally. The rapid urbanization in the Asia Pacific, large-scale infrastructure modernization in North America and Europe, and rising industrial investments in the Middle East are further accelerating the consumption of fabricated steel components. In contrast, the aluminum segment is growing rapidly but remains secondary, driven by demand for lightweight, corrosion-resistant materials in automotive, aerospace, electronics, and marine sectors. Aluminum’s high strength-to-weight ratio and recyclability make it particularly attractive for electric vehicles, aircraft structures, and high-precision machining applications, boosting growth in the Aluminum Fabrication Market.Based on Service Type, the market is categorized into Casting, Forging, Machining, Welding, and Tubing, and Others. Among all service types, machining is the dominant segment in the Global Metal Fabrication Market, owing to its critical role in producing precision components required across automotive, aerospace, machinery, electronics, energy, and defense industries. Machining processes such as turning, milling, drilling, grinding, and CNC machining deliver the high accuracy, tight tolerances, and complex geometries needed in advanced manufacturing. The growth of the CNC machining services market, driven by multi-axis machining centers, automation, and digital manufacturing, further strengthens machining’s leadership. Fabricators increasingly rely on automated CNC systems to reduce errors, improve consistency, and support high-mix, low-volume production required by global OEMs. While welding and tubing also hold substantial market share due to their importance in structural steel fabrication, pipelines, automotive bodies, and heavy equipment, they remain secondary to machining in terms of revenue and technological complexity. Casting and forging are essential for producing foundational metal shapes and high-strength parts, particularly for heavy machinery, oil & gas, and aerospace, but their market share is smaller because these processes are often carried out by specialized foundries rather than general fabrication shops.

Metal Fabrication Market Regional Insights

The Asia Pacific region dominated the Metal Fabrication Market in 2024, continues to dominate the global landscape due to its strong manufacturing ecosystem, expanding industrial base, and rapid technological advancement across major economies. China remains the epicenter of growth, driven by its massive metal manufacturing industry, extensive supply chain networks, and large-scale production capacity for sheet metal fabrication, structural steel fabrication, CNC machining, laser cutting, and robotic welding. India is emerging as one of the fastest-growing markets, supported by rising infrastructure development, expansion of fabrication workshops, increasing automotive production, and proactive government initiatives such as Make in India, which promote domestic manufacturing and the adoption of advanced fabrication equipment and automated fabrication solutions. Japan contributes significantly through its leadership in precision machining, 5-axis machining, high-end welding systems, and industrial robotics, making it a global hub for advanced fabrication technologies. South Korea continues to strengthen its position with world-class capabilities in robotic welding, metal forming & bending, and high-quality steel production, driving demand for customized fabrication services for automotive, shipbuilding, and electronics sectors. The Southeast Asian countries, including Vietnam, Indonesia, Thailand, and Malaysia, are emerging as competitive manufacturing destinations due to low production costs, rising foreign investments, and rapid growth in the steel fabrication and contract metal fabrication markets. These regions are becoming attractive alternatives to China for global outsourcing of CNC components, metal parts, and welded assemblies. Across the Asia Pacific, digital transformation and the adoption of Industry 4.0, smart factories, IoT-enabled fabrication systems, and AI-driven quality monitoring are reshaping operational efficiency. Additionally, government policies such as Made in China 2025, Japan Revitalize Strategy, and national industrial reforms are accelerating technological upgrades.Metal Fabrication Market Competitive Landscape

The global Metal Fabrication Market competitive landscape is highly fragmented yet increasingly technology-driven, with competition intensifying across integrated fabricators, specialized job shops, and global equipment manufacturers. Large multinational players such as Trumpf, Amada, Bystronic, DMG Mori, Yamazaki Mazak, ArcelorMittal, POSCO, and Thyssenkrupp dominate high-precision fabrication and advanced equipment segments due to strong R&D capabilities, automated production lines, and robust distribution networks. Mid-sized regional fabricators, including Salasar Techno Engineering, ISGEC Heavy Engineering, Karamtara Engineering, and Kapco Metal Stamping, compete on customized solutions, flexible production capacity, and cost efficiency, particularly in the Asia Pacific and North America. The competitive environment is increasingly shaped by innovations in CNC machining, robotic welding, laser cutting, metal forming & bending, and end-to-end digital fabrication systems that enable faster turnaround and higher accuracy. Players are adopting Industry 4.0, IoT-enabled monitoring, digital twins, and automated material handling to improve throughput and reduce operational costs. • In June 2024, TRUMPF announced the U.S. debut of its new Flex Cell bending automation system at FABTECH 2024 in Orlando, marking a major advancement in automated sheet-metal fabrication. The Flex Cell, designed to work seamlessly with the high-speed TruBend 7050 press brake, enables fully automated bending operations through a mobile robot that docks onto the machine within minutes and operates autonomously for several hours. With features such as double-sized material buffering, a vacuum gripper for efficient loading/unloading, TecZone Bend software for rapid programming, and automatic double-sheet detection, the system supports safe “lights-out” production and helps fabricators overcome labor shortages. • In October 2024, AMADA Italia S.r.l., a subsidiary of Amada Corporation, inaugurated its new Welding Technical Center in Piacenza, Italy, marking a significant expansion of the company’s European footprint. This center has been strategically established to support the rapidly growing demand for advanced metal fabrication equipment across the automotive, machinery, and broader industrial manufacturing sectors. The facility is designed to serve as a dedicated hub for welding technology demonstrations, customer training, and process optimization, enabling fabricators to adopt high-precision, automated welding solutions.Metal Fabrication Market Scope: Inquire before buying

Metal Fabrication Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 22.48 Bn. Forecast Period 2025 to 2032 CAGR: 4.7% Market Size in 2032: USD 32.47 Bn. Segments Covered: by Material Type Steel Aluminum Others by Service Type Casting Forging Machining Welding and Tubing Others by End User Industry Manufacturing Power and Utilities Construction Oil and Gas Others Metal Fabrication Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Metal Fabrication Key Players

1. Salasar Techno Engineering 2. ISGEC Heavy Engineering 3. Karamtara Engineering 4. Yamazaki Mazak 5. Trumpf 6. Amada Holdings 7. Bystronic 8. DMG Mori 9. Fabtech International 10. Zamil Industrial 11. Emirates Steel Arkan 12. Fractory 13. Kapco Metal Stamping 14. Summit Steel & Manufacturing 15. Precision Metal Industries 16. The Warren Company 17. Standard Iron & Wire Works 18. Danieli 19. PMP Industries 20. Model Metal 21. Interplex Holdings 22. Komaspec 23. Armco Staco 24. KIHM Metal Technologies 25. Alcoa Corporation 26. Thyssenkrupp AG 27. ArcelorMittal 28. Voestalpine AG 29. JSW Steel 30. POSCOFrequently Asked Questions:

1] What segments are covered in the Metal Fabrication Market report? Ans. The segments covered in the Metal Fabrication Market report are based on Material Type, Service Type, End-User and Region. 2] Which region is expected to hold the highest share of the Metal Fabrication Market? Ans. The Asia Pacific region is expected to hold the highest share of the Metal Fabrication Market. 3] What is the market size of the Metal Fabrication Market by 2032? Ans. The market size of the Metal Fabrication Market by 2032 is USD 32.47 Billion. 4] What is the growth rate of the Metal Fabrication Market? Ans. The Global Metal Fabrication Market is growing at a CAGR of 4.7% during the forecasting period 2025-2032. 5] What was the market size of the Metal Fabrication Market in 2024? Ans. The market size of the Metal Fabrication Market in 2024 was USD 22.48 Billion.

1. Metal Fabrication Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Metal Fabrication Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Metal Fabrication Market: Dynamics 3.1. Metal Fabrication Market Trends 3.2. Metal Fabrication Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Metal Fabrication Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Metal Fabrication Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2024-2032) 4.1. Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 4.1.1. Steel 4.1.2. Aluminum 4.1.3. Others 4.2. Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 4.2.1. Casting 4.2.2. Forging 4.2.3. Machining 4.2.4. Welding and Tubing 4.2.5. Others 4.3. Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 4.3.1. Manufacturing 4.3.2. Power and Utilities 4.3.3. Construction 4.3.4. Oil and Gas 4.3.5. Others 4.4. Metal Fabrication Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Metal Fabrication Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2024-2032) 5.1. North America Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 5.1.1. Steel 5.1.2. Aluminum 5.1.3. Others 5.2. North America Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 5.2.1. Casting 5.2.2. Forging 5.2.3. Machining 5.2.4. Welding and Tubing 5.2.5. Others 5.3. North America Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 5.3.1. Manufacturing 5.3.2. Power and Utilities 5.3.3. Construction 5.3.4. Oil and Gas 5.3.5. Others 5.4. North America Metal Fabrication Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 5.4.1.2. United States Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 5.4.1.3. United States Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 5.4.2. Canada 5.4.2.1. Canada Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 5.4.2.2. Canada Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 5.4.2.3. Canada Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 5.4.3. Mexico 5.4.3.1. Mexico Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 5.4.3.2. Mexico Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 5.4.3.3. Mexico Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 6. Europe Metal Fabrication Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2024-2032) 6.1. Europe Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 6.2. Europe Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 6.3. Europe Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Metal Fabrication Market Size and Forecast, By Country (2024-2032) 6.4.1. United Kingdom 6.4.2. France 6.4.3. Germany 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific Metal Fabrication Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2024-2032) 7.1. Asia Pacific Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 7.2. Asia Pacific Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 7.3. Asia Pacific Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Metal Fabrication Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.2. S Korea 7.4.3. Japan 7.4.4. India 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippines 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa Metal Fabrication Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2024-2032) 8.1. Middle East and Africa Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 8.2. Middle East and Africa Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 8.3. Middle East and Africa Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Metal Fabrication Market Size and Forecast, By Country (2024-2032) 8.4.1. South Africa 8.4.2. GCC 8.4.3. Nigeria 8.4.4. Rest of ME&A 9. South America Metal Fabrication Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’Units) (2024-2032) 9.1. South America Metal Fabrication Market Size and Forecast, By Material Type (2024-2032) 9.2. South America Metal Fabrication Market Size and Forecast, By Service Type (2024-2032) 9.3. South America Metal Fabrication Market Size and Forecast, By End-User (2024-2032) 9.4. South America Metal Fabrication Market Size and Forecast, By Country (2024-2032) 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1. Salasar Techno Engineering 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. ISGEC Heavy Engineering 10.3. Karamtara Engineering 10.4. Yamazaki Mazak 10.5. Trumpf 10.6. Amada Holdings 10.7. Bystronic 10.8. DMG Mori 10.9. Fabtech International 10.10. Zamil Industrial 10.11. Emirates Steel Arkan 10.12. Fractory 10.13. Kapco Metal Stamping 10.14. Summit Steel & Manufacturing 10.15. Precision Metal Industries 10.16. The Warren Company 10.17. Standard Iron & Wire Works 10.18. Danieli 10.19. PMP Industries 10.20. Model Metal 10.21. Interplex Holdings 10.22. Komaspec 10.23. Armco Staco 10.24. KIHM Metal Technologies 10.25. Alcoa Corporation 10.26. Thyssenkrupp AG 10.27. ArcelorMittal 10.28. Voestalpine AG 10.29. JSW Steel 10.30. POSCO 11. Key Findings 12. Analyst Recommendations 13. Metal Fabrication Market – Research Methodology