Industrial Gas Turbine Market is projected to grow from USD 9.29 Bn in 2024 to USD 12.27 Bn by 2032 at a CAGR of 3.54%, driven by smart tech and emission cuts.Industrial Gas Turbine Market Overview

An industrial gas turbine is a combustion engine that converts natural gas or other fuels into mechanical energy, which is then used to generate electricity or power industrial processes. These turbines are known for their high efficiency, low emissions, and flexibility in combined heat and power (CHP) systems. The industrial gas turbine market is experiencing significant growth, driven by the rising demand for efficient and cleaner power generation solutions. Increasing industrialisation, coupled with stringent government regulations on emissions, is pushing industries to adopt gas turbines over coal-based plants. For instance, the U.S. Energy Information Administration (EIA) projects a 3.5% annual growth in gas turbine capacity additions by 2030, supported by policies like the Inflation Reduction Act (IRA). North America and Asia-Pacific dominate the market, with North America leading due to shale gas abundance and government incentives for combined-cycle power plants. Meanwhile, Asia-Pacific is expanding rapidly, fueled by rising energy demands in China and India, where governments are investing heavily in gas infrastructure to reduce coal dependency. An emerging trend is the use of AI and IoT for predictive maintenance, enhancing turbine efficiency and lifespan. Governments worldwide are also funding carbon capture (CCUS) projects, further boosting market prospects.To know about the Research Methodology :- Request Free Sample Report

Global Industrial Gas Turbine Market Dynamics

Industrial Gas Turbine Market Driver Gas Turbine Technology Reduces Greenhouse Emissions to Drive Industrial Gas Turbine Market Growth Traditional coal-fired power plants are known to emit large amounts of toxic gases and contribute significantly to global warming. Coal-fired power plants are one of the major contributors to emissions. Rising greenhouse gas emissions create an urgency to develop cleaner methods of generating electricity, which is expected to increase demand for industrial gas turbines over the next decade. Natural gas, a primary fuel for gas turbines, contains very little sulfur, resulting in almost no sulfur dioxide emissions. The CO2 emissions from natural gas-fired gas turbines are also very low—0,37 kilograms of CO2 per kWh of electricity generated. This compares to 1.01 kg/kWh for lignite and 0.8 kg/kWh for anthracite. As a result, the factors listed above drive the growth of the industrial gas turbine market during the forecast period. Growing Electricity Demand Accelerates Global Market Growth The global increase, thriving industrial sector, and growth in infrastructure development activities have resulted in an enormous increase in demand for electricity. As the electricity demand grows, several countries around the world are increasing their capacity to generate electricity by building new plants or growing the capacity of existing ones! Companies are more inclined to adopt industrial gas turbine systems due to stringent government norms regarding greenhouse gas emissions. These factors augment the industrial gas turbine market growth during the forecast period. Growing environmental concerns and stringent regulatory commitments to reduce GHG emissions have focused on energy conservation, which benefits the industrial gas turbine market. Gas turbines have emerged as a critical factor for power and heat delivery systems as environmental concerns have grown. In line with rapid technological developments in combustion, aerodynamics, matter, and cooling, ongoing changes in critical power markets have been critical to this development. Increasing cash flow to replace conventional energy systems with improved units would accelerate market demand even further. The power-to-weight ratio, modularity, and high power rating all play important roles in driving dynamics in the market. The recent shale trend has resulted in increased investment in research and drilling in inland and onshore remote basins, which complements business growth. Natural gas price volatility to Create Restraint for the Industrial Gas Turbine Market Natural gas prices are affected by actions that can disrupt natural gas research. Geopolitical tensions are a disruptive factor that creates uncertainty about gas availability and demand. This may result in increased volatility in gas prices. Gas prices in the United States have dropped dramatically as a result of shale gas extraction, but prices elsewhere in the world remain relatively high. The majority of the countries in the Middle East region have significant natural gas reserves. Because of political and cultural issues, it is a highly volatile region. Additionally, due to the COVID-19 pandemic, demand has increased in recent months. Natural gas prices have dropped significantly. Gas prices have fallen, which hurts the industrial gas turbine market. Broader Scope in Emerging Economies to Create Industrial Gas Turbine Market Opportunity The rise of industrial hubs and rising FDI in all major manufacturing sectors across emerging economies such as China, India, Brazil, and Southeast Asian countries is expected to create lucrative growth opportunities for this market during the forecast period. Various foreign developers interested in establishing businesses through FDI incentive schemes are focusing on emerging economies. This will indirectly boost the country's economy and accelerate industrialisation. To attract investments and enable growth, countries such as the United States and many Asian countries have evolved and restructured their manufacturing policies and procedures. Industrialisation will accelerate the automation process, increasing overall production efficiency and streamlining operations. As a result, it is possible to conclude that the expansion of the industrial sector, particularly in emerging economies, will provide an opportunity for the industrial gas turbine market. The new contracts are occupying the attention of key participants The industrial gas turbine market is highly fragmented, with several large-scale key players operating globally. This includes a group of four to five key companies with a broader geographic presence. Several companies are increasingly investing in organic and inorganic developments in order to strengthen their global market position. The firms are looking for new contracts in order to increase their market share. For example, in February 2022, GE began construction on six 34 MWLM250EXPRESS aero-derivative gas turbines that will replace a coal plant in Colorado.Industrial Gas Turbine Market Segment Analysis

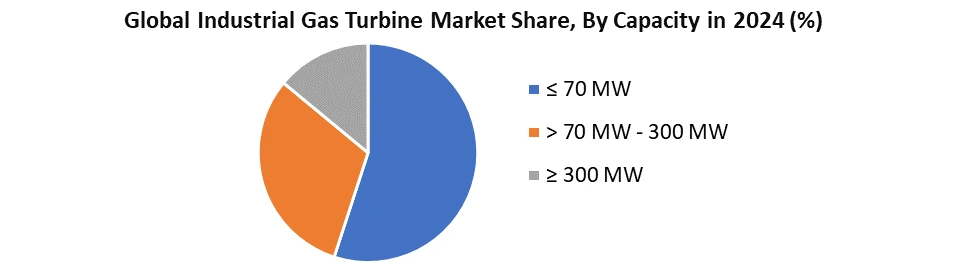

Based on Capacity, the gas turbine segment, with a capacity of ≤ 70 MW, is expected to grow at a higher annual rate through 2032. Significant Capacity across small-capacity power-generating plants and process industries has contributed to the growth. The widespread adoption and expansion of cogeneration units to meet industrial heat and energy consumption needs will drive turbine demand. Based on the Technology, in terms of technology, the heavy-duty segment dominated the industrial gas turbine market in 2024. A growing number of manufacturing plants, combined with the integration of large-scale economic zones across developing countries, have established an admirable business platform. The heavy-duty segment will grow as more captive-generating power stations are integrated to serve the electricity demand of industrial establishments. Because of the availability of highly flexible and mobile technologies, aero-derivative segments have gained significant market share in the global market. The segment also has a diverse Technology portfolio, which includes marine propulsion, utility generation, and district heating. Based on the Cycle, the combined cycle segment led the industrial gas turbine market in 2024, owing to its proximity to the environment, effective waste heat utilization, and operational efficiency. The combined cycle requires more investment than the straightforward cycle, so these plants are built in stages. First, simple cycle plants are built, and then they are gradually converted to combined cycle plants. During the forecast period, the simple cycle segment is expected to grow rapidly. Simple cycle plants are easier and more convenient to build than combined cycle plants, and they are also more cost-effective and efficient. The construction of only simple cycle power plants is increasing around the world. This drives growth in the simple cycle segment during the forecast period. Based on the Sector, the electric power utility segment dominated the global market by sector in 2024. A growing emphasis on the restoration of traditional steam and coal-fired power plants. Power plants that use gas or other renewable energy sources boost the industrial gas turbine market. The high efficiency of gas turbine power generation has given this technology a competitive advantage in comparison to traditional power generation plants.During the forecast period, the oil and gas segment is expected to grow significantly. Exploration and production activities are rapidly expanding, as is the volume of gas generated. Pipeline projects are also growing in importance. As a result, during the forecast period, the oil and gas segment will grow.

Industrial Gas Turbine Market Regional Insights

The global industrial gas turbine market has been segmented into five major regions: North America, Europe, Asia Pacific, South America, the Middle East and Africa, and Latin America. North America is expected to lead the market during the forecast period. Because of the region's increased shale gas exploration activities, the region has a large number of industrial gas turbine plants that run on natural gas. According to the US Energy Information Administration (EIA), coal currently accounts for more than 45% of the nation's power, while natural gas accounts for approximately 28%. The EIA predicts that natural gas will be the primary fuel for power generation by 2035. During the forecast period, Asia Pacific is expected to grow at a significant CAGR. The region's market growth can be attributed to several factors, including rapid industrialization, rising energy demand, and rising demand for clean energy technologies. The Asia Pacific region is heavily reliant on coal for power generation. Coal combustion emits a significant amount of pollution into the atmosphere. In countries such as Japan, China, Australia, South Korea, and India, government initiatives to reduce carbon emissions have led to the use of gas turbines. China is currently developing its 14th Five-Year Plan, which will be most beneficial to the development of gas power. The 14°" FYP will implement a robust, favourable policy to encourage more and more gas-fired power projects in China. The Europe region is also expected to expand significantly during the forecast period, with governments focusing on replacing coal with either gas turbines or other renewable sources to reduce greenhouse gas emissions. Industrial Gas Turbine Market Competitive Landscape The industrial gas turbine market in 2025 remains highly competitive, led by major players such as General Electric (GE), Siemens Energy, Mitsubishi Power, Rolls-Royce, and Ansaldo Energia. Together, these companies control more than 70% of the global market, leveraging their advanced turbine technologies, extensive global service networks, and established customer bases. GE has strengthened its position with a 29 GW order backlog and a $600 million investment in U.S. manufacturing to support AI-driven and hydrogen-capable turbines. Siemens Energy is increasing its local manufacturing footprint, notably in the Middle East, where it delivered Saudi Arabia’s first domestically assembled heavy-duty turbine. Mitsubishi Power is focusing on hydrogen-ready turbines, with new units supporting up to 50% blending, aiming for 100% capability by 2030. Rolls-Royce and Ansaldo Energia are maintaining their competitiveness through innovations in efficiency and flexible operation. The market also sees growing competition from regional firms like Doosan Enerbility in South Korea and Harbin Electric in China. Competitive strategies include digital turbine optimisation, long-term service agreements, and carbon-reduction technologies. As demand grows for cleaner and more efficient energy solutions, innovation and localisation remain key factors shaping the evolving market landscape. Industrial Gas Turbine Market Key Trends • Shift to Hydrogen-Blended & Zero-Carbon Fuels Governments and energy firms are investing heavily in hydrogen-compatible gas turbines to meet decarbonization goals. The European Commission’s Hydrogen Strategy targets 40GW of hydrogen-ready turbines by 2030. • Digital Transformation and Advanced Analytics Operators are implementing AI-driven monitoring systems to optimise performance and predict maintenance needs. These digital solutions are becoming standard for maximising turbine efficiency and lifespan. • Growing LNG Infrastructure in Asia Asia’s LNG expansion is a major turbine market driver. China aims to derive 15% of its energy from gas by 2030, requiring 200+ new gas-fired plants (NDRC). India’s LNG imports rose 25% in 2023, with plans to build 50GW of gas power capacity by 2032. Industrial Gas Turbine Market Recent Development

Company Date Key Development General Electric May 2025 Announced expansion of its Schenectady plant with a $600 million investment to bolster manufacturing capacity for AI-driven data centre turbines. May 23, 2025 Reported a 29 GW gas turbine order backlog, including hydrogen-capable units for Chevron’s data‑centre power plants; gas turbine demand remains diverse beyond AI. Siemens Energy AG May 1, 2025 Launched Saudi Arabia’s first locally made heavy-duty gas turbine as part of its localisation program. Mitsubishi Power April 14, 2025 The CEO confirmed all new European, Middle East & Africa gas turbine orders are “hydrogen-ready” currently 30% blending, with progression to 50% by mid‑2025 and 100% by 2030. August 26, 2024 Won an order for the 475 MW SATORP cogeneration plant in Jubail, Saudi Arabia; first J‑class turbine assembled in Dammam to support hydrogen-ready expansion. Industrial Gas Turbine Market Scope: Inquire before buying

Industrial Gas Turbine Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 9.29 Bn. Forecast Period 2025 to 2032 CAGR: 3.54% Market Size in 2032: USD 12.27 Bn. Segments Covered: by Capacity ≤ 70 MW > 70 MW - 300 MW ≥ 300 MW by Technology Heavy Duty Light Industrial Aeroderivative by Cycle Simple Cycle Combined Cycle by Sector Electric Power Utility Oil & Gas Manufacturing Industrial Gas Turbine Market, by region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South America)Industrial Gas Turbine Market Key Players

North America 1. General Electric (United States) 2. Solar Turbines – Caterpillar (United States) 3. Siemens Energy Inc. (United States) 4. PW Power Systems – Mitsubishi Heavy Industries (Canada) 5. Rolls-Royce North America (United States) 6. Vericor Power Systems (United States) Europe 7. Siemens Energy AG (Germany) 8. Rolls-Royce plc (United Kingdom) 9. Ansaldo Energia France (France) 10. Ansaldo Energia (Italy) 11. MAN Energy Solutions (Germany) 12. UEC-Aviadvigatel – United Engine Corporation (Russia) 13. Alstom SA (Switzerland) Asia Pacific 14. Mitsubishi Power (Japan) 15. Kawasaki Heavy Industries (Japan) 16. Harbin Electric Corporation (China) 17. Dongfang Electric Corporation (China) 18. Shanghai Electric Group (China) 19. Doosan Enerbility (South Korea) 20. Bharat Heavy Electricals Limited – BHEL (India) Middle East & Africa 21. Mubadala Energy (United Arab Emirates) 22. Saudi Aramco (Saudi Arabia) 23. Sasol (South Africa) South America 24. Siemens Energy Brazil (Brazil) 25. Industrias Juan F. Secco (Argentina) 26. WEG S.A. (Brazil) 27. Colbún S.A. (Chile)Frequently Asked Questions:

1] What are industrial gas turbines used for? Ans. A gas turbine is a combustion engine that converts natural gas or other liquid fuels to mechanical energy at the heart of a power plant. This energy then powers a generator, which generates the electrical energy that travels through power lines to homes and businesses. 2] What are the 3 basic types of gas turbines? Ans. In general, three types of gas turbine compressors are available: axial compressors, centrifugal compressors, and mixed flow compressors. 3] What are industrial turbines? Ans. To generate electricity, industrial turbines burn fuel and air at high pressures and temperatures. Turbines run on the Brayton cycle, which is a thermodynamic cycle. 4] Who are the top key players in the industrial Gas Turbine Market? Ans. The leading players in the global industrial gas turbine market in 2024 include General Electric, Siemens Energy AG, Mitsubishi Power, Rolls-Royce plc, Solar Turbines, Caterpillar, and Ansaldo Energia.

1. Industrial Gas Turbine Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Industrial Gas Turbine Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Industrial Gas Turbine Market: Dynamics 3.1. Region-wise Trends of Industrial Gas Turbine Market 3.1.1. North America Industrial Gas Turbine Market Trends 3.1.2. Europe Industrial Gas Turbine Market Trends 3.1.3. Asia Pacific Industrial Gas Turbine Market Trends 3.1.4. Middle East and Africa Industrial Gas Turbine Market Trends 3.1.5. South America Industrial Gas Turbine Market Trends 3.2. Industrial Gas Turbine Market Dynamics 3.2.1. Drivers 3.2.1.1. Low Emission Technology 3.2.1.2. Rising Power Demand 3.2.2. Restraints 3.2.3. Opportunities 3.2.3.1. Emerging Markets Expansion 3.2.3.2. FDI-Driven Industrialisation 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Energy Access Regulations 3.4.2. Smart Grid Integration 3.4.3. Product Safety Standards 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Industrial Gas Turbine Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 4.1.1. ≤ 70 MW 4.1.2. > 70 MW - 300 MW 4.1.3. ≥ 300 MW 4.2. Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 4.2.1. Heavy Duty 4.2.2. Light Industrial 4.2.3. Aeroderivative 4.3. Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 4.3.1. Simple Cycle 4.3.2. Combined Cycle 4.4. Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 4.4.1. Electric Power Utility 4.4.2. Oil & Gas 4.4.3. Manufacturing 4.5. Industrial Gas Turbine Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Industrial Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 5.1.1. ≤ 70 MW 5.1.2. > 70 MW - 300 MW 5.1.3. ≥ 300 MW 5.2. North America Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 5.2.1. Heavy Duty 5.2.2. Light Industrial 5.2.3. Aeroderivative 5.3. North America Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 5.3.1. Simple Cycle 5.3.2. Combined Cycle 5.4. North America Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 5.4.1. Electric Power Utility 5.4.2. Oil & Gas 5.4.3. Manufacturing 5.5. North America Industrial Gas Turbine Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 5.5.1.1.1. ≤ 70 MW 5.5.1.1.2. > 70 MW - 300 MW 5.5.1.1.3. ≥ 300 MW 5.5.1.2. United States Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 5.5.1.2.1. Heavy Duty 5.5.1.2.2. Light Industrial 5.5.1.2.3. Aeroderivative 5.5.1.3. United States Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 5.5.1.3.1. Simple Cycle 5.5.1.3.2. Combined Cycle 5.5.1.4. United States Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 5.5.1.4.1. Electric Power Utility 5.5.1.4.2. Oil & Gas 5.5.1.4.3. Manufacturing 5.5.2. Canada 5.5.2.1. Canada Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 5.5.2.1.1. ≤ 70 MW 5.5.2.1.2. > 70 MW - 300 MW 5.5.2.1.3. ≥ 300 MW 5.5.2.2. Canada Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 5.5.2.2.1. Heavy Duty 5.5.2.2.2. Light Industrial 5.5.2.2.3. Aeroderivative 5.5.2.3. Canada Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 5.5.2.3.1. Simple Cycle 5.5.2.3.2. Combined Cycle 5.5.2.4. Canada Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 5.5.2.4.1. Electric Power Utility 5.5.2.4.2. Oil & Gas 5.5.2.4.3. Manufacturing 5.5.3. Mexico 5.5.3.1. Mexico Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 5.5.3.1.1. ≤ 70 MW 5.5.3.1.2. > 70 MW - 300 MW 5.5.3.1.3. ≥ 300 MW 5.5.3.2. Mexico Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 5.5.3.2.1. Heavy Duty 5.5.3.2.2. Light Industrial 5.5.3.2.3. Aeroderivative 5.5.3.3. Mexico Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 5.5.3.3.1. Simple Cycle 5.5.3.3.2. Combined Cycle 5.5.3.4. Mexico Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 5.5.3.4.1. Electric Power Utility 5.5.3.4.2. Oil & Gas 5.5.3.4.3. Manufacturing 6. Europe Industrial Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.2. Europe Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.3. Europe Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.4. Europe Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5. Europe Industrial Gas Turbine Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.1.2. United Kingdom Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.1.3. United Kingdom Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.1.4. United Kingdom Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5.2. France 6.5.2.1. France Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.2.2. France Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.2.3. France Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.2.4. France Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.3.2. Germany Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.3.3. Germany Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.3.4. Germany Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.4.2. Italy Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.4.3. Italy Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.4.4. Italy Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.5.2. Spain Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.5.3. Spain Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.5.4. Spain Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.6.2. Sweden Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.6.3. Sweden Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.6.4. Sweden Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.7.2. Russia Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.7.3. Russia Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.7.4. Russia Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 6.5.8.2. Rest of Europe Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 6.5.8.3. Rest of Europe Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 6.5.8.4. Rest of Europe Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7. Asia Pacific Industrial Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.2. Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.4. Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5. Asia Pacific Industrial Gas Turbine Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.1.2. China Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.1.3. China Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.1.4. China Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.2.2. S Korea Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.2.3. S Korea Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.2.4. S Korea Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.3.2. Japan Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.3.3. Japan Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.3.4. Japan Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.4. India 7.5.4.1. India Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.4.2. India Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.4.3. India Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.4.4. India Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.5.2. Australia Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.5.3. Australia Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.5.4. Australia Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.6.2. Indonesia Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.6.3. Indonesia Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.6.4. Indonesia Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.7.2. Malaysia Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.7.3. Malaysia Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.7.4. Malaysia Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.8.2. Philippines Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.8.3. Philippines Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.8.4. Philippines Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.9.2. Thailand Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.9.3. Thailand Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.9.4. Thailand Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.10.2. Vietnam Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.10.3. Vietnam Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.10.4. Vietnam Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 7.5.11.2. Rest of Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 7.5.11.3. Rest of Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 7.5.11.4. Rest of Asia Pacific Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 8. Middle East and Africa Industrial Gas Turbine Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 8.2. Middle East and Africa Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 8.4. Middle East and Africa Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 8.5. Middle East and Africa Industrial Gas Turbine Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 8.5.1.2. South Africa Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 8.5.1.3. South Africa Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 8.5.1.4. South Africa Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 8.5.2.2. GCC Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 8.5.2.3. GCC Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 8.5.2.4. GCC Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 8.5.3.2. Egypt Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 8.5.3.3. Egypt Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 8.5.3.4. Egypt Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 8.5.4.2. Nigeria Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 8.5.4.3. Nigeria Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 8.5.4.4. Nigeria Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 8.5.5.2. Rest of ME&A Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 8.5.5.3. Rest of ME&A Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 8.5.5.4. Rest of ME&A Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 9. South America Industrial Gas Turbine Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 9.2. South America Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 9.3. South America Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 9.4. South America Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 9.5. South America Industrial Gas Turbine Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 9.5.1.2. Brazil Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 9.5.1.3. Brazil Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 9.5.1.4. Brazil Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 9.5.2.2. Argentina Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 9.5.2.3. Argentina Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 9.5.2.4. Argentina Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 9.5.3.2. Colombia Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 9.5.3.3. Colombia Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 9.5.3.4. Colombia Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 9.5.4.2. Chile Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 9.5.4.3. Chile Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 9.5.4.4. Chile Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Industrial Gas Turbine Market Size and Forecast, By Capacity (2024-2032) 9.5.5.2. Rest Of South America Industrial Gas Turbine Market Size and Forecast, By Technology (2024-2032) 9.5.5.3. Rest Of South America Industrial Gas Turbine Market Size and Forecast, By Cycle (2024-2032) 9.5.5.4. Rest Of South America Industrial Gas Turbine Market Size and Forecast, By Sector (2024-2032) 10. Company Profile: Key Players 10.1. General Electric (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Solar Turbines – Caterpillar (United States) 10.3. Siemens Energy Inc. (United States) 10.4. PW Power Systems – Mitsubishi Heavy Industries (Canada) 10.5. Rolls-Royce North America (United States) 10.6. Vericor Power Systems (United States) 10.7. Siemens Energy AG (Germany) 10.8. Rolls-Royce plc (United Kingdom) 10.9. Ansaldo Energia France (France) 10.10. Ansaldo Energia (Italy) 10.11. MAN Energy Solutions (Germany) 10.12. UEC-Aviadvigatel – United Engine Corporation (Russia) 10.13. Alstom SA (Switzerland) 10.14. Mitsubishi Power (Japan) 10.15. Kawasaki Heavy Industries (Japan) 10.16. Harbin Electric Corporation (China) 10.17. Dongfang Electric Corporation (China) 10.18. Shanghai Electric Group (China) 10.19. Doosan Enerbility (South Korea) 10.20. Bharat Heavy Electricals Limited – BHEL (India) 10.21. Mubadala Energy (United Arab Emirates) 10.22. Saudi Aramco (Saudi Arabia) 10.23. Sasol (South Africa) 10.24. Siemens Energy Brazil (Brazil) 10.25. Industrias Juan F. Secco (Argentina) 10.26. WEG S.A. (Brazil) 10.27. Colbún S.A. (Chile) 11. Key Findings 12. Industry Recommendations 13. Industrial Gas Turbine Market: Research Methodology