Global Indirect Calorimeter Market size was valued at USD 731.09 Mn in 2024 and the total Indirect Calorimeter revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 1096.72 Mn.Indirect Calorimeter Market Overview:

An indirect calorimeter is medical or scientific device used to measure an individual's energy expenditure (caloric burn rate) and metabolic activity by analysing their respiratory gas specifically oxygen (O₂) consumption and carbon dioxide (CO₂) production. Indirect calorimeter market has been experiencing robust growth fuelled by rising demand for precise metabolic measurement in critical care, sports science and obesity management coupled with increasing awareness of personalized nutrition. North America dominated indirect calorimeter market in 2024, supported by advanced healthcare infrastructure, high R&D investment and widespread adoption in ICUs for monitoring condition like sepsis and respiratory failure. Innovation leaders like COSMED, MGC Diagnostics and KORR Medical Technologies are driving advancement with portable device, AI powered analytics and cloud integrated platform that enhance accuracy and usability. Indirect Calorimeter market thrives across diverse end users with hospitals and research lab forming the core demand while sports institute and fitness centres increasingly adopt these tools for performance optimization. This expansion reflects the critical role of indirect calorimetry in modern healthcare where it bridges clinical diagnostics, preventive medicine and athletic performance all while adapting to trends like telehealth and data driven wellness.To know about the Research Methodology :- Request Free Sample Report

Indirect Calorimeter Market Dynamics:

Rising Incidence of Burn Injuries Across World to Boost Indirect Calorimeter Market Growth Burns is a prevalent medical and surgical concern all around the world. It is likely the most debilitating of all wounds, imposing a significant burden on the victim's physical, mental, and social state. Burn injuries are expected to affect over 11 million people globally each year, with 1 million persons in India. According to a recent study, mortality as high as 40.3% among 2499 burn patients was reported. Burns became one of the leading causes of disability in 2021, accounting for more than 8 million disability-adjusted life-years (DALYS). The high prevalence of burn injuries in key global regional segments has resulted in the need for effective burn treatment and management. Thermal injury causes the greatest metabolic response in severely sick individuals. Several mathematical models have been established to assess the dietary needs of the burnt patient. The sole approach regarded as the gold standard for assessing caloric expenditure is indirect calorimetry. As a result, the rising incidence of burn injuries, increasing the need for the indirect calorimeter and driving the indirect calorimeter market growth during the forecast period. High Cost to Restrain the Indirect Calorimeter Market The indirect calorimeter is a technique for measuring the consumption of oxygen and the production of CO2 in a living human organism in a precise and non-invasive manner. It requires the use of a metabolic cart, which is a sort of cart, used to properly monitor the number of oxygen people breathe and the amount of carbon dioxide they exhale when resting, eating, and performing specific tasks, although ventilator-attached modules are also available. Its most successful application is in patients for whom traditional techniques of determining dietary requirements are insufficient, such as extremely obese individuals and patients suffering from severe injuries or burns. The metabolic cart is expensive. Resting energy expenditure (REE) predictive models are regarded to be incorrect, while traditional indirect calorimetry is costly and rarely accessible for clinical application. As the result, the high cost of the indirect calorimeter is expected to restrain the indirect calorimeter market growth during the forecast period.Indirect Calorimeter Market Segment Analysis:

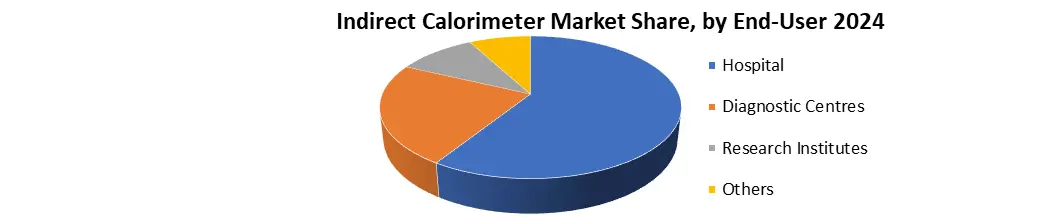

Based on Type, global indirect calorimeter market is sub segmented into the standalone and portable. In 2024, the standalone segment dominated the global indirect calorimeter market, capturing the largest share due to its widespread adoption in hospitals, ICUs, and clinical research settings. These systems offer higher precision, advanced data integration, and superior metabolic assessment capabilities, making them ideal for critical care and long-duration measurements. The MedGem is an indirect calorimeter that monitors resting oxygen consumption (VO2) and calculates REE using a modified Weir equation. Thanks to the devices, it is more cost-effective than gas analyzers or direct calorimetry devices, collect data quickly, and require little training. Although the device has been validated in children, adolescents, and adults, certain studies have raised concerns about its accuracy in children, particularly those who are overweight or obese. These factors may restrict segment growth during the forecast period. Based on End-user, global indirect calorimeter market is sub segmented into hospital, diagnostic centre, research institutes, etc. The hospital segment held the largest share of 48% and dominated the global indirect calorimeter market in 2024. The segment is expected to maintain its dominance at the end of the forecast period. In hospitals, indirect calorimetry monitors the gases in the air that one exhales to calculate how many calories one's body burns at rest. Indirect calorimetry (IC) is the gold standard for evaluating calorie requirements. IC is often utilized in all tertiary care hospital patients, with a focus on those with obesity-related data. The use of IC can be utilized to target nutritional goals since both protein and AC/REE (administered calories to resting energy expenditure ratio) indicate a trend toward improved survival at the expense of a longer duration of stay. Contrary to popular belief, parenteral feeding has a protective effect. Fuji Medical Science, a major leader in this industry with products in calorimetry and artificial environment control rooms, is stepping up R&D collaboration in East Asia to lead the way in the treatment of aging and lifestyle disorders. With the existence of large medical device firms focusing on hospitals as the key end-user, it is expected to gain market share throughout the forecast period.

Indirect Calorimeter Market Regional Insights:

North America dominated the Indirect Calorimeter Market in 2024 and is expected to dominate during the forecast period (2025-2032) North America dominated the global indirect calorimeter market with the largest share in terms of value and volume in 2024. The region is expected to maintain its dominance at the end of the forecast period. The region's increasing obese population is expected to be the key growth driver for the regional industry. In addition, growing healthcare infrastructure, rising investment in the healthcare industry and R&D sector, increasing adoption of technologically advanced equipment, and the presence of key players in the region are the factors also contributing to overall North American indirect calorimeter market growth. Another major growth driver is the presence of a well-established healthcare infrastructure and the growing awareness of the region's amenities for obese people. The United States has the highest market share in North America in 2024. Obesity is becoming increasingly common in the United States. The Centres for Disease Control and Prevention (CDC) estimates that 39.8% of American adults are obese in 2018. Obesity is frequently the underlying cause of many ailments, and people with this history seek treatment at hospitals. As a result, indirect calorimeters are increasingly being used for therapies involving these patients. And driving the regional indirect calorimeter market growth. Asia-Pacific region is expected to grow at a CAGR of 4.5% during the forecast period. The rising geriatric population, rising overweight population, and increasing incidence of burn injuries in the region are expected to be the primary growth drivers for the market. In addition, the rising healthcare industry, increasing government initiatives to boost the healthcare industry, and the growing need for advanced equipment is further expected to drive the indirect calorimeter market growth during the forecast period. An ongoing academic initiative to develop a new indirect calorimeter that aims at providing innovative and affordable technical solutions for many of the current limitations of IC in Asian countries is expected to offer a lucrative opportunity for market growth. Indirect Calorimeter Market Competitive Landscape: KORR Medical Technologies (Canada) operates in a competitive indirect calorimetry market alongside key players such as COSMED, MGC Diagnostics and Maastricht Instruments which dominate with advanced metabolic analyzers and broader product portfolios. While KORR focuses on portable and cost-effective solutions like Fitmate and ReeVue systems, competitors often offer more comprehensive clinical and research-oriented devices with integrated software and a global distribution network. Niche players like Microlife and MedGem also target similar segments with handheld devices, intensifying competition. KORR’s differentiation lies in its emphasis on affordability and ease of use, but it faces challenges in scaling against larger firms with stronger brand recognition and R&D capabilities, particularly in hospital and sports science markets. Regulatory compliance and technological innovation remain critical battlegrounds in this specialized but growing industry. Indirect Calorimeter Market Key Trends: • Portable & Wireless Solutions – Growing demand for handheld and wearable indirect calorimeters (e.g., COSMED K5, KORR ReeVue) driven by sports science, fitness, and remote patient monitoring. These devices offer real-time metabolic data without restrictive tubing, enhancing usability in field settings. • Integration with AI & Digital Health Platforms – Advanced software (e.g., MedGem’s cloud analytics, Maastricht Instruments’ research modules) now incorporates AI-driven metabolic insights, predictive modeling, and EHR compatibility, improving clinical decision-making and personalized nutrition planning. • Expansion into Obesity & Metabolic Health Management – With rising global obesity rates, indirect calorimeters are increasingly used in bariatric clinics, weight loss programs, and metabolic disorder management (e.g., Breezing Pro for personalized diet optimization), supported by insurance reimbursements in some regions. Indirect Calorimeter Market Key Developments: • General Electric (US)- June 2024: GE Healthcare announced enhancements to its CARESCAPE R860 ventilator with integrated metabolic monitoring, improving ICU patient metabolic assessment in critical care. • Maastricht Instruments BV (Netherlands)- September 2024: Launched an upgraded Q-NRG+ system with automized gas calibration and improved cloud-based data analytics for clinical research. • COSMED (Italy)- March 2024: Released the COSMED K5 wearable calorimeter with enhanced Bluetooth 5.0 connectivity for sports and clinical studies. • Shimadzu Corporation (Japan)- January 2025: Introduced a new module for indirect calorimetry in its AIM-9000 metabolic analyzer, targeting obesity and diabetes research. • HOVERLABS (India)- November 2024: Unveiled the HOVERMET portable calorimeter, focusing on low-cost metabolic screening for emerging markets.Indirect Calorimeter Market Scope: Inquire before buying

Indirect Calorimeter Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 731.09 Mn. Forecast Period 2025 to 2032 CAGR: 5.2% Market Size in 2032: USD 1096.72 Mn. Segments Covered: by Type Standalone Portable by End-user Hospital Diagnostic Centres Research Institutes Others by Application Medical Sports & Fitness Others Indirect Calorimeter Market, by region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Indirect Calorimeter Market, Key Players are

North America 1. COSA XENTAUR (US) 2. Microlife (US) 3. Parvo Medics (US) 4. Vyaire Medical (US) 5. Breezing (US) 6. General Electric (US) 7. KORR Medical Technologies (Canada) Europe 8. UNION Instruments GmbH (Germany) 9. TSE Systems (Germany) 10. ABB (Switzerland) 11. Hobré Instruments B.V. (Netherlands) 12. Maastricht Instruments BV (Netherlands) 13. COSMED (Italy) 14. Lumen (Sweden) Asia Pacific 15. Yokogawa Electric Corporation (Japan) 16. Azbil Corporation (Japan) 17. Pacific Medico Co.Ltd. (Japan) 18. MGC Diagnostics (Japan) 19. RIKEN KEIKI Co. Ltd. (Japan) 20. Shimadzu Corporations (Japan) 21. HOVERLABS (India) 22. Summit Healthcare Pvt. Ltd. (India) 23. Cosmed srl (Italy)FAQs:

1. What are the growth drivers for the Indirect Calorimeter market? Ans. The rising frequency of disease in newborn and pediatric children, the increased emphasis of the world's population on health and fitness, as well as modernization in sports training are expected to be the major driver for the Indirect Calorimeter market. 2. What is the major restraint for the Indirect Calorimeter market growth? Ans. The greater acquisition prices, reduced user-friendliness, and increased susceptibility to measurement mistakes are expected to be the major restraining factor for the Indirect Calorimeter market growth. 3. Which region is expected to lead the global Indirect Calorimeter market during the forecast period? Ans. The North American market is expected to lead the global Indirect Calorimeter market during the forecast period due to growing healthcare infrastructure, rising investment in the healthcare industry and R&D sector, increasing adoption of technologically advanced equipment, and the presence of key players in the region. 4. What is the projected market size & growth rate of the Indirect Calorimeter Market? Ans. The indirect Calorimeter Market size was valued at USD 731.09 Mn. in 2024 and the total Indirect Calorimeter revenue is expected to grow at a CAGR of 5.2% from 2025 to 2032, reaching nearly USD 1096.72 Mn. 5. What segments are covered in the Indirect Calorimeter Market report? Ans. The segments covered in the Indirect Calorimeter market report are Type, End-user, and Region.

1. Indirect Calorimeter Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Indirect Calorimeter Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Application Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Indirect Calorimeter Market: Dynamics 3.1. Indirect Calorimeter Market Trends 3.1.1. North America Indirect Calorimeter Market Trends 3.1.2. Europe Indirect Calorimeter Market Trends 3.1.3. Asia Pacific Indirect Calorimeter Market Trends 3.1.4. Middle East and Africa Indirect Calorimeter Market Trends 3.1.5. South America Indirect Calorimeter Market Trends 3.2. Global Indirect Calorimeter Market Dynamics 3.2.1. Global Indirect Calorimeter Market Drivers 3.2.1.1. Rising Incidence of Burn Injuries 3.2.2. Global Indirect Calorimeter Market Restraints 3.2.3. Global Indirect Calorimeter Market Opportunities 3.2.4. Global Indirect Calorimeter Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.4.1. Regulatory Funding 3.4.2. Health Awareness 3.4.3. Tech Innovation 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Indirect Calorimeter Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 4.1. Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 4.1.1. Standalone 4.1.2. Portable 4.2. Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 4.2.1. Hospital 4.2.2. Diagnostic Centres 4.2.3. Research Institutes 4.2.4. Others 4.3. Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 4.3.1. Medical 4.3.2. Sports & Fitness 4.3.3. Others 4.4. Indirect Calorimeter Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Indirect Calorimeter Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 5.1. North America Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 5.1.1. Standalone 5.1.2. Portable 5.2. North America Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 5.2.1. Hospital 5.2.2. Diagnostic Centres 5.2.3. Research Institutes 5.2.4. Others 5.3. North America Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 5.3.1. Medical 5.3.2. Sports & Fitness 5.3.3. Others 5.4. North America Indirect Calorimeter Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Standalone 5.4.1.1.2. Portable 5.4.1.2. United States Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 5.4.1.2.1. Hospital 5.4.1.2.2. Diagnostic Centres 5.4.1.2.3. Research Institutes 5.4.1.2.4. Others 5.4.1.3. United States Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Medical 5.4.1.3.2. Sports & Fitness 5.4.1.3.3. Others 5.4.2. Canada 5.4.2.1. Canada Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Standalone 5.4.2.1.2. Portable 5.4.2.2. Canada Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 5.4.2.2.1. Hospital 5.4.2.2.2. Diagnostic Centres 5.4.2.2.3. Research Institutes 5.4.2.2.4. Others 5.4.2.3. Canada Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Medical 5.4.2.3.2. Sports & Fitness 5.4.2.3.3. Others 5.4.3. Mexico 5.4.3.1. Mexico Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 5.4.3.1.1. Standalone 5.4.3.1.2. Portable 5.4.3.2. Mexico Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 5.4.3.2.1. Hospital 5.4.3.2.2. Diagnostic Centres 5.4.3.2.3. Research Institutes 5.4.3.2.4. Others 5.4.3.3. Mexico Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 5.4.3.3.1. Medical 5.4.3.3.2. Sports & Fitness 5.4.3.3.3. Others 6. Europe Indirect Calorimeter Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 6.1. Europe Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.2. Europe Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.3. Europe Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4. Europe Indirect Calorimeter Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.1.3. United Kingdom Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.2.3. France Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.3.3. Germany Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.4.3. Italy Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.5.3. Spain Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.6.3. Sweden Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Russia Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.7.3. Russia Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 6.4.8.3. Rest of Europe Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Indirect Calorimeter Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 7.1. Asia Pacific Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.3. Asia Pacific Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Indirect Calorimeter Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.1.3. China Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.2.3. S Korea Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.3.3. Japan Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.4.3. India Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.5.3. Australia Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.6.3. Indonesia Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Malaysia Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.7.3. Malaysia Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Philippines Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.8.3. Philippines Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Thailand Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.9.3. Thailand Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Vietnam Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.10.3. Vietnam Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 7.4.11.3. Rest of Asia Pacific Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Indirect Calorimeter Market Size and Forecast (by Value in USD Mn) (2024-2032) 8.1. Middle East and Africa Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 8.3. Middle East and Africa Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Indirect Calorimeter Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 8.4.1.3. South Africa Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 8.4.2.3. GCC Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Egypt Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 8.4.3.3. Egypt Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Nigeria Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 8.4.4.3. Nigeria Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 8.4.5.2. Rest of ME&A Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 8.4.5.3. Rest of ME&A Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 9. South America Indirect Calorimeter Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 9.1. South America Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 9.2. South America Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 9.3. South America Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 9.4. South America Indirect Calorimeter Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 9.4.1.3. Brazil Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 9.4.2.3. Argentina Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Colombia Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 9.4.3.3. Colombia Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 9.4.4.2. Chile Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 9.4.4.3. Chile Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Indirect Calorimeter Market Size and Forecast, By Type (2024-2032) 9.4.5.2. Rest Of South America Indirect Calorimeter Market Size and Forecast, By End-User (2024-2032) 9.4.5.3. Rest Of South America Indirect Calorimeter Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. COSA XENTAUR 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Microlife 10.3. Parvo Medics 10.4. Vyaire Medical 10.5. Breezing 10.6. General Electric 10.7. KORR Medical Technologies 10.8. UNION Instruments GmbH 10.9. TSE Systems 10.10. ABB 10.11. Hobré Instruments B.V. 10.12. Maastricht Instruments BV 10.13. COSMED 10.14. Lumen 10.15. Yokogawa Electric Corporation 10.16. Azbil Corporation 10.17. Pacific Medico Co.Ltd. 10.18. MGC Diagnostics 10.19. RIKEN KEIKI Co. Ltd. 10.20. Shimadzu Corporations 10.21. HOVERLABS 10.22. Summit Healthcare Pvt. Ltd. 10.23. Cosmed srl 11. Key Findings 12. Industry Recommendations 13. Indirect Calorimeter Market: Research Methodology