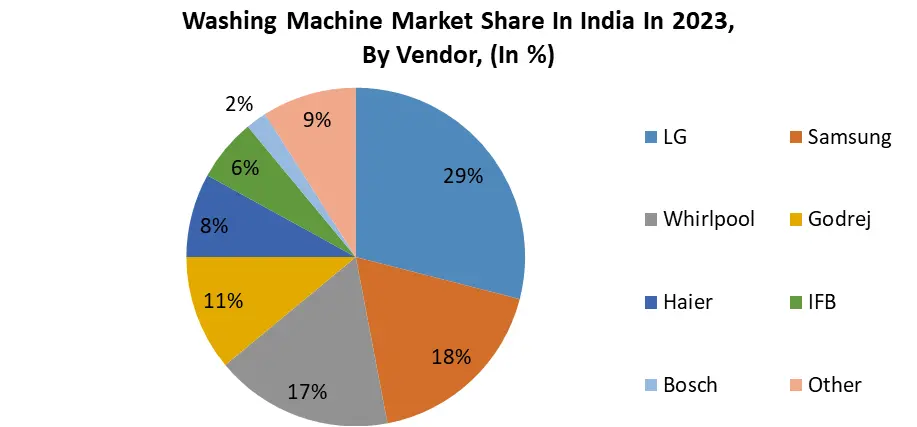

India Washing Machine Market size was valued at USD 2.288 billion in 2023 and the total India Washing Machine Market revenue is expected to grow at a CAGR of 4.46 % from 2024 to 2030, reaching nearly USD 3.105 billion. Washing machines in India are household appliances used for cleaning and washing clothes. They come in various types such as semi-automatic, fully automatic, top load, and front load, catering to diverse consumer needs. With increasing urbanization, rising disposable incomes, and evolving consumer lifestyles, washing machines have become an integral part of Indian households, easing the burden of manual laundry chores. The India washing machine market has experienced robust growth, driven by factors like urbanization, rising middle-class income, and the demand for convenience in household chores. The India Washing Machine Market has witnessed a shift from semi-automatic to fully automatic machines due to technological advancements and consumer preferences for more efficient and convenient appliances. The India Washing Machine Market size was valued at billions of dollars in recent years and is expected to further expand due to increasing consumer awareness, adoption of smart technologies, and government initiatives promoting domestic manufacturing and digitization.To know about the Research Methodology :- Request Free Sample Report The current scenario of the India washing machine market is characterized by intense competition among leading players, technological advancements, and increasing consumer demand for energy-efficient and water-saving appliances. The driving factors include rapid urbanization, changing consumer lifestyles, improving infrastructure, and the penetration of e-commerce platforms, offering consumers easy access to a wide range of products. Growth opportunities lie in product innovation, growing distribution networks, tapping into rural markets, and catering to the growing demand for environmentally friendly and IoT-enabled washing machines. Trends in the India washing machine market include the shift toward energy-efficient models, increasing demand for front-load machines, smart and connected appliances, and a focus on sustainability. Key players in the India Washing Machine Market, such as Samsung, LG, Whirlpool, IFB, and Haier, have introduced innovative features, expanded their product portfolios, and invested in R&D to meet evolving consumer preferences. Recent developments include the launch of AI-powered and IoT-enabled washing machines, strategic partnerships, and investments in manufacturing capacities to cater to the growing demand in India.

Market Dynamics:

E-commerce Surge and Product Diversification Fuelling Washing Machine Market Growth: Increasing disposable income and improved living standards propel the demand for residential fully automatic washing machines in India. As disposable incomes grow, people are willing to invest in more advanced and efficient appliances, stimulating India Washing Machine Market growth. Evolving technologies and innovations in washing machines, such as IoT integration, energy efficiency, and smart functionalities, drive India Washing Machine Market growth. Consumers seek more convenient, efficient, and feature-rich appliances, fostering demand for technologically advanced washing machines. The shift in lifestyle patterns increased working hours, and a rise in the number of nuclear families, particularly working women, amplifies the need for time-saving and efficient home appliances, boosting the India Washing Machine Market. Rapid urbanization and the construction of new residential units and apartments, especially in urban areas, foster the demand for washing machines. As more households emerge, the need for washing machines as essential household appliances grows. The entry of various international and domestic brands with a diverse range of products at different price points intensifies competition. This variety allows consumers to choose from a wide array of options, driving India Washing Machine Market growth. Government initiatives supporting electrification in rural areas and offering subsidies for home appliances enhance accessibility and affordability. This stimulates India Washing Machine Market penetration in rural regions, driving overall market growth. Increasing environmental consciousness encourages the adoption of energy-efficient washing machines. Consumers prioritize eco-friendly appliances, pushing manufacturers to develop more sustainable and energy-efficient models. Easy access to consumer financing and EMI options offered by manufacturers and financial institutions facilitates affordability and encourages consumers to invest in high-end washing machines, contributing to market growth. Manufacturers focus on product innovation, customization, and diversification of features to align with evolving consumer preferences, driving market demand. Customized offerings tailored to specific consumer needs attract more buyers. Increasing internet penetration and the growing popularity of online shopping platforms provide consumers with easy access to a wide range of washing machines. E-commerce channels offer convenience, competitive pricing, and product diversity, contributing significantly to market growth. These factors collectively fuel the growth trajectory of the India Washing Machine Market, reflecting evolving consumer preferences, technological advancements, and broader market dynamics.Maintaining Unwavering Quality Amidst Price Sensitivity in the Market: The market experiences intense rivalry among brands, compelling companies to invest significantly in marketing and innovation to maintain market share. For instance, established brands continuously vie for customer attention, necessitating extensive promotional campaigns and advanced product features. Keeping up with rapid technological changes requires constant investments in research and development. Manufacturers must regularly upgrade their products to incorporate innovative features, such as IoT integration or energy-efficient models, to meet evolving consumer preferences and stay competitive. Ensuring consistent quality while managing diverse product ranges poses a challenge. Brands must maintain stringent quality standards across varied product lines, preventing compromises that could impact customer trust and brand reputation. Indian consumers are sensitive to prices, demanding value for money. Brands must balance pricing strategies to offer competitive prices while providing enhanced features to attract customers amidst price-consciousness. Meeting diverse consumer demands for various washing machine types, capacities, and functionalities necessitates a varied product portfolio. For example, different consumer segments prefer top-loading or front-loading machines, making product diversification a challenge. Adherence to stringent regulatory standards for safety, energy efficiency, and environmental norms adds complexity to production processes. Compliance with these regulations requires continuous adjustments to manufacturing practices and the materials used. Escalating operational expenses, including labor, utilities, and marketing, impact profit margins. Brands must optimize operations and explore cost-effective strategies to maintain profitability. Changing retail landscapes, including the growth of online platforms, challenge traditional brick-and-mortar stores. Manufacturers need to adapt distribution strategies to cater to shifting consumer preferences for online purchases. Increasing awareness and consumer preferences for eco-friendly products compel manufacturers to invest in sustainable practices and materials. The industry must innovate to develop environmentally responsible washing machines, balancing ecological considerations with performance and cost-effectiveness. These challenges collectively impact the India Washing Machine Market, influencing strategic decisions and operational functions across the industry. Technological Advancements Shape Consumer Preferences for Smart Washing Solutions: Growth in disposable incomes and increased affordability foster India Washing Machine Market growth. For instance, the growing middle-class population's rising income levels have increased the propensity to invest in durable goods like washing machines, propelling India Washing Machine Market growth. Opportunities arise through technological innovations. Integrating features like IoT connectivity or smart functionalities attracts consumers seeking convenience. For example, the demand for IoT-enabled washing machines has surged due to their remote control capabilities, enhancing user experience and convenience. Rapid urbanization leads to increased demand for washing machines in urban areas due to the rise of nuclear families and working individuals. As lifestyles become more fast-paced, the need for time-saving home appliances like washing machines amplifies. The growth of e-commerce platforms provides an avenue for increasing India Washing Machine Market reach and accessibility. Online sales channels offer convenience and a wide product range, enticing consumers. This shift in purchasing preferences has fueled the market's growth by offering a hassle-free shopping experience. It is projected that by the end of 2030 the market will have 590 Mn consumers in the city areas. The per capita spending by the time has been considered at INR 50,000, which creates India a marvelous & lucrative market for washing machine firms. A report study by the MMR forecasts that the number of middle-class people who receive between INR 2 & 10 lakh will go up to 128 Mn by the end of 2025. At that time, it is projected to account for 41 % of the population. The increasing awareness of environmental sustainability drives the demand for eco-friendly washing machines. Manufacturers are focusing on energy-efficient and eco-friendly models to cater to the environmentally conscious consumer base, presenting a significant growth opportunity in the India Washing Machine Market. Government schemes promoting electrification in rural areas and subsidies for home appliances stimulate India Washing Machine Market penetration in these regions. Such initiatives enhance accessibility and affordability, driving India Washing Machine Market growth into rural markets. Meeting diverse consumer demands by offering a varied product portfolio and customized solutions creates growth prospects. Manufacturers catering to various preferences, like different machine types (top-loading, front-loading), attract a wider consumer base. Ensuring consistent product quality and adhering to stringent quality standards builds brand trust and reputation, leading to increased India Washing Machine Market share. Brands maintaining high-quality standards attract and retain customers, contributing to India Washing Machine Market growth. Embracing modern manufacturing techniques and efficient production processes optimizes costs, enhancing profitability. The adoption of lean manufacturing principles and advanced technologies improves operational efficiency, offering growth potential. Educating consumers about the benefits of technologically advanced washing machines and their long-term cost-saving advantages can drive demand. For instance, informing consumers about the energy efficiency of certain models can influence their purchase decisions, contributing to India Washing Machine Market growth.

India Washing Machine Market Segment Analysis:

Based on Technology, The Indian Washing Machine Market, segmented by technology into Fully Automatic and Semi-Automatic machines, shows a prominent dominance of the Fully Automatic segment. The Fully Automatic segment commands a substantial market share, exceeding that of Semi-Automatic machines. This dominance is attributed to the convenience, efficiency, and increasing preference for automated solutions among consumers. While the Fully Automatic segment currently dominates, the Semi-Automatic segment still holds significance due to factors like cost-effectiveness and suitability for certain consumer preferences. Despite the ongoing dominance of Fully Automatic machines, the Semi-Automatic segment is expected to maintain its market presence, particularly among price-conscious consumers or in areas with unreliable water and power supplies. Both segments cater to diverse consumer needs, with Fully Automatic machines preferred for their advanced features, and Semi-Automatic machines favored for their affordability and adaptability to specific user requirements.India Washing Machine Market Regional Insights:

The India Washing Machine market shows regional variations, with certain areas standing out as key contributors. South India emerges as a dominant region in this sector, with Karnataka spearheading advancements. The Indian Washing Machine Market exhibits varying regional dominance influenced by factors like urbanization, demographics, and economic conditions. Metros and Tier-I cities, including Mumbai, Delhi, Bengaluru, and Chennai, have historically held a dominant position due to higher disposable incomes, urban lifestyle preferences, and awareness of advanced technology. These regions have shown greater demand for technologically advanced and fully automatic washing machines, driving market growth. With rapid urbanization and increasing purchasing power in Tier-II and Tier-III cities like Pune, Jaipur, and Lucknow, there has been a notable surge in demand for washing machines, particularly semi-automatic ones, owing to their affordability and adaptability to varying water and power supplies. Rural areas are gradually becoming key growth regions due to rising aspirations and improving living standards, leading to an increasing preference for semi-automatic machines that align with affordability and practicality. Overall, while metropolitan regions have historically dominated the market due to higher purchasing capacity, Tier-II, and Tier-III cities, and rural areas are expected to witness accelerated growth due to increasing consumer awareness, availability of financing options, and improving infrastructure. Competitive Landscape Recent launches and innovations by leading brands like Haier and Whirlpool in the washing machine sector signify a transformative shift towards technologically advanced, user-centric appliances. These advancements, such as Haier's AI-enabled front and top load washing machines with a focus on hygiene and Haier's introduction of the Super Drum series offering larger capacity and enhanced fabric care, cater to evolving consumer needs. Electrolux's UltimateCare series emphasizes features like UltraMix and HygienicCare for efficient yet gentle laundry experiences. Whirlpool's emphasis on in-built heater technology and energy-efficient models aligns with increasing consumer demands for hygiene, energy conservation, and advanced functionalities. These introductions anticipate and cater to consumers' changing preferences for convenience, hygiene, and eco-friendliness, thus potentially propelling market growth by attracting a wider consumer base seeking innovative, user-friendly, and sustainable washing solutions. On May 18, 2022, Haier India introduced the new 'Made In India, Made For India' Next Gen Front and Top Load Fully Automatic IoT Enabled Washing Machines Series. The Haier 959 Front Load Washing Machines come with an advanced super silent Direct Motion Motor and a 525 mm super drum. Additionally, the Haier Top Load Washing Machines feature built-in Heater Technology capable of eliminating 106 toughest stains and 99.9% of germs, meeting modern hygiene requirements. On September 29, 2022, Electrolux unveiled its UltimateCare range of washing machines and dryers in India. The UltimateCare 300 and UltimateCare 500 series are fully automatic front-load washing machines and dryers equipped with innovative features like UltraMix, HygienicCare, Woolmark Blue Certification, Reverse Tumbling, Smart Sensors, and ColourCare. These features ensure an effortless laundry experience and gentle care for clothes throughout wash-to-dry cycles. On March 19, 2021, Haier India introduced the Super Drum Series, the industry's largest drum in Front Load Fully Automatic Washing Machines. These smart washing machines are available in 6 variants, promising deeper cleaning and extra care for fabrics. Features like Anti-Bacterial Technology and PuriSteam aim to ensure health and hygiene. On February 1, 2020, Whirlpool of India, recognized under 'Superbrands 2019-20', showcased its complete range of world-class refrigerators and washing machines. The company stood out in consumer and industry surveys conducted by the Superbrands Council, validating its position as a leading home appliance brand. On July 21, 2020, Whirlpool of India presented a wide range of fully automatic top-load washing machines equipped with advanced in-built heater technology. These machines feature the NABL Certified Antibacterial Cycle, removing up to 99.9% of harmful bacteria and allergens at 60 degrees Celsius, meeting high standards of health and hygiene. On November 1, 2019, Whirlpool of India offers an exhaustive range of energy-efficient washing machines with 5-star energy ratings. Focusing on environmental challenges, the company aims to provide advanced and eco-friendly technology to save energy and water consumption, aligning with government-approved measures for energy-efficient appliances.

India Washing Machine Market Scope: Inquire before buying

India Washing Machine Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 2.288 Bn. Forecast Period 2024 to 2030 CAGR: 4.46% Market Size in 2030: USD 3.105 Bn. Segments Covered: by Type Front Load Top Load by Technology Fully Automatic Semi-Automatic by Distribution Channel Supermarkets and Hypermarkets Specialty Stores Online Other Distribution Channels India Washing Machine Market, by Region

North India South India East India West IndiaIndia Washing Machine Market Key Players:

1. Whirlpool Corporation 2. Bosch 3. Haier Group Corporation 4. IFB Industries Limited 5. Stefab India Limited 6. Electrolux 7. Alliance Laundry Systems 8. Ramsons Garment Finishing Equipments Pvt Ltd 9. Fabcare (India) Private Limited 10. SRE Machineries Private Limited 11. Toshiba 12. TCL 13. Voltas Beko 14. Onida 15. BPL 16. LG 17. Samsung 18. Godrej 19. Lloyd 20. Croma 21. Panasonic 22. Thomson. FAQs: 1. What are the growth drivers for the India Washing Machine Market? Ans. E-commerce Surge and Product Diversification Fuelling Washing Machine Market Growth and is expected to be the major driver for the India Washing Machine Market. 2. What is the major opportunity for the India Washing Machine Market growth? Ans. Technological Advancements Shape Consumer Preferences for Smart Washing Solutions. 3. Which country is expected to lead the India Washing Machine Market during the forecast period? Ans. The South India is expected to lead the India Washing Machine Market during the forecast period. 4. What is the projected market size and growth rate of the India Washing Machine Market? Ans. India Washing Machine Market size was valued at USD 2.288 billion in 2023 and the total India Washing Machine Market revenue is expected to grow at a CAGR of 4.46 % from 2024 to 2030, reaching nearly USD 3.105 billion. 5. What segments are covered in the India Washing Machine Market report? Ans. The segments covered in the India Washing Machine Market report are by Type, Technology, Distribution Channel, and Region.

1. India Washing Machine Market: Research Methodology 2. India Washing Machine Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. India Washing Machine Market: Dynamics 3.1 India Washing Machine Market Trends 3.2 India Washing Machine Market Dynamics by Region 3.2.1 Drivers 3.2.2 Restraints 3.2.3 Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape 3.7 Analysis of Government Schemes and Initiatives For the India Washing Machine Industry 3.8 The Pandemic and Redefining of The India Washing Machine Industry Landscape 3.9 Technological Road Map 4. India Washing Machine Market: Market Size and Forecast by Segmentation (Value) (2023-2030) 4.1 India Washing Machine Market Size and Forecast, By Type (2023-2030) 4.1.1 Front Load 4.1.2 Top Load 4.2 India Washing Machine Market Size and Forecast, By Technology (2023-2030) 4.2.1 Fully Automatic 4.2.2 Semi-Automatic 4.3 India Washing Machine Market Size and Forecast, By Application (2023-2030) 4.3.1 Supermarkets and Hypermarkets 4.3.2 Specialty Stores 4.3.3 Online 4.3.4 Other Distribution Channels 4.4 India Washing Machine Market Size and Forecast, by Region (2023-2030) 4.4.1 North India 4.4.2 South India 4.4.3 West India 4.4.4 East India 5. India Washing Machine Market: Competitive Landscape 5.1 MMR Competition Matrix 5.2 Competitive Landscape 5.3 Key Players Benchmarking 5.3.1 Company Name 5.3.2 Product Segment 5.3.3 End-user Segment 5.3.4 Revenue (2023) 5.3.5 Manufacturing Locations 5.3.6 SKU Details 5.3.7 Production Capacity 5.3.8 Production for 2023 5.4 Market Analysis by Organized Players vs. Unorganized Players 5.4.1 Organized Players 5.4.2 Unorganized Players 5.5 Leading India Washing Machine Companies, by market capitalization 5.6 Market Structure 5.6.1 Market Leaders 5.6.2 Market Followers 5.6.3 Emerging Players 5.7 Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1 Whirlpool Corporation. 6.1.1 Company Overview 6.1.2 Business Portfolio 6.1.3 Financial Overview 6.1.4 SWOT Analysis 6.1.5 Strategic Analysis 6.1.6 Scale of Operation (small, medium, and large) 6.1.7 Details on Partnership 6.1.8 Regulatory Accreditations and Certifications Received by Them 6.1.9 Awards Received by the Firm 6.1.10 Recent Developments 6.2 Whirlpool Corporation 6.3 Bosch 6.4 Haier Group Corporation 6.5 IFB Industries Limited 6.6 Stefab India Limited 6.7 Electrolux 6.8 Alliance Laundry Systems 6.9 Ramsons Garment Finishing Equipments Pvt Ltd 6.10 Fabcare (India) Private Limited 6.11 SRE Machineries Private Limited 6.12 Toshiba 6.13 TCL 6.14 Voltas Beko 6.15 Onida 6.16 BPL 6.17 LG 6.18 Samsung 6.19 Godrej 6.20 Lloyd 6.21 Croma 6.22 Panasonic 6.23 Thomson. 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary