The India Sports Apparel Market was valued at USD 680.2 Million in 2024 and is projected to reach USD 2154.23 Million by 2032, growing at a robust CAGR of 15.5 %.India Sports Apparel Market Overview

The India Sports Apparel Market is witnessing rapid expansion driven by rising fitness participation, lifestyle shifts toward athleisure, and strong adoption of performance wear across Tier 1 and Tier 2 cities. In 2024, over 110 Million Indians actively participated in fitness, gym workouts, running, and sports activities, boosting demand for sportswear, activewear, and athleisure clothing. The surge in sports events such as the IPL, ISL, and marathons further accelerated branded merchandise sales. The athleisure remains the fastest-growing category, driven by urban millennials and Gen Z consumers who prefer versatile, everyday performance wear. E-commerce platforms such as Myntra, Amazon, Ajio, and Decathlon reported over 35% YOY growth in online sports apparel demand in 2024, boosted by digital shopping, influencer marketing, and brand collaborations. Despite strong growth, India’s per capita sportswear spending remains low, nearly 6–8 times lower than the US and China. This gap presents a vast opportunity for affordable performance wear, sustainable sports apparel, smart clothing, and brand-driven innovation to scale nationwide. With increasing health awareness, government initiatives such as Fit India and expanding retail networks, the India Sports Apparel Market is set to experience long-term high growth across fitness, sports, and lifestyle segments.To know about the Research Methodology :- Request Free Sample Report

India Sports Apparel Market: Dynamics

Rising Fitness Culture and Sporting Events boosts India’s Sportswear Market The India sports apparel market is experiencing strong growth driven by the rapid rise of fitness awareness, cultural transformation, and the increasing popularity of nationwide sports and fitness events. Post-pandemic, Indians are prioritizing healthier lifestyles, adopting activities such as yoga, running, gym workouts, and outdoor sports, which has significantly increased the demand for activewear, athleisure, and performance sportswear. Technology-led fitness platforms such as FITPASS, wearable devices, and AI-enabled fitness apps have made fitness more accessible, further boosting demand for high-quality sports clothing. The surge of marathons, cycling races, fitness competitions, and national sports tournaments in cities like Mumbai, Delhi, and Bangalore is another key growth catalyst. These events encourage participation from diverse age groups, creating demand for specialized sportswear, including moisture-wicking fabrics, compression wear, and lightweight apparel designed for performance and comfort. The growing involvement of women and children in sports, along with the influence of social media and celebrity-backed athleisure brands, continues to reshape consumer preferences. This fitness revolution is transforming sports apparel into both a fashion statement and a lifestyle essential. As India hosts more sporting events and embraces active living, the sportswear market in India is set to expand rapidly, offering brands significant opportunities for innovation and market penetration.High Price Sensitivity and Dominance of Unorganized Retail Slowing Growth in the India Sports Apparel Market The India sports apparel market faces a major restraint due to strong price sensitivity among consumers and the continued dominance of unorganized and counterfeit retail channels. While demand for branded sportswear, activewear, and athleisure is rising, a large portion of buyers especially in tier-II and tier-III cities still prefers low-cost alternatives. This limits the market penetration of premium brands such as Nike, Adidas, and Puma, whose high pricing often restricts adoption. The growing influx of counterfeit sports apparel across local markets and online resellers. Fake branded jerseys, low-quality gym wear, and imitation athleisure outfits are widely available at a fraction of the cost, diluting brand value and reducing sales for authentic companies. The Federation of Indian Chambers of Commerce and Industry (FICCI) has repeatedly highlighted the rapid growth of counterfeit sports goods as a major challenge across India. Also, inconsistent quality standards in unorganized retail, lack of awareness regarding performance fabrics, and limited access to premium sportswear in rural regions continue to restrain overall growth. These factors collectively hinder the expansion of the Indian sportswear market, slowing the shift toward high-quality, branded sports apparel. Increasing Penetration of Smartphones and Internet Connectivity to create Lucrative Growth opportunities to the India Sports Apparel Market A new wave of digital transformation is unlocking significant opportunities in the India sports apparel market, fueled by the rapid rise of e-commerce, growing internet access, and evolving consumer lifestyles. The expanding online ecosystem is reshaping how Indians purchase sportswear, activewear, and athleisure clothing, creating a high-growth environment for both global and domestic brands. The multiyear collaboration between the NBA and Bhaane further illustrates this momentum, showcasing how strong online retail networks can deliver a wider range of authentic merchandise to Indian consumers. India’s online fashion segment recorded a more than 20.9% surge in order volume in FY24, reflecting increasing comfort with online shopping and the preference for convenience-driven purchases. This shift allows sports apparel brands to introduce performance apparel, trendy athleisure, and sustainable sports clothing to a broader audience. With smartphone penetration rising, digital accessibility is expanding rapidly, enabling brands to connect with young consumers, fitness-focused buyers, and regional markets. Growing awareness of sustainable and ethically produced sports apparel also presents a strong differentiation opportunity. E-commerce platforms provide brands with valuable consumer insights, supporting personalized marketing, targeted advertising, and influencer collaborations. By capitalizing on India’s booming digital landscape, sports apparel brands can strengthen visibility, deepen engagement, and meet the rising demand in the dynamic Indian sportswear market. Major E-Commerce Platforms and Their Role in India’s Sports Apparel Industry

E-Commerce Platform Description Features Amazon Amazon is the world's largest marketplace offering a diverse range of products. In India, it holds a significant market share of 31.2% (2020) and provides a vast platform for selling sports apparel along with other goods. 1. Extensive reach to Millions of customers and businesses. 2. Easy registration and product listing process. 3. Efficient inventory management system. Flipkart Flipkart is India's largest e-commerce platform with a market share of 31.9% (2020). It offers a wide selection of over 150 Million products, including sports apparel, accessible through both web and app platforms. 1. Opportunity for sellers to utilize PPC advertising for product promotion. 2. Supports B2B and B2C e-commerce models. Meesho Meesho, an Indian social commerce platform, facilitates the reselling of sports apparel through social networks. It operates under both B2C and B2B e-commerce models, offering a mobile application for seamless transactions. 1. Integration with social networks for product reselling. 2. Mobile app accessibility for ease of use. India Sports Apparel Market Segment Analysis

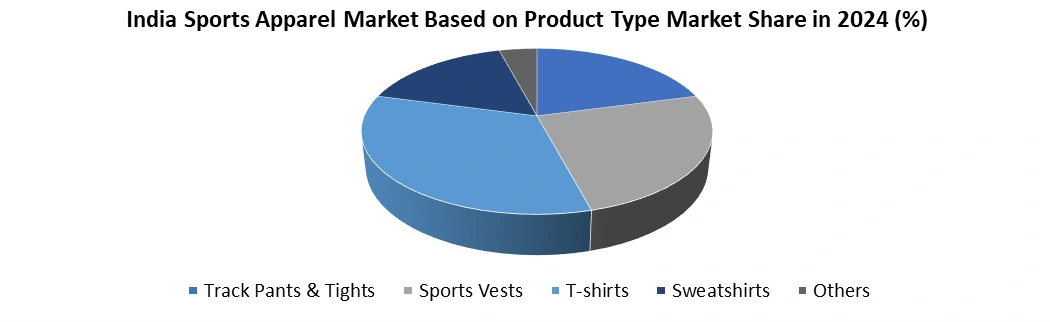

Based On product Type, the India Sports Apparel Market is segmented into Track Pants & Tights, Sports Vests, T-shirts, Sweatshirts, and Others. The T shirt segment dominated the product type segment in year 2024. Due to its widespread acceptance, affordability, and versatility across sports and everyday activities. T-shirts are the most preferred choice among consumers because they cater to multiple needs from gym workouts and running to casual athleisure fashion. The rise of fitness culture, combined with India’s climatic conditions, makes lightweight, breathable, and moisture-wicking sports T-shirts the most practical option for both men and women. The strong influence of social media, celebrity endorsements, and the growing trend of athleisure further boost demand for stylish performance T-shirts. Leading brands such as Nike, Adidas, Puma, HRX, and Decathlon frequently introduce new collections featuring advanced fabrics and trendy designs, strengthening this category’s dominance. Moreover, T-shirts are widely accessible across e-commerce platforms such as Amazon, Flipkart, and Myntra, especially in tier-II and tier-III cities, where demand for affordable activewear is rising. Their blend of comfort, performance, and fashion ensures that T-shirts continue to lead the Indian sportswear market, outperforming segments like track pants, tights, vests, and sweatshirts.

India Sports Apparel Market Regional Analysis

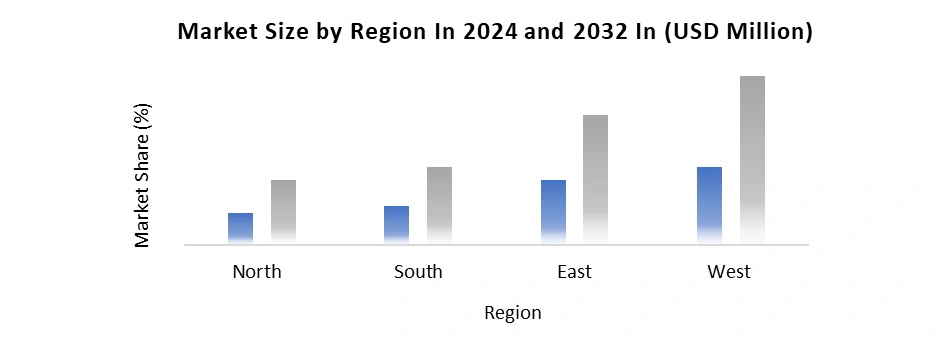

The India Sports Apparel Market reflects strong regional diversity shaped by fitness adoption, income levels, and rising digital penetration. Metro cities such as Delhi NCR, Mumbai, Bengaluru, Hyderabad, and Chennai dominate the Indian sportswear market due to high demand for premium activewear, performance sportswear, and trending athleisure wear India collections. These cities lead in gym memberships, fitness studios, and marathon participation, driving strong uptake of branded sports clothing. Tier-II and tier-III cities including Indore, Jaipur, Lucknow, and Coimbatore are rapidly emerging as growth centers, supported by expanding e-commerce sportswear India, smartphone usage, and digital fitness culture. North and West India maintain high demand for cricket, running, and training apparel, whereas South India is evolving into a hotspot for tech-enabled fitness and smart sportswear. Innovations like sustainable fabrics, moisture-wicking materials, and AI-driven size recommendations are shaping buying patterns across regions. Collaborations such as NBA × Bhaane and the rise of D2C sportswear brands are improving accessibility. While rural areas face price sensitivity, growing logistics networks and online availability continue to expand the India Sports Apparel Market’s regional reach.

India Sports Apparel Market Competitive Landscape:

The India sports apparel market in 2024 experienced intense competition as global and domestic brands adopted diverse strategies to strengthen their positions. Nike India maintained its leadership by focusing on premium performance sportswear and high-impact collaborations, including partnerships with major sports events such as the IPL, which helped deliver a 15% rise in sales. Adidas India gained momentum by expanding its sustainable sports apparel line, attracting eco-conscious buyers and achieving a 20% sales increase, reflecting rising demand for ethical fashion in the Indian sportswear market. Puma India strengthened its presence in the growing athleisure wear India segment by offering affordable, stylish, and performance-focused collections, resulting in 12% growth across urban markets. Decathlon India, with its extensive retail network and value-driven range, recorded a strong 25% growth, driven by both offline expansion and rising online purchases in the e-commerce sportswear India segment. Local brands like HRX, Cultsport, and Alcis intensified competition by offering trend-led, budget-friendly activewear tailored to Indian consumers. This competitive environment is pushing brands toward innovations such as smart fabrics, AI-driven customization, sustainability-focused collections, and stronger digital marketing strategies, shaping the evolving sports apparel market in India.India Sports Apparel Market Recent Development:

In January 2024, Japanese sports brand Asics is expanding its presence in India, focusing on Tier II and III cities owing to the rising demand for athleisure and stylish activewear. These regions currently account for 60% of Asics' e-commerce sales, while offline stores still contribute around 60% of the brand's total revenue. Asics recently opened its 111th store at DLF Promenade in New Delhi, with plans to increase the number to 120 by the end of the year and reach 200 by 2026. In 2024, the brand expects a 25-30% growth and aims to boost local production from 30% to 35-40% by 2024. In January 30Th, 2023, Adidas India entered a major retail franchise agreement with the CK Jaipuria Group to establish Adidas stores across India, focusing on tier-2 and tier-3 markets. The group aims to set up 100 Adidas footwear stores by the end of 2024, marking Adidas' largest franchise partnership in the country. This move reflects the increasing demand for sporting apparel and athleisure, which has surged post-COVID-19. The partnership also supports Adidas' strategy to increase its offline retail presence, with the launch of its first concept store of the year.India Sports Apparel Market Scope: Inquire before buying

India Sports Apparel Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 680.2 Million Forecast Period 2025 to 2032 CAGR: 15.5% Market Size in 2032: USD 2154.23 Million Segments Covered: by Product Type Track Pants & Tights Sports Vests T-shirts Sweatshirts Others by End Users Women Men Kids by Distribution Channel Online Offline India Sports Apparel Market, Key Players

1. Adidas India Marketing Private Limited 2. Alcis Sports 3. ASICS India Private Limited 4. Decathlon Sports India Pvt Ltd 5. Fila India 6. HRX 7. NG Apparel India 8. Nike India Private Limited 9. Nivia Sports (Freewill Sports Pvt Ltd) 10. Puma Sports India Private Limited 11. Sareen Sports Industries 12. Shiv Naresh Sports Pvt Ltd 13. Skechers India 14. Tyka Sports 15. Under Armour Inc.Frequently Asked Questions:

1] What segments are covered in the market report? Ans. The segments covered in the market report are based on Product Type, End-Users, and Distribution Channel. 2] What is the market size of the India Sports Apparel Market by 2032? Ans. The market size of the India Sports Apparel Market by 2032 is expected to reach USD 2154.23 Mn. 3] What is the forecast period for the India Sports Apparel Market? Ans. The forecast period for the India Sports Apparel Market is 2025-2032. 4] What was the India Sports Apparel Market Size in 2024? Ans. The India Sports Apparel Market Size was USD 2154.23 Mn in 2024.

1. India Sports Apparel Market: Research Methodology 2. India Sports Apparel Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global India Sports Apparel Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Type Segment 3.3.3. End User Segment 3.3.4. Revenue (2024) 3.3.5. Headquarter 3.4. Mergers and Acquisitions Details 4. Pricing Analysis 4.1. Global Price Trends 4.2. Price Segmentation 4.3. Cost Structure Analysis 4.4. Factors Influencing Pricing 4.5. Forecast of Price Dynamics 5. India Sports Apparel Market: Dynamics 5.1. India Sports Apparel Market Trends by Region 5.2. India Sports Apparel Market Dynamics 5.2.1.1. Drivers 5.2.1.2. Restraints 5.2.1.3. Opportunities 5.2.1.4. Challenges 5.3. PORTER’s Five Forces Analysis 5.4. PESTLE Analysis 5.5. Value Chain Analysis 5.6. Analysis of Government Schemes and Initiatives for India Sports Apparel Market 6. India Sports Apparel Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’ Units) (2024-2032) 6.1. India Sports Apparel Market Size and Forecast, By Product Type (2024-2032) 6.1.1. Track Pants & Tights 6.1.2. Sports Vests 6.1.3. T-shirts 6.1.4. Sweatshirts 6.1.5. Others 6.2. India Sports Apparel Market Size and Forecast, By End Users (2024-2032) 6.2.1. Women 6.2.2. Men 6.2.3. Kids 6.3. India Sports Apparel Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.1. Online 6.3.2. Offline 6.4. India Sports Apparel Market Size and Forecast, By Region (2024-2032) 6.4.1. North 6.4.2. South 6.4.3. East 6.4.4. West 7. Company Profile: Key Players 7.1. Adidas India Marketing Private Limited 7.1.1. Company Overview 7.1.2. Business Portfolio 7.1.3. Financial Overview 7.1.4. SWOT Analysis 7.1.5. Strategic Analysis 7.1.6. Recent Developments 7.2. ASICS India Private Limited 7.3. Alcis Sports 7.4. Decathlon Sports India Pvt Ltd 7.5. Fila India 7.6. HRX 7.7. NG Apparel India 7.8. Nike India Private Limited 7.9. Nivia Sports (Freewill Sports Pvt Ltd) 7.10. Puma Sports India Private Limited 7.11. Sareen Sports Industries 7.12. Shiv Naresh Sports Pvt Ltd 7.13. Skechers India 7.14. Tyka Sports 7.15. Under Armour Inc. 8. Key Findings 9. Analyst Recommendations