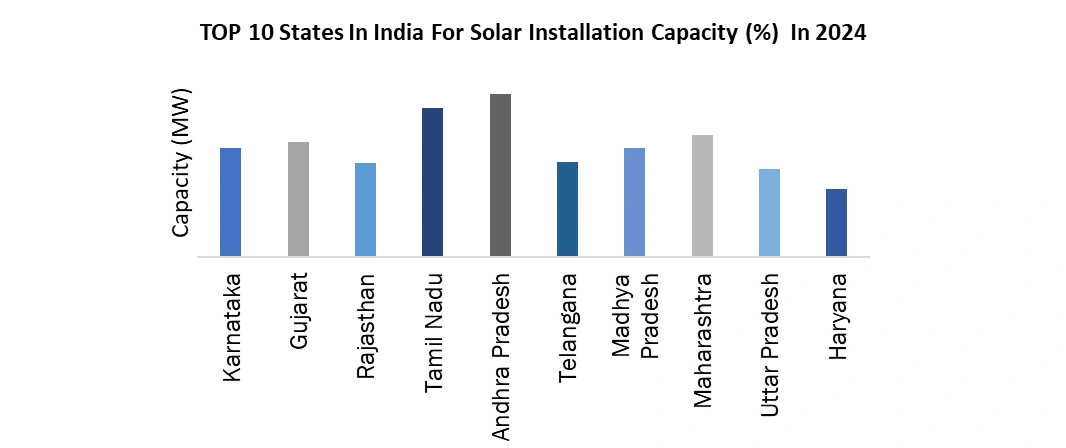

India Solar Rooftop Market size was valued at USD 6.20 Billion in 2024 and the India Solar Rooftop Market revenue is expected to reach USD 19.77 Billion by 2032, at a CAGR of 15.19 % over the forecast period in 2025-2032 India's rooftop solar market is witnessing impressive growth, driven by strong policy support, falling costs, and increasing demand for clean energy. As of 2024, the country has installed approximately 13.7 GW of rooftop solar capacity, with the residential segment leading the charge. In fact, in the first half of 2025, India added a record 3.2 GW, representing an 86% year-on-year increase in rooftop solar installations. The residential sector accounted for 74% of new installations, showcasing the rising adoption of solar energy by homeowners. Gujarat, Maharashtra, and Uttar Pradesh are among the top contributors, with Gujarat alone accounting for 29% of total rooftop solar capacity. The government’s ambitious has made solar systems more accessible, with over 13 million households registering for the scheme. By mid 2024, over 385,000 residential solar installations had been completed, adding nearly 1.8 GW of capacity. Commercial and industrial sectors also show steady growth, though at a smaller scale compared to residential. With favorable policies, such as net metering and capital subsidies, India’s rooftop solar market is poised for growth. This shift toward decentralized energy is not only promoting sustainability but also contributing to energy security and lowering electricity costs for consumers.To know about the Research Methodology:-Request Free Sample Report

India Solar Rooftop Market Dynamics:

India Solar Rooftop Market: From Policy Support to Affordable Technology India's rooftop solar market is experiencing substantial growth, driven by multiple key factors, with strong statistical backing. One of the primary enablers is government support through policies and solar incentives that make rooftop solar energy installations more financially attractive. The government has allocated USD 9 billion to facilitate rooftop solar power installation across 10 million households. This financial backing has significantly reduced the cost barrier for consumers, accelerating the adoption of solar power in India. In 2025, the market saw a 158% year-on-year increase in rooftop solar installations, highlighting the growing momentum of clean energy adoption and solar energy in India. Regionally, Gujarat leads the charge, contributing to the national rooftop solar capacity, while the top ten states collectively account for 81% of the total installations. This geographic concentration underscores the impact of state-level policies and economic incentives in driving the India Solar Rooftop Market growth. The declining cost of solar technology, including solar panels, inverters, and balance-of-system components, is another key factor. As these technologies become more affordable, solar rooftop systems become accessible to a broader range of consumers. Additionally, rising electricity tariffs are pushing residential and commercial sectors to invest in rooftop solar systems for long-term energy savings with solar. The residential sector alone accounted for 74% of new installations in 2025, reflecting strong adoption. There is untapped potential in micro, small, and medium enterprises (MSMEs), with an estimated 15 GW potential for rooftop solar power. This, along with growing awareness and continued policy support in the India Solar Rooftop Market in India, for continued expansion, helping the country move toward its renewable energy goals and a more sustainable future. India’s Solar Rooftop Market: How Energy Storage and Solar Irrigation Are Transforming Rural Areas The solar power market in India is growing rapidly, driven by government targets to achieve 500 GW of renewable energy capacity by 2030. The growth in solar farms and utility-scale solar projects presents significant opportunities, especially in rural and semi-urban regions with abundant sunlight. Companies involved in solar panel manufacturing, energy storage systems, and solar power plants stand to benefit from increasing demand. With the government offering incentives and a conducive regulatory environment, there's potential in both solar energy generation and solar power systems. With the rise of renewable energy adoption, including solar and wind, there’s a growing need for energy storage solutions to ensure power availability when generation is low. The energy storage market in India is expanding, with particular focus on lithium-ion batteries and grid storage solutions. Companies that can provide affordable, high-efficiency storage systems for both residential and industrial use will find ample opportunities. With solar-powered irrigation systems gaining traction, particularly in rural areas, there's a growing India Solar Rooftop Market for solar water pumps. These systems are highly beneficial for farmers who face unreliable power supply. By leveraging solar energy for irrigation, farmers can reduce dependence on diesel and grid electricity, resulting in long-term cost savings. The renewable energy generation grows, so does the need for more efficient power distribution systems. Smart grids and advanced metering infrastructure (AMI) solutions are key to managing distributed energy resources and ensuring grid stability. The Indian government’s push for smart cities and digitization of infrastructure presents opportunities for companies offering smart grid solutions, advanced meters, and real-time monitoring software. India is already a leader in solar, its wind energy market still has immense untapped potential. With large offshore wind projects planned along the coastlines and substantial onshore wind potential, companies involved in the design, development, and operation of wind farms have growth prospects. The government’s ambitious wind energy installation targets make it an attractive sector for investment. As India's construction industry embraces sustainability, there’s a growing demand for green building materials. From solar-powered buildings to energy-efficient insulation and eco-friendly building materials, companies that offer solutions for reducing a building's carbon footprint will be in high demand, especially in urban areas striving to meet sustainability standards. With the global shift toward green hydrogen as a clean fuel alternative, India is positioning itself as a potential hub for the hydrogen economy. Opportunities exist in the production, storage, and distribution of hydrogen, as well as in developing fuel cells for both transportation and industrial applications in India Solar Rooftop Market.India Solar Rooftop Market Segment Analysis:

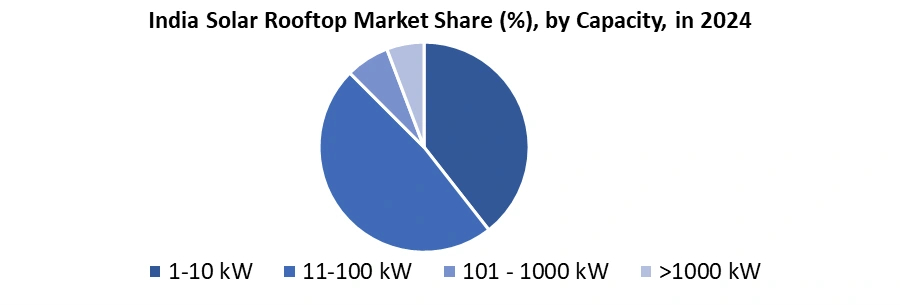

Based on capacity, the 11-100 kW segment is the dominant category in the India Solar Rooftop Market. This segment caters primarily to small commercial establishments, mid-sized industries, and residential societies, making it highly popular due to its balance of affordability and scalability. It accounts for the highest share of rooftop solar installations due to its moderate investment requirements compared to larger systems while still providing substantial energy savings. The 11-100 kW range is attractive for businesses and institutions with higher energy consumption but limited rooftop space. It benefits from government subsidies and net-metering policies, making solar adoption financially viable and lowering upfront costs. Additionally, the segment's ability to provide a rapid return on investment (ROI) due to rising electricity prices and reduced solar technology costs has further driven demand. This segment allows businesses to generate enough energy to meet a significant portion of their electricity needs while benefiting from excess power sales back to the grid, enhancing its appeal. As a result, the 11-100 kW capacity is projected to remain the dominant segment, making a substantial contribution to the growth of India’s solar rooftop market in the coming years.

India Solar Rooftop Market Regional Analysis

In 2024, South India emerged as the dominant region within the India Solar Rooftop market, commanding the largest market share. Comprising Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu, South India offers a distinctive environment for solar rooftop endeavors. The region's unique characteristics and opportunities significantly influence the uptake and expansion of solar rooftop installations. Benefiting from elevated solar irradiation levels owing to its proximity to the equator, South India stands as an optimal location for solar energy generation. The abundant sunlight year-round enhances the efficacy of solar rooftop systems, resulting in heightened energy production and shorter payback periods for consumers. South Indian states exhibit a steadfast commitment to renewable energy, exemplified through the introduction of various policies and incentives aimed at fostering solar rooftop installations. These measures encompass net metering, subsidies, tax exemptions, and feed-in tariffs, which is expected to boost the India Solar Rooftop Market growth. Progressive net metering regulations in states like Tamil Nadu and Karnataka incentivize the adoption of grid-connected solar systems. The region boasts rapidly increasing urban centers, including Bangalore, Chennai, and Hyderabad, which serve as bustling hubs for commercial and industrial activities. The presence of these entities, endowed with ample rooftop spaces, presents substantial opportunities for solar rooftop deployments. Businesses in these areas are increasingly embracing solar power to curtail electricity expenses and showcase environmental stewardship. South India harbors a significant residential market for solar rooftops. The dense urban population and burgeoning awareness of environmental sustainability have prompted a growing number of homeowners to contemplate solar installations, aiming to diminish their carbon footprint and trim energy bills.

Recent Development:

300 MW EPC Solar Project Commissioned by Tata Power In November 2025, Tata Power Renewable Energy Ltd (TPREL) commissioned a 300 MW solar PV project in Bikaner, Rajasthan under a turnkey EPC contract for NHPC Limited, supplying its entire output to Punjab State Power Corporation Ltd. The project used around 775,000 modules and complied with India’s Domestic Content Requirement (DCR) norms. This milestone reflects TPREL’s growing execution capability and aligns with India’s push for utility scale clean power deployment. 5.4 GW Solar Cell Gigafactory Started Production by Waaree Energies In January 2025, Waaree Energies Ltd began trial production at its new 5.4 GW solar cell manufacturing plant in Chikhli, Gujarat — the largest advanced cell factory in Indi. The facility focuses on high efficiency TOPCon/Mono PERC technology and supports India’s goal of strengthening domestic manufacturing and reducing reliance on imports. The establishment promises improved cost stability and supply chain resilience for Waaree. Amplus Solar Rebrands to Gentari to Consolidate Clean Energy Platform In May 2025, Amplus Solar Power Pvt. Ltd. officially rebranded as Gentari in India, integrating its C&I focused rooftop and distributed solar business into Gentari’s broader clean energy portfolio. The move is aimed at streamlining operations, scaling hybrid solutions, and leveraging Gentari’s global presence to accelerate Indian market growth.Scope of India Solar Rooftop Market: Inquire before buying

India Solar Rooftop Market Report Coverage Details Base Year: 2025 Forecast Period: 2025-2032 Historical Data: 2020 to 2025 Market Size in 2024: USD 6.20 Bn. Forecast Period 2025 to 2032 CAGR: 15.6% Market Size in 2032: USD 19.77 Bn. Segments Covered: by Capacity 1-10 kW 11-100 kW 101 - 1000 kW >1000 kW by Connectivity On-Grid Off-Grid Hybrid by End User Residential Commercial Industrial India Solar Rooftop Market Key players

1. Tata Power Solar Systems Limited 2. Amplus Solar Power Pvt. Ltd. 3. Clean Max Enviro Energy Solutions Pvt. Ltd. 4. Sunsource Energy Pvt. Ltd. 5. Orb Energy Pvt. Ltd. 6. Fourth Partner Energy Pvt. Ltd. 7. Roofsol Energy Pvt. Ltd. 8. Waaree Energies Ltd 9. Vikram Solar 10. Goldi Solar 11. Saatvik Green Energy Pvt. Ltd. 12. Renewsys India 13. Loom Solar Pvt. Ltd 14. Sunsure Energy 15. Azure Power 16. Jakson Group 17. Harsha Abakus Solar 18. U-Solar Clean Energy 19. Adani Solar 20. Jinko SolarFAQs

1. What is solar rooftop? Ans: Solar rooftop refers to the installation of solar panels on the rooftops of buildings or structures to harness solar energy for electricity generation. 2. Which are the top states in rooftop solar capacity? Ans: Maharashtra, Rajasthan, Tamil Nadu, Gujarat, and Karnataka accounted for about 52% of total installed capacity in 2024. 3. Which company leads in the industrial and commercial rooftop segment? Ans: Tata Power Solar emerged as a leader in the industrial and commercial rooftop segment according to the India Solar Rooftop Map 2015 by Bridge to India. 4. Why is the commercial segment important in the solar rooftop market? Ans: The commercial segment is crucial due to its large rooftop spaces and potential for significant cost savings, driven by government incentives and decreasing solar panel costs. 5. Which region emerged as the dominant market for solar rooftop in India? Ans: South India, including Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu, emerged as the dominant region in the solar rooftop market in 2024.

1. India Solar Rooftop Market : Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion)-By Segments 2. India Solar Rooftop Market : Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. India Solar Rooftop Market : Dynamics 3.1. India Solar Rooftop Market Trends 3.2. India Solar Rooftop Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis 3.6. Analysis of Government Schemes and Support for the Industry 4. Pricing Analysis 4.1. Price Trend By Capacity, in 2019-2024 4.2. Average Cost of Solar Panel Installation in India by (KW) 4.3. Factors Determining Solar Panel Installation Cost 4.4. Component cost of rooftop PV systems 4.5. Technology and Quality Drive Price Variation 4.6. High Upfront Cost vs. Long-Term Savings 5. Financing Models and Investment Opportunities 5.1. Emerging Financing Options 5.2. Green Bonds and Solar REITs (Real Estate Investment Trusts) 5.3. Venture Capital and Private Equity in Solar Rooftop 5.4. Return on Investment (ROI) 6. Deployment Statistics for Rooftop Solar in India 6.1. Total Number of Rooftop Solar Installations in India 6.2. Installed Capacity (in GW) of Rooftop Solar 6.3. Growth Trend in Rooftop Installations (Year-on-Year Growth %) 6.4. Urban vs Rural Distribution 7. Government Policies 7.1. Government Incentive Schemes for Rooftop Solar Deployment 7.2. Subsidies and Financial Incentives Driving Adoption 7.3. Environmental Clearances and Regulatory Permitting Framework 7.4. Tariff Structures and Net Metering Policies for Rooftop Solar 8. Emerging Technologies in the Solar Rooftop Market 8.1. Smart Inverters Enabling Grid-Responsive Rooftop Systems 8.2. Integrated Solar and Battery Storage Solutions (BESS) 8.3. AI-Driven Energy Management for Rooftop Optimization 8.4. Building-Integrated Photovoltaics (BIPV) for Urban Deployment 8.5. Next-Generation Perovskite and Tandem Solar Cell Technologies 9. India Solar Rooftop Market : Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. India Solar Rooftop Market Size and Forecast, By Capacity (2024-2032) 9.1.1.1. 1-10 kW 9.1.1.2. 11-100 kW 9.1.1.3. 101 - 1000 kW 9.1.1.4. >1000 kW 9.2. India Solar Rooftop Market Size and Forecast, By Connectivity (2024-2032) 9.2.1.1. On-Grid 9.2.1.2. Off-Grid 9.2.1.3. Hybrid Systems 9.3. India Solar Rooftop Market Size and Forecast, By End Use (2024-2032) 9.3.1.1. Residential 9.3.1.2. Commercial 9.3.1.3. Industrial 9.4. India Solar Rooftop Market Size and Forecast, By Region (2024-2032) 9.4.1.1. North India 9.4.1.2. South India 9.4.1.3. West India 9.4.1.4. East India 10. Company Profile: Key Players 10.1. Tata Power Solar Systems Limited 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Amplus Solar Power Pvt. Ltd. 10.3. Clean Max Enviro Energy Solutions Pvt. Ltd. 10.4. Sunsource Energy Pvt. Ltd. 10.5. Orb Energy Pvt. Ltd. 10.6. Fourth Partner Energy Pvt. Ltd. 10.7. Roofsol Energy Pvt. Ltd. 10.8. Waaree Energies Ltd 10.9. Vikram Solar 10.10. Goldi Solar 10.11. Saatvik Green Energy Pvt. Ltd. 10.12. Renewsys India 10.13. Loom Solar Pvt. Ltd 10.14. Sunsure Energy 10.15. Azure Power 10.16. Jakson Group 10.17. Harsha Abakus Solar 10.18. U-Solar Clean Energy 10.19. Adani Solar 10.20. Jinko Solar 11. Key Findings 12. Analyst Recommendations 13. India Solar Rooftop Market – Research Methodology