Hypertrophic Cardiomyopathy Treatment Market was valued at USD 2.31 Bn in 2024, and the Global Automated Manual Transmission Market is expected to reach USD 2.95 Bn by 2032, at a CAGR of 3.1 % during the forecast period.Hypertrophic Cardiomyopathy Treatment Market Overview:

Hypertrophic cardiomyopathy (HCM) is a condition where the heart muscle, particularly the left ventricle, becomes abnormally thick. This thickening makes it harder for the heart to pump blood effectively. The Hypertrophic Cardiomyopathy Treatment Market includes products and therapies designed to address a medical condition primarily caused by abnormal genes in the heart muscle. This genetic anomaly leads to the thickening of the walls of the left ventricle of the heart. Consequently, these thickened walls become stiff, resulting in reduced blood intake and output during each heartbeat. The market focuses on developing and providing treatments aimed at managing and alleviating symptoms, improving cardiac function, and enhancing the quality of life for individuals affected by this condition.To know about the Research Methodology :- Request Free Sample Report North America drives HCM treatment growth due to rising obesity and sedentary lifestyles, holding 42.39% market share. Key HCM players like BMS (Camzyos leader) and Cytokinetics (Aficamten) are innovating. In report, the Global Hypertrophic Cardiomyopathy (HCM) Treatment Market is examined in detail in order to provide stakeholders with the strategies based on data in approaching the dynamic market. It discusses the dynamics of the market and it points out how the discovery of genes, including the recent discovery of the ALPK3 gene variant, are driving the merits by allowing the further stratification of patients and personalized therapeutic interventions. The analysis covers emerging trends such as the dramatic changeover into focused cardiac myosin inhibitors with market driver Camzyos of Bristol Myers Squibb as well as the growing emphasis on non-obstructive HCM.

Hypertrophic Cardiomyopathy Treatment Market Dynamics:

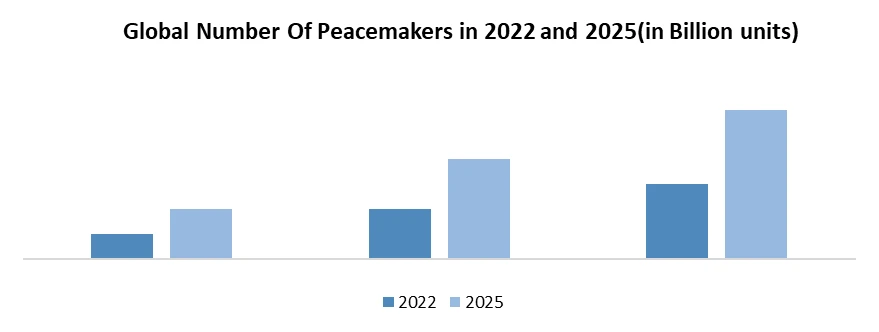

Genetic Discovery to Fuel Advancements in Hypertrophic Cardiomyopathy (HCM) Treatment Market The recent identification of a rare variant of the Alpha-protein kinase 3 (ALPK3) gene, linked to severe forms of hypertrophic cardiomyopathy (HCM), is redesigning the landscape of HCM treatment. This genetic discovery of underlying mechanisms contributes to the progression and severity of the disease. ALPK3tv carriers, comprising a small percentage of HCM patients, exhibit distinctive patterns of left ventricular hypertrophy, particularly in the apical or concentric forms. These patients are more prone to developing apical HCM, characterized by extensive fibrosis and a higher risk of progressing to heart failure. The identification of ALPK3tv provides valuable insights into patient stratification and personalized treatment approaches within the HCM population. The recognition of ALPK3tv as a significant contributor to HCM pathology not only enhances our understanding of the disease but also paves the way for the development of novel therapeutic strategies.Based on Devices, in 2024, the pacemaker has experienced significant growth in Hypertrophic Cardiomyopathy Treatment Market recent years, and that growth is expected to continue in the future. However, access to pacemakers globally is variable. The United States, Germany, and Japan. As for many implantable cardiac devices, affordability is a major concern among patients globally. As for many implantable cardiac devices, affordability is a major concern among patients globally. The number of pacemakers globally is expected to increase significantly forecast period. Pacemakers are essential life-saving implantable devices for individuals living with certain heart conditions.

Hypertrophic Cardiomyopathy Treatment Market Segment Analysis:

Hypertrophic Cardiomyopathy Treatment Market Regional Analysis:

North America is expected to drive the growth of the Hypertrophic Cardiomyopathy (HCM) therapeutics market during the forecast period, with the increasing prevalence of obesity among the younger population in North America and the increase in preference towards a sedentary lifestyle, which are the primary factors driving for hypertrophic cardiomyopathy therapeutics in these regions and holds largest share of 42.39% Hypertrophic Cardiomyopathy Treatment Market.Hypertrophic Cardiomyopathy Treatment Market Competitive Analysis:

Top Key Players of Hypertrophic Cardiomyopathy Treatment Market are Bristol Myers Squibb (BMS) (U.S.), Cytokinetics (U.S.), Novartis AG (Switzerland), Sanofi S.A. (France), Bayer AG (Germany). Bristol Myers Squibb (BMS) (U.S.) Market Leader with Camzyos (Mavacamten): BMS holds the current leading position in the targeted HCM treatment market with Camzyos, the first-in-class cardiac myosin inhibitor approved for symptomatic obstructive HCM. This drug represents a significant leap forward in treatment. Cytokinetics (U.S.) aims to enter the market with Aficamten and carve out a significant share by highlighting its potential differentiated profile (e.g., safety, LVEF management, drug interactions). Novartis AG (Switzerland) as a strong and established presence in the broader cardiovascular disease market with various drugs for heart failure, hypertension, and other conditions (e.g., Entresto for heart failure, Leqvio for cholesterol). Sanofi S.A. (France) Sanofi is a large, diversified pharmaceutical company with a presence in multiple therapeutic areas, including cardiovascular diseases. They have a global footprint and established market access. The future of Hypertrophic Cardiomyopathy treatment likely to be shaped by the continued innovation in cardiac myosin inhibitors and the exploration of new pathways for both obstructive and non-obstructive forms of the disease.Hypertrophic Cardiomyopathy Treatment Market Key Trends:

• New Drug, New Day for Hypertrophic Cardiomyopathy Treatment: • The biggest leap forward in years is Camzyos (mavacamten). Approved by the U.S. Food and Drug Administration (FDA) in 2024, it’s the first drug developed for Hypertrophic Cardiomyopathy Treatment . • Shift Towards Targeted Therapies: The market is moving away from purely symptomatic management (like beta-blockers and calcium channel blockers) towards drugs that directly address the underlying cause of HCM – the hypercontractility of the heart muscle. • Increasing Focus on Non-Obstructive HCM (nHCM): While obstructive Hypertrophic Cardiomyopathy Treatment has seen the most innovation with cardiac myosin inhibitors, there's a growing recognition of the significant unmet need in non-obstructive HCM. • Advancements in Diagnostics and Genetic Testing: Improved imaging techniques (like cardiac MRI with LGE) and the increasing accessibility of comprehensive genetic testing are leading to earlier and more accurate diagnoses of Hypertrophic Cardiomyopathy Treatment. Hypertrophic Cardiomyopathy Treatment Market Key Development: • 22 June 2025: Eastman Chemical Company (Lumar, SunTek) (U.S.): Eastman’s brands like Lumar and SunTek are well-known in the PPF market. Recent news for Eastman (as of July 2025) includes price increases on various chemical products and upcoming Q2 2025 earnings reports. • 12 July 2025: SKC Inc. (South Korea): SKC is a significant contributor to the PPF market. Recent news for SKC (as of July 2025) highlights new funding, potential benefits from AI and HBM semiconductor demand (indicating diversification), and overall stock market movements. • 19 March 2025: Kangde Xin Composite Material Co., Ltd. (KDX) (China): KDX is a key Chinese player in composite materials, including films used in various applications, likely encompassing PPF. KDX's stock performance and general market activities in China are visible, although specific PPF-related developments in this month are not explicitly detailed in the provided search results. • 1 June 2025: Garware Hi-Tech Films Ltd. (India): Garware Hi-Tech Films reported a significant rise in consolidated net profit for the March 2025 quarter and full year, indicating strong financial performance. They have a vertically integrated "chip-to-film" operation, which can be a competitive advantage in the PPF market.Hypertrophic Cardiomyopathy Treatment Market Scope: Inquiry Before Buying

Global Hypertrophic Cardiomyopathy Treatment Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.31 Bn. Forecast Period 2025 to 2032 CAGR: 3.1% Market Size in 2032: USD 2.95 Bn. Segments Covered: by Drugs Anticoagulants Antiarrhythmic Agents Beta Adrenergic Blocking Agents Calcium Channel Blockers Others by Devices Pacemakers Defibrillators Others by End User Clinics Hospitals Others Hypertrophic Cardiomyopathy Treatment Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Hypertrophic Cardiomyopathy Treatment Market, Key Players:

North America 1. Bristol Myers Squibb (U.S.) 2. Cytokinetics (U.S.) 3. Pfizer Inc. (U.S.) 4. Merck & Co., Inc. (U.S.) 5. Johnson & Johnson (U.S.) 6. Gilead Sciences, Inc. (U.S.) 7. Amgen Inc. (U.S.) 8. Imbria Pharmaceuticals (U.S.) 9. Tenaya Therapeutics (U.S.) 10. MyoKardia, Inc. (U.S.) Europe: 11. Novartis AG (Switzerland) 12. AstraZeneca Plc (Sweden) 13. Sanofi S.A. (France) 14. GSK plc (U.K.) 15. Boehringer Ingelheim GmbH (Germany) 16. ADVANZ PHARMA Corp (U.K.) 17. Recordati S.p.A. (Italy) 18. Servier Laboratories (France) Asia Pacific: 19. Takeda Pharmaceutical Company Limited (Japan) 20. Daiichi Sankyo Company, Limited (Japan) 21. Astellas Pharma Inc. (Japan) 22. Sun Pharmaceutical Industries Ltd. (India) 23. Lupin (India) 24. Aurobindo Pharma (India) 25. LianBio (China) Middle East & Africa: 26. Teva Pharmaceutical Industries Ltd. (Israel) 27. Hikma Pharmaceuticals PLC (Jordan) FAQs: 1. What region is expected to lead the Hypertrophic Cardiomyopathy Treatment Market? Ans. North America is expected to lead the Hypertrophic Cardiomyopathy Treatment Market 2. What are the restraints of the Hypertrophic Cardiomyopathy Treatment Market? Ans. Lack of Awareness, High treatment costs, etc. are the reasons to restraints the market. 3. What is the key driving factor for the growth of the Hypertrophic Cardiomyopathy Treatment Market? Ans. Technological Advancements, Genetic discoveries, etc. are the drivers for the global Hypertrophic Cardiomyopathy Treatment market. 4. What is the market size of the Global Hypertrophic Cardiomyopathy Treatment Market by 2032? Ans. The Hypertrophic Cardiomyopathy Treatment Market size was valued at USD 2.31 Billion in 2024 and the total Hypertrophic Cardiomyopathy Treatment revenue is expected to grow at a CAGR of 3.10 % from 2024 to 2030, reaching nearly USD 2.95 Billion by 2032. 5. What is the forecast period for the Global Hypertrophic Cardiomyopathy Treatment Market? Ans. The forecast period for the Hypertrophic Cardiomyopathy Treatment Market is 2025-2032.

1. Hypertrophic Cardiomyopathy Treatment Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Hypertrophic Cardiomyopathy Treatment Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Hypertrophic Cardiomyopathy Treatment Market: Dynamics 3.1. Region-wise Trends of Hypertrophic Cardiomyopathy Treatment Market 3.1.1. North America Hypertrophic Cardiomyopathy Treatment Market Trends 3.1.2. Europe Hypertrophic Cardiomyopathy Treatment Market Trends 3.1.3. Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Trends 3.1.4. Middle East and Africa Hypertrophic Cardiomyopathy Treatment Market Trends 3.1.5. South America Hypertrophic Cardiomyopathy Treatment Market Trends 3.2. Hypertrophic Cardiomyopathy Treatment Market Dynamics 3.2.1. Global Hypertrophic Cardiomyopathy Treatment Market Drivers 3.2.1.1. Genetic Discovery Fuels Advancements in Hypertrophic Cardiomyopathy 3.2.2. Global Hypertrophic Cardiomyopathy Treatment Market Restraints 3.2.3. Global Hypertrophic Cardiomyopathy Treatment Market Challenges 3.2.4. Global Hypertrophic Cardiomyopathy Treatment Market Opportunities 3.2.4.1. Growing Demand for Electric Vehicles 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government Funding for Rare Diseases 3.4.2. High Treatment Costs 3.4.3. Increasing Disease Awareness & Education 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Hypertrophic Cardiomyopathy Treatment Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 4.1. Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 4.1.1. Anticoagulants 4.1.2. Antiarrhythmic Agents 4.1.3. Beta Adrenergic Blocking Agents 4.1.4. Calcium Channel Blockers 4.1.5. Others 4.2. Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 4.2.1. Pacemakers 4.2.2. Defibrillators 4.2.3. Others 4.3. Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 4.3.1. Clinics 4.3.2. Hospitals 4.3.3. Others 4.4. Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, by region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 5.1. North America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 5.1.1. Anticoagulants 5.1.2. Antiarrhythmic Agents 5.1.3. Beta Adrenergic Blocking Agents 5.1.4. Calcium Channel Blockers 5.1.5. Others 5.2. North America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 5.2.1. Pacemakers 5.2.2. Defibrillators 5.2.3. Others 5.3. North America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 5.3.1.1. Clinics 5.3.1.2. Hospitals 5.3.1.3. Others 5.3.2. North America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, by Country (2024-2032) 5.3.3. United States 5.3.3.1. United States Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 5.3.3.1.1. Anticoagulants 5.3.3.1.2. Antiarrhythmic Agents 5.3.3.1.3. Beta Adrenergic Blocking Agents 5.3.3.1.4. Calcium Channel Blockers 5.3.3.1.5. Others 5.3.3.2. United States Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 5.3.3.2.1. Pacemakers 5.3.3.2.2. Defibrillators 5.3.3.2.3. Others 5.3.3.3. United States Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 5.3.3.3.1. Clinics 5.3.3.3.2. Hospitals 5.3.3.3.3. Others 5.3.4. Canada 5.3.4.1. Canada Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 5.3.4.1.1. Anticoagulants 5.3.4.1.2. Antiarrhythmic Agents 5.3.4.1.3. Beta Adrenergic Blocking Agents 5.3.4.1.4. Calcium Channel Blockers 5.3.4.1.5. Others 5.3.5. Canada Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 5.3.5.1. Pacemakers 5.3.5.2. Defibrillators 5.3.5.3. Others 5.3.6. Canada Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 5.3.6.1. Clinics 5.3.6.2. Hospitals 5.3.6.3. Others 5.3.7. Mexico 5.3.7.1. Mexico Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 5.3.7.1.1. Anticoagulants 5.3.7.1.2. Antiarrhythmic Agents 5.3.7.1.3. Beta Adrenergic Blocking Agents 5.3.7.1.4. Calcium Channel Blockers 5.3.7.1.5. Others 5.3.7.2. Mexico Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 5.3.7.2.1. Pacemakers 5.3.7.2.2. Defibrillators 5.3.7.2.3. Others 5.3.7.3. Mexico Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 5.3.7.3.1. Clinics 5.3.7.3.2. Hospitals 5.3.7.3.3. Others 6. Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 6.1. Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.2. Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.3. Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4. Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.1.2. United Kingdom Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.1.3. United Kingdom Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4.2. France 6.4.2.1. France Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.2.2. France Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.2.3. France Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.3.2. Germany Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.3.3. Germany Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.4.2. Italy Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.4.3. Italy Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.5.2. Spain Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.5.3. Spain Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.6.2. Sweden Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.6.3. Sweden Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.7.2. Austria Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.7.3. Austria Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 6.4.8.2. Rest of Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 6.4.8.3. Rest of Europe Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7. Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 7.1. Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.2. Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.3. Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4. Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.1.2. China Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.1.3. China Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.2.2. S Korea Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.2.3. S Korea Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.3.2. Japan Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.3.3. Japan Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.4. India 7.4.4.1. India Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.4.2. India Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.4.3. India Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.5.2. Australia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.5.3. Australia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.6.2. Indonesia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.6.3. Indonesia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.7.2. Philippines Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.7.3. Philippines Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.8.2. Malaysia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.8.3. Malaysia Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.9.2. Vietnam Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.9.3. Vietnam Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.10.2. Thailand Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.10.3. Thailand Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 7.4.11.2. Rest of Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 7.4.11.3. Rest of Asia Pacific Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 8. Middle East and Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 8.1. Middle East and Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 8.2. Middle East and Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 8.3. Middle East and Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 8.4. Middle East and Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 8.4.1.2. South Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 8.4.1.3. South Africa Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 8.4.2.2. GCC Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 8.4.2.3. GCC Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 8.4.3.2. Nigeria Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 8.4.3.3. Nigeria Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 8.4.4.2. Rest of ME&A Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 8.4.4.3. Rest of ME&A Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 9. South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 9.1. South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 9.2. South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 9.3. South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 9.4. South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 9.4.1.2. Brazil Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 9.4.1.3. Brazil Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 9.4.2.2. Argentina Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 9.4.2.3. Argentina Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Drugs (2024-2032) 9.4.3.2. Rest of South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By Devices (2024-2032) 9.4.3.3. Rest of South America Hypertrophic Cardiomyopathy Treatment Market Size and Forecast, By End users (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Bristol Myers Squibb 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Cytokinetics 10.3. Novartis AG 10.4. Pfizer Inc. 10.5. Merck & Co., Inc. 10.6. AstraZeneca Plc 10.7. Sanofi S.A. 10.8. Bayer AG 10.9. F. Hoffmann-La Roche Ltd 10.10. GSK plc 10.11. Johnson & Johnso 10.12. Teva Pharmaceutical Industries Ltd. 10.13. Gilead Sciences, Inc. 10.14. Amgen Inc. 10.15. Imbria Pharmaceuticals 10.16. Tenaya Therapeutics 10.17. Daiichi Sankyo Company, Limited 10.18. Astellas Pharma Inc. 10.19. Sun Pharmaceutical Industries Ltd. 10.20. Lupin 10.21. Aurobindo Pharma 10.22. LianBio 10.23. Hikma Pharmaceuticals PLC 10.24. Boehringer Ingelheim GmbH 10.25. ADVANZ PHARMA Corp 10.26. Recordati S.p.A. 10.27. Servier Laboratories 10.28. MyoKardia, Inc 11. Analyst Recommendations 12. Hypertrophic Cardiomyopathy Treatment Market: Research Methodology