Global Home Improvement Market Size USD 524.25 Billion in 2024, Expected to Reach USD 854.68 Billion by 2032 at 6.3% CAGR. Comprehensive Analysis of DIY & DIFM Segments, Kitchen & Bathroom Renovation Trends, Smart Home Upgrades, Regional Growth, Key Players.Home Improvement Market Overview

The most resilient consumer-driven industries, supported by rising renovation spending, ageing housing stock, and the global shift toward smart, energy-efficient living. The home renovation market continues to grow as more than 50% of homes in North America and Europe are over 40 years old, boosting sustained demand for structural upgrades, house repair and maintenance services, and modernization of outdated interiors. Growing preference for premium home remodeling services, especially in the kitchen renovation market and bathroom remodeling market, reflects rising interest in functional design, modern storage solutions, and sustainability. Smart technologies are reshaping the sector as homeowners adopt smart home improvement features such as automated lighting, connected HVAC systems, and intelligent security systems. Sustainable home renovation is another major trend, supported by EU and U.S. incentives promoting green building materials, solar home improvement trends, and home insulation improvement. This shift aligns with consumer preferences for long-term savings and environmentally responsible living. Meanwhile, the expansion of e-commerce and digital tools AR/VR design apps, digital tools for DIY home projects, and online how-to platforms, has strengthened both the DIY vs DIFM market segments. The U.S. home improvement market leads with the highest spending, supported by strong housing turnover and major players such as Home Depot and Lowe’s. APAC shows the fastest growth due to rapid urbanization and rising middle-class income, while Europe benefits from government-led efficiency retrofits.To know about the Research Methodology :- Request Free Sample Report

Trend: Rapid Adoption of Smart Home Renovation Solutions

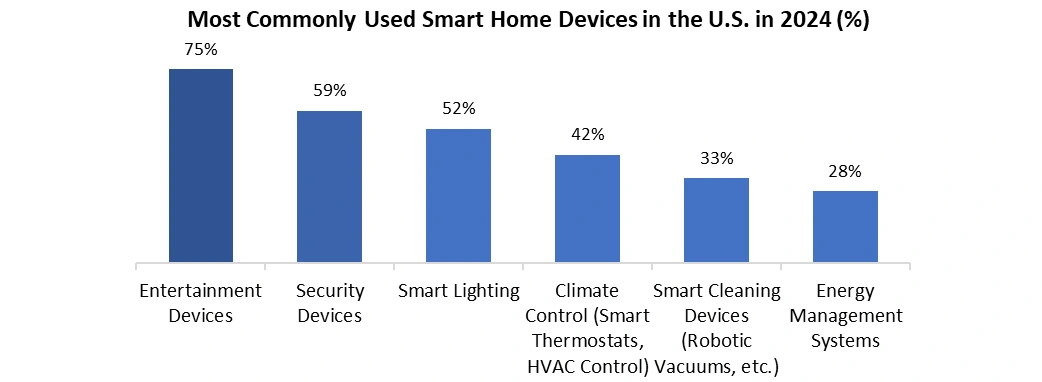

The home improvement Industry is witnessing a major shift fueled by the rapid adoption of smart home renovation solutions. Homeowners are increasingly investing in intelligent systems such as smart thermostats, AI-enabled security cameras, automated lighting, connected HVAC units, and app-controlled appliances to enhance comfort, convenience, and safety. This Home Improvement Market trend is supported by rising awareness, improved IoT affordability, and stronger Wi-Fi/5G penetration. Post-pandemic lifestyle changes have also accelerated demand for multifunctional living environments, home offices, fitness corners, entertainment areas, and hybrid-learning zones, driving higher spending on interior remodeling services and digital upgrades. The sustainable home renovation is gaining momentum, with consumers preferring energy-efficient windows, solar-powered roofing, and advanced water management systems to reduce long-term utility costs. Retailers and renovation companies utilize AI-driven design tools, AR visualization apps, and digital twins to provide personalized project planning, which boosts Home Improvement Market growth. These tools allow homeowners to preview paint finishes, flooring selections, lighting layouts, and décor options before installation. As millennials and Gen Z increasingly prioritize automation, environmental responsibility, and DIY home improvement, they are becoming key drivers of new home upgrade trends across both DIY and DIFM segments.Home Improvement Market Dynamics

Driver: Rising Renovation Demand Due to Aging Homes

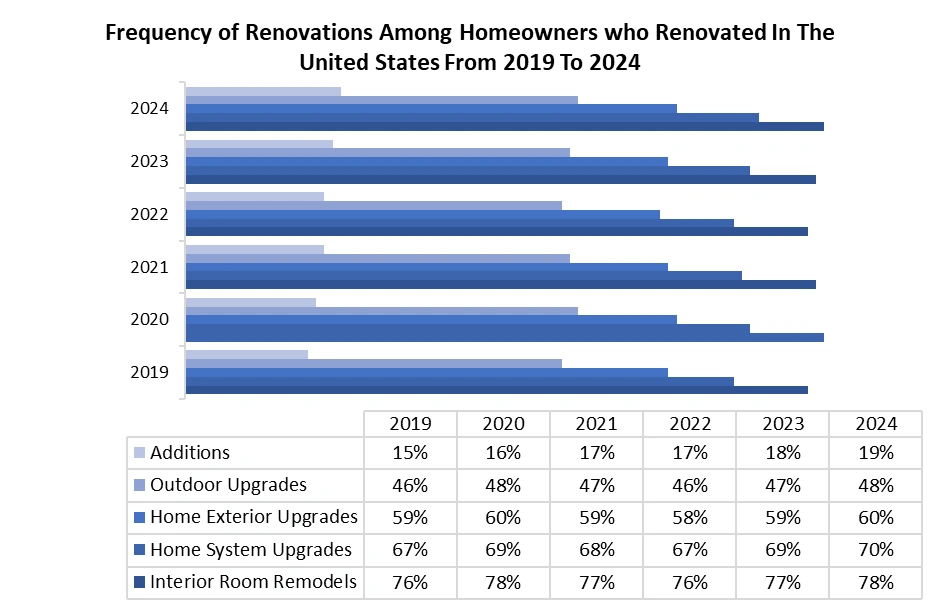

In North America and Europe, more than 50% of homes are over 40 years old, creating a massive need for modernization and structural renewal. This aging-home renovation demand stimulates spending on roofing replacement, window upgrades, HVAC modernization, electrical and plumbing repairs, and exterior improvement projects. Homeowners are strongly motivated to improve property value, especially in competitive real estate environments, through high-impact upgrades such as kitchen remodeling, bathroom renovations, and smart home improvement features that boost resale Home Improvement Market potential. The rise of hybrid and remote work has increased demand for personalized interiors, including home office installations and space optimization. The growth of e-commerce and online DIY home projects empowers consumers to handle basic repairs independently, supporting the expansion of the DIY vs DIFM ecosystem. Government incentives promoting energy-efficient upgrades, such as solar home improvement trends, insulation improvement, and adoption of green building materials, also encourage homeowners to pursue long-term cost-saving enhancements. As homes older than 20–30 years require upgrades, U.S. homeowners are renovating more frequently. Between 2019 and 2023, the proportion of households undertaking renovation grew steadily, supported by rising disposable income, lifestyle upgrades, and long-term maintenance needs, driving Home Improvement Market growth.

Restraints: Rising Costs and Skilled Labor Shortages to restrain Home Improvement Market growth

The home renovation ecosystem is experiencing an unpredictable rise in raw material prices paired with ongoing labor shortages. Costs of lumber, steel, cement, roofing shingles, and PVC have surged due to global supply chain disruptions, logistics delays, and international trade imbalances, causing homeowners and contractors to delay or scale down projects. The shortage of skilled electricians, carpenters, plumbers, and certified remodeling professionals, especially in North America and Europe, has increased labor expenses by 15–30% in several regions while prolonging project completion timelines. The inflationary pressures and higher interest rates have reduced consumer appetite for renovation financing, slowing down DIFM-based remodeling services and making larger renovation plans harder to execute.Home Improvement Market Segment Analysis

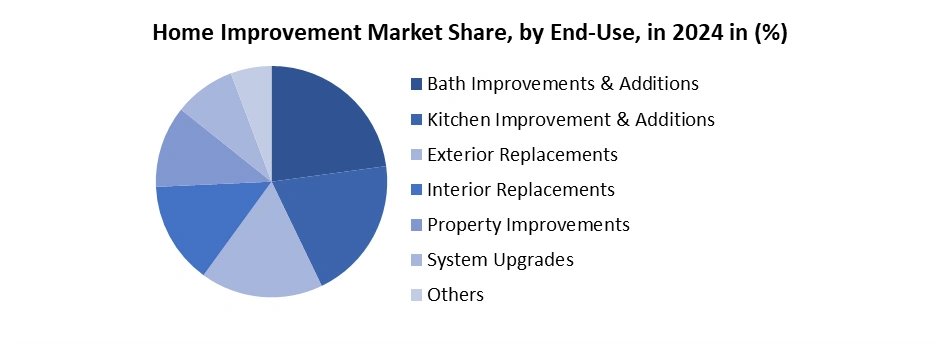

By Project, the market is broadly segmented into the Do It Yourself (DIY) and Do It For Me (DIFM). The Do-It-For-Me (DIFM) segment is the dominant project for the Home Improvement Market share, accounting for over 62% of total project spending in 2024, driven by rising reliance on professional remodeling services due to labor-intensive projects and the growing complexity of system upgrades. Many homeowners prefer hiring certified contractors for roofing replacement, plumbing and electrical upgrades, HVAC system upgrades, and full-scale kitchen and bathroom renovations. Increasing aging-home renovation demand in North America and Europe also plays a major role, as older homes require skilled labor for structural repairs and system modernization. DIFM growth is fueled by strong demand for premium finishes, smart home automation, and sustainable home renovation solutions. Rising time constraints, remote work lifestyles, and the desire for high-quality craftsmanship continue to shift consumers away from traditional DIY home improvement. The availability of flexible renovation financing, along with the expansion of e-commerce platforms providing bundled installation services, strengthens this segment.By End Use, the market is categorized into Bath Improvements & Additions, Kitchen Improvements & Additions, Exterior Replacements, Interior Replacements, Property Improvements, System Upgrades and Others. Kitchen Improvements & Additions is the largest end-use segment for the Home Improvement Market, contributing over 28% of global renovation spending in 2024, making it the most dominant category in the home renovation landscape. Kitchens are considered the highest-value improvement areas, offering a return on investment (ROI) of 70–85% in many developed markets. Spending on Home Improvement Market growth is driven by rising demand for modular kitchen upgrades, high-end kitchen cabinets, advanced countertops, and energy-efficient appliances. Modern homeowners increasingly prioritize multifunctional layouts, smart home improvement features such as voice-controlled lighting, and enhanced storage solutions. Trends in sustainable home renovation, such as eco-friendly cabinets, recycled countertops, and water-efficient fixtures, continue to influence consumer decisions. The kitchen renovation market is also expanding due to lifestyle changes, including the rise of home cooking post-pandemic and the growing preference for open-concept living spaces. Strong demand for professional remodeling services has boosted DIFM kitchen projects, especially in urban regions of North America, Europe, and APAC.

Home Improvement Market Regional Insights

North America dominated the Home Improvement Market in 2024 and is expected to continue its dominance over the forecast period. The region has leadership throughout the forecast period due to high consumer spending, strong DIY culture, and the presence of major industry players such as Home Depot and Lowe’s. The U.S. home improvement market benefits from an aging housing stock, with more than 65% of homes built before 1989, creating strong demand for system upgrades, kitchen remodeling, bathroom renovation, and energy-efficient retrofits. Rising adoption of smart home renovation solutions, including connected HVAC systems, smart lighting, and home security technologies, continues to push premium product sales. Canada contributes significantly, supported by growing residential renovation activities, green building incentives, and increased investment in exterior home improvement projects such as roofing, siding, and window replacement. A strong DIFM segment, combined with increasing financing options for renovation spending, supports steady Home Improvement Market growth across both urban and suburban regions. North America leads in DIY home improvement due to the widespread availability of online tutorials, e-commerce platforms, and retail giants offering affordable tools, materials, and project guidance. Favorable government policies encouraging energy-efficient home upgrades and sustainable home renovation boost the Home Improvement Industry growth. Growing adoption of smart home devices security systems, smart lights, and thermostats is driving home improvement upgrades, as U.S. homeowners increasingly modernize living spaces with connected, energy-efficient technologies.

Home Improvement Market Competitive Landscape

The home improvement industry is moderately consolidated, with leading players such as Home Depot, Lowe’s, ACE Hardware, Menards, and Kingfisher. Home Depot remained the largest player with revenues exceeding USD 150 billion, while Lowe’s generated over USD 86 billion, reflecting strong consumer spending on remodeling and repair services. Companies are focusing on expanding private-label product lines, improving e-commerce capabilities, and integrating AI-based design tools to attract both DIY and DIFM customers. Rising demand for energy-efficient upgrades and smart home renovation continues to intensify competition, pushing firms to invest in digital retail innovations, omnichannel logistics, and contractor partnerships. Strategic acquisitions, store expansions, and sustainable product portfolios remain core competitive strategies. • In March 2024, The Home Depot. announced four new Pro-focused distribution centers across Detroit, Southern Los Angeles, San Antonio, and Toronto to improve delivery speed and reliability for professional contractors. These hubs stock bulky materials such as lumber, insulation, and roofing shingles, enabling efficient job-lot fulfillment directly to worksites. By the end of 2024, The Home Depot plans to upgrade 17 key Pro markets with deeper inventory, tailored assortments, digital order-management tools, trade credit options, and enhanced ProXtra loyalty benefits, strengthening its leadership in the global home improvement ecosystem. • On Dec 11, 2024, Lowe’s unveiled its 2025 Total Home Strategy to accelerate long-term growth and market share. The company announced five key initiatives, including boosting Pro penetration, expanding online sales, enhancing home services, creating a unified loyalty ecosystem, and increasing space productivity. Lowe’s also introduced a new generative AI framework with partners like NVIDIA and OpenAI, launched the first product marketplace in the U.S. home improvement sector, and announced the relaunch of its MyLowe’s Pro Rewards program for 2025.Home Improvement Market Scope:Inquire before buying

Home Improvement Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 524.25 Bn. Forecast Period 2025 to 2032 CAGR: 6.3% Market Size in 2032: USD 854.68 Bn. Segments Covered: by Project Do It Yourself (DIY) Do It For Me (DIFM) by End Use Bath Improvements & Additions Kitchen Improvement & Additions Exterior Replacements Interior Replacements Property Improvements System Upgrades Others by Distribution Channel Online Offline Home Improvement Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Home Improvement Key Players

1. The Home Depot, Inc. 2. Lowe’s Companies, Inc. 3. Kingfisher plc 4. Masco Corporation 5. The Sherwin-Williams Company 6. Ace Hardware Corporation 7. Menard, Inc. 8. Wesfarmers Limited 9. B&Q 10. OBI Group Holding GmbH 11. Leroy Merlin 12. Hornbach Holding AG 13. Travis Perkins plc 14. Fastenal Company 15. True Value Company 16. 84 Lumber Company 17. Tractor Supply Company 18. Floor & Decor Holdings, Inc. 19. Mr. D.I.Y. Group (M) Berhad 20. Mr. Bricolage SA 21. Pella Corporation 22. Kohler Co. 23. Andersen Corporation 24. Watsco, Inc. 25. Beacon Roofing Supply, Inc. 26. Builders FirstSource, Inc. 27. FirstService Corporation 28. Dreamstyle Remodeling 29. DuPont de Nemours, Inc. 30. Henkel AG & Co.Frequently Asked Questions:

1] What segments are covered in the Home Improvement Market report? Ans. The segments covered in the Home Improvement Market report are based on Project, End Use, Distribution Channel and Region. 2] Which region is expected to hold the highest share of the Home Improvement Market? Ans. The North America region is expected to hold the highest share of the Home Improvement Market. 3] What is the market size of the Home Improvement Market by 2032? Ans. The market size of the Home Improvement Market by 2032 is USD 854.68 billion. 4] What is the growth rate of the Home Improvement Market? Ans. The Global Home Improvement Market is growing at a CAGR of 6.3 % during the forecasting period 2025-2032. 5] What was the market size of the Home Improvement Market in 2024? Ans. The market size of the Home Improvement Market in 2024 was USD 524.25 Billion.

1. Home Improvement Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Home Improvement Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Home Improvement Market: Dynamics 3.1. Home Improvement Market Trends 3.2. Home Improvement Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Home Improvement Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Home Improvement Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Home Improvement Market Size and Forecast, By Project (2024-2032) 4.1.1. Do It Yourself (DIY) 4.1.2. Do It For Me (DIFM) 4.2. Home Improvement Market Size and Forecast, By End Use (2024-2032) 4.2.1. Bath Improvements & Additions 4.2.2. Kitchen Improvement & Additions 4.2.3. Exterior Replacements 4.2.4. Interior Replacements 4.2.5. Property Improvements 4.2.6. System Upgrades 4.2.7. Others 4.3. Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 4.3.1. Online 4.3.2. Offline 4.4. Home Improvement Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Home Improvement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Home Improvement Market Size and Forecast, By Project (2024-2032) 5.1.1. Do It Yourself (DIY) 5.1.2. Do It For Me (DIFM) 5.2. North America Home Improvement Market Size and Forecast, By End Use (2024-2032) 5.2.1. Bath Improvements & Additions 5.2.2. Kitchen Improvement & Additions 5.2.3. Exterior Replacements 5.2.4. Interior Replacements 5.2.5. Property Improvements 5.2.6. System Upgrades 5.2.7. Others 5.3. North America Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 5.3.1. Online 5.3.2. Offline 5.4. North America Home Improvement Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Home Improvement Market Size and Forecast, By Project (2024-2032) 5.4.1.2. United States Home Improvement Market Size and Forecast, By End Use (2024-2032) 5.4.1.3. United States Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.2. Canada 5.4.2.1. Canada Home Improvement Market Size and Forecast, By Project (2024-2032) 5.4.2.2. Canada Home Improvement Market Size and Forecast, By End Use (2024-2032) 5.4.2.3. Canada Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.3. Mexico 5.4.3.1. Mexico Home Improvement Market Size and Forecast, By Project (2024-2032) 5.4.3.2. Mexico Home Improvement Market Size and Forecast, By End Use (2024-2032) 5.4.3.3. Mexico Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 6. Europe Home Improvement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Home Improvement Market Size and Forecast, By Project (2024-2032) 6.2. Europe Home Improvement Market Size and Forecast, By End Use (2024-2032) 6.3. Europe Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 6.4. Europe Home Improvement Market Size and Forecast, By Country (2024-2032) 6.4.1. United Kingdom 6.4.2. France 6.4.3. Germany 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific Home Improvement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Home Improvement Market Size and Forecast, By Project (2024-2032) 7.2. Asia Pacific Home Improvement Market Size and Forecast, By End Use (2024-2032) 7.3. Asia Pacific Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 7.4. Asia Pacific Home Improvement Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.2. S Korea 7.4.3. Japan 7.4.4. India 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippines 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa Home Improvement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Home Improvement Market Size and Forecast, By Project (2024-2032) 8.2. Middle East and Africa Home Improvement Market Size and Forecast, By End Use (2024-2032) 8.3. Middle East and Africa Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 8.4. Middle East and Africa Home Improvement Market Size and Forecast, By Country (2024-2032) 8.4.1. South Africa 8.4.2. GCC 8.4.3. Nigeria 8.4.4. Rest of ME&A 9. South America Home Improvement Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Home Improvement Market Size and Forecast, By Project (2024-2032) 9.2. South America Home Improvement Market Size and Forecast, By End Use (2024-2032) 9.3. South America Home Improvement Market Size and Forecast, By Distribution Channel (2024-2032) 9.4. South America Home Improvement Market Size and Forecast, By Country (2024-2032) 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1. The Home Depot, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Lowe’s Companies, Inc. 10.3. Kingfisher plc 10.4. Masco Corporation 10.5. The Sherwin-Williams Company 10.6. Ace Hardware Corporation 10.7. Menard, Inc. 10.8. Wesfarmers Limited 10.9. B&Q 10.10. OBI Group Holding GmbH 10.11. Leroy Merlin 10.12. Hornbach Holding AG 10.13. Travis Perkins plc 10.14. Fastenal Company 10.15. True Value Company 10.16. 84 Lumber Company 10.17. Tractor Supply Company 10.18. Floor & Decor Holdings, Inc. 10.19. Mr. D.I.Y. Group (M) Berhad 10.20. Mr. Bricolage SA 10.21. Pella Corporation 10.22. Kohler Co. 10.23. Andersen Corporation 10.24. Watsco, Inc. 10.25. Beacon Roofing Supply, Inc. 10.26. Builders FirstSource, Inc. 10.27. FirstService Corporation 10.28. Dreamstyle Remodeling 10.29. DuPont de Nemours, Inc. 10.30. Henkel AG & Co. 11. Key Findings 12. Analyst Recommendations 13. Home Improvement Market – Research Methodology