Harvester Heads Market valued at USD 4.73 Bn in 2024, projected to reach USD 6.73 Bn at a CAGR of 4.51%. Innovation surge drives demand for mechanized forestry.Harvester Heads Market Overview

Harvester heads are specialized forestry attachments used in mechanized logging to fell, delimb, and cut trees into desired lengths, enhancing efficiency in timber harvesting. The global harvester heads market is driven by increasing mechanization in forestry operations and demand for high-speed, precision-based cutting solutions. Key growth factors include the need for operational efficiency and advancements in automated harvesting technologies, though environmental concerns over deforestation pose challenges. Demand is rising from commercial forestry sectors, while supply is bolstered by manufacturers focusing on durable, customizable designs. Regionally, Asia-Pacific leads with a 39% market share, fueled by large-scale forestry activities in China and India, while North America remains strong due to advanced logging practices and heavy-duty equipment adoption. Major players like John Deere (AI-driven precision) and Komatsu Forest (electric/hybrid models) dominate through innovation and sustainability-focused solutions. End-users, including timber companies and government forestry agencies, contribute significantly to demand. Trade policies, such as tariffs on imported forestry machinery, have also influenced regional market dynamics, impacting competitive pricing and localization strategies. The report covers the Composite Rebar Market dynamics, structure by analyzing the market segments and projecting the Harvester Heads Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Harvester Heads Market.To know about the Research Methodology :- Request Free Sample Report Research Methodology: - This is a comprehensive international report targeted at present and future prospects of the Harvester Heads Market. This report presents a consolidation of primary and secondary analysis that provides market size, share, dynamics and forecast for numerous segments and sub-segments considering the macro and small environment factors. The report also covers an in-depth analysis of COVID 19 pandemic impact on the sales revenue of Harvester Heads Market by year-wise and region and on the key players revenue affected till July 2020 and expected short term and long-term impact on the market.

Global Harvester Heads Market Dynamics

The market for new and advanced harvester heads is increasingly growing in terms of increasing efficiency by raising the speed of the cutting cycle. In order to enhance the delimbing, felling, and bucking of trees located in different geographical terrains, manufacturers are coming up with different customizations which is driving the global harvester heads market. One of the main factors limiting the market is increase in global warming followed by an increase in deforestation. Climate change, desertification, soil depletion, floods, and increased levels of greenhouse gas (GHG) pollution result in forest losses. This, in turn, is accelerating global warming. Governments and various NGOs across the globe are raising concerns about increase in deforestation which may hamper global market. John Deere, a U.S.-based corporation specialized in the manufacturing of machinery for agriculture, construction, and forestry. It offers harvester heads for H412, H413, H414, H415, H480C, and H270 sequence.Global Harvester Heads Market Segment Analysis

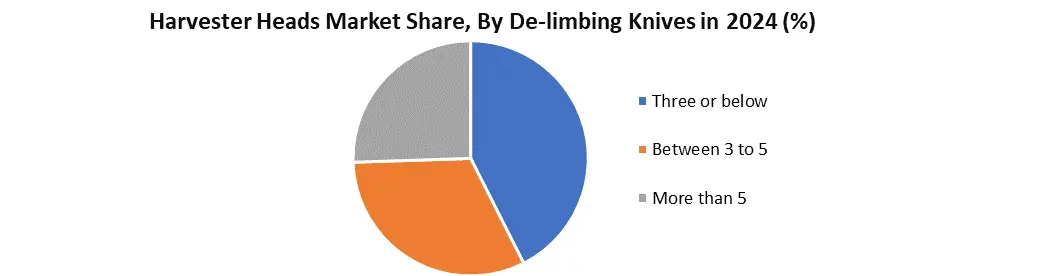

Based on Type, the 20-inch segment dominated the market in 2024.This segment is preferred due to its versatility and capability to handle medium to large-sized trees, making it suitable for both thinning and clear-cutting operations. It strikes a balance between cutting efficiency and manoeuvrability, making it ideal for varied forestry conditions across different regions. Forestry operators favour 20-inch heads for their durability, power, and compatibility with modern harvesters. Additionally, increasing demand for high-performance equipment in commercial forestry boosts its dominance over smaller or specialised variants. Based on De-limbing Knives, the segment with three or below de-limbing knives dominates the harvester heads market, primarily due to its widespread use in standard forestry operations that focus on small to medium-sized trees. This configuration offers an optimal balance between efficiency and cost-effectiveness, making it suitable for a wide range of geographic terrains and tree species. Additionally, harvester heads with fewer de-limbing knives tend to have lower maintenance requirements and reduced operational complexity, which appeals to both large commercial forestry companies and smaller operators. The versatility and reliability of this segment drive its strong market share compared to more complex designs with higher numbers of knives, which are typically reserved for specialized or high-density forestry environments.

Global Harvester Heads Market Regional Analysis

The Asia-Pacific region dominated the global harvester heads market in 2024, accounting for approximately 39% of the total market share. This dominance is driven by large-scale forestry operations in countries like China and India, along with strong government subsidies promoting mechanization. The region also witnessed a sharp rise in exports, with over 292,000 harvester units shipped, 88% originating from China. Rapid urbanization and growing demand for efficient logging equipment continue to fuel Asia-Pacific’s leadership in this market. Also, Asia-Pacific benefits from a growing focus on sustainable forestry and modernization of timber harvesting practices. Manufacturers in the region are increasingly adopting advanced technologies to improve productivity in diverse and rugged terrains. Local production capabilities and expanding infrastructure further support market growth, making the region attractive for global investors and equipment suppliers. Harvester Heads Market Competitive Landscape The harvester heads market features intense competition among key players like John Deere, Komatsu Forest, Ponsse, Tigercat, and Logset, who dominate through technological leadership and strategic innovation. John Deere leads with its AI-powered Harvest Smart system, optimizing cut precision and fuel efficiency by 15-20%, while its strong dealer network ensures global service support. Komatsu Forest focuses on hybrid and electric harvester heads, aligning with sustainability trends, and integrates IoT for real-time fleet management, reducing downtime by 25%. Ponsse excels in modular, multi-functional designs, allowing quick attachment swaps for varying tree sizes, boosting operational flexibility in Scandinavian markets. Tigercat prioritizes durability and heavy-duty performance, using reinforced steel components that extend equipment life by 30%, making it preferred for rugged terrains in North America. Logset stands out with remote-controlled automation and lightweight composite materials, improving manoeuvrability in dense forests. These players maintain dominance through R&D investments, strategic OEM partnerships, and adaptability to regional logging demands, ensuring they meet the growing need for efficient, eco-friendly forestry solutions. Harvester Heads Market Key Trends 1. Rising Demand for Mechanized Forestry Operations Automated harvester heads improve productivity by 40-50% while reducing labour costs by up to 30%, particularly in North America and Europe, where over 65% of forestry operations now use mechanised harvesters. 2. Advancements in Cutting & Automation Technology Leading manufacturers like John Deere, Komatsu, and Ponsse are integrating AI-based sensors, IoT connectivity, and laser-guided cutting systems to enhance precision and reduce wood waste by 15-20%. Smart harvester heads now feature real-time data analytics, optimising tree selection and cutting patterns, improving the yield efficiency. 3. Shift Toward Eco-Friendly & Electric Harvesting Solutions Stricter emissions regulations (e.g., EU Stage V standards) are accelerating demand for low-emission and fully electric harvester heads. In Scandinavia, over 25% of new harvester heads sold are electric, driven by government incentives and sustainability goals. 4. Increased Focus on Durability & Multi-Functionality Next-gen harvester heads now feature hardened steel blades, reinforced hydraulic systems and adaptive gripping technology, increasing lifespan. Multi-tree processing capabilities allow simultaneous cutting and delimbing, reducing operational downtime. Leading models from Logset and Tigercat now offer interchangeable heads for different tree sizes, improving versatility. Harvester Heads Market Recent Development • On January 6, 2025, John Deere (USA) announced at CES 2025 the rollout of its second-generation autonomy kit (16-camera, AI + lidar), which can be retrofitted on existing tractors and enables fully autonomous operation for large-scale farming and orchard tractors. • May 5, 2021, Ponsse Plc (Finland) introduced the PONSSE H7 HD Euca, a heavy-duty harvester head tailored for eucalyptus processing, featuring robust rollers, an automated saw, and a durable structure. • April 2, 2025, Ponsse Plc (Finland) launched the PONSSE Greasing System, an automatic chainsaw lubrication system integrated with the Opti5G control interface, enhancing maintenance efficiency. • August 28, 2024, Komatsu Forest AB (Sweden) released the Komatsu C124 MY2025, featuring upgraded hydraulics, software-controlled knife pressure, and an advanced feed system for improved reliability and energy efficiencyHarvester Heads Market Scope: Inquire before buying

Harvester Heads Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.73 Bn. Forecast Period 2025 to 2032 CAGR: 4.51% Market Size in 2032: USD 6.73 Bn. Segments Covered: by Type 16 inches 20 inches Others by De-limbing Knives Three or below Between 3 to 5 More than 5 by Feed Seed Less than 5 m/sec More than 5 m/sec by Application Small Harvester Medium Harvester Huge Harvester Others Harvester Heads Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South America)Harvester Heads Market Key Players

North America 1. John Deere (USA) 2. Caterpillar Inc. (USA) 3. Tigercat Industries Inc. (Canada) 4. Weiler Forestry (USA) 5. Risley Equipment (Canada) Europe 6. Ponsse Plc (Finland) 7. Komatsu Forest AB (Sweden) 8. Logset Oy (Finland) 9. Rottne Industri AB (Sweden) 10. Kesla Oyj (Finland) 11. Waratah Forestry Equipment (Finland) 12. Eco Log Sweden AB (Sweden) 13. SP Maskiner AB (Sweden) 14. Sampo Rosenlew Ltd. (Finland) 15. Nisula Forest Oy (Finland) 16. Malwa Forest AB (Sweden) 17. AFM-Forest Ltd. (Finland) Asia Pacific 18. Sumitomo Heavy Industries (Japan) 19. Hitachi Construction Machinery (Japan) 20. Kubota Corporation (Japan) 21. Zhejiang SUPSTAR Machinery Co., Ltd. (China) Middle East & Africa 22. Bell Equipment Limited (South Africa) 23. Africa Biomass Company (South Africa) South America 24. GTS do Brasil (Brazil) 25. Stara S.A. (Brazil) 26. Semeato (Brazil) 27. Baldan Implementos Agrícolas (Brazil)Frequently Asked Questions:

1. What is the growth rate of the Global Harvester Heads Market? Ans. The Global Harvester Heads Market is growing at a CAGR of 4.51% during the forecasting period 2025-2032. 2. What is the scope of the Global Harvester Heads Market report? Ans. Global Harvester Heads Market report helps with the PESTEL, Porter's, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. Which region is expected to lead the global Harvester Heads market during the forecast period? Ans. Asia Pacific is expected to lead the global Harvester Heads market during the forecast period. 4. Who are the key players of the Global Harvester Heads Market? Ans. Key players in the Harvester Heads Market include John Deere, Caterpillar Inc., Ponsse Plc, Komatsu Forest AB, Tigercat Industries Inc., Waratah Forestry Equipment, and Logset Oy. 5. What segments are covered in the Global Harvester Heads Market report? Ans. The segments covered in the Global Harvester Heads market report are based on Type, De-limbing Knives, Feed Seed, Application, and Region.

1. Harvester Heads Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Harvester Heads Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Service Segment 2.4.4. End-User Segment 2.4.5. Revenue (2024) 2.4.6. Geographical Presence 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Harvester Heads Market: Dynamics 3.1. Region-wise Trends of Harvester Heads Market 3.1.1. North America Harvester Heads Market Trends 3.1.2. Europe Harvester Heads Market Trends 3.1.3. Asia Pacific Harvester Heads Market Trends 3.1.4. Middle East and Africa Harvester Heads Market Trends 3.1.5. South America Harvester Heads Market Trends 3.2. Harvester Heads Market Dynamics 3.2.1. Harvester Heads Market Drivers 3.2.1.1. Terrain-Based Customization 3.2.1.2. Advanced Delimbing Technology 3.2.2. Harvester Heads Market Restraints 3.2.3. Harvester Heads Market Opportunities 3.2.3.1. Forestry Equipment Innovation 3.2.3.2. Customized Harvester Heads 3.2.4. Harvester Heads Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1. Deforestation Regulations 3.4.2. Forestry Equipment Investment 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Harvester Heads Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Harvester Heads Market Size and Forecast, By Type (2024-2032) 4.1.1. 16 inches 4.1.2. 20 inches 4.1.3. Others 4.2. Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 4.2.1. Three or below 4.2.2. Between 3 to 5 4.2.3. More than 5 4.3. Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 4.3.1. Less than 5 m/sec 4.3.2. More than 5 m/sec 4.4. Harvester Heads Market Size and Forecast, By Application (2024-2032) 4.4.1. Small Harvester 4.4.2. Medium Harvester 4.4.3. Huge Harvester 4.4.4. Others 4.5. Harvester Heads Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Harvester Heads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Harvester Heads Market Size and Forecast, By Type (2024-2032) 5.1.1. 16 inches 5.1.2. 20 inches 5.1.3. Others 5.2. North America Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 5.2.1. Three or below 5.2.2. Between 3 to 5 5.2.3. More than 5 5.3. North America Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 5.3.1. Less than 5 m/sec 5.3.2. More than 5 m/sec 5.4. North America Harvester Heads Market Size and Forecast, By Application (2024-2032) 5.4.1. Small Harvester 5.4.2. Medium Harvester 5.4.3. Huge Harvester 5.4.4. Others 5.5. North America Harvester Heads Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Harvester Heads Market Size and Forecast, By Type (2024-2032) 5.5.1.1.1. 16 inches 5.5.1.1.2. 20 inches 5.5.1.1.3. Others 5.5.1.2. United States Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 5.5.1.2.1. Three or below 5.5.1.2.2. Between 3 to 5 5.5.1.2.3. More than 5 5.5.1.3. United States Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 5.5.1.3.1. Less than 5 m/sec 5.5.1.3.2. More than 5 m/sec 5.5.1.4. United States Harvester Heads Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. Small Harvester 5.5.1.4.2. Medium Harvester 5.5.1.4.3. Huge Harvester 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Harvester Heads Market Size and Forecast, By Type (2024-2032) 5.5.2.1.1. 16 inches 5.5.2.1.2. 20 inches 5.5.2.1.3. Others 5.5.2.2. Canada Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 5.5.2.2.1. Three or below 5.5.2.2.2. Between 3 to 5 5.5.2.2.3. More than 5 5.5.2.3. Canada Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 5.5.2.3.1. Less than 5 m/sec 5.5.2.3.2. More than 5 m/sec 5.5.2.4. Canada Harvester Heads Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. Small Harvester 5.5.2.4.2. Medium Harvester 5.5.2.4.3. Huge Harvester 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Harvester Heads Market Size and Forecast, By Type (2024-2032) 5.5.3.1.1. 16 inches 5.5.3.1.2. 20 inches 5.5.3.1.3. Others 5.5.3.2. Mexico Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 5.5.3.2.1. Three or below 5.5.3.2.2. Between 3 to 5 5.5.3.2.3. More than 5 5.5.3.3. Mexico Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 5.5.3.3.1. Less than 5 m/sec 5.5.3.3.2. More than 5 m/sec 5.5.3.4. Mexico Harvester Heads Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. Small Harvester 5.5.3.4.2. Medium Harvester 5.5.3.4.3. Huge Harvester 5.5.3.4.4. Others 6. Europe Harvester Heads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.2. Europe Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.3. Europe Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.4. Europe Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5. Europe Harvester Heads Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.1.2. United Kingdom Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.1.3. United Kingdom Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.1.4. United Kingdom Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.2.2. France Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.2.3. France Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.2.4. France Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.3.2. Germany Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.3.3. Germany Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.3.4. Germany Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.4.2. Italy Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.4.3. Italy Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.4.4. Italy Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.5.2. Spain Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.5.3. Spain Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.5.4. Spain Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.6.2. Sweden Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.6.3. Sweden Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.6.4. Sweden Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.7.2. Russia Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.7.3. Russia Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.7.4. Russia Harvester Heads Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Harvester Heads Market Size and Forecast, By Type (2024-2032) 6.5.8.2. Rest of Europe Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 6.5.8.3. Rest of Europe Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 6.5.8.4. Rest of Europe Harvester Heads Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Harvester Heads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.3. Asia Pacific Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.4. Asia Pacific Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Harvester Heads Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.1.2. China Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.1.3. China Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.1.4. China Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.2.2. S Korea Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.2.3. S Korea Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.2.4. S Korea Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.3.2. Japan Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.3.3. Japan Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.3.4. Japan Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.4.2. India Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.4.3. India Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.4.4. India Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.5.2. Australia Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.5.3. Australia Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.5.4. Australia Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.6.2. Indonesia Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.6.3. Indonesia Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.6.4. Indonesia Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.7.2. Malaysia Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.7.3. Malaysia Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.7.4. Malaysia Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.8.2. Philippines Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.8.3. Philippines Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.8.4. Philippines Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.9.2. Thailand Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.9.3. Thailand Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.9.4. Thailand Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.10.2. Vietnam Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.10.3. Vietnam Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.10.4. Vietnam Harvester Heads Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Harvester Heads Market Size and Forecast, By Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 7.5.11.3. Rest of Asia Pacific Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 7.5.11.4. Rest of Asia Pacific Harvester Heads Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Harvester Heads Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Harvester Heads Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 8.3. Middle East and Africa Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 8.4. Middle East and Africa Harvester Heads Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Harvester Heads Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Harvester Heads Market Size and Forecast, By Type (2024-2032) 8.5.1.2. South Africa Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 8.5.1.3. South Africa Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 8.5.1.4. South Africa Harvester Heads Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Harvester Heads Market Size and Forecast, By Type (2024-2032) 8.5.2.2. GCC Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 8.5.2.3. GCC Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 8.5.2.4. GCC Harvester Heads Market Size and Forecast, By Application (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Harvester Heads Market Size and Forecast, By Type (2024-2032) 8.5.3.2. Egypt Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 8.5.3.3. Egypt Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 8.5.3.4. Egypt Harvester Heads Market Size and Forecast, By Application (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Harvester Heads Market Size and Forecast, By Type (2024-2032) 8.5.4.2. Nigeria Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 8.5.4.3. Nigeria Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 8.5.4.4. Nigeria Harvester Heads Market Size and Forecast, By Application (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Harvester Heads Market Size and Forecast, By Type (2024-2032) 8.5.5.2. Rest of ME&A Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 8.5.5.3. Rest of ME&A Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 8.5.5.4. Rest of ME&A Harvester Heads Market Size and Forecast, By Application (2024-2032) 9. South America Harvester Heads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Harvester Heads Market Size and Forecast, By Type (2024-2032) 9.2. South America Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 9.3. South America Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 9.4. South America Harvester Heads Market Size and Forecast, By Application (2024-2032) 9.5. South America Harvester Heads Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Harvester Heads Market Size and Forecast, By Type (2024-2032) 9.5.1.2. Brazil Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 9.5.1.3. Brazil Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 9.5.1.4. Brazil Harvester Heads Market Size and Forecast, By Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Harvester Heads Market Size and Forecast, By Type (2024-2032) 9.5.2.2. Argentina Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 9.5.2.3. Argentina Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 9.5.2.4. Argentina Harvester Heads Market Size and Forecast, By Application (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Harvester Heads Market Size and Forecast, By Type (2024-2032) 9.5.3.2. Colombia Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 9.5.3.3. Colombia Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 9.5.3.4. Colombia Harvester Heads Market Size and Forecast, By Application (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Harvester Heads Market Size and Forecast, By Type (2024-2032) 9.5.4.2. Chile Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 9.5.4.3. Chile Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 9.5.4.4. Chile Harvester Heads Market Size and Forecast, By Application (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Harvester Heads Market Size and Forecast, By Type (2024-2032) 9.5.5.2. Rest Of South America Harvester Heads Market Size and Forecast, By De-limbing Knives (2024-2032) 9.5.5.3. Rest Of South America Harvester Heads Market Size and Forecast, By Feed Seed (2024-2032) 9.5.5.4. Rest Of South America Harvester Heads Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. John Deere (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Caterpillar Inc. (USA) 10.3. Tigercat Industries Inc. (Canada) 10.4. Weiler Forestry (USA) 10.5. Risley Equipment (Canada) 10.6. Ponsse Plc (Finland) 10.7. Komatsu Forest AB (Sweden) 10.8. Logset Oy (Finland) 10.9. Rottne Industri AB (Sweden) 10.10. Kesla Oyj (Finland) 10.11. Waratah Forestry Equipment (Finland) 10.12. Eco Log Sweden AB (Sweden) 10.13. SP Maskiner AB (Sweden) 10.14. Sampo Rosenlew Ltd. (Finland) 10.15. Nisula Forest Oy (Finland) 10.16. Malwa Forest AB (Sweden) 10.17. AFM-Forest Ltd. (Finland) 10.18. Sumitomo Heavy Industries (Japan) 10.19. Hitachi Construction Machinery (Japan) 10.20. Kubota Corporation (Japan) 10.21. Zhejiang SUPSTAR Machinery Co., Ltd. (China) 10.22. Bell Equipment Limited (South Africa) 10.23. Africa Biomass Company (South Africa) 10.24. GTS do Brasil (Brazil) 10.25. Stara S.A. (Brazil) 10.26. Semeato (Brazil) 10.27. Baldan Implementos Agrícolas (Brazil) 11. Key Findings 12. Industry Recommendations 13. Harvester Heads Market: Research Methodology