Gluten Free Food Market is projected to grow from USD 7.69 Bn. in 2024, reaching USD 14.64 Bn. in 2032 at a CAGR of 8.38%, driven by clean-label demand.Gluten Free Food Market Overview

Gluten Free food refers to products that do not contain gluten, a protein found in wheat, barley, and rye. These foods are essential for people with celiac disease or gluten sensitivity, as consuming gluten can cause digestive issues and other health problems. Examples include naturally Gluten Free foods like fruits, vegetables, and rice, as well as specially processed alternatives like Gluten Free bread or pasta. The Gluten Free food market is expanding rapidly, driven by growing health awareness, increased diagnoses of gluten-related disorders, and a rising preference for clean-label, healthier diets. North America leads the market, accounting for over half of global Gluten Free product launches. Europe follows with about 30%, supported by strict food labelling regulations. Supermarkets have responded to the trend, with 85% of U.S. grocery stores now dedicating shelf space to Gluten Free products. Some major players like General Mills and Kraft Heinz dominate the market through strong distribution networks and continuous product innovation. Emerging opportunities lie in plant-based Gluten Free options and the untapped Asia-Pacific region, where Gluten Free items currently make up less than 5% of packaged foods. The market continues to evolve, with improvements in product quality and increased accessibility for a broader consumer base.To know about the Research Methodology :- Request Free Sample Report

Global Gluten Free Food Market Dynamics

The rising numbers of irritable bowel syndrome (IBS) along with celiac disease are expected to boost the requirement for Gluten Free products across all developed and developing countries. The present occurrence of these diseases in developed countries, from North America and Europe, such as the United States, Canada, Germany, and France, might further market demand. Many consumers are driven by what encourages them to adopt Gluten Free diets for improved health, to adopt Gluten Free foods, which is a compulsory health necessity. It is also noted that people who are trying new foods such as paleo or keto because of current medical conditions, and those who want to live a Gluten Free lifestyle just because it makes them feel better, are the important drivers of market demand. As the world sees a change in consumers' access to healthy food, consumers now customize their shopping experience with technological advances for their nutritional needs. It has been a long time since consumers made it available to retailers, things as in-store nutritionists and colour-coded shelf tags showing nutritional properties of certain products, such as Healthy Heart or Gluten Free.However, these efforts rely heavily on sophisticated technology that allows for greater personalisation and customisation of consumer information to meet individual nutritional needs. This has played a major role in promoting Gluten Free products in the consumer diet. Technological trends, including product design, make Gluten Free products more palatable. Additionally, production processes are technologically advanced to reduce prices. New production processes include extrusion and annealing cooking that helps increase product durability and reduce cooking losses. An increase in obesity also drives the increase in demand for Gluten Free products. Therefore, pulses have become an adequate substitute for wheat in Gluten Free products. Market Growth Opportunities The Gluten Free food industry provides a good space to make products varied and new. There are chances to create fresh types of Gluten Free traditional food items, like bread, pasta, snacks, and desserts. It is possible to produce ready-to-eat meals along with convenience foods as well as beverages. The taste, texture, and nutritional value of Gluten Free products are being enhanced due to advancements in ingredients and methods used during manufacturing processes. This is making these items more appealing for a wider range of consumers. This holds especially true for areas that have less awareness and availability of products without gluten. There still exist chances to enter fresh markets by means such as efficient distribution channels, alliances with sellers, and marketing campaigns that are focused on teaching people about Gluten Free choices. Opportunities are found in targeting specific consumer groups within the Gluten Free market for specialised product offerings. Another potential growth area is creating Gluten Free foods that match additional dietary preferences, such as vegan, paleo, or low-carb diets. Targeted solutions for niche segments like children, athletes, and seniors who have gluten sensitivity or celiac disease could also spur growth. Teamwork between food makers, sellers, and health professionals helps to increase the market by making products more accessible to people who want Gluten Free choices while improving knowledge about this diet and its effects on health. Collaboration with food service providers, restaurants, and hospitality industries can broaden the and accessibility of menu items without gluten.

The production of Gluten Free products requires specialized ingredients and processes, resulting in increased manufacturing expenses in comparison to conventional products. Consequently, their retail prices are often elevated, potentially discouraging cost-conscious consumers from regularly purchasing them. This perception of premium items due to the higher costs restricts or limits the widespread use of the product. Although the Gluten Free Free Food Market has experienced growth, there exists a constrained assortment of products in contrast to prevalent food categories. This restraint induces a more restricted selection for individuals, ultimately impacting the overall appeal and acceptance of the market by consumers. The lack of diversity among Gluten Free options potentially causes consumer tiredness or apathy over an extended period. Even with a growing recognition of gluten-related medical issues, such as celiac disease and gluten sensitivity, there persists an ongoing necessity for educating consumers about Gluten Free diets and the products that are accessible. False information or ambiguity surrounding Gluten Free labelling and ingredients can generate impediments to adopting these diets and hinder the Gluten Free Free Food Market growth.

Gluten Free Food Market Segment Analysis

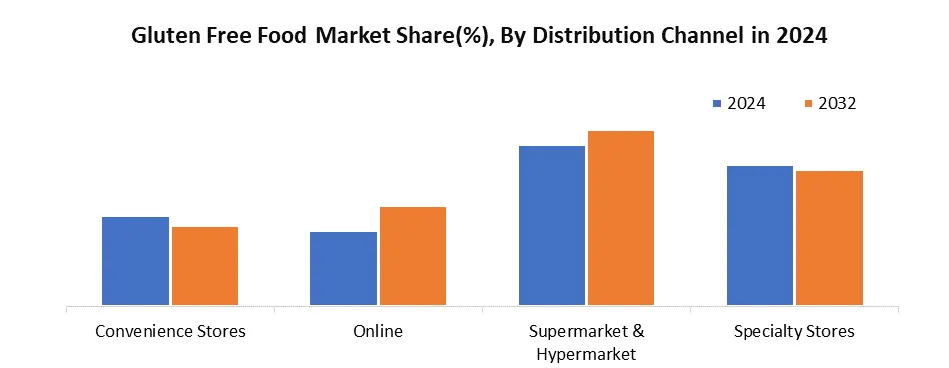

Based on the Products, the Bakery Products Segment held the largest market share of 29.3% in 2024 and is expected to maintain its dominance over the forecast period. The awareness about healthy eating is increasing that including natural, organic, and Gluten Free food is expected to drive partial growth. Features such as a portfolio of various products with innovative developments are expected to impact growth in the coming years. The growing demand for Gluten Free bread is the primary driver leading a portion of bakery production. To meet this growing demand, packaged bread producers, preeminent UK players, Warburtons, are developing brands that do not have their high-end brands, which are starting to appeal to consumers from all economic sectors. Several new bakery start-ups introduced Gluten Free bread, similar to Coconut Wraps by NUCO in the US, which is Gluten Free and explores all other health standards such as organic, raw, vegan, and paleo. These days, the growing awareness about the health benefits of baked goods and the city's rapid growth could continue to grow.Growing consumer awareness about health and natural health products contributes to developing new products in the sector. Growth in the development of marketing activities and improved distribution channels drive market growth. Bakers see this practice surpassing bread in products such as cakes, biscuits, cakes, pasta, and breakfast cereals. Gluten Free breakfast cereals are very popular, and General Mills Inc. makes up about 90% of all Cheerios' Gluten Free breakfast cereals. The trend of migration of Gluten Free foods from West to East has also led to a sharp increase in demand for baked goods in recent years. Based on the Distribution Channel, in the year 2024, the Supermarkets and Hypermarkets portion had the most significant part in revenue with 28.2%. The demand for supermarkets & hypermarkets is due to the availability of various items in one place, which is easily accessible for consumers to select products with several options. A growing number of seasonal displays, including Gluten Free products, led to the development of new products, thus increasing the segment. Supermarkets have the benefit of serving one big consumer base, making operations simpler in contrast to dealing with many smaller independent customers. Supermarkets & hypermarkets that can be accessed by a large number of consumers possess considerable sales volumes. The advantages provided by an online channel, such as purchasing from home, door delivery, free shipping, and discounts, are highly attractive to thousands of years and younger generations who select this segment. Furthermore, earlier retail costs were declining but still proving crucial for retailers' survival, making it clear that having a presence in internet retailing can be beneficial even when other channels show less profit.

Gluten Free Food Market Regional Analysis

North America dominated the Gluten Food Market by holding a significant revenue share of 38% in the year 2024. Gluten Free foods are expected to experience a surge in demand, particularly in the United States, due to their ability to mitigate digestive ailments, lower cholesterol levels, and combat obesity. The accessibility of these foods in grocery outlets is expected to further boost consumption rates. This growth is driven by increased public consciousness surrounding celiac disease, with individuals diagnosed with the illness adhering to a Gluten Free diet to avoid symptoms. Some individuals without a diagnosis also adopt a Gluten Free regimen for potential cardiovascular benefits. Asia Pacific growth is attributed to factors such as increased internet usage, a thriving e-commerce sector, and favorable census figures. Consumers in the region include those with celiac disease or gluten sensitivity, as well as health-conscious individuals seeking weight management through Gluten Free options. The implementation of innovative marketing tactics by leading manufacturers and increased consumption of nutritious food contribute to the potential for the growth of the Gluten Free food industry in this region. The Asia Pacific region is witnessing a surge in health and wellness. The market for health tourism in the region is growing, with an increase in expenses for health-related travel and the emergence of resorts catering to wellness-focused clientele. Bali and Vietnam are highlighted as notable locations within the region, with Bali offering a renowned local gastronomy that caters to Gluten Free preferences and Vietnam being a sought-after destination. Gluten Free Food Market Competitive Landscape The Gluten Free food market in 2024 is highly dynamic due to rising health awareness and increasing diagnoses of celiac disease and gluten sensitivity. Key players such as General Mills, Dr. Schär, and Hain Celestial Group are leading the market through product innovation, expanded Gluten Free lines, and strategic acquisitions. Companies like CJ CheilJedang and Freedom Foods are also enhancing their portfolios to cater to Asia-Pacific’s growing demand. Gluten Free food market competition is marked by a focus on clean labelling, taste improvement, and expanding retail and e-commerce channels globally. Companies are investing in R&D to improve taste and texture while maintaining nutritional value. Regional players are emerging, particularly in Europe and Asia-Pacific, further intensifying competition. Marketing strategies emphasize clean labelling, sustainability, and celebrity endorsements to attract health-conscious consumers. Private-label brands are also gaining traction, offering affordable alternatives. Overall, the Gluten Free food market remains dynamic, with innovation and consumer preferences shaping the competitive landscape. Gluten Free Food Market Key Trends 1. Mainstream Consumer Adoption Gluten Free food is no longer just for those with celiac disease. Health-conscious consumers are adopting it as part of a clean-eating lifestyle. This shift is expanding the market's customer base significantly. As a result, demand for Gluten Free alternatives in snacks, bakery, and ready meals has surged. 2. Sustainable Packaging and Smart Manufacturing Companies are integrating smart tech and eco-friendly packaging to stand out. Use of AI in supply chains helps manage allergens and improve traceability. Biodegradable and recyclable materials are being adopted for packaging. These practices align with consumer demand for sustainability. 3. Growth of Ready-to-Eat and Frozen Foods Busy lifestyles are fueling demand for convenient Gluten Free options. Ready-to-eat and frozen meals now form a large share of the Gluten Free segment. These products offer both time savings and dietary compliance. Popular examples include frozen pizzas, pre-cooked pasta, and microwaveable meals. Gluten Free Food Market Recent Development

Company Recent Development General Mills On March 19, 2025, in the FY2026 earnings call, General Mills announced increased marketing spend and continued focus on innovation, highlighting Cheerios Protein and Nature Valley Granola Protein products, aimed at accelerating organic growth. Dr. Schär On February 20, 2025, Dr. Schar announced a record global turnover of €676 million for 2024, marking an 11% increase year‑on‑year, driven by strong demand in Gluten Free nutrition. Hain Celestial On January 7, 2025, Hain launched a suite of certified Gluten Free, better-for-you snacks, including Garden Veggie chips, TERRA chips, and Earth’s Best organic puffs, strengthening its health-oriented lineup. CJ CheilJedang On April 24, 2024, CJ CheilJedang expanded its sauce portfolio by launching a reduced-sodium Haechandle gochujang (25% less sodium) and low-sodium Bibigo beef-bone soup, using fermentation tech for flavour retention. Gluten Free Food Market Scope: Inquiry Before Buying

Gluten Free Food Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 7.69 Bn. Forecast Period 2025 to 2032 CAGR: 8.38% Market Size in 2032: USD 14.64 Bn. Segments Covered: by Product Type Bakery Products Snacks and Ready to Eat Others by Distribution Channel Convenience Stores Online Supermarkets & Hypermarkets Specialty Stores Gluten Free Food Market, by region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand, Rest of Asia Pacific) Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of the Middle East &Africa) South America (Brazil, Argentina, Rest of South America)Gluten Free Food Market Key Players

North America 1. General Mills (USA) 2. Hain Celestial Group (USA) 3. The Kraft Heinz Company (USA) 4. Conagra Brands (USA) 5. Kellogg Company (USA) 6. Glutenull Bakery (Canada) Europe 7. Dr. Schär (Italy) 8. Warburtons (UK) 9. Bahlsen (Germany) 10. Groupe Léa Nature (France) 11. Genius Foods (UK) 12. BFree Foods (Ireland) Asia Pacific 13. Freedom Foods Group (Australia) 14. Bikano – Bikanervala Foods (India) 15. Kikkoman Corporation (Japan) 16. Wahaha Group (China) 17. CJ CheilJedang (South Korea) 18. Thai Union Group (Thailand) Middle East & Africa 19. Hunter Foods (UAE) 20. Nature’s Choice (South Africa) 21. Sugat Ltd. (Israel) 22. Halwani Bros. (Saudi Arabia) 23. Edita Food Industries (Egypt) South America 24. BRF S.A. (Brazil) 25. Molinos Río de la Plata (Argentina) 26. Carozzi S.A. (Chile) 27. Grupo Nutresa (Colombia)Frequently Asked Questions:

1] What segments are covered in the Global Gluten Free Food Market report? Ans. The segments covered in the Gluten Free Food Market report are based on Product Type, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Gluten Free Food Market? Ans. The North American region is expected to hold the highest share of the Gluten Free Food Market. 3] What is the market size of the Global Gluten Free Food Market by 2032? Ans. The market size of the Gluten Free Food Market by 2030 is expected to reach USD 14.64 Bn. 4] What is the forecast period for the Global Gluten Free Food Market? Ans. The forecast period for the Gluten Free Food Market is 2025-2032. 5] What was the market size of the Global Gluten Free Food Market in 2024? Ans. The market size of the Gluten Free Food Market in 2024 was valued at USD 7.69 Bn.

1. Gluten Free Food Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Gluten Free Food Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Service Segment 2.2.3. End-User Segment 2.2.4. Revenue (2024) 2.2.5. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Gluten Free Food Market: Dynamics 3.1. Gluten Free Food Market Trends 3.2. Gluten Free Food Market Dynamics 3.2.1. Drivers 3.2.1.1. Rising Prevalence of IBS and Celiac Disease 3.2.1.2. Rising Obesity Rates and Diet Trends 3.2.2. Restraints 3.2.3. Opportunities 3.2.3.1. Expansion of Product Range and Innovation 3.2.3.2. Food Service and Hospitality Integration 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Specialized Gluten Free ingredients 3.3.2. Technological improvements and product diversification 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Gluten Free Food Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Bakery Products 4.1.2. Snacks and Ready to Eat 4.1.3. Others 4.2. Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 4.2.1. Convenience Stores 4.2.2. Online 4.2.3. Supermarkets & Hypermarkets 4.2.4. Specialty Stores 4.3. Gluten Free Food Market Size and Forecast, By Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Gluten Free Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Bakery Products 5.1.2. Snacks and Ready to Eat 5.1.3. Others 5.2. North America Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 5.2.1. Convenience Stores 5.2.2. Online 5.2.3. Supermarkets & Hypermarkets 5.2.4. Specialty Stores 5.3. North America Gluten Free Food Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 5.3.1.1.1. Bakery Products 5.3.1.1.2. Snacks and Ready to Eat 5.3.1.1.3. Others 5.3.1.2. United States Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 5.3.1.2.1. Convenience Stores 5.3.1.2.2. Online 5.3.1.2.3. Supermarkets & Hypermarkets 5.3.1.2.4. Specialty Stores 5.3.2. Canada 5.3.2.1. Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 5.3.2.1.1. Bakery Products 5.3.2.1.2. Snacks and Ready to Eat 5.3.2.1.3. Others 5.3.2.2. Canada Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 5.3.2.2.1. Convenience Stores 5.3.2.2.2. Online 5.3.2.2.3. Supermarkets & Hypermarkets 5.3.2.2.4. Specialty Stores 5.3.3. Mexico 5.3.3.1. Mexico Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 5.3.3.1.1. Bakery Products 5.3.3.1.2. Snacks and Ready to Eat 5.3.3.1.3. Others 5.3.3.2. Mexico Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 5.3.3.2.1. Convenience Stores 5.3.3.2.2. Online 5.3.3.2.3. Supermarkets & Hypermarkets 5.3.3.2.4. Specialty Stores 6. Europe Gluten Free Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3. Europe Gluten Free Food Market Size and Forecast, by Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.1.2. United Kingdom Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.2. France 6.3.2.1. France Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.2.2. France Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.3.2. Germany Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.4.2. Italy Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.5.2. Spain Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.6.2. Sweden Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.7. Russia 6.3.7.1. Russia Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.7.2. Russia Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 6.3.8.2. Rest of Europe Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7. Asia Pacific Gluten Free Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3. Asia Pacific Gluten Free Food Market Size and Forecast, by Country (2024-2032) 7.3.1. China 7.3.1.1. China Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.1.2. China Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.2.2. S Korea Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.3.2. Japan Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.4. India 7.3.4.1. India Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.4.2. India Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.5.2. Australia Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.6.2. Indonesia Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.7. Malaysia 7.3.7.1. Malaysia Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.7.2. Malaysia Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.8. Philippines 7.3.8.1. Philippines Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.8.2. Philippines Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.9. Thailand 7.3.9.1. Thailand Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.9.2. Thailand Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.10. Vietnam 7.3.10.1. Vietnam Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.10.2. Vietnam Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 8. Middle East and Africa Gluten Free Food Market Size and Forecast (by Value in USD Billion) (2024-2032 8.1. Middle East and Africa Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 8.3. Middle East and Africa Gluten Free Food Market Size and Forecast, by Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 8.3.1.2. South Africa Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 8.3.2.2. GCC Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 8.3.3. Egypt 8.3.3.1. Egypt Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 8.3.3.2. Egypt Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 8.3.4. Nigeria 8.3.4.1. Nigeria Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 8.3.4.2. Nigeria Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 8.3.5. Rest of ME&A 8.3.5.1. Rest of ME&A Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 8.3.5.2. Rest of ME&A Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 9. South America Gluten Free Food Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032 9.1. South America Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 9.3. South America Gluten Free Food Market Size and Forecast, by Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 9.3.1.2. Brazil Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 9.3.2.2. Argentina Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 9.3.3. Colombia 9.3.3.1. Colombia Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 9.3.3.2. Colombia Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 9.3.4. Chile 9.3.4.1. Chile Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 9.3.4.2. Chile Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 9.3.5. Rest of South America 9.3.5.1. Rest of South America Gluten Free Food Market Size and Forecast, By Product Type (2024-2032) 9.3.5.2. Rest of South America Gluten Free Food Market Size and Forecast, By Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. The Kraft Heinz Company (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. General Mills (USA) 10.3. Hain Celestial Group (USA) 10.4. Conagra Brands (USA) 10.5. Kellogg Company (USA) 10.6. Glutenull Bakery (Canada) 10.7. Dr. Schär (Italy) 10.8. Warburtons (UK) 10.9. Bahlsen (Germany) 10.10. Groupe Léa Nature (France) 10.11. Genius Foods (UK) 10.12. BFree Foods (Ireland) 10.13. Freedom Foods Group (Australia) 10.14. Bikano – Bikanervala Foods (India) 10.15. Kikkoman Corporation (Japan) 10.16. Wahaha Group (China) 10.17. CJ CheilJedang (South Korea) 10.18. Thai Union Group (Thailand) 10.19. Hunter Foods (UAE) 10.20. Nature’s Choice (South Africa) 10.21. Sugat Ltd. (Israel) 10.22. Halwani Bros. (Saudi Arabia) 10.23. Edita Food Industries (Egypt) 10.24. BRF S.A. (Brazil) 10.25. Molinos Río de la Plata (Argentina) 10.26. Carozzi S.A. (Chile) 10.27. Grupo Nutresa (Colombia) 11. Key Findings 12. Industry Recommendations 13. Gluten Free Food Market: Research Methodology