Workspace as a service (WaaS) Market size was valued at USD 15.67 Bn. in 2023 and the total Insulation revenue is expected to grow by 13.9% from 2024 to 2030, reaching nearly USD 38.97 Bn.Workspace as a service (WaaS) Market Overview:

Users using Workspace as a Service can access business applications and corporate data from any location, at any time, using any mobile device. Workspace as a Service is a form of Virtual Desktop Infrastructure (VDI). WaaS enables enterprises to outsource their virtual desktop infrastructure to independent cloud service providers, whereas VDI hosts desktop operating systems on virtual machines that are housed on centralised servers within the organisation (CSPs). As a result, the employees can use their mobile devices to work from anywhere. Hardware, VDI software, desktop operating system, business apps, and corporate data can all be used to deliver WaaS. However, corporations outsource certain components to service providers rather than handling them fully in-house. Organizations will benefit from Workspace as a Service Solutions in a variety of ways, including reduced total cost of ownership, easier desktop maintenance, and enhanced flexibility and productivity.To know about the Research Methodology :- Request Free Sample Report Research Methodology: This report provides an analytical representation of the Workspace as a service (WaaS) Market as well as current trends and future forecasts to identify potential investment areas. Both primary and secondary data sources were comprehensively used in the Workspace as a service (WaaS) Market analysis. The report on various industry-affecting factors, such as government policy, the market environment, the competitive landscape, historical data, current market trends, technological development, upcoming technologies, and the technical advancement in related industries, as well as market risks, opportunities, barriers, and challenges, was a part of the research process. To obtain the final quantitative and qualitative data, every aspect that might have an impact on the markets covered by this report has been taken into account, examined in great detail, confirmed by primary research, and assessed. The market prediction takes into account the impact of other factors such as inflation, economic downturns, regulatory & policy changes, and sub-segment-level market size normalization. This information is merged with the publisher's thorough inputs and analysis to create the report. Scope of the Report: With an in-depth study and revenue forecast, the report defines and segments the WaaS market into numerous sub-segments. The Workspace as a Service Market's different drivers, opportunities, and challenges are also identified in the study, along with a technology roadmap and adoption patterns. The report's goal is to provide a thorough analysis of the workspace as a service (WaaS) market across the globe, taking into account all relevant industry players. The research analyses complex data in plain terms and presents the historical and current state of the industry together with forecasted market size and trends. The report analyses important companies, including market leaders, followers, and new entries, in detail and covers all areas of the industry. The research includes PORTER and PESTEL analysis with the possible influence of market micro-economic aspects. By examining market segmentation and forecasting market size, the report also aids in understanding the dynamics and structure of the global workspace as a service (WaaS) industry. The report serves as a resource for investors with its clear depiction of competitive analysis of leading companies by application, pricing, financial standing, product portfolio, growth strategies, and regional presence in the global workspace as a service (WaaS) market.

Workspace as a service (WaaS) Market Dynamics:

These days, the corporate climate is evolving quickly. Many companies across the globe now permitting their employees to use their own devices to access corporate IT whenever and wherever they choose, thanks to the growing demand for remote and device-independent access to business applications and corporate data. WaaS will help IT departments by lowering total cost of ownership and streamlining maintenance of infrastructure, such as servers and storage devices, by being offered as either a hosted on-premise solution or as a dedicated infrastructure using a third party infrastructure. Professional client computing is performed utilising Workspace as a Service (WaaS), a type of Virtual Desktop Infrastructure (VDI), in which users' desktop environments are offered via a network. As a result, the growing adoption of WaaS, is driving the market growth across the globe. The requirement for organisations to spend less on capital expenditures is one of the driving factors impacting the global workspace as a service (Waas) market. The workspace as a service (waas) market is about to experience growth as the sector provides hosted on-premises solutions and infrastructure with the backing of third party infrastructure. In addition, every individual user can access a virtual desktop, apps, or corporate data anytime, anywhere using smartphones, e-readers, or tablets thanks to the solutions and services in the worldwide workspaces as a service market. The WaaS market is being heavily stimulated globally by the need for organisations to reduce their capital expenditure. Bring your own device (BYOD), a global technology trend, enabling users to connect from any remote location across all areas. Because there are so many devices available, including smartphones, tablets, laptops, phablets, and many more, employees can access any business apps and data from any location at any time. Due to the growing acceptance of BYOD, it is expected that the Workspace as a Service market would experience significant growth. Businesses with numerous users registered onto the same virtual Windows server are made possible by WaaS solutions. WaaS providers handle resource provisioning, load balancing, and network difficulties, which eliminates the need for additional maintenance and associated expenditures for virtual desktop environments. WaaS has therefore become a viable option that meets the needs of businesses for desktop virtualization. Due to security issues, some businesses could find it vital to continue using their pre-WaaS devices, yet WaaS is still in demand. Due to recent international events, businesses are becoming more accepting of it, and employees like the flexibility of changing offices.Workspace as a service (WaaS) Market Segment Analysis:

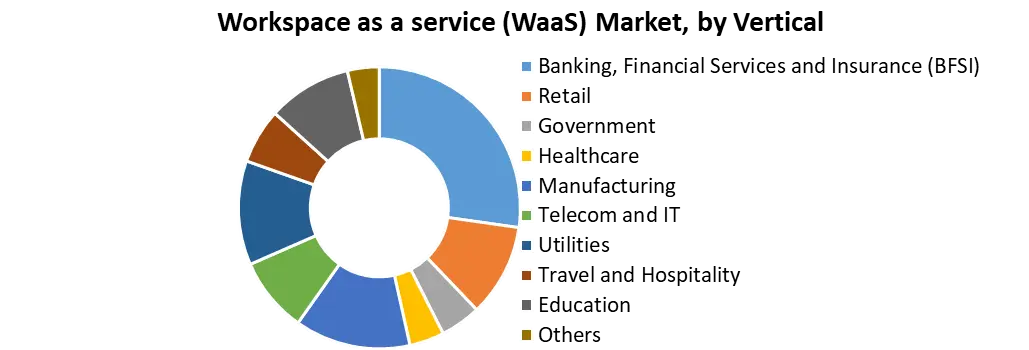

By solutions, VDI and Applications segment is expected to grow at a fastest CAGR through the forecast period. Thanks to the centralised system resources allocated to the virtual desktop as well as the desktop image's close proximity to back-end databases, storage repositories, and other resources, the VDI user experience is on par with or better than the physical workstation. Additionally, network traffic is greatly reduced and optimised using remote display protocols, allowing interactions such as screen paints, keyboard and mouse data, and other interactions to mimic the responsiveness of a local desktop. In addition, IT departments may be able to extend the life of otherwise outmoded PCs by reusing them as VDI endpoints because little actual computation occurs at the endpoint. When the need for new equipment arises, businesses can purchase thin clients and other end-user computing devices that are less expensive and less powerful. VDI offers considerable security advantages because all data resides in the data centre rather than on the device. Since no data is saved on the endpoint device, a criminal who steals a laptop from a VDI user is unable to access any of its contents. By Vertical, the Telecom and IT segment held the greatest market share accounting for 68 % in 2023. In addition, it is expected to experience the highest CAGR growth through the forecast period. BYOD and cloud computing have had significant market penetration in the telecom and IT sector. The Telecom and IT industry was a pioneer in WaaS adoption. Enterprises engaged in consulting and providing IT-based goods and services are included in the IT sector taken into account for the report. As a result, a large portion of their manufacturing assets are intangible and comprise a variety of businesses. Automation and the introduction of new apps and functionality are increasingly necessary since software applications enable firms to generate income from digital business channels. Due to the financial advantages of the cloud, this requirement has also prompted a switch.

Workspace as a service (WaaS) Market Regional Insights

The North America region has dominated the market with the largest share in 2023. With relatively high rates of BYOD, it is clear that the area needs to secure company data and discover economical solutions to manage IT installations. Using their own devices allows North America workers to save an average of 81 minutes every week. According to MMR Analysis, more than 65% of all North American businesses and workplaces adopted BYOD. These statistics show how BYOD is being used and how satisfied North America businesses are with it, giving market sellers some room to operate. Enterprise growth across the region is expected given the region's significant economic growth. As a result, the BYOD trend offers potential for market suppliers in addition to helping businesses develop.The demand for WaaS solutions in Asia Pacific are expected to rise as the number of small and medium-sized businesses increases in the region In addition, the region's high rate of mobile device adoption necessitates the use of WaaS solutions to improve system security, which is also expected to fuel the region's growth. Acquisitions Are Becoming a Common Expansion Method: The competitive landscape in the WaaS market is moderately concentrated, with both foreign and domestic firms contending for market share. Small- and medium-sized businesses are concentrating on the development of creative and cost-effective solutions, while the majority of the market's large enterprises are focused on securing their hold on an increasing number of verticals and regional markets. International corporations have started to acquire smaller businesses as a typical growth strategy.

Workspace as a service (WaaS) Market Scope: Inquire before buying

Global Workspace as a service (WaaS) Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 15.67 Bn. Forecast Period 2024 to 2030 CAGR: 13.9 % Market Size in 2030: USD 38.97 Bn. Segments Covered: by solutions VDI and Applications Desktop as a Service Hosted Applications (Unified Communication Applications) Security Solutions Others (Browser-based WaaS solutions) by Services System Integration Consulting services Managed services by Deployment Type Public Private Hybrid by End-User Enterprises Small and medium businesses(SMB) by Vertical Banking, Financial Services and Insurance (BFSI) Retail Government Healthcare Manufacturing Telecom and IT Utilities Travel and Hospitality Education Others Workspace as a service (WaaS) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Workspace as a service (WaaS) Market, Key Players

1. Amazon Web Services Inc. 2. Citrix Systems Inc. 3. VMware Inc. 4. Microsoft Corporation 5. IndependenceIT Corporation 6. Getronics Global Services BV 7. Dell Inc. 8. Unisys Corporation 9. Colt Group SA 10. Econocom Group SA/NV 11. ATSG 12. Cloud Jumper Corporation 13. Cloudalize 14. Colt Technology Services 15. dinCloud, Inc. 16. Dizzion Inc. 17. Evolve IP 18. Getronics NV 19. Google LLC FAQs: 1. What is the study period of the market? Ans. The Global Workspace as a service (WaaS) Market is studied from 2023-2030. 2. What is the growth rate of Workspace as a service (WaaS) Market? Ans. The Workspace as a service (WaaS) Market is growing at a CAGR of 13.9% over forecast period. 3. What is the market size of the Workspace as a service (WaaS) Market by 2030? Ans. The market size of the Information Technology Market by 2030 is expected to reach at USD 38.97 Bn. 4. What is the forecast period for the Workspace as a service (WaaS) Market? Ans. The forecast period for the Workspace as a service (WaaS) Market is 2024-2030. 5. What was the market size of the Workspace as a service (WaaS) Market in 2023? Ans. The market size of the Workspace as a service (WaaS) Market in 2023 was valued at USD 15.67 Bn.

1. Global Workspace as a service (WaaS) Market: Research Methodology 2. Global Workspace as a service (WaaS) Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Workspace as a service (WaaS) Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Workspace as a service (WaaS) Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Workspace as a service (WaaS) Market Segmentation 4.1 Global Workspace as a service (WaaS) Market, by Solutions (2023-2030) • VDI and Applications • Desktop as a Service • Hosted Applications (Unified Communication Applications) • Security Solutions • Others (Browser-based WaaS solutions) 4.2 Global Workspace as a service (WaaS) Market, by Services (2023-2030) • System Integration • Consulting services • Managed services 4.3 North America Workspace as a service (WaaS) Market, by Deployment Type (2023-2030) • Public • Private • Hybrid 4.4 North America Workspace as a service (WaaS) Market, by End-Users (2023-2030) • Enterprises • Small and medium businesses(SMB) 4.5 Global Workspace as a service (WaaS) Market, by Vertical (2023-2030) • Banking, Financial Services and Insurance (BFSI) • Retail • Government • Healthcare • Manufacturing • Telecom and IT • Utilities • Travel and Hospitality • Education • Others 5. North America Workspace as a service (WaaS) Market(2023-2030) 5.1 North America Workspace as a service (WaaS) Market, by Solutions (2023-2030) • VDI and Applications • Desktop as a Service • Hosted Applications (Unified Communication Applications) • Security Solutions • Others (Browser-based WaaS solutions) 5.2 North America Workspace as a service (WaaS) Market, by Services (2023-2030) • System Integration • Consulting services • Managed services 5.3 North America Workspace as a service (WaaS) Market, by Deployment Type (2023-2030) • Public • Private • Hybrid 5.4 North America Workspace as a service (WaaS) Market, by End-Users (2023-2030) • Enterprises • Small and medium businesses(SMB) 5.5 North America Workspace as a service (WaaS) Market, by Vertical (2023-2030) • Banking, Financial Services and Insurance (BFSI) • Retail • Government • Healthcare • Manufacturing • Telecom and IT • Utilities • Travel and Hospitality • Education • Others 5.6 North America Workspace as a service (WaaS) Market, by Country (2023-2030) • United States • Canada • Mexico 6. Europe Workspace as a service (WaaS) Market (2023-2030) 6.1. European Workspace as a service (WaaS) Market, by Solutions (2023-2030) 6.2. European Workspace as a service (WaaS) Market, by Services (2023-2030) 6.3. European Workspace as a service (WaaS) Market, by Deployment Type (2023-2030) 6.4. European Workspace as a service (WaaS) Market, by End-Users (2023-2030) 6.5. European Workspace as a service (WaaS) Market, by Vertical (2023-2030) 6.6. European Workspace as a service (WaaS) Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Workspace as a service (WaaS) Market (2023-2030) 7.1. Asia Pacific Workspace as a service (WaaS) Market, by Solutions (2023-2030) 7.2. Asia Pacific Workspace as a service (WaaS) Market, by Services (2023-2030) 7.3. Asia Pacific Workspace as a service (WaaS) Market, by Deployment Type (2023-2030) 7.4. Asia Pacific Workspace as a service (WaaS) Market, by End-Users (2023-2030) 7.5. Asia Pacific Workspace as a service (WaaS) Market, by Vertical (2023-2030) 7.6. Asia Pacific Workspace as a service (WaaS) Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Workspace as a service (WaaS) Market (2023-2030) 8.1 Middle East and Africa Workspace as a service (WaaS) Market, by Solutions (2023-2030) 8.2. Middle East and Africa Workspace as a service (WaaS) Market, by Services (2023-2030) 8.3. Middle East and Africa Workspace as a service (WaaS) Market, by Deployment Type (2023-2030) 8.4. Middle East and Africa Workspace as a service (WaaS) Market, by End-Users (2023-2030) 8.5. Middle East and Africa Workspace as a service (WaaS) Market, by Vertical (2023-2030) 8.6. Middle East and Africa Workspace as a service (WaaS) Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Workspace as a service (WaaS) Market (2023-2030) 9.1. South America Workspace as a service (WaaS) Market, by Solutions (2023-2030) 9.2. South America Workspace as a service (WaaS) Market, by Services (2023-2030) 9.3. South America Workspace as a service (WaaS) Market, by Deployment Type (2023-2030) 9.4. South America Workspace as a service (WaaS) Market, by End-Users (2023-2030) 9.5. South America Workspace as a service (WaaS) Market, by Vertical (2023-2030) 9.6. South America Workspace as a service (WaaS) Market, by Country (2023-2030) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Amazon Web Services Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Citrix Systems Inc. 10.3 VMware Inc. 10.4 Microsoft Corporation 10.5 IndependenceIT Corporation 10.6 Getronics Global Services BV 10.7 Dell Inc. 10.8 Unisys Corporation 10.9 Colt Group SA 10.10 Econocom Group SA/NV 10.11 ATSG 10.12 Cloud Jumper Corporation 10.13 Cloudalize 10.14 Colt Technology Services 10.15 dinCloud, Inc. 10.16 Dizzion Inc. 10.17 Evolve IP 10.18 Getronics NV 10.19 Google LLC