Wellhead Equipment Market: The Key to Operational Efficiency in Oil & Gas Wellhead Equipment Market to reach USD 10.34 Bn by 2032 from USD 7.5 Bn in 2025 at 4.7% CAGR.Wellhead Equipment Market Overview:

The Wellhead Equipment Market is critical in oil and gas operations, ensuring safe and efficient extraction from oil wells. As of 2024, global oil production reached 101 Billion barrels per day (mb/d), with offshore drilling contributing to 40% of this output. The Wellhead Equipment Market is projected to grow USD 10.34 billion by 2032, growing at a 4.7% CAGR from USD 7.5 billion in 2025. Technological advancements are driving the market, with 75% of wellhead systems expected to incorporate automation by 2025, reducing unplanned downtime 30-40%.To know about the Research Methodology: Request Free Sample Report

Key Highlights

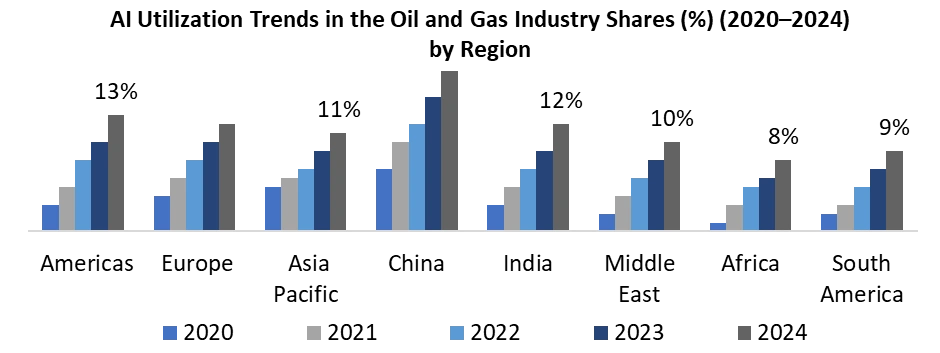

• The Asia-Pacific region is set to grow at 7.5% annually, with China contributing 15% to global demand. • 25% of wellhead equipment demand in the Middle East comes from offshore fields, mainly from Saudi Arabia and the UAE. • Major players like Schlumberger, Baker Hughes, and Halliburton dominate the market, with organized players holding around 60% market share by 2025. • Advancements in automation and subsea technology are driving market expansion, meeting rising global energy demands. • 89% of oil & gas companies are investing in data analytics to optimize wellhead equipment. • 25% improvement in operational efficiency globally due to automation in wellhead systems, including subsea wellheads. • The AI in oil & gas market is projected to reach USD 5.28 billion by 2030, enhancing predictive maintenance and real-time monitoring. • 80% of offshore platforms now use digital automation, improving safety and reliability of Blowout Preventers and Christmas Tree Wellheads. • Innovation in subsea wellhead systems is being driven by leading manufacturers, with increased adoption of IoT, AI, and advanced well integrity solutions, particularly in the Asia-Pacific region.

Wellhead Equipment Market Dynamics

Operational Efficiency Boosts Market Growth The oil prices averaging USD 65–70/bbl in 2025, wellhead equipment plays a crucial role in reducing operational costs. Automation and predictive maintenance reduce maintenance costs by 20% and extend equipment lifespan by 18%, improving efficiency in offshore, onshore, and subsea operations. Integration Challenges Limit Growth Despite the high ROI, around 30% of wellhead automation projects fail due to poor system integration, cybersecurity issues, and workforce resistance. These challenges are particularly significant in regions with legacy systems, such as Russia, Africa, and South America. AI and Autonomous Operations Create Opportunities By 2026, 60% of oil companies plan to adopt AI-driven wellhead systems. Emerging markets like India, China, and the Middle East are leading the adoption of automated wellhead systems, enabling real-time monitoring, predictive maintenance, and increased asset utilization. Wellhead Automation Adoption in Offshore Fields By 2025, approximately 80% of offshore platforms are expected to operate with digital automation systems, improving safety, reliability, and production efficiency in offshore wellhead operations.

Trend Description Rising Deepwater and Ultra-Deepwater Exploration Growing global investment in offshore energy projects—particularly in regions such as the Gulf of Mexico, Brazil, and West Africa—is driving demand for high-pressure, corrosion-resistant wellhead equipment. As shallow reserves mature, operators are increasingly moving toward deepwater and ultra-deepwater fields that require advanced wellhead systems capable of withstanding extreme subsea conditions. Increasing Adoption of Modular and Compact Wellhead Systems Oilfield operators are increasingly adopting modular, pre-assembled, and compact wellhead systems to reduce rig time, enhance operational efficiency, and lower costs. These systems simplify installation, minimize downtime, and enable faster deployment across both onshore and offshore wells. The heightened focus on cost optimization and operational efficiency, particularly following oil price volatility, is accelerating this trend. Growing Focus on Digitalization and Predictive Maintenance Digital technologies—including IoT sensors, AI-driven analytics, and real-time monitoring—are transforming wellhead equipment operations. Predictive maintenance capabilities allow operators to identify potential failures before they occur, reducing downtime and extending equipment life. Increasing investments in digital wellhead solutions are also helping operators optimize production, meet stricter environmental regulations, and enhance drilling safety.

Well Head Equipment Market Segment Analysis:

By Type: The market is divided into Conventional Wellhead, Subsea Wellhead, Dual Completion Wellhead, Unitized / Integrated Wellhead Systems, and Others (Custom & HPHT-specific designs). Among these, the Conventional Wellhead segment held the largest market share in 2025 due to its cost-effectiveness, simplicity, and reliability in onshore applications. These wellheads are widely used in mature oil fields and less complex environments, making them the preferred choice for many onshore oil and gas operators. Conventional wellheads are particularly popular in low-pressure fields, offering ease of installation and maintenance, which are crucial for maintaining operational efficiency in production fields.The Subsea Wellhead segment is the fastest-growing in the Wellhead Equipment Market, projected to grow at the highest annual growth rate through 2032. This growth is driven by the rising demand for offshore oil and gas exploration, particularly in deepwater and ultra-deepwater fields.

Well Head Equipment Market Regional Analysis:

North America held the largest market share around 37% in 2025, driven by: • Extensive shale oil and gas developments. • High offshore activity in the Gulf of Mexico. • Investments in digital and automated wellhead systems. • Ongoing modernisation of aging assets in the region. Asia-Pacific is the Fastest-Growing Region in the Wellhead Equipment Market: • Expanding oil & gas exploration, offshore drilling, and increasing energy consumption. • Significant investments in subsea wellhead systems and wellhead automation. • Modernization of oilfield infrastructure in China, India, and Australia. • Strong regional demand for advanced wellhead technologies, driving the adoption of automation and subsea systems. Proven Oil Reserves in Major Country in 2024In the Middle East & Africa, countries like Saudi Arabia, UAE, Nigeria, and Angola are heavily investing in advanced wellhead technologies. These investments are aimed at supporting offshore exploration and the deployment of high-pressure wellhead systems, which are crucial for increasing production and improving reliability in challenging offshore environments.

Proven Natural Gas Reserves in Major Country in 2024 Russia leads with 48,960 billion cubic meters, followed by the United States with 17,912 billion cubic meters, and Saudi Arabia with 9,727 billion cubic meters. Other significant countries include Qatar and Iran, further highlighting the global distribution of natural gas reserves. Recent Development in Wellhead Equipment Market: In May 2025, SLB introduced its Electris digitally enabled well solutions, bringing real-time monitoring and predictive analytics into completions and wellhead systems to optimize production. TechnipFMC continues to expand its subsea wellhead portfolio, focusing on modular, compact systems that cut installation time and costs, particularly in deepwater environments. In June 2025, Baker Hughes and Cactus, Inc. declared a landmark joint venture in surface pressure control (SPC) services, signalling a major shift in the global wellhead equipment landscape. Under the deal, Cactus will assume operational control with a 65% ownership stake, while Baker Hughes retains 35%, ensuring strategic alignment with its portfolio optimisation strategy.

Wellhead Equipment Market Report Scope: Inquire before buying

Global Wellhead Equipment Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 7.5 Bn. Forecast Period 2026 to 2032 CAGR: 4.5% Market Size in 2032: USD 10.34 Bn. Segments Covered: by Type Conventional Wellhead Subsea Wellhead Dual Completion Wellhead Unitized / Integrated Wellhead Systems Others (Custom & HPHT-specific designs) by Component Casing Heads Casing Spools Tubing Heads Casing Hangers Tubing Hangers Secondary & Metal-to-Metal Seals Christmas Trees (Surface & Subsea) Valves (Gate, Choke, Ball) Actuators & Control Systems by Pressure Rating Low pressure (up to 3,000 psi) Medium pressure (3,000- 10,000 psi) High Pressure (Above 10,000 psi) by Well Type Oil Gas Geothermal CCS & Hydrogen Storage Wells by Application Onshore Offshore Wellhead Equipment Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Well Head Equipment Market, Key Players

1. Schlumberger N.V. 2. Baker Hughes Company 3. Weatherford International plc 4. Halliburton Company 5. National Oilwell Varco (NOV) 6. TechnipFMC 7. Oil States International, Inc. 8. Forum Energy Technologies 9. Weir Group PLC 10. Delta Corporation 11. Stream Flo Industries Ltd. 12. Cactus Wellhead LLC 13. Great Lakes Wellhead, Inc. 14. Integrated Equipment, Inc. 15. Jereh Group / Jereh Oilfield Equipment 16. Jiangsu Sanyi Petroleum Equipment Co., Ltd. 17. JMP Petroleum Technologies, Inc. 18. MSP/Drilex, Inc. 19. Sunnda Corporation 20. UZTEL S.A. 21. Oilfield Services, Inc. (OSI) 22. Flowserve Corporation 23. Wellhead Systems, Inc. 24. Dril Quip (part of SLB / Innovex) 25. Prysmian Group 26. Vallourec 27. Tenaris 28. Wood PLC 29. Superior Energy Services 30. Aker Solutions FAQ 1. What factors are driving the growing demand for advanced wellhead equipment in offshore and deepwater drilling? Answer: The increasing complexity of offshore and deepwater drilling, driven by the depletion of onshore resources and the need for new reserves, is a major factor. 2. How is the adoption of automation and digitalization in wellhead systems impacting operational efficiency and safety in the oil and gas industry? Answer: Automation and digitalization are enhancing operational efficiency by allowing for real-time monitoring, predictive maintenance, and remote diagnostics, leading to reduced downtime and maintenance costs. 3. What role do environmental regulations play in shaping the design and manufacturing of wellhead equipment? Are companies adapting quickly enough to meet stricter emission standards? Answer: Manufacturers are focusing on energy-efficient equipment and designs that prevent leaks and spills, especially in sensitive offshore environments. While larger companies have made strides, some smaller manufacturers may struggle to keep up with rapid regulatory changes. 4. Which regions are likely to experience the highest growth in wellhead equipment demand, and what factors are contributing to this regional growth? Answer: Asia-Pacific, particularly China and India, is expected to see the highest growth due to rising energy demands, oil and gas exploration, and rapid industrialization. North America, especially the U.S., driven by shale oil production and offshore drilling in the Gulf of Mexico, also presents significant growth opportunities.

1. Well Head Equipment Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Well Head Equipment Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2025 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Well Head Equipment Market: Dynamics 3.1. Well Head Equipment Market Trends 3.2. Well Head Equipment Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Technology & Material Insights 4.1. Comparison of material types 4.2. Performance differentiation parameters 4.3. Material innovations for HPHT and sour gas applications 4.4. Longevity, maintenance, and serviceability 4.5. Compatibility with onshore and offshore operations 4.6. Emerging technologies and smart wellheads 4.7. Thermal, chemical, and mechanical resistance benchmarking 5. Application Analysis 5.1. Role in drilling and well completion 5.2. Application in oil and gas production operations 5.3. Use in high-pressure and sour service wells 5.4. Process optimization and downtime reduction 5.5. Impact on safety and regulatory compliance 5.6. Integration with upstream production systems 6. Cost, ROI & Operational Efficiency 6.1. Total cost of ownership 6.2. ROI comparison by well type 6.3. Operational efficiency metrics 6.4. Cost impact of wear and component failure 6.5. Payback period analysis 6.6. Advanced vs conventional wellhead systems 6.7. Energy and resource efficiency 7. Sustainability & Environmental Impact 7.1. Environmental footprint of materials 7.2. Emission control and leak prevention 7.3. Energy efficiency in operations 7.4. Environmental compliance standards 7.5. Reusable and modular component impact 7.6. Circular economy initiatives 7.7. Impact on spill and contamination risk 8. Supply Chain & Procurement Analysis 8.1. Supplier concentration and OEM dominance 8.2. Lead time and delivery benchmarking 8.3. Raw material dependency risks 8.4. Strategic sourcing of high-spec components 8.5. Vendor evaluation criteria 8.6. Impact of logistics disruptions 8.7. Procurement best practices 9. Operational Performance & Reliability 9.1. Lifecycle performance metrics 9.2. Pressure integrity consistency 9.3. Load and stress handling capability 9.4. Downtime due to failures or maintenance 9.5. Reliability in extreme operating conditions 9.6. Preventive maintenance benchmarking 9.7. Correlation with production uptime 10. Regulatory Compliance & Quality Standards 10.1. Industry standards and certifications 10.2. Offshore and safety compliance requirements 10.3. Validation and testing protocols 10.4. Regional regulatory impact on design 10.5. Quality assurance metrics 10.6. Audit readiness and inspection support 10.7. Certification trends 11. Well Head Equipment Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 11.1. Well Head Equipment Market Size and Forecast, By Type (2025-2032) 11.1.1. Conventional Wellhead 11.1.2. Subsea Wellhead 11.1.3. Dual Completion Wellhead 11.1.4. Unitized / Integrated Wellhead Systems 11.1.5. Others (Custom & HPHT-specific designs) 11.2. Well Head Equipment Market Size and Forecast, By Component (2025-2032) 11.2.1. Casing Heads 11.2.2. Casing Spools 11.2.3. Tubing Heads 11.2.4. Casing Hangers 11.2.5. Tubing Hangers 11.2.6. Secondary & Metal-to-Metal Seals 11.2.7. Christmas Trees (Surface & Subsea) 11.2.8. Valves (Gate, Choke, Ball) 11.2.9. Actuators & Control Systems 11.3. Well Head Equipment Market Size and Forecast, By Pressure Rating (2025-2032) 11.3.1. Low pressure (up to 3,000 psi) 11.3.2. Medium pressure (3,000- 10,000 psi) 11.3.3. High Pressure (Above 10,000 psi) 11.4. Well Head Equipment Market Size and Forecast, By Well Type (2025-2032) 11.4.1. Oil 11.4.2. Gas 11.4.3. Geothermal 11.4.4. CCS & Hydrogen Storage Wells 11.5. Well Head Equipment Market Size and Forecast, By Application (2025-2032) 11.5.1. Onshore 11.5.2. Offshore 11.6. Well Head Equipment Market Size and Forecast, By Region (2025-2032) 11.6.1. North America 11.6.2. Europe 11.6.3. Asia Pacific 11.6.4. Middle East and Africa 11.6.5. South America 12. North America Well Head Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 12.1. North America Well Head Equipment Market Size and Forecast, By Type (2025-2032) 12.2. North America Well Head Equipment Market Size and Forecast, By Component (2025-2032) 12.3. North America Well Head Equipment Market Size and Forecast, By Pressure Rating (2025-2032) 12.4. North America Well Head Equipment Market Size and Forecast, By Well Type (2025-2032) 12.5. North America Well Head Equipment Market Size and Forecast, By Application (2025-2032) 12.6. North America Well Head Equipment Market Size and Forecast, by Country (2025-2032) 12.6.1. United States 12.6.2. Canada 12.6.3. Mexico 13. Europe Well Head Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 13.1. Europe Well Head Equipment Market Size and Forecast, By Type (2025-2032) 13.2. Europe Well Head Equipment Market Size and Forecast, By Component (2025-2032) 13.3. Europe Well Head Equipment Market Size and Forecast, By Pressure Rating (2025-2032) 13.4. Europe Well Head Equipment Market Size and Forecast, By Well Type (2025-2032) 13.5. Europe Well Head Equipment Market Size and Forecast, By Application (2025-2032) 13.6. Europe Well Head Equipment Market Size and Forecast, by Country (2025-2032) 13.6.1. United Kingdom 13.6.2. France 13.6.3. Germany 13.6.4. Italy 13.6.5. Spain 13.6.6. Sweden 13.6.7. Russia 13.6.8. Rest of Europe 14. Asia Pacific Well Head Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 14.1. Asia Pacific Well Head Equipment Market Size and Forecast, By Type (2025-2032) 14.2. Asia Pacific Well Head Equipment Market Size and Forecast, By Component (2025-2032) 14.3. Asia Pacific Well Head Equipment Market Size and Forecast, By Pressure Rating (2025-2032) 14.4. Asia Pacific Well Head Equipment Market Size and Forecast, By Well Type (2025-2032) 14.5. Asia Pacific Well Head Equipment Market Size and Forecast, By Application (2025-2032) 14.6. Asia Pacific Well Head Equipment Market Size and Forecast, by Country (2025-2032) 14.6.1. China 14.6.2. S Korea 14.6.3. Japan 14.6.4. India 14.6.5. Australia 14.6.6. Indonesia 14.6.7. Malaysia 14.6.8. Philippines 14.6.9. Thailand 14.6.10. Vietnam 14.6.11. Rest of Asia Pacific 15. Middle East and Africa Well Head Equipment Market Size and Forecast (by Value in USD Billion) (2025-2032) 15.1. Middle East and Africa Well Head Equipment Market Size and Forecast, By Type (2025-2032) 15.2. Middle East and Africa Well Head Equipment Market Size and Forecast, By Component (2025-2032) 15.3. Middle East and Africa Well Head Equipment Market Size and Forecast, By Pressure Rating (2025-2032) 15.4. Middle East and Africa Well Head Equipment Market Size and Forecast, By Well Type (2025-2032) 15.5. Middle East and Africa Well Head Equipment Market Size and Forecast, By Application (2025-2032) 15.6. Middle East and Africa Well Head Equipment Market Size and Forecast, by Country (2025-2032) 15.6.1. South Africa 15.6.2. GCC 15.6.3. Egypt 15.6.4. Nigeria 15.6.5. Rest of ME&A 16. South America Well Head Equipment Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 16.1. South America Well Head Equipment Market Size and Forecast, By Type (2025-2032) 16.2. South America Well Head Equipment Market Size and Forecast, By Component (2025-2032) 16.3. South America Well Head Equipment Market Size and Forecast, By Pressure Rating (2025-2032) 16.4. South America Well Head Equipment Market Size and Forecast, By Well Type (2025-2032) 16.5. South America Well Head Equipment Market Size and Forecast, By Application (2025-2032) 16.6. South America Well Head Equipment Market Size and Forecast, by Country (2025-2032) 16.6.1. Brazil 16.6.2. Argentina 16.6.3. Colombia 16.6.4. Chile 16.6.5. Rest Of South America 17. Company Profile: Key Players 17.1. Schlumberger N.V. 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Financial Overview 17.1.4. SWOT Analysis 17.1.5. Strategic Analysis 17.1.6. Recent Developments 17.2. Baker Hughes Company 17.3. Weatherford International plc 17.4. Halliburton Company 17.5. National Oilwell Varco (NOV) 17.6. TechnipFMC 17.7. Oil States International, Inc. 17.8. Forum Energy Technologies 17.9. Weir Group PLC 17.10. Delta Corporation 17.11. Stream Flo Industries Ltd. 17.12. Cactus Wellhead LLC 17.13. Great Lakes Wellhead, Inc. 17.14. Integrated Equipment, Inc. 17.15. Jereh Group / Jereh Oilfield Equipment 17.16. Jiangsu Sanyi Petroleum Equipment Co., Ltd. 17.17. JMP Petroleum Technologies, Inc. 17.18. MSP/Drilex, Inc. 17.19. Sunnda Corporation 17.20. UZTEL S.A. 17.21. Oilfield Services, Inc. (OSI) 17.22. Flowserve Corporation 17.23. Wellhead Systems, Inc. 17.24. Dril Quip (part of SLB / Innovex) 17.25. Prysmian Group 17.26. Vallourec 17.27. Tenaris 17.28. Wood PLC 17.29. Superior Energy Services 17.30. Aker Solutions 18. Key Findings 19. Analyst Recommendations 20. Well Head Equipment Market: Research Methodology