Vehicle-To-Grid Technology Market was valued at USD 4.25 Bn. in 2024 and the total Global Vehicle-To-Grid Technology Market revenue is Expected to grow at a CAGR of 23.2% from 2025 to 2032 reaching nearly USD 22.56 Bn. by 2032. Vehicle-to-grid (V2G) technology enables electric vehicles (EVs) to interact with the power grid, allowing them to both draw electricity from the grid to charge their batteries and to discharge electricity back to the grid, providing grid services such as demand response, peak shaving, and energy storage. The Vehicle-To-Grid Technology Market is expected rapid growth driven by the concept of Grid to Vehicle (G2V), which facilitates smart charging schedules to control EV battery charging rates based on grid demand. G2V enables unidirectional power flow between the grid and EVs, optimizing power grid operations by providing auxiliary services such as spinning reserve and power grid control.To know about the Research Methodology:-Request Free Sample Report The implementation of G2V requires energy trading policies between EV owners and power utilities to incentivize off-peak charging, reducing peak-hour loads and maximizing system profits. However, V2G services, including peak load shaving and voltage control, are crucial for grid stability but are currently limited. Vehicle-To-Grid Technology Market developments include notable mergers and acquisitions, such as Hitachi's acquisition of a majority stake in ABB Power Grids, and partnerships such as The Lion Electric Co. and Nuvve Corporation's collaboration on V2G technology. Additionally, new launches like Boulder Electric Vehicle's testing of vehicle-to-grid technology demonstrate the growing momentum in this sector, indicating a promising future for V2G technology as a key player in enhancing grid flexibility and sustainability.

Vehicle-To-Grid Technology Market Dynamics:

Increasing EV Adoption Rates Globally are Expanding the Pool of Vehicles Available for Vehicle-To-Grid (V2G) Programs, Enhancing Grid Stability The increasing adoption of electric vehicles (EVs) globally, particularly in countries like Norway and China, is expanding the pool of vehicles available to participate in V2G programs, thereby enhancing grid stability. Government initiatives and incentives, such as subsidies for EV purchases and tax credits, further stimulate demand for V2G solutions, while advancements in smart grid infrastructure facilitate seamless integration of V2G systems into existing grid networks. Moreover, the growing focus on grid resilience, driven by concerns over extreme weather events and grid disruptions, is prompting utilities to invest in V2G technology as a means to improve grid reliability during emergencies. Environmental sustainability goals and ambitious renewable energy targets are driving the adoption of V2G technology worldwide, with countries like Germany leveraging V2G solutions to support renewable energy integration and reduce reliance on fossil fuels. Ongoing technological innovations in battery storage, vehicle-to-grid communication protocols, and software algorithms are also enhancing the efficiency and performance of V2G systems, while partnerships and collaborations between automotive manufacturers, energy companies, and technology providers are fostering innovation and Vehicle-To-Grid Technology Market growth. Furthermore, emerging markets with growing EV adoption rates, such as India and Brazil, present significant opportunities for V2G technology providers to capitalize on, further driving industry growth and Vehicle-To-Grid Technology Market growth.Inadequate charging infrastructure and grid connectivity hinder access to V2G services, particularly in regions with insufficient infrastructure The Vehicle-To-Grid Technology Market faces several restraints and challenges that impede its widespread adoption and growth. Infrastructure limitations, such as inadequate charging infrastructure and grid connectivity, hinder access to V2G services for EV owners in regions with insufficient infrastructure. Moreover, concerns about battery degradation due to frequent cycling in V2G applications raise questions about long-term battery health, as demonstrated by Nissan's V2G pilot project in Denmark. Regulatory hurdles and lack of standardized protocols further complicate V2G integration, creating uncertainties for stakeholders and slowing Vehicle-To-Grid Technology Market development. Additionally, limited consumer awareness and education about V2G technology, coupled with security and privacy concerns surrounding data exchange between EVs and the grid, pose significant barriers to market acceptance and adoption. Interoperability challenges stemming from the absence of standardized communication protocols between V2G systems and various EV models hinder system integration and scalability. Economic viability remains a concern due to high upfront costs of V2G infrastructure installation and uncertainties surrounding revenue streams and return on investment (ROI) for V2G projects. Grid stability and reliability issues arise from integrating large numbers of EVs into the grid for V2G services, potentially exacerbating grid congestion and voltage fluctuations without proper grid management. Limited scalability, technological complexity, and the need for sophisticated technical expertise further exacerbate implementation challenges, delaying deployment and increasing project costs.

Vehicle-To-Grid Technology Market Segment Analysis:

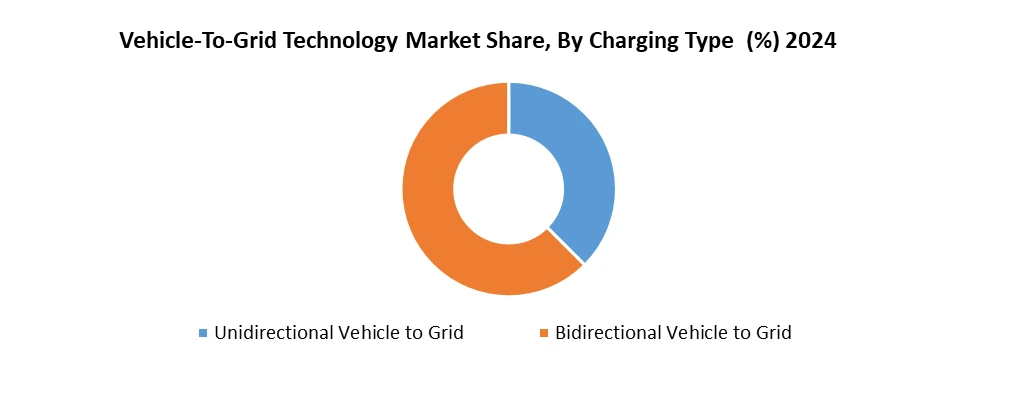

Based on Type, Unidirectional V2G systems primarily enable electric vehicles (EVs) to discharge electricity back to the grid, providing grid services such as demand response and peak shaving. These systems are widely adopted in applications where grid stabilization and ancillary services are paramount, such as in regions with high renewable energy penetration. On the other hand, bidirectional V2G systems allow for both charging and discharging of EV batteries, offering greater flexibility and potential revenue streams for EV owners through participation in energy markets and grid services. Bidirectional V2G technology is gaining traction in markets where grid integration and energy trading are prioritized, fostering innovation and Vehicle-To-Grid Technology Market growth. Based on Application the Market is segmented into Peak Power Sales, Spinning Reserves, Base Load Power, Reactive Power and Others. Peak to Power Sales segment dominated the market in 2024 and is expected to hold largest share during the forecast period. Dominance due to increasing need to manage high energy demand during peak load periods. V2G systems allow electric vehicles to discharge stored energy back into the grid, helping utilities meet short-term surges without investing in additional infrastructure. This not only stabilizes the grid but also creates a revenue stream for EV owners and fleet operators, making it a financially viable and scalable application for early V2G adoption.]

Vehicle-To-Grid Technology Market Regional Insights:

North America Dominated the Vehicle-To-Grid Technology Market The Vehicle-To-Grid Technology Market exhibits diverse regional dynamics, driven by varying regulatory landscapes, infrastructure development, and market maturity. In North America, particularly in the United States, robust government support and favorable policies, such as tax incentives for electric vehicle (EV) adoption and grid modernization initiatives, stimulate Vehicle-To-Grid Technology Market growth. Strategic collaborations between automotive manufacturers, utilities, and technology providers propel innovation and deployment of V2G solutions. In Europe, stringent emissions regulations and ambitious renewable energy targets drive demand for V2G technology, with countries like Germany and the UK leading in V2G adoption and deployment. The European Union's clean energy initiatives and funding programs further accelerate V2G market development. In the Asia-Pacific region, rapid urbanization, increasing EV adoption, and investments in smart grid infrastructure fuel V2G market growth. Countries like China and Japan are at the forefront of V2G innovation, leveraging government incentives and industry partnerships to advance V2G deployment. Emerging markets in Southeast Asia, such as Singapore and Thailand, present untapped opportunities for V2G technology adoption, driven by growing awareness of energy sustainability and grid resilience. Vehicle-To-Grid Technology Market Competitive Landscape: The Vehicle-To-Grid Technology Market is characterized by strategic partnerships, collaborations, and product innovations driving competitive dynamics. Notably, in November 2020, The Lion Electric Co. partnered with Nuvve Corporation to integrate V2G technology into Lion's zero-emission school buses, allowing dynamic energy storage and discharge. This collaboration underscores the trend towards incorporating V2G capabilities as a standard feature in electric vehicle offerings. Furthermore, Boulder Electric Vehicle's launch of its V2G technology in December 2020 signifies a significant product expansion, with the company testing bidirectional electric vehicle charging systems to reduce energy loads and utility expenses. Additionally, mergers and acquisitions contribute to Vehicle-To-Grid Technology Market consolidation, as demonstrated by Hitachi's acquisition of a majority stake in ABB Power Grids in July 2020. These key developments underscore the industry's focus on technological innovation, strategic partnerships, and Vehicle-To-Grid Technology Market growth to capitalize on the growing demand for V2G solutions globally.Vehicle-To-Grid Technology Market Scope:Inquire before buying

Global Vehicle-To-Grid Technology Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.25 Bn. Forecast Period 2025 to 2032 CAGR: 23.2% Market Size in 2032: USD 22.56 Bn. Segments Covered: by Charging Type Unidirectional Vehicle to Grid Bidirectional Vehicle to Grid by Vehicle Type Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) by Component Smart Meters Electric Vehicle Supply Equipment (EVSE) Software Home Energy Management (HEM) Systems by Application Peak Power Sales Spinning Reserves Base Load Power Reactive Power Others by End User Residential Commercial Industrial Vehicle-To-Grid Technology Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vehicle-To-Grid Technology Market Key Players:

Major Contributors in the Vehicle-To-Grid Technology Industry in North America: 1. AC Propulsion Inc., United States 2. Boulder Electric Vehicle, United States 3. Coritech Services Inc., United States 4. Edison International, United States 5. Enerdel, United States 6. EV Grid, United States 7. Next Energy, United States Leading Figures in the European and Asian Vehicle-To-Grid Technology Sector: 1. DENSO Corporation, Japan 2. Hitachi, Japan 3. Honda Motor Co., Ltd., Japan 4. Mitsubishi Motors Corporation, Japan 5. Nissan, Kanagawa Prefecture, Japan 6. ENGIE Group, France 7. Groupe Renault, France 8. OVO Energy Ltd, United KingdomFAQs:

1] What Major Key players in the Global Vehicle-To-Grid Technology Market report? Ans. The Major Key players covered in the Vehicle-To-Grid Technology Market report are AC Propulsion, Edison International, DENSO Co., Boulder Electric Vehicle, Nissan, Enerdel, EV Grid, Hitachi, Next Energy, NRG Energy. 2] Which region is expected to hold the highest share in the Global Vehicle-To-Grid Technology Market? Ans. North America region is expected to hold the highest share in the Vehicle-To-Grid Technology Market. 3] What is the market size of the Global Vehicle-To-Grid Technology Market by 2032? Ans. The market size of the Vehicle-To-Grid Technology Market by 2032 is expected to reach 22.56 USD Billion. 4] What is the forecast period for the Global Vehicle-To-Grid Technology Market? Ans. The forecast period for the Vehicle-To-Grid Technology Market is 2024-2032. 5] What was the market size of the Global Market in 2024? Ans. The market size of the Market in 2024 was valued at USD 4.25 Billion.

1. Vehicle-To-Grid Technology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Vehicle-To-Grid Technology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Vehicle-To-Grid Technology Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Vehicle-To-Grid Technology Market: Dynamics 3.1. Vehicle-To-Grid Technology Market Trends by Region 3.1.1. North America Vehicle-To-Grid Technology Market Trends 3.1.2. Europe Vehicle-To-Grid Technology Market Trends 3.1.3. Asia Pacific Vehicle-To-Grid Technology Market Trends 3.1.4. Middle East and Africa Vehicle-To-Grid Technology Market Trends 3.1.5. South America Vehicle-To-Grid Technology Market Trends 3.2. Vehicle-To-Grid Technology Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Vehicle-To-Grid Technology Market Drivers 3.2.1.2. North America Vehicle-To-Grid Technology Market Restraints 3.2.1.3. North America Vehicle-To-Grid Technology Market Opportunities 3.2.1.4. North America Vehicle-To-Grid Technology Market Challenges 3.2.2. Europe 3.2.2.1. Europe Vehicle-To-Grid Technology Market Drivers 3.2.2.2. Europe Vehicle-To-Grid Technology Market Restraints 3.2.2.3. Europe Vehicle-To-Grid Technology Market Opportunities 3.2.2.4. Europe Vehicle-To-Grid Technology Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Vehicle-To-Grid Technology Market Drivers 3.2.3.2. Asia Pacific Vehicle-To-Grid Technology Market Restraints 3.2.3.3. Asia Pacific Vehicle-To-Grid Technology Market Opportunities 3.2.3.4. Asia Pacific Vehicle-To-Grid Technology Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Vehicle-To-Grid Technology Market Drivers 3.2.4.2. Middle East and Africa Vehicle-To-Grid Technology Market Restraints 3.2.4.3. Middle East and Africa Vehicle-To-Grid Technology Market Opportunities 3.2.4.4. Middle East and Africa Vehicle-To-Grid Technology Market Challenges 3.2.5. South America 3.2.5.1. South America Vehicle-To-Grid Technology Market Drivers 3.2.5.2. South America Vehicle-To-Grid Technology Market Restraints 3.2.5.3. South America Vehicle-To-Grid Technology Market Opportunities 3.2.5.4. South America Vehicle-To-Grid Technology Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Vehicle-To-Grid Technology Industry 3.8. Analysis of Government Schemes and Initiatives For Vehicle-To-Grid Technology Industry 3.9. Vehicle-To-Grid Technology Market Trade Analysis 3.10. The Global Pandemic Impact on Vehicle-To-Grid Technology Market 4. Vehicle-To-Grid Technology Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 4.1.1. Unidirectional Vehicle to Grid 4.1.2. Bidirectional Vehicle to Grid 4.2. Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 4.2.1. Battery Electric Vehicles (BEVs) 4.2.2. Plug-in Hybrid Electric Vehicles (PHEVs) 4.2.3. Fuel Cell Electric Vehicles (FCEVs) 4.3. Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 4.3.1. Smart Meters 4.3.2. Electric Vehicle Supply Equipment (EVSE) 4.3.3. Software 4.3.4. Home Energy Management (HEM) Systems 4.4. Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 4.4.1. Peak Power Sales 4.4.2. Spinning Reserves 4.4.3. Base Load Power 4.4.4. Reactive Power 4.4.5. Others 4.5. Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 4.5.1. Residential 4.5.2. Commercial 4.5.3. Industrial 4.6. Vehicle-To-Grid Technology Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Vehicle-To-Grid Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 5.1.1. Unidirectional Vehicle to Grid 5.1.2. Bidirectional Vehicle to Grid 5.2. North America Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 5.2.1. Battery Electric Vehicles (BEVs) 5.2.2. Plug-in Hybrid Electric Vehicles (PHEVs) 5.2.3. Fuel Cell Electric Vehicles (FCEVs) 5.3. North America Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 5.3.1. Smart Meters 5.3.2. Electric Vehicle Supply Equipment (EVSE) 5.3.3. Software 5.3.4. Home Energy Management (HEM) Systems 5.4. North America Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 5.4.1. Peak Power Sales 5.4.2. Spinning Reserves 5.4.3. Base Load Power 5.4.4. Reactive Power 5.4.5. Others 5.5. North America Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 5.5.1. Residential 5.5.2. Commercial 5.5.3. Industrial 5.6. North America Vehicle-To-Grid Technology Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 5.6.1.1.1. Unidirectional Vehicle to Grid 5.6.1.1.2. Bidirectional Vehicle to Grid 5.6.1.2. United States Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.1.2.1. Battery Electric Vehicles (BEVs) 5.6.1.2.2. Plug-in Hybrid Electric Vehicles (PHEVs) 5.6.1.2.3. Fuel Cell Electric Vehicles (FCEVs) 5.6.1.3. United States Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 5.6.1.3.1. Smart Meters 5.6.1.3.2. Electric Vehicle Supply Equipment (EVSE) 5.6.1.3.3. Software 5.6.1.3.4. Home Energy Management (HEM) Systems 5.6.1.4. United States Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Peak Power Sales 5.6.1.4.2. Spinning Reserves 5.6.1.4.3. Base Load Power 5.6.1.4.4. Reactive Power 5.6.1.4.5. Others 5.6.1.5. United States Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 5.6.1.5.1. Residential 5.6.1.5.2. Commercial 5.6.1.5.3. Industrial 5.6.2. Canada 5.6.2.1. Canada Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 5.6.2.1.1. Unidirectional Vehicle to Grid 5.6.2.1.2. Bidirectional Vehicle to Grid 5.6.2.2. Canada Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.2.2.1. Battery Electric Vehicles (BEVs) 5.6.2.2.2. Plug-in Hybrid Electric Vehicles (PHEVs) 5.6.2.2.3. Fuel Cell Electric Vehicles (FCEVs) 5.6.2.3. Canada Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 5.6.2.3.1. Smart Meters 5.6.2.3.2. Electric Vehicle Supply Equipment (EVSE) 5.6.2.3.3. Software 5.6.2.3.4. Home Energy Management (HEM) Systems 5.6.2.4. Canada Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Peak Power Sales 5.6.2.4.2. Spinning Reserves 5.6.2.4.3. Base Load Power 5.6.2.4.4. Reactive Power 5.6.2.4.5. Others 5.6.2.5. Canada Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 5.6.2.5.1. Residential 5.6.2.5.2. Commercial 5.6.2.5.3. Industrial 5.6.3. Mexico 5.6.3.1. Mexico Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 5.6.3.1.1. Unidirectional Vehicle to Grid 5.6.3.1.2. Bidirectional Vehicle to Grid 5.6.3.2. Mexico Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 5.6.3.2.1. Battery Electric Vehicles (BEVs) 5.6.3.2.2. Plug-in Hybrid Electric Vehicles (PHEVs) 5.6.3.2.3. Fuel Cell Electric Vehicles (FCEVs) 5.6.3.3. Mexico Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 5.6.3.3.1. Smart Meters 5.6.3.3.2. Electric Vehicle Supply Equipment (EVSE) 5.6.3.3.3. Software 5.6.3.3.4. Home Energy Management (HEM) Systems 5.6.3.4. Mexico Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Peak Power Sales 5.6.3.4.2. Spinning Reserves 5.6.3.4.3. Base Load Power 5.6.3.4.4. Reactive Power 5.6.3.4.5. Others 5.6.3.5. Mexico Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 5.6.3.5.1. Residential 5.6.3.5.2. Commercial 5.6.3.5.3. Industrial 6. Europe Vehicle-To-Grid Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.2. Europe Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.3. Europe Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.4. Europe Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.5. Europe Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6. Europe Vehicle-To-Grid Technology Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.1.2. United Kingdom Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.1.3. United Kingdom Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.1.4. United Kingdom Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6.2. France 6.6.2.1. France Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.2.2. France Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.2.3. France Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.2.4. France Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.3.2. Germany Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.3.3. Germany Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.3.4. Germany Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.4.2. Italy Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.4.3. Italy Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.4.4. Italy Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.5.2. Spain Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.5.3. Spain Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.5.4. Spain Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.6.2. Sweden Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.6.3. Sweden Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.6.4. Sweden Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.7.2. Austria Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.7.3. Austria Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.7.4. Austria Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 6.6.8.2. Rest of Europe Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 6.6.8.3. Rest of Europe Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 6.6.8.4. Rest of Europe Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.2. Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.3. Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.4. Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6. Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.1.2. China Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.1.3. China Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.1.4. China Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.2.2. S Korea Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.2.3. S Korea Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.2.4. S Korea Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.3.2. Japan Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.3.3. Japan Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.3.4. Japan Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.4. India 7.6.4.1. India Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.4.2. India Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.4.3. India Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.4.4. India Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.5.2. Australia Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.5.3. Australia Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.5.4. Australia Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.6.2. Indonesia Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.6.3. Indonesia Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.6.4. Indonesia Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.7.2. Malaysia Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.7.3. Malaysia Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.7.4. Malaysia Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.8.2. Vietnam Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.8.3. Vietnam Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.8.4. Vietnam Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.9.2. Taiwan Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.9.3. Taiwan Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.9.4. Taiwan Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 7.6.10.2. Rest of Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 7.6.10.4. Rest of Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Vehicle-To-Grid Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 8.2. Middle East and Africa Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 8.3. Middle East and Africa Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 8.4. Middle East and Africa Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 8.6. Middle East and Africa Vehicle-To-Grid Technology Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 8.6.1.2. South Africa Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.1.3. South Africa Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 8.6.1.4. South Africa Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 8.6.2.2. GCC Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.2.3. GCC Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 8.6.2.4. GCC Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 8.6.3.2. Nigeria Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.3.3. Nigeria Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 8.6.3.4. Nigeria Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 8.6.4.2. Rest of ME&A Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 8.6.4.3. Rest of ME&A Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 8.6.4.4. Rest of ME&A Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 9. South America Vehicle-To-Grid Technology Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 9.2. South America Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 9.3. South America Vehicle-To-Grid Technology Market Size and Forecast, by Component(2024-2032) 9.4. South America Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 9.5. South America Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 9.6. South America Vehicle-To-Grid Technology Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 9.6.1.2. Brazil Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.1.3. Brazil Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 9.6.1.4. Brazil Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 9.6.2.2. Argentina Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.2.3. Argentina Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 9.6.2.4. Argentina Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Vehicle-To-Grid Technology Market Size and Forecast, by Charging Type (2024-2032) 9.6.3.2. Rest Of South America Vehicle-To-Grid Technology Market Size and Forecast, by Vehicle Type (2024-2032) 9.6.3.3. Rest Of South America Vehicle-To-Grid Technology Market Size and Forecast, by Component (2024-2032) 9.6.3.4. Rest Of South America Vehicle-To-Grid Technology Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Vehicle-To-Grid Technology Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. AC Propulsion Inc., United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Boulder Electric Vehicle, United States 10.3. Coritech Services Inc., United States 10.4. Edison International, United States 10.5. Enerdel, United States 10.6. EV Grid, United States 10.7. Next Energy, United States 10.8. DENSO Corporation, Japan 10.9. Hitachi, Japan 10.10. Honda Motor Co., Ltd., Japan 10.11. Mitsubishi Motors Corporation, Japan 10.12. Nissan, Kanagawa Prefecture, Japan 10.13. ENGIE Group, France 10.14. Groupe Renault, France 10.15. OVO Energy Ltd, United Kingdom 11. Key Findings 12. Industry Recommendations 13. Vehicle-To-Grid Technology Market: Research Methodology 14. Terms and Glossary