The Transparent Resin Polymer Market size was valued at USD 15.37 billion in 2024. The total Transparent Resin Polymer Industry is expected to grow by 6.83 % from 2024 to 2032, reaching nearly USD 26.07 Billion in 2032.Global Transparent Resin Polymer Market Overview

Transparent resin polymer refers to a type of synthetic resin, often a polymer, that is designed to be transparent or translucent, allowing light to pass through. These resins are used in various applications where clarity is important, such as in optics, lighting, and 3D printing. Growing demand for recyclable, high-performance, and visually appealing materials across key sectors such as electronics, packaging, construction, and optics is driving the expansion of the Transparent Resin Polymer Market. These polymers are increasingly preferred due to their high impact resistance, flexibility, and ability to meet sustainability goals. Innovations in material science are reshaping the industry, supporting the development of bio-derived and advanced resins that align with global environmental regulations. Recent innovations highlight the industry’s transition toward sustainable and high-performance materials. In December 2023, LyondellBasell introduced a recycled resin made from marine plastics for use in automotive injection molding. In January 2023, SABIC launched its ULTEM resin, designed to deliver scratch resistance and cost-effective performance for electronic components. Similarly, in September 2023, Delrin unveiled a high molecular weight resin aimed at enhancing fatigue durability, making it a suitable alternative to metal in demanding applications. These advancements are expanding the use of transparent resin polymers in areas such as flat panel displays, optical lenses, AV equipment, and clear food packaging. Major industry players, including INEOS Styrolution, Eastman, Kaneka, and Sundow Polymers, are at the forefront of this evolution, prioritizing the development of sustainable, bio-based, and high-performance resin solutions to meet growing environmental and functional demands.To know about the Research Methodology :- Request Free Sample Report

Transparent Resin Polymer Market Dynamics:

Rising Demand for Aesthetics & Transparency to Drive the Transparent Resin Polymer Market Growth The increasing need for aesthetic appeal and product transparency is playing an important role in the growth of the transparent resin polymer market. Nowadays, consumers prefer stylish, modern, and clear designs, especially in sectors such as automotive, electronics, and packaging. Transparent resins such as polycarbonate, PMMA, and PET offer clarity, strength, and design flexibility, making them suitable for creating attractive, lightweight products. As an example, clear resins are regularly used in the automotive industry to shade automotive headlamps and lighting systems, dashboard and display panels, as well as for covering styling elements. Clear resins are standard in car design and production. In the case of the Tesla Model 3, polycarbonate materials are used in a variety of automotive component designs to improve design, safety, and weight. These materials improved the aesthetics and overall appearance and provided a level of durability not found in glass or other framing materials. Also, the companies such as Apple and other electronic companies who now prefer to use clear and translucent plastic material to provide a modern stylistic influence, and premium visual appeal to various smartphone cases and accessories. This usage pattern of clear plastics adds a level of sophistication and cleanliness that meets an expectation from consumers today. In the food & beverage packaging sector, clear PET containers allow end customers to see exactly what they are buying, hence creating trust, and increasing shelf impact as customers are more likely to purchase products they can see and infer information about with their "naked eye". The willingness for professional industries to fuse design with practical concepts has increased the adoption of clear resin materials. Across applications, from technology to packaging, even jewelry businesses are using these materials to keep up, improve consumer experience, and meet or exceed the consumers' expectations for a clean and sophisticated look while also performing well as a high-performance material. This increasing demand and desire for high-performance resins are expected to lead to significant growth across the transparent resin polymer market in the next few years, as companies look to continuously innovate. Raw Material & Production Cost Volatility to hamper the Transparent Resin Polymer Market Growth The volatility in costs associated with raw materials and production presents a major limitation to the transparent resin polymer industry. While most transparent resins, such as MABS, are manufactured from raw materials derived from a petroleum-based feedstock such as methacrylate and acrylonitrile, the price of both crude oil and petrochemicals can be unpredictable. Due to these frequent fluctuations and unpredictable production costs, it is difficult for manufacturers to maintain or engineer price stability while undertaking long-term production capital investments. Unpredictable spikes in costs adversely impact the profit margin of manufacturers because they are not able to increase and fully pass along the production cost increases to customers. The unexpected change in predictable manufacturing prices and related inputs results in lower productivity generation and contributes to stagnated expansion, R&D, and opportunities to innovate. The prices related to transparent resin products also tend to be very sensitive to changes in price because sustained variations in consumer purchase orders, along with low awareness of reactivity between product prices, means when raw materials costs rise, end-users purchasing transparent resin products will change their purchasing orders to lower priced options such as ABS, PC, PP, or PET if available, which further reduces demand and suppresses industry growth. In March 2023, the price of methyl methacrylate reached USD 1,499/MT, approximately, and in just over a week, it increased by USD 35/MT. The unexpected spike in costs furthered a strain on production planning and caused a significant decline in the Purchasing Manager Index (PMI), suggesting that management confidence has been shaken with this change in costs. The entire transparent plastics industry has also seen similar delays in new investment, from C-suite manufacturing executives who have had their plans for the establishment of new sales agreements thwarted by continuous unforeseen energy and raw materials costs. Bio‑based & Sustainable Resin Development creates lucrative growth opportunities for the Transparent Resin Polymer Market The transparent resin polymer Industry is experiencing strong growth opportunities through the development of bio-based and sustainable resins. The awareness of environmental problems globally, paired with increased mandates on carbon emissions and plastic waste, is transforming the resin industry towards more environmentally friendly materials. This transition is clear in the packaging, automotive, construction, and electronics sectors, where manufacturers are proactively removing petroleum-based plastics in exchange for greener solutions. Government incentives and policies are supporting innovation and market acceptance of bio-based resins, such as those derived from renewable vanillin and fatty acid-based derivatives. Advances in polymer chemistry, which improve clarity, strength, and thermal stability and match the performance of conventional resins, are expanding product applications. A trending application of bio-based resins involves photopolymer resins for 3D printing: applied to manufacturing recyclable and high-performance 3D-printed parts in healthcare and the consumer electronics industry. The bio-based resins also support circular economy values, such as recyclability and organic compostability, facilitate brand differentiation, and fulfill the requirements of consumers who embrace sustainable products. Consequently, bio-based transparent resins represent a shift in the thinking of the industry, where commercial opportunity meets environmental responsibility.Global Transparent Resin Polymer Market Segment Analysis

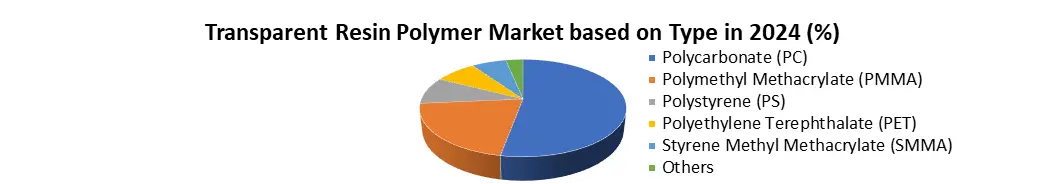

Based On Type, the Transparent Resin Polymer Market based on type divided into, Polycarbonate (PC), Polymethyl Methacrylate (PMMA), Polystyrene (PS), Polyethylene Terephthalate (PET), Styrene and Methyl Methacrylate (SMMA). The Polycarbonate segment held the largest market share in year 2024.Due to its superior physical and optical properties. Polycarbonate is largely preferred owing to its great impact-resistance, heat-stability, and transparency, which make it an excellent choice for demanding applications in automotive, electronics, construction and optical media. The rise in lightweight, durable materials in vehicle components and systems where glazing is involved further aided polypropylene demand. The increase usage of polycarbonate sheets in architectural applications, and in electronic devices supported growth. Thus far it is attractive for these markets as it can be recycled, and many adhere to safety regulations. Altogether, rapid urbanization in emerging economies along with increased investment in infrastructure lent to growth of the segment as it will always be an appealing solution across the industries. As long as the industries continue to demand both performance and beauty, polycarbonate will remain a preferred product, in 2024 it dominates the market.

Regional Analysis

Asia Pacific Region held the largest market share in the year 2024. Due to its vast industrial base, growing demand across end-use sectors, and strong government support. China alone accounts for around 35% of global plastic resin output, supported by over 15,000 manufacturing units and immense production capacity. India and Southeast Asia are also rapidly expanding their manufacturing ecosystems, reinforcing regional strength. The region sees high consumption from the packaging, automotive, electronics, and construction industries. Rising e-commerce, urbanization, and healthcare needs drive demand for advanced packaging using transparent resins. Meanwhile, automotive and electronics manufacturers in China and Japan prioritize lightweight, aesthetic materials, further boosting adoption. Rapid infrastructure development across APAC supports high usage of transparent polymers in coatings, adhesives, and building materials. Cost efficiency, local raw material access, and low labor costs make Asia-Pacific highly competitive. Government incentives and infrastructure investments in countries like China and India support resin production growth. A real-time example includes APAC's role in COVID-19 vaccine packaging (2023–2024), showcasing the region’s agility and production strength in transparent resin-based materials.Transparent Resin Polymer Market: Competitive Landscape The strategic initiatives from major players aim to strengthen their market position and cater to growing global demand. SABIC, a leading chemical company, has expanded its transparent plastic portfolio with the launch of LEXAN CXT resin in January 2018. This high-clarity, high-heat polycarbonate copolymer is designed for demanding applications in optical electronics, consumer goods, and healthcare. Additionally, SABIC entered into a 50-50 joint venture with SINOPEC in October 2017 to build a polycarbonate plant in Tianjin, China, reinforcing its manufacturing capabilities in Asia. Meanwhile, The Dow Chemical Company has enhanced its competitive edge by completing a USD 6 billion ethylene production facility in Texas in March 2017. This strategic move allows Dow to benefit from the U.S. shale gas boom, reducing raw material costs and ensuring supply chain efficiency. Furthermore, LyondellBasell's acquisition of A. Schulman in February 2018 for USD 2.25 billion, has significantly boosted its footprint in the advanced polymer solutions sector. This acquisition broadens LyondellBasell’s global reach and product offerings in high-performance resins. Collectively, these strategic initiatives by key players are shaping the competitive dynamics of the transparent resin polymer market, with a focus on innovation, geographic expansion, and cost leadership. Recent Developments in Transparent Resin Polymer Market • In September 2024, Formlabs announced the launch of a new range of resin materials, including casting resin, ceramic-filled dental resin, and several others designed to meet the evolving needs of precision applications in dental, jewelry, and engineering sectors. • In June 2024, Braskem Wnew entered into a strategic collaboration with Georg Utz AG to develop a circular, chemically recycled Polypropylene (PP) solution specifically aimed at sustainable food transport packaging, reinforcing both companies’ commitment to circular economy practices. • In March 2024, Airtech Advanced Materials Group and Caracol, a leader in robotic 3D printing, formed a partnership to advance the Large Format Additive Manufacturing (LFAM) market. The collaboration combines Dahltram resins with HERON AM robotic technology, aiming to deliver scalable and efficient industrial 3D printing solutions. • In March 2024, SABIC, the Saudi Arabian chemical giant, introduced a new scratch-resistant resin formulated for the automotive industry, addressing demands for enhanced durability, aesthetics, and long-term performance in vehicle interiors and exterior parts.

Transparent Resin Polymer Market Scope: Inquire before buying

Transparent Resin Polymer Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 15.37 Bn. Forecast Period 2025 to 2032 CAGR: 6.83 % Market Size in 2032: USD 26.07 Bn. Segments Covered: by Type Polycarbonate (PC) Polymethyl Methacrylate (PMMA) Polystyrene (PS) Polyethylene Terephthalate (PET) Styrene Methyl Methacrylate (SMMA) Others by Application Packaging Automotive Electronics & Electricals Construction Medical Devices Consumer Goods Transparent Resin Polymer Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Transparent Resin Polymer Market Top Key players

1. LyondellBasell (Netherlands) 2. ExxonMobil (U.S.) 3. SABIC (Saudi Arabia) 4. BASF SE (Germany) 5. INEOS Styrolution (UK/Germany) 6. Celanese Corporation (U.S.) 7. Dow Chemical 8. Covestro AG (Germany) 9. DuPont de Nemours (U.S.) 10. Mitsubishi Chemical Holdings (Japan) 11. Eastman Chemical Company (U.S.) 12. 3M Company (U.S.) 13. Henkel AG & Co. (Germany) 14. Huntsman Corporation (U.S.) 15. Momentive Performance Materials (U.S.) 16. DSM Engineering Plastics (Netherlands) 17. Toray Industries (Japan) 18. Wanhua Chemical Group (China) 19. Shin-Etsu Chemical (Japan) 20. Asahi Glass Co. (AGC Inc.) (Japan) 21. Zymergen Inc. (U.S.) 22. Solvay S.A. (Belgium) 23. Evonik Industries (Germany) 24. Arkema SA (France) 25. Mitsui Chemicals (Japan) 26. Hyosung Chemical (South Korea) 27. Poliya (Turkey) 28. Kaneka Corporation (Japan) 29. Ensinger GmbH (Germany)Frequently Asked Questions

1. What is driving the demand for transparent resin polymers? Answer: Rising consumer preference for visually appealing packaging, increased applications in electronics, automotive lighting, and medical devices, and growing construction activities are key demand drivers. 2. Which industries use transparent resin polymers the most? Answer: Major end-use industries include packaging, automotive, electronics, construction, and healthcare. 3. What are the key challenges in the market? Answer: High raw material cost volatility, environmental concerns regarding recyclability, and competition from alternative materials are significant challenges. 4. Which region dominates the market? Answer: Asia-Pacific holds the largest market share due to rapid industrialization, strong manufacturing bases in China and India, and expanding infrastructure projects. 5. Are bio-based transparent resins gaining popularity? Answer: Yes. Bio-based alternatives are gaining traction due to growing environmental awareness and regulatory pressure on petroleum-based plastics.

1. Transparent Resin Polymer Market: Research Methodology 2. Transparent Resin Polymer Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Transparent Resin Polymer Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Service Segment 3.3.3. End-user Segment 3.3.4. Revenue (2024) 3.3.5. Company Locations 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Mergers and Acquisitions Details 4. Transparent Resin Polymer Market: Dynamics 4.1. Transparent Resin Polymer Market Trends 4.2. Transparent Resin Polymer Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technology Roadmap 4.6. Regulatory Landscape 4.7. Key Opinion Leader Analysis for Transparent Resin Polymer Market 4.8. Analysis of Government Schemes and Initiatives for the Transparent Resin Polymer Market 5. Transparent Resin Polymer Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 5.1.1. Polycarbonate (PC) 5.1.2. Polymethyl Methacrylate (PMMA) 5.1.3. Polystyrene (PS) 5.1.4. Polyethylene Terephthalate (PET) 5.1.5. Styrene Methyl Methacrylate (SMMA) 5.1.6. Others 5.2. Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 5.2.1. Packaging 5.2.2. Automotive 5.2.3. Electronics & Electricals 5.2.4. Construction 5.2.5. Medical Devices 5.2.6. Consumer Goods 5.3. Transparent Resin Polymer Market Size and Forecast, by region (2024-2032) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Transparent Resin Polymer Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. North America Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 6.1.1. Polycarbonate (PC) 6.1.2. Polymethyl Methacrylate (PMMA) 6.1.3. Polystyrene (PS) 6.1.4. Polyethylene Terephthalate (PET) 6.1.5. Styrene Methyl Methacrylate (SMMA) 6.1.6. Others 6.2. North America Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 6.2.1. Packaging 6.2.2. Automotive 6.2.3. Electronics & Electricals 6.2.4. Construction 6.2.5. Medical Devices 6.2.6. Consumer Goods 6.3. North America Transparent Resin Polymer Market Size and Forecast, by Country (2024-2032) 6.3.1. United States 6.3.1.1. United States Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 6.3.1.1.1. Polycarbonate (PC) 6.3.1.1.2. Polymethyl Methacrylate (PMMA) 6.3.1.1.3. Polystyrene (PS) 6.3.1.1.4. Polyethylene Terephthalate (PET) 6.3.1.1.5. Styrene Methyl Methacrylate (SMMA) 6.3.1.1.6. Others 6.3.1.2. United States Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 6.3.1.2.1. Packaging 6.3.1.2.2. Automotive 6.3.1.2.3. Electronics & Electricals 6.3.1.2.4. Construction 6.3.1.2.5. Medical Devices 6.3.1.2.6. Consumer Goods 6.3.2. Canada 6.3.2.1. Canada Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 6.3.2.1.1. Polycarbonate (PC) 6.3.2.1.2. Polymethyl Methacrylate (PMMA) 6.3.2.1.3. Polystyrene (PS) 6.3.2.1.4. Polyethylene Terephthalate (PET) 6.3.2.1.5. Styrene Methyl Methacrylate (SMMA) 6.3.2.1.6. Others 6.3.2.2. Canada Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 6.3.2.2.1. Packaging 6.3.2.2.2. Automotive 6.3.2.2.3. Electronics & Electricals 6.3.2.2.4. Construction 6.3.2.2.5. Medical Devices 6.3.2.2.6. Consumer Goods 6.3.3. Mexico 6.3.3.1. Mexico Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 6.3.3.1.1. Polycarbonate (PC) 6.3.3.1.2. Polymethyl Methacrylate (PMMA) 6.3.3.1.3. Polystyrene (PS) 6.3.3.1.4. Polyethylene Terephthalate (PET) 6.3.3.1.5. Styrene Methyl Methacrylate (SMMA) 6.3.3.1.6. Others 6.3.3.2. Mexico Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 6.3.3.2.1. Packaging 6.3.3.2.2. Automotive 6.3.3.2.3. Electronics & Electricals 6.3.3.2.4. Construction 6.3.3.2.5. Medical Devices 6.3.3.2.6. Consumer Goods 7. Europe Transparent Resin Polymer Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Europe Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.2. Europe Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3. Europe Transparent Resin Polymer Market Size and Forecast, by Country (2024-2032) 7.3.1. United Kingdom 7.3.1.1. United Kingdom Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.1.2. United Kingdom Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3.2. France 7.3.2.1. France Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.2.2. France Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3.3. Germany 7.3.3.1. Germany Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.3.2. Germany Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3.4. Italy 7.3.4.1. Italy Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.4.2. Italy Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3.5. Spain 7.3.5.1. Spain Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.5.2. Spain Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3.6. Sweden 7.3.6.1. Sweden Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.6.2. Sweden Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3.7. Austria 7.3.7.1. Austria Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.7.2. Austria Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 7.3.8. Rest of Europe 7.3.8.1. Rest of Europe Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 7.3.8.2. Rest of Europe Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8. Asia Pacific Transparent Resin Polymer Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Asia Pacific Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.2. Asia Pacific Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3. Asia Pacific Transparent Resin Polymer Market Size and Forecast, by Country (2024-2032) 8.3.1. China 8.3.1.1. China Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.1.2. China Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.2. S Korea 8.3.2.1. S Korea Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.2.2. S Korea Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.3. Japan 8.3.3.1. Japan Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.3.2. Japan Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.4. India 8.3.4.1. India Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.4.2. India Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.5. Australia 8.3.5.1. Australia Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.5.2. Australia Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.6. Indonesia 8.3.6.1. Indonesia Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.6.2. Indonesia Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.7. Malaysia 8.3.7.1. Malaysia Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.7.2. Malaysia Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.8. Vietnam 8.3.8.1. Vietnam Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.8.2. Vietnam Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.9. Taiwan 8.3.9.1. Taiwan Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.9.2. Taiwan Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 8.3.10. Rest of Asia Pacific 8.3.10.1. Rest of Asia Pacific Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 8.3.10.2. Rest of Asia Pacific Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 9. Middle East and Africa Transparent Resin Polymer Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. Middle East and Africa Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 9.2. Middle East and Africa Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 9.3. Middle East and Africa Transparent Resin Polymer Market Size and Forecast, by Country (2024-2032) 9.3.1. South Africa 9.3.1.1. South Africa Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 9.3.1.2. South Africa Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 9.3.2. GCC 9.3.2.1. GCC Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 9.3.2.2. GCC Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 9.3.3. Nigeria 9.3.3.1. Nigeria Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 9.3.3.2. Nigeria Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 9.3.4. Rest of ME&A 9.3.4.1. Rest of ME&A Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 9.3.4.2. Rest of ME&A Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 10. South America Transparent Resin Polymer Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 10.1. South America Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 10.2. South America Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 10.3. South America Transparent Resin Polymer Market Size and Forecast, by Country (2024-2032) 10.3.1. Brazil 10.3.1.1. Brazil Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 10.3.1.2. Brazil Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 10.3.2. Argentina 10.3.2.1. Argentina Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 10.3.2.2. Argentina Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 10.3.3. Chile 10.3.3.1. Chile Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 10.3.3.2. Chile Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 10.3.4. Rest Of South America 10.3.4.1. Rest Of South America Transparent Resin Polymer Market Size and Forecast, By Type (2024-2032) 10.3.4.2. Rest Of South America Transparent Resin Polymer Market Size and Forecast, By Application (2024-2032) 11. Company Profile: Key Players 11.1. LyondellBasell (Netherlands) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. ExxonMobil (U.S.) 11.3. SABIC (Saudi Arabia) 11.4. BASF SE (Germany) 11.5. INEOS Styrolution (UK/Germany) 11.6. Celanese Corporation (U.S.) 11.7. Dow Chemical 11.8. Covestro AG (Germany) 11.9. DuPont de Nemours (U.S.) 11.10. Mitsubishi Chemical Holdings (Japan) 11.11. Eastman Chemical Company (U.S.) 11.12. 3M Company (U.S.) 11.13. Henkel AG & Co. (Germany) 11.14. Huntsman Corporation (U.S.) 11.15. Momentive Performance Materials (U.S.) 11.16. DSM Engineering Plastics (Netherlands) 11.17. Toray Industries (Japan) 11.18. Wanhua Chemical Group (China) 11.19. Shin-Etsu Chemical (Japan) 11.20. Asahi Glass Co. (AGC Inc.) (Japan) 11.21. Zymergen Inc. (U.S.) 11.22. Solvay S.A. (Belgium) 11.23. Evonik Industries (Germany) 11.24. Arkema SA (France) 11.25. Mitsui Chemicals (Japan) 11.26. Hyosung Chemical (South Korea) 11.27. Poliya (Turkey) 11.28. Kaneka Corporation (Japan) 11.29. Ensinger GmbH (Germany) 12. Key Findings 13. Industry Recommendations