The Global Touch Screen Display Market was valued at USD 62.18 Billion in 2024 and is projected to reach USD 157.29 Billion by 2032, growing at a CAGR of 12.3%.Touch Screen Display Market Overview

The Touch Screen Display Market is experiencing strong global growth, supported by rising demand for smartphones, tablets, laptops, interactive kiosks, and automotive infotainment systems. Increasing digital adoption across sectors such as education, retail, healthcare, and industrial automation is driving widespread integration of capacitive, infrared, optical, and OLED-based touch technologies. The shift toward smart classrooms, self-service kiosks, and connected vehicles continues to expand market opportunities. In 2025, Samsung introduced next-generation foldable OLED and ultra-thin touch displays, emphasizing flexibility, durability, and superior visual performance. At Touch Taiwan 2025, manufacturers showcased advanced micro-LED touch panels, known for high brightness, long lifespan, and enhanced energy efficiency ideal for large interactive displays. Additionally, touch modules are being upgraded with metal mesh and silver nanowire materials, enabling faster response speeds and thinner form factors. AI-driven enhancements such as gesture recognition, multi-touch precision, and haptic feedback are further transforming user interaction. As smart technologies continue to advance, the Touch Screen Display Market is expected for sustained long-term growth.To know about the Research Methodology :- Request Free Sample Report

Touch Screen Display Market Dynamics

Rising Demand for Smart Devices & High-Resolution Touch Displays Drive the Growth of Touch Screen Display Market The Touch Screen Display Market is driven strongly by the surging adoption of smartphones, tablets, wearables, and automotive touch displays. Consumers now expect multi-touch, high-brightness, and AMOLED touch screens that offer superior clarity and responsiveness. In 2024, global smartphone shipments surpassed 1.17 billion units, led by brands such as Samsung, Apple, and Xiaomi, fueling demand for capacitive touch screen displays. The automotive sector is also transforming rapidly, with over 70% of new vehicles in the U.S., Germany, China, and Japan integrating infotainment touch panels and in-dash touch units. Models such as the Tesla Model 3, Hyundai Ioniq 5, and BMW iX use large-format touch displays, accelerating adoption of projected capacitive technology and in-cell / on-cell touch interfaces. Additionally, retail and corporate sectors are increasing deployments of interactive kiosk displays, POS touch terminals, and touch-enabled digital signage. The growth of 5G devices, IoT wearables, and smart home touch panels further boosts the market. Rising digital transformation across industries, combined with consumer preference for seamless touchscreen user experiences, continues to act as a major market driver.High Manufacturing Costs & Supply Chain Disruptions in Touch Display Components limits the growth of Touch Screen Display Market A major restraint for the Touch Screen Display Market is the increasing manufacturing cost of high-end touch panels, especially OLED, flexible touch displays, and AMOLED touch screens. Producing these panels requires advanced processes like thin-film encapsulation, laser-based lamination, and high-purity conductive films, contributing to higher production expenses. According to MMR Study, the cost of manufacturing a flexible OLED touch display is 30–40% higher than a standard LCD touch panel. In 2024, supply chain issues intensified due to shortages of ITO films, semiconductors, and glass substrates, impacting suppliers in China, Taiwan, South Korea, and Japan. For example, the temporary shutdown of display fabs operated by BOE, AUO, and LG Display caused delays in delivering touch components for smartphones and automotive displays. Rising prices of rare materials like indium further affected production cost stability. Geopolitical tensions and logistics delays added pressure, increasing lead times by 20–25% globally. These challenges restrict affordability for mid-range device manufacturers, weaken supply reliability, and slow adoption of advanced touchscreen technologies in cost-sensitive markets. Rapid Expansion of Smart Automotive Displays & AI-Enabled Touchscreen Innovations The most lucrative opportunity in the Touch Screen Display Market is the fast-growing demand for smart automotive touch displays, AI-based touch interfaces, and gesture-controlled dashboards. By 2025, more than 85% of new vehicles from brands like Mercedes-Benz, Toyota, Ford, and Tata Motors incorporate touchscreen infotainment systems and digital cockpit displays. Automakers are integrating OLED touch panels, curved touch displays, and haptic-feedback touchscreens to enhance driver experience. For example, the Mercedes EQS Hyperscreen uses a 56-inch AI-powered touchscreen, while Tesla continues to lead with its 17-inch center touchscreen. Growth in autonomous and connected vehicles accelerates demand for multi-touch, high-brightness, and sunlight-readable automotive touch displays. Additionally, industries such as retail, education, and healthcare are adopting interactive touch whiteboards, touch kiosks, and AI-driven smart displays, with installations rising 30% year-on-year globally. The rise of factory automation, Industry 4.0, and IoT devices also creates strong opportunities for rugged industrial touch panels. As AI enables features like predictive touch, gesture recognition, and voice-assist-enabled touch interfaces, the market is positioned for significant innovation-driven growth.

Touch Screen Display Market Segment Analysis

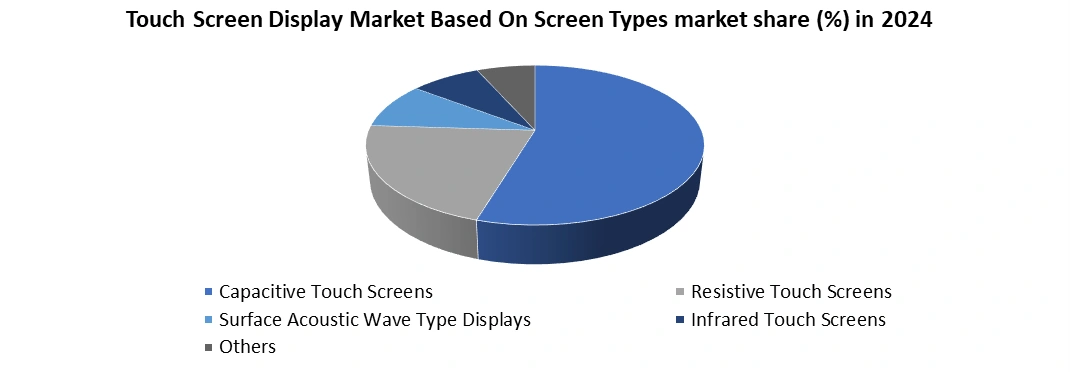

Based On Screen Types, the Touch Screen Display Market is segmented into Capacitive Touch Screens, Resistive Touch Screens, Surface Acoustic Wave Type Displays, Infrared Touch Screens, and Others. Capacitive touch screens dominate the Touch Screen Display Market due to their exceptional strength, durability, and multi-touch performance. They are widely used in smartphones, tablets, wearables, automotive displays, POS systems, and business kiosks. Their glass surface resists scratches, while dirt and fingerprints do not affect functionality, making them ideal for high-traffic commercial environments. As global electronics demand rises, capacitive technology remains the preferred choice for premium, high-clarity displays. Infrared touch screens lead large-format and industrial applications because their beam-break technology enables accurate, pressure-less touch detection. They work with gloves and styluses, making them ideal for ATMs, industrial automation, plant control systems, medical devices, ticketing machines, and interactive whiteboards. Their scalability supports displays above 32 inches, strengthening dominance in public and industrial systems. Optical touch screens gain momentum for their affordability and scalability, while resistive touch screens show slow growth due to limited durability and no multi-touch support.

Touch Screen Display Market Regional Analysis

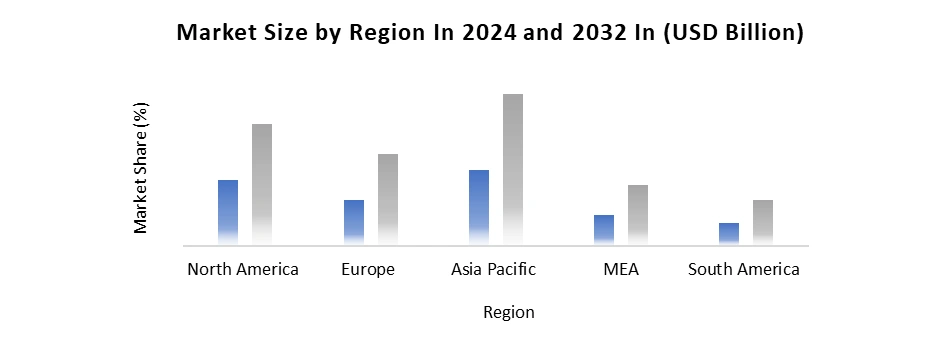

Asia Pacific Dominated the Touch Screen Display Market in year 2024. due to its strong electronics manufacturing ecosystem, massive consumer base, and rapid adoption of digital devices. Countries like China, South Korea, Japan, and India played a central role in touch display production and consumption. China alone produced over 70% of the world’s smartphones in 2024, driving large-scale demand for capacitive, AMOLED, and on-cell touch displays. Leading display manufacturers such as BOE, TCL CSOT, and Tianma expanded their touch panel production lines, supplying screens to global brands including Apple, Xiaomi, OPPO, and Vivo. South Korea strengthened the region’s dominance with Samsung Display and LG Display, which continued mass production of OLED and flexible touch screens for premium devices. Meanwhile, India’s electronics manufacturing output grew more than 20% year-on-year, supported by government programs like Make in India, boosting local assembly of touch-enabled smartphones, smart TVs, and automotive displays. Japan contributed advanced technologies such as haptic touch, optical touch sensors, and automotive touch modules used by Toyota, Honda, and Sony. Rising adoption of smart kiosks, POS systems, and digital classrooms across Asia further accelerated touch display deployment. Together, these factors made Asia Pacific the global hub for touch screen innovation and production in 2024.

Touch Screen Display Market Competitive Analysis

The Touch Screen Display Market is highly competitive, driven by rapid innovation, large-scale manufacturing, and continuous upgrades in display technologies. Leading companies such as Samsung Display, LG Display, BOE Technology, Innolux, AUO, and Japan Display Inc. (JDI) dominate the landscape with strong capabilities in OLED, AMOLED, LCD, and projected-capacitive touch panels. These players invest heavily in R&D, focusing on flexible touch screens, in-cell/on-cell technology, haptic touch, and sunlight-readable displays to meet rising demand from smartphones, automotive infotainment, and interactive kiosks. Chinese manufacturers like TCL CSOT, Tianma, and Visionox are rapidly expanding production capacity, offering cost advantages and competing in both mid-range and premium device segments. Global brands such as Apple, Xiaomi, and Samsung collaborate directly with display suppliers to customize touch modules for next-generation devices. Meanwhile, niche companies specializing in infrared, optical, and industrial touch screens, including 3M, Elo Touch Solutions, and Zytronic, strengthen competition in commercial, retail, and industrial markets. Strategic partnerships, manufacturing expansion, and product differentiation remain key competitive strategies across the industry.Touch Screen Display Market Recent Development

In June 2025, Dixon Technologies applied for approval from the Indian government to establish a joint venture with HKC for manufacturing advanced display modules used in smartphones, notebooks, and smart TVs. The company aims to develop this facility as a “lighthouse factory,” showcasing next-generation manufacturing excellence and automation in India’s expanding display ecosystem. In April 2022, Fujitsu introduced its new service portfolio, Fujitsu Computing as a Service (CaaS). The platform is designed to accelerate global digital transformation (DX) by offering cloud-based access to some of the world’s most advanced computing technologies, enabling businesses to innovate faster and operate more efficiently. In January 2022, NEC Corporation entered into an agreement to acquire Blue Danube Systems, Inc., a U.S.-based provider of 5G RAN, CBRS, and 4G solutions. The company also delivers advanced AI and ML software that helps network operators improve spectrum efficiency and accelerate 5G deployment, strengthening NEC’s capabilities in next-generation mobile technologies.Touch Screen Display Market Scope: Inquiry Before Buying

Global Touch Screen Display Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 62.18 Bn. Forecast Period 2025 to 2032 CAGR: 12.3% Market Size in 2032: USD 157.29Bn. Segments Covered: by Screen Type Capacitive Touch Screens Resistive Touch Screens Optical Infrared Touch Screens Others by Application Display/Digital Signage Kiosks Consumer Electronics Laptops & Tablets and Smart Television Smartphones & Smart Wearables by End User Residential Commercial Industrial Touch Screen Display Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Touch Screen Display Key Players

1. Samsung Display 2. LG Display 3. BOE Technology Group 4. Innolux Corporation 5. AU Optronics (AUO) 6. TCL CSOT 7. Sharp Corporation 8. Japan Display Inc. (JDI) 9. HannStar Display 10. Planar Systems 11. ELO Touch Solutions 12. TPK Holding Co. Ltd. 13. Wintek Corporation 14. Fujitsu Components 15. NEC Display Solutions 16. 3M Company 17. Corning Incorporated 18. Nissha Co. Ltd. 19. Atmel Corporation 20. MELFAS Inc. 21. Zytronic PLC 22. Baltra Technology 23. Tianma Microelectronics 24. Truly International Holdings 25. O-Film Tech Co. Ltd. 26. Universal Display Corporation (UDC) 27. Hyundai Display 28. TouchNetix 29. Crystal Display Systems (CDS) 30. E Ink HoldingsFrequently Asked Questions:

1. Which region represents the most potential market for Touch Screen Displays? Answer: The Asia-Pacific (APAC) region is expected to show the strongest potential, driven by rising adoption of touch-enabled solutions in education, digital classrooms, and collaborative learning environments. Increasing government investment in smart education is further boosting demand. 2. What factors are expected to drive market growth during the forecast period? Answer: The primary growth driver is the surging global use of smartphones and tablets, along with rapid digitalization across industries. Expanding demand for interactive devices, smart kiosks, and touch-enabled consumer electronics also supports market expansion. 3. What is the projected size and growth rate of the Touch Screen Display Market? Answer: The Touch Screen Display Market was valued at USD 62.18 billion in 2024 and is expected to grow at a 12.3% CAGR from 2024 to 2030, reaching approximately USD 157.29 billion by the end of the forecast period. 4. What segments are included in the Touch Screen Display Market report? Answer: The report covers segmentation by Screen Type, Application, End User, and Region, offering a detailed analysis across each category.

1. Touch Screen Display Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Touch Screen Display Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Touch Screen Display Market: Dynamics 3.1. Touch Screen Display Market Trends 3.2. Touch Screen Display Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Touch Screen Display Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Touch Screen Display Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 4.1. Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 4.1.1. Capacitive Touch Screens 4.1.2. Resistive Touch Screens 4.1.3. Optical 4.1.4. Infrared Touch Screens 4.1.5. Others 4.2. Touch Screen Display Market Size and Forecast, By Application (2024-2032) 4.2.1. Display/Digital Signage 4.2.2. Kiosks 4.2.3. Consumer Electronics 4.2.3.1. Laptops & Tablets and Smart Television 4.2.3.2. Smartphones & Smart Wearables 4.3. Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 4.3.1. Residential 4.3.2. Commercial 4.3.3. Industrial 4.4. Touch Screen Display Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Touch Screen Display Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 5.1. North America Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 5.2. North America Touch Screen Display Market Size and Forecast, By Application (2024-2032) 5.3. North America Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 5.4. North America Touch Screen Display Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 5.4.1.2. United States Touch Screen Display Market Size and Forecast, By Application (2024-2032) 5.4.1.3. United States Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 5.4.2. Canada 5.4.2.1. Canada Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 5.4.2.2. Canada Touch Screen Display Market Size and Forecast, By Application (2024-2032) 5.4.2.3. Canada Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 5.4.3. Mexico 5.4.3.1. Mexico Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 5.4.3.2. Mexico Touch Screen Display Market Size and Forecast, By Application (2024-2032) 5.4.3.3. Mexico Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 6. Europe Touch Screen Display Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 6.1. Europe Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 6.2. Europe Touch Screen Display Market Size and Forecast, By Application (2024-2032) 6.3. Europe Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Touch Screen Display Market Size and Forecast, By Country (2024-2032) 6.4.1. United Kingdom 6.4.2. France 6.4.3. Germany 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific Touch Screen Display Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 7.1. Asia Pacific Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 7.2. Asia Pacific Touch Screen Display Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Touch Screen Display Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.2. S Korea 7.4.3. Japan 7.4.4. India 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippines 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa Touch Screen Display Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 8.1. Middle East and Africa Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 8.2. Middle East and Africa Touch Screen Display Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Touch Screen Display Market Size and Forecast, By Country (2024-2032) 8.4.1. South Africa 8.4.2. GCC 8.4.3. Nigeria 8.4.4. Rest of ME&A 9. South America Touch Screen Display Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in 000’ Units) (2024-2032) 9.1. South America Touch Screen Display Market Size and Forecast, By Screen Type (2024-2032) 9.2. South America Touch Screen Display Market Size and Forecast, By Application (2024-2032) 9.3. South America Touch Screen Display Market Size and Forecast, By End-User (2024-2032) 9.4. South America Touch Screen Display Market Size and Forecast, By Country (2024-2032) 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1. Samsung Display 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. LG Display 10.3. BOE Technology Group 10.4. Innolux Corporation 10.5. AU Optronics (AUO) 10.6. TCL CSOT 10.7. Sharp Corporation 10.8. Japan Display Inc. (JDI) 10.9. HannStar Display 10.10. Planar Systems 10.11. ELO Touch Solutions 10.12. TPK Holding Co. Ltd. 10.13. Wintek Corporation 10.14. Fujitsu Components 10.15. NEC Display Solutions 10.16. 3M Company 10.17. Corning Incorporated 10.18. Nissha Co. Ltd. 10.19. Atmel Corporation 10.20. MELFAS Inc. 10.21. Zytronic PLC 10.22. Baltra Technology 10.23. Tianma Microelectronics 10.24. Truly International Holdings 10.25. O-Film Tech Co. Ltd. 10.26. Universal Display Corporation (UDC) 10.27. Hyundai Display 10.28. TouchNetix 10.29. Crystal Display Systems (CDS) 10.30. E Ink Holdings 11. Key Findings 12. Analyst Recommendations 13. Touch Screen Display Market – Research Methodology