The Tooth Regeneration Market size was valued at USD 4.3 billion in 2024 and is expected to grow by 5.6% from 2025 to 2032, reaching nearly USD 6.65 billion in 2032Tooth Regeneration Market Overview

Tooth regeneration is a cutting-edge process within the field of regenerative medicine that leverages stem cells or tooth bud cells, often in combination with growth factors, to create a customized structure capable of developing into a fully functional tooth. Unlike traditional restorative dental procedures, which rely on artificial materials such as crowns or implants, tooth regeneration aims to restore natural dental anatomy and functionality, offering a biological solution that integrates seamlessly with the patient’s oral tissues. The technological advancements in regenerative medicine, tissue engineering, and biomaterials have significantly enhanced the feasibility and effectiveness of the Tooth Regeneration Market. Innovations such as biomimetic scaffolds, nanomaterials, and growth factor delivery systems are enabling precise control over tooth formation, improving both structural integrity and aesthetic outcomes.To know about the Research Methodology :- Request Free Sample Report The revolutionary advancements in regenerative medicine and the increasing demand for natural, minimally invasive dental solutions. Traditional dental treatments, such as implants and dentures, come with limitations in terms of comfort, longevity, and aesthetics. In contrast, innovative tooth regeneration therapies, powered by stem cells, biomaterials, and advanced tissue engineering, are transforming the landscape by enabling the precise regrowth of enamel, dentin, and dental pulp. In the Tooth Regeneration Market, such therapies are gaining traction as they meet the increasing demand for procedures that combine effectiveness with cosmetic appeal. As patients increasingly prioritize natural-looking results, the adoption of regenerative dental solutions is expected to accelerate, driving growth and innovation. The rising prevalence of dental disorders, particularly among aging populations, is driving the Tooth Regeneration Market growth. Conditions such as tooth decay, periodontal diseases, and tooth loss are creating a significant demand for therapies that offer long-term solutions without invasive procedures. Biologically based treatments, including cell-based regeneration and scaffold-assisted dental therapies, are gaining traction due to their superior durability, enhanced comfort, and reduced recovery times compared to conventional methods.

Tooth Regeneration Market Dynamics

Increasing Incidence of Dental Disease to Drive Tooth Regeneration Market Growth Dental conditions such as tooth decay, cavities, periodontal disease, and pulp damage are becoming increasingly common across all age groups, particularly among aging populations and in regions with limited access to preventive dental care. These conditions result in tooth loss or deterioration, highlighting the increasing need for therapies that not only restore functionality but also preserve natural aesthetics. Advancements in regenerative dentistry, including stem cell therapy, tissue engineering, and biomaterial-based scaffolds, are addressing these challenges by enabling the regeneration of enamel, dentin, and pulp. Such therapies provide a biologically compatible alternative to traditional dentures and implants, offering longer-lasting and more natural solutions, thereby driving growth in the Tooth Regeneration Market. The growing incidence of dental diseases is driving patients and dental professionals to adopt these innovative approaches, as conventional restorative methods fail to meet the increasing expectations for durability, comfort, and cosmetic appeal. The global geriatric population is expanding rapidly, particularly in North America and Europe, where age-related dental degeneration is a common concern. This demographic shift is intensifying the demand for regenerative dental treatments that can address complex dental issues with minimally invasive procedures. Rising awareness about oral health, coupled with the desire for improved quality of life and functional dental solutions, is accelerating adoption, which drives Tooth Regeneration Market growth. Healthcare providers and dental technology companies are responding by investing heavily in research and development, clinical trials, and product innovation to meet the growing demand. As a result, the increasing incidence of dental diseases is not only driving Tooth Regeneration Market growth but also encouraging technological advancements that are transforming the landscape of modern dentistry. This trend positions tooth regeneration as a critical solution for addressing widespread dental health challenges while meeting the evolving needs of patients worldwide. High Costs and Regulatory Challenges to Restraint Tooth Regeneration Market Developing advanced regenerative therapies involves expensive research, complex clinical trials, and the integration of cutting-edge technologies like stem cells, scaffolds, and bioactive compounds. These costs translate into higher treatment prices, limiting accessibility for a large segment of patients, particularly in emerging markets. The regulatory approvals for new dental regenerative products in the Tooth Regeneration Market are stringent, requiring extensive clinical validation to ensure safety and efficacy. Navigating these regulatory pathways can be time-consuming and expensive, delaying product commercialization and impacting market growth. The adoption of innovative therapies is sometimes hindered by limited awareness among dental practitioners and patients regarding long-term benefits and procedural complexities. Tooth Regeneration Companies ensure compliance with regional healthcare standards and quality guidelines, which vary across markets and add operational challenges.Tooth Regeneration Market Segment Analysis

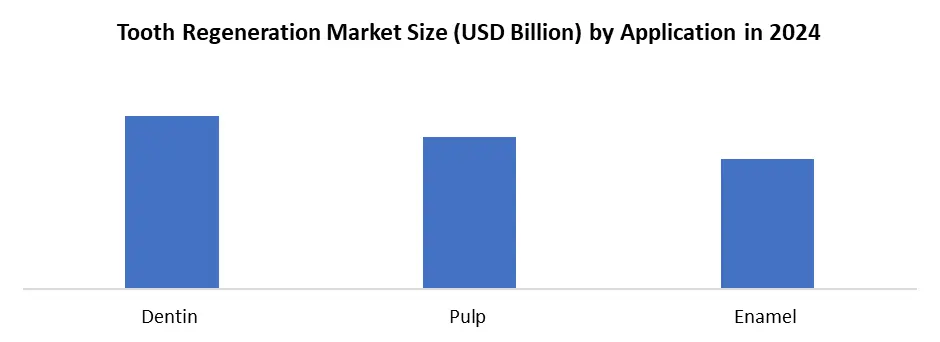

Based on the Method, the market is segmented into Stem Cell Therapy, Tissue Engineering, Drug Therapy / Small‑Molecule Treatment, Laser Treatment and Others. Stem Cell Therapy dominated the Tooth Regeneration Market in 2024. Leveraging dental pulp stem cells, mesenchymal stem cells, and induced pluripotent stem cells, this approach enables the regrowth of enamel, dentin, and pulp, providing biologically compatible alternatives to conventional implants and dentures. Stem cell therapy is gaining traction due to its ability to restore both functionality and aesthetics, addressing patient demand for minimally invasive, long-lasting treatments. Leading research institutions and biotech companies are focusing on optimizing cell sourcing, scaffold integration, and delivery methods to enhance treatment outcomes and accelerate clinical adoption. The development of combined approaches in the Tooth Regeneration Market, integrating stem cells with growth factors and 3D-printed biomaterials, is expanding the therapy’s scope, making it applicable across various dental conditions. Regulatory approvals, ongoing clinical trials, and strategic collaborations between academic institutions and industry players are further driving the growth of stem cell-based solutions. With its proven efficacy, rising patient awareness, and strong research momentum, stem cell therapy is positioned to maintain its dominance as the preferred method for next-generation tooth regeneration solutions, transforming restorative dentistry globally.Based on the Application, the market is categorized into the Dentin, Pulp and Enamel. Dentin is expected to dominate the Tooth Regeneration Market over the forecast period. Dentin, being the protective layer beneath enamel, plays a crucial role in tooth integrity and health. Innovative regenerative approaches, including stem cell therapy, tissue scaffolds, and biomimetic materials, are increasingly employed to restore damaged dentin, offering durable and functional solutions compared to conventional fillings. The rising geriatric population, coupled with increasing incidences of dental decay and trauma, is driving the demand for dentin-focused therapies. The research advancements in growth factors, scaffold designs, and bioactive compounds are enhancing the predictability and effectiveness of dentin regeneration. Dental practitioners are adopting these regenerative solutions to provide minimally invasive, patient-friendly treatments that preserve natural tooth structure and improve long-term oral health outcomes. Tooth Regeneration Market leaders are investing in R&D, clinical validation, and partnerships to expand the availability of dentin regeneration products. As awareness among patients and dentists grows, dentin regeneration is poised to remain the dominant application segment, reflecting its critical role in restorative dentistry and its potential to transform the tooth regeneration landscape.

Tooth Regeneration Market Regional Insights

North America dominated the Tooth Regeneration Market in 2024 and is expected to continue its dominance over the forecast period. This leadership is largely attributed to the region’s advanced healthcare infrastructure, strong investment in research and development, and early adoption of cutting-edge dental technologies. The U.S. and Canada have been at the forefront of regenerative dentistry innovations, leveraging breakthroughs in stem cell therapy, biomaterials, and tissue engineering to develop highly effective tooth regeneration solutions. Patients in North America increasingly prefer minimally invasive, biologically based treatments that restore natural tooth functionality and aesthetics, driving the demand for innovative therapies over traditional dental implants and dentures. The region’s robust regulatory framework and supportive government initiatives for healthcare innovation further strengthen its market position. Extensive funding for clinical trials, research grants, and public-private partnerships accelerates the commercialization of advanced regenerative therapies. Leading Tooth Regeneration Market players, including Dentsply Sirona, Straumann, and Osstem Implant, are actively investing in technology development, strategic collaborations, and product launches to capture market share in North America. The rising prevalence of dental diseases, especially among the aging population, is boosting the adoption of regenerative dental solutions. Geriatric patients increasingly seek long-term, durable treatments that offer both functionality and aesthetic appeal, presenting a steady growth opportunity for the Tooth Regeneration Market. North America’s dominance is further reinforced by high patient awareness, accessibility to state-of-the-art dental care, and an established network of dental clinics equipped to implement advanced regenerative therapies.Tooth Regeneration Market Competitive Landscape

The Tooth Regeneration Industry is highly dynamic and competitive, driven by rapid technological advancements, increasing research investments, and strategic collaborations among key players. Tooth Regeneration Leading companies such as Harvard University’s Wyss Institute, the University of Pennsylvania’s School of Dental Medicine, Osstem Implant, Dentsply Sirona, and Straumann are at the forefront, focusing on innovative stem cell-based therapies, biomaterials, and 3D-printed scaffolds to develop biologically compatible and durable dental solutions. These organizations are heavily investing in R&D to enhance the efficacy, precision, and scalability of regenerative treatments, aiming to provide fully functional, natural-looking teeth. Collaborations between academic institutions, biotechnology firms, and dental technology companies are shaping the competitive landscape, accelerating the transition from experimental research to commercial applications. Tooth Regeneration companies are leveraging strategic partnerships, licensing agreements, and acquisitions to expand their technological capabilities and geographic reach, particularly in emerging markets such as the Asia-Pacific, where dental awareness and medical tourism are driving growth. Tooth Regeneration Market players are increasingly focusing on developing minimally invasive solutions that cater to patient preferences for comfort, aesthetics, and faster recovery, which has intensified competition in product innovation. Additionally, regulatory compliance and clinical trial success remain key differentiators, as firms strive to gain approvals for advanced therapies and establish themselves as leaders in the regenerative dentistry segment. Tooth Regeneration Market: Recent Developments On August 2025, the Ivoclar Group has advanced the dental industry through several key developments. The company formed strategic partnerships with Plug and Play to accelerate digital dentistry innovations and with MALO CLINIC to develop cutting-edge treatment concepts. At IDS 2025, Ivoclar unveiled new products, including the IPS e.max ZirCAD Prime block for chairside CAD/CAM monolithic crowns and OptraGate 2, an innovative aid for efficient relative isolation. Additionally, Ivoclar reinforced its commitment to education by hosting the Ivoclar Summer School 2025, providing practical international training for dental students. These initiatives highlight Ivoclar’s focus on combining innovation, collaboration, and education to enhance dental care and treatment efficiency. On 6 August 2025, Dentsply Sirona has not announced any new developments specifically focused on tooth regeneration. However, the company continues to advance in regenerative dentistry through its OSSIX product line, which includes solutions like OSSIX Bone, OSSIX Volumax, and OSSIX Plus. These products utilize GLYMATRIX Core Technology, a proprietary method that cross-links collagen molecules using naturally occurring sugars to create a stable, biocompatible matrix supporting bone and tissue regeneration. While these innovations enhance regenerative capabilities in dental procedures, they are not directly related to the regrowth of natural teeth.Tooth Regeneration Market Trends

Trend Description Stem Cell-Based Therapies Stem cell technology is revolutionizing tooth regeneration by enabling the growth of dental tissues, including enamel, dentin, and pulp. Researchers are exploring pluripotent and dental pulp stem cells to develop fully functional teeth, reducing the need for prosthetics. As clinical trials progress, stem cell-based therapies are expected to become a mainstream dental solution, offering minimally invasive, long-lasting, and biologically compatible treatments that align with patient demand for natural tooth restoration. 3D Printing and Biofabrication The integration of 3D printing in dental regeneration allows the precise fabrication of scaffolds and tooth structures customized to individual patients. Biofabrication techniques combine biomaterials with living cells to create functional dental tissues. This approach accelerates treatment timelines, enhances precision, and improves patient outcomes by enabling tailored, patient-specific solutions. Minimally Invasive Regenerative Dentistry There is a growing shift toward less invasive dental procedures that prioritize tissue preservation and patient comfort. Techniques such as scaffold-assisted regeneration, laser-assisted therapies, and injectable biomaterials minimize surgical intervention while promoting natural tooth repair. This trend aligns with rising consumer awareness of aesthetic outcomes and reduced recovery times. Dental professionals are increasingly adopting these methods to enhance patient satisfaction, making regenerative dentistry more accessible, safer, and compatible with modern dental care standards. Global Tooth Regeneration Market Scope: Inquire before buying

Global Tooth Regeneration Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.3 Bn. Forecast Period 2025 to 2032 CAGR: 5.6% Market Size in 2032: USD 6.65 Bn. Segments Covered: by Method Stem Cell Therapy Tissue Engineering Drug Therapy / Small‑Molecule Treatment Laser Treatment Others by Age Group Pediatric Adult Geriatric by Application Dentin Pulp Enamel by End User Hospitals & Clinics Specialized Dental Clinics Research & Academic Institutes Others Tooth Regeneration Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tooth Regeneration Key Players:

North America 1. Dentsply Sirona (USA) 2. Straumann (USA) 3. Osstell (USA) 4. Nobel Biocare (USA) 5. Ivoclar Vivadent (USA) 6. Organogenesis Inc. (USA) 7. AlloSource (USA) 8. BioHorizons (USA) 9. Advanced BioMatrix (USA) 10. Henry Schein (USA) Europe 1. Geistlich Pharma (Switzerland) 2. BioGaia (Sweden) 3. Straumann Group (Switzerland) 4. Septodont (France) 5. Camlog Biotechnologies (Germany) 6. Nobel Biocare Europe (Switzerland) 7. Medartis AG (Switzerland) 8. Dentsply Sirona Europe (Germany) 9. Ivoclar Vivadent Europe (Liechtenstein) 10. Medtronic Dental (UK) Asia-Pacific 1. Osstem Implant (South Korea) 2. Dio Implant (South Korea) 3. Shandong SINODENT (China) 4. BioMimetic Therapeutics (China) 5. Nobel Biocare Asia (Japan) 6. Straumann Asia (Singapore) 7. Chongqing Medical & Dental Co. (China) 8. SNU Dental Biotech (South Korea) 9. GC Corporation (Japan) 10. Tokuyama Dental (Japan)Frequently Asked Questions:

1. Which region has the largest share in the Tooth Regeneration Market? Ans: The North America region held the largest Tooth Regeneration Market share in 2024. 2. What is the growth rate of the Tooth Regeneration Market? Ans: The Tooth Regeneration is growing at a CAGR of 5.6% during the forecasting period 2025-232. 3. What is the scope of the Tooth Regeneration Market report? Ans: The Tooth Regeneration Market report helps with the PESTEL, Porter's, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Tooth Regeneration Market? Ans: The key players in the Tooth Regeneration Market are Dentsply Sirona (USA), Straumann (USA),Osstell (USA),Nobel Biocare (USA), Ivoclar Vivadent (USA), Organogenesis Inc. (USA), AlloSource (USA), BioHorizons (USA) and Others. 5. What is the study period of the Tooth Regeneration Market? Ans: The Tooth Regeneration Market is studied from 2024 to 2032.

1. Tooth Regeneration Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Tooth Regeneration Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Tooth Regeneration Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Tooth Regeneration Market: Dynamics 3.1. Tooth Regeneration Market Trends by Region 3.1.1. North America Tooth Regeneration Market Trends 3.1.2. Europe Tooth Regeneration Market Trends 3.1.3. Asia Pacific Tooth Regeneration Market Trends 3.1.4. Middle East and Africa Tooth Regeneration Market Trends 3.1.5. South America Tooth Regeneration Market Trends 3.2. Tooth Regeneration Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Tooth Regeneration Market Drivers 3.2.1.2. North America Tooth Regeneration Market Restraints 3.2.1.3. North America Tooth Regeneration Market Opportunities 3.2.1.4. North America Tooth Regeneration Market Challenges 3.2.2. Europe 3.2.2.1. Europe Tooth Regeneration Market Drivers 3.2.2.2. Europe Tooth Regeneration Market Restraints 3.2.2.3. Europe Tooth Regeneration Market Opportunities 3.2.2.4. Europe Tooth Regeneration Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Tooth Regeneration Market Drivers 3.2.3.2. Asia Pacific Tooth Regeneration Market Restraints 3.2.3.3. Asia Pacific Tooth Regeneration Market Opportunities 3.2.3.4. Asia Pacific Tooth Regeneration Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Tooth Regeneration Market Drivers 3.2.4.2. Middle East and Africa Tooth Regeneration Market Restraints 3.2.4.3. Middle East and Africa Tooth Regeneration Market Opportunities 3.2.4.4. Middle East and Africa Tooth Regeneration Market Challenges 3.2.5. South America 3.2.5.1. South America Tooth Regeneration Market Drivers 3.2.5.2. South America Tooth Regeneration Market Restraints 3.2.5.3. South America Tooth Regeneration Market Opportunities 3.2.5.4. South America Tooth Regeneration Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Tooth Regeneration Industry 3.8. Analysis of Government Schemes and Initiatives For Tooth Regeneration Industry 3.9. Tooth Regeneration Market Trade Analysis 3.10. The Global Pandemic Impact on Tooth Regeneration Market 4. Tooth Regeneration Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 4.1.1. Stem Cell Therapy 4.1.2. Tissue Engineering 4.1.3. Drug Therapy / Small‑Molecule Treatment 4.1.4. Laser Treatment 4.1.5. Others 4.2. Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 4.2.1. Pediatric 4.2.2. Adult 4.2.3. Geriatric 4.3. Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 4.3.1. Dentin 4.3.2. Pulp 4.3.3. Enamel 4.4. Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 4.4.1. Hospitals & Clinics 4.4.2. Specialized Dental Clinics 4.4.3. Research & Academic Institutes 4.4.4. Others 4.5. Tooth Regeneration Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Tooth Regeneration Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 5.1.1. Stem Cell Therapy 5.1.2. Tissue Engineering 5.1.3. Drug Therapy / Small‑Molecule Treatment 5.1.4. Laser Treatment 5.1.5. Others 5.2. North America Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 5.2.1. Pediatric 5.2.2. Adult 5.2.3. Geriatric 5.3. North America Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 5.3.1. Dentin 5.3.2. Pulp 5.3.3. Enamel 5.4. North America Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 5.4.1. Hospitals & Clinics 5.4.2. Specialized Dental Clinics 5.4.3. Research & Academic Institutes 5.4.4. Others 5.5. North America Tooth Regeneration Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 5.5.1.1.1. Stem Cell Therapy 5.5.1.1.2. Tissue Engineering 5.5.1.1.3. Drug Therapy / Small‑Molecule Treatment 5.5.1.1.4. Laser Treatment 5.5.1.1.5. Others 5.5.1.2. United States Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 5.5.1.2.1. Pediatric 5.5.1.2.2. Adult 5.5.1.2.3. Geriatric 5.5.1.3. United States Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Dentin 5.5.1.3.2. Pulp 5.5.1.3.3. Enamel 5.5.1.4. United States Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 5.5.1.4.1. Hospitals & Clinics 5.5.1.4.2. Specialized Dental Clinics 5.5.1.4.3. Research & Academic Institutes 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 5.5.2.1.1. Stem Cell Therapy 5.5.2.1.2. Tissue Engineering 5.5.2.1.3. Drug Therapy / Small‑Molecule Treatment 5.5.2.1.4. Laser Treatment 5.5.2.1.5. Others 5.5.2.2. Canada Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 5.5.2.2.1. Pediatric 5.5.2.2.2. Adult 5.5.2.2.3. Geriatric 5.5.2.3. Canada Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Dentin 5.5.2.3.2. Pulp 5.5.2.3.3. Enamel 5.5.2.4. Canada Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 5.5.2.4.1. Hospitals & Clinics 5.5.2.4.2. Specialized Dental Clinics 5.5.2.4.3. Research & Academic Institutes 5.5.2.4.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 5.5.3.1.1. Stem Cell Therapy 5.5.3.1.2. Tissue Engineering 5.5.3.1.3. Drug Therapy / Small‑Molecule Treatment 5.5.3.1.4. Laser Treatment 5.5.3.1.5. Others 5.5.3.2. Mexico Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 5.5.3.2.1. Pediatric 5.5.3.2.2. Adult 5.5.3.2.3. Geriatric 5.5.3.3. Mexico Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Dentin 5.5.3.3.2. Pulp 5.5.3.3.3. Enamel 5.5.3.4. Mexico Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 5.5.3.4.1. Hospitals & Clinics 5.5.3.4.2. Specialized Dental Clinics 5.5.3.4.3. Research & Academic Institutes 5.5.3.4.4. Others 6. Europe Tooth Regeneration Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.2. Europe Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.3. Europe Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.4. Europe Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5. Europe Tooth Regeneration Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.1.2. United Kingdom Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.1.3. United Kingdom Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5.2. France 6.5.2.1. France Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.2.2. France Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.2.3. France Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.3.2. Germany Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.3.3. Germany Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.4.2. Italy Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.4.3. Italy Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.5.2. Spain Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.5.3. Spain Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.6.2. Sweden Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.6.3. Sweden Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.7.2. Austria Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.7.3. Austria Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 6.5.8.2. Rest of Europe Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 6.5.8.3. Rest of Europe Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Tooth Regeneration Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.2. Asia Pacific Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.3. Asia Pacific Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5. Asia Pacific Tooth Regeneration Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.1.2. China Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.1.3. China Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.2.2. S Korea Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.2.3. S Korea Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.3.2. Japan Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.3.3. Japan Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.4. India 7.5.4.1. India Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.4.2. India Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.4.3. India Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.5.2. Australia Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.5.3. Australia Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.6.2. Indonesia Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.6.3. Indonesia Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.7.2. Malaysia Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.7.3. Malaysia Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.8.2. Vietnam Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.8.3. Vietnam Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.9.2. Taiwan Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.9.3. Taiwan Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 7.5.10.2. Rest of Asia Pacific Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 7.5.10.3. Rest of Asia Pacific Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Tooth Regeneration Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 8.2. Middle East and Africa Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 8.3. Middle East and Africa Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 8.5. Middle East and Africa Tooth Regeneration Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 8.5.1.2. South Africa Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 8.5.1.3. South Africa Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 8.5.2.2. GCC Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 8.5.2.3. GCC Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 8.5.3.2. Nigeria Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 8.5.3.3. Nigeria Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 8.5.4.2. Rest of ME&A Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 8.5.4.3. Rest of ME&A Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 9. South America Tooth Regeneration Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 9.2. South America Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 9.3. South America Tooth Regeneration Market Size and Forecast, by Application(2024-2032) 9.4. South America Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 9.5. South America Tooth Regeneration Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 9.5.1.2. Brazil Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 9.5.1.3. Brazil Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 9.5.2.2. Argentina Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 9.5.2.3. Argentina Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Tooth Regeneration Market Size and Forecast, by Method (2024-2032) 9.5.3.2. Rest Of South America Tooth Regeneration Market Size and Forecast, by Age Group (2024-2032) 9.5.3.3. Rest Of South America Tooth Regeneration Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Tooth Regeneration Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Dentsply Sirona (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Straumann (USA) 10.3. Osstell (USA) 10.4. Nobel Biocare (USA) 10.5. Ivoclar Vivadent (USA) 10.6. Organogenesis Inc. (USA) 10.7. AlloSource (USA) 10.8. BioHorizons (USA) 10.9. Advanced BioMatrix (USA) 10.10. Henry Schein (USA) 10.11. Geistlich Pharma (Switzerland) 10.12. BioGaia (Sweden) 10.13. Straumann Group (Switzerland) 10.14. Septodont (France) 10.15. Camlog Biotechnologies (Germany) 10.16. Nobel Biocare Europe (Switzerland) 10.17. Medartis AG (Switzerland) 10.18. Dentsply Sirona Europe (Germany) 10.19. Ivoclar Vivadent Europe (Liechtenstein) 10.20. Medtronic Dental (UK) 10.21. Osstem Implant (South Korea) 10.22. Dio Implant (South Korea) 10.23. Shandong SINODENT (China) 10.24. BioMimetic Therapeutics (China) 10.25. Nobel Biocare Asia (Japan) 10.26. Straumann Asia (Singapore) 10.27. Chongqing Medical & Dental Co. (China) 10.28. SNU Dental Biotech (South Korea) 10.29. GC Corporation (Japan) 10.30. Tokuyama Dental (Japan) 11. Key Findings 12. Industry Recommendations 13. Tooth Regeneration Market: Research Methodology 14. Terms and Glossary