Tantalum Capacitors Market size was valued at USD 3.67 billion in 2023 and is expected to grow to USD 4.99 billion by 2030, representing a compound annual growth rate (CAGR) of 4.5% during the forecast period Tantalum capacitors are electronic component that utilize tantalum metal as their anode, covered by a thin layer of tantalum oxide as the dielectric, and enclosed by a conductive cathode. These capacitors are known for their high capacitance density and stability, making them valuable in various electronic applications where reliability and compact size are essential. The tantalum capacitors market has been exhibiting steady growth driven by increasing demand in various electronic devices including smartphones, laptops, automotive electronics, and industrial equipment. The rising adoption of portable electronic devices, expanding telecommunications infrastructure, and the growing automotive industry worldwide. Major players in the tantalum capacitors market such as AVX Corporation, KEMET Electronics Corporation, and Vishay Intertechnology have been focusing on research and development initiatives to introduce advanced tantalum capacitor technologies, aiming for higher capacitance, miniaturization, and enhanced performance. Additionally, efforts towards sustainable and conflict-free tantalum sourcing have been observed among key industry players, aligning with global initiatives promoting ethical and responsible sourcing practices. The Tantalum Capacitors Market has been witnessing advancements in manufacturing techniques, improving the production efficiency and quality of tantalum capacitors. The use of tantalum in electronic devices is subject to a number of regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act. These regulations are designed to prevent the use of conflict minerals, such as tantalum, that are mined in war-torn countries.To know about the Research Methodology:-Request Free Sample Report 5G Expansion and Tantalum Capacitors Enabling Telecommunications Growth One significant driver of the tantalum capacitors market is the increasing demand within the consumer electronics segment. The ubiquitous presence of smartphones, wearables, tablets, and laptops has propelled the need for smaller yet efficient electronic Product Types. For instance, smartphones have increasingly incorporated tantalum capacitors due to their space-saving attributes and reliability, supporting the devices' power management and performance. Moreover, the automotive industry has significantly contributed to the Tantalum Capacitors Market demand. As the automotive sector transitions toward electric vehicles (EVs) and integrates advanced technologies within vehicles, the demand for tantalum capacitors has surged. These capacitors play a pivotal role in supporting various functionalities in modern vehicles, including safety systems, infotainment, and advanced driver-assistance systems (ADAS), thereby fostering Tantalum Capacitors Market growth. In parallel, the industrial automation sector's evolution and the proliferation of the Industrial Internet of Things (IIoT) have augmented the demand for tantalum capacitors. These Product Types are integral in powering and supporting control systems, sensors, and equipment within industrial settings, enhancing operational efficiency and productivity across industries. Furthermore, the ongoing development and expansion of telecommunications infrastructure, particularly the global rollout of 5G networks, have fueled the demand for tantalum capacitors. These capacitors enable the efficient operation of network equipment, facilitating faster data transmission and bolstering connectivity, thus driving the Tantalum Capacitors Market upward trajectory. Technological advancements in the manufacturing of tantalum capacitors have been a notable growth driver. Innovations leading to higher capacitance values, smaller form factors, and improved performance have catered to the evolving requirements of modern electronic devices. For instance, the development of high-capacitance solid tantalum capacitors has been instrumental in meeting the demand for compact yet high-performance capacitors in various applications. The Tantalum Capacitors Market growth has also been propelled by the expanding usage of tantalum capacitors in medical devices. These capacitors find application in critical healthcare equipment for monitoring, diagnostics, and treatment purposes, owing to their reliability and stability, thus contributing significantly to the healthcare sector's technological advancements. Additionally, the emphasis on sustainable and ethical sourcing practices has shaped the tantalum capacitors market. Key industry players have focused on ensuring responsible sourcing of tantalum, promoting conflict-free production, and adhering to ethical standards, aligning with global initiatives supporting ethical supply chains. The defense and aerospace sectors have also emerged as substantial contributors to the tantalum capacitors market. These industries require high-performance electronic Product Types, including tantalum capacitors, for use in sophisticated applications such as avionics, satellite systems, and military equipment, thus further driving Tantalum Capacitors Market growth. For instance, In June 2023, Vishay Intertechnology introduced a new series of wet tantalum capacitors with hermetic glass-to-metal seals. These capacitors are designed for use in harsh environments, such as avionics and aerospace applications. Quality Concerns and Reliability Challenges in Tantalum Capacitors Market Trend One of the defining characteristics of the Tantalum Capacitors Market is its sensitivity to supply chain dynamics, given its reliance on tantalum ore, a crucial raw material sourced primarily from regions like Central Africa. Geopolitical instabilities in these key production regions have historically caused disruptions, directly impacting the Tantalum Capacitors Market. Moreover, the Tantalum Capacitors Market has grappled with the volatility of raw material prices, directly tied to tantalum ore fluctuations, necessitating adaptive pricing strategies and supply chain management to sustain market stability. In addition to supply-related issues, the Tantalum Capacitors Market contends with fierce competition from alternative capacitor technologies. Ceramic and aluminum electrolytic capacitors pose a notable challenge, showcasing performance comparable to tantalum capacitors. The Tantalum Capacitors Market growth trajectory is further influenced by evolving environmental regulations impacting tantalum mining and processing practices. Complying with stringent environmental norms adds operational complexities, affecting production costs and sourcing strategies within the Tantalum Capacitors Market. Moreover, quality and reliability concerns have arisen within the Tantalum Capacitors Market, affecting consumer confidence. Instances of capacitor failures due to voltage fluctuations or manufacturing defects have prompted a reevaluation of quality control measures and manufacturing standards. Addressing these concerns is crucial for restoring trust and sustaining the Market's growth momentum. China's 5G Revolution Boosting Demand for Tantalum Capacitors Market Electric vehicles use more tantalum capacitors than traditional gasoline-powered vehicles. The U.S. Department of Energy (DOE) unveiled a monumental initiative, a USD 15.5 billion funding and loan package aimed at revitalizing and retooling established factories, specifically targeting the swift transition to electric vehicles (EVs). This extensive financial commitment is strategically designed not only to propel the shift towards EVs but also to bolster employment opportunities while ensuring a fair and equitable transition within the EV industry. By channeling investments into existing manufacturing facilities, the initiative seeks to facilitate the necessary adaptations required for these factories to embrace and integrate EV production processes. This comprehensive support package embodies the government's dedication to fostering a robust EV infrastructure, generating employment opportunities, and steering the nation towards a sustainable and eco-friendly transportation ecosystem. This increased demand is propelling growth in the Tantalum Capacitors Market.The flourishing expansion of 5G networks, especially in China, has sparked a substantial surge in demand for sophisticated electronic Product Types tantalum capacitors. Chinese telecom operators have invested significantly, exceeding $59.4 billion, to drive the advancement of 5G technology. This monumental investment has led to a significant boost in the Tantalum Capacitors Market. The rapid rollout of 5G technology in China, with over 1.85 million 5G base stations already in place, highlights the crucial role tantalum capacitors play in enabling this wireless network's expansion. The 2022 World 5G Convention showcased remarkable progress in 5G's commercial utilization, driving a paradigm shift in various sectors. The surge in mobile data consumption, nearly doubling in the past three years, has been propelled by 5G, facilitating critical applications like remote work, online education, and pandemic control measures. This heightened demand for tantalum capacitors, driven by 5G's exponential growth and industry-specific applications, illustrates their pivotal role in fostering efficient connectivity and industrial advancements within the evolving landscape of China's economy. In April 2023, TDK Corporation declared the development of a new type of tantalum capacitor with a self-healing mechanism. This capacitor is designed to withstand voltage spikes and other overstress conditions

Tantalum Capacitors Market Segment Analysis:

Based on product type, the market has been divided into Tantalum Foil Electrolytic Capacitor, Tantalum Capacitors with Porous Anode and Liquid Electrolyte, and Tantalum Capacitors with Porous Anode and Solid Electrolyte. Among these, the tantalum foil electrolytic Capacitor sub-segment is projected to generate the maximum revenue. The tantalum foil electrolytic Capacitor sub-segment witnessed the highest revenue in 2023. One notable application of tantalum foil electrolytic capacitors is in the aerospace sector. These capacitors are extensively used in avionics and space exploration equipment due to their high reliability and capacity to withstand extreme temperatures and harsh conditions prevalent in outer space. For instance, in satellites and spacecraft, tantalum capacitors play a critical role in providing stable and consistent electrical performance, ensuring the functionality of communication systems, sensors, and other vital Product Types. Moreover, the automotive industry relies significantly on tantalum foil electrolytic capacitors. In modern vehicles, these capacitors contribute to various electronic systems, including engine control units, infotainment systems, and safety features. Their ability to offer high capacitance in a compact form factor makes them ideal for use in small and lightweight automotive electronic modules, aiding in enhanced fuel efficiency and performance. The electronics sector also benefits immensely from tantalum foil electrolytic capacitors. They are integrated into a wide array of devices, such as smartphones, laptops, and other portable electronics. Due to their small size and high capacitance, these capacitors enable miniaturization, contributing to the development of sleeker and more compact electronic gadgets without compromising on performance. For instance, in smartphones, tantalum capacitors support power management, ensuring stable and efficient power delivery to various Product Types. Medical equipment is another domain where tantalum foil electrolytic capacitors find extensive use. In critical medical devices like pacemakers, defibrillators, and implantable medical electronics, these capacitors offer long-term reliability and stability, ensuring the seamless operation of life-saving equipment. The renewable energy sector has also witnessed the integration of tantalum foil electrolytic capacitors. In solar power systems and wind turbines, these capacitors aid in energy storage and power conversion, contributing to the efficient harnessing of renewable energy sources. Their ability to handle high temperatures and voltage fluctuations makes them suitable for harsh environmental conditions prevalent in renewable energy installations. Additionally, the telecommunications industry relies heavily on tantalum foil electrolytic capacitors, particularly in network infrastructure equipment. They are crucial in ensuring stable and reliable performance in routers, switches, and base stations, contributing to the seamless operation of communication networks. For instance, in the deployment of 5G networks, tantalum capacitors play a vital role in supporting faster data transmission and enhancing network efficiency.Tantalum Capacitors Market Regional Insights:

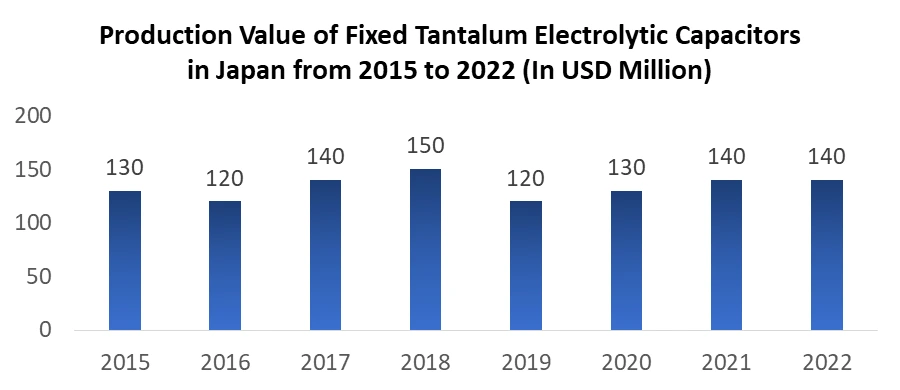

Asia pacific region dominated the Tantalum Capacitors Market in the year 2023, and is expected to continue its dominance during the forecast period. The year 2023 witnessed the This supremacy stems from the region's multifaceted strengths across diverse industries. Asia Pacific serves as a thriving manufacturing hub, boasting countries like China, Japan, South Korea, and Taiwan, renowned for their prowess in producing high-quality electronic Product Types, including tantalum capacitors. The escalating demand for consumer electronics, particularly in nations like China and South Korea, fuels a substantial need for these capacitors, underpinning the region's stronghold in the market. Moreover, Asia Pacific's robust automotive industry, especially in Japan and South Korea, contributes significantly to the demand for tantalum capacitors, essential for the integration of advanced electronic systems in electric vehicles (EVs). The region's rapid deployment and expansion of 5G networks, predominantly in China and South Korea, further amplifies the requirement for tantalum capacitors in telecommunications infrastructure. Additionally, substantial investments in industrial automation, government support for the electronics sector, strategic alliances, and research and development initiatives bolster Asia Pacific's pivotal role in shaping and maintaining dominance in the global tantalum capacitors market. Murata Manufacturing, Japan: A global leader in capacitors, with major production facilities in China and Vietnam, catering to the regional demand. Samsung Electronics, South Korea: Integrates tantalum capacitors in its vast range of smartphones, TVs, and other consumer electronics. BYD Company, China: A major electric vehicle manufacturer extensively uses tantalum capacitors in its battery management systems.Competitive Landscape:

In March 2023, KEMET introduces the T521 KO-CAP High Voltage Organic Polymer Tantalum Capacitors, a cutting-edge series designed to meet the demands of diverse electronic applications. Boasting voltage ratings reaching up to 75V and capacitance values up to 330µF, these capacitors offer exceptional features including high ripple current capability, a secure failure mode, and low Equivalent Series Resistance (ESR). They excel in volumetric efficiency and maintain stable temperature characteristics. Compliant with RoHS standards and halogen-free, these Product Types are lead-free upon selection of a 100% Sn termination finish. Tailored for DC-DC converters, power supply inputs, and higher application voltages like 12V, 24V, 28V, and 48V input rails, the T521 KO-CAP Series revolutionizes capacitor technology. With a tantalum anode and Ta₂O₅ dielectric, these capacitors integrate a conductive organic polymer in place of the conventional MnO₂ cathode plate, ensuring minimal ESR and enhanced capacitance retention at high frequencies, thus positioning them as a premier choice for advanced electronic systems.Global Tantalum Capacitors Market Scope: Inquire before buying

Global Tantalum Capacitors Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.67 Bn. Forecast Period 2024 to 2030 CAGR: 4.5% Market Size in 2030: US $ 4.99 Bn. Segments Covered: by Product Tantalum Foil Electrolytic Capacitor Tantalum Capacitors with Porous Anode and Liquid Electrolyte Tantalum Capacitors with Porous Anode and Solid Electrolyte by Type Sample and Hold Circuits Power Supply Filtering Military Applications Medical Electronics Audio Amplifiers Wireless Handset Telecommunications Infrastructure Tantalum Capacitors Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tantalum Capacitors Market Key Players:

North America 1. KEMET Corporation (United States) 2. AVX Corporation (United States) 3. Vishay Intertechnology, Inc. (United States) 4. Cornell Dubilier Electronics (United States) 5. EEStor Corporation (Canada) Europe 6. H.C. Starck GmbH (Germany) 7. Exxelia (France) Asia Pacific 8. Panasonic Corporation (Japan) 9. Rohm Co., Ltd. (Japan) 10. Kyocera Corporation (Japan) 11. NEC TOKIN Corporation (Japan) 12. Murata Manufacturing Co., Ltd. (Japan) 13. TDK Corporation (Japan) 14. Samsung Electro-Mechanics (South Korea) 15. Lelon Electronics Corporation (Taiwan) 16. Capxon International Electronic Company Limited (China) 17. Jianghai Capacitor Co., Ltd. (China) 18. Sunlord Electronics (China) 19. Suzhou Trigon Semiconductor Technology Co., Ltd. (China) FAQ: 1] What segments are covered in the Global Tantalum Capacitors Market report? Ans. The segments covered in the Tantalum Capacitors Market report are based on product type and Application. 2] Which region is expected to hold the highest share in the Global Tantalum Capacitors Market? Ans. The Asia-Pacific region is expected to hold the highest share in the Tantalum Capacitors Market. 3] What is the market size of the Global Tantalum Capacitors Market by 2030? Ans. The market size of the Tantalum Capacitors Market by 2030 is expected to reach USD 4.99 Bn. 4] Who are the top key players in the Tantalum Capacitors Market? Ans. TDK Corporation (Japan), Samsung Electro-Mechanics (South Korea), and Lelon Electronics Corporation (Taiwan) are the top key players in the Tantalum Capacitors Market. 5] What was the market size of the Global Tantalum Capacitors Market in 2023? Ans. The market size of the Tantalum Capacitors Market in 2023 was valued at USD 3.67 Bn.

1. Tantalum Capacitors Market: Research Methodology 2. Tantalum Capacitors Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Tantalum Capacitors Market: Dynamics 3.1. Tantalum Capacitors Market Trends by Region 3.1.1. North America Tantalum Capacitors Market Trends 3.1.2. Europe Tantalum Capacitors Market Trends 3.1.3. Asia Pacific Tantalum Capacitors Market Trends 3.1.4. Middle East and Africa Tantalum Capacitors Market Trends 3.1.5. South America Tantalum Capacitors Market Trends 3.2. Tantalum Capacitors Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Tantalum Capacitors Market Drivers 3.2.1.2. North America Tantalum Capacitors Market Restraints 3.2.1.3. North America Tantalum Capacitors Market Opportunities 3.2.1.4. North America Tantalum Capacitors Market Challenges 3.2.2. Europe 3.2.2.1. Europe Tantalum Capacitors Market Drivers 3.2.2.2. Europe Tantalum Capacitors Market Restraints 3.2.2.3. Europe Tantalum Capacitors Market Opportunities 3.2.2.4. Europe Tantalum Capacitors Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Tantalum Capacitors Market Drivers 3.2.3.2. Asia Pacific Tantalum Capacitors Market Restraints 3.2.3.3. Asia Pacific Tantalum Capacitors Market Opportunities 3.2.3.4. Asia Pacific Tantalum Capacitors Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Tantalum Capacitors Market Drivers 3.2.4.2. Middle East and Africa Tantalum Capacitors Market Restraints 3.2.4.3. Middle East and Africa Tantalum Capacitors Market Opportunities 3.2.4.4. Middle East and Africa Tantalum Capacitors Market Challenges 3.2.5. South America 3.2.5.1. South America Tantalum Capacitors Market Drivers 3.2.5.2. South America Tantalum Capacitors Market Restraints 3.2.5.3. South America Tantalum Capacitors Market Opportunities 3.2.5.4. South America Tantalum Capacitors Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Tantalum Capacitors Market 3.8. Analysis of Government Schemes and Initiatives For the Tantalum Capacitors Market 3.9. The Global Pandemic Impact on the Tantalum Capacitors Market 4. Tantalum Capacitors Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 4.1.1. Tantalum Foil Electrolytic Capacitor 4.1.2. Tantalum Capacitors with Porous Anode and Liquid Electrolyte 4.1.3. Tantalum Capacitors with Porous Anode and Solid Electrolyte 4.2. Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 4.2.1. Sample and Hold Circuits 4.2.2. Power Supply Filtering 4.2.3. Military Applications 4.2.4. Medical Electronics 4.2.5. Audio Amplifiers 4.2.6. Wireless Handset 4.2.7. Telecommunications Infrastructure 4.3. Tantalum Capacitors Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Tantalum Capacitors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 5.1.1. Tantalum Foil Electrolytic Capacitor 5.1.2. Tantalum Capacitors with Porous Anode and Liquid Electrolyte 5.1.3. Tantalum Capacitors with Porous Anode and Solid Electrolyte 5.2. North America Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 5.2.1. Sample and Hold Circuits 5.2.2. Power Supply Filtering 5.2.3. Military Applications 5.2.4. Medical Electronics 5.2.5. Audio Amplifiers 5.2.6. Wireless Handset 5.2.7. Telecommunications Infrastructure 5.3. North America Tantalum Capacitors Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 5.3.1.1.1. Tantalum Foil Electrolytic Capacitor 5.3.1.1.2. Tantalum Capacitors with Porous Anode and Liquid Electrolyte 5.3.1.1.3. Tantalum Capacitors with Porous Anode and Solid Electrolyte 5.3.1.2. United States Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 5.3.1.2.1. Sample and Hold Circuits 5.3.1.2.2. Power Supply Filtering 5.3.1.2.3. Military Applications 5.3.1.2.4. Medical Electronics 5.3.1.2.5. Audio Amplifiers 5.3.1.2.6. Wireless Handset 5.3.1.2.7. Telecommunications Infrastructure 5.3.2. Canada 5.3.2.1. Canada Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 5.3.2.1.1. Tantalum Foil Electrolytic Capacitor 5.3.2.1.2. Tantalum Capacitors with Porous Anode and Liquid Electrolyte 5.3.2.1.3. Tantalum Capacitors with Porous Anode and Solid Electrolyte 5.3.2.2. Canada Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 5.3.2.2.1. Sample and Hold Circuits 5.3.2.2.2. Power Supply Filtering 5.3.2.2.3. Military Applications 5.3.2.2.4. Medical Electronics 5.3.2.2.5. Audio Amplifiers 5.3.2.2.6. Wireless Handset 5.3.2.2.7. Telecommunications Infrastructure 5.3.3. Mexico 5.3.3.1. Mexico Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 5.3.3.1.1. Tantalum Foil Electrolytic Capacitor 5.3.3.1.2. Tantalum Capacitors with Porous Anode and Liquid Electrolyte 5.3.3.1.3. Tantalum Capacitors with Porous Anode and Solid Electrolyte 5.3.3.2. Mexico Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 5.3.3.2.1. Sample and Hold Circuits 5.3.3.2.2. Power Supply Filtering 5.3.3.2.3. Military Applications 5.3.3.2.4. Medical Electronics 5.3.3.2.5. Audio Amplifiers 5.3.3.2.6. Wireless Handset 5.3.3.2.7. Telecommunications Infrastructure 6. Europe Tantalum Capacitors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.2. Europe Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3. Europe Tantalum Capacitors Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.1.2. United Kingdom Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3.2. France 6.3.2.1. France Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.2.2. France Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.3.2. Germany Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.4.2. Italy Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.5.2. Spain Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.6.2. Sweden Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.7.2. Austria Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 6.3.8.2. Rest of Europe Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7. Asia Pacific Tantalum Capacitors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.2. Asia Pacific Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3. Asia Pacific Tantalum Capacitors Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.1.2. China Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.2.2. S Korea Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.3.2. Japan Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.4. India 7.3.4.1. India Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.4.2. India Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.5.2. Australia Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.6.2. Indonesia Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.7.2. Malaysia Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.8.2. Vietnam Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.9.2. Taiwan Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 7.3.10.2. Rest of Asia Pacific Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 8. Middle East and Africa Tantalum Capacitors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 8.2. Middle East and Africa Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 8.3. Middle East and Africa Tantalum Capacitors Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 8.3.1.2. South Africa Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 8.3.2.2. GCC Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 8.3.3.2. Nigeria Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 8.3.4.2. Rest of ME&A Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 9. South America Tantalum Capacitors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 9.2. South America Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 9.3. South America Tantalum Capacitors Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 9.3.1.2. Brazil Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 9.3.2.2. Argentina Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Tantalum Capacitors Market Size and Forecast, By Product Type (2023-2030) 9.3.3.2. Rest Of South America Tantalum Capacitors Market Size and Forecast, By Application (2023-2030) 10. Global Tantalum Capacitors Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Tantalum Capacitors Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Adtell Integration (United States) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Adtran, Inc. (United States) 11.3. ADVA Optical Networking (Germany) 11.4. Broadcom, Inc. (United States) 11.5. Ciena Corporation (United States) 11.6. Cisco Systems, Inc. (United States) 11.7. CommScope (United States) 11.8. Corning, Inc. (United States) 11.9. Finisar Corporation (United States) 11.10. Fujitsu Optical Product Types Ltd. (Japan) 11.11. Furukawa Electric (Japan) 11.12. Hamamatsu Photonics K.K. (Japan) 11.13. Hengtong (China) 11.14. Huawei Technologies Co., Ltd. (China) 11.15. HUBER+SUHNER AG (Switzerland) 11.16. Jiangsu Fasten Company Ltd. (China) 11.17. Lumentum Operations LLC (United States) 11.18. Optiwave Systems, Inc. (Canada) 11.19. TongDing, Group Co., Ltd. (China) 11.20. ZTT International Limited (China) 12. Key Findings 13. Industry Recommendations