Global Sulfuric Acid Market size was USD 20.54 billion in 2024 and is expected to reach USD 49.78 billion by 2032, at a 11.7% CAGR, driven by fertilizer and phosphoric acid production, mining, metal processing, batteries, and stricter environmental norms.Sulfuric Acid Market Overview

Sulfuric acid is a strong, corrosive inorganic acid (H₂SO₄) widely used in fertilizers, chemical manufacturing, metal processing, batteries, and industrial applications due to its powerful dehydrating and oxidizing properties. Strong fertilizer demand across the Asia Pacific, particularly China and India, continues to drive the Sulfuric Acid Market, where more than 55% of total H₂SO₄ output is used for phosphoric acid manufacturing. Industrial sulfuric acid applications in metal processing, pigments, detergents, and petrochemicals elevate global sulfuric acid demand, while increasing EV penetration boosts consumption of battery electrolytes. Environmental regulations are encouraging low-emission technologies, supporting growth in wet sulfuric acid process markets and improving global production efficiency, driving the sulfuric acid market. Price volatility remains a challenge, as elemental sulfur costs fluctuated by 20–30% in 2023–24, affecting margins in fertilizer and chemical manufacturing industries. Rising wastewater treatment needs, expanding mining operations, and increasing demand for fertilizer acid across developing nations offer strong market opportunities. Asia Pacific leads the Market revenue by region, followed by North America and Europe.To know about the Research Methodology :- Request Free Sample Report

Trend: Rapid global shift toward low-emission DCDA sulfuric acid plant technology

Modern double contact double absorption units deliver up to 99.8% conversion efficiency, reduce SO₂ emissions by more than 85%, and generate substantial industrial steam, making them ideal for fertilizer, smelter, and chemical manufacturing operations. This trend is significantly shaping the Sulfuric Acid market, especially in the Asia Pacific, where large-scale expansions are underway in China, India, and Indonesia to meet rising fertilizer-grade sulfuric acid requirements. Governments and industry bodies are promoting integrated facilities that recover waste heat and use advanced gas cleaning systems. Tightened sulfuric acid plant environmental regulations in Europe and North America further accelerate the migration from older lead chamber and basic contact systems to advanced DCDA or hybrid wet sulfuric acid process units. Investments from OCP, Ma’aden, DuPont Clean Technologies, BASF, and Chemtrade highlight the global momentum toward high-purity, energy-optimized production. Rising global sulfuric acid demand from phosphoric acid production, as well as growing mining and metal processing, reinforces the need for efficient, low-emission technologies. This technology-driven transition represents one of the most influential sulfuric acid market trends of the coming decade. The increasing demand for phosphoric acid production using sulfuric acid As the world’s population grows and fertilizer usage intensifies across Asia Pacific, Africa, and Latin America, the need for phosphate fertilizers such as DAP, MAP, SSP, and TSP continues to rise. This directly boosts the Sulphuric Acid Market, which remains a core input for fertilizer acid production. India and China together consume more than 65 million tonnes annually, positioning agriculture as the most influential segment of global sulfuric acid demand. Supportive government policies such as India’s nutrient-based subsidy (NBS) and China’s boosting of domestic fertilizer self-reliance enhance sulfuric acid market growth. Additionally, new fertilizer complexes in Morocco, Saudi Arabia, and Indonesia are creating strong sulfuric acid industry opportunities. Rising phosphate ore processing, integrated DCDA plant installations, and strong demand for industrial acids in crop protection chemicals also reinforce this momentum. • Import Analysis of Fertilizers Brazil remains the world’s largest fertilizer importer in 2024, driven by its extensive agricultural acreage and dependence on external nutrient inputs. India and the USA follow, reflecting strong crop production requirements, while China, France, Canada, Mexico, Australia, Turkey, and Thailand maintain steady import levels aligned with diverse farming activities. Parallelly, sulfuric acid demand is rising globally as it is essential for producing phosphoric acid used in phosphate fertilizers. Increased consumption of NPK fertilizers, industrial chemicals, and emerging battery applications is accelerating sulfuric acid production capacity, strengthening its role as a critical raw material in agriculture and manufacturing value chains.• Export Analysis of Fertilizers Russia dominates global fertilizer exports in 2024, driven by large production capacity and competitive pricing. China and Canada follow with strong manufacturing bases and abundant resources, while the U.S., Morocco, and Saudi Arabia remain vital suppliers. Belgium, the Netherlands, and Turkey provide consistent export volumes supporting global supply chains. At the same time, sulfuric acid exports are rising as demand increases for phosphoric acid production, fertilizers, metals processing, and battery materials. Expanding industrialization in developing regions is boosting trade, reinforcing sulfuric acid’s role as a critical commodity chemical across agriculture and manufacturing sectors.

High Volatility in Elemental Sulfur to Sulfuric Acid Feedstock Prices The refining industry, responsible for nearly 70% of sulfur feedstock, experienced 20–30% price fluctuations in 2023–24 due to refinery maintenance cycles, geopolitical disruptions, and shifting oil output levels. This instability affects the sulphuric acid market, especially in regions dependent on imported sulfur such as India, Brazil, and parts of Southeast Asia. When sulfur prices spike by USD 40–60 per tonne, fertilizer producers, smelters, and chemical manufacturers face margin pressure, affecting the broader sulfuric acid market outlook. Smelter shutdowns in Chile, the U.S., and Canada tighten supply, impacting by-product sulfuric acid from smelters and pushing up sulfuric acid price trends. Logistics bottlenecks, including port congestion and rising freight rates, add additional sulfuric acid industry challenges, disrupting procurement for large-scale DCDA plants. Environmental regulations requiring high-cost emission control systems also increase operational burdens for small and mid-size producers.

Sulfuric Acid Market Segment Analysis

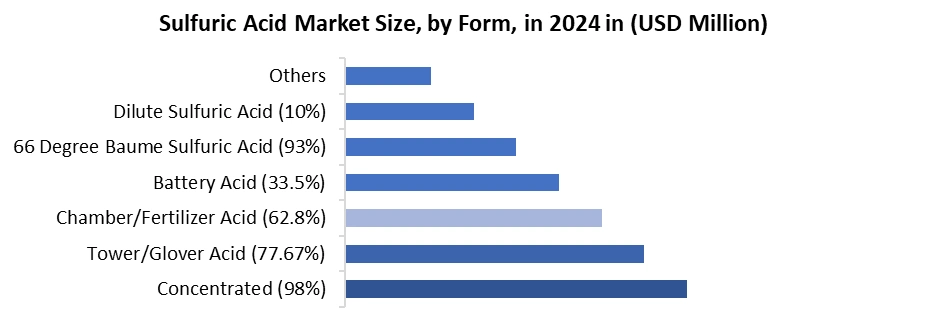

By Raw Material, the market is segmented into the Base metal smelters, Elemental Sulfur, Pyrite Ore and Others. The elemental sulfur dominated the global sulfuric acid market in 2024. This dominance is driven by the expanding refining industry, rising global sulfuric acid demand, and the continuous shift toward cleaner feedstock compared to base metal smelter sulfuric acid supply or pyrite roasting. With refineries producing large volumes of recovered sulfur through hydrodesulfurization, the cost advantage of converting elemental sulfur to sulfuric acid has strengthened, especially across the Asia Pacific and the Middle East. The high purity and operational efficiency of elemental sulfur-based DCDA units support fertilizer, mining, and chemical manufacturing. This raw material also aligns with sustainability goals, offering lower emissions than smelter-acid routes. In the sulfuric acid market, elemental sulfur plays a strategic role in ensuring supply stability for phosphoric acid production, enabling growth in phosphate fertilizers, where more than 55% of total sulfuric acid consumption is used. The refineries continue to be the primary suppliers of elemental sulfur, supported by long-term contracts with fertilizer producers in India, Morocco, and China.By Form, the market is categorized into the Concentrated (98%), Tower/Glover Acid (77.67%), Chamber/Fertilizer Acid (62.8%), Battery Acid (33.5%), 66 Degree Baume Sulfuric Acid (93%), Dilute Sulfuric Acid (10%) and Others. Concentrated Sulfuric Acid (98%) is expected to dominate the Sulfuric Acid Market over the forecast period. This high-purity form is essential for core downstream sectors, including fertilizer-grade sulfuric acid, chemical synthesis, petroleum refining, and sulfuric acid in mining and metal processing. The dominance of the 98% grade is tied to its indispensable role in phosphoric acid production using sulfuric acid, which feeds the global phosphate fertilizer industry, particularly DAP, MAP, SSP, and TSP. Rising consumption across China, India, Morocco, and the U.S. reinforces demand for this concentration. The industrial sulfuric acid applications segment, including detergents, pharmaceuticals, pigments, and battery electrolytes, relies heavily on 98% acid for consistent performance. The segment benefits from efficient production in DCDA sulfuric acid plants (double contact double absorption), supporting strong operational economics and reduced emissions.

Sulfuric Acid Market Regional Insights

Asia Pacific dominated the Sulfuric Acid Market in 2024 and is expected to continue its dominance over the forecast period. The region’s leadership is driven by exceptionally high fertilizer consumption in China and India, where more than 55% of regional output supports phosphoric acid manufacturing and downstream phosphate fertilizers. Strong growth in metal processing, battery manufacturing, and chemical intermediates further strengthens regional demand. China alone produces nearly 90–95 million tonnes annually, while India exceeds 20 million tonnes, supported by refinery-based elemental sulfur conversion and expansions of DCDA units. Rising industrial acid usage, rapid agricultural intensification, and expanding smelter operations across ASEAN nations act as major global sulfuric acid demand drivers. Asia Pacific benefits from new capacity additions, low-cost feedstock availability, and government-backed investments in fertilizer self-reliance, creating substantial sulfuric acid market opportunities. Increasing use of the contact process, modernization of wet-process facilities, and improved supply chains contribute to stable output and competitive pricing. Demand from EV battery electrolytes, wastewater treatment, and pigment manufacturing is expected to support regional expansion.Sulfuric Acid Market Competitive Landscape

The sulfuric acid industry is highly competitive, with global producers focusing on capacity expansion, cost-efficient elemental sulfur conversion, and low-emission technologies to strengthen their sulfuric acid market share. Key players such as BASF, OCP Group, Mosaic, Chemtrade, Aurubis, and Ma’aden dominate through integrated fertilizer production, securing raw material access, and expanding DCDA sulfuric acid plants to meet rising global sulfuric acid demand. The mining and metal processing companies are adopting sustainable leaching technologies, while chemical manufacturers invest in ultra-pure grades for electronics. Strategic collaborations, backward integration into elemental sulfur, and investments in the wet sulfuric acid process. Regionally, China, India, the U.S., and Morocco lead production due to strong sulfuric acid demand in the fertilizer industry, especially for phosphoric acid manufacturing. Price fluctuations, regulatory norms, and technological upgrades. • On 30 April 2025, BASF announced a major investment in a new semiconductor-grade sulfuric acid (H₂SO₄) plant at its Ludwigshafen site. The high-purity facility costing a high double-digit million-euro amount supports Europe’s expanding semiconductor ecosystem, with operations starting in 2027. The project strengthens supply chain reliability by providing ultra-pure sulfuric acid for chip manufacturing, benefiting automotive, mobile communication, and AI applications, while reinforcing BASF’s strategic partnerships and leadership in advanced electronic chemicals. • On 17 July 2024, OCP Group awarded Worley Chemetics a notice of award to develop three new greenfield sulfuric acid plants at the Mzinda Phosphate Hub in Morocco. The project includes delivery of proprietary sulfuric acid technology, engineering, procurement, specialized equipment, and site services. Designed for higher efficiency and lower emissions, the plants will support OCP’s Green Investment Programme, helping expand fertilizer production capacity from 12 million to 20 million tonnes by 2027 using clean energy and sustainable water resources.Sulfuric Acid Market Scope: Inquire before buying

Global Sulfuric Acid Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 20.54 Bn. Forecast Period 2025 to 2032 CAGR: 11.7% Market Size in 2032: USD 49.78 Bn. Segments Covered: by Raw Material Base metal smelters Elemental Sulfur Pyrite Ore Others by Form Concentrated (98%) Tower/Glover Acid (77.67%) Chamber/Fertilizer Acid (62.8%) Battery Acid (33.5%) 66 Degree Baume Sulfuric Acid (93%) Dilute Sulfuric Acid (10%) Others by Purity Type Standard Ultra-pure by Manufacturing Process Contact Process Lead chamber process Wet sulfuric acid process Metabisulfite process Others by Application Fertilizers Chemical Manufacturing Metal Processing Petroleum Refining Textile Processing Pulp & Paper Automotive Batteries Others by Distribution Channel Direct Sales Online Platforms Others Sulfuric Acid Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sulfuric Acid Key Players

1. BASF SE 2. The Mosaic Company 3. OCP Group 4. Chemtrade Logistics 5. PVS Chemicals 6. Aurubis AG 7. KANTO Chemical Co., Inc. 8. INEOS Group 9. DuPont 10. Ma’aden 11. Akzo Nobel Industrial Chemicals 12. Agrium Inc. 13. Valero Energy Corporation 14. Linde plc 15. Honeywell International 16. LANXESS AG 17. Atul Ltd. 18. Sumitomo Chemical Co., Ltd. 19. Aditya Birla Chemicals 20. Togglin Chemicals Co. 21. Trinidad Sulphur Company 22. Southern States Chemical 23. WeylChem Group 24. Incitec Pivot Limited (IPL) 25. Hindalco Industries 26. Jordan Phosphate Mines Company (JPMC) 27. Boliden Group 28. GreenPacific Corp 29. KMG Chemicals 30. Qatar Industrial Manufacturing Company (QIMC)Frequently Asked Questions:

1] What is the growth rate of the Global Sulfuric Acid Market? Ans. The Global Sulfuric Acid Market is growing at a significant rate of 11.7% during the forecast period. 2] Which region is expected to dominate the Global Sulfuric Acid Market? Ans. Asia Pacific is expected to dominate the Sulfuric Acid Market during the forecast period. 3] What was the Global Sulfuric Acid Market size in 2024? Ans. The Sulfuric Acid Market size is expected to reach USD 20.54 billion in 2024. 4] What is the expected Global Sulfuric Acid Market size by 2032? Ans. The Sulfuric Acid Market size is expected to reach USD 49.78 billion by 2032. 5] Which are the top players in the Global Sulfuric Acid Market? Ans. The major players in the Global Sulfuric Acid Market are BASF SE, The Mosaic Company, OCP Group, Chemtrade Logistics, PVS Chemical and Others. 6] What are the factors driving the Global Sulfuric Acid Market growth? Ans. The global sulfuric acid market is driven by rising fertilizer demand, growing phosphoric acid production, expanding chemical and metals processing industries, rapid industrialization, and increasing use in batteries, wastewater treatment, and electronics manufacturing.

1. Sulfuric Acid Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Sulfuric Acid Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End-User Segment 2.2.5. Revenue Details in 2024 2.2.6. Market Share (%) 2.2.7. Growth Rate (%) 2.2.8. Return on Investment (%) 2.2.9. Technological Capabilities 2.2.10. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Sulfuric Acid Market: Dynamics 3.1. Sulfuric Acid Market Trends 3.2. Sulfuric Acid Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Sulfuric Acid Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 4.1. Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 4.1.1. Base metal smelters 4.1.2. Elemental Sulfur 4.1.3. Pyrite Ore 4.1.4. Others 4.2. Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 4.2.1. Concentrated (98%) 4.2.2. Tower/Glover Acid (77.67%) 4.2.3. Chamber/Fertilizer Acid (62.8%) 4.2.4. Battery Acid (33.5%) 4.2.5. 66 Degree Baume Sulfuric Acid (93%) 4.2.6. Dilute Sulfuric Acid (10%) 4.2.7. Others 4.3. Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 4.3.1. Standard 4.3.2. Ultra-pure 4.4. Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 4.4.1. Contact Process 4.4.2. Lead chamber process 4.4.3. Wet sulfuric acid process 4.4.4. Metabisulfite process 4.4.5. Others 4.5. Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 4.5.1. Fertilizers 4.5.2. Chemical Manufacturing 4.5.3. Metal Processing 4.5.4. Petroleum Refining 4.5.5. Textile Processing 4.5.6. Pulp & Paper 4.5.7. Automotive Batteries 4.5.8. Others 4.6. Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 4.6.1. Direct Sales 4.6.2. Online Platforms 4.6.3. Others 4.7. Sulfuric Acid Market Size and Forecast, By Region (2024-2032) 4.7.1. North America 4.7.2. Europe 4.7.3. Asia Pacific 4.7.4. Middle East and Africa 4.7.5. South America 5. North America Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 5.1. Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 5.2. Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 5.3. Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 5.4. Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 5.5. Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 5.6. Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 5.7. North America Sulfuric Acid Market Size and Forecast, by Country (2024-2032) 5.7.1. United States 5.7.1.1. Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 5.7.1.2. Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 5.7.1.3. Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 5.7.1.4. Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024- 5.7.1.5. Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 5.7.1.6. Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 5.7.2. Canada 5.7.2.1. Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 5.7.2.2. Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 5.7.2.2.1. 5.7.2.3. Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 5.7.2.4. Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 5.7.2.5. Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 5.7.2.6. Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 5.7.3. Mexico 5.7.3.1. Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 5.7.3.2. Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 5.7.3.2.1. 5.7.3.3. Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 5.7.3.4. Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 5.7.3.5. Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 5.7.3.6. Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6. Europe Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 6.1. Europe Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.2. Europe Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.3. Europe Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.4. Europe Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.5. Europe Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.6. Europe Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7. Europe Sulfuric Acid Market Size and Forecast, by Country (2024-2032) 6.7.1. United Kingdom 6.7.1.1. United Kingdom Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.1.2. United Kingdom Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.1.3. United Kingdom Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.1.4. United Kingdom Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.1.5. United Kingdom Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.1.6. United Kingdom Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.2. France 6.7.2.1. France Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.2.2. France Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.2.3. France Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.2.4. France Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.2.5. France Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.2.6. France Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.3. Germany 6.7.3.1. Germany Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.3.2. Germany Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.3.3. Germany Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.3.4. Germany Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.3.5. Germany Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.3.6. Germany Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.4. Italy 6.7.4.1. Italy Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.4.2. Italy Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.4.3. Italy Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.4.4. Italy Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.4.5. Italy Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.4.6. Italy Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.5. Spain 6.7.5.1. Spain Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.5.2. Spain Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.5.3. Spain Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.5.4. Spain Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.5.5. Spain Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.5.6. Spain Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.6. Sweden 6.7.6.1. Sweden Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.6.2. Sweden Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.6.3. Sweden Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.6.4. Sweden Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.6.5. Sweden Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.6.6. Sweden Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.7. Russia 6.7.7.1. Russia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.7.2. Russia Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.7.3. Russia Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.7.4. Russia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.7.5. Russia Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.7.6. Russia Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 6.7.8. Rest of Europe 6.7.8.1. Rest of Europe Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 6.7.8.2. Rest of Europe Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 6.7.8.3. Rest of Europe Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 6.7.8.4. Rest of Europe Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 6.7.8.5. Rest of Europe Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 6.7.8.6. Rest of Europe Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7. Asia Pacific Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 7.1. Asia Pacific Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.2. Asia Pacific Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.3. Asia Pacific Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.4. Asia Pacific Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.5. Asia Pacific Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.6. Asia Pacific Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7. Asia Pacific Sulfuric Acid Market Size and Forecast, by Country (2024-2032) 7.7.1. China 7.7.1.1. China Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.1.2. China Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.1.3. China Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.1.4. China Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.1.5. China Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.1.6. China Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.2. S Korea 7.7.2.1. S Korea Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.2.2. S Korea Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.2.3. S Korea Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.2.4. S Korea Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.2.5. S Korea Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.2.6. S Korea Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.3. Japan 7.7.3.1. Japan Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.3.2. Japan Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.3.3. Japan Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.3.4. Japan Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.3.5. Japan Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.3.6. Japan Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.4. India 7.7.4.1. India Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.4.2. India Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.4.3. India Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.4.4. India Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.4.5. India Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.4.6. India Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.5. Australia 7.7.5.1. Australia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.5.2. Australia Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.5.3. Australia Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.5.4. Australia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.5.5. Australia Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.5.6. Australia Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.6. Indonesia 7.7.6.1. Indonesia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.6.2. Indonesia Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.6.3. Indonesia Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.6.4. Indonesia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.6.5. Indonesia Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.6.6. Indonesia Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.7. Malaysia 7.7.7.1. Malaysia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.7.2. Malaysia Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.7.3. Malaysia Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.7.4. Malaysia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.7.5. Malaysia Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.7.6. Malaysia Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.8. Philippines 7.7.8.1. Philippines Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.8.2. Philippines Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.8.3. Philippines Sulfuric Acid Market Size and Forecast, By Purity Type Philippines Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.8.4. Philippines Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.8.5. Philippines Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.9. Thailand 7.7.9.1. Thailand Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.9.2. Thailand Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.9.3. Thailand Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.9.4. Thailand Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.9.5. Thailand Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.9.6. Thailand Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.10. Vietnam 7.7.10.1. Vietnam Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.10.2. Vietnam Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.10.3. Vietnam Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.10.4. Vietnam Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.10.5. Vietnam Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.10.6. Vietnam Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 7.7.11. Rest of Asia Pacific 7.7.11.1. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 7.7.11.2. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 7.7.11.3. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 7.7.11.4. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 7.7.11.5. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 7.7.11.6. Rest of Asia Pacific Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 8. Middle East and Africa Sulfuric Acid Market Size and Forecast (by Value in USD Billion and Volume in Metric Tons) (2024-2032 8.1. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 8.2. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 8.3. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 8.4. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 8.5. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 8.6. Middle East and Africa Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 8.7. Middle East and Africa Sulfuric Acid Market Size and Forecast, by Country (2024-2032) 8.7.1. South Africa 8.7.1.1. South Africa Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 8.7.1.2. South Africa Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 8.7.1.3. South Africa Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 8.7.1.4. South Africa Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 8.7.1.5. South Africa Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 8.7.1.6. South Africa Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.2. GCC 8.7.2.1. GCC Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 8.7.2.2. GCC Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 8.7.2.3. GCC Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 8.7.2.4. GCC Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 8.7.2.5. GCC Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 8.7.2.6. GCC Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.3. Egypt 8.7.3.1. Egypt Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 8.7.3.2. Egypt Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 8.7.3.3. Egypt Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 8.7.3.4. Egypt Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 8.7.3.5. Egypt Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 8.7.3.6. Egypt Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.4. Nigeria 8.7.4.1. Nigeria Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 8.7.4.2. Nigeria Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 8.7.4.3. Nigeria Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 8.7.4.4. Nigeria Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 8.7.4.5. Nigeria Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 8.7.4.6. Nigeria Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 8.7.5. Rest of ME&A 8.7.5.1. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 8.7.5.2. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 8.7.5.3. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 8.7.5.4. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 8.7.5.5. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 8.7.5.6. Rest of ME&A Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 9. South America Sulfuric Acid Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 9.1. South America Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 9.2. South America Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 9.3. South America Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 9.4. South America Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 9.5. South America Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 9.6. South America Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 9.7. South America Sulfuric Acid Market Size and Forecast, by Country (2024-2032) 9.7.1. Brazil 9.7.1.1. Brazil Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 9.7.1.2. Brazil Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 9.7.1.3. Brazil Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 9.7.1.4. Brazil Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 9.7.1.5. Brazil Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 9.7.1.6. Brazil Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.2. Argentina 9.7.2.1. Argentina Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 9.7.2.2. Argentina Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 9.7.2.3. Argentina Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 9.7.2.4. Argentina Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 9.7.2.5. Argentina Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 9.7.2.6. Argentina Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.3. Colombia 9.7.3.1. Colombia Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 9.7.3.2. Colombia Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 9.7.3.3. Colombia Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 9.7.3.4. Colombia Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 9.7.3.5. Colombia Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 9.7.3.6. Colombia Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.4. Chile 9.7.4.1. Chile Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 9.7.4.2. Chile Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 9.7.4.3. Chile Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 9.7.4.4. Chile Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 9.7.4.5. Chile Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 9.7.4.6. Chile Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 9.7.5. Rest Of South America 9.7.5.1. Rest Of South America Sulfuric Acid Market Size and Forecast, By Raw Material (2024-2032) 9.7.5.2. Rest Of South America Sulfuric Acid Market Size and Forecast, By Form (2024-2032) 9.7.5.3. Rest Of South America Sulfuric Acid Market Size and Forecast, By Purity Type (2024-2032) 9.7.5.4. Rest Of South America Sulfuric Acid Market Size and Forecast, By Manufacturing Process (2024-2032) 9.7.5.5. Rest Of South America Sulfuric Acid Market Size and Forecast, By Application (2024-2032) 9.7.5.6. Rest Of South America Sulfuric Acid Market Size and Forecast, By Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. BASF SE 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. The Mosaic Company 10.3. OCP Group 10.4. Chemtrade Logistics 10.5. PVS Chemicals 10.6. Aurubis AG 10.7. KANTO Chemical Co., Inc. 10.8. INEOS Group 10.9. DuPont 10.10. Ma’aden 10.11. Akzo Nobel Industrial Chemicals 10.12. Agrium Inc. 10.13. Valero Energy Corporation 10.14. Linde plc 10.15. Honeywell International 10.16. LANXESS AG 10.17. Atul Ltd. 10.18. Sumitomo Chemical Co., Ltd. 10.19. Aditya Birla Chemicals 10.20. Togglin Chemicals Co. 10.21. Trinidad Sulphur Company 10.22. Southern States Chemical 10.23. WeylChem Group 10.24. Incitec Pivot Limited (IPL) 10.25. Hindalco Industries 10.26. Jordan Phosphate Mines Company (JPMC) 10.27. Boliden Group 10.28. GreenPacific Corp 10.29. KMG Chemicals 10.30. Qatar Industrial Manufacturing Company (QIMC) 11. Key Findings 12. Analyst Recommendations 13. Sulfuric Acid Market: Research Methodology