The Submersible Pumps Market size was valued at USD 16.22 Billion in 2024 and the total Submersible Pumps revenue is expected to grow at a CAGR of 7.1 % from 2025 to 2032, reaching nearly USD 28.08 Billion by 2032.Submersible Pumps Market Overview:

Submersible pumps are specially designed pumping devices that operate while fully submerged in water or other fluids, offering efficient liquid handling with minimal noise and reduced risk of cavitation. Widely used in agriculture, construction, oil & gas, water supply, and wastewater treatment, they provide reliable, energy-efficient, and long-lasting pumping solutions. The increasing demand for efficient water management, agricultural irrigation, industrial dewatering, and wastewater treatment solutions across both developed and developing economies drives, Submersible Pumps Market growth.To know about the Research Methodology :- Request Free Sample Report Submersible pumps, which operate by being fully submerged in the fluid they pump, offer several advantages such as high efficiency, lower maintenance, reduced priming issues, and the ability to handle corrosive or slurry-based fluids, making them indispensable in modern infrastructure and industrial applications. In the agriculture sector, increasing reliance on borewell submersible pumps for irrigation is boosting adoption, especially in water-scarce regions where consistent and reliable groundwater extraction is essential. The rapid urbanization and population growth are straining municipal water supply and sewage systems, pushing governments and municipalities to invest in advanced pumping technologies for drainage, flood control, and wastewater treatment facilities. Industries such as oil & gas, mining, and construction are major contributors to the Submersible Pumps Market growth, as submersible pumps are used extensively for dewatering mines, handling drilling fluids, and managing construction site water.

Submersible Pumps Market Dynamics:

Increasing Demand for Water & Wastewater Management to drive the Submersible Pumps Market As the world’s population rises and urbanization accelerates, the pressure on municipal water supply and drainage systems has intensified significantly. Submersible pumps, known for their ability to operate while fully submerged, provide a reliable and cost-efficient solution for extracting, transporting, and managing water in residential, commercial, and industrial applications. Wastewater treatment plants, stormwater drainage systems, and sewage facilities increasingly deploy submersible pumps because of their high durability, ability to handle solid waste, and minimal risk of cavitation. The growing scarcity of clean water resources is pushing governments and private organizations to strengthen water infrastructure through sustainable solutions. This trend is significantly boosting the Submersible Pumps Market, as these pumps are increasingly adopted for groundwater extraction, desalination plants, and rainwater harvesting systems. In agriculture, the expanding use of borewell submersible pumps ensures consistent irrigation, reducing farmers’ dependence on erratic rainfall. Meanwhile, industries such as oil & gas, mining, and construction rely on submersible pumps for dewatering, slurry handling, and process fluid management, broadening the Submersible Pumps Market scope. The integration of smart technologies, including IoT-enabled monitoring and energy-efficient motors, enhances pump performance, reduces operational costs, and extends service life, making them highly attractive in sustainability-focused economies. High Operational Costs and Maintenance Challenges to Hamper the Submersible Pumps Market Submersible pumps, especially those used in deep borewells, mining, and oilfield operations, are expensive to install, and their submerged positioning makes regular inspection difficult. Any malfunction requires dismantling and extraction, leading to costly downtime and labor expenses. The frequent exposure to abrasive materials, chemical-laden wastewater, and corrosive environments reduces pump efficiency and shortens service life, necessitating frequent replacements, which hamper Submersible Pumps Market growth. In developing regions, limited access to skilled technicians and high electricity costs restrict adoption, particularly among small-scale farmers and low-income households. While energy-efficient models are available, their higher upfront cost acts as a barrier for cost-sensitive markets, slowing overall penetration.Submersible Pumps Market Segment Analysis

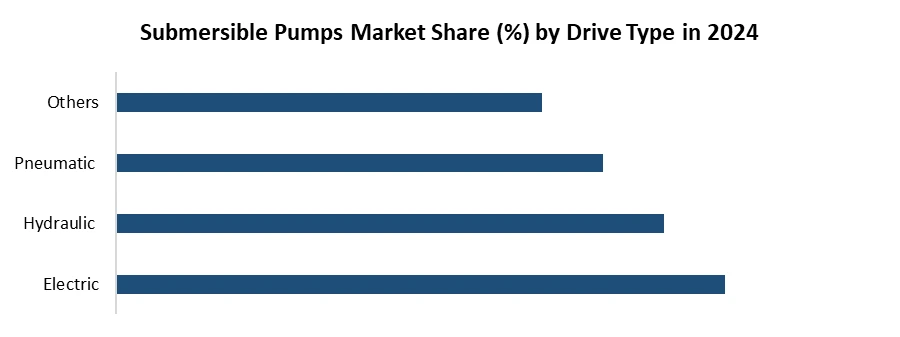

Based on the Product, the market is categorized into the Borewell, Openwell, Non-Clog and Others. Borewell is expected to dominate the Submersible Pumps Market over the forecast period. These pumps are highly efficient for deep-water applications as they are installed inside borewells, ensuring continuous water flow even under low water levels. The increasing dependence on groundwater for drinking and farming in densely populated countries such as India and China significantly boosts demand for this segment. The rapid urbanization and growing pressure on municipal water supply systems have increased the adoption of borewell pumps for residential and commercial applications. Their energy efficiency, low operational costs, and long service life make them more attractive than alternatives like open-well pumps. The integration of advanced materials and smart monitoring systems has further enhanced their durability and performance, reducing clogging and maintenance needs. Additionally, government initiatives promoting sustainable irrigation practices and rural electrification programs across developing economies are driving installations of borewell submersible pumps. With growing concerns over water scarcity and increasing drilling of deeper wells, the borewell segment is expected to remain the leading product category in the Submersible Pumps Market, maintaining strong demand across agricultural, municipal, and industrial sectors.Based on Drive Type, the market is categorized into the Electric, Hydraulic, Pneumatic and Others. The electric drive type held the Submersible Pumps Market in 2024. These pumps are powered by electricity, offering superior efficiency, reliability, and adaptability compared to hydraulic and pneumatic types. The rising global electrification rate, coupled with technological advancements in motor design, has boosted the adoption of electric-driven pumps. In agriculture, electric submersible pumps are increasingly replacing traditional pumping systems, offering a consistent water supply for irrigation at lower energy costs. In urban areas, municipalities rely heavily on electric submersible pumps for sewage, drainage, and water treatment operations due to their high flow rate and minimal maintenance requirements. The oil & gas industry also benefits from electric submersible pumps, especially in artificial lift applications, where they provide a cost-effective solution for enhancing crude oil production. The integration of IoT and automation technologies has made electric pumps smarter, allowing remote monitoring, predictive maintenance, and energy optimization, driving the Submersible Pumps Market growth.

Submersible Pumps Market Regional Insights

Asia Pacific dominated the Submersible Pumps Market in 2024. The region’s growing demand for water supply, wastewater treatment, and agricultural irrigation created a strong need for efficient pumping solutions. Countries such as China, India, and Southeast Asian nations contributed heavily to this dominance due to large-scale construction projects, population growth, and government initiatives focused on clean water access and sustainable resource management. The agriculture sector, particularly in India and China, accelerated adoption, as submersible pumps play a crucial role in irrigation and groundwater extraction. The expanding mining and oil & gas activities in countries such as Australia and Indonesia supported higher demand for heavy-duty submersible pumps. Regional manufacturers strengthened the market by providing cost-competitive and customized solutions, catering to local requirements and increasing accessibility for small- and medium-scale users. The rising investments in smart city projects and wastewater management initiatives across the Asia-Pacific encouraged the integration of energy-efficient and advanced pump technologies. Submersible Pumps companies such as Grundfos, Xylem, and Sulzer have been expanding their presence in the region, collaborating with local distributors and investing in localized production to capture growing opportunities. Submersible Pumps Market Competitive Landscape The competitive landscape of the Submersible Pumps Market is shaped by a mix of established multinational corporations and regional players, each focusing on technological advancements, cost-effectiveness, and sustainable solutions to capture market share. Submersible Pumps Leading global players such as Grundfos, Xylem, KSB Group, Sulzer, and Wilo hold strong positions due to their diversified product portfolios, extensive R&D investments, and well-established distribution networks across North America, Europe, and Asia-Pacific. The companies are increasingly prioritizing the development of smart pump systems integrated with IoT and remote monitoring technologies, enabling predictive maintenance, real-time performance optimization, and reduced downtime. Their innovation strategies emphasize sustainability by incorporating energy-efficient motors, wear-resistant materials, and designs that minimize clogging in demanding applications such as wastewater treatment and mining. For instance, acquisitions in the water and wastewater sector have enabled global leaders to strengthen market presence in emerging economies where infrastructure development is accelerating. Submersible Pumps Market Recent Development April 30, 2024 – Grundfos Launches SE Range Heavy-Duty Wastewater Submersible Pumps Grundfos introduced its new SE range 48 1.5–15-hp submersible wastewater pumps, designed for municipal, utility, and industrial applications handling raw sewage, process water, and unscreened solids. Equipped with single-channel or SuperVortex impellers, the pumps allow free passage of solids up to 4 inches, minimizing clogging risks. Key features include non-stop operation with liquidless motor cooling, moisture-proof cable entry, cartridge shaft seal, and interchangeable motor units for flexible use. July 23, 2024 – Flowserve Acquires LNG Pumping Technology from NexGen Cryo Flowserve Corporation announced the acquisition of intellectual property and R&D assets from NexGen Cryogenic Solutions, enhancing its cryogenic LNG submerged pump technology portfolio. This includes advanced pumps and cold energy recovery turbine (CERT) systems designed for liquefaction, shipping, and regasification markets. The acquisition strengthens Flowserve’s decarbonization strategy, diversifies offerings, and supports its presence in the energy transition. Leveraging NexGen Cryo’s expertise and Flowserve’s global network, the company aims to deliver greater efficiency, reliability, and lower operating costs for LNG customers. Submersible Pumps Market Recent Trends

Trend Description Adoption of Energy-Efficient & Smart Pumps Industries are increasingly investing in energy-efficient submersible pumps integrated with IoT and digital monitoring systems. These solutions lower power consumption, extend equipment life, and enable predictive maintenance. The growing push for sustainability and operational cost savings is fueling their adoption across municipal, industrial, and agricultural applications, making them a key growth driver. Integration of Smart and Energy-Efficient Technologies The shift toward smart pumping solutions with IoT-enabled monitoring, automation, and variable frequency drives (VFDs). These innovations optimize energy consumption, reduce downtime, and extend pump life. With rising electricity costs and sustainability goals, industries and municipalities are increasingly adopting energy-efficient submersible pumps, driving significant growth opportunities across water, wastewater, and industrial applications. Expansion of Solar-Powered Submersible Pumps Solar-driven submersible pumps are gaining rapid adoption in agriculture, irrigation, and rural water supply systems due to their energy savings and integration with renewable energy sources. Governments worldwide are providing subsidies and incentives to promote the adoption of solar irrigation systems. With rising fuel and electricity costs, farmers and rural communities increasingly prefer solar-powered pumps, creating strong growth opportunities. Scope of the Global Submersible Pumps Market: Inquire before buying

Global Submersible Pumps Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 16.22 Bn. Forecast Period 2025 to 2032 CAGR: 7.1% Market Size in 2032: USD 28.08 Bn. Segments Covered: by Product Borewell Openwell Non-Clog Others by Capacity Low High Medium by Drive Type Electric Hydraulic Pneumatic Others by Operation Continuous Intermittent Automatic/Float-Activated Manual Others by End Use Industry Water & Wastewater Management Agriculture & Irrigation Oil & Gas Construction & Building Services Chemical & Industrial Processing Mining & Metals Power Generation Others Submersible Pumps Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Submersible Pumps Market, Key Players:

North America 1. Flowserve Corporation (USA) 2. Xylem Inc. (USA) 3. ITT Goulds Pumps Inc. (USA) 4. Zoeller Pump Company (USA) 5. Gorman-Rupp Company (USA) 6. Franklin Electric Co., Inc. (USA) 7. Baker Hughes (USA) 8. Halliburton (USA) Europe 1. KSB SE & Co. KGaA (Germany) 2. Wilo SE (Germany) 3. Sulzer Ltd. (Switzerland) 4. Atlas Copco AB (Sweden) 5. Weir Group Plc (UK) 6. Interpump Group (Italy) 7. Calpeda S.p.A. (Italy) 8. Pedrollo S.p.A. (Italy) 9. Dab Pumps (Italy) 10. Grundfos (Denmark) Asia-Pacific 1. Kirloskar Brothers Limited (India) 2. CRI Pumps (India) 3. Shakti Pumps (India) 4. Ebara Corporation (Japan) 5. Tsurumi Manufacturing Co. Ltd. (Japan) 6. KBL Industries (India) 7. Shanghai Kaiquan Pump Group (China) 8. LEO Group Pump (China) 9. Torishima Pump (Japan) 10. Toshiba Water Solutions (JaFAQs:

1] What Key players are in the Global Submersible Pumps Market report? Ans. The Major Key players covered in the Submersible Pumps Market report are Flowserve Corporation (USA),Xylem Inc. (USA),ITT Goulds Pumps Inc. (USA),Zoeller Pump Company (USA),Gorman-Rupp Company (USA),Franklin Electric Co., Inc. (USA),Baker Hughes (USA), Halliburton (USA) and Others. 2] Which region is expected to hold the largest share in the Global Market? Ans. Asia Pacific is expected to hold the largest share in the Submersible Pumps Market. 3] What is the expected Global Submersible Pumps Market Size by 2032? Ans. The expected Global Submersible Pumps Market Size by 2032 is USD 28.08 Billion. 4] What is the forecast period for the Global Submersible Pumps Market? Ans. The forecast period for the Submersible Pumps Market is 2025-2032. 5] What was the market size of the Global Submersible Pumps Market in 2024? Ans. The Submersible Pumps Market Size in 2024 was valued at USD 16.22 Billion.

1. Submersible Pumps Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Submersible Pumps Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Submersible Pumps Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Submersible Pumps Market: Dynamics 3.1. Submersible Pumps Market Trends by Region 3.1.1. North America Submersible Pumps Market Trends 3.1.2. Europe Submersible Pumps Market Trends 3.1.3. Asia Pacific Submersible Pumps Market Trends 3.1.4. Middle East and Africa Submersible Pumps Market Trends 3.1.5. South America Submersible Pumps Market Trends 3.2. Submersible Pumps Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Submersible Pumps Market Drivers 3.2.1.2. North America Submersible Pumps Market Restraints 3.2.1.3. North America Submersible Pumps Market Opportunities 3.2.1.4. North America Submersible Pumps Market Challenges 3.2.2. Europe 3.2.2.1. Europe Submersible Pumps Market Drivers 3.2.2.2. Europe Submersible Pumps Market Restraints 3.2.2.3. Europe Submersible Pumps Market Opportunities 3.2.2.4. Europe Submersible Pumps Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Submersible Pumps Market Drivers 3.2.3.2. Asia Pacific Submersible Pumps Market Restraints 3.2.3.3. Asia Pacific Submersible Pumps Market Opportunities 3.2.3.4. Asia Pacific Submersible Pumps Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Submersible Pumps Market Drivers 3.2.4.2. Middle East and Africa Submersible Pumps Market Restraints 3.2.4.3. Middle East and Africa Submersible Pumps Market Opportunities 3.2.4.4. Middle East and Africa Submersible Pumps Market Challenges 3.2.5. South America 3.2.5.1. South America Submersible Pumps Market Drivers 3.2.5.2. South America Submersible Pumps Market Restraints 3.2.5.3. South America Submersible Pumps Market Opportunities 3.2.5.4. South America Submersible Pumps Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Submersible Pumps Industry 3.8. Analysis of Government Schemes and Initiatives For Submersible Pumps Industry 3.9. Submersible Pumps Market Trade Analysis 3.10. The Global Pandemic Impact on Submersible Pumps Market 4. Submersible Pumps Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Submersible Pumps Market Size and Forecast, by Product (2024-2032) 4.1.1. Borewell 4.1.2. Openwell 4.1.3. Non-Clog 4.1.4. Others 4.2. Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 4.2.1. Low 4.2.2. High 4.2.3. Medium 4.3. Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 4.3.1. Electric 4.3.2. Hydraulic 4.3.3. Pneumatic 4.3.4. Others 4.4. Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 4.4.1. Continuous 4.4.2. Intermittent 4.4.3. Automatic/Float-Activated 4.4.4. Manual 4.4.5. Others 4.5. Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 4.5.1. Water & Wastewater Management 4.5.2. Agriculture & Irrigation 4.5.3. Oil & Gas 4.5.4. Construction & Building Services 4.5.5. Chemical & Industrial Processing 4.5.6. Mining & Metals 4.5.7. Power Generation 4.5.8. Others 4.6. Submersible Pumps Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Submersible Pumps Market Size and Forecast, by Product (2024-2032) 5.1.1. Borewell 5.1.2. Openwell 5.1.3. Non-Clog 5.1.4. Others 5.2. North America Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 5.2.1. Low 5.2.2. High 5.2.3. Medium 5.3. North America Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 5.3.1. Electric 5.3.2. Hydraulic 5.3.3. Pneumatic 5.3.4. Others 5.4. North America Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 5.4.1. Continuous 5.4.2. Intermittent 5.4.3. Automatic/Float-Activated 5.4.4. Manual 5.4.5. Others 5.5. North America Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 5.5.1. Water & Wastewater Management 5.5.2. Agriculture & Irrigation 5.5.3. Oil & Gas 5.5.4. Construction & Building Services 5.5.5. Chemical & Industrial Processing 5.5.6. Mining & Metals 5.5.7. Power Generation 5.5.8. Others 5.6. North America Submersible Pumps Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Submersible Pumps Market Size and Forecast, by Product (2024-2032) 5.6.1.1.1. Borewell 5.6.1.1.2. Openwell 5.6.1.1.3. Non-Clog 5.6.1.1.4. Others 5.6.1.2. United States Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 5.6.1.2.1. Low 5.6.1.2.2. High 5.6.1.2.3. Medium 5.6.1.3. United States Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 5.6.1.3.1. Electric 5.6.1.3.2. Hydraulic 5.6.1.3.3. Pneumatic 5.6.1.3.4. Others 5.6.1.4. United States Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 5.6.1.4.1. Continuous 5.6.1.4.2. Intermittent 5.6.1.4.3. Automatic/Float-Activated 5.6.1.4.4. Manual 5.6.1.4.5. Others 5.6.1.5. United States Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 5.6.1.5.1. Water & Wastewater Management 5.6.1.5.2. Agriculture & Irrigation 5.6.1.5.3. Oil & Gas 5.6.1.5.4. Construction & Building Services 5.6.1.5.5. Chemical & Industrial Processing 5.6.1.5.6. Mining & Metals 5.6.1.5.7. Power Generation 5.6.1.5.8. Others 5.6.2. Canada 5.6.2.1. Canada Submersible Pumps Market Size and Forecast, by Product (2024-2032) 5.6.2.1.1. Borewell 5.6.2.1.2. Openwell 5.6.2.1.3. Non-Clog 5.6.2.1.4. Others 5.6.2.2. Canada Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 5.6.2.2.1. Low 5.6.2.2.2. High 5.6.2.2.3. Medium 5.6.2.3. Canada Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 5.6.2.3.1. Electric 5.6.2.3.2. Hydraulic 5.6.2.3.3. Pneumatic 5.6.2.3.4. Others 5.6.2.4. Canada Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 5.6.2.4.1. Continuous 5.6.2.4.2. Intermittent 5.6.2.4.3. Automatic/Float-Activated 5.6.2.4.4. Manual 5.6.2.4.5. Others 5.6.2.5. Canada Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 5.6.2.5.1. Water & Wastewater Management 5.6.2.5.2. Agriculture & Irrigation 5.6.2.5.3. Oil & Gas 5.6.2.5.4. Construction & Building Services 5.6.2.5.5. Chemical & Industrial Processing 5.6.2.5.6. Mining & Metals 5.6.2.5.7. Power Generation 5.6.2.5.8. Others 5.6.3. Mexico 5.6.3.1. Mexico Submersible Pumps Market Size and Forecast, by Product (2024-2032) 5.6.3.1.1. Borewell 5.6.3.1.2. Openwell 5.6.3.1.3. Non-Clog 5.6.3.1.4. Others 5.6.3.2. Mexico Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 5.6.3.2.1. Low 5.6.3.2.2. High 5.6.3.2.3. Medium 5.6.3.3. Mexico Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 5.6.3.3.1. Electric 5.6.3.3.2. Hydraulic 5.6.3.3.3. Pneumatic 5.6.3.3.4. Others 5.6.3.4. Mexico Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 5.6.3.4.1. Continuous 5.6.3.4.2. Intermittent 5.6.3.4.3. Automatic/Float-Activated 5.6.3.4.4. Manual 5.6.3.4.5. Others 5.6.3.5. Mexico Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 5.6.3.5.1. Water & Wastewater Management 5.6.3.5.2. Agriculture & Irrigation 5.6.3.5.3. Oil & Gas 5.6.3.5.4. Construction & Building Services 5.6.3.5.5. Chemical & Industrial Processing 5.6.3.5.6. Mining & Metals 5.6.3.5.7. Power Generation 5.6.3.5.8. Others 6. Europe Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.2. Europe Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.3. Europe Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.4. Europe Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.5. Europe Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6. Europe Submersible Pumps Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.1.2. United Kingdom Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.1.3. United Kingdom Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.1.4. United Kingdom Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.1.5. United Kingdom Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6.2. France 6.6.2.1. France Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.2.2. France Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.2.3. France Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.2.4. France Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.2.5. France Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.3.2. Germany Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.3.3. Germany Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.3.4. Germany Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.3.5. Germany Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.4.2. Italy Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.4.3. Italy Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.4.4. Italy Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.4.5. Italy Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.5.2. Spain Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.5.3. Spain Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.5.4. Spain Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.5.5. Spain Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.6.2. Sweden Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.6.3. Sweden Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.6.4. Sweden Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.6.5. Sweden Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.7.2. Austria Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.7.3. Austria Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.7.4. Austria Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.7.5. Austria Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Submersible Pumps Market Size and Forecast, by Product (2024-2032) 6.6.8.2. Rest of Europe Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 6.6.8.3. Rest of Europe Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 6.6.8.4. Rest of Europe Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 6.6.8.5. Rest of Europe Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7. Asia Pacific Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.3. Asia Pacific Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.4. Asia Pacific Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.5. Asia Pacific Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6. Asia Pacific Submersible Pumps Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.1.2. China Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.1.3. China Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.1.4. China Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.1.5. China Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.2.2. S Korea Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.2.3. S Korea Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.2.4. S Korea Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.2.5. S Korea Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.3.2. Japan Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.3.3. Japan Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.3.4. Japan Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.3.5. Japan Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.4. India 7.6.4.1. India Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.4.2. India Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.4.3. India Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.4.4. India Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.4.5. India Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.5.2. Australia Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.5.3. Australia Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.5.4. Australia Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.5.5. Australia Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.6.2. Indonesia Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.6.3. Indonesia Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.6.4. Indonesia Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.6.5. Indonesia Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.7.2. Malaysia Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.7.3. Malaysia Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.7.4. Malaysia Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.7.5. Malaysia Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.8.2. Vietnam Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.8.3. Vietnam Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.8.4. Vietnam Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.8.5. Vietnam Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.9.2. Taiwan Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.9.3. Taiwan Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.9.4. Taiwan Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.9.5. Taiwan Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Product (2024-2032) 7.6.10.2. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 7.6.10.3. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 7.6.10.4. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 7.6.10.5. Rest of Asia Pacific Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 8. Middle East and Africa Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Submersible Pumps Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 8.3. Middle East and Africa Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 8.4. Middle East and Africa Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 8.5. Middle East and Africa Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 8.6. Middle East and Africa Submersible Pumps Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Submersible Pumps Market Size and Forecast, by Product (2024-2032) 8.6.1.2. South Africa Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 8.6.1.3. South Africa Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 8.6.1.4. South Africa Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 8.6.1.5. South Africa Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Submersible Pumps Market Size and Forecast, by Product (2024-2032) 8.6.2.2. GCC Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 8.6.2.3. GCC Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 8.6.2.4. GCC Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 8.6.2.5. GCC Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Submersible Pumps Market Size and Forecast, by Product (2024-2032) 8.6.3.2. Nigeria Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 8.6.3.3. Nigeria Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 8.6.3.4. Nigeria Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 8.6.3.5. Nigeria Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Submersible Pumps Market Size and Forecast, by Product (2024-2032) 8.6.4.2. Rest of ME&A Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 8.6.4.3. Rest of ME&A Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 8.6.4.4. Rest of ME&A Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 8.6.4.5. Rest of ME&A Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 9. South America Submersible Pumps Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Submersible Pumps Market Size and Forecast, by Product (2024-2032) 9.2. South America Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 9.3. South America Submersible Pumps Market Size and Forecast, by Drive Type(2024-2032) 9.4. South America Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 9.5. South America Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 9.6. South America Submersible Pumps Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Submersible Pumps Market Size and Forecast, by Product (2024-2032) 9.6.1.2. Brazil Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 9.6.1.3. Brazil Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 9.6.1.4. Brazil Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 9.6.1.5. Brazil Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Submersible Pumps Market Size and Forecast, by Product (2024-2032) 9.6.2.2. Argentina Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 9.6.2.3. Argentina Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 9.6.2.4. Argentina Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 9.6.2.5. Argentina Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Submersible Pumps Market Size and Forecast, by Product (2024-2032) 9.6.3.2. Rest Of South America Submersible Pumps Market Size and Forecast, by Capacity (2024-2032) 9.6.3.3. Rest Of South America Submersible Pumps Market Size and Forecast, by Drive Type (2024-2032) 9.6.3.4. Rest Of South America Submersible Pumps Market Size and Forecast, by Operation (2024-2032) 9.6.3.5. Rest Of South America Submersible Pumps Market Size and Forecast, by End Use Industry (2024-2032) 10. Company Profile: Key Players 10.1. Flowserve Corporation (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Xylem Inc. (USA) 10.3. ITT Goulds Pumps Inc. (USA) 10.4. Zoeller Pump Company (USA) 10.5. Gorman-Rupp Company (USA) 10.6. Franklin Electric Co., Inc. (USA) 10.7. Baker Hughes (USA) 10.8. Halliburton (USA) 10.9. KSB SE & Co. KGaA (Germany) 10.10. Wilo SE (Germany) 10.11. Sulzer Ltd. (Switzerland) 10.12. Atlas Copco AB (Sweden) 10.13. Weir Group Plc (UK) 10.14. Interpump Group (Italy) 10.15. Calpeda S.p.A. (Italy) 10.16. Pedrollo S.p.A. (Italy) 10.17. Dab Pumps (Italy) 10.18. Grundfos (Denmark) 10.19. Kirloskar Brothers Limited (India) 10.20. CRI Pumps (India) 10.21. Shakti Pumps (India) 10.22. Ebara Corporation (Japan) 10.23. Tsurumi Manufacturing Co. Ltd. (Japan) 10.24. KBL Industries (India) 10.25. Shanghai Kaiquan Pump Group (China) 10.26. LEO Group Pump (China) 10.27. Torishima Pump (Japan) 10.28. Toshiba Water Solutions (Japan) 11. Key Findings 12. Industry Recommendations 13. Submersible Pumps Market: Research Methodology 14. Terms and Glossary