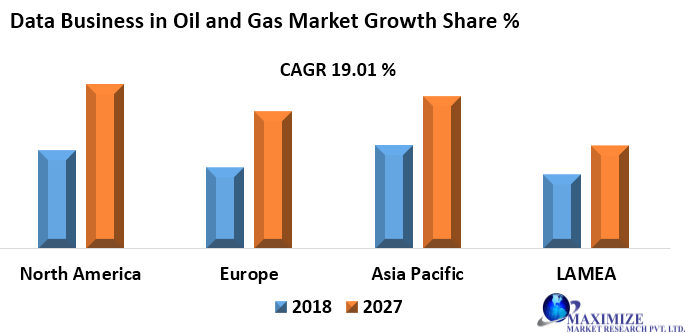

Global Data Business in Oil and Gas Market size is expected to reach nearly US$ Bn by 2027 with the CAGR of 19.01% during the forecast period.To know about the Research Methodology :- Request Free Sample Report On the global level, North America is the largest dominating region in the data business in oil and gas market with 39% share. The major driving factors for this sectors are the presence of key industry players, increasing oil production, shale oil reserves, and necessary infrastructure in the U.S. is attributed to drive the region’s growth. Whereas Asia Pacific is predictable to be the fastest growing region in the data business in oil and gas market. Enhanced oil exploration and more production with advanced technology in the APAC region is needed on priority due to rising oil consumption. Increasing adoption of advance technological solutions in the oil and gas industry across countries like, Russia, Japan, China & India are anticipated to drive the growth in Data Business in Oil and Gas Market. Moreover countries in North America like, Canada, and the U.S are expected to offer prominent opportunities to the market. The report study has analyzed revenue impact of covid-19 pandemic on the sales revenue of market leaders, market followers and disrupters in the report and same is reflected in our analysis. Data generated in the oil and gas industry is increasing in volume, variety, and velocity. Oil and gas industry needs new technologies to integrate and interpret such large amounts of structured and unstructured data generated daily from different data sources such as seismic data, geological data, well logging data, etc. which has increased the demand and boosting the growth of Global Data Business in Oil and Gas Market. The Global Data Business in Oil and Gas Market is an emerging sector and its dynamics are thoroughly studied and explained, which helps reader to understand emerging market trends, drivers, restraints, opportunities, and challenges at global and regional level for the Global Data Business in Oil and Gas Market.

Global Data Business in Oil and Gas Market is studied by Various Segments:

The report from Maximize market research provides the detail study of various segments of the Global Automotive Clutch Market and listed below:Scope of the Global Data Business in Oil and Gas Market: Inquire before buying

Global Data Business in Oil and Gas Market,by Component

• Big Data o Software Data Analytics Data Collection Data Visualization and Discovery Data Management o Services Consulting System Integration Operation and Maintenance • Data Management o Software Corporate Data Management (CDM)/Enterprise Data Management (EDM) Project Data Management (PDM) National Data Repository (NDR) o Services Consulting& Planning Integration& Implementation Operation & Maintenance • Direct Data MonetizationGlobal Data Business in Oil and Gas Market,by Oil Companies

• National Oil Companies (NOCs) • Independent Oil Companies (IOCs) • National Data Repositories (NDRs)Global Data Business in Oil and Gas Market,by Application

• Upstream o Conventional o Unconventional • Midstream • DownstreamGlobal Data Business in Oil and Gas Market, by E&P Lifecycle

• Exploration • Development • Production Global Data Business in Oil and Gas Market is segmented by Component, which is further classified as Big Data, Data Management, Direct Data Monetization, Market is also segmented by oil companies that is again divided as National, Independent, National data Repository. Market is studied on the basis of Application which is again sub segmented as Upstream, Midstream, Down Stream. Other segment of market is E&P Lifecycle which is studied by Exploration, Development, Production type of Data Business in Oil and Gas Market. Around the globe demand for oil & gas is drastically increasing, The large amount of data generated in the oil and gas industry can be used to determine new oil deposits to meet the global oil and gas demand and to increase operational efficiencies in the upstream, midstream, and downstream sectors of the industry. To optimize functions and enhance safety standards in the oil and gas industry it has become necessary to classifying and restructuring the massive amounts of data generated with the data management solutions. With big data analytics solutions, data is analyzed to find optimum oil drilling locations. The data business market is expected to witness growth over the forecast period to integrate and interpret large amounts of structured and unstructured data generated daily from exploration, production, and development of oil and gas. In the E&P lifecycle of the oil and gas industry, exploration is the key segment driven mainly by shale gas exploration activities, deep-water exploration activities, declined exploration costs and rising focus on near field explorations.Region wise Market Analysis & Forecast:

The report covers a geographic breakdown and a detailed analysis of each of the before said segments across North America, Europe, Asia Pacific, and LAMEA, and each countries under it – • North America U.S. Canada Mexico • Europe Germany France UK Italy Spain Rest of Europe • Asia Pacific Japan China India Rest of Asia-Pacific • LAMEA Latin America Middle East AfricaGlobal Data Business in Oil and Gas Market: Competition Landscape

The Global Data Business in Oil and Gas Market has the presence of a large number of players. Major players in the Global Data Business in Oil and Gas Market are concentrating on developing new technologies to facilitate the industry with lowest time and low expenditure consuming technologies. The report covers the market with details about competition, new entrants, strategic alliances, mergers and acquisition, leaders and followers in the industry with the market dynamics by region. It will also help to understand the position of each player in the market by region, by segment with their expansion plans, R&D expenditure and organic & in-organic growth strategies. Long term association, strategic alliances, supply chain agreement and mergers & acquisition activities are covered in the report in detail from 2014 to 2019. Expected alliances and agreement in forecast period will give future course of action in the market to the readers. All major & important players are profiled, benchmarked in the report on different parameters that will help reader to gain insight about the market in minimum time.Global Data Business in Oil and Gas Market Company Profiles –

The major players operating in the Global Data Business in Oil and Gas Market, analyzed in the report are: • IBM • Dell EMC • Oracle • SAP • Cisco Software • SAS Institute • Microsoft • Accenture • Tata Consultancy Services • Hitachi Vantara • Schlumberger • Datawatch • Drillinginfo • Hortonworks • Newgen Software • Halliburton • Informatica • MapR Technologies • Cloudera • Palantir Solutions • Capgemini • OSIsoftObjective of the Global Data Business in Oil and Gas Market:

The objective of the report is to present a comprehensive analysis of Global Data Business in Oil and Gas Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all aspects of the industry with a dedicated study of key players that includes market leaders, followers and new entrants by region. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors by region on the market are presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Data Business in Oil and Gas Market dynamics, structure by analyzing the market segments and project the Global Data Business in Oil and Gas Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Global Data Business in Oil and Gas Market make the report investor’s guide.

Global Data Business in Oil and Gas Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Data Business in Oil and Gas Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global Data Business in Oil and Gas Market Analysis and Forecast 6.1. Global Data Business in Oil and Gas Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global Data Business in Oil and Gas Market Analysis and Forecast, by Component 7.1. Introduction and Definition 7.2. Key Findings 7.3. Global Data Business in Oil and Gas Market Value Share Analysis, by Component 7.4. Global Data Business in Oil and Gas Market Size (US$ Mn) Forecast, by Component 7.5. Global Data Business in Oil and Gas Market Analysis, by Component 7.6. Global Data Business in Oil and Gas Market Attractiveness Analysis, by Component 8. Global Data Business in Oil and Gas Market Analysis and Forecast, by Oil Companies 8.1. Introduction and Definition 8.2. Key Findings 8.3. Global Data Business in Oil and Gas Market Value Share Analysis, by Oil Companies 8.4. Global Data Business in Oil and Gas Market Size (US$ Mn) Forecast, by Oil Companies 8.5. Global Data Business in Oil and Gas Market Analysis, by Oil Companies 8.6. Global Data Business in Oil and Gas Market Attractiveness Analysis, by Oil Companies 9. Global Data Business in Oil and Gas Market Analysis and Forecast, By Application 9.1. Introduction and Definition 9.2. Key Findings 9.3. Global Data Business in Oil and Gas Market Value Share Analysis, By Application 9.4. Global Data Business in Oil and Gas Market Size (US$ Mn) Forecast, By Application 9.5. Global Data Business in Oil and Gas Market Analysis, By Application 9.6. Global Data Business in Oil and Gas Market Attractiveness Analysis, By Application 10. Global Data Business in Oil and Gas Market Analysis and Forecast, by E&P Lifecycle 10.1. Introduction and Definition 10.2. Key Findings 10.3. Global Data Business in Oil and Gas Market Value Share Analysis, by E&P Lifecycle 10.4. Global Data Business in Oil and Gas Market Size (US$ Mn) Forecast, by E&P Lifecycle 10.5. Global Data Business in Oil and Gas Market Analysis, by E&P Lifecycle 10.6. Global Data Business in Oil and Gas Market Attractiveness Analysis, by E&P Lifecycle 11. Global Data Business in Oil and Gas Market Analysis, by Region 11.1. Global Data Business in Oil and Gas Market Value Share Analysis, by Region 11.2. Global Data Business in Oil and Gas Market Size (US$ Mn) Forecast, by Region 11.3. Global Data Business in Oil and Gas Market Attractiveness Analysis, by Region 12. North America Data Business in Oil and Gas Market Analysis 12.1. Key Findings 12.2. North America Data Business in Oil and Gas Market Overview 12.3. North America Data Business in Oil and Gas Market Value Share Analysis, by Component 12.4. North America Data Business in Oil and Gas Market Forecast, by Component 12.4.1. Big Data 12.4.1.1. Software 12.4.1.1.1. Data Analytics 12.4.1.1.2. Data Collection 12.4.1.1.3. Data Visualization and Discovery 12.4.1.1.4. Data Management 12.4.1.2. Services 12.4.1.2.1. Consulting 12.4.1.2.2. System Integration 12.4.1.2.3. Operation and Maintenance 12.4.2. Data Management 12.4.2.1. Software 12.4.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 12.4.2.1.2. Project Data Management (PDM) 12.4.2.1.3. National Data Repository (NDR) 12.4.2.2. Services 12.4.2.2.1. Consulting & Planning 12.4.2.2.2. Integration & Implementation 12.4.2.2.3. Operation & Maintenance 12.4.3. Direct Data Monetization 12.5. North America Data Business in Oil and Gas Market Value Share Analysis, by Oil Companies 12.6. North America Data Business in Oil and Gas Market Forecast, by Oil Companies 12.6.1. National Oil Companies (NOCs) 12.6.2. Independent Oil Companies (IOCs) 12.6.3. National Data Repositories (NDRs) 12.7. North America Data Business in Oil and Gas Market Value Share Analysis, By Application 12.8. North America Data Business in Oil and Gas Market Forecast, By Application 12.8.1. Upstream 12.8.1.1. Conventional 12.8.1.2. Unconventional 12.8.2. Midstream 12.8.3. Downstream 12.9. North America Data Business in Oil and Gas Market Value Share Analysis, by E&P Lifecycle 12.10. North America Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 12.10.1. Exploration 12.10.2. Development 12.10.3. Production 12.11. North America Data Business in Oil and Gas Market Value Share Analysis, by Country 12.12. North America Data Business in Oil and Gas Market Forecast, by Country 12.12.1. U.S. 12.12.2. Canada 12.13. North America Data Business in Oil and Gas Market Analysis, by Country 12.14. U.S. Data Business in Oil and Gas Market Forecast, by Component 12.14.1. Big Data 12.14.1.1. Software 12.14.1.1.1. Data Analytics 12.14.1.1.2. Data Collection 12.14.1.1.3. Data Visualization and Discovery 12.14.1.1.4. Data Management 12.14.1.2. Services 12.14.1.2.1. Consulting 12.14.1.2.2. System Integration 12.14.1.2.3. Operation and Maintenance 12.14.2. Data Management 12.14.2.1. Software 12.14.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 12.14.2.1.2. Project Data Management (PDM) 12.14.2.1.3. National Data Repository (NDR) 12.14.2.2. Services 12.14.2.2.1. Consulting & Planning 12.14.2.2.2. Integration & Implementation 12.14.2.2.3. Operation & Maintenance 12.14.3. Direct Data Monetization 12.15. U.S. Data Business in Oil and Gas Market Forecast, by Oil Companies 12.15.1. National Oil Companies (NOCs) 12.15.2. Independent Oil Companies (IOCs) 12.15.3. National Data Repositories (NDRs) 12.16. U.S. Data Business in Oil and Gas Market Forecast, By Application 12.16.1. Upstream 12.16.1.1. Conventional 12.16.1.2. Unconventional 12.16.2. Midstream 12.16.3. Downstream 12.17. U.S. Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 12.17.1. Exploration 12.17.2. Development 12.17.3. Production 12.18. Canada Data Business in Oil and Gas Market Forecast, by Component 12.18.1. Big Data 12.18.1.1. Software 12.18.1.1.1. Data Analytics 12.18.1.1.2. Data Collection 12.18.1.1.3. Data Visualization and Discovery 12.18.1.1.4. Data Management 12.18.1.2. Services 12.18.1.2.1. Consulting 12.18.1.2.2. System Integration 12.18.1.2.3. Operation and Maintenance 12.18.2. Data Management 12.18.2.1. Software 12.18.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 12.18.2.1.2. Project Data Management (PDM) 12.18.2.1.3. National Data Repository (NDR) 12.18.2.2. Services 12.18.2.2.1. Consulting & Planning 12.18.2.2.2. Integration & Implementation 12.18.2.2.3. Operation & Maintenance 12.18.3. Direct Data Monetization 12.19. Canada Data Business in Oil and Gas Market Forecast, by Oil Companies 12.19.1. National Oil Companies (NOCs) 12.19.2. Independent Oil Companies (IOCs) 12.19.3. National Data Repositories (NDRs) 12.20. Canada Data Business in Oil and Gas Market Forecast, By Application 12.20.1. Upstream 12.20.1.1. Conventional 12.20.1.2. Unconventional 12.20.2. Midstream 12.20.3. Downstream 12.21. Canada Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 12.21.1. Exploration 12.21.2. Development 12.21.3. Production 12.22. North America Data Business in Oil and Gas Market Attractiveness Analysis 12.22.1. By Component 12.22.2. By Oil Companies 12.22.3. By Application 12.22.4. By E&P Lifecycle 12.23. PEST Analysis 12.24. Key Trends 12.25. Key Developments 13. Europe Data Business in Oil and Gas Market Analysis 13.1. Key Findings 13.2. Europe Data Business in Oil and Gas Market Overview 13.3. Europe Data Business in Oil and Gas Market Value Share Analysis, by Component 13.4. Europe Data Business in Oil and Gas Market Forecast, by Component 13.4.1. Big Data 13.4.1.1. Software 13.4.1.1.1. Data Analytics 13.4.1.1.2. Data Collection 13.4.1.1.3. Data Visualization and Discovery 13.4.1.1.4. Data Management 13.4.1.2. Services 13.4.1.2.1. Consulting 13.4.1.2.2. System Integration 13.4.1.2.3. Operation and Maintenance 13.4.2. Data Management 13.4.2.1. Software 13.4.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 13.4.2.1.2. Project Data Management (PDM) 13.4.2.1.3. National Data Repository (NDR) 13.4.2.2. Services 13.4.2.2.1. Consulting & Planning 13.4.2.2.2. Integration & Implementation 13.4.2.2.3. Operation & Maintenance 13.4.3. Direct Data Monetization 13.5. Europe Data Business in Oil and Gas Market Value Share Analysis, by Oil Companies 13.6. Europe Data Business in Oil and Gas Market Forecast, by Oil Companies 13.6.1. National Oil Companies (NOCs) 13.6.2. Independent Oil Companies (IOCs) 13.6.3. National Data Repositories (NDRs) 13.7. Europe Data Business in Oil and Gas Market Value Share Analysis, By Application 13.8. Europe Data Business in Oil and Gas Market Forecast, By Application 13.8.1. Upstream 13.8.1.1. Conventional 13.8.1.2. Unconventional 13.8.2. Midstream 13.8.3. Downstream 13.9. Europe Data Business in Oil and Gas Market Value Share Analysis, by E&P Lifecycle 13.10. Europe Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 13.10.1. Exploration 13.10.2. Development 13.10.3. Production 13.11. Europe Data Business in Oil and Gas Market Value Share Analysis, by Country 13.12. Europe Data Business in Oil and Gas Market Forecast, by Country 13.12.1. Germany 13.12.2. U.K. 13.12.3. France 13.12.4. Italy 13.12.5. Spain 13.12.6. Rest of Europe 13.13. Europe Data Business in Oil and Gas Market Analysis, by Country 13.14. Germany Data Business in Oil and Gas Market Forecast, by Component 13.14.1. Big Data 13.14.1.1. Software 13.14.1.1.1. Data Analytics 13.14.1.1.2. Data Collection 13.14.1.1.3. Data Visualization and Discovery 13.14.1.1.4. Data Management 13.14.1.2. Services 13.14.1.2.1. Consulting 13.14.1.2.2. System Integration 13.14.1.2.3. Operation and Maintenance 13.14.2. Data Management 13.14.2.1. Software 13.14.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 13.14.2.1.2. Project Data Management (PDM) 13.14.2.1.3. National Data Repository (NDR) 13.14.2.2. Services 13.14.2.2.1. Consulting & Planning 13.14.2.2.2. Integration & Implementation 13.14.2.2.3. Operation & Maintenance 13.14.3. Direct Data Monetization 13.15. Germany Data Business in Oil and Gas Market Forecast, by Oil Companies 13.15.1. National Oil Companies (NOCs) 13.15.2. Independent Oil Companies (IOCs) 13.15.3. National Data Repositories (NDRs) 13.16. Germany Data Business in Oil and Gas Market Forecast, By Application 13.16.1. Upstream 13.16.1.1. Conventional 13.16.1.2. Unconventional 13.16.2. Midstream 13.16.3. Downstream 13.17. Germany Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 13.17.1. Exploration 13.17.2. Development 13.17.3. Production 13.18. U.K. Data Business in Oil and Gas Market Forecast, by Component 13.18.1. Big Data 13.18.1.1. Software 13.18.1.1.1. Data Analytics 13.18.1.1.2. Data Collection 13.18.1.1.3. Data Visualization and Discovery 13.18.1.1.4. Data Management 13.18.1.2. Services 13.18.1.2.1. Consulting 13.18.1.2.2. System Integration 13.18.1.2.3. Operation and Maintenance 13.18.2. Data Management 13.18.2.1. Software 13.18.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 13.18.2.1.2. Project Data Management (PDM) 13.18.2.1.3. National Data Repository (NDR) 13.18.2.2. Services 13.18.2.2.1. Consulting & Planning 13.18.2.2.2. Integration & Implementation 13.18.2.2.3. Operation & Maintenance 13.18.3. Direct Data Monetization 13.19. U.K. Data Business in Oil and Gas Market Forecast, by Oil Companies 13.19.1. National Oil Companies (NOCs) 13.19.2. Independent Oil Companies (IOCs) 13.19.3. National Data Repositories (NDRs) 13.20. U.K. Data Business in Oil and Gas Market Forecast, By Application 13.20.1. Upstream 13.20.1.1. Conventional 13.20.1.2. Unconventional 13.20.2. Midstream 13.20.3. Downstream 13.21. U.K. Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 13.21.1. Exploration 13.21.2. Development 13.21.3. Production 13.22. France Data Business in Oil and Gas Market Forecast, by Component 13.22.1. Big Data 13.22.1.1. Software 13.22.1.1.1. Data Analytics 13.22.1.1.2. Data Collection 13.22.1.1.3. Data Visualization and Discovery 13.22.1.1.4. Data Management 13.22.1.2. Services 13.22.1.2.1. Consulting 13.22.1.2.2. System Integration 13.22.1.2.3. Operation and Maintenance 13.22.2. Data Management 13.22.2.1. Software 13.22.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 13.22.2.1.2. Project Data Management (PDM) 13.22.2.1.3. National Data Repository (NDR) 13.22.2.2. Services 13.22.2.2.1. Consulting & Planning 13.22.2.2.2. Integration & Implementation 13.22.2.2.3. Operation & Maintenance 13.22.3. Direct Data Monetization 13.23. France Data Business in Oil and Gas Market Forecast, by Oil Companies 13.23.1. National Oil Companies (NOCs) 13.23.2. Independent Oil Companies (IOCs) 13.23.3. National Data Repositories (NDRs) 13.24. France Data Business in Oil and Gas Market Forecast, By Application 13.24.1. Upstream 13.24.1.1. Conventional 13.24.1.2. Unconventional 13.24.2. Midstream 13.24.3. Downstream 13.25. France Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 13.25.1. Exploration 13.25.2. Development 13.25.3. Production 13.26. Italy Data Business in Oil and Gas Market Forecast, by Component 13.26.1. Big Data 13.26.1.1. Software 13.26.1.1.1. Data Analytics 13.26.1.1.2. Data Collection 13.26.1.1.3. Data Visualization and Discovery 13.26.1.1.4. Data Management 13.26.1.2. Services 13.26.1.2.1. Consulting 13.26.1.2.2. System Integration 13.26.1.2.3. Operation and Maintenance 13.26.2. Data Management 13.26.2.1. Software 13.26.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 13.26.2.1.2. Project Data Management (PDM) 13.26.2.1.3. National Data Repository (NDR) 13.26.2.2. Services 13.26.2.2.1. Consulting & Planning 13.26.2.2.2. Integration & Implementation 13.26.2.2.3. Operation & Maintenance 13.26.3. Direct Data Monetization 13.27. Italy Data Business in Oil and Gas Market Forecast, by Oil Companies 13.27.1. National Oil Companies (NOCs) 13.27.2. Independent Oil Companies (IOCs) 13.27.3. National Data Repositories (NDRs) 13.28. Italy Data Business in Oil and Gas Market Forecast, By Application 13.28.1. Upstream 13.28.1.1. Conventional 13.28.1.2. Unconventional 13.28.2. Midstream 13.28.3. Downstream 13.29. Italy Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 13.29.1. Exploration 13.29.2. Development 13.29.3. Production 13.30. Spain Data Business in Oil and Gas Market Forecast, by Component 13.30.1. Big Data 13.30.1.1. Software 13.30.1.1.1. Data Analytics 13.30.1.1.2. Data Collection 13.30.1.1.3. Data Visualization and Discovery 13.30.1.1.4. Data Management 13.30.1.2. Services 13.30.1.2.1. Consulting 13.30.1.2.2. System Integration 13.30.1.2.3. Operation and Maintenance 13.30.2. Data Management 13.30.2.1. Software 13.30.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 13.30.2.1.2. Project Data Management (PDM) 13.30.2.1.3. National Data Repository (NDR) 13.30.2.2. Services 13.30.2.2.1. Consulting & Planning 13.30.2.2.2. Integration & Implementation 13.30.2.2.3. Operation & Maintenance 13.30.3. Direct Data Monetization 13.31. Spain Data Business in Oil and Gas Market Forecast, by Oil Companies 13.31.1. National Oil Companies (NOCs) 13.31.2. Independent Oil Companies (IOCs) 13.31.3. National Data Repositories (NDRs) 13.32. Spain Data Business in Oil and Gas Market Forecast, By Application 13.32.1. Upstream 13.32.1.1. Conventional 13.32.1.2. Unconventional 13.32.2. Midstream 13.32.3. Downstream 13.33. Spain Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 13.33.1. Exploration 13.33.2. Development 13.33.3. Production 13.34. Rest of Europe Data Business in Oil and Gas Market Forecast, by Component 13.34.1. Big Data 13.34.1.1. Software 13.34.1.1.1. Data Analytics 13.34.1.1.2. Data Collection 13.34.1.1.3. Data Visualization and Discovery 13.34.1.1.4. Data Management 13.34.1.2. Services 13.34.1.2.1. Consulting 13.34.1.2.2. System Integration 13.34.1.2.3. Operation and Maintenance 13.34.2. Data Management 13.34.2.1. Software 13.34.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 13.34.2.1.2. Project Data Management (PDM) 13.34.2.1.3. National Data Repository (NDR) 13.34.2.2. Services 13.34.2.2.1. Consulting & Planning 13.34.2.2.2. Integration & Implementation 13.34.2.2.3. Operation & Maintenance 13.34.3. Direct Data Monetization 13.35. Rest of Europe Data Business in Oil and Gas Market Forecast, by Oil Companies 13.35.1. National Oil Companies (NOCs) 13.35.2. Independent Oil Companies (IOCs) 13.35.3. National Data Repositories (NDRs) 13.36. Rest of Europe Data Business in Oil and Gas Market Forecast, By Application 13.36.1. Upstream 13.36.1.1. Conventional 13.36.1.2. Unconventional 13.36.2. Midstream 13.36.3. Downstream 13.37. Rest Of Europe Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 13.37.1. Exploration 13.37.2. Development 13.37.3. Production 13.38. Europe Data Business in Oil and Gas Market Attractiveness Analysis 13.38.1. By Component 13.38.2. By Oil Companies 13.38.3. By Application 13.38.4. By E&P Lifecycle 13.39. PEST Analysis 13.40. Key Trends 13.41. Key Developments 14. Asia Pacific Data Business in Oil and Gas Market Analysis 14.1. Key Findings 14.2. Asia Pacific Data Business in Oil and Gas Market Overview 14.3. Asia Pacific Data Business in Oil and Gas Market Value Share Analysis, by Component 14.4. Asia Pacific Data Business in Oil and Gas Market Forecast, by Component 14.4.1. Big Data 14.4.1.1. Software 14.4.1.1.1. Data Analytics 14.4.1.1.2. Data Collection 14.4.1.1.3. Data Visualization and Discovery 14.4.1.1.4. Data Management 14.4.1.2. Services 14.4.1.2.1. Consulting 14.4.1.2.2. System Integration 14.4.1.2.3. Operation and Maintenance 14.4.2. Data Management 14.4.2.1. Software 14.4.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 14.4.2.1.2. Project Data Management (PDM) 14.4.2.1.3. National Data Repository (NDR) 14.4.2.2. Services 14.4.2.2.1. Consulting & Planning 14.4.2.2.2. Integration & Implementation 14.4.2.2.3. Operation & Maintenance 14.4.3. Direct Data Monetization 14.5. Asia Pacific Data Business in Oil and Gas Market Value Share Analysis, by Oil Companies 14.6. Asia Pacific Data Business in Oil and Gas Market Forecast, by Oil Companies 14.6.1. National Oil Companies (NOCs) 14.6.2. Independent Oil Companies (IOCs) 14.6.3. National Data Repositories (NDRs) 14.7. Asia Pacific Data Business in Oil and Gas Market Value Share Analysis, By Application 14.8. Asia Pacific Data Business in Oil and Gas Market Forecast, By Application 14.8.1. Upstream 14.8.1.1. Conventional 14.8.1.2. Unconventional 14.8.2. Midstream 14.8.3. Downstream 14.9. Asia Pacific Data Business in Oil and Gas Market Value Share Analysis, by E&P Lifecycle 14.10. Asia Pacific Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 14.10.1. Exploration 14.10.2. Development 14.10.3. Production 14.11. Asia Pacific Data Business in Oil and Gas Market Value Share Analysis, by Country 14.12. Asia Pacific Data Business in Oil and Gas Market Forecast, by Country 14.12.1. China 14.12.2. India 14.12.3. Japan 14.12.4. ASEAN 14.12.5. Rest of Asia Pacific 14.13. Asia Pacific Data Business in Oil and Gas Market Analysis, by Country 14.14. China Data Business in Oil and Gas Market Forecast, by Component 14.14.1. Big Data 14.14.1.1. Software 14.14.1.1.1. Data Analytics 14.14.1.1.2. Data Collection 14.14.1.1.3. Data Visualization and Discovery 14.14.1.1.4. Data Management 14.14.1.2. Services 14.14.1.2.1. Consulting 14.14.1.2.2. System Integration 14.14.1.2.3. Operation and Maintenance 14.14.2. Data Management 14.14.2.1. Software 14.14.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 14.14.2.1.2. Project Data Management (PDM) 14.14.2.1.3. National Data Repository (NDR) 14.14.2.2. Services 14.14.2.2.1. Consulting & Planning 14.14.2.2.2. Integration & Implementation 14.14.2.2.3. Operation & Maintenance 14.14.3. Direct Data Monetization 14.15. China Data Business in Oil and Gas Market Forecast, by Oil Companies 14.15.1. National Oil Companies (NOCs) 14.15.2. Independent Oil Companies (IOCs) 14.15.3. National Data Repositories (NDRs) 14.16. China Data Business in Oil and Gas Market Forecast, By Application 14.16.1. Upstream 14.16.1.1. Conventional 14.16.1.2. Unconventional 14.16.2. Midstream 14.16.3. Downstream 14.17. China Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 14.17.1. Exploration 14.17.2. Development 14.17.3. Production 14.18. India Data Business in Oil and Gas Market Forecast, by Component 14.18.1. Big Data 14.18.1.1. Software 14.18.1.1.1. Data Analytics 14.18.1.1.2. Data Collection 14.18.1.1.3. Data Visualization and Discovery 14.18.1.1.4. Data Management 14.18.1.2. Services 14.18.1.2.1. Consulting 14.18.1.2.2. System Integration 14.18.1.2.3. Operation and Maintenance 14.18.2. Data Management 14.18.2.1. Software 14.18.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 14.18.2.1.2. Project Data Management (PDM) 14.18.2.1.3. National Data Repository (NDR) 14.18.2.2. Services 14.18.2.2.1. Consulting & Planning 14.18.2.2.2. Integration & Implementation 14.18.2.2.3. Operation & Maintenance 14.18.3. Direct Data Monetization 14.19. India Data Business in Oil and Gas Market Forecast, by Oil Companies 14.19.1. National Oil Companies (NOCs) 14.19.2. Independent Oil Companies (IOCs) 14.19.3. National Data Repositories (NDRs) 14.20. India Data Business in Oil and Gas Market Forecast, By Application 14.20.1. Upstream 14.20.1.1. Conventional 14.20.1.2. Unconventional 14.20.2. Midstream 14.20.3. Downstream 14.21. India Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 14.21.1. Exploration 14.21.2. Development 14.21.3. Production 14.22. Japan Data Business in Oil and Gas Market Forecast, by Component 14.22.1. Big Data 14.22.1.1. Software 14.22.1.1.1. Data Analytics 14.22.1.1.2. Data Collection 14.22.1.1.3. Data Visualization and Discovery 14.22.1.1.4. Data Management 14.22.1.2. Services 14.22.1.2.1. Consulting 14.22.1.2.2. System Integration 14.22.1.2.3. Operation and Maintenance 14.22.2. Data Management 14.22.2.1. Software 14.22.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 14.22.2.1.2. Project Data Management (PDM) 14.22.2.1.3. National Data Repository (NDR) 14.22.2.2. Services 14.22.2.2.1. Consulting & Planning 14.22.2.2.2. Integration & Implementation 14.22.2.2.3. Operation & Maintenance 14.22.3. Direct Data Monetization 14.23. Japan Data Business in Oil and Gas Market Forecast, by Oil Companies 14.23.1. National Oil Companies (NOCs) 14.23.2. Independent Oil Companies (IOCs) 14.23.3. National Data Repositories (NDRs) 14.24. Japan Data Business in Oil and Gas Market Forecast, By Application 14.24.1. Upstream 14.24.1.1. Conventional 14.24.1.2. Unconventional 14.24.2. Midstream 14.24.3. Downstream 14.25. Japan Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 14.25.1. Exploration 14.25.2. Development 14.25.3. Production 14.26. ASEAN Data Business in Oil and Gas Market Forecast, by Component 14.26.1. Big Data 14.26.1.1. Software 14.26.1.1.1. Data Analytics 14.26.1.1.2. Data Collection 14.26.1.1.3. Data Visualization and Discovery 14.26.1.1.4. Data Management 14.26.1.2. Services 14.26.1.2.1. Consulting 14.26.1.2.2. System Integration 14.26.1.2.3. Operation and Maintenance 14.26.2. Data Management 14.26.2.1. Software 14.26.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 14.26.2.1.2. Project Data Management (PDM) 14.26.2.1.3. National Data Repository (NDR) 14.26.2.2. Services 14.26.2.2.1. Consulting & Planning 14.26.2.2.2. Integration & Implementation 14.26.2.2.3. Operation & Maintenance 14.26.3. Direct Data Monetization 14.27. ASEAN Data Business in Oil and Gas Market Forecast, by Oil Companies 14.27.1. National Oil Companies (NOCs) 14.27.2. Independent Oil Companies (IOCs) 14.27.3. National Data Repositories (NDRs) 14.28. ASEAN Data Business in Oil and Gas Market Forecast, By Application 14.28.1. Upstream 14.28.1.1. Conventional 14.28.1.2. Unconventional 14.28.2. Midstream 14.28.3. Downstream 14.29. ASEAN Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 14.29.1. Exploration 14.29.2. Development 14.29.3. Production 14.30. Rest of Asia Pacific Data Business in Oil and Gas Market Forecast, by Component 14.30.1. Big Data 14.30.1.1. Software 14.30.1.1.1. Data Analytics 14.30.1.1.2. Data Collection 14.30.1.1.3. Data Visualization and Discovery 14.30.1.1.4. Data Management 14.30.1.2. Services 14.30.1.2.1. Consulting 14.30.1.2.2. System Integration 14.30.1.2.3. Operation and Maintenance 14.30.2. Data Management 14.30.2.1. Software 14.30.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 14.30.2.1.2. Project Data Management (PDM) 14.30.2.1.3. National Data Repository (NDR) 14.30.2.2. Services 14.30.2.2.1. Consulting & Planning 14.30.2.2.2. Integration & Implementation 14.30.2.2.3. Operation & Maintenance 14.30.3. Direct Data Monetization 14.31. Rest of Asia Pacific Data Business in Oil and Gas Market Forecast, by Oil Companies 14.31.1. National Oil Companies (NOCs) 14.31.2. Independent Oil Companies (IOCs) 14.31.3. National Data Repositories (NDRs) 14.32. Rest of Asia Pacific Data Business in Oil and Gas Market Forecast, By Application 14.32.1. Upstream 14.32.1.1. Conventional 14.32.1.2. Unconventional 14.32.2. Midstream 14.32.3. Downstream 14.33. Rest of Asia Pacific Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 14.33.1. Exploration 14.33.2. Development 14.33.3. Production 14.34. Asia Pacific Data Business in Oil and Gas Market Attractiveness Analysis 14.34.1. By Component 14.34.2. By Oil Companies 14.34.3. By Application 14.34.4. By E&P Lifecycle 14.35. PEST Analysis 14.36. Key Trends 14.37. Key Developments 15. Middle East & Africa Data Business in Oil and Gas Market Analysis 15.1. Key Findings 15.2. Middle East & Africa Data Business in Oil and Gas Market Overview 15.3. Middle East & Africa Data Business in Oil and Gas Market Value Share Analysis, by Component 15.4. Middle East & Africa Data Business in Oil and Gas Market Forecast, by Component 15.4.1. Big Data 15.4.1.1. Software 15.4.1.1.1. Data Analytics 15.4.1.1.2. Data Collection 15.4.1.1.3. Data Visualization and Discovery 15.4.1.1.4. Data Management 15.4.1.2. Services 15.4.1.2.1. Consulting 15.4.1.2.2. System Integration 15.4.1.2.3. Operation and Maintenance 15.4.2. Data Management 15.4.2.1. Software 15.4.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 15.4.2.1.2. Project Data Management (PDM) 15.4.2.1.3. National Data Repository (NDR) 15.4.2.2. Services 15.4.2.2.1. Consulting & Planning 15.4.2.2.2. Integration & Implementation 15.4.2.2.3. Operation & Maintenance 15.4.3. Direct Data Monetization 15.5. Middle East & Africa Data Business in Oil and Gas Market Value Share Analysis, by Oil Companies 15.6. Middle East & Africa Data Business in Oil and Gas Market Forecast, by Oil Companies 15.6.1. National Oil Companies (NOCs) 15.6.2. Independent Oil Companies (IOCs) 15.6.3. National Data Repositories (NDRs) 15.7. Middle East & Africa Data Business in Oil and Gas Market Value Share Analysis, By Application 15.8. Middle East & Africa Data Business in Oil and Gas Market Forecast, By Application 15.8.1. Upstream 15.8.1.1. Conventional 15.8.1.2. Unconventional 15.8.2. Midstream 15.8.3. Downstream 15.9. Middle East & Africa Data Business in Oil and Gas Market Value Share Analysis, by E&P Lifecycle 15.10. Middle East & Africa Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 15.10.1. Exploration 15.10.2. Development 15.10.3. Production 15.11. Middle East & Africa Data Business in Oil and Gas Market Value Share Analysis, by Country 15.12. Middle East & Africa Data Business in Oil and Gas Market Forecast, by Country 15.12.1. GCC 15.12.2. South Africa 15.12.3. Rest of Middle East & Africa 15.13. Middle East & Africa Data Business in Oil and Gas Market Analysis, by Country 15.14. GCC Data Business in Oil and Gas Market Forecast, by Component 15.14.1. Big Data 15.14.1.1. Software 15.14.1.1.1. Data Analytics 15.14.1.1.2. Data Collection 15.14.1.1.3. Data Visualization and Discovery 15.14.1.1.4. Data Management 15.14.1.2. Services 15.14.1.2.1. Consulting 15.14.1.2.2. System Integration 15.14.1.2.3. Operation and Maintenance 15.14.2. Data Management 15.14.2.1. Software 15.14.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 15.14.2.1.2. Project Data Management (PDM) 15.14.2.1.3. National Data Repository (NDR) 15.14.2.2. Services 15.14.2.2.1. Consulting & Planning 15.14.2.2.2. Integration & Implementation 15.14.2.2.3. Operation & Maintenance 15.14.3. Direct Data Monetization 15.15. GCC Data Business in Oil and Gas Market Forecast, by Oil Companies 15.15.1. National Oil Companies (NOCs) 15.15.2. Independent Oil Companies (IOCs) 15.15.3. National Data Repositories (NDRs) 15.16. GCC Data Business in Oil and Gas Market Forecast, By Application 15.16.1. Upstream 15.16.1.1. Conventional 15.16.1.2. Unconventional 15.16.2. Midstream 15.16.3. Downstream 15.17. GCC Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 15.17.1. Exploration 15.17.2. Development 15.17.3. Production 15.18. South Africa Data Business in Oil and Gas Market Forecast, by Component 15.18.1. Big Data 15.18.1.1. Software 15.18.1.1.1. Data Analytics 15.18.1.1.2. Data Collection 15.18.1.1.3. Data Visualization and Discovery 15.18.1.1.4. Data Management 15.18.1.2. Services 15.18.1.2.1. Consulting 15.18.1.2.2. System Integration 15.18.1.2.3. Operation and Maintenance 15.18.2. Data Management 15.18.2.1. Software 15.18.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 15.18.2.1.2. Project Data Management (PDM) 15.18.2.1.3. National Data Repository (NDR) 15.18.2.2. Services 15.18.2.2.1. Consulting & Planning 15.18.2.2.2. Integration & Implementation 15.18.2.2.3. Operation & Maintenance 15.18.3. Direct Data Monetization 15.19. South Africa Data Business in Oil and Gas Market Forecast, by Oil Companies 15.19.1. National Oil Companies (NOCs) 15.19.2. Independent Oil Companies (IOCs) 15.19.3. National Data Repositories (NDRs) 15.20. South Africa Data Business in Oil and Gas Market Forecast, By Application 15.20.1. Upstream 15.20.1.1. Conventional 15.20.1.2. Unconventional 15.20.2. Midstream 15.20.3. Downstream 15.21. South Africa Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 15.21.1. Exploration 15.21.2. Development 15.21.3. Production 15.22. Rest of Middle East & Africa Data Business in Oil and Gas Market Forecast, by Component 15.22.1. Big Data 15.22.1.1. Software 15.22.1.1.1. Data Analytics 15.22.1.1.2. Data Collection 15.22.1.1.3. Data Visualization and Discovery 15.22.1.1.4. Data Management 15.22.1.2. Services 15.22.1.2.1. Consulting 15.22.1.2.2. System Integration 15.22.1.2.3. Operation and Maintenance 15.22.2. Data Management 15.22.2.1. Software 15.22.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 15.22.2.1.2. Project Data Management (PDM) 15.22.2.1.3. National Data Repository (NDR) 15.22.2.2. Services 15.22.2.2.1. Consulting & Planning 15.22.2.2.2. Integration & Implementation 15.22.2.2.3. Operation & Maintenance 15.22.3. Direct Data Monetization 15.23. Rest of Middle East & Africa Data Business in Oil and Gas Market Forecast, by Oil Companies 15.23.1. National Oil Companies (NOCs) 15.23.2. Independent Oil Companies (IOCs) 15.23.3. National Data Repositories (NDRs) 15.24. Rest of Middle East & Africa Data Business in Oil and Gas Market Forecast, By Application 15.24.1. Upstream 15.24.1.1. Conventional 15.24.1.2. Unconventional 15.24.2. Midstream 15.24.3. Downstream 15.25. Rest of Middle East & Africa Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 15.25.1. Exploration 15.25.2. Development 15.25.3. Production 15.26. Middle East & Africa Data Business in Oil and Gas Market Attractiveness Analysis 15.26.1. By Component 15.26.2. By Oil Companies 15.26.3. By Application 15.26.4. By E&P Lifecycle 15.27. PEST Analysis 15.28. Key Trends 15.29. Key Developments 16. South America Data Business in Oil and Gas Market Analysis 16.1. Key Findings 16.2. South America Data Business in Oil and Gas Market Overview 16.3. South America Data Business in Oil and Gas Market Value Share Analysis, by Component 16.4. South America Data Business in Oil and Gas Market Forecast, by Component 16.4.1. Big Data 16.4.1.1. Software 16.4.1.1.1. Data Analytics 16.4.1.1.2. Data Collection 16.4.1.1.3. Data Visualization and Discovery 16.4.1.1.4. Data Management 16.4.1.2. Services 16.4.1.2.1. Consulting 16.4.1.2.2. System Integration 16.4.1.2.3. Operation and Maintenance 16.4.2. Data Management 16.4.2.1. Software 16.4.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 16.4.2.1.2. Project Data Management (PDM) 16.4.2.1.3. National Data Repository (NDR) 16.4.2.2. Services 16.4.2.2.1. Consulting & Planning 16.4.2.2.2. Integration & Implementation 16.4.2.2.3. Operation & Maintenance 16.4.3. Direct Data Monetization 16.5. South America Data Business in Oil and Gas Market Value Share Analysis, by Oil Companies 16.6. South America Data Business in Oil and Gas Market Forecast, by Oil Companies 16.6.1. National Oil Companies (NOCs) 16.6.2. Independent Oil Companies (IOCs) 16.6.3. National Data Repositories (NDRs) 16.7. South America Data Business in Oil and Gas Market Value Share Analysis, By Application 16.8. South America Data Business in Oil and Gas Market Forecast, By Application 16.8.1. Upstream 16.8.1.1. Conventional 16.8.1.2. Unconventional 16.8.2. Midstream 16.8.3. Downstream 16.9. South America Data Business in Oil and Gas Market Value Share Analysis, by E&P Lifecycle 16.10. South America Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 16.10.1. Exploration 16.10.2. Development 16.10.3. Production 16.11. South America Data Business in Oil and Gas Market Value Share Analysis, by Country 16.12. South America Data Business in Oil and Gas Market Forecast, by Country 16.12.1. Brazil 16.12.2. Mexico 16.12.3. Rest of South America 16.13. South America Data Business in Oil and Gas Market Analysis, by Country 16.14. Brazil Data Business in Oil and Gas Market Forecast, by Component 16.14.1. Big Data 16.14.1.1. Software 16.14.1.1.1. Data Analytics 16.14.1.1.2. Data Collection 16.14.1.1.3. Data Visualization and Discovery 16.14.1.1.4. Data Management 16.14.1.2. Services 16.14.1.2.1. Consulting 16.14.1.2.2. System Integration 16.14.1.2.3. Operation and Maintenance 16.14.2. Data Management 16.14.2.1. Software 16.14.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 16.14.2.1.2. Project Data Management (PDM) 16.14.2.1.3. National Data Repository (NDR) 16.14.2.2. Services 16.14.2.2.1. Consulting & Planning 16.14.2.2.2. Integration & Implementation 16.14.2.2.3. Operation & Maintenance 16.14.3. Direct Data Monetization 16.15. Brazil Data Business in Oil and Gas Market Forecast, by Oil Companies 16.15.1. National Oil Companies (NOCs) 16.15.2. Independent Oil Companies (IOCs) 16.15.3. National Data Repositories (NDRs) 16.16. Brazil Data Business in Oil and Gas Market Forecast, By Application 16.16.1. Upstream 16.16.1.1. Conventional 16.16.1.2. Unconventional 16.16.2. Midstream 16.16.3. Downstream 16.17. Brazil Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 16.17.1. Exploration 16.17.2. Development 16.17.3. Production 16.18. Mexico Data Business in Oil and Gas Market Forecast, by Component 16.18.1. Big Data 16.18.1.1. Software 16.18.1.1.1. Data Analytics 16.18.1.1.2. Data Collection 16.18.1.1.3. Data Visualization and Discovery 16.18.1.1.4. Data Management 16.18.1.2. Services 16.18.1.2.1. Consulting 16.18.1.2.2. System Integration 16.18.1.2.3. Operation and Maintenance 16.18.2. Data Management 16.18.2.1. Software 16.18.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 16.18.2.1.2. Project Data Management (PDM) 16.18.2.1.3. National Data Repository (NDR) 16.18.2.2. Services 16.18.2.2.1. Consulting & Planning 16.18.2.2.2. Integration & Implementation 16.18.2.2.3. Operation & Maintenance 16.18.3. Direct Data Monetization 16.19. Mexico Data Business in Oil and Gas Market Forecast, by Oil Companies 16.19.1. National Oil Companies (NOCs) 16.19.2. Independent Oil Companies (IOCs) 16.19.3. National Data Repositories (NDRs) 16.20. Mexico Data Business in Oil and Gas Market Forecast, By Application 16.20.1. Upstream 16.20.1.1. Conventional 16.20.1.2. Unconventional 16.20.2. Midstream 16.20.3. Downstream 16.21. Mexico Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 16.21.1. Exploration 16.21.2. Development 16.21.3. Production 16.22. Rest of South America Data Business in Oil and Gas Market Forecast, by Component 16.22.1. Big Data 16.22.1.1. Software 16.22.1.1.1. Data Analytics 16.22.1.1.2. Data Collection 16.22.1.1.3. Data Visualization and Discovery 16.22.1.1.4. Data Management 16.22.1.2. Services 16.22.1.2.1. Consulting 16.22.1.2.2. System Integration 16.22.1.2.3. Operation and Maintenance 16.22.2. Data Management 16.22.2.1. Software 16.22.2.1.1. Corporate Data Management (CDM)/Enterprise Data Management (EDM) 16.22.2.1.2. Project Data Management (PDM) 16.22.2.1.3. National Data Repository (NDR) 16.22.2.2. Services 16.22.2.2.1. Consulting & Planning 16.22.2.2.2. Integration & Implementation 16.22.2.2.3. Operation & Maintenance 16.22.3. Direct Data Monetization 16.23. Rest of South America Data Business in Oil and Gas Market Forecast, by Oil Companies 16.23.1. National Oil Companies (NOCs) 16.23.2. Independent Oil Companies (IOCs) 16.23.3. National Data Repositories (NDRs) 16.24. Rest of South America Data Business in Oil and Gas Market Forecast, By Application 16.24.1. Upstream 16.24.1.1. Conventional 16.24.1.2. Unconventional 16.24.2. Midstream 16.24.3. Downstream 16.25. Rest of South America Data Business in Oil and Gas Market Forecast, by E&P Lifecycle 16.25.1. Exploration 16.25.2. Development 16.25.3. Production 16.26. South America Data Business in Oil and Gas Market Attractiveness Analysis 16.26.1. By Component 16.26.2. By Oil Companies 16.26.3. By Application 16.26.4. By E&P Lifecycle 16.27. PEST Analysis 16.28. Key Trends 16.29. Key Developments 17. Company Profiles 17.1. Market Share Analysis, by Company 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 17.2.2. New Product Launches and Product Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment and Applications 17.2.3.2. M&A Key Players, Forward Integration and Backward Integration 17.3. Company Profiles: Key Players 17.3.1. IBM 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Product Portfolio 17.3.1.4. Business Strategy 17.3.1.5. Recent Developments 17.3.1.6. Development Footprint 17.3.2. Dell EMC 17.3.3. Oracle 17.3.4. SAP 17.3.5. Cisco Software 17.3.6. SAS Institute 17.3.7. Microsoft 17.3.8. Accenture 17.3.9. Tata Consultancy Services 17.3.10. Hitachi Vantara 17.3.11. Schlumberger 17.3.12. Datawatch 17.3.13. Drillinginfo 17.3.14. Hortonworks 17.3.15. Newgen Software 17.3.16. Halliburton 17.3.17. Informatica 17.3.18. MapR Technologies 17.3.19. Cloudera 17.3.20. Palantir Solutions 17.3.21. Capgemini 17.3.22. OSIsoft 18. Primary Key Insights